false

2023

FY

0001829966

P3Y

P3Y

0001829966

2022-10-01

2023-09-30

0001829966

2023-03-31

0001829966

2024-01-11

0001829966

2023-09-30

0001829966

2022-09-30

0001829966

2021-10-01

2022-09-30

0001829966

us-gaap:PreferredStockMember

2021-09-30

0001829966

us-gaap:CommonStockMember

2021-09-30

0001829966

us-gaap:AdditionalPaidInCapitalMember

2021-09-30

0001829966

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-09-30

0001829966

us-gaap:RetainedEarningsMember

2021-09-30

0001829966

2021-09-30

0001829966

us-gaap:PreferredStockMember

2022-09-30

0001829966

us-gaap:CommonStockMember

2022-09-30

0001829966

us-gaap:AdditionalPaidInCapitalMember

2022-09-30

0001829966

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-09-30

0001829966

us-gaap:RetainedEarningsMember

2022-09-30

0001829966

us-gaap:PreferredStockMember

2021-10-01

2022-09-30

0001829966

us-gaap:CommonStockMember

2021-10-01

2022-09-30

0001829966

us-gaap:AdditionalPaidInCapitalMember

2021-10-01

2022-09-30

0001829966

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-10-01

2022-09-30

0001829966

us-gaap:RetainedEarningsMember

2021-10-01

2022-09-30

0001829966

us-gaap:PreferredStockMember

2022-10-01

2023-09-30

0001829966

us-gaap:CommonStockMember

2022-10-01

2023-09-30

0001829966

us-gaap:AdditionalPaidInCapitalMember

2022-10-01

2023-09-30

0001829966

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-10-01

2023-09-30

0001829966

us-gaap:RetainedEarningsMember

2022-10-01

2023-09-30

0001829966

us-gaap:PreferredStockMember

2023-09-30

0001829966

us-gaap:CommonStockMember

2023-09-30

0001829966

us-gaap:AdditionalPaidInCapitalMember

2023-09-30

0001829966

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-09-30

0001829966

us-gaap:RetainedEarningsMember

2023-09-30

0001829966

2023-09-28

2023-09-29

0001829966

EBET:AspireRelatedCompaniesMember

2021-09-29

2021-10-02

0001829966

us-gaap:GoodwillMember

2022-10-01

2023-09-30

0001829966

EBET:PropertyAndEquipmentMember

2022-10-01

2023-09-30

0001829966

EBET:IntangibleAssetsMember

2021-10-01

2022-09-30

0001829966

EBET:PropertyAndEquipmentMember

2021-10-01

2022-09-30

0001829966

EBET:MaltaOfficeSpaceMember

2021-08-01

0001829966

us-gaap:FairValueInputsLevel1Member

2023-09-30

0001829966

us-gaap:FairValueInputsLevel2Member

2023-09-30

0001829966

us-gaap:FairValueInputsLevel3Member

2023-09-30

0001829966

us-gaap:FairValueInputsLevel1Member

2022-09-30

0001829966

us-gaap:FairValueInputsLevel2Member

2022-09-30

0001829966

us-gaap:FairValueInputsLevel3Member

2022-09-30

0001829966

EBET:AspireRelatedCompaniesMember

2022-10-01

2023-09-30

0001829966

EBET:AspireRelatedCompaniesMember

2021-10-02

0001829966

2021-10-02

0001829966

us-gaap:SeniorNotesMember

2023-09-30

0001829966

EBET:RevolvingNoteMember

2023-09-30

0001829966

EBET:NoteDueToAspireMember

2023-09-30

0001829966

EBET:ConvertibleNotesMember

2023-09-30

0001829966

EBET:OtherBorrowingsMember

2023-09-30

0001829966

EBET:TotalBorrowingsMember

2023-09-30

0001829966

us-gaap:AccruedLiabilitiesMember

2023-09-30

0001829966

us-gaap:SeniorNotesMember

2022-09-30

0001829966

EBET:NoteDueToAspireMember

2022-09-30

0001829966

EBET:ConvertibleNotesMember

2022-09-30

0001829966

EBET:OtherBorrowingsMember

2022-09-30

0001829966

EBET:TotalBorrowingsMember

2022-09-30

0001829966

us-gaap:AccruedLiabilitiesMember

2022-09-30

0001829966

us-gaap:SeniorNotesMember

2021-11-29

0001829966

us-gaap:SeniorNotesMember

2021-11-28

2021-11-29

0001829966

2023-02-01

2023-02-02

0001829966

us-gaap:SeniorNotesMember

us-gaap:WarrantMember

2023-02-28

0001829966

2023-12-28

2023-12-29

0001829966

EBET:SeniorNoteMember

2022-09-01

2023-06-30

0001829966

EBET:ForbearanceAgreementMember

2022-10-01

2023-09-30

0001829966

EBET:RevolvingNoteMember

2023-09-29

0001829966

2023-09-29

0001829966

EBET:RevolvingNoteMember

2023-09-28

2023-09-29

0001829966

EBET:RevolvingNoteMember

2022-09-28

2023-09-29

0001829966

EBET:RevolvingNoteMember

2023-09-30

0001829966

EBET:SeniorNoteMember

2022-10-01

2023-09-30

0001829966

EBET:SeniorNoteMember

2021-10-01

2022-09-30

0001829966

EBET:SeniorNoteMember

2023-09-30

0001829966

EBET:ESEGPromissoryNotesMember

2020-09-02

0001829966

EBET:ESEGPromissoryNotesMember

2020-09-01

2020-09-02

0001829966

EBET:TwoLendersMember

EBET:ESEGPromissoryNotesMember

srt:ScenarioForecastMember

2025-09-01

0001829966

EBET:ESEGPromissoryNotesMember

EBET:WarrantsMember

2020-09-02

0001829966

EBET:ESEGPromissoryNotesMember

2020-10-01

2021-09-30

0001829966

EBET:ESEGPromissoryNotesMember

2021-10-01

2022-09-30

0001829966

EBET:ESEGPromissoryNotesMember

us-gaap:CommonStockMember

2022-10-01

2023-09-30

0001829966

EBET:ESEGPromissoryNotesMember

2022-10-01

2023-09-30

0001829966

us-gaap:CommonStockMember

2023-07-26

0001829966

us-gaap:PreferredStockMember

2023-07-26

0001829966

us-gaap:CommonStockMember

us-gaap:PrivatePlacementMember

2022-06-15

2022-06-16

0001829966

EBET:WarrantsMember

us-gaap:PrivatePlacementMember

2022-06-16

0001829966

us-gaap:PrivatePlacementMember

2022-06-15

2022-06-16

0001829966

EBET:SecuritiesPurchaseAgreementsMember

2023-02-01

2023-02-02

0001829966

EBET:SecuritiesPurchaseAgreementsMember

2023-02-02

0001829966

EBET:PlacementAgentMember

2023-02-01

2023-02-02

0001829966

EBET:SeriesAConvertiblePreferredStockMember

EBET:AspireGlobalMember

2021-10-01

2021-10-02

0001829966

EBET:SeriesAConvertiblePreferredStockMember

EBET:AspireGlobalMember

2021-10-02

0001829966

EBET:ConversionOfPreferredStockMember

us-gaap:CommonStockMember

2022-10-01

2023-09-30

0001829966

EBET:ConversionOfPreferredStockMember

us-gaap:SeriesAPreferredStockMember

2022-10-01

2023-09-30

0001829966

EBET:Plan2020Member

2023-07-26

0001829966

EBET:Plan2020Member

2022-10-01

2023-09-30

0001829966

EBET:Plan2020Member

2023-09-30

0001829966

us-gaap:RestrictedStockMember

2022-10-01

2023-09-30

0001829966

EBET:CommonStockAwardsMember

2022-10-01

2023-09-30

0001829966

EBET:CommonStockAwardsMember

2021-10-01

2022-09-30

0001829966

EBET:CommonStockAwardsMember

2023-09-30

0001829966

2023-07-26

0001829966

2023-07-25

2023-07-26

0001829966

us-gaap:SeniorNotesMember

EBET:WarrantsMember

2022-10-01

2023-09-30

0001829966

EBET:WarrantsMember

us-gaap:SeniorNotesMember

2023-09-30

0001829966

EBET:PreferredStockholdersMember

EBET:WarrantsMember

2022-10-01

2023-09-30

0001829966

EBET:PreferredStockholdersMember

EBET:WarrantsMember

EBET:June2022PrivatePlacementMember

2022-10-01

2023-09-30

0001829966

EBET:CommonStockOptionsMember

2022-10-01

2023-09-30

0001829966

EBET:CommonStockOptionsMember

2021-10-01

