0001172222false00011722222024-01-302024-01-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 30, 2024

HAWAIIAN HOLDINGS INC

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-31443 | | 71-0879698 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

3375 Koapaka Street, Suite G-350

Honolulu, HI 96819

(Address of principal executive offices, including zip code)

(808) 835-3700

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common stock ($0.01 par value) | HA | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On January 30, 2024, the Registrant issued a press release announcing its financial results for the fourth quarter and full year ended December 31, 2023. A copy of the press release is furnished as Exhibit 99.1 to this report and incorporated herein by reference.

All of the information furnished in this report (including Exhibit 99.1) shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and unless expressly set forth by specific reference in such filings, shall not be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and regardless of any general incorporation language in such filings.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Dated: January 30, 2024 | |

| | |

| | HAWAIIAN HOLDINGS, INC. |

| | |

| | | | |

| | By: | /s/ Shannon L. Okinaka |

| | | Name: | Shannon L. Okinaka |

| | | Title: | Executive Vice President, Chief Financial Officer and Treasurer |

Exhibit 99.1

NEWS

| | | | | | | | |

FOR IMMEDIATE RELEASE

Tuesday, January 30, 2024 | | INVESTOR RELATIONS CONTACT: Marcy Morita - (808) 480-8582 Investor.Relations@HawaiianAir.com

MEDIA RELATIONS CONTACT: Alex Da Silva (808) 835-3712 News@HawaiianAir.com |

Hawaiian Holdings Reports 2023 Fourth Quarter and Full Year Financial Results

HONOLULU — January 30, 2024 — Hawaiian Holdings, Inc. (NASDAQ: HA) (the “Company”), parent company of Hawaiian Airlines, Inc. (“Hawaiian”), today reported its financial results for the fourth quarter and full year 2023.

“I am grateful to our team who accomplished an extraordinary amount, including realizing foundational investments during a challenging year,” said Hawaiian Airlines President and CEO Peter Ingram. “Demand is solid across our networks, our brand remains strong in Japan as the market recovers, and we have seen steady improvement in travel to Maui. We expect the combination with Alaska will create an even more competitive combined airline, positioning the Hawaiian Airlines brand to flourish in the years ahead.”

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Fourth Quarter 2023 - Key Financial Metrics and Results |

| | GAAP | | YoY Change | | Adjusted (a) | | YoY Change |

| Net Loss | | ($101.2M) | | ($51.0M) | | ($122.7M) | | ($98.0M) |

| Diluted EPS | | ($1.96) | | ($0.98) | | ($2.37) | | ($1.88) |

| Pre-tax Margin | | (19.0)% | | (10.4) pts. | | (22.9)% | | (18.6) pts. |

| EBITDA | | ($71.8M) | | ($65.7M) | | ($98.1M) | | ($123.7M) |

| Operating Cost per ASM | | 15.30¢ | | (0.16)¢ | | 11.77¢ | | 0.88¢ |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Full Year 2023 - Key Financial Metrics and Results |

| | GAAP | | YoY Change | | Adjusted (a) | | YoY Change |

| Net Loss | | ($260.5M) | | ($20.4M) | | ($313.5M) | | ($103.1M) |

| Diluted EPS | | ($5.05) | | ($0.38) | | ($6.08) | | ($2.00) |

| Pre-tax Margin | | (12.1)% | | (1.0) pts. | | (14.5)% | | (4.5) pts. |

| EBITDA | | ($103.6M) | | ($41.8M) | | ($169.0M) | | ($138.0M) |

| Operating Cost per ASM | | 14.90¢ | | (0.36)¢ | | 11.29¢ | | 0.51¢ |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

(a) See Table 4 for a reconciliation of adjusted net loss, adjusted diluted EPS, adjusted pre-tax margin, adjusted EBITDA, and adjusted operating cost per ASM (CASM excluding fuel and non-recurring items) to each of their respective most directly comparable GAAP financial measure.

Statistical data, as well as a reconciliation of the reported non-GAAP financial measures, can be found in the accompanying tables.

Liquidity and Capital Resources

As of December 31, 2023 the Company had:

•Unrestricted cash, cash equivalents and short-term investments of $908.5 million

•Outstanding debt and finance lease obligations of $1.7 billion

•Liquidity of $1.1 billion, including an undrawn revolving credit facility of $235 million

Revenue Environment

Following the Maui wildfires, Hawaiian saw a steady recovery of travel from North America to Maui. Non-Maui routes and international markets ex-Japan continued to perform and demand remained solid. In international markets, strong U.S. and other point-of sale demand, coupled with an increase in Japan-originating traffic, contributed to a 20.7% point increase in International passenger load factor year-over-year. Premium products continued to demonstrate strong performance for the fourth quarter and full year 2023.

The Company’s overall operating revenue for the fourth quarter 2023 was down 8.5% compared to the fourth quarter of 2022 on 3.3% higher capacity. In addition to the impact from the Maui wildfires, pandemic-related spoilage and revenue from pent-up travel demand in 2022 drove the year-over-year decline. The Company's overall operating revenue for 2023 was up 2.8% from 2022 on 8.1% higher capacity.

Other Revenue for fourth quarter 2023 was down 15.9% compared to the same period in 2022, primarily driven by a decrease in cargo revenue. Cargo activity in 2022 was higher than normal due to lingering pandemic-related effects. Full year 2023 Other Revenue was down 16.2% compared to 2022, driven by decreases in cargo revenue and contract services.

