0001739942False00017399422024-02-082024-02-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

February 8, 2024

Date of Report (Date of earliest event reported)

SOLARWINDS CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| | | |

| Delaware | 001-38711 | 81-0753267 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

7171 Southwest Parkway

Building 400

Austin, Texas 78735

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (512) 682-9300

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Common Stock, $0.001 par value | SWI | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On February 8, 2024, SolarWinds Corporation (“SolarWinds”) issued a press release regarding, and will hold a conference call announcing, its financial results for the fiscal quarter and fiscal year ended December 31, 2023. A copy of SolarWinds' press release is attached hereto as Exhibit 99.1.

The information contained in this report shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section. The information in this report shall not be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

SolarWinds refers to non-GAAP financial information in both the press release and the conference call. A reconciliation of these non-GAAP financial measures to the comparable GAAP financial measures is contained in the attached press release.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

| | | | | | | | |

Exhibit

Number | | Description |

| | |

| | Press release issued by SolarWinds Corporation dated February 8, 2024. |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | SOLARWINDS CORPORATION |

| | | |

| Dated: | February 8, 2024 | By: | /s/ J. Barton Kalsu |

| | | J. Barton Kalsu |

| | | Chief Financial Officer |

| | | |

SolarWinds Announces Fourth Quarter and Full Year 2023 Results

AUSTIN, Texas - February 8, 2024 - SolarWinds Corporation (NYSE: SWI), a leading provider of simple, powerful, secure observability and IT management software, today reported results for its fourth quarter and full year ended December 31, 2023.

Fourth Quarter 2023 Financial Highlights

•Total revenue for the fourth quarter of $198.1 million, representing 6% year-over-year growth, and total recurring revenue representing 92% of total revenue.

•Net loss for the fourth quarter of $0.6 million.

•Adjusted EBITDA for the fourth quarter of $87.0 million, representing a margin of 44% of total revenue and 17% year-over-year growth.

Full Year 2023 Financial Highlights

•Total revenue for the full year of $758.7 million, representing 5% year-over-year growth, and total recurring revenue representing 92% of total revenue.

•Net loss for the full year of $9.1 million.

•Adjusted EBITDA for the full year of $328.6 million, representing a margin of 43% of total revenue and 17% year-over-year growth.

•Subscription Annual Recurring Revenue (ARR) of $233.2 million, representing year-over-year growth of 34%, and Total ARR of $684.1 million, representing year-over-year growth of 8%.

For a reconciliation of our GAAP to non-GAAP results, please see the tables below.

“We are pleased to finish the year with fourth quarter and full-year revenue and adjusted EBITDA results that exceeded our guidance, while also expanding our margins” said Sudhakar Ramakrishna, President and Chief Executive Officer of SolarWinds. “Our year-over-year growth in full-year revenue, total ARR, subscription revenue, and adjusted EBITDA represent significant progress towards the priorities we set forth at the beginning of 2023, including our subscription-first strategy, continued focus on customer success and retention, innovation on the SolarWinds Platform, and strong operating discipline. In 2024, we intend to accelerate the execution and progress towards our established priorities.”

Recent Business Highlights

•In October, SolarWinds announced findings from its Service Desk Customer Report, including that the average SolarWinds Service Desk customer saved 23 hours a week due to reduced ticket volumes.

•In November, SolarWinds announced SolarWinds Database Observability, which provides full visibility into databases to increase the performance, scalability, and efficiency of digital services and applications.

•At AWS re:Invent 2023, SolarWinds unveiled the latest enhancements to SolarWinds Observability, including support for OpenTelemetry, new Kubernetes® application-centric intelligence, and the addition of cloud-enabled open-source and No-SQL database observability capabilities.

•SolarWinds appeared in the Gartner Market Guide for IT Service Management Platforms, 2023 report and as a “Contender” for the first time in the Forrester Wave for Enterprise Service Management, 2023 report.

•SolarWinds received several industry awards and recognitions in the fourth quarter, including Tech Ascension DevOps Innovation of the Year; Business Intelligence Product of the Year for IT Service Management; IT Security Awards 2023 winner in the Cloud Security category for Secure by Design; Cloud Awards finalist for Best Hybrid Cloud Solution; Dev Insider 2023 Awards silver winner in the observability category; Public Relations Department of the Year in the BIG Public Relations & Marketing Excellence Awards; and IP Insider 2023 Awards gold winner in the network monitoring category.

•In January 2024, SolarWinds refinanced its first lien term loans and decreased the applicable margin for its secured overnight financing rate (“SOFR”) borrowings.

Balance Sheet

At December 31, 2023, total cash and cash equivalents and short-term investments were $289.2 million and total debt was $1.2 billion.

The financial results included in this press release are preliminary and pending final review by the company and its external auditors. Financial results will not be final until SolarWinds files its annual report on Form 10-K for the period. Information about SolarWinds' use of non-GAAP financial measures is provided below under “Non-GAAP Financial Measures.”

Financial Outlook

As of February 8, 2024, SolarWinds is providing its financial outlook for the first quarter and full year of 2024. The financial information below represents forward-looking non-GAAP financial information, including an estimate of adjusted EBITDA and non-GAAP diluted earnings per share. These non-GAAP financial measures exclude, among other items mentioned below, stock-based compensation expense and related employer-paid payroll taxes, amortization, certain expenses related to the cyberattack that occurred in December 2020 (the “Cyber Incident”), restructuring costs, and other costs related to non-recurring items. We have not reconciled our estimates of these non-GAAP financial measures to their most directly comparable GAAP measure as a result of uncertainty regarding, and the potential variability of, these excluded items in future periods. Accordingly, reconciliation is not available without unreasonable effort, although it is important to note that these excluded items could be material to our results computed in accordance with GAAP in future periods. Our reported results provide reconciliations of non-GAAP financial measures to their nearest GAAP equivalents.