2022-09-30

0001829966

EBET:CommonStockOptionsMember

2023-09-30

0001829966

EBET:WarrantsMember

2021-09-30

0001829966

EBET:WarrantsMember

2020-10-01

2021-09-30

0001829966

EBET:WarrantsMember

2021-10-01

2022-09-30

0001829966

EBET:WarrantsMember

2022-09-30

0001829966

EBET:WarrantsMember

2022-10-01

2023-09-30

0001829966

EBET:WarrantsMember

2023-09-30

0001829966

EBET:StockOptionsMember

2021-09-30

0001829966

EBET:StockOptionsMember

2020-10-01

2021-09-30

0001829966

EBET:StockOptionsMember

2021-10-01

2022-09-30

0001829966

EBET:StockOptionsMember

2022-09-30

0001829966

EBET:StockOptionsMember

2022-10-01

2023-09-30

0001829966

EBET:StockOptionsMember

2023-09-30

0001829966

EBET:SoftwareMember

2023-09-30

0001829966

EBET:SoftwareMember

2022-09-30

0001829966

us-gaap:FurnitureAndFixturesMember

2023-09-30

0001829966

us-gaap:FurnitureAndFixturesMember

2022-09-30

0001829966

us-gaap:GoodwillMember

2022-10-01

2023-09-30

0001829966

us-gaap:OtherIntangibleAssetsMember

2022-10-01

2023-09-30

0001829966

EBET:TrademarksTradenamesAndCustomerRelationshipsMember

2023-09-30

0001829966

EBET:AspireAssetsMember

2022-10-01

2023-09-30

0001829966

EBET:AspireAssetsMember

2021-10-01

2022-09-30

0001829966

EBET:KarambaTrademarksAndTradenamesMember

2023-09-30

0001829966

us-gaap:InternetDomainNamesMember

EBET:ESEGLimitedMember

2020-09-02

0001829966

us-gaap:InternetDomainNamesMember

2020-09-02

0001829966

us-gaap:InternetDomainNamesMember

2020-09-01

2020-09-02

0001829966

us-gaap:InternetDomainNamesMember

2022-10-01

2023-09-30

0001829966

us-gaap:InternetDomainNamesMember

2021-10-01

2022-09-30

0001829966

EBET:OnlineBettingTechnologyMember

EBET:UponExecutionOfAgreementMember

2020-10-01

2020-10-02

0001829966

EBET:OnlineBettingTechnologyMember

EBET:UponExerciseOfOptionMember

2020-10-01

2020-10-02

0001829966

EBET:OnlineBettingTechnologyMember

2021-05-01

2021-05-03

0001829966

EBET:OnlineBettingTechnologyMember

2021-05-03

0001829966

EBET:OnlineBettingTechnologyMember

2021-10-01

2022-09-30

0001829966

EBET:TrademarksAndTradenamesIndefiniteLivesMember

2023-09-30

0001829966

EBET:TrademarksAndTradenamesIndefiniteLivesMember

2022-09-30

0001829966

EBET:TrademarksAndTradenamesThreeYearLivesMember

2023-09-30

0001829966

EBET:TrademarksAndTradenamesThreeYearLivesMember

2022-09-30

0001829966

us-gaap:CustomerRelationshipsMember

2023-09-30

0001829966

us-gaap:CustomerRelationshipsMember

2022-09-30

0001829966

us-gaap:OtherIntangibleAssetsMember

2023-09-30

0001829966

us-gaap:OtherIntangibleAssetsMember

2022-09-30

0001829966

EBET:BousteadSecuritiesMember

2022-10-01

2023-09-30

0001829966

EBET:ChairmanMember

2022-10-01

2023-09-30

0001829966

EBET:TwoCommitteeMembersMember

2022-10-01

2023-09-30

0001829966

EBET:MrLourieMember

2022-10-01

2023-09-30

0001829966

us-gaap:PreferredStockMember

2022-10-01

2023-09-30

0001829966

us-gaap:PreferredStockMember

2021-10-01

2022-09-30

0001829966

us-gaap:ConvertibleDebtMember

2022-10-01

2023-09-30

0001829966

us-gaap:ConvertibleDebtMember

2021-10-01

2022-09-30

0001829966

EBET:StockOptionsMember

2022-10-01

2023-09-30

0001829966

EBET:StockOptionsMember

2021-10-01

2022-09-30

0001829966

EBET:CommonStockWarrantsMember

2022-10-01

2023-09-30

0001829966

EBET:CommonStockWarrantsMember

2021-10-01

2022-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

iso4217:EUR

iso4217:GBP

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C., 20549

FORM 10-K

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2023

OR

| ☐ |

TRANSACTION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________________

to ___________________

Commission File Number: 001-40334

EBET, Inc.

(Exact Name of Registrant as Specified in its

Charter)

| Nevada |

|

85-3201309 |

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(I.R.S.

Employer Identification No.) |

3960 Howard Hughes Parkway, Suite 500, Las Vegas,

NV 89169

(Address of Principal Executive Offices) (Zip

Code)

Registrant’s Telephone Number, including

Area Code: (888) 411-2726

Securities registered pursuant to Section 12(b) of the Exchange Act:

None.

Securities registered pursuant to Section 12(g) of the Exchange Act:

Common Stock, par value $0.001.

Indicate by check mark if the registrant is a well-known seasoned issuer,

as defined in Rule 405 of the Securities Act. Yes ☐ No

☒

Indicate by check mark if the registrant is not required to file reports

pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No

☒

Indicate by check mark whether the registrant (1) has filed all reports

required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter

periods as the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No

☐

Indicate by check mark whether the registrant has submitted electronically

every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such

shorter period that the registrant was required to submit such files). Yes ☒ No

☐

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging

growth company” in Rule 12b-2 of the Exchange Act. (check one)

| Large accelerated filer ☐ |

|

Accelerated filer ☐ |

| Non-accelerated filer ☒ |

|

Smaller reporting company ☒ |

| |

|

Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on

and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section

404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

☐

If securities are registered pursuant to Section 12(b) of the Act,

indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to

previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements

that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during

the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as

defined in Rule 12b-2 of the Act). YES ☐ No ☒

The aggregate market value of the registrant’s voting equity

held by non-affiliates of the registrant, computed by reference to the price at which the common stock was last sold as of the last business

day of the registrant’s most recently completed second fiscal quarter, was $5,189,593. In determining the market value of the voting

equity held by non-affiliates, securities of the registrant beneficially owned by directors, officers and 10% or greater shareholders

of the registrant have been excluded. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares of the registrant’s common stock outstanding

as of January 11, 2024 was 14,979,642.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of this registrant’s definitive proxy statement for

its 2024 Annual Meeting of Stockholders to be filed with the SEC no later than 120 days after the end of the registrant’s fiscal

year are incorporated herein by reference in Part III of this Annual Report on Form 10-K.

