false

0001514443

0001514443

2023-12-07

2023-12-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): December

7, 2023

AMERIGUARD

SECURITY SERVICES, INC.

(Exact Name of Registrant as Specified in its Charter)

| Nevada

|

|

333-173039 |

|

99-0363866 |

(State of

incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

5470

W. Spruce Avenue, Suite 102

Fresno,

CA 00000

(Address of principal executive offices)

(559)

271-5984

(Registrant’s telephone number, including area

code)

(Former Name or former address if changed from last

report.)

Securities registered pursuant to Section 12(g)

of the Act: None

Securities registered pursuant to Section 12(b)

of the Act: None

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2 below):

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a - 12) |

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13d-4(c)) |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

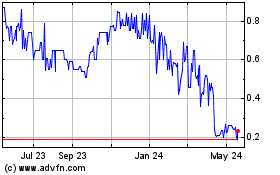

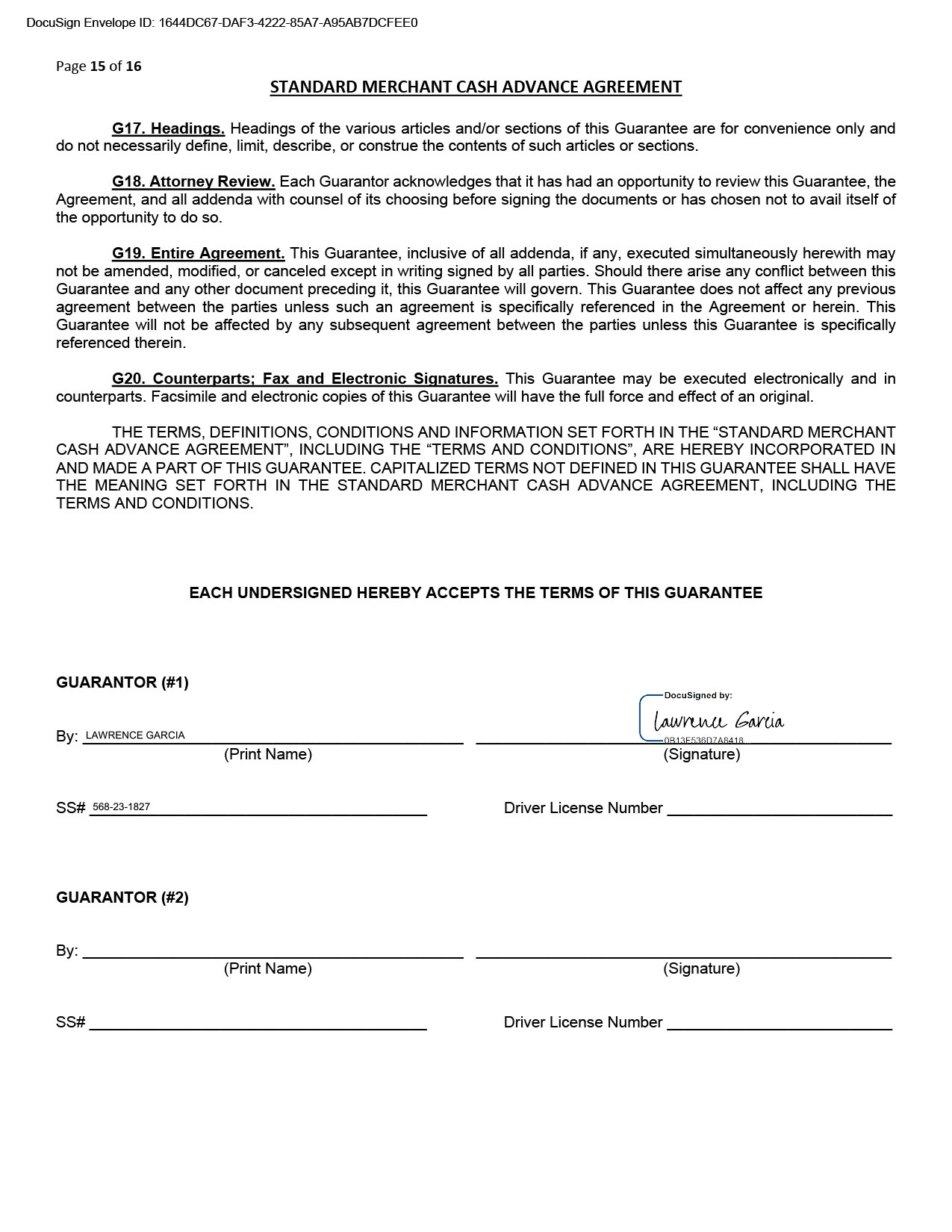

Item 1.01 Entry into a Material Definitive Agreement.

On December 18, 2023, Ameriguard Security Services

Inc. (“AGSS”) entered into a revenue purchase agreement with Velocity Capital Group LLC (“VCG”), pursuant to which

AGSS received $412,500 from VCG, for a purchase amount of $565,125. The purchased interest percentage was 8.48%. AGSS committed to paying

VCG $17,660 weekly.