Financial Outlook for First Quarter of 2024

SolarWinds’ management currently expects to achieve the following results for the first quarter of 2024:

•Total revenue in the range of $187 to $192 million, representing growth of approximately 2% over the first quarter of 2023 total revenue at the midpoint of the range.

•Adjusted EBITDA of approximately $81.5 to $84.5 million, representing growth of approximately 7% over the first quarter of 2023 adjusted EBITDA at the midpoint of the range.

•Non-GAAP diluted earnings per share of $0.20 to $0.22.

•Weighted average outstanding diluted shares of approximately 171.3 million.

Financial Outlook for Full Year of 2024

SolarWinds’ management currently expects to achieve the following results for the full year of 2024:

•Total revenue in the range of $771 to $786 million, representing growth of approximately 3% over the full year of 2023 total revenue at the midpoint of the range.

•Adjusted EBITDA of approximately $350 to $360 million, representing growth of approximately 8% over the full year of 2023 adjusted EBITDA at the midpoint of the range.

•Non-GAAP diluted earnings per share of $0.95 to $1.00.

•Weighted average outstanding diluted shares of approximately 173.2 million.

Additional details on the company's outlook will be provided on the conference call.

Conference Call and Webcast

In conjunction with this announcement, SolarWinds will host a conference call today to discuss its financial results, business, and business outlook at 7:30 a.m. CT (8:30 a.m. ET/5:30 a.m. PT). A live webcast of the call and materials presented during the call will be available on the SolarWinds Investor Relations website at http://investors.solarwinds.com. A live dial-in will be available domestically at +1 (888) 510-2008 and internationally at +1 (646) 960-0306. To access the live call, please dial in 5-10 minutes before the scheduled start time and enter the conference passcode 2975715. A replay of the webcast will be available on a temporary basis shortly after the event on the SolarWinds Investor Relations website.

Forward-Looking Statements

This press release contains “forward-looking” statements, which are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including statements regarding our financial outlook for the first quarter and the full year 2024. These forward-looking statements are based on management's beliefs and assumptions and on information currently available to management. Forward-looking statements include all statements that are not historical facts and may be identified by terms such as “aim,” “anticipate,” “believe,” “can,” “could,” “seek,” “should,” “feel,” “expect,” “will,” “would,” “plan,” “project,” “intend,” “estimate,” “continue,” “may,” or similar expressions and the negatives of those terms. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, the following: (a) risks related to the Cyber Incident, including with respect to (1) litigation and investigation risks related to the Cyber Incident, including as a result of the pending civil complaint filed by the Securities and Exchange Commission against us and our Chief Information Security Officer, including that we may incur significant costs in defending ourselves and may be unsuccessful in doing so, resulting in exposure to potential penalties, judgements, fines, settlement-related costs, and penalties and other costs and liabilities related thereto, (2) numerous financial, legal, reputational and other risks to us related to the Cyber Incident, including risks that the incident, SolarWinds’ response thereto or litigation related to the Cyber Incident may result in the loss of business as a result of termination or non-renewal of agreements, or reduced purchases or upgrades of our products, reputational damage adversely affecting customer, partner, and vendor relationships and investor confidence, increased attrition of personnel and distraction of key and other personnel, indemnity obligations, damages for contractual breach, penalties for violation of applicable laws or regulations, significant costs for remediation, and the incurrence of other liabilities and risks related to the impact of any such costs and liabilities, and (3) the possibility that our steps to secure our internal environment, improve our product development environment, and ensure the security and integrity of the software that we deliver to our customers may not be successful or sufficient to protect against future threat actors or attacks, or be perceived by existing and prospective customers as sufficient to address the harm caused by the Cyber Incident; (b) other risks related to cybersecurity, including that we may experience other security incidents or have vulnerabilities in our systems and services exploited, whether through the actions or inactions of our employees, our customers, insider threats, or otherwise, which may result in compromises or breaches of our and our customers’ systems, or theft or misappropriation of our and our customers’ confidential, proprietary, or personal information, as well as exposure to legal and other liabilities, including the related risk of higher customer, employee, and partner attrition and the loss of key personnel, as well as negative impacts to our sales, renewals, and upgrades; (c) risks related to the evolving breadth of our sales motion and challenges, investments, and additional costs associated with increased selling efforts toward enterprise customers and adopting a subscription-first approach; (d) risks relating to increased investments in, and the timing and success of, our ongoing transformation from monitoring to observability; (e) risks related to any shifts in our revenue mix and the timing of how we recognize revenue as we transition to subscription; (f) risks related to using artificial intelligence ("AI”) in our business and our solutions, including risks related to evolving regulation of artificial intelligence, machine learning, and the receipt, collection, storage, processing, and transfer of data as well as the threat of cyberattacks created through AI or leveraging AI; (g) potential foreign exchange gains and losses related to expenses and sales denominated in currencies other than the functional currency of an associated entity; (h) any of the following factors either generally or as a result of the impacts of global macroeconomic conditions, including the wars in Israel and Ukraine, geopolitical tensions involving China, disruptions in the global supply chain and energy markets, inflation, uncertainty over liquidity concerns in the broader financial services industry, foreign currency exchange rates, and the effects of the global COVID pandemic or other public health crisis on the global economy, or on our business operations and financial condition, or on the business operations and financial conditions of our customers, their end-customers, and our prospective customers: (1) reductions in information technology spending or delays in purchasing decisions by our customers, their end-customers, and our prospective customers, (2) the inability to sell products to new customers, or to sell additional products or upgrades to our existing customers, or to convert our maintenance customers to subscription products, (3) any decline in our renewal or net retention rates, or any delay or loss of U.S. government sales, (4) the inability to generate significant volumes of high quality sales leads from our digital marketing initiatives and convert such leads into new business at acceptable conversion rates, (5) the timing and adoption of new products, product upgrades, or pricing model changes by us or our competitors, (6) changes in interest rates, (7) risks associated with our international operations and any international expansion efforts, and (8) ongoing sanctions and export controls; (i) the possibility that our operating income could fluctuate and may decline as percentage of revenue as we make further expenditures to expand our infrastructure, product offerings, and sales motion in order to support additional growth in our business; (j) our ability to compete effectively in the markets we serve and the risks of increased competition as we enter new markets; (k) our ability to attract,

