false

0001553788

0001553788

2024-01-24

2024-01-24

0001553788

SBEV:CommonStockParValue0.001PerShareMember

2024-01-24

2024-01-24

0001553788

SBEV:WarrantsToPurchaseSharesOfCommonStockMember

2024-01-24

2024-01-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

January 24, 2024

| SPLASH

BEVERAGE GROUP, INC. |

| (Exact Name of Registrant as Specified in Its Charter) |

| |

| Nevada |

| (State or Other Jurisdiction of Incorporation) |

| 001-40471 |

|

34-1720075 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

| |

1314 East Las Olas Blvd, Suite 221

Fort Lauderdale, Florida 33316 |

|

| (Address of Principal Executive Offices) |

| |

| (954) 745-5815 |

| (Registrant’s Telephone Number, Including Area Code) |

| |

| (Former Name or Former Address, if Changed Since Last Report) |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on

which registered |

| Common Stock, par value $0.001 per share |

|

SBEV |

|

NYSE American LLC |

| Warrants to purchase shares of common stock |

|

SBEV-WT |

|

NYSE American LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers;

Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On

January 24, 2024, the Board of Directors of Splash Beverage Group, Inc. (the “Company”) appointed Ms. Stacy McLaughlin

to serve as Chief Financial Officer of the Company, effective as of the same date.

Prior to joining the Company,

Ms. McLaughlin, 42, was the Chief Financial Officer of Material Technologies, Corp. from 2022 to 2023. From 2013 to 2021, Ms. McLaughlin

was the Vice President and Chief Financial Officer of Willdan Group, Inc. (Willdan), and prior to that, she was their Compliance

Manager from 2010 to 2013. During her tenure at Willdan, she was responsible for accounting and finance functions, SEC reporting,

investor relations, treasury, and managed a follow-on equity offering. Prior to Willdan, Ms. McLaughlin was, from 2009 to 2010,

Senior Associate at Windes & McClaughry Accountancy Corporation and, from 2004 to 2009, Senior Audit Associate at the public

accounting firm KPMG LLP. Ms. McLaughlin has a Masters in Accounting from the University of Southern California and BS from the

University of Arizona. Ms. McLaughlin is a Certified Public Accountant (CPA).

There is no family relationship

between Ms. McLaughlin and any director or executive officer of the Company. There are no transactions between Ms. McLaughlin and

the Company that would be required to be reported under Item 404(a) of Regulation S-K.

There is no arrangement

or understanding between Ms. McLaughlin and any other persons, pursuant to which she was selected as Chief Financial Officer. Ms.

McLaughlin has not engaged in any transaction, or any currently proposed transaction, in which the Company was or is to be a participant

and the amount involved exceeds $120,000, and in which any related person had or will have a direct or indirect material interest.

There are no family relationships between Ms. McLaughlin and any director or executive officer of the Company.

In connection with Ms. McLaughlin’s

employment as Chief Financial Officer of the Company, Ms. McLaughlin and the Company entered into an employment agreement (the

“McLaughlin Employment Agreement”), dated as of January 22, 2024, effective as of January 24, 2024. Ms. McLaughlin

will serve as Chief Financial Officer until the next meeting of stockholders, or until her

earlier death resignation or removal.

The foregoing description

of the McLaughlin Employment Agreement is qualified in its entirety by reference to the full text of the McLaughlin Employment

Agreement, a copy of which is attached hereto as Exhibit 10.1 and incorporated herein in its entirety by reference.

In

connection with Ms. McLaughlin’s appointment as Chief Financial Officer, former

Interim Chief Financial Officer, Fatima Dhalla, has resigned as the Interim Chief Financial Officer of the Company, effective

January 19, 2024.