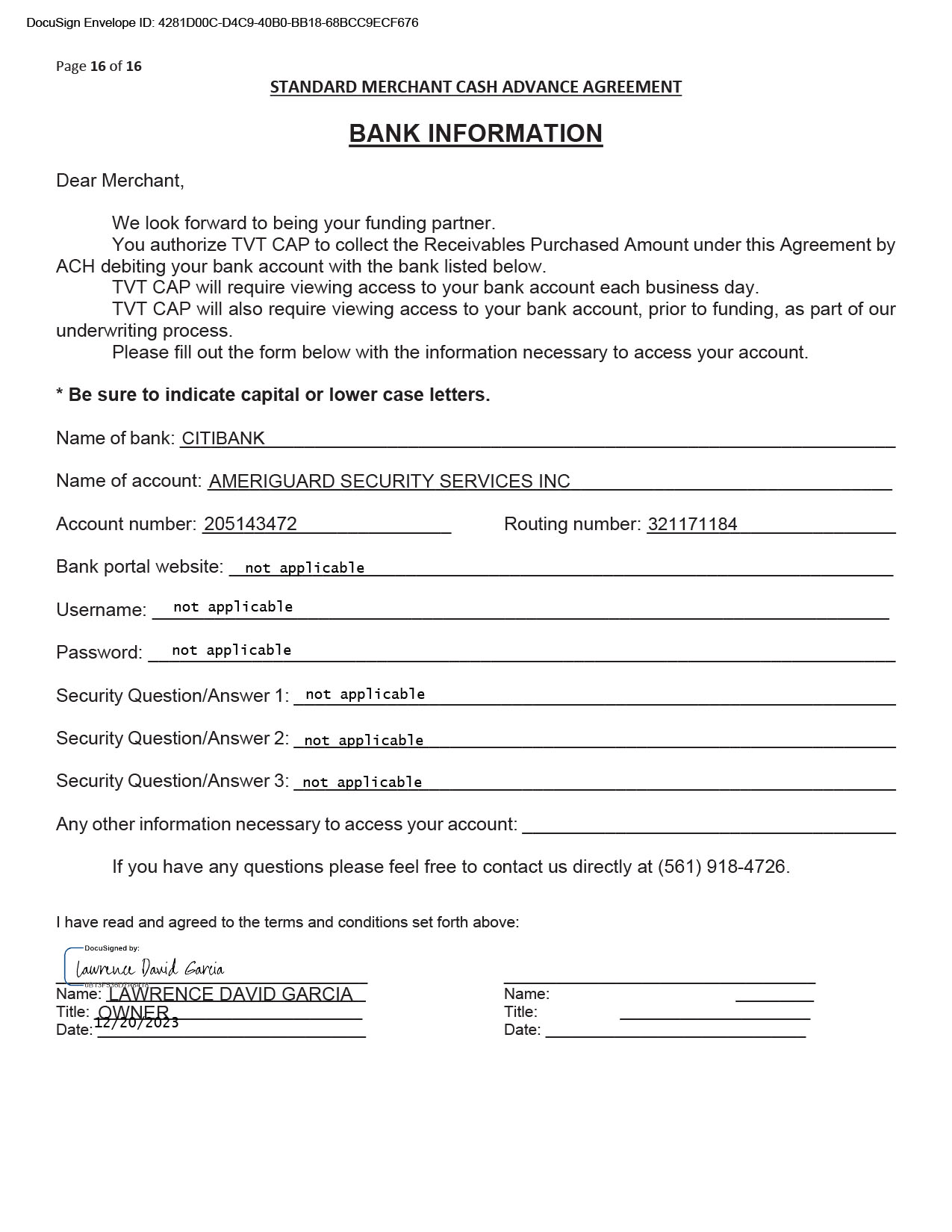

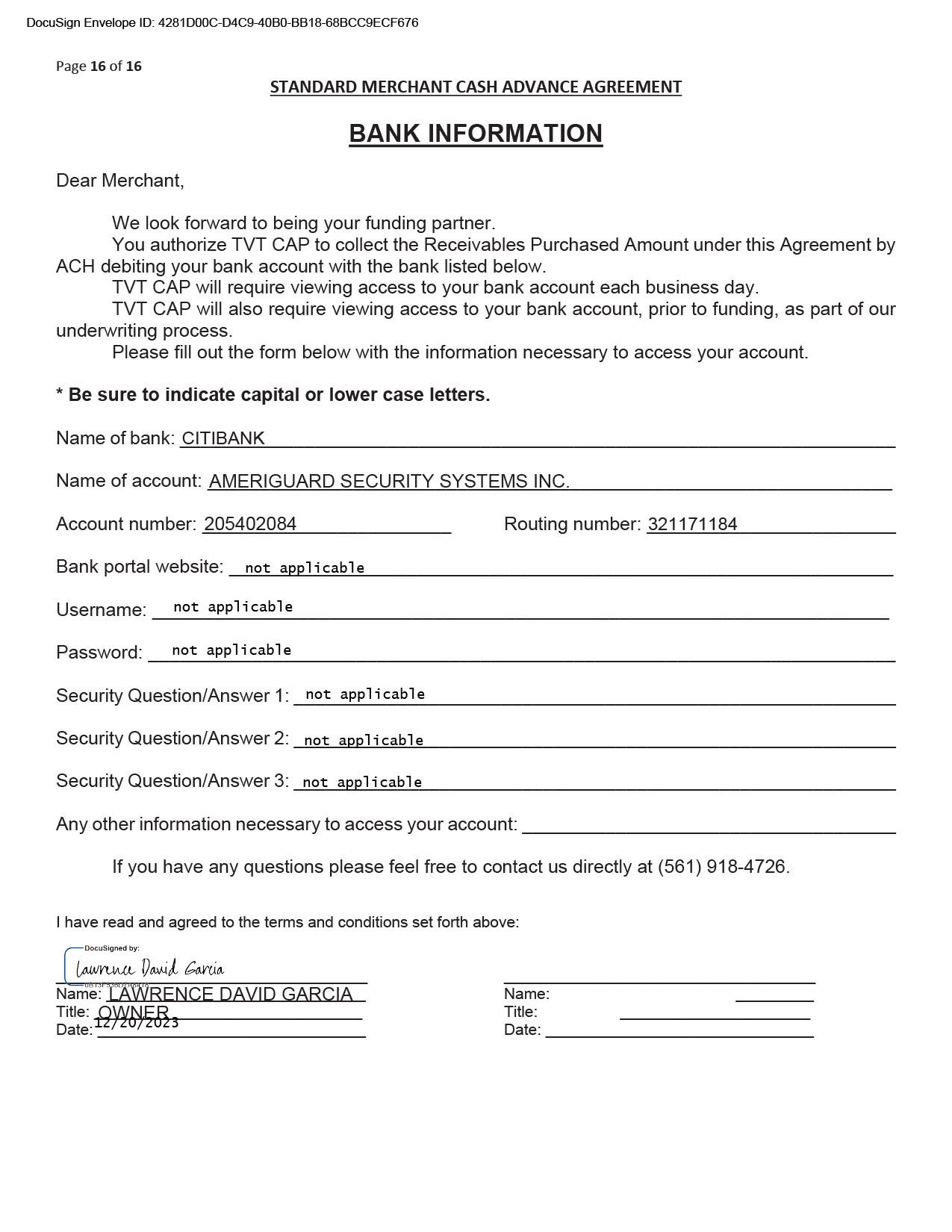

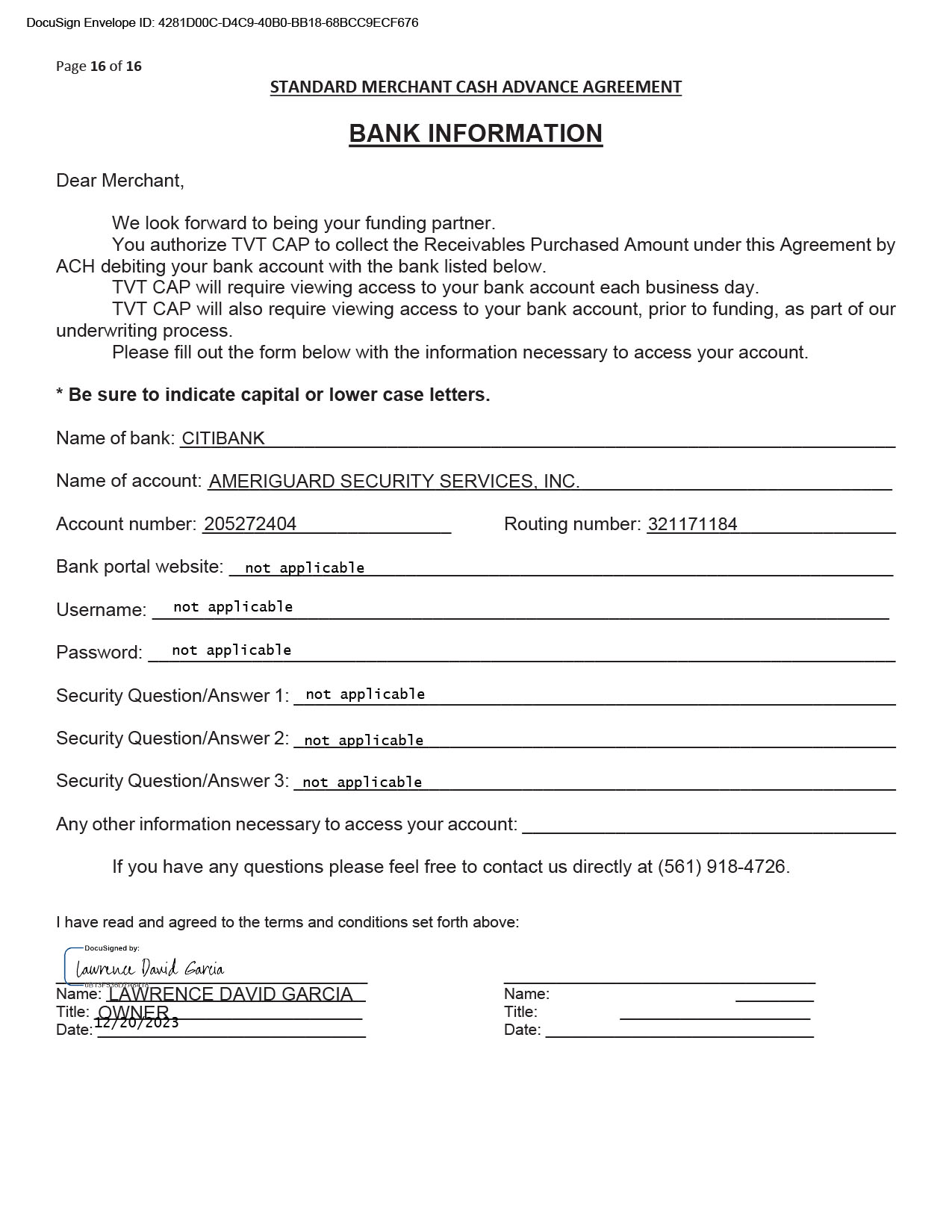

On December 20, 2023, AGSS entered into a standard

merchant cash advance agreement with TVT CAP (“TVT”), pursuant to which AGSS received $736,000 from TVT, for a purchase price

of $800,000 and a purchased receivables amount of $1,199,200. The purchased interest percentage was 14.87%. AGSS committed to paying VCG

$49,966.67 weekly.

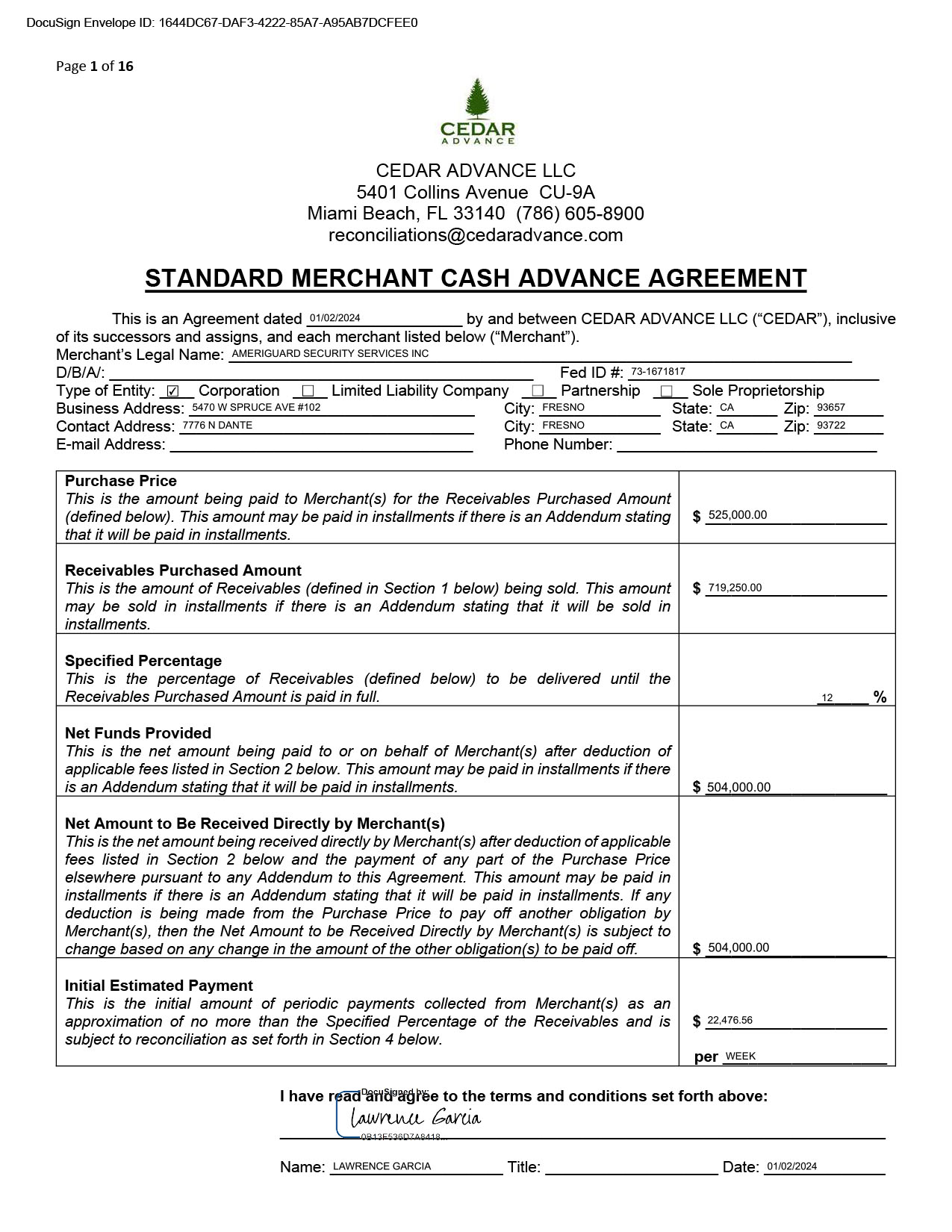

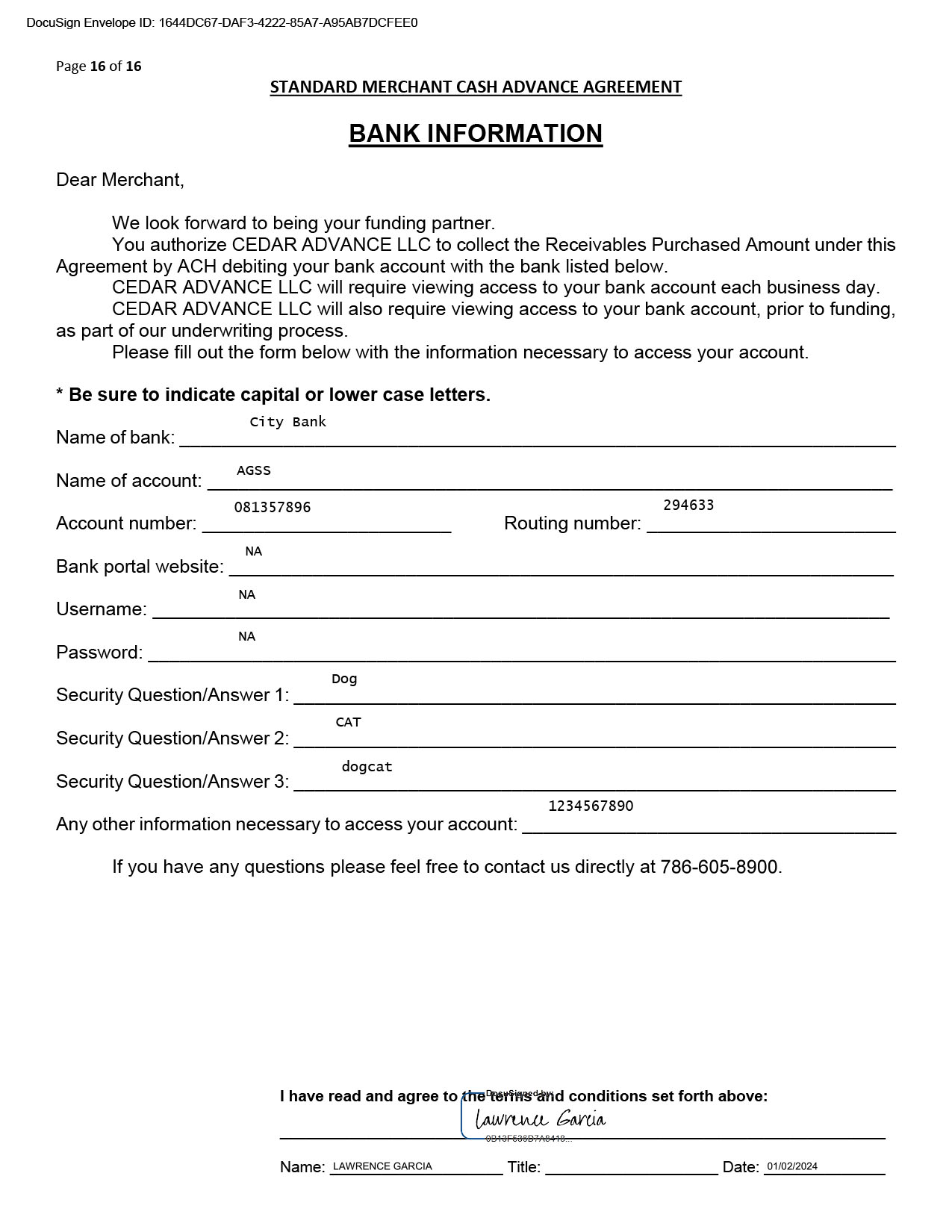

On January 2, 2024, AGSS entered into a standard

merchant cash advance agreement with Cedar Advance LLC (“Cedar”), pursuant to which AGSS received $504,000 from Cedar, for

a purchase price of $525,000 and a purchased receivables amount of $719,250. The purchased interest percentage was 12%. AGSS committed

to paying VCG $22,476.56 weekly.

Prior to the date of the respective agreement, AGSS

had no relationship or dealings with VCG, TVT, nor Cedar.

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 7, 2023, the Board of Directors of

AGSS resolved to appoint Jason Bovell as the Chief Financial Officer of AGSS and reassign Mike Goossen from Chief Financial Officer to

Senior Controller. Accordingly, Mike Goossen, will cease to be AGSS’ Chief Financial Officer but will be Senior Controller. There

were no disagreements between Mike Goossen and AGSS.

Mr. Jason Bovell, 42 is the new CFO of AmeriGuard

Security Services, Inc. From 2013 to 2023, he was a Managing Director at Bovell Financial a full-service accounting firm and provided

services such as Advisory, CFO Services, and Tax services to businesses, funds, and governmental agencies. From 2012 to 2013, he served

as a Controller for an energy company (SEEA) in which he was tasked with building out the accounting department and creating a new accounting

system that met the Department of Energy’s approval. From 2010 to 2012, Mr. Bovell worked for the Center for Disease Control

as a Senior Auditor & Cost Analyst. Prior to this, he worked for Cox Enterprises as a Tax Senior in 2006. Prior to this, Mr. Bovell

worked for PricewaterhouseCoopers, in the tax practice with stints on the audit side as well. Mr. Bovell received a Bachelor of Arts

degree in Business Administration with a concentration in Accounting from Morehouse College and a Master of Arts degree in Taxation from

the University of Denver.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

10.1 |

|

Revenue

purchase agreement, by and between Velocity Capital Group LLC and Ameriguard Security Services Inc., dated December 18, 2023.

|

| |

|

|

|

10.2 |

|

Standard

merchant cash advance agreement, by and between TVT CAP and Ameriguard Security Services Inc., dated December 20, 2023. |

| |

|

|

|

10.3 |

|

Standard

merchant cash advance agreement, by and between Cedar Advance LLC and Ameriguard Security Services Inc., dated January 2, 2024.

|

| |

|

|

| 99.1

|

|

Resolutions

of the Board of Directors, dated December 7, 2023 |

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

January 16, 2024

| Ameriguard Security Services Inc. |

|

| |

|

|

| |

/s/

Lawrence Garcia |

|

| By: |

Lawrence Garcia |

|

| Title: |

President |

|

Exhibit 10.1

DocuSign

Envelope ID: 7A6A1668-DE25-4DCF-B595-BB1783DC9903 REVENUE PURCHASE AGREEMENT Agreement dated 12/18/2023 between

Velocity Capital Group LLC (“VCG”) and the Merchant listed below (“MERCHANT”) MERCHANT INFORMATION