TABLE OF CONTENTS

References in this Form 10-K to “we”,

“us”, “its”, “our” or the “Company” are to EBET, Inc., as appropriate to the context.

Cautionary Statement About

Forward-Looking Statements

We make forward-looking statements under the “Risk

Factors,” “Business,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

and in other sections of this report. In some cases, you can identify these statements by forward-looking words such as “may,”

“might,” “should,” “would,” “could,” “expect,” “plan,” “anticipate,”

“intend,” “believe,” “estimate,” “predict,” “potential” or “continue,”

and the negative of these terms and other comparable terminology. These forward-looking statements, which are subject to known and unknown

risks, uncertainties and assumptions about us, may include projections of our future financial performance based on our growth strategies

and anticipated trends in our business. These statements are only predictions based on our current expectations and projections about

future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ

materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements. In

particular, you should consider the numerous risks and uncertainties described under “Risk Factors”.

While we believe we have identified material risks,

these risks and uncertainties are not exhaustive. Other sections of this report may describe additional factors that could adversely impact

our business and financial performance. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties

emerge from time to time, and it is not possible to predict all risks and uncertainties, nor can we assess the impact of all factors on

our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained

in any forward-looking statements.

Although we believe the

expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity,

performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy or completeness of

any of these forward-looking statements. You should not rely upon forward looking statements as predictions of future events. We are

under no duty to update any of these forward-looking statements after the date of this report to conform our prior statements to

actual results or revised expectations, and we do not intend to do so.

Forward-looking statements include, but are not

limited to, statements about:

| |

· |

our ability to successfully incorporate the acquired assets from Aspire Global; |

| |

|

|

| |

· |

our ability to maintain compliance with our debt obligations (or obtain future waivers from such compliance) including but not limited to third party invoices as they become due; |

| |

|

|

| |

· |

our ability to obtain additional funding to develop additional services and offerings; |

| |

|

|

| |

· |

compliance with obligations under intellectual property licenses with third parties; |

| |

|

|

| |

· |

market acceptance of our new offerings; |

| |

|

|

| |

· |

competition from existing online offerings or new offerings that may emerge; |

| |

|

|

| |

· |

our ability to establish or maintain collaborations, licensing or other arrangements; |

| |

|

|

| |

· |

our ability and third parties’ abilities to protect intellectual property rights; |

| |

|

|

| |

· |

our ability to adequately support future growth; and |

| |

|

|

| |

· |

our ability to attract and retain key personnel to manage our business effectively. |

We caution you not to place undue reliance

on the forward-looking statements, which speak only as of the date of this report in the case of forward-looking statements contained

in this report.

You should not rely upon forward-looking statements

as predictions of future events. Our actual results and financial condition may differ materially from those indicated in the forward-looking

statements. We qualify all of our forward-looking statements by these cautionary statements. Although we believe that the expectations

reflected in the forward looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

Therefore, you should not rely on any of the forward-looking statements. In addition, with respect to all of our forward-looking statements,

we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of

1995.

PART I

Overview

We operate platforms to provide

a real money online gambling experience focused on i-gaming including casino, sportsbook and esports events. The Company operates under

a Curacao gaming sublicense and under operator service agreements with Aspire Global plc (“Aspire”) allowing EBET to provide

online betting services to various countries around the world.

Aspire Global Plc’s (“Aspire”) Business to Consumer

(“B2C”) Business

In order to accelerate the growth and expand market

access for our esports product offerings, on November 29, 2021, we acquired Aspire’s B2C Business.

The acquisition of Aspire’s B2C business

was intended to provide the following strategic benefits:

| |

· |

ownership of a portfolio of B2C proprietary online casino and sportsbook brands consisting of Karamba, Hopa, Griffon Casino, BetTarget, Dansk777, and GenerationVIP; |

| |

|

|

| |

· |

operator service

agreements with Aspire who provides the on-line gaming platform and a managed services offering, including customer service,

customer on-boarding and payment processing ensuring operational stability and continuity. |

Our gaming sub-license from the Curacao Gaming

Authority and the licenses made available to us from the acquisition of the Aspire B2C business allows us to accept wagers from residents

in certain territories throughout the world.

Focus on i-Gaming Operations

During the quarter ending September 30, 2022, the

Company halted further development of its esports products and platform. These efforts have resulted in an increased focus on the Company’s

i-gaming business and the halting of further investment in the Company’s esports products and technologies. As a result of the Company’s

actions as referenced above, it does not expect to launch its esports products in the foreseeable future.

Recent Developments

On April 27, 2023, the Company

was notified by its gaming platform operator services provider Aspire Global plc (“Aspire”) that the gaming regulatory authority

in Germany had sent a letter received by Aspire on April 25, 2023 stating that Aspire would be required to shut down activity of its gaming

operations in Germany effective as of 10 days from receipt of said letter until such time as Aspire was otherwise granted a license to

operate in Germany. Aspire informed the Company that although it sought an extension of the requested shutdown deadline, it was not successful

in receiving an extension of time and/or any form of other relief from this request. In order to meet the subject German regulator requirement,

Aspire shut down its activities in Germany on May 7, 2023 and as a result the gaming websites owned by the Company that operate in Germany

were shut down on that date. During the year ended September 30, 2023 and 2022 revenue generated in German markets was $9,686,372

and $17,555,683, respectively. During the same periods gross profit contributed from the German markets was $2,775,605 and $3,741,443,

respectively. As of September 30, 2023, the Company determined that its intangible assets and goodwill were impaired as a result of the

loss of the gaming websites owned by the Company that operate in Germany after being shut down in May 2023, and the overall decline in

the Company’s results of operations throughout the fiscal year. The Company recognized a total impairment loss of $44,917,891, consisting

of $24,790,233 related to goodwill and $20,127,658 related to intangible assets, primarily indefinite lived assets and customer relationships,

which were fully impaired as of September 30, 2023.

On June 7, 2023, the Board

of Directors of the Company created a Strategic Alternatives Committee to review and evaluate potential strategic alternatives in its

sole discretion and exercise related powers that are typical of such committees. The directors who are members of the Strategic Alternatives

Committee are Christopher Downs (the Chairman), Dennis Neilander and Michael Nicklas. On June 30, 2023, the Compensation Committee and

the Strategic Alternatives Committee reviewed and approved the payment of compensation to members of the Strategic Alternatives Committee

in addition to the Company’s standard compensation arrangements for non-employee directors, the Strategic Alternatives Committee

recommended that the full Board approve it, and the Board did so. Under this plan, the Chairman of the committee will receive a monthly

retainer of $15,000 and the other two members of the committee will receive a monthly retainer of $12,000. These fee arrangements will

be reevaluated if the committee remains in place after six months.