Item

9.01 Exhibits

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this Current Report on Form 8-K to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

SPLASH BEVERAGE GROUP, INC. |

| |

|

|

| Dated: January 30, 2024 |

By: |

/s/ Robert Nistico |

| |

Name: |

Robert Nistico |

| |

Title: |

Chief Executive Officer |

EXHIBIT 10.1

EMPLOYMENTAGREEMENT

This

EMPLOYMENT AGREEMENT

(this “Agreement”),

dated January

22, 2024,

is entered

into by and

between Splash Beverages

Inc., a Nevada

Corporation (the “Company”),

and Stacy

McLaughlin (“Executive”) XXXXXXXXXXX

Florida XXXXX.

PRELIMINARY

STATEMENTS

The

Company desires for Executive to serve

as Chief

Financial Officer of

the Company, and Executive desires

to serve in such capacity with the Company

on the terms and conditions as hereinafter

set forth.

NOW,

THEREFORE, the

parties hereto agree

as follows:

STATEMENT

OF AGREEMENT

Section

1. EMPLOYMENT

Section

1.1 Term of Employment. The

Company shall continue to employ

Executive commencing on January 24, 2024

and continuing, with no fixed termination date, until

either party gives proper notice to the other as required

in Section 3.1 to terminate the Agreement. The

period during which the

Executive is employed by the Company

is herein referred to as

the “Term”,

and shall be

deemed to commence on the

date of this Agreement,

January 24, 2024.

Section

1.2 Title and Duties.

During the Term, Executive shall be employed

as Chief Financial Officer (“CFO”)

of the Company. Executive

shall further perform such reasonable executive and managerial

responsibilities and duties

consistent with the title and position

of CFO as outlined in the Offer Letter and as may be assigned

to Executive from time

to time by the Chief

Executive Officer (CEO) and or the Board of Directors of

the Company (the “Board’’).

Executive shall report to the CEO. Executive shall

diligently devote Executive’s business

skill, time and effort to

Executive’s employment hereunder

and shall not

serve any

other entity in

any capacity other

than as an

advisor or board

director without the consent

of the Board, provided, however, that Executive shall be

entitled annually to vacation

(subject to Section 1.3)

and sick leave pursuant to

policies adopted by the Company from time to time

for employees of the Company,

and may engage in civic and charitable activities to

the extent they

do not materially interfere with her performance of

her duties hereunder.

Section

1.3 Vacation

Executive shall

receive four

weeks of paid

vacation per year

which shall accrue

and be recorded

in accordance

with the Company’s

governing policies.

The scheduling of Executive’s

vacation must be approved in advance by the

Company in consideration

of business

needs and

operating requirements.

Executive shall

only be permitted

to take

two weeks of

vacation at one

time unless special

permission is granted

by the Company. Executive shall not receive

pay in lieu of vacation,

except as required by law upon termination or

separation from

employment.

Section

2. COMPENSATION

Section

2.1 Salary.

The Company

shall pay Executive

during the

Term an annual base salary (the “Base

Salary”) of $325,000 payable in accordance with the

Company’s regular payroll practices, with such payroll deductions and withholdings as required by law. Executive will

be eligible for a Base Salary increase each year, based on cost of living adjustments and the performance of the Executive.

The aforementioned Base Salary increases will be determined by the CEO.

Section

2.2 Stock Grants and Options Executive shall

be entitled to Splash

Beverage Group Inc.’s Equity

and Stock Plan

and as outlined

in the Offer

Letter (See schedule

A below).

Section

2.3 Bonus Opportunity. For each full year of the Term, Executive shall

be eligible for a discretionary annual bonus, as

determined by the CEO, of up

to 50% of Executive’s Base Salary.

Executive must be employed as of the final date of the evaluation period to

be eligible for

the discretionary annual

bonus.

Section

2.4 Expenses. Executive

shall be

entitled to

receive prompt reimbursement for

all reasonable business

expenses incurred by

Executive in the

performance of Executive’s

duties for the Company during the Term, in accordance with

the policies and procedures adopted by

the Company from

time to time

for executive officers

of the Company. Executive shall furnish

appropriate documentation of such expenses, including documentation required

by the Internal

Revenue Service

Section

2.5 Benefits. During the Term, Executive shall be entitled to participate in all qualified

plans, holidays and

other employee benefits

which the Company,

in its sole

discretion ,

may maintain

from time to

time for the

benefit of its

employees in

general, or,

if the Company should discontinue

or cause to be discontinued any such

benefits, then similar benefits, if any, as may be provided by the Company to its employees

in general. Nothing herein

requires the Company

to establish

or maintain

any specific

benefit plan.

