0000006281false00000062812024-01-242024-01-24

_________________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________________________________________________________________________

FORM 8-K

_____________________________________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 24, 2024

_____________________________________________________________________________________________________

| | |

|

| Analog Devices, Inc. |

| (Exact name of Registrant as Specified in its Charter) |

|

______________________________________________________________________________________________________ | | | | | | | | | | | | | | |

| | | | |

| Massachusetts | | 1-7819 | | 04-2348234 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | |

| | | | | | | | | | | |

| | | |

| One Analog Way | |

| Wilmington, | MA | 01887 |

| (Address of Principal Executive Offices) | (Zip Code) |

| | | |

Registrant's telephone number, including area code: (781) 935-5565

Not Applicable | | |

| (Former Name or Former Address, if Changed Since Last Report) |

______________________________________________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange

on which registered |

| Common Stock $0.16 2/3 par value per share | | ADI | | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment of Richard C. Puccio, Jr. as Executive Vice President and Chief Financial Officer

On January 25, 2024, Analog Devices, Inc. (the “Company”) announced the appointment of Richard C. Puccio, Jr. as Executive Vice President and Chief Financial Officer (principal financial officer), effective as of February 5, 2024. In this role, Mr. Puccio will set the Company’s financial strategy and lead the Company’s global finance operations. James Mollica will continue to serve as the Company’s interim Chief Financial Officer (principal financial officer) until Mr. Puccio’s first date of employment.

Mr. Puccio, 56, most recently served as the Chief Financial Officer at Amazon Web Services, Inc. (“AWS”), a leading global cloud and technology services provider, from May 2021 to January 2024. Prior to his role at AWS, Mr. Puccio was at PricewaterhouseCoopers, a professional services firm, for nearly 29 years, serving as a Partner for 21 years.

There are no family relationships between Mr. Puccio and any director, executive officer or person nominated or chosen by the Company to become a director or executive officer of the Company. There are no transactions in which Mr. Puccio has an interest requiring disclosure under Item 404(a) of Regulation S-K.

Employment Arrangements with Mr. Puccio

In connection with his appointment as Executive Vice President and Chief Financial Officer, the Company entered into an offer letter with Mr. Puccio (the “Offer Letter”) setting forth the terms of his employment and compensation. Under the terms of the Offer Letter, Mr. Puccio’s annual base salary will be $670,000, and he will be eligible for an annual cash incentive bonus with a target award percentage of 125% of base salary under the Company’s Executive Performance Incentive Plan. In addition, Mr. Puccio will receive a one-time hiring bonus of $500,000.

Pursuant to the Offer Letter and in accordance with the Company’s equity award guidelines and policies, on the 15th of the month following his start date (or if Nasdaq is closed on that day, the next succeeding business day that Nasdaq is open), Mr. Puccio will be granted a restricted stock unit award with a grant date value of $10 million, which vests in equal annual installments over a three-year period, commencing on the first anniversary of the grant date, subject to Mr. Puccio’s continued employment with the Company through each vesting date. Mr. Puccio will also receive an annual equity award for fiscal year 2024 with a grant date value of $5.5 million, which will be comprised of the same types of equity received by other executives reporting to the Company’s Chief Executive Officer.

In connection with Mr. Puccio’s appointment, the Company and Mr. Puccio will enter into the Company’s standard (i) Employee Retention Agreement for officers and key employees, the form of which has been previously filed as Exhibit 10.1 to the Company’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (the “SEC”) on May 22, 2012, and (ii) Indemnification Agreement for executive officers, previously filed as Exhibit 10.30 to the Company’s Annual Report on Form 10-K for the fiscal year ended November 1, 2008 filed with the SEC on November 25, 2008.

Item 7.01. Regulation FD Disclosure.

A press release, dated January 25, 2024, announcing the appointment of Richard C. Puccio, Jr. as Executive Vice President and Chief Financial Officer of the Company is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information under this Item 7.01, including the press release attached hereto as exhibit 99.1, is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended regardless of any general incorporation language in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits | | | | | | | | |

| | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

| | |

| | |

| | |

| | |

| | |

| | |

| 104 | | Cover page Interactive Data File (formatted as inline XBRL). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | | | | | | | | | | |

| | | | | | |

| Date: | January 25, 2024 | ANALOG DEVICES, INC. | |

| | | By: | /s/ Janene I. Asgeirsson | |

| | | | Janene I. Asgeirsson | |

| | | | | Senior Vice President, Chief Legal Officer and Corporate Secretary | |

CONTACT:

Michael Lucarelli

Vice President, Investor Relations and FP&A

Analog Devices

Investor.Relations@analog.com

Ferda Millan

Global PR and External Communications

Analog Devices

Ferda.Millan@analog.com

For Release: January 25, 2024

Analog Devices Appoints Richard C. Puccio, Jr. as Executive Vice President and Chief Financial Officer

January 25, 2024—Wilmington, MA—Analog Devices, Inc. (Nasdaq: ADI) today announced that Richard C. Puccio, Jr. will join the company on February 5, 2024 as Executive Vice President and Chief Financial Officer. In this role, Mr. Puccio will set ADI’s financial strategy and lead the company’s global finance operations. Mr. Puccio will report to CEO and Chair Vincent Roche.