Fourth Quarter and Full Year 2023 Highlights

Routes and scheduled services

•Operated 108% of its 2022 capacity: 96%, 112%, and 172% capacity on its North America, Neighbor Island, and International routes, respectively

•Launched ticket sales for new daily nonstop service between Salt Lake City and Honolulu, which will commence on May 15, 2024

•Announced expansion of service in Sacramento with four weekly flights to Līhuʻe, Kauaʻi starting May 24, 2024 and three weekly flights to Kona on the Island of Hawaiʻi starting May 25, 2024

Awards and Recognition

•Ranked highest for economy travel customer satisfaction in Consumer Reports' 2023 Airline Travel Buying Guide

•Named the best domestic airline in Travel + Leisure’s 2023 "World's Best Awards" annual reader survey

•Rated as one of the top airlines in the U.S. by Condé Nast Traveler readers for the 2023 Readers’ Choice Awards

•Awarded best new business class in 2023 by TheDesignAir for its new business class product, the Leihōkū Suites

Guest experience

•Received FAA approval of the Starlink system on the Airbus A321neo, which is currently being installed on that fleet. Hawaiian will be the first major airline to put this technology on-board, and it is expected to be the fastest, most capable inflight connectivity available worldwide, offered free to every guest

•Collaborated with Hawaiʻi lifestyle brand Noho Home to design Hawaiian's new in-flight amenity kits and soft goods with a focus on sustainability and rooted in aloha. Amenities are made with responsibly sourced materials and offered to Business Class guests on long-haul flights a la carte to minimize waste

Environmental, Social and Corporate Governance

In May 2023, the Company published its 2023 Corporate Kuleana (Responsibility) Report, providing progress on Environmental, Social and Governance (ESG) priorities, which included a decarbonization roadmap with interim targets to lower greenhouse gas emissions focused on replacing petroleum jet fuel with sustainable aviation fuel (SAF); plans to decrease life-cycle jet fuel emissions per revenue ton mile by 45% by 2035; and efforts to replace 10% of conventional jet fuel with SAF by 2030. The report also highlights Hawaiian's employee diversity, including the highest percentage of women pilots of any major U.S. airline.

Other activities in 2023 include the following:

•Engaged over 1,500 volunteers who donated over 8,500 hours of community service work for more than 200 organizations throughout Hawaiʻi and other markets we serve

•Donated $109,500 through the Hawaiian Airlines Foundation as a grant to Kāko'o 'Ōiwi, a nonprofit organization dedicated to advancing the cultural, spiritual and traditional practices of the Native Hawaiian community. The grant funded the construction of a produce washing and packing facility to serve small, family farms in the area

•Brought the Holoholo Challenge virtual race series to Kauaʻi which raised almost $25,000 in proceeds benefiting the National Tropical Botanical Garden’s McBryde Garden, a 259-acre conservation and research area that is home to the world’s largest collection of native Hawaiian flora

•Provided wide-ranging support for the Maui Community, including direct gifts of $50,000 each to the Hawaiʻi Foodbank, Maui Food Bank, and Hawaiʻi Community Foundation's Maui Strong Fund, and a donor-matching HawaiianMiles campaign for the American Red Cross Hawaiʻi totaling approximately 140 million HawaiianMiles. Additionally, Hawaiian assisted with the evacuation of displaced residents and visitors and the transportation of first responders to Maui, and also supported relief efforts by carrying over 193,000 lbs. of essential cargo

The Company continues to focus on creating long-term value and positively impacting the people, environment and communities it serves. The Company will publish its fifth annual Corporate Kuleana Report in the spring of 2024.

Merger Agreement

On December 3, 2023, Alaska Air Group, Inc. and the Company announced that they have entered into a definitive agreement under which Alaska Airlines will acquire Hawaiian for $18.00 per share in cash, for a transaction value of approximately $1.9 billion, inclusive of $0.9 billion of Hawaiian's net debt. The combined company will unlock more destinations for consumers and expand choice of critical air service options and access throughout the Pacific region, Continental United States and globally. The acquisition is conditioned on required regulatory approvals, approval by the Company's shareholders, and other customary closing conditions. It is expected to close in 12-18 months from the announcement date.

First Quarter 2024 Outlook

The table below summarizes the Company's expectations for the quarter ending March 31, 2024 expressed as an expected percentage change compared to the results for the quarter ended March 31, 2023. Figures include the expected impacts of the Company’s freighter operation, which are not yet expected to be material.

| | | | | | | | | | | | | | | | | | | | |

| Item | | GAAP First Quarter 2024 Guidance | | Non-GAAP Equivalent | | Non-GAAP First Quarter 2024 Guidance |

| Available Seat Miles (ASMs) | | Up 2.5% to up 5.5% | | | | |

| Operating Revenue per ASM (RASM) | | Down 1.0% to up 2.0% | | | | |

Costs per ASM (CASM) | | Up 5.0% to up 7.2% | | CASM excluding fuel and non-recurring items (a) | | Up 8.0% to up 11.0% |

Gallons of Jet Fuel Consumed (c) | | Up 4.0% to up 7.0% | | | | |

Average fuel price per gallon, including taxes and delivery (b) | | $2.66 | | Economic Fuel Price per Gallon (a)(b)(c) | | $2.71 |

| Effective Tax Rate | | ~21% | | | | |

Full Year 2024 Outlook

The table below summarizes the Company's expectations for the full year ending December 31, 2024 expressed as an expected percentage change compared to the results for the year ended December 31, 2023. Figures include the expected impacts of the Company’s freighter operation as the Company establishes its freighter operation.

| | | | | | | | | | | | | | | | | | | | |

| Item | | GAAP Full Year 2024 Guidance | | Non-GAAP Equivalent | | Non-GAAP Full Year 2024 Guidance |

| ASMs | | Up 6.0% to up 9.0% | | | | |

CASM | | Up 0.7% to up 3.0% | | CASM excluding fuel and non-recurring items (a) | | Flat to up 3.0% |

Gallons of Jet Fuel Consumed (c) | | Up 4.0% to up 7.0% | | | | |

Average fuel price per gallon, including taxes and delivery (b) | | $2.55 | | Economic Fuel Price per Gallon (a)(b)(c) | | $2.59 |

| Capital Expenditures | | $500M to $550M | | | | |

(a) See Table 3 and Table 4 for a reconciliation of CASM excluding fuel and non-recurring items and economic fuel price per gallon to each of their respective most directly comparable GAAP financial measures.

(b) Average fuel price per gallon and economic fuel price per gallon estimates are based on the January 12, 2024 fuel forward curve.