Merchant’s Legal Name: AMERIGUARD SECURITY SERVICES, INC. D/B/A: AMERIGUARD SECURITY SERVICES Type of Entity: Corporation

State of Incorporation: California Federal Tax ID: 73-1671817 Business Phone: 559-271-5984 Contact Name: LAWRENCE DAVID GARCIA Mobile:

559-352-1216 Email Address: lg@ameriguardsecurity.com Mailing Address: 7776 N DANTE City: FRESNO State: CA Zip: 93722 Physical Address:

5470 WEST SPRUCE AVENUE #102 City: FRESNO State: CA Zip: 93657 Purchase Price: $412,500.00 Purchased Percentage: 8.48% Purchased Amount:

$565,125.00 Payment Frequency: Weekly Remittance: $17,660.00 Merchant hereby sells, assigns, and transfers to VCG (making VCG the

absolute owner) in consideration of the Purchase Price specified above, the Purchased Percentage of all of Merchant’s future accounts,

contract rights and other entitlements arising from or relating to the payment of monies from Merchant’s customer’s and/or

other third party payors (the “Receipts” defined as all payments made by cash, check, electronic transfer or other form of

monetary payment in the ordinary course of the Merchant’s business), for the payments due to Merchant as a result of Merchant’s

sale of goods and/or services (the “Transactions”) until the Purchased Amount has been delivered by or on behalf of Merchant

to VCG. Merchant is selling a portion of a future revenue stream to VCG at a discount, not borrowing money from VCG, therefore there

is no interest rate or payment schedule and no time period during which the Purchased Amount must be collected by VCG. The Remittance

is a good faith estimate of (a) Purchased Percentage multiplied -by (b) the daily average revenues of Seller during the previous calendar

month divided by (c) the number of business days in the calendar month. Merchant going bankrupt or going out of business, or experiencing

a slowdown in business, or a delay in collecting its receivables, in and of itself, does not constitute a breach of this Agreement. VCG

is entering this Agreement knowing the risks that Merchant’s business may slow down or fail, and VCG assumes these risks based

on Merchant’s representations, warranties and covenants in this Agreement, which are designed to give VCG a reasonable and fair

opportunity to receive the benefit of its bargain. Merchant and Guarantor are only guaranteeing their performance of the terms of this

Revenue Purchase Agreement, and are not guaranteeing the payment of the Purchased Amount. The initial Remittance shall be as described

above. The Remittance is subject to adjustment as set forth in Paragraph 1.4. VCG will debit the Remittance each business day from only

one depositing bank account, which account must be acceptable to, and pre-approved by, VCG (the “Ac- count”) into which Merchant

and Merchant’s customers shall remit the Receipts from each Transaction, until such time as VCG receives payment in full of the

Purchased Amount. Merchant hereby authorizes VCG to ACH debit the Agreed Remittance from the Account on the agreed upon Payment Frequency;

a daily basis means any day that is not a United States banking holiday. VCG’s payment of the Purchase Price shall be deemed the

acceptance and performance by VCG of this Agreement. Merchant understands that it is responsible for ensuring that the Agreed Remittance

to be debited by VCG remains in the Account and will be held responsible for any fees incurred by VCG resulting from a rejected ACH attempt

or an Event of Default. VCG is not responsible for any overdrafts or rejected transactions that may result from VCG’s ACH debiting

the Agreed Remittance under the terms of this Agreement. Notwithstanding anything to the contrary in this Agreement or any other agreement

be- tween VCG and Merchant, upon the occurrence of an Event of Default under Section 3 of the MERCHANT AGREEMENT TERMS AND CONDITIONS

the Purchased Percentage shall equal 100%. A list of all fees applicable under this Agreement is contained in Appendix A. THE MERCHANT

AGREEMENT “TERMS AND CONDITIONS”, THE “SECURITY AGREEMENT AND GUARANTY” AND THE “ADMINISTRATIVE FORM HEREOF,

ARE ALL HEREBY INCORPORATED IN AND MADE A PART OF THIS MERCHANT AGREEMENT. FOR THE MERCHANT (#1) By: LAWRENCE DAVID GARCIA

(Print Name) (Title) (Signature) FOR THE MERCHANT (#2) By: (Print Name) (Title) BY THE OWNER (#1) By: LAWRENCE

DAVID GARCIA (Print Name) (Title) BY THE OWNER (#2) By: (Print Name) 1 (Title) (Signature)

DocuSign

Envelope ID: 7A6A1668-DE25-4DCF-B595-BB1783DC9903 MER_CH_A_NT_AGR_EE_M_E_N_T_TERMS A_ND CO_NDITIONS 1 TERMS OF ENROLLMENT INPROGRAM

1.1 Merchant Deposit Agreement and Processor. Merchant shall (A) execute an agreement acceptable to VCG with

a Bank acceptable to VCG to obtain electronic fund transfer services for the Account, and (B) if applicable, execute an agreement acceptable

to VCG with a credit and debit card processor (the “Processor”) instructing the Processor to deposit all Receipts into the

Account. Merchant shall provide VCG and/or its au-thorized agent(s) with all of the information, authorizations and passwords necessary

for verifying Merchant’s receivables, receipts, deposits and withdrawals into and from the Account. Merchant hereby authorizes

VCG and/or its agent(s) to withdraw from the Account via ACH debit the amounts owed to VCG for the receipts as specified herein and to

pay such amounts to VCG. These authorizations apply not only to the approved Account but also to any subsequent or alternate account

used by the Merchant for these deposits, whether pre- approved by VCG or not. This addi-tional authorization is not a waiver of VCG’s

entitlement to declare this Agreement breached by Merchant as a result of its u sage of an account which VCG did not first pre-approve

in writing prior to Merchant’s usage thereof. The aforementioned authorizations shall be irrevocable without the written consent

of VCG. 1.2 Term of Agreement. This Agreement shall remain in full force and effect until the entire Purchased Amount

and any other amounts due are received by VCG as per the terms of this Agreement. 1.3 Future Purchase of Increments.

Subject to the terms of this Agreement, VCG offers to purchase additional Receipts in the “Increments” stated in on Page

1 of this Agreement, if any. VCG reserves the right to delay or rescind the offer to purchase any Increment or any additional Re ceipts,

in its sole and absolute discretion. 1.4 Adjustments to the Remittance. If an Event of Default has not occurred,

every two (2) calendar weeks after the funding of the Purchase Price to Merchant, Merchant may give notice to VCG to request a decrease

in the Remittance. The amount shall be decreased if the amount received by VCG was more than the Purchased Percentage of all revenue

of Merchant since the date of this Revenue Purchase Agreement. The Remittance shall be modified to more closely reflect the Merchant’s

actual receipts by multiplying the Merchant’s actual receipts by the Purchased Percentage divided by the number of business days

in the previous (2) calendar weeks. Seller shall provide VCG with viewing access to their bank account as well as all information reasonably

requested by VCG to properly calculate the Merchant’s Remittance. At the end of the two (2) calendar weeks the Merchant may request

another adjustment pursuant to this paragraph or it is agreed that the Merchant’s Remittance shall return to the Remittance as

agreed upon on Page 1 of this Agreement. 1.5 Financial Condition. Merchant and Guarantor(s) (as hereinafter defined

and limited) authorize VCG and its agents to investigate their finan-cial responsibility and history, and will provide to VCG any authorizations,

bank or financial statements, tax returns, etc., as VCG deems necessary in its sole and absolute discretion prior to or at any time after

execution of this Agreement. A photocopy of this authorization will be deemed as ac-ceptable as an authorization for release of financial

and credit information. VCG is authorized to update such information and financial and credit profiles from time to time as it deems

appropriate. 1.6 Transactional History. Merchant authorizes all of its banks, brokers and processor to provide VCG

with Merchant’s banking, brokerage and/ or processing history to determine qualification or continuation in this program and for

collections purposes. Merchant shall provide VCG with copies of any documents related to Merchant’s card processing activity or

financial and banking affairs within five days after a request from VCG. 1.7 Indemnification. Merchant and Guarantor(s)

jointly and severally indemnify and hold harmless Processor, its officers, directors and shareholders against all losses, damages, claims,

liabilities and expenses (including reasonable attorney’s fees) incurred by Processor resulting from (a) claims asserted by VCG

for monies owed to VCG from Merchant and (b) actions taken by Processor in reliance upon any fraudulent, misleading or decep-tive information

or instructions provided by VCG. 1.8 No Liability. In no event will VCG be liable for any claims asserted by Merchant or

Guarantors under any legal theory for lost profits, lost revenues, lost business opportunities, exemplary, punitive, special, incidental,

indirect or consequential damages, each of which is waived by both Merchant and Guarantor(s). In the event these claims are nonetheless

raised, Merchant and Guarantors will be jointly liable for all of VCG’s at-torney’s fees and expenses resulting therefrom.

1.9 Reliance on Terms. Section 1.1, 1.6, 1.7, 1.8 and 2.5 of this Agreement are agreed to for the benefit of Merchant,

VCG, Processor, and Mer-chant’s bank and notwithstanding the fact that Processor and the bank is not a party of this Agreement,

Processor and the bank may rely upon their terms and raise them as a defense in any action. 1.10 Sale of Receipts. Merchant

and VCG agree that the Purchase Price under this Agreement is in exchange for the Purchased Amount, and that such Purchase Price is not

intended to be, nor shall it be construed as a loan from VCG to Merchant. Merchant agrees that the Purchase Price is in exchange for

the Receipts pursuant to this Agreement, and that it equals the fair market value of such Receipts. VCG has purchased and shall own all

the Receipts described in this Agreement up to the full Purchased Amount as the Receipts are created. Payments made to VCG in respect

to the full amount of the Receipts shall be conditioned upon Merchant’s sale of products and services, and the payment therefore

by Merchant’s customers. In no event shall the aggregate of all amounts or any portion thereof be deemed as interest hereunder,

and in the event it is found to be interest despite the parties hereto specifically representing that it is NOT interest, it shall be

found that no sum charged or collected hereunder shall exceed the highest rate permissible at law. In the event that a court nonetheless

determines that VCG has charged or received interest hereunder in excess of the highest applicable rate, the rate in effect hereunder

shall automatically be reduced to the maximum rate permitted by applicable law and VCG shall promptly refund to Merchant any interest

received by VCG in excess of the maximum lawful rate, it being intended that Merchant not pay or contract to pay, and that VCG not receive

or contract to receive, directly or indirectly in any manner whatsoever, interest in excess of that which may be paid by Merchant under

applicable law. As a result thereof, Merchant knowingly and willingly waives the defense of Usury in any action or proceeding. 1.11

Power of Attorney. Merchant irrevocably appoints VCG as its agent and attorney-in-fact with full authority to take any action

or execute any instrument or document to settle all obligations due to VCG from Processor, or in the case of a violation by Merchant

of Section 1or the oc- currence of an Event of Default under Section 3 hereof, including without limitation (i) to obtain and adjust

insurance; (ii) to collect monies due or to become due under or in respect of any of the Collateral; (iii) to receive, endorse and collect

any checks, notes, drafts, instruments, docu- ments or chattel paper in connection with clause (i) or clause (ii) above; (iv) to sign

Merchant’s name on any invoice, bill of lading, or assignment di- recting customers or account debtors to make payment directly

to VCG; and (v) to contact Merchant’s banks and financial institutions us- ing Merchant and Guarantor(s) personal information to

verify the existence of an account and obtain account balances (vi) to file any claims or take any action or institute any proceeding

which VCG may deem necessary for the collection of any of the unpaid Purchased Amount from the Collateral or otherwise to enforce its

rights with respect to payment of the Purchased Amount. 1.12 Protections against Default. The following Protections 1 through

8 may be invoked by VCG immediately and without notice to Merchant in the event: (a) Merchant takes any action to discourage the use

of electronic check processing that are settled through Processor, or permits any event to occur that could have an adverse effect on

the use, acceptance, or authorization of checks or other payments or deposits for the purchase of Merchant’s services and products

including but not limited to direct deposit of any checks into a bank account without scanning into the VCG electronic check processor;

(b) Merchant changes its arrangements with Processor or the Bank in any way that is adverse or unacceptable to VCG; (c) Merchant changes

the electronic check processor through which the Receipts are settled from Processor to another electronic check processor, or permits

any event to occur that could cause diversion of any of Merchant’s check or deposit transactions to another processor; (d) Merchant

inten-tionally interrupts the operation of this business transfers, moves, sells, disposes, or otherwise conveys its business and/or

assets 2 Initials

DocuSign

Envelope ID: 7A6A1668-DE25-4DCF-B595-BB1783DC9903 (i) the express prior written consent of VCG, and (ii) the written agreement of any

VCG or transferee to the assumption of all of Merchant’s obliga-tions under this Agreement pursuant to documentation satisfactory

to VCG; (e) Merchant takes any action, fails to take any action, or offers any in-centive— economic or otherwise—the result

of which will be to induce any customer or customers to pay for Merchant’s services with any means other than payments, checks

or deposits that are settled through Processor; or (f) Merchant fails to provide VCG with copies of any documents related to Merchant’s

card processing activity of financial and banking affairs within five days after a request from VCG. These protections are in addition

to any other remedies available to VCG at law, in equity or otherwise pursuant to this Agreement. Protection 1. The full

uncollected Purchased Amount plus all fees (including reasonable attorney’s fees) due under this Agreement and the attached Security

Agreement become due and payable in full immediately. Protection 2. VCG may enforce the provisions of the Limited Personal

Guaranty of Performance against the Guarantor(s). Protection 3. Merchant hereby authorizes VCG to execute in the name of

the Merchant a Confession of Judgment in favor of VCG in the amount of Purchased Amount stated in the Agreement. Upon an Event of Default,

VCG may enter that Confession of Judgment as a Judgment with the Clerk of any Court and execute thereon. Protection 4.