On June 28, 2023, based on the approval of the

Strategic Alternatives Committee, that committee’s favorable recommendation to the Board, and the Board’s subsequent approval,

the Company hired Houlihan Lokey Capital, Inc. (“Houlihan”) as the Company’s exclusive financial advisor to provide

financial advisory and investment banking services in connection with one or more of a sale, recapitalization, restructuring or any other

financial transactions involving the Company. The continued engagement of Houlihan is required by the Lender during the term of the Forbearance

Agreement discussed below.

On June 30, 2023, the Company,

the subsidiaries of the Company and CP BF Lending, LLC (“Lender”) entered into a forbearance agreement (the “Forbearance

Agreement”). Pursuant to the Forbearance Agreement, the Company acknowledged, among other items, that, as of June 30, 2023, it was

in default under the Credit Agreement, the Lender had the right to accelerate the Loan, and the Lender had the right to impose the default

rate of interest under the Credit Agreement. Pursuant to the Forbearance Agreement, the Lender agreed to forbear from exercising its rights

and remedies against the Company and the Guarantors under the Credit Documents until the earlier of September 15, 2023, which has been

extended by the Lender as described in the following paragraphs, or until a termination event occurs pursuant to the Forbearance Agreement.

A termination event under the Forbearance Agreement consists of the filing of a bankruptcy proceeding by the Company or any Guarantor,

the occurrence of a new event of default under the Credit Agreement, or the failure by the Company or any Guarantor to perform any material

requirement, covenant, or obligation under the Forbearance Agreement. During the forbearance period, the Lender agreed, among other items,

not to accelerate the Loan, initiate any bankruptcy filings, or apply any default rates of interest. As partial consideration for the

Lender agreeing to enter into the Forbearance Agreement, the Company paid a forbearance fee equal to 50 basis points of the outstanding

principal amount of the Loan (or $130,425), which amount was added to the principal balance of the loan. In addition, on June 30, 2023,

the Company made a prepayment of the Loan in the amount of $2.0 million, which in turn reduced the minimum cash balance requirement under

the Credit Agreement to $0.

On

September 15, 2023, the Company, the subsidiaries of the Company and the Lender entered into an amendment number 1 to the Forbearance

Agreement (the “Forbearance Amendment No. 1”). The Amendment extended the Forbearance Date from September 15, 2023 until October

31, 2023. As partial consideration for the Lender agreeing to enter into the Amendment, the Company paid a forbearance fee of $90,000,

which was added to the outstanding principal amount of the Loan.

In connection with the Forbearance

Amendment No. 1, the Lender agreed to provide the Company with a revolving line of credit in the amount of $2.0 million (the “Revolving

Note”), with any advances under the Revolving Note to be made in the sole discretion of the Lender. On

September 29, 2023, the Lender agreed to increase the maximum available amount of the Revolving Loan to $4.0 million. The Company paid

Lender a fee of $40,000 in connection with the increase. The Revolving Note has a maturity date of November 29, 2024 and carries

an interest rate of 15.0% per annum, provided that upon an occurrence of default the interest rate will increase to the default rate under

the Loan. The Revolving Note is an Obligation as defined in the Credit Agreement and as such is secured by the collateral in which the

Company and the Guarantors have granted liens and security interests to the Lender in connection with the Loan. All discretionary advances

shall terminate automatically and all outstanding principal together with accrued but unpaid interest and fees shall become immediately

due and payable, without notice to or action by any party, on the earlier of the termination date of the Forbearance Agreement, or the

maturity date of the Revolving Note, unless otherwise extended by the Lender. As of September 30, 2023, the outstanding balance on the

Revolving Note was $1,690,000.

On October 1, 2023, the Company,

the subsidiaries of the Company and the Lender entered into an amendment number 2 to the Forbearance Agreement (the “Forbearance

Amendment No. 2”). The Forbearance Amendment No. 2 extended the Forbearance Date from October 31, 2023 until June 30, 2025, and

provided that instead of interest being payable monthly in cash, such interest shall accrue in arrears and can be added to the outstanding

principal balance of the Loan. The interest rate on the Loan and the Revolving Note was increased to 16.5% per annum. The Forbearance

Amendment No. 2 further added that the Company’s suspension from trading or failure to be listed on the Nasdaq Capital Market for

more than 30 calendar days would constitute a Termination Event under the Forbearance Agreement as amended. Pursuant to Forbearance Amendment

No. 2, the Company agreed that to the extent it receives net proceeds from or in connection with a judgment, settlement or other in or

out of court resolution of a commercial tort claim, the Company will: (i) make a prepayment on the Loan or the Revolving Note (discussed

below) of 100% of such net proceeds; and (ii) make an additional payment to the Lender equal to 5% of any such net proceeds (prior to

the payments set forth in subsection (i)) in excess of $50.0 million. On November 11, 2023, Lender provided the Company with an extension

of the Nasdaq Capital Market delisting/suspension Termination Event for an additional 40 calendar days up to December 23, 2023 and on

December 19, 2023, the Lender provided the Company with an additional extension of 40 days.

On January 9, 2024, the Company,

the subsidiaries of the Company and the Lender entered into a Third Amendment to Credit Agreement (the “Amendment No. 3”).

The Amendment No. 3 increased the maximum available amount of the Revolving Loan from $4.0 million to $6.5 million and provided such additional

loan availability under a use of proceeds that including working capital as well as funding for our litigation matters, materially including

our litigation against Aspire. In connection with entering into Amendment No. 3, the Company and the Lender entered in a second amended

and restated note conversion option agreement (the “Conversion Agreement”), pursuant to which the Company agreed that the

Lender shall have the right to convert the principal balance and accrued interest under the Loan and Revolving Note into shares of Company

common stock at a conversion price of $0.116 per share (subject to adjustment for stock splits, stock dividends and other similar events).

The foregoing conversion price is subject to future adjustment to the lowest price per share referenced in any equity related instrument

the Company issues to any other person until the Lender has exercised its conversion rights. Pursuant to the Conversion Agreement, the

Lender is prohibited from converting its debt to the extent that such conversion would result in the number of shares of common stock

beneficially owned by Lender and its affiliates exceeding 9.99% of the total number of shares of common stock outstanding immediately

after giving effect to the conversion, which percentage may be increased or decreased at the holder’s election provided any adjustment

would not become effective for 61 days. The Company agreed to file a resale registration statement providing for the resale by the Lender

of the shares of common stock that may be received upon the foregoing conversion within 30 calendar days of the Lender’s request,

and to use commercially reasonable efforts to cause such registration statement to become effective within 90 days of such request. To

the extent that the Company does not have sufficient authorized shares of common stock to allow for the full conversion permitted by the

Conversion Agreement, upon the Lender’s request, the Company will be required to use its reasonable best efforts to obtain approval

of an increase in the Company's authorized shares from its shareholders. During any period of time that the Company does not have sufficient

authorized shares to allow for the full conversion permitted by the Conversion Agreement, the Company will be prohibited from issuing

any shares of common stock or common stock equivalents. As a result of Amendment No. 3, the exercise price of the warrants issued to the holders of Preferred Stock was

reset to $0.116 per share.