(c) Gallons of jet fuel consumed do not include fuel used in the freighter operation, as those expenses are pass-through expenses not born by the Company.

Statistical information, as well as a reconciliation of certain non-GAAP financial measures, can be found in the accompanying tables.

Investor Conference Call

The Company's quarterly and full year earnings conference call is scheduled to begin today (January 30, 2024) at 4:30 p.m. Eastern Time (USA). The conference call will be broadcast live over the Internet. Investors may listen to the live audio webcast on the investor relations section of the Company’s website at HawaiianAirlines.com. For those who are not available for the live webcast, the call will be archived and available for 90 days on the investor relations section of the Company's website.

About Hawaiian Airlines

Now in its 95th year of continuous service, Hawaiian is Hawaiʻi's largest and longest-serving airline. Hawaiian offers approximately 150 daily flights within the Hawaiian Islands, and nonstop flights between Hawaiʻi and 15 U.S. gateway cities – more than any other airline – as well as service connecting Honolulu and American Samoa, Australia, the Cook Islands, Japan, New Zealand, South Korea and Tahiti.

Consumer surveys by Condé Nast Traveler and TripAdvisor have placed Hawaiian among the top of all domestic airlines serving Hawaiʻi. The carrier was named Hawaiʻi's best employer by Forbes in 2022 and has topped Travel + Leisure’s World’s Best list as the No. 1 U.S. airline for the past two years. Hawaiian has also led all U.S. carriers in on-time performance for 18 consecutive years (2004-2021) as reported by the U.S. Department of Transportation.

The airline is committed to connecting people with aloha by offering complimentary meals for all guests on transpacific routes and the convenience of no change fees on Main Cabin and Premium Cabin seats. HawaiianMiles members also enjoy flexibility with miles that never expire. As Hawai‘i’s hometown airline, Hawaiian encourages guests to Travel Pono and experience the islands safely and respectfully.

Hawaiian Airlines, Inc. is a subsidiary of Hawaiian Holdings, Inc. (NASDAQ: HA). Additional information is available at HawaiianAirlines.com. Follow Hawaiian's Twitter updates (@HawaiianAir), become a fan on Facebook (Hawaiian Airlines), and follow us on Instagram (hawaiianairlines). For career postings and updates, follow Hawaiian's LinkedIn page.

For media inquiries, please visit Hawaiian Airlines' online newsroom.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that reflect the Company’s current views with respect to certain current and future events and financial performance. Such forward-looking statements include, without limitation, the Company’s positioning for the upcoming year; plans for additional route service; expectations related to the merger with Alaska; expectations about the Starlink systems to be installed on the A321 fleet and in-flight amenity kits; expectations related to Hawaiian’s freighter operation; the Company's environmental commitments; the Company’s outlook for the first fiscal quarter and fiscal year 2024; and statements as to other matters that do not relate strictly to historical facts or statements of assumptions underlying any of the foregoing. Words such as “expects,” “anticipates,” “projects,” “intends,” “plans,” “believes,” “estimates,” variations of such words, and similar expressions are also intended to identify such forward-looking statements. These forward-looking statements are and will be subject to many risks, uncertainties and assumptions relating to the Company’s operations and business environment, all of which may cause the Company’s actual results to be materially different from any future results, expressed or implied, in these forward-looking statements.

The Company is subject to risks, uncertainties and assumptions that could cause the Company’s results to differ materially from the results expressed or implied by such forward-looking statements, including the risks, uncertainties and assumptions discussed from time to time in the Company’s public filings and public announcements, including the Company’s Annual Report on Form 10-K and the Company’s Quarterly Reports on Form 10-Q, as well as other documents that may be filed by the Company from time to time with the Securities and Exchange Commission. All forward-looking statements included in this document are based on information available to the Company on the date hereof. The Company does not undertake to publicly update or revise any forward-looking statements to reflect events or circumstances that may arise after the date hereof even if experience or future changes make it clear that any projected results expressed or implied herein will not be realized.

Table 1.

Hawaiian Holdings, Inc.

Consolidated Statements of Operations

(in thousands, except for per share data) (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| | | 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| | (in thousands, except per share data) |

| Operating Revenue: | | | | | | | | | | | | |

| Passenger | | $ | 601,621 | | | $ | 650,841 | | | (7.6) | % | | $ | 2,460,005 | | | $ | 2,335,440 | | | 5.3 | % |

| Other | | 67,453 | | | 80,194 | | | (15.9) | % | | 256,279 | | | 305,827 | | | (16.2) | % |

| Total | | 669,074 | | | 731,035 | | | (8.5) | % | | 2,716,284 | | | 2,641,267 | | | 2.8 | % |

| Operating Expenses: | | | | | | | | | | | | |

| Wages and benefits | | 223,012 | | | 218,045 | | | 2.3 | % | | 951,524 | | | 833,137 | | | 14.2 | % |

| Aircraft fuel, including taxes and delivery | | 202,059 | | | 213,204 | | | (5.2) | % | | 766,133 | | | 817,077 | | | (6.2) | % |

| Aircraft rent | | 28,914 | | | 25,859 | | | 11.8 | % | | 109,741 | | | 103,846 | | | 5.7 | % |

| Maintenance materials and repairs | | 75,296 | | | 65,219 | | | 15.5 | % | | 244,296 | | | 236,153 | | | 3.4 | % |

| Aircraft and passenger servicing | | 44,815 | | | 42,060 | | | 6.6 | % | | 176,698 | | | 152,550 | | | 15.8 | % |

| Commissions and other selling | | 30,808 | | | 32,076 | | | (4.0) | % | | 117,132 | | | 113,843 | | | 2.9 | % |

| Depreciation and amortization | | 32,840 | | | 33,735 | | | (2.7) | % | | 133,615 | | | 136,169 | | | (1.9) | % |

| Other rentals and landing fees | | 44,797 | | | 37,122 | | | 20.7 | % | | 171,371 | | | 147,143 | | | 16.5 | % |

| Purchased services | | 36,001 | | | 33,637 | | | 7.0 | % | | 144,822 | | | 129,350 | | | 12.0 | % |