VCG may enforce its security interest in the Collateral. Protection 5. The entire Purchased Amount and all fee (including

reasonable attorney’s fees) shall become immediately payable to VCG from Merchant. Protection 6. VCG may proceed

to protect and enforce its right and remedies by lawsuit. In any such lawsuit, if VCG recovers a Judgment against Merchant, Merchant

shall be liable for all of VCG’s costs of the lawsuit, including but not limited to all reasonable attorneys’ fees and court

costs. Protection 7. This Agreement shall be deemed Merchant’s Assignment of Merchant’s Lease of Merchant’s

business premises to VCG. Upon breach of any provision in this Agreement, VCG may exercise its rights under this Assignment of Lease

without prior Notice to Merchant. Protection 8. VCG may debit Merchant’s depository accounts wherever situated by means of ACH

debit or facsimile signature on a computer-generated check drawn on Merchant’s bank account or otherwise for all sums due to VCG.

1.13 Protection of Information. Merchant and each person signing this Agreement on behalf of Merchant and/or as

Owner or Guarantor, in respect of himself or herself personally, authorizes VCG to disclose information concerning Merchant’s and

each Owner’s and each Guarantor’s credit stand-ing (including credit bureau reports that VCG obtains) and business conduct

only to agents, affiliates, subsidiaries, and credit reporting bureaus. Merchant and each Owner and each Guarantor hereby and each waives

to the maximum extent permitted by law any claim for damages against VCG or any of its affiliates relating to any (i)investigation undertaken

by or on behalf of VCG as permitted by this Agreement or (ii) disclosure of information as permitted by this Agreement. 1.14 Confidentiality.

Merchant understands and agrees that the terms and conditions of the products and services offered by VCG, including this Agreement

and any other VCG documents (collectively, “Confidential Information”) are proprietary and confidential information of VCG.

Ac-cordingly, unless disclosure is required by law or court order, Merchant shall not disclose Confidential Information of VCG to any

person other than an attorney, accountant, financial advisor or employee of Merchant who needs to know such information for the purpose

of advising Merchant (“Advisor”), provided such Advisor uses such information solely for the purpose of advising Merchant

and first agrees in writing to be bound by the terms of this section. A breach hereof entitles VCG to not only damages and reasonable

attorney’s fees but also to both a Temporary Restraining Order and a Preliminary Injunction without Bond or Security. 1.15 Publicity.

Merchant and each of Merchant’s Owners and all Guarantors hereto all hereby authorizes VCG to use its, his or her name in listings

of clients and in advertising and marketing materials. 1.16 D/B/A’s. Merchant hereby acknowledges and agrees that

VCG may be using “doing business as” or “d/b/a” names in connection with vari-ous matters relating to the transaction

between VCG and Merchant, including the filing of UCC-1 financing statements and other notices or filings. 2 REPRESENTATIONS, WARRANTIES

ANDCOVENANTS Merchant represents warrants and covenants that, as of this date and during the term of this Agreement: 2.1Financial

Condition and Financial Information. Merchant’s and Guarantors’ bank and financial statements, copies of which have

been furnished to VCG, and future statements which will be furnished hereafter at the discretion of VCG, fairly represent the financial

condition of Merchant at such dates, and since those dates there has been no material adverse changes, financial or otherwise, in such

condition, operation or ownership of Mer- chant. Merchant and Guarantors have a continuing, affirmative obligation to advise VCG of any

material adverse change in their financial condition, operation or ownership. VCG may request statements at any time during the performance

of this Agreement and the Merchant and Guarantors shall provide them to VCG within five business days after request from VCG. Merchant’s

or Guarantors’ failure to do so is a material breach of this Agreement. 2.2 Governmental Approvals. Merchant

is in compliance and shall comply with all laws and has valid permits, authorizations and licenses to own, operate and lease its properties

and to conduct the business in which it is presently engaged and/or will engage in hereafter. 2.3 Authorization.

Merchant, and the person(s) signing this Agreement on behalf of Merchant, have full power and authority to incur and perform the obligations

under this Agreement, all of which have been duly authorized. 2.4 Use of Funds. Merchant agrees that it shall use

the Purchase Price for business purposes and not for personal, family, or household purposes. 2.5 Electronic Check Processing Agreement.

Merchant will not change its Processor, add terminals, change its financial institution or bank account(s)or take any other action

that could have any adverse effect upon Merchant’s obligations under this Agreement, without VCG’s prior written consent.

Any such changes shall be a material breach of this Agreement. 2.6 Change of Name or Location. Merchant will not conduct

Merchant’s businesses under any name other than as disclosed to the Processor and VCG, nor shall Merchant change any of its places

of business without prior written consent by VCG. 2.7 Daily Batch Out. Merchant will batch out receipts with the Processor

on a daily basis if applicable. 2.8 Estoppel Certificate. Merchant will at every and all times, and from time to time,

upon at least one (1) day’s prior notice from VCG to Merchant, execute, acknowledge and deliver to VCG and/or to any other person,

firm or corporation specified by VCG, a statement certifying that this Agreement is unmodified and in full force and effect (or, if there

have been modifications, that the same is in full force and effect as modified and stating the modifications) and stating the dates which

the Purchased Amount or any portion thereof has been repaid. 2.9 No Bankruptcy. As of the date of this Agreement, Merchant

is not insolvent and does not contemplate filing for bankruptcy in the next six months and has not consulted with a bankruptcy attorney

or filed any petition for bankruptcy protection under Title 11 of the United States Code and there has been no involuntary petition brought

or pending against Merchant. Merchant further warrants that it does not anticipate filing any such bankruptcy petition and it does not

anticipate that an involuntary petition will be filed against it. 2.10 Unencumbered Receipts. Merchant has good, complete,

unencumbered and marketable title to all Receipts, free and clear of any and all liabilities, liens, claims, changes, restrictions, conditions,

options, rights, mortgages, security interests, equities, pledges and encumbrances of any kind or nature whatsoever or any other rights

or interests that may be inconsistent with the transactions contemplated with, or adverse to the interests of VCG. 2.11 Business

Purpose. Merchant is a valid business in good standing under the laws of the jurisdictions in which it is organized and/or operates,

and Merchant is entering into this Agreement for business purposes and not as a consumer for personal, family or household purposes.

2.12 Defaults under Other Contracts. Merchant’s execution of, and/or performance under this Agreement, will

not cause or create an event of default by Merchant under any contract with another person or entity. 2.13 Good Faith.

Merchant and Guarantors hereby affirm that Merchant is receiving the Purchase Price and selling VCG the Purchased Amount in good faith

and will use the Purchase Price funds to maintain and grow Merchant’s business. 3 Initials

DocuSign

Envelope ID: 7A6A1668-DE25-4DCF-B595-BB1783DC9903 3 EVENTS OF DEFAULT ANDREMEDIES 3.1 Events of Default. The

occurrence of any of the following events shall constitute an “Event of Default” hereunder: Merchant or Guarantor shall violate

any term or covenant in this Agreement; Any representation or warranty by Merchant in this Agreement shall prove to have been incorrect,

false or misleading in any material respect when made; (c) the sending of notice of termination by Merchant or verbally notifying VCG

of its intent to breach this Agreement; the Merchant fails to give VCG 24 hours advance notice that there will be insufficient funds

in the account such that the ACH of the Remittance amount will not be honored by Merchant’s bank, and the Merchant fails to supply

all requested documentation and allow for daily and/or real time monitoring of its bank account; Merchant shall transfer or sell all

or substantially all of its assets; Merchant shall make or send notice of any intended bulk sale or transfer by Merchant; Merchant shall

use multiple depository accounts without the prior written consent of VCG Merchant shall change its depositing account without the prior

written consent of VCG; or Merchant shall close its depositing account used for ACH debits without the prior written consent of VCG Merchant’s

bank returns a code other than NSF cutting VCG from its collections Merchant has 5 bounced payments or stops payments to VCG Merchant

shall default under any of the terms, covenants and conditions of any other agreement with VCG. 3.2 Limited Personal Guaranty

In the Event of a Default, VCG will enforce its rights against the Guarantors of this transaction. Said Guarantors will be jointly and

severally liable to VCG for all of VCG’s losses and damages, in additional to all costs and expenses and legal fees associated

with such enforcement. 3.3 Remedies. In case any Event of Default occurs and is not waived pursuant to Section 4.4.

hereof, VCG may proceed to protect and enforce its rights or remedies by suit in equity or by action at law, or both, whether for the

specific performance of any covenant, agreement or other provision contained herein, or to enforce the discharge of Merchant’s

obligations hereunder (including the Guaranty) or any other legal or equitable right or remedy. All rights, powers and remedies of VCG

in connection with this Agreement may be exercised at any time by VCG after the occurrence of an Event of Default, are cumulative and

not exclusive, and shall be in addition to any other rights, powers or remedies provided by law or equity. 3.4 Costs.

Merchant shall pay to VCG all reasonable costs associated with (a) an Event or Default, (b) breach by Merchant of the Covenants in

this Agreement and the enforcement thereof, and(c) the enforcement of VCG‘s remedies set forth in this Agreement, including but

not limited to court costs and attorney’s fees. 3.5 Required Notifications. Merchant is required to give VCG

written notice within 24 hours of any filing under Title ll of the United States Code. Merchant is required to give VCG seven days’

written notice prior to the closing of any sale of all or substantially all of the Merchant’s assets or stock. 4 MISCELLANEOUS

4.1 Modifications; Agreements. No modification, amendment, waiver or consent of any provision of this Agreement shall

be effective unless the same shall be in writing and signed by VCG. 4.2 Assignment. VCG may assign, transfer or sell its

rights to receive the Purchased Amount or delegate its duties hereunder, either in whole or in part. 4.3 Notices. All notices,

requests, consents, demands and other communications hereunder shall be delivered by certified mail, return receipt re-quested, to the

respective parties to this Agreement at the addresses set forth in this Agreement. Notices to VCG shall become effective only upon receipt

by VCG. Notices to Merchant shall become effective three days after mailing. 4.4 Waiver Remedies. No failure on the part

of VCG to exercise, and no delay in exercising any right under this Agreement shall operate as a waiver thereof, nor shall any single

or partial exercise of any right under this Agreement preclude any other or further exercise thereof or the exercise of any other right.

The remedies provided hereunder are cumulative and not exclusive of any remedies provided by law or equity. 4.5 Binding Effect;

Governing Law, Venue and Jurisdiction. This Agreement shall be binding upon and inure to the benefit of Merchant, VCG and their

respective successors and assigns, except that Merchant shall not have the right to assign its rights hereunder or any interest herein

without the prior written consent of VCG which consent may be withheld in VCG’s sole discretion. VCG reserves the rights to assign

this Agreement with or without prior written notice to Merchant. This Agreement shall be governed by and construed in accordance with

the laws of the state of New York, without regards to any applicable principals of conflicts of law. Any suit, action or proceeding arising

hereunder, or the interpretation, performance or breach hereof, shall, if VCG so elects, be instituted in any court sitting in New York,

(the “Acceptable Forums”). Merchant agrees that the Acceptable Forums are convenient to it, and submits to the jurisdiction

of the Acceptable Forums and waives any and all objections to jurisdiction or venue. Should such proceeding be initiated in any other

forum, Merchant waives any right to oppose any motion or application made by VCG to transfer such proceeding to an Acceptable Forum.

Merchant agrees that VCG may serve Merchant with process via certified mail by depositing into a United States Postal Service depositary,

a properly postage envelope addressed to Merchant at its address listed herein (or such other address that Merchant specifically requests

in writing that VCG substitute in place of the address listed herein). 4.6 Survival of Representation, etc. All representations,

warranties and covenants herein shall survive the execution and delivery of this Agreement and shall continue in full force until all

obligations under this Agreement shall have been satisfied in full and this Agreement shall have terminated. 4.7 Interpretation.

All Parties hereto have reviewed this Agreement with attorney of their own choosing and have relied only on their own attorneys’

guidance and advice. No construction determinations shall be made against either Party hereto as drafter. 4.8 Severability.

In case any of the provisions in this Agreement is found to be invalid, illegal or unenforceable in any respect, the validity, legality

and enforceability of any other provision contained herein shall not in any way be affected or impaired. 4.9 Entire Agreement.

Any provision hereof prohibited by law shall be ineffective only to the extent of such prohibition without invalidating the remaining

provisions hereof. This Agreement and the Security Agreement and Guaranty hereto embody the entire agreement between Merchant and VCG

and supersede all prior agreements and understandings relating to the subject matter hereof. 4.10 JURY TRIAL WAIVER. THE

PARTIES HERETO WAIVE TRIAL BY JURY IN ANY COURT IN ANY SUIT, ACTION OR PROCEEDING ON ANY MATTER ARISING INCONNECTION WITH OR IN ANY WAY

RELATED TO THE TRANSACTIONS OR THEENFORCEMENT HEREOF. THE PARTIES HERETO ACKNOWLEDGE THAT EACH MAKES THIS WAIVER KNOWINGLY, WILLINGLY

AND VOLUNTARILY AND WITHOUT DURESS, AND ONLY AFTER EXTENSIVE CONSIDERATION OF THE RAMIFICATIONS OF THIS WAIVER WITH THEIR ATTORNEYS.