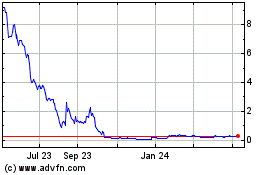

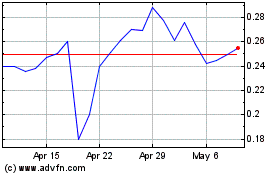

Due to a failure to meet the

Nasdaq Stock Market listing standards, the Company’s common stock was delisted from The Nasdaq Capital Market on October 13, 2023.

The Company’s common stock was initially traded on the OTC Pink Sheets until December 6, 2023, when the Company began trading on

the OTCQB exchange.

Market for i-Gaming Gambling

Online gambling has been

legalized by various countries globally owing to employment opportunities and more tax revenue for local and state governments. According

to Mordor Intelligence, the European online gambling market is forecasted to be $52.3 billion for 2024 and is expected to reach $88.2

billion by 2029, potentially registering a compound annual growth rate (“CAGR”) of 11.01%. According to Mordor intelligence,

the US online gambling (i-gaming) market is expected to reach USD $10.98 billion by 2029, a potential CAGR of 16.52% from 2024 to 2029.

The growing consumer adoption of betting apps and free to play models in online gambling are among major factors expected to drive market

growth in the coming years. The development can be ascribed to the legalization of gambling in various European countries, including

UK, Italy, Malta, France, Spain, and Germany. Other regions such as the US, Canada and Asia are recording higher CAGR figures.

Increased smartphone and internet penetration

and easy access to casino gaming platforms is positively influencing the market statistics. Moreover, the availability of cost-effective

betting applications is expected to favor the market growth over the forecast period. Online casino and sportsbook operators emphasize

developing information solutions that support and assist gamblers, safeguard the authenticity of gambling activities, and prevent

fraudulent activities. Online gambling sites offer a free-play version of their games, creating growth potential for the business.

The COVID-19 pandemic played a crucial role in

expediting the online gambling demand as people spent most of their time indoors and opted for online games for their leisure. Additionally,

the availability of secure options for digital payment is also stimulating the adoption of online gambling apps. The market growth may

be further accelerated by the increased adoption of digital currency, and other digital payment methods, and websites provided by betting

and gambling companies.

Our Products and Services

We currently operate 6 online wagering brands,

via websites and mobile apps, where we accept deposits and funds from our customers and offer our customers the ability to use those funds

to wager on slot and table games, live casino games as well as virtual sport computer simulated games and sportsbetting.

Our Technology and Product Development

In order to create the best real-money wagering

experience for our customers, we have developed a new front-end framework for our brands, and have rolled it out for Karamba. We plan to

roll it out to the rest of the brands in 2024. This new framework will:

| |

· |

Provide our customers with a much-improved user experience; |

| |

· |

Increase customer acquisition and conversion rates |

| |

· |

Optimize and increase customer retention metrics. |

Our Intellectual Property

We license software from third parties which we

believe will give us competitive advantages and create valuable and new experiences in the future for customers during their wagering

experience.

On September 1, 2020, our wholly owned subsidiary,

ESEG Limited, entered into three domain purchase agreements pursuant to which it acquired the following domain names: Esportsbook.com,

Browserbets.com, esportsgames.com, Esportstechnologies.com, Browserbet.com, Fantasyduel.com and Esportsgamers.com.

We also own dozens of trademarks both in the United

States and internationally and our trademarks and related brands are central to our operations our online wagering brands. Some of our

key trademarks including Karamba, Hopa, Bettarget, Gogawi and derivations thereof.

Competition

We operate in the global entertainment and gaming

industries and there is intense competition among online gaming and entertainment providers. A number of established, well-financed companies

producing online gaming products and services compete with our offerings, and other well-capitalized companies may introduce competitive

services.

Human Capital Resources

As a multinational technology company with approximately

28 employees and contractors located in 7 countries, our business success is driven by our highly skilled workforce. With our global technology

and product team, we are focused on delivering new, innovative and exciting products to our growing base of customers.

We recognize that engaging and developing our employees

is a key to our success and we rely on attracting and retaining our talent to deliver on our mission. During the year we have implemented

a new human resources system to better understand employees’ satisfaction through quarterly performance assessments. These assessments

ensure we understand how we can better deliver on our investments in technology and meet our customers’ needs.

We also offer our employees a competitive compensation

package with health and welfare benefits for our employees and family members. In addition, every employee is eligible for equity awards

to share in our financial success.

Government Regulation

We are subject to various U.S. and foreign laws

and regulations that affect our ability to operate our product offerings. These product offerings are generally subject to extensive and

evolving regulations that could change based on political and social norms and that could be interpreted in ways that could negatively

impact our business.

Our gaming sub-license from the Curacao Gaming

Authority and the licenses made available to us from the acquisition of the Aspire B2C business allows us to accept wagers from residents

in certain territories throughout the world. Our focus is to invest and develop our business in Western Europe, Asia and Latin America.

We currently do not have the ability to accept wagers from customers based in the United States.

The gaming industry is highly regulated and we

must maintain compliance with licenses and pay gaming taxes or a percentage of revenue where required by the jurisdictions in which we

operate in order to continue our operations. Our business is subject to compliance with extensive regulation under the laws, rules and

regulations of the jurisdictions in which we operate. These laws, rules and regulations generally concern the responsibility, financial

stability, integrity and character of the owners, managers and persons with material financial interests in the gaming operations. Violations

of laws or regulations in one jurisdiction could result in disciplinary action in that and other jurisdictions.

Data Protection and Privacy

Because we handle, collect, store, receive, transmit

and otherwise process certain personal information of our users and employees, we are also subject to federal, state and foreign laws

related to the privacy and protection of such data.

With our operations in Europe, we face particular

privacy, data security and data protection risks in connection with requirements of the General Data Protection Regulation of the European

Union (EU) 2016/679 (the “GDPR”) and other data protection regulations. Any failure to comply with these rules may result

in regulatory fines or penalties including orders that require us to change the way we process data. In the event of a data breach, we

are also subject to breach notification laws in the jurisdictions in which we operate, including the GDPR, and the risk of litigation

and regulatory enforcement actions.

We have in the past and may

in the future incur data breaches that adversely affect our operations. During the most recent quarter, we became aware of what appeared

to be unsolicited marketing contacts from unknown third parties offering player incentives on signup to certain of our sites (“Marketing

Contacts”). We investigated these Marketing Contacts both internally and with the assistance of a third-party forensic firm and

were unable to identify the source of any such contact as having occurred on our platform or system. We have no role in the player registration

process and are totally reliant on our platform provider, Aspire, to manage, control and operate such process. Upon first learning of

the Marketing Contacts, we notified Aspire of the issue and continue to monitor the situation with Aspire. To date, we have no reason

to believe that our own internal systems or any system under our control has any issue, weakness or vulnerability – however there

is always a risk that bugs, flaws, hacks, incidents could occur, resulting in unsolicited emails and texts to users and new registrants

on our sites given what has apparently occurred with the Marketing Contacts on the Aspire platform. Although the subject Marketing Contacts

events ceased in November 2023 there is no certainty that such incidents could not occur again.

Any significant change to applicable laws, regulations,

interpretations of laws or regulations, or market practices, regarding the use of personal data, or regarding the manner in which we seek

to comply with applicable laws and regulations, could require us to make modifications to our products, services, policies, procedures,

notices, and business practices, including potentially material changes. Such changes could potentially have an adverse impact on our

business.