| | | | | | | | | | | | |

| Special items | | 10,561 | | | 12,500 | | | (15.5) | % | | 10,561 | | | 18,803 | | | (43.8) | % |

| | | | | | | | | | | | |

| Other | | 51,721 | | | 50,365 | | | 2.7 | % | | 184,066 | | | 163,250 | | | 12.8 | % |

| Total | | 780,824 | | | 763,822 | | | 2.2 | % | | 3,009,959 | | | 2,851,321 | | | 5.6 | % |

| Operating Loss | | (111,750) | | | (32,787) | | | 240.8 | % | | (293,675) | | | (210,054) | | | 39.8 | % |

| Nonoperating Income (Expense): | | | | | | | | | | | | |

| | | | | | | | | | | | |

| Interest expense and amortization of debt discounts and issuance costs | | (22,358) | | | (23,054) | | | | | (90,540) | | | (95,815) | | | |

| Interest income | | 13,543 | | | 11,858 | | | | | 57,231 | | | 32,141 | | | |

| Capitalized interest | | 3,123 | | | 1,070 | | | | | 8,833 | | | 4,244 | | | |

| Other components of net periodic benefit cost | | (1,707) | | | 1,252 | | | | | (6,614) | | | 5,065 | | | |

| Losses on fuel derivatives | | (6,992) | | | (1,978) | | | | | (12,619) | | | (3,041) | | | |

| Loss on extinguishment of debt | | — | | | — | | | | | — | | | (8,568) | | | |

| Gains (losses) on investments, net | | 6,304 | | | (4,563) | | | | | (602) | | | (43,082) | | | |

| Gains (losses) on foreign debt | | (7,245) | | | (15,629) | | | | | 11,500 | | | 26,667 | | | |

| Other, net | | 100 | | | 913 | | | | | (1,308) | | | (1,406) | | | |

| Total | | (15,232) | | | (30,131) | | | | | (34,119) | | | (83,795) | | | |

| Loss Before Income Taxes | | (126,982) | | | (62,918) | | | | | (327,794) | | | (293,849) | | | |

| Income tax benefit | | (25,800) | | | (12,758) | | | | | (67,300) | | | (53,768) | | | |

| Net Loss | | $ | (101,182) | | | $ | (50,160) | | | | | $ | (260,494) | | | $ | (240,081) | | | |

| Net Loss Per Common Stock Share: | | | | | | | | | | | | |

| Basic | | $ | (1.96) | | | $ | (0.98) | | | | | $ | (5.05) | | | $ | (4.67) | | | |

| Diluted | | $ | (1.96) | | | $ | (0.98) | | | | | $ | (5.05) | | | $ | (4.67) | | | |

| Weighted Average Number of Common Stock Shares Outstanding: | | | | | | | | | | | | |

| Basic | | 51,655 | | | 51,413 | | | | | 51,596 | | | 51,361 | | | |

| Diluted | | 51,655 | | | 51,413 | | | | | 51,596 | | | 51,361 | | | |

| | | | | | | | | | | | |

Table 2.

Hawaiian Holdings, Inc.

Selected Statistical Data

(in thousands, except as otherwise indicated) (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| | | 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| | (in thousands, except as otherwise indicated) |

| Scheduled Operations: | | | | | | | | | | | | |

| Revenue passengers flown | | 2,655 | | | 2,651 | | | 0.2 | % | | 10,876 | | | 9,995 | | | 8.8 | % |

| Revenue passenger miles (RPM) | | 4,219,482 | | 3,982,719 | | 5.9 | % | | 16,860,663 | | 14,932,750 | | 12.9 | % |

| Available seat miles (ASM) | | 5,100,896 | | 4,931,687 | | 3.4 | % | | 20,196,230 | | 18,636,466 | | 8.4 | % |

| Passenger revenue per RPM (Yield) | | 14.26 | ¢ | | 16.34 | ¢ | | (12.7) | % | | 14.59 | ¢ | | 15.64 | ¢ | | (6.7) | % |

| Passenger load factor (RPM/ASM) | | 82.7 | % | | 80.8 | % | | 1.9 | pt. | | 83.5 | % | | 80.1 | % | | 3.4 | pt. |

| Passenger revenue per ASM (PRASM) | | 11.79 | ¢ | | 13.20 | ¢ | | (10.7) | % | | 12.18 | ¢ | | 12.53 | ¢ | | (2.8) | % |

| Total Operations: | | | | | | | | | | | | |

| Revenue passengers flown | | 2,656 | | | 2,655 | | | — | % | | 10,879 | | | 10,015 | | | 8.6 | % |

| RPM | | 4,220,584 | | 3,988,798 | | 5.8 | % | | 16,864,998 | | 14,964,500 | | 12.7 | % |

| ASM | | 5,103,666 | | 4,940,514 | | 3.3 | % | | 20,204,497 | | 18,684,642 | | 8.1 | % |

| Passenger load factor (RPM/ASM) | | 82.7 | % | | 80.7 | % | | 2.0 | pt. | | 83.5 | % | | 80.1 | % | | 3.4 | pt. |

| Operating revenue per ASM (RASM) | | 13.11 | ¢ | | 14.80 | ¢ | | (11.4) | % | | 13.44 | ¢ | | 14.14 | ¢ | | (5.0) | % |

| Operating cost per ASM (CASM) | | 15.30 | ¢ | | 15.46 | ¢ | | (1.0) | % | | 14.90 | ¢ | | 15.26 | ¢ | | (2.4) | % |

| CASM excluding aircraft fuel and non-recurring items (a) | | 11.77 | ¢ | | 10.89 | ¢ | | 8.1 | % | | 11.29 | ¢ | | 10.78 | ¢ | | 4.7 | % |

| Aircraft fuel expense per ASM (b) | | 3.96 | ¢ | | 4.32 | ¢ | | (8.3) | % | | 3.79 | ¢ | | 4.37 | ¢ | | (13.3) | % |

| Revenue block hours operated | | 52,961 | | 51,715 | | 2.4 | % | | 211,019 | | 195,361 | | 8.0 | % |

| Gallons of jet fuel consumed | | 68,756 | | 64,485 | | 6.6 | % | | 268,491 | | 239,231 | | 12.2 | % |

| Average cost per gallon of jet fuel (actual) (b) | | $ | 2.94 | | | $ | 3.31 | | | (11.2) | % | | $ | 2.85 | | | $ | 3.42 | | | (16.7) | % |

Economic fuel cost per gallon (b)(c) | | $ | 2.98 | | | $ | 3.31 | | | (10.0) | % | | $ | 2.89 | | | $ | 3.42 | | | (15.5) | % |

(a) See Table 4 for a reconciliation of CASM excluding aircraft fuel and non-recurring items to its most directly comparable GAAP financial measure.

