false000109355700010935572024-02-082024-02-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): February 8, 2024

DEXCOM, INC.

(Exact Name of the Registrant as Specified in Its Charter)

| | | | | | | | |

| Delaware | 000-51222 | 33-0857544 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | |

6340 Sequence Drive, San Diego, CA | | 92121 |

(Address of Principal Executive Offices) | | (Zip Code) |

(858) 200-0200

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

| Common Stock, $0.001 Par Value Per Share | | DXCM | | Nasdaq Global Select Market |

| | | | | | | | | | | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | |

| | Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

| | | | | |

| ITEM 2.02. | RESULTS OF OPERATIONS AND FINANCIAL CONDITION. |

On February 8, 2024, DexCom, Inc. (“Dexcom”) issued a press release announcing its financial results for the quarter and year ended December 31, 2023 and certain other information. A copy of the press release is furnished as Exhibit 99.1 to this report.

The information in this Item 2.02, including Exhibit 99.1 hereto, is furnished shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. The information contained herein and in the accompanying exhibit is not incorporated by reference in any filing of Dexcom under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, except as shall be expressly set forth by specific reference in such a filing.

| | | | | |

| ITEM 9.01. | FINANCIAL STATEMENTS AND EXHIBITS. |

(d) Exhibits.

| | | | | | | | |

| | |

| Number | | Description |

| |

| | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| | |

| DEXCOM, INC. |

| |

| By: | | /s/ JEREME M. SYLVAIN Jereme M. Sylvain Executive Vice President and Chief Financial Officer (Principal Financial and Accounting Officer) |

| | |

Date: | | February 8, 2024 |

Exhibit 99.1

Dexcom Reports Fourth Quarter and Fiscal Year 2023 Financial Results

SAN DIEGO - (BUSINESS WIRE-February 8, 2024) - DexCom, Inc. (Nasdaq: DXCM) today reported its financial results as of and for the quarter and fiscal year ended December 31, 2023.

Fourth Quarter 2023 Financial Highlights:

•Revenue grew 27% versus the same quarter of the prior year to $1.03 billion on a reported basis and 26% on an organic1 basis.

•U.S. revenue growth of 27% and international revenue growth of 27% on a reported basis. International revenue growth was 23% on an organic1 basis.

•GAAP operating income of $216.9 million or 21.0% of revenue, an increase of 560 basis points compared to the fourth quarter of 2022. Non-GAAP operating income* of $242.7 million or 23.5% of reported revenue, an increase of 240 basis points compared with the same quarter of the prior year.

Full Year 2023 Financial Highlights:

•Full year revenue grew 24% versus the prior year to $3.62 billion on a reported basis and 24% on an organic2 basis.

•U.S. revenue growth of 23% and international revenue growth of 30% on a reported basis. International revenue growth was 30% on an organic2 basis.

•GAAP operating income of $597.7 million or 16.5% of revenue, an increase of 310 basis points compared to 2022. Non-GAAP operating income* of $718.6 million or 19.8% of revenue, an increase of 310 basis points over the prior year.

Fourth Quarter 2023 Strategic Highlights:

•Submitted Stelo, Dexcom’s new glucose sensor for people with type 2 diabetes who do not use insulin, to the FDA for review.

•Advanced pump connectivity with the integration of Dexcom G7 and Tandem Diabetes Care’s t:slim X2 insulin pump software, as well as the iLet Bionic Pancreas from Beta Bionics, supporting greater customer choice in insulin delivery.

•Submitted Dexcom’s direct-to-watch feature, which will enable customers to use a smartwatch as their primary receiver, to the FDA for review.

•In support of National Diabetes Month, partnered with several Dexcom Warriors in a global awareness campaign to advocate for greater access to diabetes technology.

“2023 was an incredible year for Dexcom with significantly expanded access, another year of record new customer starts, and growing momentum behind our global rollout of Dexcom G7,” said Kevin Sayer, Dexcom’s chairman, president and CEO. “We are looking forward to another great year in 2024 as we strive to improve the health of significantly more people around the world with Dexcom CGM technology.”

