0000821189false00008211892024-01-112024-01-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 11, 2024

_______________

EOG RESOURCES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 1-9743 | 47-0684736 |

(State or other jurisdiction

of incorporation) | (Commission File

Number) | (I.R.S. Employer

Identification No.) |

1111 Bagby, Sky Lobby 2

Houston, Texas 77002

(Address of principal executive offices) (Zip Code)

713-651-7000

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | EOG | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EOG RESOURCES, INC.

Item 7.01 Regulation FD Disclosure.

I. Price Risk Management

With the objective of enhancing the certainty of future revenues and cash flows, from time to time EOG enters into financial price swap, option, swaption, collar and basis swap contracts. EOG accounts for financial commodity derivative contracts using the mark-to-market accounting method.

For the fourth quarter of 2023, EOG anticipates a net gain of $298 million on the mark-to-market of its financial commodity derivative contracts. During the fourth quarter of 2023, the net cash received from settlements of financial commodity derivative contracts was $18 million.

Consistent with EOG's customary practice, in calculating Adjusted Net Income (Loss) (Non-GAAP) for the fourth quarter of 2023, EOG expects to (among other expected adjustments) subtract from reported Net Income (Loss) the anticipated net gain of $298 million on the mark-to-market of its financial commodity derivative contracts and add to reported Net Income (Loss) the $18 million of net cash received from settlements of financial commodity derivative contracts, as presented in the summary below (in millions).

| | | | | | | | |

| Three Months Ended

December 31, 2023

Before Tax |

| | |

| Reported Net Income (Loss) (GAAP) | $ | ** |

| Adjustments: | | |

| Net Gain on Mark-to-Market Financial Commodity Derivative Contracts | | (298) | |

| Net Cash Received from Settlements of Financial Commodity Derivative Contracts | | 18 | |

| Other Adjustments | | ** |

| Adjusted Net Income (Loss) (Non-GAAP) | $ | ** |

_________________

** To be reported as part of EOG's press release scheduled to be furnished on Form 8-K on February 22, 2024.

For the quarter ended December 31, 2023, NYMEX WTI crude oil averaged $78.33 per Bbl, and NYMEX natural gas at Henry Hub averaged $2.87 per MMBtu. EOG's actual realizations for crude oil and natural gas for the quarter ended December 31, 2023, differ from these NYMEX prices due to delivery location (basis), quality and appropriate revenue adjustments. EOG's actual realizations for NGLs are influenced by the components extracted, including ethane, propane, butane and natural gasoline, among others, and the respective market pricing for each component.

In connection with its financial commodity derivative contracts, EOG had no collateral posted at December 31, 2023, and had no collateral held at December 31, 2023.

II. Financial Commodity Derivative Transactions

Presented below is a comprehensive summary of EOG's financial commodity derivative contracts as of December 31, 2023. For a summary of EOG's financial commodity derivative contracts as of October 31, 2023, see "Financial Commodity Derivative Transactions" in Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations of EOG's Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2023, filed on November 2, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Crude Oil Financial Price Swap Contracts |

| | | | Contracts Sold | | Contracts Purchased |

| Period | | Settlement Index | | Volume (MBbld) | | Weighted Average

Price ($/Bbl) | | Volume (MBbld) | | Weighted Average Price ($/Bbl) |

| | | | | | | | | | |

| January - March 2023 (closed) | | NYMEX WTI | | 95 | | | $ | 67.90 | | | 6 | | | $ | 102.26 | |

| April - May 2023 (closed) | | NYMEX WTI | | 91 | | | 67.63 | | | 2 | | | 98.15 | |

| June 2023 (closed) | | NYMEX WTI | | 2 | | | 69.10 | | | 2 | | | 98.15 | |

| | | | | | | | | | | | | | | | | | | | |

| Natural Gas Financial Price Swap Contracts |

| | | | Contracts Sold |

| Period | | Settlement Index | | Volume

(MMBtud in thousands) | | Weighted Average

Price ($/MMBtu) |

| | | | | | |

| January - December 2023 (closed) | | NYMEX Henry Hub | | 300 | | | $ | 3.36 | |

| January 2024 (closed) | | NYMEX Henry Hub | | 725 | | | 3.07 | |

| February - December 2024 | | NYMEX Henry Hub | | 725 | | | 3.07 | |

| January - December 2025 | | NYMEX Henry Hub | | 725 | | | 3.07 | |

| | | | | | | | | | | | | | | | | | | | |

| Natural Gas Basis Swap Contracts |

| | | | Contracts Sold |

| Period | | Settlement Index | | Volume

(MMBtud in thousands) | | Weighted Average Price Differential

($/MMBtu) |

| | | | | | |

| January - December 2023 (closed) | | NYMEX Henry Hub HSC Differential (1) | | 135 | | | $ | 0.01 | |

| January - December 2024 | | NYMEX Henry Hub HSC Differential | | 10 | | | 0.00 | |

| January - December 2025 | | NYMEX Henry Hub HSC Differential | | 10 | | | 0.00 | |

_________________

(1) This settlement index is used to fix the differential between pricing at the Houston Ship Channel and NYMEX Henry Hub prices.