retain, and motivate employees; (l) any violation of legal and regulatory requirements or any misconduct by our employees or partners; (m) our inability to successfully identify, complete, and integrate acquisitions and manage our growth effectively; (n) risks associated with our status as a controlled company; and (o) such other risks and uncertainties described more fully in documents filed with or furnished to the Securities and Exchange Commission, including the risk factors discussed in our Annual Report on Form 10-K for the year ended December 31, 2022 filed on February 22, 2023, our Quarterly Reports on Form 10-Q, and our Annual Report on Form 10-K for the year ended December 31, 2023, that we anticipate filing on or before March 15, 2024. All information provided in this release is as of the date hereof and SolarWinds undertakes no duty to update this information except as required by law.

Non-GAAP Financial Measures

In addition to financial measures prepared in accordance with GAAP, we use certain non-GAAP financial measures to clarify and enhance our understanding, and aid in the period-to-period comparison, of our performance. We believe that these non-GAAP financial measures provide supplemental information that is meaningful when assessing our operating performance because they exclude the impact of certain amounts that our management and board of directors do not consider part of core operating results when assessing our operational performance, allocating resources, preparing annual budgets and determining compensation. Accordingly, these non-GAAP financial measures may provide insight to investors into the motivation and decision-making of management in operating the business.

SolarWinds also believes that investors and security analysts use these non-GAAP financial measures to (a) compare and evaluate its performance from period to period and (b) compare its performance to those of its competitors. These non-GAAP measures exclude certain items that can vary substantially from company to company depending upon their financing and accounting methods, the book value of their assets, their capital structures, and the method by which their assets were acquired.

There are limitations associated with the use of these non-GAAP financial measures. These non-GAAP financial measures are not prepared in accordance with GAAP, do not reflect a comprehensive system of accounting and may not be completely comparable to similarly titled measures of other companies due to potential differences in the exact method of calculation between companies. Certain items that are excluded from these non-GAAP financial measures can have a material impact on operating and net income (loss).

As a result, these non-GAAP financial measures have limitations and should not be considered in isolation from, or as a substitute for, the most comparable GAAP measures. SolarWinds' management and board of directors compensate for these limitations by using these non-GAAP financial measures as supplements to GAAP financial measures and by reviewing the reconciliations of the non-GAAP financial measures to their most comparable GAAP financial measure. Set forth in the tables below are the corresponding GAAP financial measures for each non-GAAP financial measure presented. Investors are encouraged to review the reconciliations of these non-GAAP financial measures to their most comparable GAAP financial measures that are set forth in the tables below.

Non-GAAP Revenue on a Constant Currency Basis. We provide non-GAAP revenue on a constant currency basis to provide a framework for assessing our performance excluding the effect of foreign currency rate fluctuations. To present this information, current period results for entities reporting in currencies other than U.S. Dollars are converted into U.S. Dollars at the average exchange rates in effect during the corresponding prior period presented. We believe that providing non-GAAP revenue on a constant currency basis facilitates the comparison of revenue to prior periods.

Non-GAAP Cost of Revenue and Non-GAAP Operating Income. We provide non-GAAP cost of revenue and non-GAAP operating income and related non-GAAP margins excluding such items as amortization of acquired intangible assets, stock-based compensation expense and related employer-paid payroll taxes, acquisition and other costs, restructuring costs, Cyber Incident costs, and goodwill and indefinite-lived asset impairment. Management believes these measures are useful for the following reasons:

•Amortization of Acquired Intangible Assets. We provide non-GAAP information that excludes expenses related to purchased intangible assets associated with our acquisitions, including our acquired technologies. We believe that eliminating this expense from our non-GAAP measures is useful to investors, because the amortization of acquired intangible assets can be inconsistent in amount and frequency and is significantly impacted by the timing and magnitude of our acquisition transactions, which also vary in frequency from

period to period. Accordingly, we analyze the performance of our operations in each period without regard to such expenses.

•Stock-Based Compensation Expense and Related Employer-Paid Payroll Taxes. We provide non-GAAP information that excludes expenses related to stock-based compensation and related employer-paid payroll taxes. We believe that the exclusion of stock-based compensation expense provides for a better comparison of our operating results to prior periods and to our peer companies as the calculations of stock-based compensation vary from period to period and company to company due to different valuation methodologies, subjective assumptions, and the variety of award types. Employer-paid payroll taxes on stock-based compensation is dependent on our stock price and the timing of the taxable events related to the equity awards, over which our management has little control, and does not correlate to the core operation of our business. Because of these unique characteristics of stock-based compensation and related employer-paid payroll taxes, management excludes these expenses when analyzing the organization’s business performance.

•Acquisition and Other Costs. We exclude certain expense items resulting from acquisitions, such as legal, accounting and advisory fees, changes in fair value of contingent consideration, costs related to integrating the acquired businesses, deferred compensation, severance, and retention expense. In addition, we exclude certain other non-recurring costs, including internal investigation costs. We consider these adjustments, to some extent, to be unpredictable and dependent on a significant number of factors that are outside of our control. Furthermore, acquisitions result in operating expenses that would not otherwise have been incurred by us in the normal course of our organic business operations. We believe that providing these non-GAAP measures that exclude acquisition and other costs, allows users of our financial statements to better review and understand the historical and current results of our operations, and also facilitates comparisons to our historical results and results of less acquisitive peer companies, both with and without such adjustments.

•Restructuring Costs. We provide non-GAAP information that excludes restructuring costs, such as severance, lease impairments and other costs incurred in connection with the exiting of certain leased facilities, and other contracts as they relate to our corporate restructuring and exit activities, and costs related to the separation of employment with executives of the Company. These costs are inconsistent in amount and are significantly impacted by the timing and nature of these events. Therefore, although we may incur these types of expenses in the future, we believe that eliminating these costs for purposes of calculating the non-GAAP financial measures facilitates a more meaningful evaluation of our operating performance and comparisons to our past operating performance.