(b) Includes applicable taxes and fees.

(c) See Table 3 for a reconciliation of economic fuel cost per gallon to its most directly comparable GAAP financial measure.

Table 3.

Hawaiian Holdings, Inc.

Economic Fuel Expense

(in thousands, except per-gallon amounts) (unaudited)

The price and availability of aircraft fuel is volatile due to global economic and geopolitical factors that we can neither control nor accurately predict. The increase in aircraft fuel expense is illustrated in the following table:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, | | Twelve months ended December 31, | | |

| | | 2023 | | 2022 | | % Change | | 2023 | | 2022 | | | | % Change | | |

| | | (in thousands, except per-gallon amounts) | | |

| Aircraft fuel expense, including taxes and delivery | | $ | 202,059 | | | $ | 213,204 | | | (5.2) | % | | $ | 766,133 | | | $ | 817,077 | | | | | (6.2) | % | | |

| Fuel gallons consumed | | 68,756 | | | 64,485 | | | 6.6 | % | | 268,491 | | | 239,231 | | | | | 12.2 | % | | |

| Average fuel price per gallon, including taxes and delivery | | $ | 2.94 | | | $ | 3.31 | | | (11.2) | % | | $ | 2.85 | | | $ | 3.42 | | | | | (16.7) | % | | |

The Company believes that economic fuel expense is a good measure of the effect of fuel prices on its business as it most closely approximates the net cash outflow associated with the purchase of fuel for its operations in a period. The Company defines economic fuel expense as GAAP fuel expense plus losses/(gains) realized through actual cash (receipts)/payments received from or paid to hedge counterparties for fuel hedge derivative contracts settled during the period.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Twelve Months Ended December 31, | | | | | | | | | | |

| | 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change | | | | | | | | | | |

| | (in thousands, except per-gallon amounts) | | | | | | | | | | |

| Aircraft fuel expense, including taxes and delivery | | $ | 202,059 | | | $ | 213,204 | | | (5.2) | % | | $ | 766,133 | | | $ | 817,077 | | | (6.2) | % | | | | | | | | | | |

| Realized losses on settlement of fuel derivative instruments | | 2,749 | | | 401 | | | 585.5 | % | | 10,923 | | | 401 | | | 2,623.9 | % | | | | | | | | | | |

| Economic fuel expense | | $ | 204,808 | | | $ | 213,605 | | | (4.1) | % | | $ | 777,056 | | | $ | 817,478 | | | (4.9) | % | | | | | | | | | | |

| Fuel gallons consumed | | 68,756 | | | 64,485 | | | 6.6 | % | | 268,491 | | | 239,231 | | | 12.2 | % | | | | | | | | | | |

| Economic fuel costs per gallon | | $ | 2.98 | | | $ | 3.31 | | | (10.0) | % | | $ | 2.89 | | | $ | 3.42 | | | (15.5) | % | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Estimated three months ending March 31, 2024 | | Estimated twelve months ending December 31, 2024 |

| | (in thousands, except per-gallon amounts) |

| Aircraft fuel expense, including taxes and delivery | | $ | 179,716 | | - | $ | 184,901 | | | $ | 709,756 | | - | $ | 730,230 | |

| Realized (gains)/losses on settlement of fuel derivative contracts | | 2,775 | | - | 2,775 | | | 11,100 | | - | 11,100 | |

| Economic fuel expense | | $ | 182,491 | | | $ | 187,676 | | | $ | 720,856 | | | $ | 741,330 | |

| Fuel gallons consumed | | 67,447 | | - | 69,393 | | | 278,051 | | - | 286,072 | |

| Economic fuel costs per gallon | | $ | 2.71 | | - | $ | 2.71 | | | $ | 2.59 | | - | $ | 2.59 | |

Table 4.

Hawaiian Holdings, Inc.

Non-GAAP Financial Measures Reconciliation (unaudited)

The Company evaluates its financial performance utilizing various GAAP and non-GAAP financial measures, including adjusted net income (loss), adjusted operating expenses, adjusted diluted net income (loss) per share (EPS), CASM, Passenger Revenue per RPM, adjusted EBITDA, and adjusted pre-tax margin. Pursuant to Regulation G, the Company has included the following reconciliation of reported non-GAAP financial measures to comparable financial measures reported on a GAAP basis. The adjustments are described below:

•CBA related expense.

◦In February 2023, pilots represented by the Air Line Pilots Association (ALPA) ratified a new four-year CBA, which included, amongst other things, a signing bonus, pay scale increases across all fleet types, improved health benefits and cost sharing, and enhancements to the Company's postretirement and disability plans. In connection with the ratification, the Company recorded a signing bonus and vacation liability true-up of $17.7 million which were recorded in wages and benefits during the quarter ended March 31, 2023.

◦In February 2022, employees represented by the IAM-M and IAM-C ratified a new CBA, which included a one-time signing bonus of $2.1 million, which was recorded in wages and benefits during the first quarter of 2022. During the second quarter of 2022, the Company and the IAM completed a separation program under the CBA and recognized a $2.6 million one-time expense, which was recorded in wages and benefits.