4.11 CLASS ACTION WAIVER. THE PARTIES HERETO WAIVE ANY RIGHT TO ASSERT ANY CLAIMS AGAINST THE OTHER PARTY AS A REPRESENTATIVE

OR MEMBER IN ANY CLASS OR REPRESENTATIVE ACTION, EXCEPT WHERE SUCH WAIVER IS PROHIBITED BY LAW AS AGAINST PUBLIC POLICY. TO THE EXTENT

EITHER PARTY IS PERMITTED BY LAW OR COURT OF LAW TO PROCEED WITH A CLASS OR REPRESENTATIVE ACTION AGAINST THE OTHER, THE PARTIES HEREBY

AGREE THAT: (l) THE PREVAILING PARTY SHALL NOT BE ENTITLED TO RECOVER ATTORNEYS’ FEES OR COSTS ASSOCIATED WITH PURSUING THE CLASS

OR REPRESENTATIVE ACTION (NOT WITHSTANDING ANY OTHER PROVISION IN THIS AGREEMENT); AND ( 2) THE PARTY WHO INITIATES OR PARTICIPATES AS

A MEMBER OF THE CLASS WILL NOT SUBMIT A CLAIM OR OTHERWISE PARTICIPATE IN ANY RECOVERY SECURED THROUGH THE CLASS OR REPRESENTATIVE ACTION.

IMAGE OMITTED 4.12

Facsimile & Digital Acceptance. Facsimile signatures and digital signatures hereon shall be deemed acceptable for all

purposes. Initials_4

DocuSign

Envelope ID: 7A6A1668-DE25-4DCF-B595-BB1783DC9903 SECURITY AGREEMENT AND GUARANTY Merchant’s Legal Name: AMERIGUARD

SECURITY SERVICES, INC. DBA: AMERIGUARD SECURITY SERVICES Federal Tax ID: 73-1671817 Physical Address: 5470 WEST SPRUCE AVENUE #102 City:

FRESNO State: CA Zip: 93657 Additional Guarantor(s): AMERIGUARD SEC SYSTEMS INC. & AMERIGUARD SECURITY SERVICES, INC. & AMERIGUARDSECURITY.COM

& 6487 N BENDEL AVE FRESNO, CA 93722 FRESNO COUNTY AND Secondary Contact Full Address: , , , SECURITY AGREEMENT Security

Interest. This Agreement will constitute a security agreement under the Uniform Commercial Code. Merchant and Guarantor(s) grants

to VCG a security interest in and lien upon: (a) all accounts, chattel paper, documents, equipment, general intangibles, instruments,

and inventory, as those terms are each defined in Article 9 of the Uniform Commercial Code (the “UCC”), now or hereafter

owned or acquired by Merchant and/or Guarantor(s), (b) all proceeds, as that term is defined in Article 9 of the UCC (c) all funds at

any time in the Merchant’s and/or Guarantor(s) Account, regardless of the source of such funds, (d) present and future Electronic

Check Transactions, and (e) any amount which may be due to VCG under this Agreement, including but not limited to all rights to receive

any payments or credits under this Agreement (collectively, the “Secured Assets”). Merchant agrees to provide other security

to VCG upon request to secure Merchant’s obligations under this Agreement. Merchant agrees that, if at any time there are insufficient

funds in Merchant’s Account to cover VCG’s entitlements under this Agreement, VCG is granted a further security interest

in all of Merchant’s assets of any kind whatsoever, and such assets shall then become Secured Assets. These security interests

and liens will secure all of VCG’s entitlements under this Agreement and any other agreements now existing or later entered into

between Merchant, VCG or an affiliate of VCG. VCG is authorized to file any and all notices or filings it deems necessary or appropriate

to enforce its entitlements hereunder. This security interest may be exercised by VCG without notice or demand of any kind by making

an immediate withdrawal or freezing the Secured Assets. VCG shall have the right to notify account debtors at any time. Pursuant to Article

9 of the Uniform Commercial Code, as amended from time to time, VCG has control over and may direct the disposition of the Secured Assets,

without further consent of Merchant. Merchant hereby represents and warrants that no other person or entity has a security interest in

the Secured Assets. With respect to such security interests and liens, VCG will have all rights afforded under the Uniform Commercial

Code, any other applicable law and in equity. Merchant will obtain from VCG written consent prior to granting a security interest of

any kind in the Secured Assets to a third party. Merchant and Guarantor (s) agree(s) that this is a contract of recoupment and VCG is

not required to file a motion for relief from a bankruptcy action automatic stay to realize on any of the Secured Assets. Nevertheless,

Merchant and Guarantor(s) agree(s) not to contest or object to any motion for relief from the automatic stay filed by VCG. Merchant and

Guarantor(s) agree(s) to execute and deliver to VCG such instruments and documents VCG may reasonably request to perfect and confirm

the lien, security interest and right of set off set forth in this Agreement. VCG is authorized to execute all such instruments and documents

in Merchant’s and Guarantor(s) name. Merchant and Guarantor(s) each acknowledge and agree that any security interest granted to

VCG under any other agreement between Merchant or Guarantor(s) and VCG (the “Cross-Collateral”) will secure the obligations

here under and under the Merchant Agreement. Merchant and Guarantor(s) each agrees to execute any documents or take any action in connection

with this Agreement as VCG deems necessary to perfect or maintain VCG’s first priority security interest in the Collateral and

the Additional Collateral, including the execution of any account control agreements. Merchant and Guarantor(s) each hereby authorizes

VCG to file any financing statements deemed necessary by VCG to perfect or maintain VCG’s security interest. Merchant and Guarantor(s)

shall be liable for, and VCG may charge and collect, all costs and expenses, including but not limited to attorney’s fees, which

may be incurred by VCG in protecting, preserving and enforcing VCG’s security interest and rights. Negative Pledge. Merchant

and Guarantor(s) each agrees not to create, incur, assume, or permit to exist, directly or indirectly, any lien on or with respect to

any of the Collateral or the Additional Collateral, as applicable. Consent to Enter Premises and Assign Lease. VCG shall have

the right to cure Merchant’s default in the payment of rent on the following terms. In the event Merchant is served with papers

in an action against Merchant for nonpayment of rent or for summary eviction, VCG may execute its rights and remedies under the Assignment

of Lease. Merchant also agrees that VCG may enter into an agreement with Merchant’s landlord giving VCG the right: (a) to enter

Merchant’s premises and to take possession of the fixtures and equipment therein for the purpose of protecting and preserving same;

and/or (b) to assign Merchant’s lease to another qualified business capable of operating a business comparable to Merchant’s

at such premises. Remedies. Upon any Event of Default, VCG may pursue any remedy available at law (including those available under

the provisions of the UCC), or in equity to collect, enforce, or satisfy any obligations then owing to VCG, whether by acceleration or

otherwise. 5 Initials

DocuSign

Envelope ID: 7A6A1668-DE25-4DCF-B595-BB1783DC9903 GUARANTY OF PERFORMANCE THE TERMS, DEFINITIONS, CONDITIONS AND INFORMATION

SET FORTH IN THE “MERCHANT AGREEMENT”, INCLUDING THE “TERMS AND CONDITIONS”, ARE HEREBY INCORPORATED IN AND MADE

A PART OF THIS SECURITY AGREEMENT AND GUARANTY. CAPITALIZED TERMS NOT DEFINED IN THIS SECURITY AGREEMENT AND GUARANTY, SHALL HAVE THE

MEANING SET FORTH IN THE MERCHANT AGREEMENT, INCLUDING THE TERMS ANDCONDITIONS. VCG As an additional inducement for VCG to enter into

this Agreement, the undersigned Guarantor(s) hereby provides VCG with this Guaranty. Guarantor(s) will not be personally liable for any

amount due under this Agreement unless Merchant commits an Event of Default pursuant to Paragraph 3.1 of this Agreement. Each

Guarantor shall be jointly and severally liable for all amounts owed to VCG in the Event of Default. Guarantor(s) guarantee Merchant’s

good faith, truthfulness and performance of all of the representations, warranties, covenants made by Merchant in this Agreement as each

may be renewed, amended, extended or otherwise modified (the “Guaranteed Obligations”). Guarantor’s obligations are

due at the time of any breach by Merchant of any representation, warranty, or covenant made by Merchant in the Agreement. Guarantor

Waivers. In the event of a breach of the above, VCG may seek recovery from Guarantors for all of VCG’s losses and damages by

enforcement of VCG’s rights under this Agreement without first seeking to obtain payment from Merchant, any other guarantor, or

any Collateral or Additional Collateral VCG may hold pursuant to this Agreement or any other guaranty. VCG does not have to notify Guarantor

of any of the following events and Guarantor will not be released from its obligations under this Agreement if it is not notified of:

(i) Merchant’s failure to pay timely any amount required under the Merchant Agreement; (ii) any adverse change in Merchant’s

financial condition or business; (iii) any sale or other disposition of any collateral securing the Guaranteed Obligations or any other

guaranty of the Guaranteed Obligations; (iv) VCG’s acceptance of this Agreement; and (v) any renewal, extension or other modification

of the Merchant Agreement or Merchant’s other obligations to VCG. In addition, VCG may take any of the following actions without

releasing Guarantor from any of its obligations under this Agreement: (i) renew, extend or otherwise modify the Merchant Agreement or

Merchant’s other obligations to VCG; (ii) release Merchant from its obligations to VCG; (iii) sell, release, impair, waive or otherwise

fail to realize upon any collateral securing the Guaranteed Obligations or any other guaranty of the Guaranteed Obligations; and (iv)

foreclose on any collateral securing the Guaranteed Obligations or any other guaranty of the Guaranteed Obligations in a manner that

impairs or precludes the right of Guarantor to obtain reimbursement for payment under this Agreement. Until the Purchased Amount and

Merchant’s other obligations to VCG under the Merchant Agreement and this Agreement are paid in full, Guarantor shall not seek

reimbursement from Merchant or any other guarantor for any amounts paid by it under this Agreement. Guarantor permanently waives and

shall not seek to exercise any of the following rights that it may have against Merchant, any other guarantor, or any collateral provided

by Merchant or any other guarantor, for any amounts paid by it, or acts performed by it, under this Agreement: (i) subordination; (ii)

reimbursement; (iii) performance; (iv) indemnification; or (v) contribution. In the event that VCG must return any amount paid by Merchant

or any other guarantor of the Guaranteed Obligations because that person has become subject to a proceeding under the United States Bankruptcy

Code or any similar law, Guarantor’s obligations under this Agreement shall include that amount. Guarantor Acknowledgement.

The terms of section 4.5 in the Agreement shall also apply to Guarantor. VCG may serve Guarantor with process via certified mail

be depositing into a United States Postal Service depositary, a properly postage envelope addressed to Guarantor at his or her last know

address (or such other address that Guarantor specifically requests in writing that VCG utilize for this purpose). Guarantor acknowledges

that: (i) He/She is bound by the Class Action Waiver provision in the Merchant Agreement Terms and Conditions; (ii) He/She understands

the seriousness of the provisions of this Agreement; (ii) He/She has had a full opportunity to consult with counsel of his/her choice;

and (iii) He/She has consulted with counsel of its choice or has decided not to avail himself/herself of that opportunity. FOR

THE MERCHANT (#1) By: LAWRENCE DAVID GARCIA -23-1827 Driver’s License Number A3150865 (Print Name) (SSN#) FOR THE

MERCHANT (#2) By: Driver’s License Number (Print Name) (Signature) (SSN#) BY OWNER (#1) By:LAWRENCE DAVID

GARCIA -23-1827 (Print Name) (SSN#) Driver’s License Number A3150865 BY OWNER (#2) By: Driver’s License Number

(Print Name) (Signature) (SSN#) FOR THE GURANTOR(S) By: LAWRENCE DAVID GARCIA -23-1827 Driver’s License Number A3150865

(Print Name) (SSN#) FOR THE GURANTOR(S) By: Driver’s License Number (Print Name) (Signature) (SSN#) 6