•Cyber Incident Costs. We exclude certain expenses resulting from the Cyber Incident. Expenses include costs to investigate and remediate the Cyber Incident, costs of lawsuits and investigations related thereto, including settlement costs and legal and other professional services, consulting services being provided to customers at no charge, and estimated loss contingencies. Cyber Incident costs are provided net of expected and received insurance reimbursements, although the timing of recognizing insurance reimbursements has differed from the timing of recognizing the associated expenses. We expect to incur significant legal and other professional services expenses associated with the Cyber Incident in future periods. The Cyber Incident results in operating expenses that would not have otherwise been incurred by us in the normal course of our organic business operations. We believe that providing non-GAAP measures that exclude these costs facilitates a more meaningful evaluation of our operating performance and comparisons to our past operating performance. We continue to invest significantly in cybersecurity and expect to make additional investments. These investments are in addition to the Cyber Incident costs and not included in the net Cyber Incident costs reported.

•Goodwill and Indefinite-Lived Intangible Asset Impairment. We provide non-GAAP information that excludes non-cash goodwill and indefinite-lived intangible asset impairment charges. We believe that providing these non-GAAP measures that exclude these non-cash impairment charges allows users of our financial statements to better review and understand our historical and current operating results. In addition, as a significant portion of our goodwill and indefinite-lived intangible assets were derived from the February 2016 take-private transaction, providing these non-GAAP measures that exclude these impairment charges facilitates comparisons to our peers who may not have undertaken a transformational acquisition resulting in significant goodwill and indefinite-lived intangible assets.

Non-GAAP Net Income (Loss) and Non-GAAP Net Income (Loss) Per Diluted Share. We believe that the use of non-GAAP net income (loss) and non-GAAP net income (loss) per diluted share is helpful to our investors to clarify and enhance their understanding of past performance and future prospects. Non-GAAP net income (loss) is calculated as net income (loss) excluding the adjustments to non-GAAP cost of revenue and non-GAAP operating income, certain other non-operating gains and losses and the income tax effect of the non-GAAP exclusions. We define non-GAAP net income (loss) per diluted share as non-GAAP net income (loss) divided by the weighted average outstanding diluted common shares.

Adjusted EBITDA and Adjusted EBITDA Margin. We regularly monitor adjusted EBITDA and adjusted EBITDA margin, as it is a measure we use to assess our operating performance. We define adjusted EBITDA as net income (loss), excluding amortization of acquired intangible assets and developed technology, depreciation expense, stock-based compensation expense and related employer-paid payroll taxes, restructuring costs, acquisition and other costs, Cyber Incident costs, net, goodwill and indefinite-lived intangible asset impairment, interest expense, net, debt-related costs including fees related to our credit agreements, debt extinguishment and refinancing costs, unrealized foreign currency (gains) losses, and income tax expense (benefit). We define adjusted EBITDA margin as adjusted EBITDA divided by total revenue. Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are: although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements; adjusted EBITDA excludes the impact of restructuring impairment charges related to exited leased facilities which may continue to require future cash rent payments; adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; adjusted EBITDA does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debt; adjusted EBITDA does not reflect tax payments that may represent a reduction in cash available to us; and other companies, including companies in our industry, may calculate adjusted EBITDA differently, which reduces its usefulness as a comparative measure.

Unlevered Free Cash Flow. Unlevered free cash flow is a measure of our liquidity used by management to evaluate cash flow from operations, after the deduction of capital expenditures and prior to the impact of our capital structure, acquisition and other costs, restructuring costs, Cyber Incident costs, net, employer-paid payroll taxes on stock awards and other one-time items, that can be used by us for strategic opportunities and strengthening our balance sheet. However, given our debt obligations, unlevered free cash flow does not represent residual cash flow available for discretionary expenses.

Other Defined Terms

Subscription Annual Recurring Revenue (Subscription ARR). Subscription ARR represents the annualized recurring value of all active subscription contracts at the end of a reporting period.

Total Annual Recurring Revenue (Total ARR). Total ARR represents the sum of Subscription ARR and the annualized value of all maintenance contracts related to perpetual licenses active at the end of a reporting period.

We use Subscription ARR and Total ARR to better understand and assess the performance of our business, as our mix of revenue generated from recurring revenue has increased in recent years. Subscription ARR and Total ARR each provides a normalized view of customer retention, renewal and expansion, as well as growth from new customers. Subscription ARR and Total ARR should each be viewed independently of revenue and deferred revenue and are not intended to be combined with or to replace either of those items.

#SWIfinancials

About SolarWinds

SolarWinds (NYSE:SWI) is a leading provider of simple, powerful, secure observability and IT management software built to enable customers to accelerate their digital transformation. Our solutions provide organizations worldwide—regardless of type, size, or complexity—with a comprehensive and unified view of today’s modern, distributed, and hybrid network environments. We continuously engage IT service and operations professionals, DevOps and SecOps professionals, and Database Administrators (DBAs) to understand the challenges they face in maintaining high-performing and highly available IT infrastructures, applications, and environments. The insights we gain from them, in places like our THWACK® community, allow us to address customers’ needs now, and in the

future. Our focus on the user and our commitment to excellence in end-to-end hybrid IT management have established SolarWinds as a worldwide leader in solutions for observability, IT service management, application performance, and database management. Learn more today at www.solarwinds.com.

The SolarWinds, SolarWinds & Design, Orion, and THWACK trademarks are the exclusive property of SolarWinds Worldwide, LLC or its affiliates, are registered with the U.S. Patent and Trademark Office, and may be registered or pending registration in other countries. All other SolarWinds trademarks, service marks, and logos may be common law marks or are registered or pending registration. All other trademarks mentioned herein are used for identification purposes only and are trademarks of (and may be registered trademarks of) their respective companies.