Section

3. TERMINATION

OF EMPLOYMENT

Section

3.1 Termination. The

Company shall have

the right to

terminate Executive’ s employment hereunder

upon twenty one (21) days prior written notice, and Executive shall have the right to

resign upon twenty one (21)

days prior written notice, for any

reason or for no stated

reason, at any time. The notice

period does not commence until the notice is actually

received by the other party. The notice period shall

be deemed to be waived

in the event of termination of Executive with

cause. The Company reserves the right to require immediate termination with pay in-lieu of the twenty day notice

period.

Section

3.2 Rights of Executive Upon Termination. In the event that

Executive’s employment is terminated for any reason or no

reason, the Company shall have

no further obligation to Executive under

this Agreement except for payment, subject to

any right of set-off, to Executive of

(A) Executive’s accrued, but unpaid Base Salary

through the date of termination, (B)

accrued but unused vacation (to the extent legally required to be paid), and (C)

any unreimbursed expenses , subject to Section 2.4.

In

addition, in the event

that Executive is terminated

by the Company without cause (as defined below),

Executive shall be entitled

to severance

(“ Severance”) of

continued payment of

Executive’s Base

Salary in effect

at the

time of

termination of

employment for a

period of

twelve (12) months

following such

termination in

accordance with

the Company’

s regular payroll practices. Notwithstanding the

foregoing, receipt of Severance

shall be conditioned

upon Executive

executing a

customary release

within thirty (30)

days of the receipt

thereof by the

Company. Such customary

release may not

include the release of

disputes or claims relating

to Executive ‘

s participation in the Splash Beverage Stock / Equity

Plan. Provided such

customary release has been signed and not

revoked, such severance payments shall

begin on the next regular

payroll date after the 45th day after

the Executive’s termination

date in accordance with the Company’ s

regular payroll practices and

with such payroll

deductions and

withholdings as

required by

law.

“Cause”

(whether or not capitalized) includes,

as determined by the Company, Executive’s:

(i) being convicted

of fraud

or other

material acts

of dishonesty

with respect to the

Company; (ii)

commission of

a felony

or misdemeanor

involving moral turpitude;

(iii)

willful disobedience

of or insubordination

with respect

to a lawful

directive that causes

material harm

to the Company;

(iv) intentional

neglect of

the performance

of duties which Executive fails to cure

(if curable) within ten days of

receipt of written notice from the Company

(so long as not recurring

in nature for which Executive received prior notice in

respect thereof); (v) intentional withholding or

nondisclosure of material

information to the Company that causes material harm to

the Company; (vi) knowingly acting

to the

detriment of

the Company for

a party (other

than any governmental authority or agency)

whose interests are adverse to

the Company; (vii) disclosing

Company information materially prejudicial to the

Company other than in the course of performing

her duties

with the

Company; (viii)

being convicted

of a felony;

(ix) possession or use

by Executive of drugs or

prohibited substances or the

excessive drinking

of alcoholic beverages on

a recurring basis which impairs

Executive’s ability to perform her duties under this

Agreement; or (x) material violation of any written

personal conduct or

ethics code

adopted by

the Company,

which, if

curable, Executive

fails to cure

within ten

days of

receipt of

written notice

from the

Company.

Section

3.3 Obligations

of Executive Following

Termination. In

the event that Executive

‘ s employment

is terminated pursuant to

Section 3.1, Executive shall have

no further obligations hereunder

(other than

under Sections 4 and; and

to provide reasonable cooperation

to the

Company respecting

a transition

of Executive’s

duties without

charge to the

Company (but

subject to reimbursement

by the Company

of any reasonable

out-of- pocket costs

incurred by

Executive in

the course

of such cooperation

with the Company’s prior approval

for the reimbursement).