1 Fourth quarter 2023 organic revenue is $1.03 billion and excludes $8.2 million of foreign exchange impact.

2 Full year 2023 organic revenue is $3.6 billion and excludes $0.2 million of foreign exchange impact.

2024 Annual Guidance

The company is reiterating fiscal year 2024 guidance for Revenue, Non-GAAP Gross Profit Margin and Non-GAAP Operating Margin, and establishing Adjusted EBITDA Margin guidance at the following levels:

•Revenue of approximately $4.15 - 4.35 billion (16 - 21% organic growth3)

•Non-GAAP Gross Profit Margin of approximately 63 - 64%

•Non-GAAP Operating Margin of approximately 20%

•Adjusted EBITDA Margin of approximately 29%

Fourth Quarter 2023 Financial Results

Revenue: In the fourth quarter of 2023, worldwide revenue grew 27% to $1.03 billion on a reported basis, up from $815.2 million in the fourth quarter of 2022. Volume growth in conjunction with strong new customer additions continues to be the primary driver of revenue growth as awareness of real-time CGM increases.

Gross Profit: GAAP gross profit totaled $656.6 million or 63.5% of revenue for the fourth quarter of 2023, compared to $541.3 million or 66.4% of revenue in the fourth quarter of 2022.

Non-GAAP gross profit* totaled $663.8 million or 64.2% of revenue for the fourth quarter of 2023, compared to $543.7 million or 66.7% of reported revenue in the fourth quarter of 2022.

Operating Income: GAAP operating income for the fourth quarter of 2023 was $216.9 million, compared to GAAP operating income of $125.4 million for the fourth quarter of 2022.

Non-GAAP operating income* for the fourth quarter of 2023 was $242.7 million, compared to non-GAAP operating income of $172.1 million for the fourth quarter of 2022.

Net Income and Diluted Net Income Per Share: GAAP net income was $256.3 million, or $0.62 per diluted share, for the fourth quarter of 2023, compared to GAAP net income of $91.8 million, or $0.22 per diluted share, for the same quarter of 2022.

Non-GAAP net income* was $202.8 million, or $0.50 per diluted share, for the fourth quarter of 2023, compared to non-GAAP net income of $136.3 million, or $0.34 per diluted share, for the same quarter of 2022. The fourth quarter 2023 non-GAAP net income excludes $10.1 million of amortization of intangible assets, $2.0 million of business transition and related costs, $13.7 million of intellectual property litigation costs, $0.9 million of income from equity investments, and $78.4 million of tax adjustments.

Cash and Liquidity: As of December 31, 2023, Dexcom held $2.72 billion in cash, cash equivalents and marketable securities and our revolving credit facility remains undrawn. The cash balance represents significant financial and strategic flexibility as Dexcom continues to expand production capacity and explore new market opportunities.

* See Table E below for a reconciliation of these GAAP and non-GAAP financial measures.

Conference Call

Management will hold a conference call today starting at 4:30 p.m. (Eastern Time). The conference call will be concurrently webcast. The link to the webcast will be available on the Dexcom Investor Relations website at investors.dexcom.com by navigating to “Events and Presentations,” and will be archived for future reference. To listen to the conference call, please dial (888) 414-4585 (US/Canada) or (646) 960-0331 (International) and use the confirmation ID “9430114” approximately five minutes prior to the start time.

3 Organic growth excludes non-CGM revenue acquired or divested in the trailing twelve months, as well as the impact of foreign exchange. Assumes divestiture of certain non-CGM assets that accounted for approximately $30 million of revenue in fiscal year 2023. 2024 organic growth expectation calculated excluding that contribution from the 2023 base.

Statement Regarding Use of Non-GAAP Financial Measures

This press release and the accompanying tables include non-GAAP financial measures. For a description of these non-GAAP financial measures, including the reasons management uses each measure, and reconciliations of these non-GAAP financial measures to the most directly comparable financial measures prepared in accordance with Generally Accepted Accounting Principles (GAAP), please see the section of the accompanying tables titled “About Non-GAAP Financial Measures” as well as the related Table E. We have not reconciled our total Revenue, Non-GAAP Gross Profit Margin, Non-GAAP Operating Margin and Adjusted EBITDA Margin estimates for fiscal year 2023 because certain items that impact these figures are uncertain or out of our control and cannot be reasonably predicted. Accordingly, a reconciliation of total Revenue, Non-GAAP Gross Profit Margin, Non-GAAP Operating Margin and Adjusted EBITDA Margin is not available without unreasonable effort.