Curacao License

The Curacao Ministry of Justice has only granted

four online gaming Master Licenses. Our license is a sublicense from one of the four master license holders, Gaming Services Provider

N.V. #365/JAZ. The Curacao Ministry of Justice allows an applicant for a sublicense from a Master License holder to operate under the

master license holder’s license, so long as they meet certain operating and compliance criteria, including, without limitation,

providing quarterly and annual submissions and conducting “know your customer” procedures. These criteria must be met at the

stage of application as well as on an ongoing basis. As such, so long as we maintain the requisite criteria for holding the sublicense,

as a sublicensee we can enjoy the same privileges and rights that the Master License holder has, but without the ability to issue licenses.

This single sublicense covers any kind of game

requiring skill or chance, including esports and sports betting. Additionally, it also allows the operator to carry out and offer services

related to i-gaming including aggregators, software providers, and platform operators.

The entities that evaluate our ongoing compliance

are the Master License holder and the Curacao Gaming Control Board. There is no set standard, to date, to quantify sanctions. These are

reviewed on an individual basis. The framework to suspend a sublicense is based on the severity of the infraction, and includes, not paying

licensing fees, not adhering to policies or resolving customer issues, and not keeping required “know your customer” procedures

up to date. Where direct violations of the sublicense agreement pertain to the compliance with the Master License, suspensions would be

enforced until the sublicense holder has submitted all needed information or documents as requested by the Master License holder or the

Curacao Gaming Board. In addition, any customer complaints that are not resolved could result in a suspension of our sublicense depending

on the severity of the issue. Finally, marketing or accepting players from prohibited countries could result in an immediate suspension

of our sublicense. In such case, we would need to show that IP geo blocking of the countries has been implemented and measures put in

place to ensure we are not accepting customers from said country moving forward.

Responsible and Safer Gaming

We view the safety and welfare of our users as

critical to our business and have made appropriate investments in our processes and systems. We are committed to industry-leading responsible

gaming practices and seek to provide our users with the resources and services they need to play responsibly.

Corporate Structure

EBET, Inc. was formed in Nevada in September of

2020 and currently has wholly owned subsidiaries in Ireland, Malta, Gibraltar, Israel, Belize, Curacao and Cyprus.

Available Information

Our Internet address is ebet.gg. On this

website, we post the following filings as soon as reasonably practicable after they are electronically filed with or furnished to the

U.S. Securities and Exchange Commission (“SEC”): our Annual Reports on Form 10-K; our Quarterly Reports on Form 10-Q; our

Current Reports on Form 8-K; our proxy statements related to our annual stockholders’ meetings; and any amendments to those reports

or statements. All such filings are available on our website free of charge. The charters of our audit, nominating and governance and

compensation committees and our Code of Business Conduct and Ethics Policy are also available on our website and in print to any stockholder

who requests them. The content on our website is not incorporated by reference into this Form 10-K.

An investment in our securities involves a high

degree of risk. You should consider carefully all of the material risks described below, together with the other information contained

in this Form 10-K. If any of the following events occur, our business, financial condition, results of operations and cash flows may be

materially adversely affected.

Risks Related to the Company’s Business,

Operations and Industry

Our completed acquisition of the Aspire

assets remains subject to integration risks.

On November 29, 2021, we completed our acquisition

of Aspire’s portfolio of B2C proprietary online casino and sportsbook brands, including Karamba, Hopa, Griffon Casino, BetTarget,

Dansk777, and GenerationVIP.

Successful integration of Aspire’s operations

and personnel into our existing business places an additional burden on management and other internal resources. The diversion of management’s

attention and any difficulties encountered in the transition and integration process could harm our business, financial condition, results

of operations and prospects.

Furthermore, the overall integration of the businesses

may result in material unanticipated problems, expenses, liabilities, competitive responses, and loss of customers and other relationships.

The difficulties of combining the operations of the companies include, among others, difficulties in conforming procedures, other policies,

business cultures and compensation structures, assimilating employees, keeping existing customers and obtaining new customers. Our failure

to meet the challenges involved in continuing to integrate the operations of these new assets or to otherwise realize any of the anticipated

benefits of the acquisition could adversely impair our business and operations.

We are party to a Forbearance Agreement

(including that forbearance agreed pursuant to that certain Amendment to Credit Agreement No. 3) which expires on June 30, 2025, unless

extended by the Lender, and if we are unable to comply with the Forbearance Agreement then the lender could declare a default of the Credit

Agreement wherein we would be required to immediately repay the amounts due under the Credit Agreement.

On November 29, 2021, we entered

into a Credit Agreement with CP BF Lending, LLC (“Lender”) to finance the acquisition of the Aspire assets that we purchased

on the same date, via a term loan in the maximum principal amount of $30.0 million with a maturity of 36 months. On June 30, 2023, we,

our subsidiaries and our Lender with respect to our Senior Notes, entered into a Forbearance Agreement. Pursuant to the Forbearance Agreement,

we acknowledged, among other items, that, as June 30, 2023, we were in default under the Credit Agreement, the Lender had the right to

accelerate the Loan, and the Lender had the right to impose the default rate of interest under the Credit Agreement. Pursuant to the Forbearance

Agreement, the Lender agreed to forbear from exercising its rights and remedies against the Company and the Guarantors under the Credit

Documents until the earlier of September 15, 2023. A termination event under the Forbearance Agreement consists of the filing of a bankruptcy

proceeding by us or any guarantor, the occurrence of a new event of default under the Credit Agreement, or the failure by us or any guarantor

to perform any material requirement, covenant, or obligation under the Forbearance Agreement. During the forbearance period, the Lender

agreed, among other items, not to accelerate the Loan, initiate any bankruptcy filings, or apply any default rates of interest.

On October 1, 2023, we,

our subsidiaries and the Lender entered into an amendment number 2 to the Forbearance Agreement (the “Forbearance Amendment

No. 2”). The Forbearance Amendment No. 2 extended the Forbearance Date from October 31, 2023 until June 30, 2025, and provides

that instead of interest being payable monthly in cash, such interest shall accrue in arrears and can be added to the outstanding

principal balance of the Loan. The interest rate on the Loan and the Revolving Note was increased to 16.5% per annum. Pursuant to

Forbearance Amendment No. 2, we agreed that to the extent we receive net proceeds from or in connection with a judgment, settlement

or other in or out of court resolution of a commercial tort claim, the Company will: (i) make a prepayment on the Loan or the

Revolving Note of 100% of such net proceeds; and (ii) make an additional payment to the Lender equal to 5% of any such net proceeds

(prior to the payments set forth in subsection (i)) in excess of $50.0 million.

The

borrowings under the Credit Agreement are secured by a first priority lien on our assets. If we fail to comply with the terms of the Forbearance

Agreement, the Lender could declare an event of default, which would give it the right to declare all borrowings outstanding, together

with accrued and unpaid interest and fees, to be immediately due and payable. In addition, since the borrowings under the Credit Agreement

are secured by a first priority lien on our assets, upon such an event of default, the Lender may foreclose on our assets.

Our recurring losses

from operations raise substantial doubt regarding our ability to continue as a going concern. Our ability to continue as a going concern

requires that we obtain sufficient funding to finance our operations in the near term.