•Employee retention credit (ERC). During the three months ended December 31, 2023, the Company received a $32.5 million employee retention credit under the CARES Act, which was recorded in Wages and benefits in the Consolidated Statements of Operations. In addition, the Company received $1.8 million in interest income in connection with the ERC, which was recorded in Interest income in the Consolidated Statements of Operations.

•Contract termination amortization. In December 2022, the Company entered into a Memorandum of Understanding (MOU) with one of its third-party service providers to early terminate its Amended and Restated Complete Fleet Services Agreement (Amended CFS) covering A330-200 aircraft. The Amended CFS was originally scheduled to run through December 2027, but terminated in April 2023. Upon execution of the MOU, the Company recognized in fiscal year 2022 $12.5 million in termination fees. As of December 31, 2022, the Company had approximately $24.1 million in deferred liabilities to be recognized into earnings over the remaining contract term as contra-maintenance materials and repairs expense. During the three and twelve months ended December 31, 2023, the Company recognized approximately $0.0 million and $24.1 million, respectively, in amortization within Maintenance, materials and repairs in the Consolidated Statements of Operations.

•Special items. The Company recorded the following as special items:

◦During the third quarter of 2022, the Company estimated the fair value of our remaining ATR-42 and ATR-72 aircraft, which resulted in the recognition of a $6.3 million impairment charge recorded as a Special item in the Company's Consolidated Statements of Operations.

◦During the fourth quarter of 2022, the Company entered into a Memorandum of Understanding (MOU) with its third-party service provider to early terminate its Amended and Restated Complete Fleet Services (CFS) Agreement (Amended CFS). The Amended CFS was originally scheduled to run through December 2027, but terminated in April 2023. In connection with the MOU, the Company agreed to pay a total of $12.5 million in termination fees, which was recognized at execution as a Special item in the Company's Consolidated Statements of Operations.

◦During the year ended December 31, 2023, the Company recorded $10.6 million in Special items related to expenses related to its merger with Alaska Air Group, primarily consisting of legal, advisory, and other fees.

•Loss (gain) on sale of aircraft. During the second quarter of 2022, the Company sold three ATR-72 aircraft and recognized a $2.6 million gain on the transactions, which was recorded in Other operating expense in the Company's Consolidated Statements of Operations.

•Gain on sale of commercial real estate. In February 2023, the Company entered into an agreement for the sale of its commercial real estate and recognized a gain on sale of $10.2 million, which was recorded in Other operating expense in the Consolidated Statements of Operations.

•Interest income on federal tax refund. In March 2023, the Company received $4.7 million in interest in connection with a $66.8 million federal tax refund received related to fiscal year 2018. The interest was recorded in Interest income in the Consolidated Statements of Operations. In December 2023, the Company received $1.8 million in interest income in connection with the ERC, which was recorded in Interest income in the Consolidated Statements of Operations.

•Changes in fair value of fuel derivative instruments. Changes in fair value of fuel derivative contracts, net of tax, are based on market prices for open contracts as of the end of the reporting period, and include the unrealized amounts of fuel derivatives (not designated as hedges) that will settle in future periods and the reversal of prior period unrealized amounts.

•Loss on extinguishment of debt. During the second quarter of 2022, the Company recognized a $8.6 million loss on the extinguishment of its remaining outstanding Series 2020-1A and Series 2020-1B Equipment Notes. Loss on extinguishment of debt is excluded to allow investors to better analyze our core operational performance and more readily compare our results to other airlines in the periods presented below.

•Unrealized loss (gain) on foreign debt. Unrealized loss (gain) on foreign debt is based on fluctuation in exchange rates and the measurement of foreign-denominated debt to our functional currency.

•Unrealized loss (gain) on equity securities. Unrealized losses on equity securities and gains on derivative instruments in our investment portfolio are driven by changes in market prices and currency fluctuations, which are recorded in Other nonoperating expense in the consolidated statements of operations.

The Company believes that adjusting for the impact of employee retention credits, changes in fair value of equity securities and fuel derivative contracts, fluctuations in exchange rates on debt instruments denominated in foreign currency, non-recurring expenses and income/gains (including CBA-related, contract termination amortization, special items, interest income on tax refund, gain or loss on sale of aircraft, gain on sale of commercial real estate, and loss on extinguishment of debt and the tax effect of such adjustments helps investors better analyze the Company's operational performance and compare its results to other airlines in the periods presented.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | Total | | Diluted Per Share | | Total | | Diluted Per Share | | Total | | Diluted Per Share | | Total | | Diluted Per Share |

| | (in thousands, except per share data) |

| GAAP net loss, as reported | | $ | (101,182) | | | $ | (1.96) | | | $ | (50,160) | | | $ | (0.98) | | | $ | (260,494) | | | $ | (5.05) | | | $ | (240,081) | | | $ | (4.67) | |

| Adjusted for: | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| CBA related expense | | — | | | — | | | — | | | — | | | 17,727 | | | 0.34 | | | 4,678 | | | 0.09 | |

| Employee retention credit (ERC) | | (32,516) | | | (0.63) | | | — | | | — | | | (32,516) | | | (0.63) | | | — | | | — | |

| Contract termination amortization | | — | | | — | | | — | | | — | | | (24,085) | | | (0.47) | | | — | | | — | |

| Special items | | 10,561 | | | 0.21 | | | 12,500 | | | 0.24 | | | 10,561 | | | 0.21 | | | 18,803 | | | 0.37 | |

| | | | | | | | | | | | | | | | |

| Loss (gain) on sale of aircraft | | — | | | — | | | — | | | — | | | 392 | | | 0.01 | | | (2,578) | | | (0.05) | |

| Gain on sale of commercial real estate | | — | | | — | | | — | | | — | | | (10,179) | | | (0.20) | | | — | | | — | |

| Interest income on federal tax refund | | (1,820) | | | (0.03) | | | — | | | — | | | (6,492) | | | (0.13) | | | — | | | — | |

| Changes in fair value of fuel derivative instruments | | 4,243 | | | 0.08 | | | 1,577 | | | 0.03 | | | 1,696 | | | 0.03 | | | 2,640 | | | 0.05 | |