“Rich brings tremendous experience and capability from his more than three decades of leading financial advisory and high-growth business operations activities in complex technology sectors, and this makes him a great addition to ADI’s leadership team. We welcome Rich’s sharp business acumen to enable ADI to accelerate the effectiveness of our operations in a world of increasing opportunity and complexity,” said Vincent Roche, ADI’s CEO and Chair. “I would also like to thank Jim Mollica for his partnership and contribution as interim CFO, and I look forward to Jim’s continued leadership in ADI’s finance organization,” continued Mr. Roche.

Mr. Puccio joins ADI from Amazon Web Services (AWS), a leading global cloud and technology services provider, where he served as CFO. In his role at AWS, Mr. Puccio partnered closely with the business to manage more than 200 fully featured services, including compute, storage, databases, robotics, machine learning and artificial intelligence (AI), Internet of Things (IoT), mobile, and security, among many other technologies. Prior to his role at AWS, Mr. Puccio was at PricewaterhouseCoopers (PwC) for nearly 29 years, where he served as a partner for over two decades. During his tenure at PwC, Mr. Puccio primarily served clients in the global technology, semiconductor, and semiconductor capital equipment industries.

“With its innovative spirit, amazing talent, and dedication to enriching lives and the world around us, ADI has exceptionally strong growth potential. I’m delighted to be joining ADI as the company’s new CFO and look forward to bringing my digital, software, and platform experience to the company as we play an increasingly important role in creating the Intelligent Edge and driving new levels of shareholder value,” said Mr. Puccio.

Mr. Puccio earned his AB in Economics from Harvard University and his MBA from Boston University.

About Analog Devices, Inc.

Analog Devices, Inc. (NASDAQ: ADI) is a global semiconductor leader that bridges the physical and digital worlds to enable breakthroughs at the Intelligent Edge. ADI combines analog, digital, and software technologies into solutions that help drive advancements in digitized factories, mobility, and digital healthcare, combat climate change, and reliably connect humans and the world. With revenue of more than $12 billion in FY23 and approximately 26,000 people globally working alongside 125,000 global customers, ADI ensures today’s innovators stay Ahead of What’s Possible. Learn more at www.analog.com and on LinkedIn and Twitter (X).

Forward Looking Statements

This release contains forward-looking statements, which address a variety of subjects including, for example, our statements regarding stakeholder value creation; innovation trends; and other future events. Statements that are not historical facts, including statements about our beliefs, plans and expectations, are forward-looking statements. Such statements are based on our current expectations and are subject to a number of factors and uncertainties, which could cause actual results to differ materially from those described in the forward-looking statements. The following important factors and uncertainties, among others, could cause actual results to differ materially from those described in these forward-looking statements: the effects of business, economic, political, legal, and regulatory uncertainty or conflicts upon our global operations; changes in demand for semiconductors and the related changes in demand and supply for our products; products that may be diverted from our authorized distribution channels; manufacturing delays, product availability, and supply chain disruptions; our future liquidity, capital needs, and capital expenditures; our development of technologies and research and development investments; our ability to compete successfully in the markets in which we operate; changes in our estimates of our expected tax rates based on current tax law; adverse results in litigation matters; the risk that we will be unable to retain and hire key personnel; security breaches or other cyber incidents; unanticipated difficulties or expenditures relating to integrating Maxim; uncertainty as to the long-term value of our common stock; and the risk that expected benefits, synergies, and growth prospects of acquisitions, including those from our acquisition of Maxim, may not be fully achieved in a timely manner, or at all. For additional information about factors that could cause actual results to differ materially from those described in the forward-looking statements, please refer to our filings with the Securities and Exchange Commission, including the risk factors contained in our most recent Annual Report on Form 10-K. Forward-looking statements represent management’s current expectations and are inherently uncertain. Except as required by law, we do not undertake any obligation to update forward-looking statements made by us to reflect subsequent events or circumstances.

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

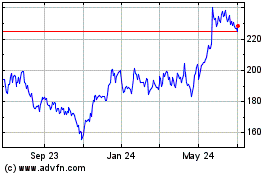

Analog Devices (NASDAQ:ADI)

Historical Stock Chart

From Mar 2024 to Apr 2024

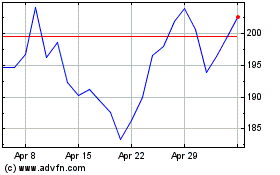

Analog Devices (NASDAQ:ADI)

Historical Stock Chart

From Apr 2023 to Apr 2024