© 2024 SolarWinds Worldwide, LLC. All rights reserved.

CONTACTS:

| | | | | |

| Media: | Investors: |

Jenne Barbour

Phone: 512.498.6804

Media: pr@solarwinds.com | Tim Karaca

Phone: 512.498.6739

Investors: ir@solarwinds.com |

SolarWinds Corporation

Consolidated Balance Sheets

(In thousands, except share and per share information)

(Unaudited)

| | | | | | | | | | | |

| December 31, |

| 2023 | | 2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 284,695 | | | $ | 121,738 | |

| Short-term investments | 4,477 | | | 27,114 | |

| Accounts receivable, net of allowances of $743 and $1,173 as of December 31, 2023 and 2022, respectively | 103,455 | | | 100,204 | |

| Income tax receivable | 459 | | | 987 | |

| | | |

| Prepaid and other current assets | 28,241 | | | 57,350 | |

| | | |

| Total current assets | 421,327 | | | 307,393 | |

| Property and equipment, net | 19,669 | | | 26,634 | |

| Operating lease assets | 43,776 | | | 61,418 | |

| Deferred taxes | 133,224 | | | 134,922 | |

| Goodwill | 2,397,545 | | | 2,380,059 | |

| Intangible assets, net | 183,688 | | | 243,980 | |

| Other assets, net | 51,686 | | | 45,600 | |

| | | |

| Total assets | $ | 3,250,915 | | | $ | 3,200,006 | |

| Liabilities and stockholders’ equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 9,701 | | | $ | 14,045 | |

| Accrued liabilities and other | 56,643 | | | 68,284 | |

| Current operating lease liabilities | 14,925 | | | 15,005 | |

| | | |

| Accrued interest payable | 942 | | | 579 | |

| Income taxes payable | 29,240 | | | 11,841 | |

| Current portion of deferred revenue | 344,907 | | | 337,541 | |

| Current debt obligation | 12,450 | | | 9,338 | |

| | | |

| Total current liabilities | 468,808 | | | 456,633 | |

| Long-term liabilities: | | | |

| Deferred revenue, net of current portion | 42,070 | | | 38,945 | |

| Non-current deferred taxes | 1,933 | | | 8,582 | |

| Non-current operating lease liabilities | 49,848 | | | 59,235 | |

| Other long-term liabilities | 55,278 | | | 74,193 | |

| Long-term debt, net of current portion | 1,190,934 | | | 1,192,765 | |

| | | |

| Total liabilities | 1,808,871 | | | 1,830,353 | |

| Commitments and contingencies | | | |

| Stockholders’ equity: | | | |

| Common stock, $0.001 par value: 1,000,000,000 shares authorized and 166,637,506 and 161,928,532 shares issued and outstanding as of December 31, 2023 and 2022, respectively | 167 | | | 162 | |

| Preferred stock, $0.001 par value: 50,000,000 shares authorized and no shares issued and outstanding as of December 31, 2023 and 2022, respectively | — | | | — | |

| Additional paid-in capital | 2,688,854 | | | 2,627,370 | |

Accumulated other comprehensive loss | (28,103) | | | (48,114) | |

| Accumulated deficit | (1,218,874) | | | (1,209,765) | |

| Total stockholders’ equity | 1,442,044 | | | 1,369,653 | |

| Total liabilities and stockholders’ equity | $ | 3,250,915 | | | $ | 3,200,006 | |

SolarWinds Corporation

Consolidated Statements of Operations

(In thousands, except per share information)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue: | | | | | | | |

| Subscription | $ | 67,726 | | | $ | 49,701 | | | $ | 234,236 | | | $ | 167,676 | |

| Maintenance | 115,123 | | | 115,053 | | | 462,072 | | | 458,901 | |

| Total recurring revenue | 182,849 | | | 164,754 | | | 696,308 | | | 626,577 | |

| License | 15,290 | | | 22,315 | | | 62,432 | | | 92,790 | |

| Total revenue | 198,139 | | | 187,069 | | | 758,740 | | | 719,367 | |

| Cost of revenue: | | | | | | | |

| Cost of recurring revenue | 18,752 | | | 17,994 | | | 73,636 | | | 67,848 | |

| Amortization of acquired technologies | 3,096 | | | 3,632 | | | 13,369 | | | 28,135 | |

| Total cost of revenue | 21,848 | | | 21,626 | | | 87,005 | | | 95,983 | |

| Gross profit | 176,291 | | | 165,443 | | | 671,735 | | | 623,384 | |

| Operating expenses: | | | | | | | |

| Sales and marketing | 63,836 | | | 67,274 | | | 249,265 | | | 257,746 | |

| Research and development | 24,993 | | | 24,238 | | | 100,173 | | | 92,330 | |

| General and administrative | 32,596 | | | 32,956 | | | 123,716 | | | 149,461 | |

| Amortization of acquired intangibles | 11,496 | | | 12,938 | | | 48,208 | | | 52,325 | |

| Goodwill impairment | — | | | — | | | — | | | 891,101 | |

| Total operating expenses | 132,921 | | | 137,406 | | | 521,362 | | | 1,442,963 | |

| Operating income (loss) | 43,370 | | | 28,037 | | | 150,373 | | | (819,579) | |

| Other income (expense): | | | | | | | |

| Interest expense, net | (28,510) | | | (25,705) | | | (115,848) | | | (83,374) | |

Other expense, net | (189) | | | (3,213) | | | (386) | | | (5,074) | |

| Total other expense | (28,699) | | | (28,918) | | | (116,234) | | | (88,448) | |

Income (loss) before income taxes | 14,671 | | | (881) | | | 34,139 | | | (908,027) | |

Income tax expense | 15,247 | | | 9,530 | | | 43,248 | | | 21,386 | |

| Net loss | $ | (576) | | | $ | (10,411) | | | $ | (9,109) | | | $ | (929,413) | |

Net loss available to common stockholders | $ | (576) | | | $ | (10,411) | | | $ | (9,109) | | | $ | (929,413) | |