We have sustained losses from

operations since inception, which as of September 30, 2023, accumulated to $151,158,440, including an operating loss of $65,708,506 and

$32,644,277 for the years ended September 30, 2023 and 2022, respectively, and have a working capital deficit of $60,685,945. We

do not expect to be profitable in the foreseeable future and have had recurring negative cash flows from operations. These net losses

and negative cash flows have had, and will continue to have, an adverse effect on our stockholders’ equity and working capital.

The continuation of the Company as a going concern is dependent upon our ability to obtain continued financial support from our stockholders,

necessary equity or debt financing to continue operations and the attainment of profitable operations. These factors, among others, raised

substantial doubt about our ability to continue as a going concern. Our ability to continue as a going concern requires that we obtain

sufficient funding to finance our operations in the near term. If we are unable to obtain sufficient funding, our business, prospects,

financial condition and results of operations will be materially and adversely affected, and we may be unable to continue as a going concern.

If we are unable to continue as a going concern, we may have to liquidate our assets and may receive less than the value at which those

assets are carried on our audited financial statements, and it is likely that investors will lose all or a part of their investment. If

we seek additional financing to fund our business activities in the future and there remains substantial doubt about our ability to continue

as a going concern, investors or other financing sources may be unwilling to provide additional funding to us on commercially reasonable

terms or at all.

Accordingly, our auditor has concluded that substantial

doubt exists regarding our ability to continue as a going concern. Our audited financial statements appearing at the end of this Annual

Report have been prepared on a going concern basis, which contemplates the realization of assets and satisfaction of liabilities in the

ordinary course of business. These financial statements do not include any adjustments relating to the recoverability and classification

of recorded asset amounts or the amounts and classification of liabilities that might result from the outcome of these uncertainties related

to our ability to operate on a going concern basis. In its report on our financial statements for the years ended September 30, 2023

and 2022, our independent registered public accounting firm included an explanatory paragraph stating that our recurring losses from operations

and negative cash flows since inception and our need to raise additional funding to finance our operations raise substantial doubt about

our ability to continue as a going concern. The perception that we may not be able to continue as a going concern may cause others to

choose not to deal with us due to concerns about our ability to meet our contractual obligations.

We are an early development stage company with a limited operating

history and a history of losses.

Although our predecessor has been in business since

2016, during our predecessor’s existence substantially all of our efforts prior to the acquisition of the Aspire i-gaming assets

were focused on developing our technology and intellectual property and operating our first-generation website. As a result, we have generated

limited revenues and have incurred a substantial accumulated deficit as of September 30, 2023. There can be no assurance that we will

generate sufficient revenues leading to profitability. If we cannot achieve our business objectives including working with our Lender

in connection with amending certain financial covenants contained in the Credit Agreement, raising additional capital and reducing our

gaming platform services fees, investors in our shares will likely suffer a loss of their entire investment.

We have a new business model, which makes it difficult for us

to forecast our financial results, creates uncertainty as to how investors will evaluate our prospects, and increases the risk that we

will not be successful.

We have a new business model and are in the process

of developing new offerings, expanding our existing i-gaming offerings and related jurisdictions and developing other revenue sources

from the monetization of our business intelligence and otherwise. Accordingly, it will be difficult for us to forecast our future financial

results, and it is uncertain how our new business model will affect investors’ perceptions and expectations with respect to our

business and economic prospects. Additionally, our new business model may not be successful. Consequently, you should not rely upon any

past financial results as indicators of our future financial performance.

Our current and future online offerings are part of new and evolving

industries, presenting significant uncertainty and business risks, and we are reliant on our service provider to comply with evolving

regulations.

The online gaming and interactive entertainment

industry is relatively new and continuing to evolve. Whether these industries grow and whether our online business will ultimately succeed,

will be affected by, among other things, developments in gaming platforms, legal and regulatory developments (such as the passage of new

laws or regulations or the extension of existing laws or regulations to online gaming activities), taxation of gaming activities, data

privacy laws and regulation and other factors that we are unable to predict and which are beyond our control. Given the dynamic evolution

of these industries, it can be difficult to plan strategically, and it is possible that competitors will be more successful than us at

adapting to the changing landscape and pursuing business opportunities. Additionally, as the online gaming industry advances, including

with respect to regulation, we may become subject to additional compliance-related costs. Consequently, we are unable to provide assurance

that our online and interactive offerings will grow at anticipated rates or be successful in the long term.

We are dependent on third

parties to comply with a variety of gaming regulations, and their failure to have complied or comply with these regulations going forward

could adversely affect our business. In April 2023, we were notified by our gaming platform operator services provider, Aspire, that the

gaming regulatory authority in Germany had sent Aspire a letter stating that Aspire would be required to shut down activity of its gaming

operations in Germany unless Aspire was otherwise granted a license to operate in Germany within weeks of receipt of said letter. Aspire

was apparently unable to meet any such license requirements as set out by the German regulator in the time required and in order to meet

the subject German regulator requirement, Aspire shut down its activities in Germany on May 7, 2023. As a result, the gaming websites

owned by us that operate in Germany were shut down on that date. These events had an immediate and ongoing negative impact on our

revenues and business in general, the extent to which we continue to determine. There is no certainty that such events would not occur

again in any connection with activity we undertake pursuant to our operator agreements with Aspire.

We have a limited operating history and we expect a number of

factors will cause our operating results to fluctuate on an annual basis, which may make it difficult to predict our future performance.

We are an i-gaming gambling platform with a limited

operating history. Consequently, any predictions made about our future success or viability may not be as accurate as they could be if

we had a longer operating history. We anticipate that our operating results will significantly fluctuate from quarter to quarter and year

to year due to a variety of factors, many of which are beyond our control. In particular, you should consider that we cannot provide assurance

that we will be able to:

| |

· |

successfully develop and introduce our updated website; |

| |

|

|

| |

· |

maintain our management team; |

| |

|

|

| |

· |

raise sufficient funds in the capital markets to effectuate our business plan; |

| |

|

|

| |

· |

attract, enter into or maintain contracts with, and retain customers and vendors; and/or |

| |

|

|

| |

· |

compete effectively in the extremely competitive environment in which we operate. |

These factors are our best estimates of possible

factors that will affect our future operating results, however, they should not be considered a complete recitation of possible factors

that could affect the Company.

We will require substantial additional funding in the short term,

which may not be available to us on acceptable terms, or at all, and, if not so available, may require us to delay, limit, reduce or cease

our operations.

To date, we have relied primarily on equity financing

and on the Revolving Note with our Lender to carry on our business. We have limited financial resources, negative operating cash flow

and no assurance that sufficient funding will be available to us to fund our operating expenses and to further develop our business. We

expect our current cash on hand will not enable us to fund our operating expenses and capital expenditure requirements beyond the next

twelve months. Unless we achieve profitability, we anticipate that we will need to raise additional capital to fund our operations while

we implement and execute our business plan. We currently do not have any contracts or commitments for additional financing and are reliant

on the Revolving Note to fund our operations. Pursuant to the Revolving Note, our Lender is not required to provide us with any specific

amount of financing and we are dependent on our Lender agreeing to provide us with future working capital. There can be no assurance that

any additional capital will be available on a timely basis or on terms that will be acceptable to us. Failure to obtain such additional

financing could result in delay or indefinite postponement of operations or the further development of our business with the possible

loss of such properties or assets. If adequate funds are not available or are not available on acceptable terms, we may not be able to

fund our business or the expansion thereof, take advantage of strategic acquisitions or investment opportunities or respond to competitive

pressures. Such inability to obtain additional financing when needed could have a material adverse effect on our business, results of

operations, cash flow, financial condition and prospects.