| Loss on extinguishment of debt | | — | | | — | | | — | | | — | | | — | | | — | | | 8,568 | | | 0.17 | |

| Unrealized loss (gain) on foreign debt | | 7,123 | | | 0.14 | | | 15,501 | | | 0.30 | | | (11,668) | | | (0.22) | | | (26,196) | | | (0.51) | |

| | | | | | | | | | | | | | | | |

| Unrealized loss (gain) on equity securities | | (13,904) | | | (0.27) | | | 2,110 | | | 0.04 | | | (10,755) | | | (0.21) | | | 24,949 | | | 0.49 | |

| | | | | | | | | | | | | | | | |

| Tax effect of adjustments | | 4,824 | | | 0.09 | | | (6,211) | | | (0.12) | | | 12,269 | | | 0.24 | | | (1,242) | | | (0.02) | |

| Adjusted Net Loss | | $ | (122,671) | | | $ | (2.37) | | | $ | (24,683) | | | $ | (0.49) | | | $ | (313,544) | | | $ | (6.08) | | | $ | (210,459) | | | $ | (4.08) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended

December 31, | | Twelve months ended

December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | (in thousands) |

| Income (Loss) Before Income Taxes | | $ | (126,982) | | | $ | (62,918) | | | $ | (327,794) | | | $ | (293,849) | |

| Adjusted for: | | | | | | | | |

| CBA related expense | | — | | | — | | | 17,727 | | | 4,678 | |

| Employee retention credit (ERC) | | (32,516) | | | — | | | (32,516) | | | — | |

| Contract termination amortization | | — | | | — | | | (24,085) | | | — | |

| Special items | | 10,561 | | | 12,500 | | | 10,561 | | | 18,803 | |

| | | | | | | | |

| Loss (gain) on sale of aircraft | | — | | | — | | | 392 | | | (2,578) | |

| Gain on sale of commercial real estate | | — | | | — | | | (10,179) | | | — | |

| Interest income on federal tax refund | | (1,820) | | | — | | | (6,492) | | | — | |

| Changes in fair value of fuel derivative instruments | | 4,243 | | | 1,577 | | | 1,696 | | | 2,640 | |

| Loss on extinguishment of debt | | — | | | — | | | — | | | 8,568 | |

| Unrealized loss (gain) on foreign debt | | 7,123 | | | 15,501 | | | (11,668) | | | (26,196) | |

| | | | | | | | |

| Unrealized loss (gain) on equity securities | | (13,904) | | | 2,110 | | | (10,755) | | | 24,949 | |

| | | | | | | | |

Adjusted Loss Before Income Taxes | | $ | (153,295) | | | $ | (31,230) | | | $ | (393,113) | | | $ | (262,985) | |

Adjusted EBITDA

The Company believes that adjusting earnings for interest, taxes, depreciation and amortization, non-recurring operating expenses (such as changes in unrealized gains and losses on financial instruments) and one-time charges helps investors better analyze the Company's financial performance by allowing for company-to-company and period-over-period comparisons that are unaffected by company-specific or one-time occurrences.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended

December 31, | | Twelve months ended

December 31, | | |

| | 2023 | | 2022 | | 2023 | | 2022 | | |

| | (in thousands) | | |

Net Loss before Taxes | | $ | (126,982) | | | $ | (62,918) | | | $ | (327,794) | | | $ | (293,849) | | | |

| Depreciation & Amortization | | 32,840 | | | 33,735 | | | 133,615 | | | 136,169 | | | |

| Interest and amortization of debt | | 22,358 | | | 23,054 | | | 90,540 | | | 95,815 | | | |

| EBITDA, as reported | | (71,784) | | | (6,129) | | | (103,639) | | | (61,865) | | | |

| Adjusted for: | | | | | | | | | | |

| CBA related expense | | — | | | — | | | 17,727 | | | 4,678 | | | |

| Employee retention credit (ERC) | | (32,516) | | | — | | | (32,516) | | | — | | | |

| Contract termination amortization | | — | | | — | | | (24,085) | | | — | | | |

| Special items | | 10,561 | | | 12,500 | | | 10,561 | | | 18,803 | | | |

| | | | | | | | | | |

| Loss (gain) on sale of aircraft | | — | | | — | | | 392 | | | (2,578) | | | |

| Gain on sale of commercial real estate | | — | | | — | | | (10,179) | | | — | | | |

| Interest income on federal tax refund | | (1,820) | | | — | | | (6,492) | | | — | | | |

| Changes in fair value of fuel derivative contracts | | 4,243 | | | 1,577 | | | 1,696 | | | 2,640 | | | |

| Loss on extinguishment of debt | | — | | | — | | | — | | | 8,568 | | | |

| Unrealized loss (gain) on foreign debt | | 7,123 | | | 15,501 | | | (11,668) | | | (26,196) | | | |

| | | | | | | | | | |

| Unrealized loss (gain) on investment securities | | (13,904) | | | 2,110 | | | (10,755) | | | 24,949 | | | |

| | | | | | | | | | |

| Adjusted EBITDA | | $ | (98,097) | | | $ | 25,559 | | | $ | (168,958) | | | $ | (31,001) | | | |

Operating Costs per Available Seat Mile (CASM)

The Company has separately listed in the table below its fuel costs per ASM and non-GAAP unit costs, excluding fuel and non-recurring items. These amounts are included in CASM, but for internal purposes the Company consistently uses cost metrics that exclude fuel and non-recurring items (if applicable) to measure and monitor its costs.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| | (in thousands, except CASM data) |

| GAAP operating expenses | | $ | 780,824 | | | $ | 763,822 | | | $ | 3,009,959 | | | $ | 2,851,321 | |