About DexCom, Inc.

DexCom, Inc. empowers people to take real-time control of health through innovative continuous glucose monitoring (CGM) systems. Headquartered in San Diego, Calif., and with operations across Europe and select parts of Asia/Oceania, Dexcom has emerged as a leader of diabetes care technology. By listening to the needs of users, caregivers, and providers, Dexcom works to simplify and improve diabetes management around the world. For more information about Dexcom CGM, visit www.dexcom.com.

Category: IR

Cautionary Statement Regarding Forward Looking Statements

This press release contains forward-looking statements that are not purely historical regarding Dexcom’s or its management’s intentions, beliefs, expectations and strategies for the future, including those related to Dexcom’s estimated total Revenue, Non-GAAP Gross Profit Margin, Non-GAAP Operating Margin, and Adjusted EBITDA Margin for fiscal 2024, as well as expected growth rates as compared to the year ended December 31, 2023. All forward-looking statements included in this press release are made as of the date of this release, based on information currently available to Dexcom, deal with future events, are subject to various risks and uncertainties, and actual results could differ materially from those anticipated in those forward-looking statements. The risks and uncertainties that may cause actual results to differ materially from Dexcom’s current expectations are more fully described in “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of Dexcom’s most recently filed periodic reports on Form 10-K and Form 10-Q and subsequent filings filed with the Securities and Exchange Commission. Except as required by law, Dexcom assumes no obligation to update any such forward-looking statement after the date of this report or to conform these forward-looking statements to actual results.

INVESTOR RELATIONS CONTACT:

Sean Christensen

Vice President - Finance and Investor Relations

investor-relations@dexcom.com

(858) 203-6657

MEDIA CONTACT:

James McIntosh

(619) 884-2118

DexCom, Inc.

Table A

Consolidated Balance Sheets

(In millions, except par value data)

| | | | | | | | | | | |

| December 31, 2023 | | December 31, 2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 566.3 | | | $ | 642.3 | |

| Short-term marketable securities | 2,157.8 | | | 1,813.9 | |

| Accounts receivable, net | 973.9 | | | 713.3 | |

| Inventory | 559.6 | | | 306.7 | |

| Prepaid and other current assets | 168.3 | | | 192.6 | |

| Total current assets | 4,425.9 | | | 3,668.8 | |

| Property and equipment, net | 1,113.1 | | | 1,055.6 | |

| Operating lease right-of-use assets | 71.4 | | | 80.0 | |

| Goodwill | 25.2 | | | 25.7 | |

| Intangibles, net | 134.5 | | | 173.3 | |

| Deferred tax assets | 419.4 | | | 341.2 | |

| Other assets | 75.0 | | | 47.1 | |

| Total assets | $ | 6,264.5 | | | $ | 5,391.7 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable and accrued liabilities | $ | 1,345.5 | | | $ | 901.8 | |

| Accrued payroll and related expenses | 171.0 | | | 134.3 | |

| Current portion of long-term senior convertible notes | — | | | 772.6 | |

| Short-term operating lease liabilities | 21.1 | | | 20.5 | |

| Deferred revenue | 18.4 | | | 10.1 | |

| Total current liabilities | 1,556.0 | | | 1,839.3 | |

| Long-term senior convertible notes | 2,434.2 | | | 1,197.7 | |

| Long-term operating lease liabilities | 80.1 | | | 94.6 | |

| Other long-term liabilities | 125.6 | | | 128.3 | |

| Total liabilities | 4,195.9 | | | 3,259.9 | |

| Commitments and contingencies | | | |

| Stockholders’ equity: | | | |

| Preferred stock, $0.001 par value, 5.0 million shares authorized; no shares issued and outstanding at December 31, 2023 and December 31, 2022 | — | | | — | |

Common stock, $0.001 par value, 800.0 million shares authorized; 407.2 million and 385.4 million shares issued and outstanding, respectively, at December 31, 2023; and 393.2 million and 386.3 million shares issued and outstanding, respectively, at December 31, 2022 | 0.4 | | | 0.4 | |

| Additional paid-in capital | 3,514.6 | | | 2,258.1 | |

| Accumulated other comprehensive loss | (16.7) | | | (11.6) | |

| Retained earnings | 1,021.4 | | | 479.9 | |

| Treasury stock, at cost; 21.8 million shares at December 31, 2023 and 6.9 million shares at December 31, 2022 | (2,451.1) | | | (595.0) | |

| Total stockholders’ equity | 2,068.6 | | | 2,131.8 | |

| Total liabilities and stockholders’ equity | $ | 6,264.5 | | | $ | 5,391.7 | |

DexCom, Inc.