Net loss available to common stockholders per share: | | | | | | | |

| Basic loss per share | $ | — | | | $ | (0.06) | | | $ | (0.06) | | | $ | (5.78) | |

| Diluted loss per share | $ | — | | | $ | (0.06) | | | $ | (0.06) | | | $ | (5.78) | |

Weighted-average shares used to compute net loss available to common stockholders per share: | | | | | | | |

Shares used in computation of basic loss per share | 166,239 | | | 161,721 | | | 164,631 | | | 160,841 | |

Shares used in computation of diluted loss per share | 166,239 | | | 161,721 | | | 164,631 | | | 160,841 | |

SolarWinds Corporation

Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | |

| | | Twelve Months Ended December 31, |

| | | | | 2023 | | 2022 |

| Cash flows from operating activities | | | | | | | |

Net loss | | | | | $ | (9,109) | | | $ | (929,413) | |

Adjustments to reconcile net loss to net cash provided by operating activities: | | | | | | | |

| Depreciation and amortization | | | | | 82,198 | | | 94,981 | |

| Goodwill and indefinite-lived intangible asset impairment | | | | | — | | | 906,350 | |

| Provision for losses on accounts receivable | | | | | (389) | | | 951 | |

| Stock-based compensation expense | | | | | 75,727 | | | 67,050 | |

| | | | | | | |

| Amortization of debt issuance costs | | | | | 10,718 | | | 9,056 | |

| Loss on extinguishment of debt | | | | | — | | | 3,822 | |

| | | | | | | |

| Deferred taxes | | | | | (1,140) | | | (6,741) | |

| | | | | | | |

| | | | | | | |

| (Gain) loss on foreign currency exchange rates | | | | | (14) | | | 1,525 | |

Lease impairment charges | | | | | 11,392 | | | — | |

| Other non-cash (benefits) expenses | | | | | 192 | | | (30) | |

| Changes in operating assets and liabilities, net of assets acquired and liabilities assumed in business combinations: | | | | | | | |

| Accounts receivable | | | | | (1,568) | | | (6,846) | |

| Income taxes receivable | | | | | 539 | | | 99 | |

| Prepaid and other assets | | | | | 29,391 | | | (28,898) | |

| Accounts payable | | | | | (4,357) | | | 6,751 | |

| Accrued liabilities and other | | | | | (15,339) | | | 25,759 | |

| Accrued interest payable | | | | | 362 | | | 426 | |

| Income taxes payable | | | | | (1,616) | | | (9,290) | |

| Deferred revenue | | | | | 6,389 | | | 19,689 | |

| Other long-term liabilities | | | | | 89 | | | (735) | |

Net cash provided by operating activities | | | | | 183,465 | | | 154,506 | |

| Cash flows from investing activities | | | | | | | |

| Purchases of investments | | | | | (8,388) | | | (67,133) | |

| Maturities of investments | | | | | 30,535 | | | 39,633 | |

| Purchases of property and equipment | | | | | (4,353) | | | (7,463) | |

Capitalized software development costs | | | | | (13,674) | | | (13,037) | |

| Purchases of intangible assets | | | | | (244) | | | (250) | |

| Acquisitions, net of cash acquired | | | | | — | | | (6,500) | |

| | | | | | | |

| Other investing activities | | | | | 564 | | | 437 | |

Net cash provided by (used in) investing activities | | | | | 4,440 | | | (54,313) | |

| Cash flows from financing activities | | | | | | | |

| | | | | | | |

| | | | | | | |

| Proceeds from issuance of common stock under employee stock purchase plan | | | | | 3,377 | | | 3,151 | |

| Repurchase of common stock and incentive restricted stock | | | | | (18,830) | | | (11,130) | |

| Exercise of stock options | | | | | 143 | | | 59 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Repayments of borrowings from credit agreement | | | | | (9,338) | | | (664,350) | |

| Payment of debt issuance costs | | | | | — | | | (36,925) | |

| | | | | | | |

Net cash used in financing activities | | | | | (24,648) | | | (709,195) | |

Effect of exchange rate changes on cash and cash equivalents | | | | | (300) | | | (1,376) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | |

| | | Twelve Months Ended December 31, |

| | | | | 2023 | | 2022 |

| Net increase (decrease) in cash and cash equivalents | | | | | 162,957 | | | (610,378) | |

| Cash and cash equivalents | | | | | | | |

| Beginning of period | | | | | 121,738 | | | 732,116 | |

| End of period | | | | | $ | 284,695 | | | $ | 121,738 | |

| | | | | | | |

| Supplemental disclosure of cash flow information | | | | | | | |

| Cash paid for interest | | | | | $ | 111,861 | | | $ | 79,614 | |

| Cash paid for income taxes | | | | | $ | 40,964 | | | $ | 33,117 | |

| | | | | | | |

| Non-cash investing and financing transactions | | | | | | | |

| Stock-based compensation included in capitalized software development costs | | | | | $ | 1,246 | | | $ | 1,171 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

SolarWinds Corporation

Reconciliation of GAAP to Non-GAAP Financial Measures

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| (in thousands, except margin and per share data) |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| GAAP cost of revenue | $ | 21,848 | | | $ | 21,626 | | | $ | 87,005 | | | $ | 95,983 | |

| Stock-based compensation expense and related employer-paid payroll taxes | (496) | | | (491) | | | (2,085) | | | (2,077) | |

| Amortization of acquired technologies | (3,096) | | | (3,632) | | | (13,369) | | | (28,135) | |

| | | | | | | |

| | | | | | | |

| Restructuring costs | — | | | — | | | (377) | | | — | |

| Cyber Incident costs | — | | | (9) | | | — | | | (178) | |

| Non-GAAP cost of revenue | $ | 18,256 | | | $ | 17,494 | | | $ | 71,174 | | | $ | 65,593 | |

| | | | | | | |

| GAAP gross profit | $ | 176,291 | | | $ | 165,443 | | | $ | 671,735 | | | $ | 623,384 | |