Section

4. COVENANTS.

Section

4.1 Restrictive

Covenants.

(a) Non-Competition. Executive absolutely

and unconditionally covenants and agrees that for the period commencing on the effective

date of this Agreement, and continuing during

the Term and for

a period of six months

thereafter (the “Restrictive

Period’’), Executive shall not directly as an employee, consultant, partner or owner

(other than a 2%

or less equity interest in a publicly

traded company), engage or participate in a

competing business. The term “competing business” means

(i) the manufacture, marketing,

development, licensing, distribution

and/or sale of any Tequila, Sports Drink or single serve wine based beverages, and

(ii) any other business being conducted by the Company during

the Term.

(b) Non-Solicitation.

Executive absolutely and unconditionally covenants and agrees that

during the Term and the Restrictive Period,

Executive shall not, either

directly or indirectly,

for any reason,

whether for

Executive’s own

account or for

the account

of any other person, natural or

legal, without the

prior written consent of the Company:

(i) solicit, employ,

hire, deal with

or otherwise

interfere with any

contract or

relationship of the Company with

any employee, officer,

director or any independent contractor of the Company

(including the Company’s

subsidiaries), while such

person or

entity is employed by or

associated with the Company or in the case of former employees

within one year of the termination of such person’s

employment with the Company during the Restrictive Period

(unless such person was

terminated by the Company); (ii) solicit,

accept, deal with or otherwise interfere

with any existing or proposed contract

or relationship of the Company

with any person, natural or legal,

who is an investor, customer, client

or supplier of the

Company during

the Restrictive Period.

(c) Use and Treatment of Confidential Information. Executive agrees not

to disclose, divulge, publish, communicate, publicize, disseminate or otherwise reveal, either directly or indirectly, any

Confidential Information to any person, natural or legal, except in

the performance of

Executive’s duties during Executive’s

employment by the Company.

The term “Confidential Information” means all information in any

form relating to

the past, present or future

business affairs, including without limitation,

research, development or business plans, operations or systems, of the Company or a person not a party to this Agreement

whose information the Company has in its

possession under obligations

of confidentiality , which is disclosed by the Company to Executive

or which is

produced or developed while Executive is an owner

of, employee or director of the Company.

In addition, “Confidential Information” shall include the terms

set forth in Section 2, provided

that Executive may share the information set forth in Section 2 with her

immediate family (so long as they

do not work

for any competitor of the Company) and legal and tax advisors,

and as otherwise required by law.

The term “Confidential Information” shall not include any information of the Company

which (i) becomes publicly known

through no wrongful act of Executive,

(ii) is received from a

person not a party to this Agreement

who is free to disclose

it to Executive, or (iii) is lawfully required

to be disclosed to any

governmental agency or is otherwise required to be

disclosed by law, subpoena or

court order but only to

the extent of such requirement, provided that before making such disclosure Executive shall give the Company an

adequate opportunity to interpose an objection or take action to assure confidential handling of such

information .

Ownership

and Return of

Confidential Information.

All Confidential

Information

disclosed to

or obtained by

Executive in tangible

form (including,

without limitation,

information incorporated

in computer

software or held

in electronic

storage media)

shall be

and remain

the property of the Company.

AII such Confidential Information possessed by Executive shall be returned to the Company at the time

Executive ceases employment with the Company.

Upon the return of Confidential Information, it shall not

thereafter be retained in any form, in whole or

in part, by Executive.