III. Forward-Looking Statements

Information Regarding Forward-Looking Statements

This Current Report on Form 8-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, including, among others, statements and projections regarding EOG's future financial position, operations, performance, business strategy, goals, returns and rates of return, budgets, reserves, levels of production, capital expenditures, costs and asset sales, statements regarding future commodity prices and statements regarding the plans and objectives of EOG's management for future operations, are forward‐looking statements. EOG typically uses words such as "expect," "anticipate," "estimate," "project," "strategy," "intend," "plan," "target," "aims," "ambition," "initiative," "goal," "may," "will," "focused on," "should" and "believe" or the negative of those terms or other variations or comparable terminology to identify its forward‐looking statements. In particular, statements, express or implied, concerning EOG's future financial or operating results and returns or EOG's ability to replace or increase reserves, increase production, generate returns and rates of return, replace or increase drilling locations, reduce or otherwise control drilling, completion and operating costs and capital expenditures, generate cash flows, pay down or refinance indebtedness, achieve, reach or otherwise meet initiatives, plans, goals, ambitions or targets with respect to emissions, other environmental matters, safety matters or other ESG (environmental/social/governance) matters, or pay and/or increase dividends are forward‐looking statements. Forward-looking statements are not guarantees of performance. Although EOG believes the expectations reflected in its forward-looking statements are reasonable and are based on reasonable assumptions, no assurance can be given that such assumptions are accurate or will prove to have been correct or that any of such expectations will be achieved (in full or at all) or will be achieved on the expected or anticipated timelines. Moreover, EOG's forward-looking statements may be affected by known, unknown or currently unforeseen risks, events or circumstances that may be outside EOG's control. Important factors that could cause EOG's actual results to differ materially from the expectations reflected in EOG's forward-looking statements include, among others:

•the timing, extent and duration of changes in prices for, supplies of, and demand for, crude oil and condensate, natural gas liquids (NGLs), natural gas and related commodities;

•the extent to which EOG is successful in its efforts to acquire or discover additional reserves;

•the extent to which EOG is successful in its efforts to (i) economically develop its acreage in, (ii) produce reserves and achieve anticipated production levels and rates of return from, (iii) decrease or otherwise control its drilling, completion and operating costs and capital expenditures related to, and (iv) maximize reserve recovery from, its existing and future crude oil and natural gas exploration and development projects and associated potential and existing drilling locations;

•the success of EOG's cost-mitigation initiatives and actions in offsetting the impact of inflationary pressures on EOG's operating costs and capital expenditures;

•the extent to which EOG is successful in its efforts to market its production of crude oil and condensate, NGLs and natural gas;

•security threats, including cybersecurity threats and disruptions to our business and operations from breaches of our information technology systems, physical breaches of our facilities and other infrastructure or breaches of the information technology systems, facilities and infrastructure of third parties with which we transact business;

•the availability, proximity and capacity of, and costs associated with, appropriate gathering, processing, compression, storage, transportation, refining, and export facilities;

•the availability, cost, terms and timing of issuance or execution of mineral licenses and leases and governmental and other permits and rights-of-way, and EOG's ability to retain mineral licenses and leases;

•the impact of, and changes in, government policies, laws and regulations, including climate change-related regulations, policies and initiatives (for example, with respect to air emissions); tax laws and regulations (including, but not limited to, carbon tax and emissions-related legislation); environmental, health and safety laws and regulations relating to disposal of produced water, drilling fluids and other wastes, hydraulic fracturing and access to and use of water; laws and regulations affecting the leasing of acreage and permitting for oil and gas drilling and the calculation of royalty payments in respect of oil and gas production; laws and regulations imposing additional permitting and disclosure requirements, additional operating restrictions and conditions or restrictions on drilling and completion operations and on the transportation of crude oil, NGLs and natural gas; laws and regulations with respect to financial derivatives and hedging activities; and laws and regulations with respect to the import and export of crude oil, natural gas and related commodities;

•the impact of climate change-related policies and initiatives at the corporate and/or investor community levels and other potential developments related to climate change, such as (but not limited to) changes in consumer and industrial/commercial behavior, preferences and attitudes with respect to the generation and consumption of energy; increased availability of, and increased consumer and industrial/commercial demand for, competing energy sources (including alternative energy sources); technological advances with respect to the generation, transmission, storage and consumption of energy; alternative fuel requirements; energy conservation measures and emissions-related legislation; decreased demand for, and availability of, services and facilities related to the exploration for, and production of, crude oil, NGLs and natural gas; and negative perceptions of the oil and gas industry and, in turn, reputational risks associated with the exploration for, and production of, crude oil, NGLs and natural gas;