Adjusted for: | | | | | | | | |

| CBA related expense | | — | | | — | | | (17,727) | | | (4,678) | |

| Employee retention credit (ERC) | | 32,516 | | | — | | | 32,516 | | | — | |

| Contract termination amortization | | — | | | — | | | 24,085 | | | — | |

| Special items | | (10,561) | | | (12,500) | | | (10,561) | | | (18,803) | |

| | | | | | | | |

| Gain (loss) on sale of aircraft | | — | | | — | | | (392) | | | 2,578 | |

| Gain on sale of commercial real estate | | — | | | — | | | 10,179 | | | — | |

Operating Expenses excluding non-recurring items | | 802,779 | | | 751,322 | | | 3,048,059 | | | 2,830,418 | |

| Aircraft fuel, including taxes and delivery | | (202,059) | | | (213,204) | | | (766,133) | | | (817,077) | |

| Operating Expenses excluding fuel and non-recurring items | | $ | 600,720 | | | $ | 538,118 | | | $ | 2,281,926 | | | $ | 2,013,341 | |

| Available Seat Miles | | 5,103,666 | | | 4,940,514 | | | 20,204,497 | | | 18,684,642 | |

| CASM—GAAP | | 15.30 | ¢ | | 15.46 | ¢ | | 14.90 | ¢ | | 15.26 | ¢ |

| Aircraft fuel, including taxes and delivery | | (3.96) | | | (4.32) | | | (3.79) | | | (4.37) | |

| CBA related expense | | — | | | — | | | (0.09) | | | (0.02) | |

| Employee retention credit (ERC) | | 0.64 | | | — | | | 0.15 | | | — | |

| Contract termination amortization | | — | | | — | | | 0.12 | | | — | |

| Special items | | (0.21) | | | (0.25) | | | (0.05) | | | (0.10) | |

| | | | | | | | |

| Gain (loss) on sale of aircraft | | — | | | — | | | — | | | 0.01 | |

| Gain on sale of commercial real estate | | — | | | — | | | 0.05 | | | — | |

| CASM excluding fuel and non-recurring items | | 11.77 | ¢ | | 10.89 | ¢ | | 11.29 | ¢ | | 10.78 | ¢ |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Estimated three months ending March 31, 2024 | | Estimated twelve months ending December 31, 2024 | |

| | (in thousands, except CASM data) |

| GAAP operating expenses | | $ | 785,786 | | - | $ | 825,746 | | | $ | 3,214,296 | | - | $ | 3,377,846 | | |

| Aircraft fuel, including taxes and delivery | | (179,716) | | - | (184,901) | | | (709,756) | | - | (730,230) | | |

| Non-recurring items | | (4,999) | | | (4,999) | | | (85,698) | | | (85,698) | | |

| Adjusted operating expenses | | $ | 601,071 | | - | $ | 635,846 | | | $ | 2,418,842 | | - | $ | 2,561,918 | | |

| Available seat miles | | 5,040,454 | | - | 5,187,980 | | | 21,416,766 | | - | 22,022,901 | | |

| CASM - GAAP | | 15.59 | ¢ | - | 15.92 | ¢ | | 15.01 | ¢ | - | 15.34 | ¢ | |

| Aircraft fuel, including taxes and delivery | | (3.57) | | - | (3.56) | | | (3.32) | | - | (3.32) | | |

| Non-recurring items | | (0.10) | | | (0.10) | | | (0.40) | | | (0.39) | | |

| | | | | | | | | |

| CASM excluding fuel and non-recurring items | | 11.92 | ¢ | - | 12.26 | ¢ | | 11.29 | ¢ | - | 11.63 | ¢ | |

Pre-tax margin

The Company excludes unrealized (gains) losses from fuel derivative instruments, foreign debt, and equity securities, gain on the sale of aircraft, and non-recurring items from pre-tax margin for the same reasons as described above.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended

December 31, | | Twelve months ended

December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Pre-Tax Margin, as reported | | (19.0) | % | | (8.6) | % | | (12.1) | % | | (11.1) | % |

| Adjusted for: | | | | | | | | |

| CBA related expense | | — | | | — | | | 0.6 | | | 0.2 | |

| Employee retention credit | | (4.9) | | | — | | | (1.2) | | | — | |

| Contract termination amortization | | — | | | — | | | (0.9) | | | — | |

| Special items | | 1.6 | | | 1.7 | | | 0.4 | | | 0.7 | |

| | | | | | | | |

| Loss (gain) on sale of aircraft | | — | | | — | | | — | | | (0.1) | |

| Gain on sale of commercial real estate | | — | | | — | | | (0.4) | | | — | |

| Interest income on federal tax refund | | (0.3) | | | — | | | (0.2) | | | — | |

| Changes in fair value of fuel derivative contracts | | 0.6 | | | 0.2 | | | 0.1 | | | 0.1 | |

| Loss on extinguishment of debt | | — | | | — | | | — | | | 0.3 | |

| Unrealized loss (gain) on foreign debt | | 1.2 | | | 2.1 | | | (0.4) | | | (1.0) | |

| | | | | | | | |

| Unrealized loss (gain) on equity securities | | (2.1) | | | 0.3 | | | (0.4) | | | 0.9 | |

| | | | | | | | |

| Adjusted Pre-Tax Margin | | (22.9) | % | | (4.3) | % | | (14.5) | % | | (10.0) | % |

v3.24.0.1

Cover Page Cover Page

|

Jan. 30, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 30, 2024

|

| Entity Registrant Name |

HAWAIIAN HOLDINGS INC

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-31443

|

| Entity Tax Identification Number |

71-0879698

|

| Entity Address, Address Line One |

3375 Koapaka Street,

|

| Entity Address, Address Line Two |

Suite G-350

|

| Entity Address, City or Town |

Honolulu,

|

| Entity Address, State or Province |

HI

|

| Entity Address, Postal Zip Code |

96819

|

| City Area Code |

808

|

| Local Phone Number |

835-3700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock ($0.01 par value)

|

| Trading Symbol |

HA

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001172222

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

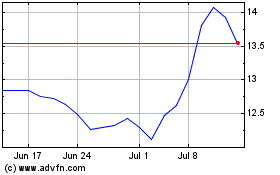

Hawaiian (NASDAQ:HA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hawaiian (NASDAQ:HA)

Historical Stock Chart

From Apr 2023 to Apr 2024