DocuSign

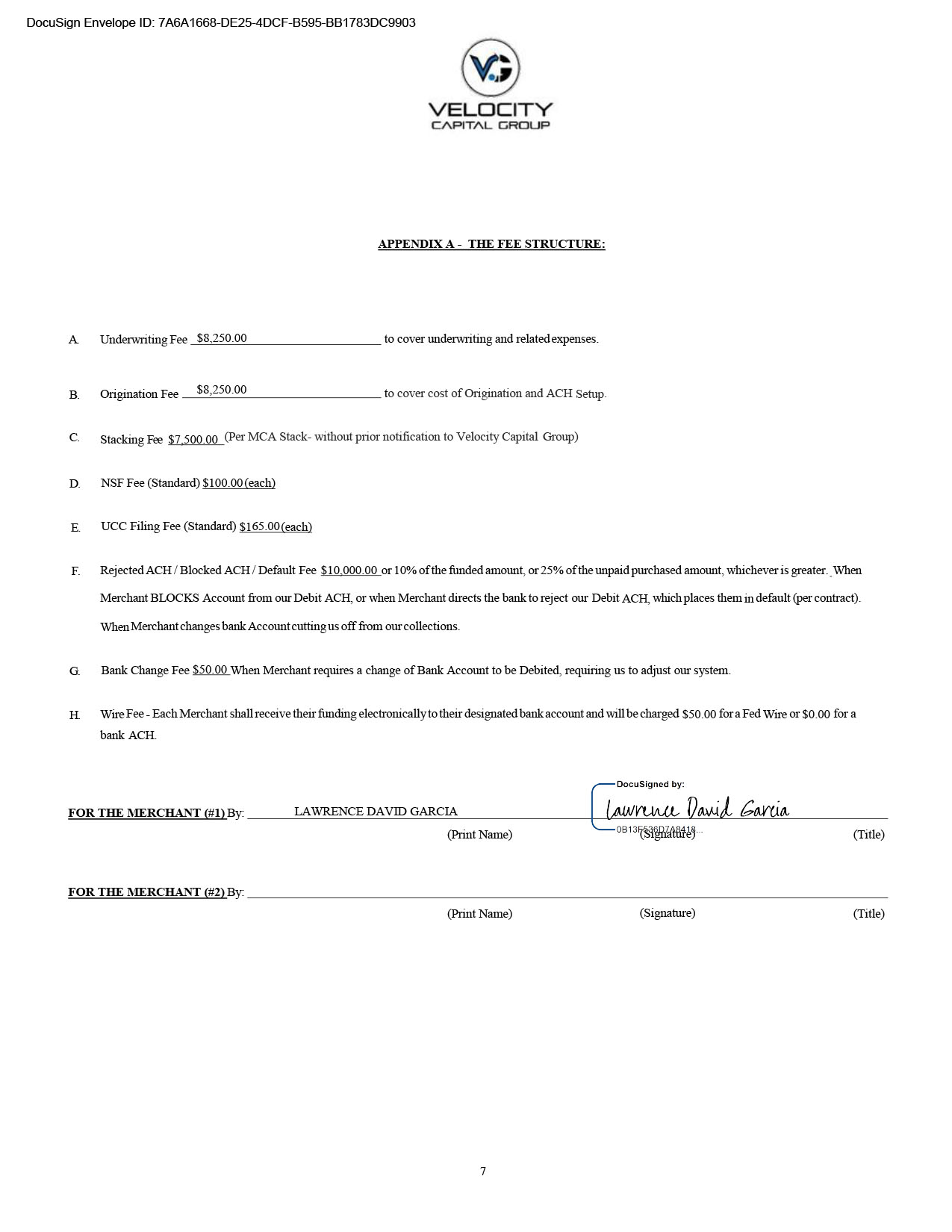

Envelope ID: 7A6A1668-DE25-4DCF-B595-BB1783DC9903 APPENDIX A - THE FEE STRUCTURE: A. Underwriting Fee $8,250.00 to cover

underwriting and related expenses. B. Origination Fee $8,250.00 to cover cost of Origination and ACH Setup. Stacking Fee $7,500.00

(Per MCA Stack- without prior notification to Velocity Capital Group) NSF Fee (Standard) $100.00 (each) UCC Filing Fee (Standard)

$165.00 (each) Rejected ACH / Blocked ACH / Default Fee $10,000.00 or 10% of the funded amount, or 25% of the unpaid purchased

amount, whichever is greater. When Merchant BLOCKS Account from our Debit ACH, or when Merchant directs the bank to reject our Debit

ACH, which places them in default (per contract). When Merchant changes bank Account cutting us off from our collections. Bank Change

Fee $50.00 When Merchant requires a change of Bank Account to be Debited, requiring us to adjust our system. Wire Fee - Each Merchant

shall receive their funding electronically to their designated bank account and will be charged $50.00 for a Fed Wire or $0.00 for a

bank ACH. FOR THE MERCHANT (#1) By: LAWRENCE DAVID GARCIA (Print Name) (Title) FOR THE MERCHANT (#2) By:

(Print Name) (Signature) (Title) 7

DocuSign

Envelope ID: 7A6A1668-DE25-4DCF-B595-BB1783DC9903 AUTHORIZATION AGREEMENT FOR DIRECT DEPOSIT (ACH CREDIT) AND DIRECT PAYMENTS (ACH

DEBITS) PAYMENTS WILL APPEAR ON YOUR BANK STATEMENTS AS “ Velocity Capital Group” and/or “VCG” DEFINITIONS: VCG:

VELOCITY CAPITAL GROUP, LLC Seller: AMERIGUARD SECURITY SERVICES, INC. Tax ID: 73-1671817 (Merchant’s Legal Name)

Merchant Agreement: Merchant Agreement between VCG and Seller, dated as of 12/18/2023. DESIGNATED CHECKING ACCOUNT:

Bank Name: CITI BANK Branch: ABA: Routing: 321171184 DDA: Account: 205270226 Capitalized terms used in this Authorization Agreement

without definition shall have the meanings set forth in the Merchant Agreement. By signing below, Seller attests that the Designated

Checking Account was established for business purposes and not primarily for personal, family or household purposes. This Authorization

Agreement for Direct Deposit (ACH Credit) and Direct Payments (ACH Debits) is part of (and incorporated by reference into) the Merchant

Agreement. Seller should keep a copy of this important legal document for Seller’s records. DISBURSMENT OF ADVANCE PROCEEDS.

By signing below, Seller authorizes VCG to disburse the Advance proceeds less the amount of any applicable fees upon Advance approval

by initiating ACH credits to the Designated Checking Account, in the amounts and at the times specified in the Merchant Agreement. By

signing below, Seller also authorizes VCG to collect amounts due from Seller under the Merchant Agreement by initiating ACH debits to

the Designated Checking Account, as follows: In the amount of: $17,660.00 (Or) Percentage of each Banking Deposit: 20.00% On the

Following Days: Monday If any payment date falls on a weekend or holiday, I understand and agree that the payment may be executed on

the next business day. If a payment is rejected by Seller’s financial institution for any reason, including without limitation

insufficient funds, Seller understands that VCG may, at its discretion, attempt to process the payment again as permitted under applicable

ACH rules. Seller also authorizes VCG to initiate ACH entries to correct any erroneous payment transaction. MISCELLANEOUS. VCG

is not responsible for any fees charged by Seller’s bank as the result of credits or debits initiated under this Authorization

Agreement. The origination of ACH debits and credits to the Designated Checking Account must comply with applicable provisions of state

and federal law, and the rules and operating guidelines of NACHA (formerly known as the National Automated Clearing House Association).

This Authorization Agreement is to remain in full force and effect until VCG has received written notification from Seller at the address

set forth be- low at least 5 banking days prior of its termination to afford VCG a reasonable opportunity to act on it. The individual

signing below on behalf of Seller certifies that he/she is an authorized signer on the Designate Checking Account. Seller will not dispute

any ACH transaction initiated pursuant to this Authorization Agreement, provided the transaction corresponds to the terms of this Authorization

Agreement. Seller requests the financial institution that holds the Designated Checking Account to honor all ACH entries initiated in

accordance with this Authorization Agreement. Seller: AMERIGUARD SECURITY SERVICES, INC. (Merchant’s Legal Name) Title: X (Signature)

Print Name: LAWRENCE DAVID GARCIA 8

DocuSign

Envelope ID: 7A6A1668-DE25-4DCF-B595-BB1783DC9903 Dear Merchant, Thank you for accepting an offer from Velocity Capital Group LLC. We

are looking forward to building a relationship with your business that al lows you to reach and exceed your goals. Please note that prior

to funding your account, our Underwriting department needs to see the most recent balance and activity information in real-time as a

fraud countermeasure and in order to ensure the health of your business aligns with the terms of your offer. For your convenience, we

have three secure options for you to choose from to complete this step. After being completed and executed, you can fax the agreement

to 718-744-2858 Option 1) Please provide information required for read-only access* to your business account. Bank portal website:

Username: Password: Security Question/Answer 1: Security Question/Answer2: Security Question/Answer3: Any other information necessary

to access your account: Option 2) Provide an email address which will receive a secure 3rd party link, allowing you to log in on your

own machine through industry standard Decision Logic. (https://www .decisionlogic.com/) Your valid email address (please ensure correct spelling and case sensitivity): Option 3) You may call into a secure line

to complete this step with a live representative. Secure Verification Number: 833-VCG FUND * Read only access can be easily arranged

by calling your Bank, allowing our underwriters to view account information without being able to transfer, debit or otherwise access