(d) Remedies

upon Breach. The parties acknowledge that Confidential

Information and the other protections afforded

to the Company by this Agreement

are valuable and unique and that any breach of any of the covenants contained in this Section 4.

may result in

irreparable and substantial injury to

the Company for

which it may

not have an adequate remedy at law . In the

event of a

breach or threatened breach of any of

the covenants contained in this

Section 4.1, the

Company shall be

entitled to obtain

from any court having competent jurisdiction, with respect to the Executive, temporary, preliminary and permanent

injunctive relief prohibiting any

such breach, as

well reimbursement for all reasonable costs, including attorneys ‘ fees, incurred

in enjoining any such breach. Any such relief shall be in addition to and not

in lieu of

any appropriate relief in

the way of monetary damages and equitable accounting

of all earnings, profits and

other benefits arising from such violation,

which rights shall

be cumulative and

in addition to any other rights or remedies to which the Company may be entitled. Executive does hereby waive any

requirement for the Company to post a bond for any injunction. If, however, a court nevertheless requires a bond to be posted, Executive agrees that such bond shall

be in a nominal amount.

(e) Other

Entities. For purposes

of Sections 4.l(a) through (f),

and Section 4.2, the “Company”

shall be deemed to include the

direct and indirect

subsidiaries of

the Company, and the

Parent and

its direct

and indirect

subsidiaries.

Section

4.2 Non-Disparagement.

During the

Term, and thereafter,

Executive agrees

not to defame

or disparage or

criticize the Company,

its business plan, procedures, products,

services, development,

finances, financial condition,

capabilities or other aspect of

its business, or any of its stakeholders, and the Company agrees not to defame or disparage

or criticize Executive, in any medium (whether oral,

written, electronic or

otherwise, whether

currently existing

or hereafter created),

to any person

or entity, without

limitation in time. Notwithstanding the foregoing sentence, the

Executive and the Company may confer in confidence with

her or its respective advisors and make truthful statements

as required by law. This

Section 4.3 shall survive any termination of

Executive’s employment

and any

termination of

this Agreement.

Section

4.3 Exceptions. Anything in this Agreement to the

contrary notwithstanding, Executive shall not be restricted

from: (i) disclosing information that is required to be

disclosed by law, court order or

other valid and appropriate legal

process; provided, however, that in the event such disclosure

is required by law,

Executive shall provide the Company

with prompt notice of such

requirement so that

the Company may seek an appropriate protective order prior

to any such required

disclosure by Executive;

or

(ii) reporting possible violations of federal, state,

or local law or regulation

to any governmental agency

or entity,

or from making

other disclosures that are

protected under the whistleblower provisions of

federal, state, or

local law or regulation, and Executive

shall not

need the

prior authorization

of the

Company to

make any

such reports or

disclosures and

shall not

be required to

notify the

Company that

Executive has made such

reports or disclosures.

Notwithstanding anything in the foregoing

to the contrary, in

accordance with

the Defend

Trade Secrets

Act of

2016, Executive

will not be criminally

or civilly liable for disclosing a trade

secret if it was disclosed: (I) to any

government official or attorney in confidence directly

or indirectly for the

sole purpose of reporting

or investigating a

suspected violation

of law; (2) in a

complaint or other document filed

in a lawsuit

or other

proceeding if

filed under seal;

or (3)

to an

attorney or used

in a court proceeding in

a retaliation lawsuit if any document

containing a trade

secret is filed

under seal

and is

not disclosed except

pursuant to

court order.

Section

4.4 No Other Severance Benefits.

Except as specifically set forth in this Agreement, Executive

covenants and agrees that Executive shall not be entitled

to any other form of

severance benefits

from the Company,

including, without

limitation, benefits otherwise

payable under

any of the

Company’s regular

severance policies,

in the event Executive’s employment hereunder

ends for any reason

and, except with respect

to obligations of

the Company expressly

provided for

herein.

Section

5. GENERAL PROVISIONS

Section

5.1 Notice.

Any notice

required or

permitted hereunder shall

be given

in writing and

shall be

deemed effectively

given upon

the earliest

of (i) personal

delivery ,

(ii) actual

receipt or (iii)

the third

full day

following deposit

in the United

States mail

with postage

prepaid, addressed

to the Company

at its

principal offices,

to the

attention of

the Board (care

of the Chairman)

with a copy

to the Secretary,

or, if

to Executive,

to such

home or

other address as Executive

has most recently provided in writing to the Company.