Table B

Consolidated Statements of Operations

(In millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | $ | 1,034.5 | | | $ | 815.2 | | | $ | 3,622.3 | | | $ | 2,909.8 | |

| Cost of sales | 377.9 | | | 273.9 | | | 1,333.4 | | | 1,026.7 | |

| Gross profit | 656.6 | | | 541.3 | | | 2,288.9 | | | 1,883.1 | |

| Operating expenses: | | | | | | | |

| Research and development | 136.1 | | | 116.3 | | | 505.8 | | | 484.2 | |

| | | | | | | |

| Selling, general and administrative | 303.6 | | | 299.6 | | | 1,185.4 | | | 1,007.7 | |

| Total operating expenses | 439.7 | | | 415.9 | | | 1,691.2 | | | 1,491.9 | |

| Operating income | 216.9 | | | 125.4 | | | 597.7 | | | 391.2 | |

Other income (expense), net | 29.3 | | | 7.8 | | | 112.7 | | | (0.4) | |

| Income before income taxes | 246.2 | | | 133.2 | | | 710.4 | | | 390.8 | |

| Income tax expense (benefit) | (10.1) | | | 41.4 | | | 168.9 | | | 49.6 | |

| Net income | $ | 256.3 | | | $ | 91.8 | | | $ | 541.5 | | | $ | 341.2 | |

| | | | | | | |

| Basic net income per share | $ | 0.67 | | | $ | 0.24 | | | $ | 1.40 | | | $ | 0.88 | |

| Shares used to compute basic net income per share | 384.1 | | | 386.3 | | | 386.0 | | | 389.4 | |

| Diluted net income per share | $ | 0.62 | | | $ | 0.22 | | | $ | 1.30 | | | $ | 0.82 | |

| Shares used to compute diluted net income per share | 415.9 | | | 425.9 | | | 425.5 | | | 427.5 | |

DexCom, Inc.

Table C

Revenue by Geography

(Dollars in millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| U.S. revenue | $ | 769.1 | | | $ | 606.4 | | | $ | 2,625.3 | | | $ | 2,142.0 | |

| Year over year growth | 27 | % | | 17 | % | | 23 | % | | 16 | % |

| % of total revenue | 74 | % | | 74 | % | | 72 | % | | 74 | % |

| | | | | | | |

| International revenue | $ | 265.4 | | | $ | 208.8 | | | $ | 997.0 | | | $ | 767.8 | |

| Year over year growth | 27 | % | | 15 | % | | 30 | % | | 28 | % |

| % of total revenue | 26 | % | | 26 | % | | 28 | % | | 26 | % |

| | | | | | | |

Total revenue (1) | $ | 1,034.5 | | | $ | 815.2 | | | $ | 3,622.3 | | | $ | 2,909.8 | |

| Year over year growth | 27 | % | | 17 | % | | 24 | % | | 19 | % |

(1) The sum of the revenue components may not equal total revenue due to rounding.

DexCom, Inc.

Table D

Revenue by Component

(Dollars in millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

Sensor and other revenue (1) (2) | $ | 947.0 | | | $ | 714.8 | | | $ | 3,250.7 | | | $ | 2,522.3 | |

| Year over year growth | 32 | % | | 19 | % | | 29 | % | | 22 | % |

| % of total revenue | 92 | % | | 88 | % | | 90 | % | | 87 | % |

| | | | | | | |

Hardware revenue (1) (3) | $ | 87.5 | | | $ | 100.4 | | | $ | 371.6 | | | $ | 387.5 | |

| Year over year growth | (13) | % | | 1 | % | | (4) | % | | 1 | % |

| % of total revenue | 8 | % | | 12 | % | | 10 | % | | 13 | % |

| | | | | | | |

Total revenue (4) | $ | 1,034.5 | | | $ | 815.2 | | | $ | 3,622.3 | | | $ | 2,909.8 | |

| Year over year growth | 27 | % | | 17 | % | | 24 | % | | 19 | % |

(1) Includes allocated subscription revenue.