| | | | | | | |

| Stock-based compensation expense and related employer-paid payroll taxes | 496 | | | 491 | | | 2,085 | | | 2,077 | |

| Amortization of acquired technologies | 3,096 | | | 3,632 | | | 13,369 | | | 28,135 | |

| | | | | | | |

| | | | | | | |

| Restructuring costs | — | | | — | | | 377 | | | — | |

| Cyber Incident costs | — | | | 9 | | | — | | | 178 | |

| Non-GAAP gross profit | $ | 179,883 | | | $ | 169,575 | | | $ | 687,566 | | | $ | 653,774 | |

| GAAP gross margin | 89.0 | % | | 88.4 | % | | 88.5 | % | | 86.7 | % |

| Non-GAAP gross margin | 90.8 | % | | 90.6 | % | | 90.6 | % | | 90.9 | % |

| | | | | | | |

| GAAP sales and marketing expense | $ | 63,836 | | | $ | 67,274 | | | $ | 249,265 | | | $ | 257,746 | |

| Stock-based compensation expense and related employer-paid payroll taxes | (7,482) | | | (5,810) | | | (26,444) | | | (22,597) | |

| Acquisition and other costs | (12) | | | — | | | (225) | | | — | |

| | | | | | | |

| Restructuring costs | — | | | — | | | (2,857) | | | (163) | |

| Cyber Incident costs | — | | | — | | | — | | | (130) | |

| Non-GAAP sales and marketing expense | $ | 56,342 | | | $ | 61,464 | | | $ | 219,739 | | | $ | 234,856 | |

| | | | | | | |

| GAAP research and development expense | $ | 24,993 | | | $ | 24,238 | | | $ | 100,173 | | | $ | 92,330 | |

| Stock-based compensation expense and related employer-paid payroll taxes | (1,887) | | | (2,860) | | | (11,659) | | | (11,230) | |

| | | | | | | |

| | | | | | | |

| Restructuring costs | (148) | | | — | | | (2,093) | | | — | |

| Cyber Incident costs | — | | | — | | | — | | | (2) | |

| Non-GAAP research and development expense | $ | 22,958 | | | $ | 21,378 | | | $ | 86,421 | | | $ | 81,098 | |

| | | | | | | |

| GAAP general and administrative expense | $ | 32,596 | | | $ | 32,956 | | | $ | 123,716 | | | $ | 149,461 | |

| Stock-based compensation expense and related employer-paid payroll taxes | (10,951) | | | (7,391) | | | (37,215) | | | (32,117) | |

| Acquisition and other costs | (672) | | | (108) | | | (2,387) | | | (540) | |

| | | | | | | |

| Restructuring costs | 114 | | | (90) | | | (14,921) | | | (1,400) | |

| Cyber Incident costs, net | (2,205) | | | (5,931) | | | 2,084 | | | (25,923) | |

| Goodwill and indefinite-lived intangible asset impairment | — | | | — | | | — | | | (15,249) | |

| Non-GAAP general and administrative expense | $ | 18,882 | | | $ | 19,436 | | | $ | 71,277 | | | $ | 74,232 | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| (in thousands, except margin and per share data) |

| GAAP operating expenses | $ | 132,921 | | | $ | 137,406 | | | $ | 521,362 | | | $ | 1,442,963 | |

| Stock-based compensation expense and related employer-paid payroll taxes | (20,320) | | | (16,061) | | | (75,318) | | | (65,944) | |

| Amortization of acquired intangibles | (11,496) | | | (12,938) | | | (48,208) | | | (52,325) | |

| Acquisition and other costs | (684) | | | (108) | | | (2,612) | | | (540) | |

| | | | | | | |

| Restructuring costs | (34) | | | (90) | | | (19,871) | | | (1,563) | |

| Cyber Incident costs, net | (2,205) | | | (5,931) | | | 2,084 | | | (26,055) | |

| Goodwill and indefinite-lived intangible asset impairment | — | | | — | | | — | | | (906,350) | |

| Non-GAAP operating expenses | $ | 98,182 | | | $ | 102,278 | | | $ | 377,437 | | | $ | 390,186 | |

| | | | | | | |

| GAAP operating income (loss) | $ | 43,370 | | | $ | 28,037 | | | $ | 150,373 | | | $ | (819,579) | |

| | | | | | | |

| Stock-based compensation expense and related employer-paid payroll taxes | 20,816 | | | 16,552 | | | 77,403 | | | 68,021 | |

| Amortization of acquired technologies | 3,096 | | | 3,632 | | | 13,369 | | | 28,135 | |

| Amortization of acquired intangibles | 11,496 | | | 12,938 | | | 48,208 | | | 52,325 | |

| Acquisition and other costs | 684 | | | 108 | | | 2,612 | | | 540 | |

| | | | | | | |

| Restructuring costs | 34 | | | 90 | | | 20,248 | | | 1,563 | |

| Cyber Incident costs, net | 2,205 | | | 5,940 | | | (2,084) | | | 26,233 | |

| Goodwill and indefinite-lived intangible asset impairment | — | | | — | | | — | | | 906,350 | |

| Non-GAAP operating income | $ | 81,701 | | | $ | 67,297 | | | $ | 310,129 | | | $ | 263,588 | |

| GAAP operating margin | 21.9 | % | | 15.0 | % | | 19.8 | % | | (113.9) | % |

| Non-GAAP operating margin | 41.2 | % | | 36.0 | % | | 40.9 | % | | 36.6 | % |

| | | | | | | |

GAAP net loss | $ | (576) | | | $ | (10,411) | | | $ | (9,109) | | | $ | (929,413) | |

| | | | | | | |

| Stock-based compensation expense and related employer-paid payroll taxes | 20,816 | | | 16,552 | | | 77,403 | | | 68,021 | |

| Amortization of acquired technologies | 3,096 | | | 3,632 | | | 13,369 | | | 28,135 | |