We conduct our operations outside the United States and that

exposes us to foreign currency transaction and translation risks. As a result, changes in the valuation of the U.S. dollar in relation

to other currencies, primarily the Euro, could have positive or negative effects on our profit and financial position.

Our global operations are likely to expose us to

foreign currency transaction and translation risks. Our functional currency is the U.S. dollar, and as a result, we will be subject to

foreign currency fluctuation as all of our revenues, and a significant majority of our operating expenses will not be denominated in the

U.S. dollar. We are not licensed in the United States, so we do not have revenues denominated in U.S. dollars. A decrease in the value

of non-U.S. dollar currencies, primarily the Euro, against the U.S. dollar could impact our ability to repay our U.S. dollar denominated

liabilities, including our term Debt. These risks related to exchange rate fluctuations may increase in future periods as our operations

outside of the United States expand.

We rely on information technology and other systems and services

provided by third parties, primarily by Aspire Global plc, and any failures, errors, defects or disruptions in these systems or services

could diminish our brand and reputation, subject us to liability, disrupt our business and adversely affect our operating results and

growth prospects. The third-party platforms upon which these systems and software are made available could contain undetected errors.

Our technology infrastructure

is critical to the performance of our offerings and to user satisfaction. As part of the acquisition of Aspires’ B2C Business, we

entered into Operator Services Agreements with Aspire for a three (3) year period each, which requires Aspire to provide key licensing

and operational services in each jurisdiction where Aspire is licensed and operational. However, the systems provided by Aspire, on which

we rely, may not be adequately designed with the necessary reliability and redundancy to avoid performance delays or outages that could

be harmful to our business. We cannot assure you that the measures we take, in connection with Aspire, to prevent or hinder cyber-attacks

and protect our systems, data and user information and to prevent outages, data or information loss, fraud and to prevent or detect security

breaches, including a disaster recovery strategy for server and equipment failure and back-office systems and the use of third parties

for certain cybersecurity services, will provide absolute security. We have experienced, and we may in the future experience, website

disruptions, outages and other performance problems due to a variety of factors, including infrastructure changes, human or software errors

and capacity constraints. Such disruptions and/or future disruptions from unauthorized access to, fraudulent manipulation of, or tampering

with our computer systems and technological infrastructure, or those of third parties, could result in a wide range of negative outcomes,

each of which could materially adversely affect our business, financial condition, results of operations and prospects.

Additionally, our products or products provided

by Aspire, may contain errors, bugs, flaws or corrupted data, and these defects may only become apparent after their launch. If a particular

product offering is unavailable when users attempt to access it or navigation through our offerings is slower than they expect, users

may be unable to place their bets or set their line-ups in time and may be less likely to return to our products and services as often,

if at all. Furthermore, programming errors, defects and data corruption could disrupt our operations, adversely affect the experience

of our users, harm our reputation, cause our users to stop utilizing our offerings, divert our resources and delay market acceptance of

our offerings, any of which could result in legal liability to us or harm our business, financial condition, results of operations and

prospects.

We believe that if our users have a negative experience

with our offerings, or if our brand or reputation is negatively affected, users may be less inclined to continue or resume utilizing our

products or to recommend our offerings to other potential users. As such, a failure or significant interruption in our service could harm

our reputation, business and operating results.

We rely on other third-party data providers for real-time and

accurate data for events, and we cannot guarantee that such third parties will perform adequately or will not terminate their relationships

with us.

We currently rely on third-party data providers

to obtain accurate information regarding schedules, results, performance and outcomes of events. We rely on this data to determine when

and how bets are settled. If we experience errors or delays in receiving this data, it may result in us incorrectly settling bets. If

we cannot adequately resolve the issue with our users, our users may have a negative experience with our offerings, our brand or reputation

may be negatively affected, and our users may be less inclined to continue or resume utilizing our products or recommend our platform

to other potential users.

Our success in the i- gaming market depends on our ability to

develop and manage frequent introductions of innovative products and operate within the guidelines of the content owners (publishers)

in order to attract and retain users.

The i-gaming industries are characterized by dynamic

customer demand and technological advances. As a result, we must continually introduce and successfully market new technologies in order

to remain competitive and effectively stimulate customer demand. The process of developing new products and systems is inherently complex

and uncertain. It requires accurate anticipation of changing customer needs and end user preferences as well as emerging technological

trends. If our competitors develop new content and technologically innovative products, and we fail to keep pace, our business could be

adversely affected. Additionally, the introduction of products embodying new technology and the emergence of new industry standards can

render our existing offerings obsolete and unmarketable. To remain competitive, we must invest resources towards research and development

efforts to introduce new and innovative products with dynamic features to attract new customers and retain existing customers. If we fail

to accurately anticipate customer needs and end-user preferences through the development of new products and technologies, we could lose

business to our competitors, which would adversely affect our results of operations and financial position.

We can provide no assurance that we will successfully

develop new products or enhance and improve our existing products, that new products and enhanced and improved existing products will

achieve market acceptance or that the introduction of new products or enhanced existing products by others will not render our products

obsolete. Dynamic customer demand and technological advances often demand high levels of research and development expenditures in order

to meet accelerated product introductions, and the life cycles of certain products may be short, which could adversely affect our operating

results. In some cases, our new products and solutions may require long development and testing periods and may not be introduced in a

timely manner or may not achieve the broad market acceptance necessary to generate significant revenue. Our inability to develop solutions

that meet customer needs and compete successfully against competitors’ offerings could have a material adverse effect on our business,

financial condition and results of operations.

Reductions in discretionary consumer spending could have an adverse

effect on our business, financial condition, results of operations and prospects.

The demand for entertainment and leisure activities

tends to be highly sensitive to changes in consumers’ disposable income, and thus can be affected by changes in the economy and

consumer tastes, both of which are difficult to predict and beyond our control. Unfavorable changes in general economic conditions, including

recessions, economic slowdown, and sustained high levels of unemployment may reduce customers’ disposable income or result in fewer

individuals engaging in entertainment and leisure activities, including gambling. As a result, we cannot ensure that demand for our products

or services will remain constant. Continued or renewed adverse developments affecting economies throughout the world, including a general

tightening of availability of credit, decreased liquidity in many financial markets, increasing interest rates, increasing energy costs,

acts of war or terrorism, natural disasters, declining consumer confidence, sustained high levels of unemployment or significant declines

in stock markets, could lead to a further reduction in discretionary spending on leisure activities, such as gambling. Any significant

or prolonged decrease in consumer spending on entertainment or leisure activities could reduce our online games, reducing our cash flows

and revenues. If we experience a significant unexpected decrease in demand for our products, we could incur losses.

Negative events or negative media coverage relating to, or a

declining popularity of, daily fantasy sports, sports betting, the underlying sports or athletes, or online sports betting in particular,

could have an adverse impact on our business.

Public opinion can significantly influence our

business. Unfavorable publicity regarding us, for example, changes to our product, product quality, litigation, or regulatory activity,

or regarding the actions of third parties with whom we have relationships or the underlying sports could seriously harm our reputation.

Negative public perception could also lead to new restrictions on or to the prohibition of sports betting in jurisdictions in which we

currently operate. Such negative publicity could also adversely affect the size, demographics, engagement, and loyalty of our customer