(2) Includes services, freight, accessories, Non-CGM acquired revenue, etc.

(3) Includes transmitter and receiver revenue.

(4) The sum of the revenue components may not equal total revenue due to rounding.

DexCom, Inc.

Table E

Itemized Reconciliation Between GAAP and Non-GAAP Financial Measures

(In millions, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| GAAP gross profit | $ | 656.6 | | | $ | 541.3 | | | $ | 2,288.9 | | | $ | 1,883.1 | |

Amortization of intangible assets (1) | 7.2 | | | 2.4 | | | 28.6 | | | 2.4 | |

| Non-GAAP gross profit | $ | 663.8 | | | $ | 543.7 | | | $ | 2,317.5 | | | $ | 1,885.5 | |

| | | | | | | |

| GAAP operating income | $ | 216.9 | | | $ | 125.4 | | | $ | 597.7 | | | $ | 391.2 | |

Amortization of intangible assets (1) | 10.1 | | | 4.2 | | | 36.7 | | | 9.9 | |

Business transition and related costs (2) | 2.0 | | | 24.1 | | | 4.9 | | | 39.5 | |

Intellectual property litigation costs (3) | 13.7 | | | 18.4 | | | 79.3 | | | 44.5 | |

| | | | | | | |

| Non-GAAP operating income | $ | 242.7 | | | $ | 172.1 | | | $ | 718.6 | | | $ | 485.1 | |

| | | | | | | |

| GAAP net income | $ | 256.3 | | | $ | 91.8 | | | $ | 541.5 | | | $ | 341.2 | |

Business transition and related costs (2) | 2.0 | | | 23.9 | | | 4.6 | | | 39.3 | |

| Depreciation and amortization | 52.5 | | | 36.3 | | | 186.0 | | | 155.9 | |

Intellectual property litigation costs (3) | 13.7 | | | 18.4 | | | 79.3 | | | 44.5 | |

| | | | | | | |

Income from equity investments (4) | (0.9) | | | — | | | (1.9) | | | (0.2) | |

| Share-based compensation | 36.9 | | | 34.0 | | | 150.8 | | | 126.5 | |

| Interest expense and interest income | (28.9) | | | (8.7) | | | (114.7) | | | (5.2) | |

| Income tax (benefit) expense | (10.1) | | | 41.4 | | | 168.9 | | | 49.6 | |

| Adjusted EBITDA | $ | 321.5 | | | $ | 237.1 | | | $ | 1,014.5 | | | $ | 751.6 | |

| | | | | | | |

| GAAP net income | $ | 256.3 | | | $ | 91.8 | | | $ | 541.5 | | | $ | 341.2 | |

Amortization of intangible assets (1) | 10.1 | | | 4.2 | | | 36.7 | | | 9.9 | |

Business transition and related costs (2) | 2.0 | | | 24.1 | | | 4.9 | | | 39.5 | |

Intellectual property litigation costs (3) | 13.7 | | | 18.4 | | | 79.3 | | | 44.5 | |

| | | | | | | |

Income from equity investments (4) | (0.9) | | | — | | | (1.9) | | | (0.2) | |

Adjustments related to taxes (5) | (78.4) | | | (2.2) | | | (47.0) | | | (84.9) | |

| Non-GAAP net income | $ | 202.8 | | | $ | 136.3 | | | $ | 613.5 | | | $ | 350.0 | |

| | | | | | | |

| GAAP net income | $ | 256.3 | | | $ | 91.8 | | | $ | 541.5 | | | $ | 341.2 | |

| Interest expense on senior convertible notes, net of tax | 3.0 | | | 2.8 | | | 12.6 | | | 11.0 | |

GAAP net income used for diluted EPS, if-converted (6) | $ | 259.3 | | | $ | 94.6 | | | $ | 554.1 | | | $ | 352.2 | |

| | | | | | | |

| Non-GAAP net income | $ | 202.8 | | | $ | 136.3 | | | $ | 613.5 | | | $ | 350.0 | |

| Interest expense on senior convertible notes, net of tax | 1.2 | | | 1.2 | | | 4.9 | | | 4.8 | |

Non-GAAP net income used for diluted EPS, if-converted (6) | $ | 204.0 | | | $ | 137.5 | | | $ | 618.4 | | | $ | 354.8 | |

DexCom, Inc.

