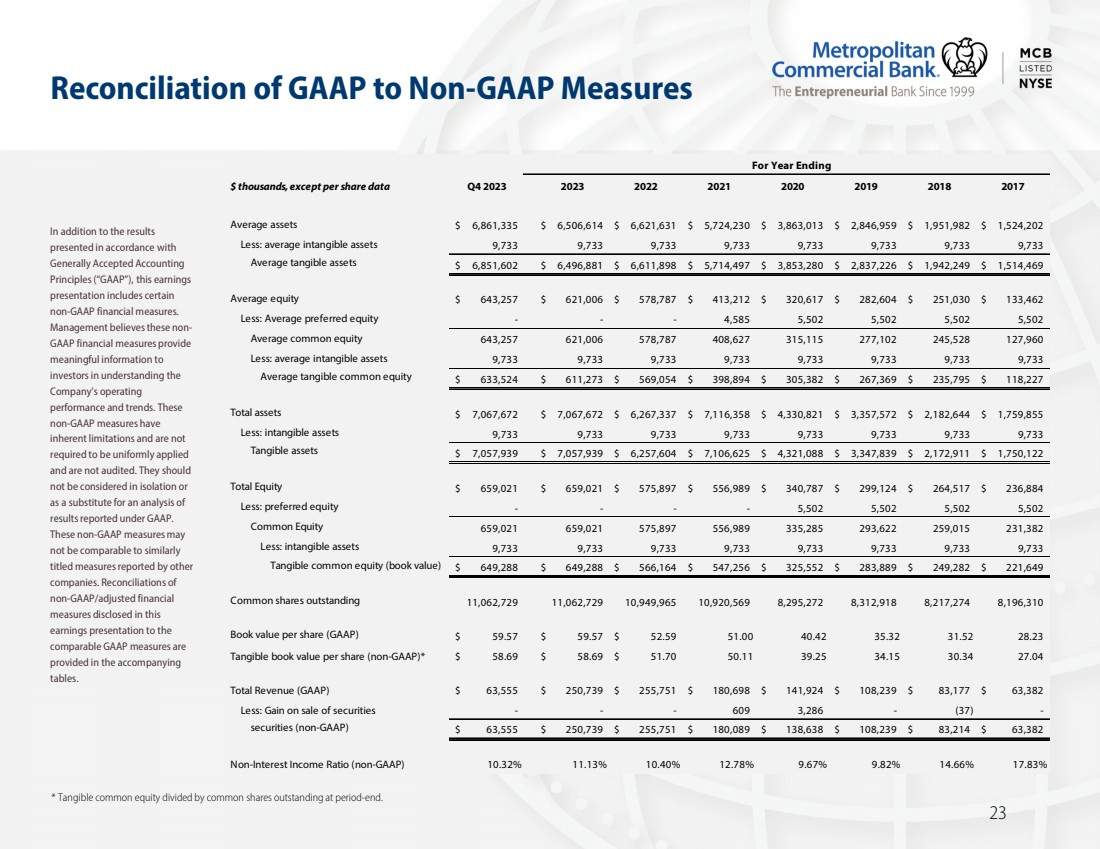

| Reconciliation of GAAP to Non-GAAP Measures

* Tangible common equity divided by common shares outstanding at period-end.

In addition to the results

presented in accordance with

Generally Accepted Accounting

Principles (“GAAP”), this earnings

presentation includes certain

non-GAAP financial measures.

Management believes these non-GAAP financial measures provide

meaningful information to

investors in understanding the

Company’s operating

performance and trends. These

non-GAAP measures have

inherent limitations and are not

required to be uniformly applied

and are not audited. They should

not be considered in isolation or

as a substitute for an analysis of

results reported under GAAP.

These non-GAAP measures may

not be comparable to similarly

titled measures reported by other

companies. Reconciliations of

non-GAAP/adjusted financial

measures disclosed in this

earnings presentation to the

comparable GAAP measures are

provided in the accompanying

tables.

23

$ thousands, except per share data Q4 2023 2023 2022 2021 2020 2019 2018 2017

Average assets $ 6,861,335 $ 6,506,614 $ 6,621,631 $ 5,724,230 $ 3,863,013 $ 2,846,959 $ 1,951,982 $ 1,524,202

Less: average intangible assets 9,733 9,733 9,733 9,733 9,733 9,733 9,733 9,733

Average tangible assets $ 6,851,602 $ 6,496,881 $ 6,611,898 $ 5,714,497 $ 3,853,280 $ 2,837,226 $ 1,942,249 $ 1,514,469

Average equity $ 643,257 $ 621,006 $ 578,787 $ 413,212 $ 320,617 $ 282,604 $ 251,030 $ 133,462

Less: Average preferred equity - - - 4,585 5,502 5,502 5,502 5,502

Average common equity 643,257 621,006 578,787 408,627 315,115 277,102 245,528 127,960

Less: average intangible assets 9,733 9,733 9,733 9,733 9,733 9,733 9,733 9,733

Average tangible common equity $ 633,524 $ 611,273 $ 569,054 $ 398,894 $ 305,382 $ 267,369 $ 235,795 $ 118,227

Total assets $ 7,067,672 $ 7,067,672 $ 6,267,337 $ 7,116,358 $ 4,330,821 $ 3,357,572 $ 2,182,644 $ 1,759,855

Less: intangible assets 9,733 9,733 9,733 9,733 9,733 9,733 9,733 9,733

Tangible assets $ 7,057,939 $ 7,057,939 $ 6,257,604 $ 7,106,625 $ 4,321,088 $ 3,347,839 $ 2,172,911 $ 1,750,122

Total Equity $ 659,021 $ 659,021 $ 575,897 $ 556,989 $ 340,787 $ 299,124 $ 264,517 $ 236,884

Less: preferred equity - - - - 5,502 5,502 5,502 5,502

Common Equity 659,021 659,021 575,897 556,989 335,285 293,622 259,015 231,382

Less: intangible assets 9,733 9,733 9,733 9,733 9,733 9,733 9,733 9,733

Tangible common equity (book value) $ 649,288 $ 649,288 $ 566,164 $ 547,256 $ 325,552 $ 283,889 $ 249,282 $ 221,649

Common shares outstanding 11,062,729 11,062,729 10,949,965 10,920,569 8,295,272 8,312,918 8,217,274 8,196,310

Book value per share (GAAP) $ 59.57 $ 59.57 $ 52.59 51.00 40.42 35.32 31.52 28.23

Tangible book value per share (non-GAAP)* $ 58.69 $ 58.69 $ 51.70 50.11 39.25 34.15 30.34 27.04

Total Revenue (GAAP) $ 63,555 $ 250,739 $ 255,751 $ 180,698 $ 141,924 $ 108,239 $ 83,177 $ 63,382

Less: Gain on sale of securities - - - 609 3,286 - (37) -

securities (non-GAAP) $ 63,555 $ 250,739 $ 255,751 $ 180,089 $ 138,638 $ 108,239 $ 83,214 $ 63,382

Non-Interest Income Ratio (non-GAAP) 10.32% 11.13% 10.40% 12.78% 9.67% 9.82% 14.66% 17.83%

For Year Ending |