funds. ISO on file: Oval Ventures, LLC ISO Rep on file: Carlos Brown Initials: 9

Exhibit 10.2

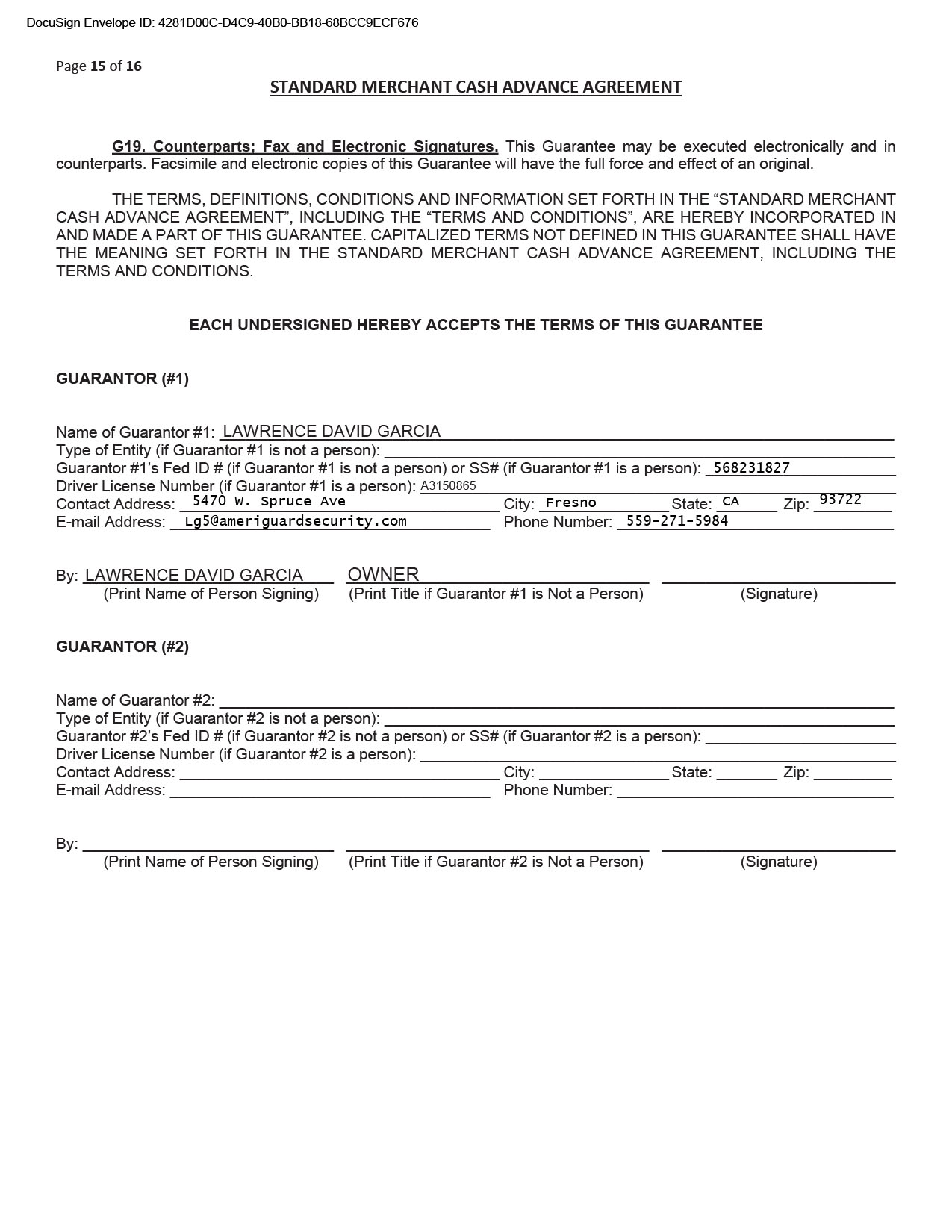

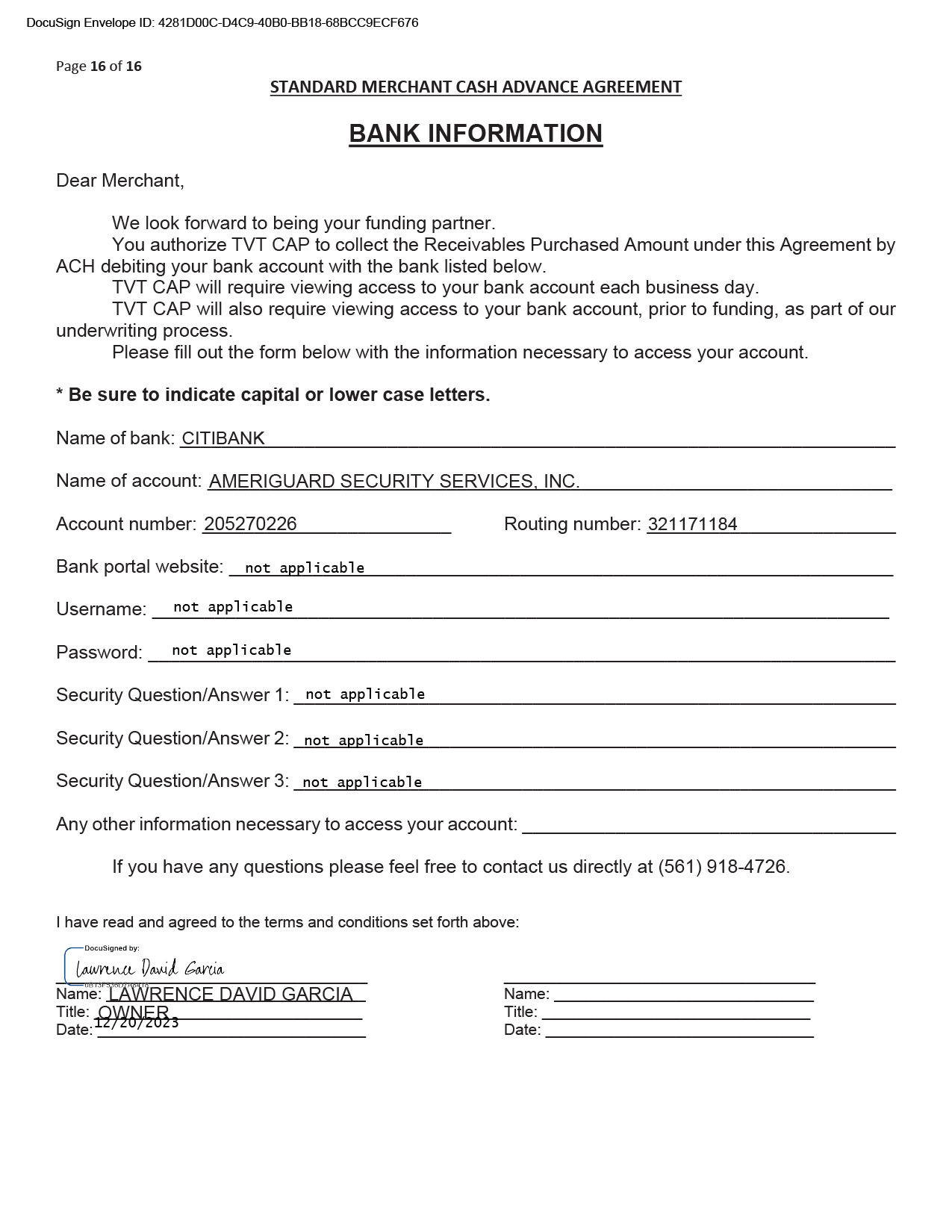

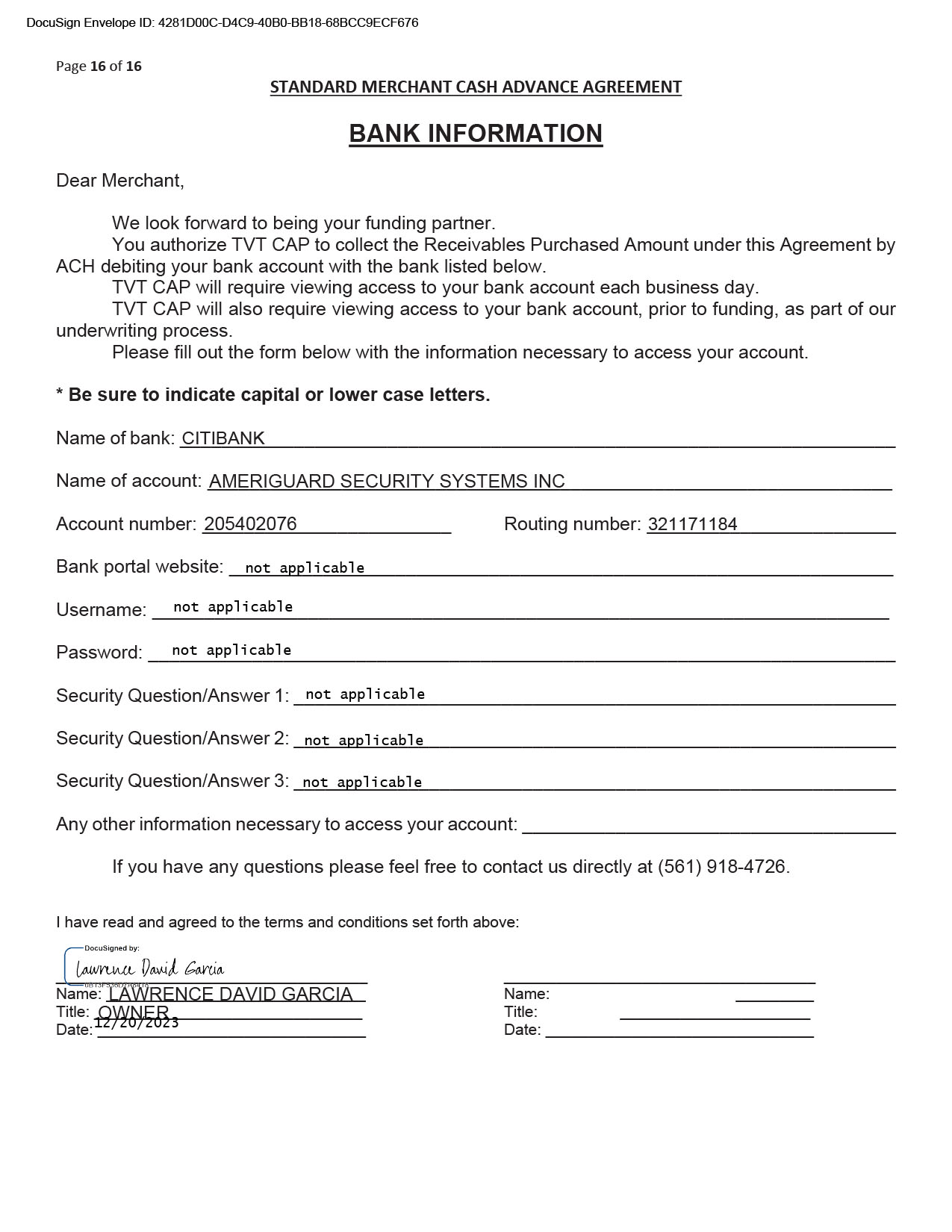

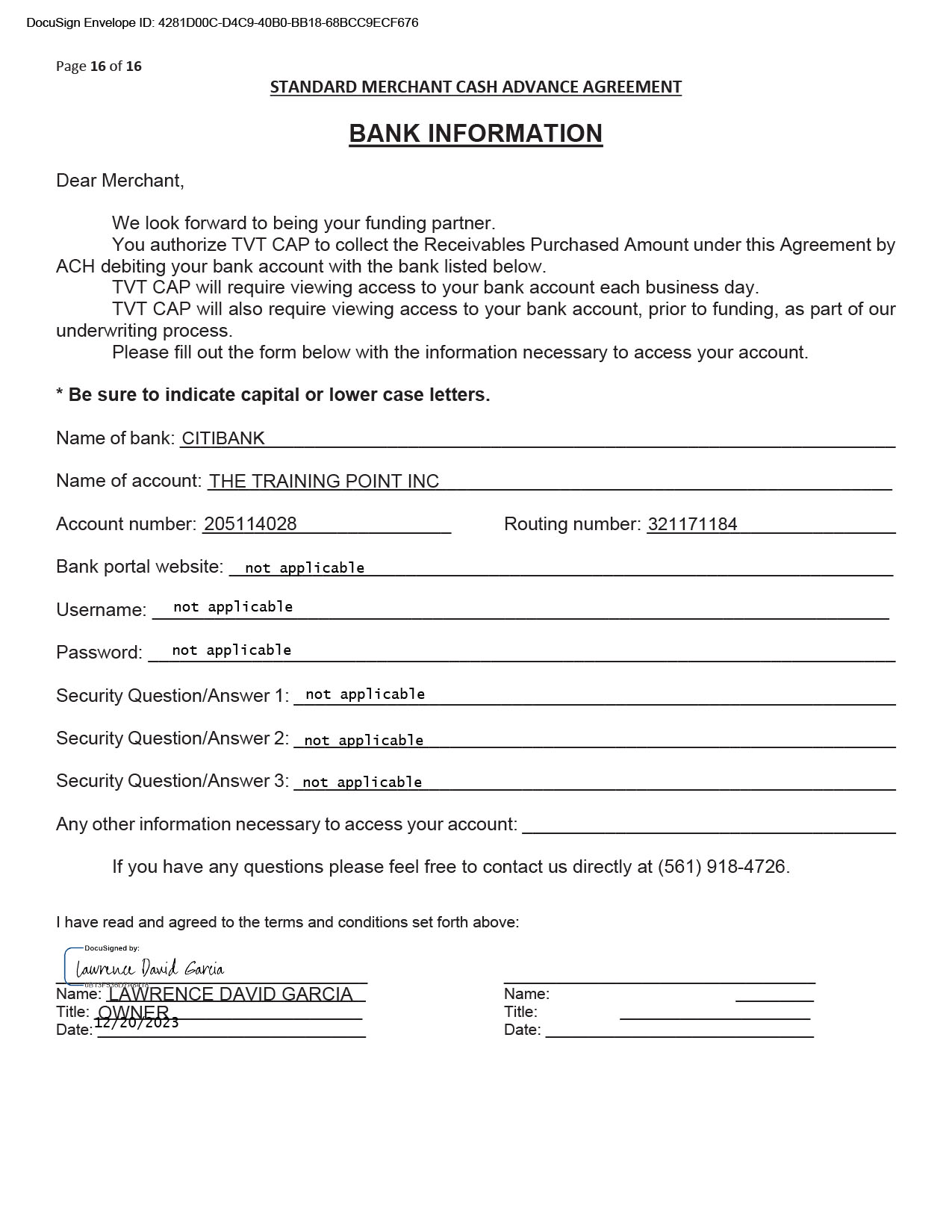

DocuSign Envelope ID: 4281D00C-D4C9-40B0-BB18-68BCC9ECF676 Page 1 of 16 TVT CAP 4300 Biscayne Blvd, Ste 203, Miami, FL 33137 (561) 918-4726 shalom@tvtcapinc.com ver. 7/31/23 FLSTANDARD MERCHANT CASH ADVANCE AGREEMENT This is an Agreement dated 12/20/2023 by and between TVT CAP (“TVT”), inclusive of its successors and assigns, and each merchant listed below (“Merchant”). Merchant’s Legal Name: AMERIGUARD SECURITY SERVICES, INC. D/B/A/: AMERIGUARD SECURITY SERVICES Fed ID #: 99-0363866 Type of Entity: CORPORATION City: FRESNO Business Address: 5470 W SPRUCE SUITE 102 State: CA Zip: 93722 Contact Address: 5470 W SPRUCE SUITE 102 City: FRESNO State: CA Zip: 93722 E-mail Address: LG@AMERIGUARDSERVICES.COM Phone Number: 5592715984 Purchase Price This is the amount being paid to Merchant(s) for the Receivables Purchased Amount $ 800,000.00 (defined below). This amount may be paid in installments if there is an Addendum stating that it will be paid in installments. Receivables Purchased Amount This is the amount of Receivables (defined in Section 1 below) being sold. This amount $ 1,199,200.00 may be sold in installments if there is an Addendum stating that it will be sold in installments. Specified Percentage 14.87 % This is the percentage of Receivables (defined below) to be delivered until the Receivables Purchased Amount is paid in full. Net Funds Provided This is the net amount being paid to or on behalf of Merchant(s) after deduction of $ 736,000.00 applicable fees listed in Section 2 below. This amount may be paid in installments if there is an Addendum stating that it will be paid in installments. Net Amount to Be Received Directly by Merchant(s) This is the net amount being received directly by Merchant(s) after deduction of applicable fees listed in Section 2 below and the payment of any part of the Purchase Price elsewhere pursuant to any Addendum to this Agreement. This amount may be paid in installments if there is an Addendum stating that it will be paid in installments. If any deduction is being made from the Purchase Price to pay off another obligation by $ 736,000.00 Merchant(s), then the Net Amount to be Received Directly by Merchant(s) is subject to change based on any change in the amount of the other obligation(s) to be paid off. Initial Estimated Payment $ 49,966.67 This is the initial amount of periodic payments collected from Merchant(s) as an per WEEK approximation of no more than the Specified Percentage of the Receivables and is subject to reconciliation as set forth in Section 4 below. I have read and agree to the terms and conditions set forth above: __________________________________________________________ 12/20/2023 Name and Title: LAWRENCE DAVID GARCIA OWNER Date: ______________