•continuing political and social concerns relating to climate change and the greater potential for shareholder activism, governmental inquiries and enforcement actions and litigation and the resulting expenses and potential disruption to EOG's day-to-day operations;

•the extent to which EOG is able to successfully and economically develop, implement and carry out its emissions and other ESG-related initiatives and achieve its related targets and initiatives;

•EOG's ability to effectively integrate acquired crude oil and natural gas properties into its operations, identify and resolve existing and potential issues with respect to such properties and accurately estimate reserves, production, drilling, completion and operating costs and capital expenditures with respect to such properties;

•the extent to which EOG's third-party-operated crude oil and natural gas properties are operated successfully, economically and in compliance with applicable laws and regulations;

•competition in the oil and gas exploration and production industry for the acquisition of licenses, leases and properties;

•the availability and cost of, and competition in the oil and gas exploration and production industry for, employees, labor and other personnel, facilities, equipment, materials (such as water, sand, fuel and tubulars) and services;

•the accuracy of reserve estimates, which by their nature involve the exercise of professional judgment and may therefore be imprecise;

•weather, including its impact on crude oil and natural gas demand, and weather-related delays in drilling and in the installation and operation (by EOG or third parties) of production, gathering, processing, refining, compression, storage, transportation, and export facilities;

•the ability of EOG's customers and other contractual counterparties to satisfy their obligations to EOG and, related thereto, to access the credit and capital markets to obtain financing needed to satisfy their obligations to EOG;

•EOG's ability to access the commercial paper market and other credit and capital markets to obtain financing on terms it deems acceptable, if at all, and to otherwise satisfy its capital expenditure requirements;

•the extent to which EOG is successful in its completion of planned asset dispositions;

•the extent and effect of any hedging activities engaged in by EOG;

•the timing and extent of changes in foreign currency exchange rates, interest rates, inflation rates, global and domestic financial market conditions and global and domestic general economic conditions;

•the duration and economic and financial impact of epidemics, pandemics or other public health issues;

•geopolitical factors and political conditions and developments around the world (such as the imposition of tariffs or trade or other economic sanctions, political instability and armed conflict), including in the areas in which EOG operates;

•the extent to which EOG incurs uninsured losses and liabilities or losses and liabilities in excess of its insurance coverage;

•acts of war and terrorism and responses to these acts; and

•the other factors described under ITEM 1A, Risk Factors of EOG's Annual Report on Form 10-K for the year ended December 31, 2022, and any updates to those factors set forth in EOG's subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K.

In light of these risks, uncertainties and assumptions, the events anticipated by EOG's forward-looking statements may not occur, and, if any of such events do, we may not have anticipated the timing of their occurrence or the duration or extent of their impact on our actual results. Accordingly, you should not place any undue reliance on any of EOG's forward-looking statements. EOG's forward-looking statements speak only as of the date made, and EOG undertakes no obligation, other than as required by applicable law, to update or revise its forward-looking statements, whether as a result of new information, subsequent events, anticipated or unanticipated circumstances or otherwise.

| | | | | |

| Glossary: | |

| $/Bbl | Dollars per barrel |

| $/MMBtu | Dollars per million British Thermal Units |

| Bbl | Barrel |

| EOG | EOG Resources, Inc. |

| HSC | Houston Ship Channel |

| MBbld | Thousand barrels per day |

| MMBtu | Million British Thermal Units |

| MMBtud | Million British Thermal Units per day |

| NGL | Natural Gas Liquids |

| NYMEX | New York Mercantile Exchange |

| WTI | West Texas Intermediate |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | | EOG RESOURCES, INC.

(Registrant) |

| | | |

| | | |

| | | |

| Date: January 11, 2024 | By: | /s/ ANN D. JANSSEN Ann D. Janssen Executive Vice President and Chief Financial Officer (Principal Financial Officer and Duly Authorized Officer) |

Document and Entity Information Document

|

Jan. 11, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 11, 2024

|

| Entity Registrant Name |

EOG RESOURCES, INC

|

| Entity Central Index Key |

0000821189

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-9743

|

| Entity Tax Identification Number |

47-0684736

|

| Entity Address, Address Line One |

1111 Bagby

|

| Entity Address, Address Line Two |

Sky Lobby 2

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77002

|

| City Area Code |

713

|

| Local Phone Number |

651-7000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

EOG

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

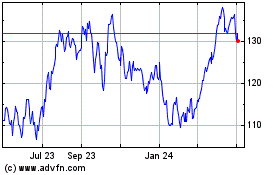

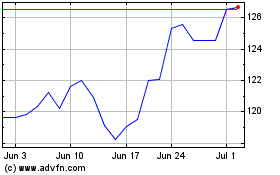

EOG Resources (NYSE:EOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

EOG Resources (NYSE:EOG)

Historical Stock Chart

From Apr 2023 to Apr 2024