Section

5.2 Assignment; Binding Effect. Neither Executive nor

the Company may assign

this Agreement without

the prior

written consent

of the other

party, except that the Company

may assign this Agreement

to any affiliate thereof, or to any subsequent purchaser

of the Company of all or substantially all

of the assets of the Company,

or by operation of law.

This Agreement shall

be binding upon the heirs,

executors, and administrators of Executive to the extent that personal service to the Company

is not required.

Section

5.3 Choice of Law; Consent to

Jurisdiction; Waiver of Jury Trial. THIS

AGREEMENT SHALL

BE GOVERNED

BY, CONSTRUED IN

ACCORDANCE WITH

AND ENFORCED UNDER THE

LAWS OF THE STATE

OF FLORIDA. ALL SUITS, ACTIONS OR PROCEEDINGS ARISING OUT

OF OR RELATING TO THIS AGREEMENT, SHALL BE BROUGHT IN A

STATE OR FEDERAL COURT

LOCATED IN TAMPA,

STATE OF FLORIDA,

WHICH COURTS SHALL BE THE EXCLUSIVE FORUM FOR ALL SUCH

SUITS, ACTIONS OR PROCEEDINGS. EXECUTIVE AND THE COMPANY

HEREBY WAIVE ANY OBJECTION WHICH EXECUTIVE OR

IT MAY NOW OR HEREAFTER HAVE

TO THE LAYING OF VENUE IN ANY

SUCH COURT OR ANY SUCH SUIT,

ACTION

OR PROCEEDING. EXECUTIVE

AND THE COMPANY

HEREBY IRREVOCABLY CONSENT

AND SUBMIT

THEMSELVES TO

THE JURISDICTION

OF THE COURTS

OF THE STATE

OF FLORIDA

FOR THE PURPOSES

OF ANY S

UIT, ACTION OR

PROCEEDING ARISING OUT OF THIS AGREEMENT.

TO THE FULLEST EXTENT PERMITTED

BY LAW, EXECUTIVE AND THE COMPANY

HEREBY WAIVE ANY RIGHT TO

A TRIAL BY

JURY IN ANY SUIT, ACTION

OR PROCEEDING ARISING

OUT OF OR

RELATING TO

THIS AGREEMENT

AND AGREE

THAT ANY SUCH

SUIT, ACTION OR

PROCEEDING SHALL BE TRIED BEFORE

A COURT AND NOT BEFORE

A JURY.

Section

5.4 Amendment; Waiver. No modification, amendment or termination of this Agreement

shall be valid unless

made in writing and signed by the parties hereto. Any waiver

by any

party of

any violation of,

breach of

or default

under any provision

of this

Agreement, by the other party shall

not be construed as,

or constitute, a continuing waiver of such

provision, or waiver

of any other

violation of

breach of or

default under

any other provision of

this Agreement.

Section

5.5 Withholding of Taxes. The Company may withhold from

any amounts

payable under

this Agreement all

federal, state,

city or

other local taxes

as shall

be required to

be withheld pursuant

to any law

or government

regulation or

ruling.

Section

5.6 Severability. Any provision of this Agreement, which is prohibited or

unenforceable in any jurisdiction

shall, as to such jurisdiction,

be ineffective to the extent possible without invalidating

the remaining provisions hereof or affecting the validity

or enforceability of

such provision

in any other

jurisdiction.

Section

5.7 Survival of

Certain Obligations. The

obligations of the Company and

Executive set forth in this

Agreement which by their terms extend beyond or survive

the termination of the

Term (whether or not specifically

provided) shall not be affected or diminished

in any way

by the termination

of the Term.

Section

5.8 Headings. The headings in this Agreement are

intended solely for convenience

and shall

be disregarded

in interpreting the

Agreement.

Section

5.9 Third Parties.

Nothing expressed

or implied

in this Agreement

is intended, or shall be

construed, to confer

upon or give any

person or entity other

than the Company and

Executive any rights

or remedies

under this Agreement.