Table E (Continued)

Itemized Reconciliation Between GAAP and Non-GAAP Financial Measures

(In millions, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

GAAP diluted net income per share (6) | $ | 0.62 | | | $ | 0.22 | | | $ | 1.30 | | | $ | 0.82 | |

Amortization of intangible assets (1) | 0.02 | | | 0.01 | | | 0.09 | | | 0.02 | |

Business transition and related costs (2) | — | | | 0.06 | | | 0.01 | | | 0.10 | |

Intellectual property litigation costs (3) | 0.03 | | | 0.05 | | | 0.19 | | | 0.11 | |

Income from equity investments (4) | — | | | — | | | — | | | — | |

Adjustments related to taxes (5) | (0.19) | | | (0.01) | | | (0.12) | | | (0.21) | |

Impact of adjustment to GAAP diluted shares (7) | 0.01 | | | — | | | 0.03 | | | 0.01 | |

Non-GAAP diluted net income per share (6) (8) | $ | 0.50 | | | $ | 0.34 | | | $ | 1.52 | | | $ | 0.87 | |

| | | | | | | |

| GAAP diluted weighted-average shares outstanding | 415.9 | | | 425.9 | | | 425.5 | | | 427.5 | |

| Non-GAAP diluted weighted-average shares outstanding | 406.6 | | | 407.0 | | | 407.3 | | | 408.6 | |

| | | | | | | |

| Reconciliation of non-GAAP diluted weighted-average shares outstanding: | | | | | | | |

| GAAP diluted weighted-average shares outstanding | 415.9 | | | 425.9 | | | 425.5 | | | 427.5 | |

Adjustment for dilutive impact of senior convertible notes due 2023 (9) | (1.6) | | | (18.9) | | | (13.1) | | | (18.9) | |

| | | | | | | |

Adjustment for dilutive impact of senior convertible notes due 2028 (9) | (7.7) | | | — | | | (5.1) | | | — | |

| Non-GAAP diluted weighted-average shares outstanding | 406.6 | | | 407.0 | | | 407.3 | | | 408.6 | |

(1) Represents amortization of acquired intangible assets.

(2) For the three and twelve months ended December 31, 2023, business transition and related costs are primarily related to rent for vacated office space in San Diego, California. For the three months ended December 31, 2022, business transition and related costs are primarily related to vacating a building in San Diego, resulting in a non-cash impairment charge of $23 million. For the twelve months ended December 31, 2022, business transition and related costs are primarily related to consulting fees and expenses as the result of transitioning to a flexible working environment, including an impairment charge and accelerated depreciation of tenant improvements.

(3) We have excluded third party attorney’s fees, costs, and expenses incurred by the Company exclusively in connection with the Company’s patent infringement litigation against Abbott Diabetes Care, Inc., as further described in the section titled “Legal Proceedings” appearing in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

(4) Represents a gain from the sale of an equity investment.

(5) For the three months ended December 31, 2023, tax adjustments are primarily related to the Verily sales-based milestone payment. For the twelve months ended December 31, 2023, tax adjustments are primarily related to the tax effect of non-GAAP adjustments, including the intra-entity transfer of certain intellectual property and excess tax benefits from share-based compensation for employees. For the three months ended December 31, 2022, tax adjustments are primarily related to the tax effect of non-GAAP adjustments. For the twelve months ended December 31, 2022, tax adjustments are primarily related to excess tax benefits recognized from share-based compensation for employees and the Verily regulatory milestone payment.

(6) When our senior convertible notes are dilutive on a GAAP or non-GAAP basis, net income used for calculating GAAP and non-GAAP diluted net income per share includes an interest expense add back, net of tax, under the if-converted method. In loss periods, basic and diluted net loss per share are the same since the effect of potential common shares is anti-dilutive and therefore excluded.

(7) The adjustments are for the transition from GAAP diluted net income per share to non-GAAP diluted net income per share due to our senior convertible notes.