DocuSign Envelope ID: 4281D00C-D4C9-40B0-BB18-68BCC9ECF676 Page 2 of 16 STANDARD MERCHANT CASH ADVANCE AGREEMENT TERMS AND CONDITIONS 1. Sale of Future Receipts. Merchant(s) hereby sell, assign, and transfer to TVT (making TVT the absolute owner) in consideration of the funds provided (“Purchase Price”) specified above, all of each Merchant’s future accounts, contract rights, and other obligations arising from or relating to the payment of monies from each Merchant’s customers and/or other third party payors (the “Receivables”, defined as all payments made by cash, check, credit or debit card, electronic transfer, or other form of monetary payment in the ordinary course of each merchant’s business), for the payment of each Merchant’s sale of goods or services until the amount specified above (the “Receivables Purchased Amount”) has been delivered by Merchant(s) to TVT. Each Merchant hereby acknowledges that until the Receivables Purchased Amount has been received in full by TVT, each Merchant’s Receivables, up to the balance of the Receivables Purchased Amount, are the property of TVT and not the property of any Merchant. Each Merchant agrees that it is a fiduciary for TVT and that each Merchant will hold Receivables in trust for TVT in its capacity as a fiduciary for TVT. The Receivables Purchased Amount shall be paid to TVT by each Merchant irrevocably authorizing only one depositing account acceptable to TVT (the “Account”) to remit the percentage specified above (the “Specified Percentage”) of each Merchant’s settlement amounts due from each transaction, until such time as TVT receives payment in full of the Receivables Purchased Amount. Each Merchant hereby authorizes TVT to ACH debit in one or more ACH transactions the specified remittances and any applicable fees listed in Section 2 from the Account on a daily basis (unless a different frequency is provided for herein) as of the next business day after the date of this Agreement and will provide TVT with all required access codes and monthly bank statements. Each Merchant understands that it will be held responsible for any fees resulting from a rejected ACH attempt or an Event of Default (see Section 2). TVT is not responsible for any overdrafts or rejected transactions that may result from TVT’s ACH debiting the Specified Percentage amounts under the terms of this Agreement. Each Merchant acknowledges and agrees that until the amount of the Receivables collected by TVT exceeds the amount of the Purchase Price, TVT will be permitted not to treat any amount collected under this Agreement as profit for taxation and accounting purposes. 2. Additional Fees. In addition to the Receivables Purchased Amount, each Merchant will be held responsible to TVT for the following fees, where applicable: A. $ 64,000.00 - to cover underwriting, the ACH debit program, and expenses related to the procurement and initiation of the transactions encompassed by this Agreement. This will be deducted from payment of the Purchase Price. Wire Fee - Merchant(s) shall receive funding electronically to the Account and will be charged $50.00 for a Fed Wire or $0.00 for a bank ACH. This will be deducted from payment of the Purchase Price. NSF/Rejected ACH Fee - $50.00 for each time an ACH debit to the Account by TVT is returned or otherwise rejected. No Merchant will be held responsible for such a fee if any Merchant gives TVT notice no more than one business day in advance that the Account will have insufficient funds to be debited by TVT and no Merchant is otherwise in default of the terms of the Agreement. Each such fee may be deducted from any payment collected by TVT or may be collected in addition to any other payment collected by TVT under this Agreement. Default Fee - $2,500.00 - if an Event of Default has taken place under Section 30. UCC Fee - $195.00 – to cover TVT filing a UCC-1 financing statement to secure its interest in the Receivables Purchased Amount. A $195.00 UCC termination fee will be charged if a UCC filing is terminated. $ 0.00 - compliance with applicable disclosure requirements. This will be deducted from payment of the Purchase Price. Court costs, arbitration fees, collection agency fees, attorney fees, expert fees, and any other expenses incurred in litigation, arbitration, or the enforcement of any of TVT’s legal or contractual rights against each Merchant and/or each Guarantor, if required, as explained in other Sections of this Agreement. 3. Estimated Payments. Instead of debiting the Specified Percentage of Merchant’s Receivables, TVT may instead debit an “Estimated Payment” from the Account every WEEK . The Estimated Payment is intended to be an approximation of no more than the Specified Percentage. The initial amount of the Estimated Payment is $ 49,966.67 , subject to reconciliation as set forth in Section 4. Notwithstanding any provision herein to the contrary, TVT is permitted to debit the Account to make up for a previous Estimated Payment that was not debited because TVT was closed that day, to make up for any previous Estimated Payment that was not collected because the debit did not clear for any reason, to collect any amount due resulting from a reconciliation as set forth in Section 4, to collect any of the fees listed in Section 2, or to collect any amount due as a result of an Event of Default defined in Section 30. 4. Reconciliations. Any Merchant may contact TVT’s Reconciliation Department to request that TVT conduct a

DocuSign Envelope ID: 4281D00C-D4C9-40B0-BB18-68BCC9ECF676 Page 3 of 16 STANDARD MERCHANT CASH ADVANCE AGREEMENT reconciliation in order to ensure that the amount that TVT has collected equals the Specified Percentage of Merchant(s)’s Receivables under this Agreement. A request for a reconciliation by any Merchant must be made by giving written notice of the request to TVT or by sending an e-mail to shalom@tvtcapinc.com stating that a reconciliation is being requested. In order to effectuate the reconciliation, any Merchant must produce with its request any and all statements covering the period from the date of this Agreement through the date of the request for a reconciliation and, if available, the login and password for the Account. TVT will complete each reconciliation requested by any Merchant within two business days after receipt of proper notice of a request for one accompanied by the information and documents required for it. TVT may also conduct a reconciliation on its own at any time by reviewing Merchant(s)’s Receivables covering the period from the date of this Agreement until the date of initiation of the reconciliation, each such reconciliation will be completed within two business days after its initiation, and TVT will give each Merchant written notice of the determination made based on the reconciliation within one business day after its completion. If a reconciliation determines that TVT collected more than it was entitled to, then TVT will credit to the Account all amounts to which TVT was not entitled and, if there is an Estimated Payment, decrease the amount of the Estimated Payment so that it is consistent with the Specified Percentage of Merchant(s)’s Receivables from the date of the Agreement through the date of the reconciliation. If a reconciliation determines that TVT collected less than it was entitled to, then TVT will debit from the Account all additional amounts to which TVT was entitled and, if there is an Estimated Payment, increase the amount of the Estimated Payment so that it is consistent with the Specified Percentage of Merchant(s)’s Receivables from the date of the Agreement through the date of the reconciliation. Nothing herein limits the amount of times that a reconciliation may be requested or conducted. 5. Merchant Deposit Agreement. Merchant(s) shall appoint a bank acceptable to TVT, to obtain electronic fund transfer services and/or “ACH” payments. Merchant(s) shall provide TVT and/or its authorized agent with all of the information, authorizations, and passwords necessary to verify each Merchant’s Receivables. Merchant(s) shall authorize TVT and/or its agent(s) to deduct the amounts owed to TVT for the Receivables as specified herein from settlement amounts which would otherwise be due to each Merchant and to pay such amounts to TVT by permitting TVT to withdraw the Specified Percentage by ACH debiting of the account. The authorization shall be irrevocable as to each Merchant absent TVT’s written consent until the Receivables Purchased Amount has been paid in full or the Merchant becomes bankrupt or goes out of business without any prior default under this Agreement. 6. Term of Agreement. The term of this Agreement is indefinite and shall continue until TVT receives the full Receivables Purchased Amount, or earlier if terminated pursuant to any provision of this Agreement. The provisions of Sections 1, 2, 3, 4, 5, 6, 7, 9, 10, 12, 13, 14, 15, 16, 17, 18, 22, 25, 26, 27, 28, 29, 30, 31, 32, 33, 34, 35, 36, 37, 38, 39, 40, 41, 42, 43, 44, 45, 46, 47, 48, 49, 50, and 51 shall survive any termination of this Agreement. 7. Ordinary Course of Business. Each Merchant acknowledges that it is entering into this Agreement in the ordinary course of its business and that the payments to be made from each Merchant to TVT under this Agreement are being made in the ordinary course of each Merchant’s business. 8. Financial Condition. Each Merchant and each Guarantor (Guarantor being defined as each signatory to the Guarantee of this Agreement) authorizes TVT and its agent(s) to investigate each Merchant’s financial responsibility and history, and will provide to TVT any bank or financial statements, tax returns, and other documents and records, as TVT deems necessary prior to or at any time after execution of this Agreement. A photocopy of this authorization will be deemed as acceptable for release of financial information. TVT is authorized to update such information and financial profiles from time to time as it deems appropriate. 9. Monitoring, Recording, and Electronic Communications. TVT may choose to monitor and/or record telephone calls with any Merchant and its owners, employees, and agents. By signing this Agreement, each Merchant agrees that any call between TVT and any Merchant or its representatives may be monitored and/or recorded. Each Merchant and each Guarantor grants access for TVT to enter any Merchant’s premises and to observe any Merchant’s premises without any prior notice to any Merchant at any time after execution of this Agreement. TVT may use automated telephone dialing, text messaging systems, and e-mail to provide messages to Merchant(s), Owner(s) (Owner being defined as each person who signs this Agreement on behalf of a Merchant), and Guarantor(s) about Merchant(s)’s account. Telephone messages may be played by a machine automatically when the telephone is answered, whether answered by an Owner, a Guarantor, or someone else. These messages may also be recorded by the recipient’s answering machine or voice mail. Each Merchant, each Owner, and each Guarantor gives TVT permission to call or send a text message to any telephone number given to TVT in connection with this Agreement and to

DocuSign Envelope ID: 4281D00C-D4C9-40B0-BB18-68BCC9ECF676 Page 4 of 16 STANDARD MERCHANT CASH ADVANCE AGREEMENT play pre-recorded messages and/or send text messages with information about this Agreement and/or any Merchant’s account over the phone. Each Merchant, each Owner, and each Guarantor also gives TVT permission to communicate such information to them by e-mail. Each Merchant, each Owner, and each Guarantor agree that TVT will not be liable to any of them for any such calls or electronic communications, even if information is communicated to an unintended recipient. Each Merchant, each Owner, and each Guarantor acknowledge that when they receive such calls or electronic communications, they may incur a charge from the company that provides them with telecommunications, wireless, and/or Internet services, and that TVT has no liability for any such charges. 10. Accuracy of Information Furnished by Merchant and Investigation Thereof. To the extent set forth herein, each of the parties is obligated upon his, her, or its execution of the Agreement to all terms of the Agreement. Each Merchant and each Owner signing this Agreement represent that he or she is authorized to sign this Agreement for each Merchant, legally binding said Merchant to its obligations under this Agreement and that the information provided herein and in all of TVT’s documents, forms, and recorded interview(s) is true, accurate, and complete in all respects. TVT may produce a monthly statement reflecting the delivery of the Specified Percentage of Receivables from Merchant(s) to TVT. An investigative report may be made in connection with the Agreement. Each Merchant and each Owner signing this Agreement authorize TVT, its agents and representatives, and any credit-reporting agency engaged by TVT, to (i) investigate any references given or any other statements obtained from or about each Merchant or any of its Owners for the purpose of this Agreement, and (ii) pull credit report at any time now or for so long as any Merchant and/or Owners(s) continue to have any obligation to TVT under this Agreement or for TVT’s ability to determine any Merchant’s eligibility to enter into any future agreement with TVT. Any misrepresentation made by any Merchant or Owner in connection with this Agreement may constitute a separate claim for fraud or intentional misrepresentation. Authorization for soft pulls: Each Merchant and each Owner understands that by signing this Agreement, they are providing ‘written instructions’ to TVT under the Fair Credit Reporting Act, authorizing TVT to obtain information from their personal credit profile or other information from Experian, TransUnion, and Equifax. Each Merchant and each Guarantor authorizes TVT to obtain such information solely to conduct a pre-qualification for credit. Authorization for hard pulls: Each Merchant and each Owner understands that by signing this Agreement, they are providing ‘written instructions’ to TVT under the Fair Credit Reporting Act, authorizing TVT to obtain information from their personal credit profile or other information from Experian, TransUnion, and Equifax. Each Merchant and each Guarantor authorizes TVT to obtain such information in accordance with a merchant cash advance application. 11. Transactional History. Each Merchant authorizes its bank to provide TVT with its banking and/or credit card processing history. 12. Indemnification. Each Merchant and each Guarantor jointly and severally indemnify and hold harmless each Merchant’s credit card and check processors (collectively, “Processor”) and Processor’s officers, directors, and shareholders against all losses, damages, claims, liabilities, and expenses (including reasonable attorney and expert fees) incurred by Processor resulting from (a) claims asserted by TVT for monies owed to TVT from any Merchant and (b) actions taken by any Processor in reliance upon information or instructions provided by TVT. 13. No Liability. In no event will TVT be liable for any claims asserted by any Merchant under any legal theory for lost profits, lost revenues, lost business opportunities, exemplary, punitive, special, incidental, indirect, or consequential damages, each of which is waived by each Merchant and each Guarantor. 14. Sale of Receivables. Each Merchant and TVT agree that the Purchase Price under this Agreement is in exchange for the Receivables Purchased Amount and that such Purchase Price is not intended to be, nor shall it be construed as a loan from TVT to any Merchant. TVT is entering into this Agreement knowing the risks that each Merchant’s business may decline or fail, resulting in TVT not receiving the Receivables Purchased Amount. Any Merchant going bankrupt, going out of business, or experiencing a slowdown in business or a delay in collecting Receivables will not on its own without anything more be considered a breach of this Agreement. Each Merchant agrees that the Purchase Price in exchange for the Receivables pursuant to this Agreement equals the fair market value of such Receivables. TVT has purchased and shall own all the Receivables described in this Agreement up to the full Receivables Purchased Amount as the Receivables are created. Payments made to TVT in respect to the full amount of the Receivables shall be conditioned upon each Merchant’s sale of products and services and the payment therefor by each Merchant’s customers in the manner provided in this Agreement. Each Merchant and each Guarantor acknowledges that TVT does not purchase, sell, or offer to purchase or sell securities and that this Agreement is not a security, an offer to sell any security, or a solicitation of an