Section

5.10 Counterparts.

This Agreement

may be executed

in counterparts,

and all of such counterparts

(including facsimile or PDF), when separate

counterparts have been executed by

the parties hereto, shall be deemed to be one

and the same agreement. This

Agreement shall

only become effective

as of the

date hereof.

Section

5.11 No

Cooperation. Without limitation

to any other

provision

herein set forth, Executive agrees not

to act in any manner

that might damage the business of

the Company or any affiliate thereof. Executive

further agrees that Executive will not knowingly counsel

or assist any attorneys or their clients

in the presentation or

prosecution of any

disputes, differences, grievances, claims,

charges, or complaints

by any

third party

against the Company

or any affiliate

thereof, unless

under a

subpoena or other

court order to

do so. Executive

agrees both

to notify immediately

the Board (care

of the Chairman)

upon receipt of any such subpoena or court

order, and to furnish, within three business days of

its receipt,

a copy of

such subpoena or

court order to

any of the

Company or

any affiliate thereof.

If approached

by anyone

for counsel or

assistance in

the presentation

or prosecution of any disputes,

differences, grievances, claims, charges, or complaints

against the Company

or any affiliate

thereof, Executive

shall state no

more than that

Executive cannot provide counsel or assistance.

Without

limitation to the preceding paragraph,

Executive shall reasonably provide assistance

and cooperation to the Company or any affiliate thereof

in any legal or administrative

proceedings or

inquiries concerning

events which

occurred at such

time as such person was

an employee of the Company (or any affiliated or related entity) and involving

any such person

about which Executive

has relevant knowledge

or information. In the

event that Executive

is served

notice of such legal process following the date hereof,

the Company (or its designee) shall compensate

Executive with reasonable consulting fees of $250.00 per

hour plus any out-of-pocket expenses Executive may incur in performing Executive’s

obligation to cooperate; provided that the foregoing shall

only be payable from and after such time as

when Executive is no longer an employee of

the Company, and only

for periods thereafter. By way of example,

but without limitation,

assistance and cooperation

may include: (1) identifying documentation

or specific dates; (2) meeting with legal counsel of the

Company or any affiliate thereof from time to time to assist

in the preparation of arguments and the discovery or

compilation of factual

matters; and (3) providing testimony or statements in connection with

any legal or

administrative proceedings

or inquiries. The

Company (or

its affiliates and

related persons) shall

provide Executive

with reasonable

advance notice of any

such legal

process and shall

work with Executive to find mutually convenient

times to meet or communicate

with Executive

concerning such matters.

For

the avoidance of doubt,

this Section 5.11 shall

survive any termination

of Executive’s employment and

any termination of

this Agreement.

Section

5.12 409A. The

parties intend that

the payments and

benefits provided for in

this Agreement to either be exempt from Section 409A of

the Internal Revenue

Code, as amended

(the “Code”)

or be provided in a manner that complies with Section 409A of

the Code. Notwithstanding

anything contained herein

to the contrary,

all payments and benefits which are payable upon

a termination of employment hereunder shall be paid or provided

only upon those terminations

of employment that constitute a

separation from service from

the Company within the meaning of

Section 409A of the Code

(determined after

applying the presumptions

set forth in

Treas. Reg. Section l.409A-l(h)(l)). For

purposes of Section 409A of the Code, the

right to a series of installment

payments hereunder shall be treated as

a right to a series of separate payments.

ln the event

Executive is

a specified

employee under

Section 409A of

the Code,

for purposes of any

payment on termination of employment hereunder, if such

payment would otherwise be made within six months of

termination, such payment

will be paid to Executive

in a lump sum cash amount

on the first payroll date which is more

than six

months following the

date of Executive’s termination, to the

extent required to avoid any

adverse tax

consequences under Section 409A of

the Code.

