Prairie Operating Co. Expands Core Asset Base

February 05 2024 - 4:10PM

Prairie Operating Co. (Nasdaq: PROP; the “Company” or “Prairie”)

today announced that it has acquired a 1,280 acre drillable spacing

unit (“DSU”) and eight fully permitted proven undeveloped (“PUD”)

drilling locations in the DJ Basin, from a private seller, for

$900,000.

The strategic acquisition of the 1,280 acre DSU

and eight permitted PUDs, when added to the 62 PUDs the Company

expects to acquire from Nickel Road Operating LLC (“NRO”), would

expand Prairie’s permitted drilling inventory to 70 wells.(1) The

oil and gas leases offset Prairie’s existing acreage position in

northern Weld County, Colorado, adding over 2.6 MMboe in reserves

and approximately $40 million in PV10 value to Prairie’s existing

DJ Basin portfolio.(2) The PUDs are also liquids rich, offset by

Niobrara developments yielding 75% oil / 85% liquids, and near

existing midstream infrastructure.

“This acquisition is a prime example of our

commitment to disciplined and opportunistic growth.” stated Ed

Kovalik, Chairman and CEO. “Adding additional drill ready

locations expands our total proven reserves and creates immediate

value for the Company."

- On a pro forma basis following the closing of the NRO

acquisition expected in the first half of this year.

- According to an independent, third-party reserve report of the

newly acquired assets by Cawley, Gillespie & Associates, Inc.

(“CG&A”) using SEC pricing as of December 31, 2023 and an

effective date of February 1, 2024 for the leasehold

acquisition.

About Prairie Operating Co.

Prairie Operating Co. (Nasdaq: PROP) is a

Houston-based publicly traded independent energy company engaged in

the development and acquisition of proven, producing oil and

natural gas resources in the United States. The Company’s

assets and operations are concentrated in the oil and liquids-rich

regions of the Denver-Julesburg (DJ) Basin, with a primary focus on

the Niobrara and Codell formations. The Company is committed

to the responsible development of its oil and natural gas resources

and is focused on maximizing returns through consistent growth,

capital discipline, and sustainable cash flow generation. To

learn more, visit www.prairieopco.com.

Non-GAAP Financial Measures

PV10 is derived from the Standardized Measure of

Discounted Future Net Cash Flows (“Standardized Measure”), which is

the most directly comparable GAAP financial measure for proved

reserves. PV10 is a computation of the Standardized Measure

on a pre-tax basis. PV10 is equal to the Standardized Measure at

the applicable date, before deducting future income taxes

discounted at 10 percent. We believe that the presentation of

PV10 is relevant and useful to our investors as supplemental

disclosure to the Standardized Measure, or after-tax amount,

because it presents the discounted future net cash flows

attributable to our reserves before considering future corporate

income taxes and our current tax structure. While the standardized

measure is dependent on the unique tax situation of each company,

PV10 is based on prices and discount factors that are consistent

for all companies.

Forward-Looking Statements

The information included herein and in any oral

statements made in connection herewith include “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. All statements, other than statements of

present or historical fact included herein, are forward-looking

statements. When used herein, including any oral statements made in

connection herewith, the words “could,” “should,” “will,” “may,”

“believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,”

the negative of such terms and other similar expressions are

intended to identify forward-looking statements, although not all

forward-looking statements contain such identifying words. These

forward-looking statements are based on the Company’s current

expectations and assumptions about future events and are based on

currently available information as to the outcome and timing of

future events. Statements concerning oil and gas reserves also may

be deemed to be forward-looking statements in that they reflect

estimates based on certain assumptions that the resources involved

can be economically exploited. Except as otherwise required by

applicable law, the Company disclaims any duty to update any

forward-looking statements, all of which are expressly qualified by

the statements in this section, to reflect events or circumstances

after the date hereof. The Company cautions you that these

forward-looking statements are subject to risks and uncertainties,

most of which are difficult to predict and many of which are beyond

the control of the Company. These risks include, but are not

limited to, the ultimate outcome of the acquisition of NRO by the

Company; the Company's ability to consummate the proposed

transaction with NRO; the Company's ability to finance the proposed

transaction with NRO; the possibility that the Company may be

unable to achieve expected free cash flow accretion, production

levels, drilling, operational efficiencies and other anticipated

benefits within the expected time-frames or at all and to

successfully integrate NRO's operations with those of the Company;

that such integration may be more difficult, time-consuming or

costly than expected; that operating costs, customer loss and

business disruption may be greater than expected following the

proposed transaction or the public announcement of the proposed

transaction; uncertainties inherent in estimating quantities of

oil, natural gas and NGL reserves and projecting future rates of

production and the amount and timing of development expenditures;

commodity price and cost volatility and inflation; general

economic, financial, legal, political, and business conditions and

changes in domestic and foreign markets; the risks related to the

growth of the Company’s business; and the effects of competition on

the Company’s future business. Should one or more of the risks or

uncertainties described herein and in any oral statements made in

connection therewith occur, or should underlying assumptions prove

incorrect, actual results and plans could differ materially from

those expressed in any forward-looking statements. There may be

additional risks not currently known by the Company or that the

Company currently believes are immaterial that could cause actual

results to differ from those contained in the forward-looking

statements. Additional information concerning these and other

factors that may impact the Company’s expectations can be found in

the Company’s periodic filings with the Securities and Exchange

Commission (the “SEC”), including the Company’s Annual Report on

Form 10-K filed with the SEC on March 31, 2023, and any

subsequently filed Quarterly Report and Current Report on Form 8-K.

The Company’s SEC filings are available publicly on the SEC’s

website at www.sec.gov.

Reserve Information

The Company obtained the reserve report

information referenced herein from CG&A with respect to the

acquired reserves. The reserves were calculated in accordance with

SEC guidelines using the price of $76.97 per barrel for oil, $2.229

per MCF for gas, and $20.65 per barrel for NGL. The base rates of

oil of $78.22 bbl and gas of $2.637 per million British Thermal

Units (MMBtu) were based upon WTI-Cushing spot prices (EIA) during

2023 and upon Henry Hub spot prices (Platts Gas Daily) during 2023,

respectively. The reserve classifications and the economic

considerations applied in the reserve report conform to the

criteria set forth in the 2018 Petroleum Resources Management

System (PRMS) approved by the Society of Petroleum Engineers (SPE).

All reserve estimates represent CG&A's best judgment based on

data available at the time of preparation of the reserve report,

and CG&A's assumptions as to future economic and regulatory

conditions. It should be realized that the reserves are actually

recovered, the revenue derived from, and the actual cost incurred

could be more or less than the estimated amounts.

Investor Relations

Contact:Wobbe Ploegsmawp@prairieopco.com832.274.3449

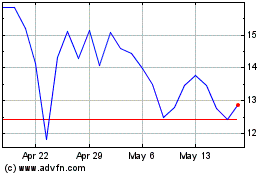

Prairie Operating (NASDAQ:PROP)

Historical Stock Chart

From Mar 2024 to Apr 2024

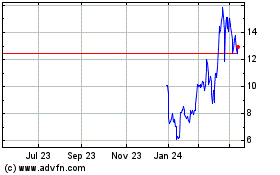

Prairie Operating (NASDAQ:PROP)

Historical Stock Chart

From Apr 2023 to Apr 2024