| Amortization of acquired intangibles | 11,496 | | | 12,938 | | | 48,208 | | | 52,325 | |

| Acquisition and other costs | 684 | | | 108 | | | 2,612 | | | 540 | |

| | | | | | | |

| Restructuring costs | 34 | | | 90 | | | 20,248 | | | 1,523 | |

| Cyber Incident costs, net | 2,205 | | | 5,940 | | | (2,084) | | | 26,233 | |

| Goodwill and indefinite-lived intangible asset impairment | — | | | — | | | — | | | 906,350 | |

| Loss on extinguishment of debt | — | | | 1,892 | | | — | | | 3,822 | |

| | | | | | | |

Tax (benefits) expense associated with above adjustments | 1,729 | | | (560) | | | (6,201) | | | (23,708) | |

| Non-GAAP net income | $ | 39,484 | | | $ | 30,181 | | | $ | 144,446 | | | $ | 133,828 | |

| | | | | | | |

| | | | | | | |

GAAP diluted loss per share | $ | — | | | $ | (0.06) | | | $ | (0.06) | | | $ | (5.78) | |

| Non-GAAP diluted earnings per share | $ | 0.24 | | | $ | 0.19 | | | $ | 0.88 | | | $ | 0.83 | |

Reconciliation of GAAP Net Income (Loss) to Adjusted EBITDA

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| (in thousands, except margin data) |

| Net loss | $ | (576) | | | $ | (10,411) | | | $ | (9,109) | | | $ | (929,413) | |

| Amortization and depreciation | 19,387 | | | 20,874 | | | 80,023 | | | 94,981 | |

Income tax expense | 15,247 | | | 9,530 | | | 43,248 | | | 21,386 | |

| Interest expense, net | 28,510 | | | 25,705 | | | 115,848 | | | 83,374 | |

| | | | | | | |

| Unrealized foreign currency (gains) losses | 600 | | | 2,423 | | | (14) | | | 1,525 | |

| Acquisition and other costs | 684 | | | 108 | | | 2,612 | | | 540 | |

| | | | | | | |

Debt-related costs(1) | 99 | | | 3,687 | | | 400 | | | 5,909 | |

| Stock-based compensation expense and related employer-paid payroll taxes | 20,816 | | | 16,552 | | | 77,403 | | | 68,021 | |

Restructuring costs(2) | 34 | | | 90 | | | 20,248 | | | 1,523 | |

| Cyber Incident costs, net | 2,205 | | | 5,940 | | | (2,084) | | | 26,233 | |

| Goodwill and indefinite-lived intangible asset impairment | — | | | — | | | — | | | 906,350 | |

| Adjusted EBITDA | $ | 87,006 | | | $ | 74,498 | | | $ | 328,575 | | | $ | 280,429 | |

| Adjusted EBITDA margin | 43.9 | % | | 39.8 | % | | 43.3 | % | | 39.0 | % |

________

(1)Debt-related costs for the three and twelve months ended December 31, 2022 include losses on extinguishments of debt of $1.9 million and $3.8 million, respectively.

(2)Restructuring costs for the twelve months ended December 31, 2023 includes $13.6 million of non-cash lease impairment and other accelerated depreciation expense incurred in connection with the exiting of certain leased facilities.

Reconciliation of Revenue to Non-GAAP Revenue

on a Constant Currency Basis

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| | 2023 | | 2022 | | Growth Rate | | 2023 | | 2022 | | Growth Rate |

| | | | | | | | | | | |

| (in thousands, except percentages) |

| Total GAAP revenue | $ | 198,139 | | | $ | 187,069 | | | 5.9 | % | | $ | 758,740 | | | $ | 719,367 | | | 5.5 | % |

Estimated foreign currency impact(1) | (1,499) | | | — | | | (0.8) | | | (1,703) | | | — | | | (0.2) | |

| Non-GAAP total revenue on a constant currency basis | $ | 196,640 | | | $ | 187,069 | | | 5.1 | % | | $ | 757,037 | | | $ | 719,367 | | | 5.2 | % |

________

(1)The estimated foreign currency impact is calculated using the average foreign currency exchange rates in the comparable prior year monthly periods and applying those rates to foreign-denominated revenue in the corresponding monthly periods in the three and twelve months ended December 31, 2023.

Reconciliation of Unlevered Free Cash Flow

(Unaudited)

| | | | | | | | | | | | | | | |

| | | | Twelve Months Ended December 31, |

| | | | | | 2023 | | 2022 |

| | | | | | | |

| | | | | (in thousands) |

Net cash provided by operating activities | | | | | $ | 183,465 | | | $ | 154,506 | |

Capital expenditures(1) | | | | | (18,271) | | | (20,750) | |

| Free cash flow | | | | | 165,194 | | | 133,756 | |

| Cash paid for interest and other debt related items | | | | | 105,168 | | | 75,978 | |

| Cash paid for acquisition and other costs, restructuring costs, Cyber Incident costs, net, employer-paid payroll taxes on stock awards and other one-time items | | | | | 13,194 | | | 33,498 | |

| Unlevered free cash flow (excluding forfeited tax shield) | | | | | 283,556 | | | 243,232 | |

Forfeited tax shield related to interest payments(2) | | | | | (29,084) | | | (19,505) | |

| Unlevered free cash flow | | | | | $ | 254,472 | | | $ | 223,727 | |

_______________

(1)Includes purchases of property and equipment, capitalized software development costs and purchases of intangible assets.

(2)Forfeited tax shield related to interest payments assumes a statutory rate of 26.0% for the twelve months ended December 31, 2023 and 24.5% for the twelve months ended December 31, 2022.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

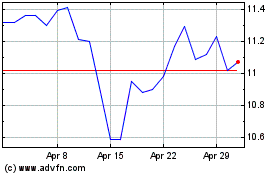

SolarWinds (NYSE:SWI)

Historical Stock Chart

From Mar 2024 to Apr 2024

SolarWinds (NYSE:SWI)

Historical Stock Chart

From Apr 2023 to Apr 2024