(8) The sum of the non-GAAP per share components may not equal the totals due to rounding.

(9) We adjust for the dilutive effect of our senior convertible notes when the effect is not the same on a GAAP and non-GAAP basis for a given period.

ABOUT NON-GAAP FINANCIAL MEASURES

The accompanying press release dated February 8, 2024 contains non-GAAP financial measures. These non-GAAP financial measures include organic revenue, non-GAAP gross profit margin, non-GAAP operating income, non-GAAP operating margin, non-GAAP net income, non-GAAP diluted net income per share, and non-GAAP diluted weighted average shares outstanding, as well as adjusted EBITDA.

We use these non-GAAP financial measures for financial and operational decision making and as a means to evaluate period-to-period comparisons. We believe that they provide useful information about operating results, enhance the overall understanding of our operating performance and future prospects, and allow for greater transparency with respect to key metrics used by senior management in our financial and operational decision making. Our non-GAAP financial measures exclude amounts that we do not consider part of ongoing operating results when planning and forecasting and when assessing the performance of the organization and our senior management. We compute non-GAAP financial measures using the same consistent method from quarter to quarter and year to year. We may consider whether other significant items that arise in the future should be excluded from our non-GAAP financial measures.

We believe that non-GAAP measures have limitations in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with U.S. GAAP and that these measures should only be used to evaluate our results of operations in conjunction with the corresponding GAAP measures. We therefore report non-GAAP financial measures in addition to, and not as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. These non-GAAP financial measures are not based on any comprehensive set of accounting rules or principles, differ from GAAP measures with the same names, and may differ from non-GAAP financial measures with the same or similar names that are used by other companies. We believe that non-GAAP financial measures should only be used to evaluate our results of operations in conjunction with the corresponding GAAP financial measures. We encourage investors to carefully consider our results under GAAP, as well as our supplemental non-GAAP information and the reconciliations between these presentations, to more fully understand our business.

Management believes organic revenue is a meaningful metric to investors as it provides a more consistent comparison of the company’s revenue to prior periods as well as to industry peers. We exclude the following items from the non-GAAP financial measure for organic revenue:

•The effect of non-CGM revenue acquired or divested in the trailing twelve months.

•The effect of foreign currency fluctuations.

Management believes that the presentation of operating results that excludes these items provides useful supplemental information to investors and facilitates the analysis of our core operating results and comparison of operating results across reporting periods. Management also believes that this supplemental non-GAAP information is therefore useful to investors in analyzing and assessing our past and future operating performance.

Table E reconciles the non-GAAP financial measures in the press release to the most directly comparable financial measures prepared in accordance with GAAP.

We exclude the following items from non-GAAP financial measures for non-GAAP gross profit, non-GAAP operating income, non-GAAP operating margin, non-GAAP net income, and non-GAAP diluted net income per share:

•Amortization of acquired intangible assets

•Business transition and related costs associated with acquisition and divestiture, integration and business transition activities, including severance, relocation, consulting, leasehold exit costs, third party merger and acquisition costs, and other costs directly associated with such activities

•Income or loss from equity investments

•Third party intellectual property litigation costs in connection with the Company's patent infringement litigation against Abbott Diabetes Care, Inc.

•Litigation settlement costs

•Gain or loss on extinguishment of debt

•Adjustments related to taxes for the excluded items above, as well as excess benefits or tax deficiencies from stock-based compensation, and the quarterly impact of other discrete items

Adjusted EBITDA excludes non-cash operating charges for share-based compensation, depreciation and amortization as well as non-operating items such as interest income, interest expense, gain or loss on extinguishment of debt, income or loss from equity investments, and income tax expense or benefit. For the reasons explained above, adjusted EBITDA also excludes business transition and related costs, litigation settlement costs, and intellectual property litigation costs.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

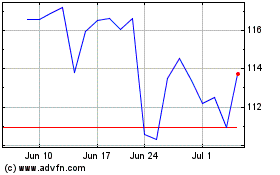

DexCom (NASDAQ:DXCM)

Historical Stock Chart

From Mar 2024 to Apr 2024

DexCom (NASDAQ:DXCM)

Historical Stock Chart

From Apr 2023 to Apr 2024