Section

5.13 No Right to Sue.

Executive acknowledges and

agrees that Executive shall

not have

any right to

enforce any rights

or obligations

under this

Agreement against

any person or entity other than

the Company or any entity or person to which

this Agreement has

been assigned by the Company,

and that Executive shall

not sue any person

or entity other than

the Company to enforce

any rights and obligations under

this Agreement or otherwise with

respect to

Executive’s employment with

the Company or

the cessation

thereof. For the avoidance

of doubt, this Section

5.13 shall survive any termination of Executive’s employment

and any termination of this Agreement. In

the event of a dispute concerning

the rights

or obligations under

this Agreement, the prevailing

party will be

entitled to her

or its

reasonable attorney’s

fees and costs.

Section

5.14 Acknowledgement. The parties acknowledge that they have had an adequate opportunity

to read this

Agreement, to

consider it and

to consult with

an attorney if so desired.

Section

5.15 Entire Agreement.

This Agreement sets

forth the entire

understanding of the parties to this Agreement regarding the subject

matter hereof and supersedes all prior agreements, arrangements,

communications, representations

and warranties,

whether oral or

written, between

the parties regarding

the subject matter

hereof. In no

event shall Executive be

entitled to any

rights with respect

to Executive’s engagement

with the Company,

or otherwise

with respect to

the Company,

other than

as provided herein.

Nothing in this Agreement shall confer upon any

member of the Company any fiduciary obligation to Executive.

SIGNATURE PAGE

FOLLOWS:

IN

WITN ESS

WHEREOF, the

Company and

Executive have

executed

this Employment

Agreement as of

the date

first

written above.

| SPLASH

BEVERAGES INC., |

|

|

|

| Chairman and

CEO, Robert Nistico: |

|

| |

|

| STACY MCLAUGHLIN AS

AN INDIVIDUAL |

|

|

|

| SIGNATURE: |

|

Schedule A

In

the event our

ESO plan allows

for a choice

of Option or

Restricted Shares of

SBEV, the following terms for either

choice will apply:

Stock

Option Plan:

| ● | 200K

initial

grant

and

completely

vested. |

| ● | 200K

After

your

first

12

months

service |

| ● | 200K

After

your

second

12

months

service |

Our

“evergreen” plan is

under review and

there are occasional

additional awards unplanned

and not part of the current ESO Plan.

Schedule

A Second Option

Stock

Equity Plan

| ● | 600,000

restricted

shares,

50,000

per

quarter

will

vest

quarterly

from

the

initial

date

of

service

for

3

years. |

| ● | In

the

event

you

are

terminated

for

cause,

no

shares

during

the

quarter

of

termination

will

be

awarded. |

Our “evergreen”

plan is under

review and there

are occasional additional

awards unplanned and not part

of the current ESO Plan.

v3.24.0.1

Cover

|

Jan. 24, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 24, 2024

|

| Entity File Number |

001-40471

|

| Entity Registrant Name |

SPLASH

BEVERAGE GROUP, INC.

|

| Entity Central Index Key |

0001553788

|

| Entity Tax Identification Number |

34-1720075

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

1314 East Las Olas Blvd

|

| Entity Address, Address Line Two |

Suite 221

|

| Entity Address, City or Town |

Fort Lauderdale

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33316

|

| City Area Code |

(954)

|

| Local Phone Number |

745-5815

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, par value $0.001 per share |

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

SBEV

|

| Security Exchange Name |

NYSEAMER

|

| Warrants to purchase shares of common stock |

|

| Title of 12(b) Security |

Warrants to purchase shares of common stock

|

| Trading Symbol |

SBEV-WT

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SBEV_CommonStockParValue0.001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SBEV_WarrantsToPurchaseSharesOfCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

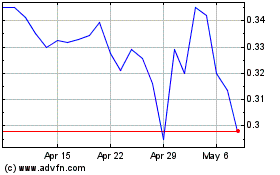

Splash Beverage (AMEX:SBEV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Splash Beverage (AMEX:SBEV)

Historical Stock Chart

From Apr 2023 to Apr 2024