False0000897448AMARIN CORP PLCUK00-000000000008974482024-01-102024-01-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): January 10, 2024

Amarin Corporation plc

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

England and Wales |

0-21392 |

Not applicable |

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|

|

|

|

|

|

Iconic Offices, The Greenway, Block C Ardilaun Court, 112 – 114 St Stephens Green, Dublin 2, Ireland |

Not applicable |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: +353 1 6699 020

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol |

Name of each exchange on which registered |

American Depositary Shares (ADS(s)), each ADS representing the right to receive one (1) Ordinary Share of Amarin Corporation plc |

AMRN |

NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On January 10, 2024, Amarin Corporation plc (the “Company”) issued a press release announcing its preliminary 2023 revenue results and year end cash position, and 2024 priorities (the "Press Release"). A copy of the Press Release is furnished herewith as Exhibit 99.1.

Item 7.01. Regulation FD Disclosure.

The Company will present further details on the matters noted above at the 42nd Annual J.P. Morgan Healthcare Conference on January 10, 2024 at 4:30 p.m. Eastern Time/1:30 Pacific Time, which presentation will be accessible by a live webcast through the Company’s website at https://investor.amarincorp.com/events-and-presentations/events. A copy of the Company’s investor deck, which will be referenced during the Company’s webcast presentation, is furnished herewith as Exhibit 99.2

The information set forth under Item 2.02, Item 7.01, and in the Press Release and the Investor Deck furnished as Exhibit 99.1 and Exhibit 99.2 herewith shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

* * *

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

Date: January 10, 2024 |

|

Amarin Corporation plc |

|

|

|

|

|

|

By: |

/s/ Patrick Holt |

|

|

|

Patrick Holt |

|

|

|

President and Chief Executive Officer |

AMARIN PROVIDES PRELIMINARY FOURTH QUARTER 2023 SELECTED FINANCIALS AND OUTLINES KEY PRIORITIES FOR 2024

-- Reported Unaudited Total Revenues of Between $72 Million - $74 Million in the Fourth Quarter of 2023 --

-- Company Ends 2023 with a Cash Position of $321 Million and Delivered Full-Year Positive Cash Flow of ~$10 Million --

-- 2024 Key Priorities Include Accelerating Revenue in Key European Launch Markets, Retaining IPE Market Leadership in the US and Maximizing Patient Uptake in Rest of World (RoW) Through Partnerships --

-- Company Announces Plan to Initiate Share Repurchase Program of Up to $50 Million --

-- Amarin to Present at 42nd Annual J.P. Morgan Healthcare Conference on January 10, 2024 --

DUBLIN, Ireland and BRIDGEWATER, N.J., January 10, 2024 – Amarin Corporation plc (NASDAQ:AMRN) today provided a business update, including preliminary unaudited fourth quarter 2023 revenue and its year-end cash position, its 2023 progress and 2024 priorities and its plan to initiate a share repurchase program, ahead of its presentation to investors at the 42nd Annual J.P. Morgan Healthcare Conference in San Francisco.

Amarin Announces Preliminary (Unaudited) Fourth-Quarter and Full-Year 2023 Revenues and Cash Position

Revenues: For the fourth quarter, Amarin estimates total revenue between $72 to $74 million (Europe ~$1.5 million; U.S. $64 - $65 million; RoW $7 - $8 million – including supply shipments and milestone achievement) and between $304 to $306 million for the full year 2023.

Cash Position: Amarin ended 2023 with approximately $321 million in cash and investments, with positive cash flow of approximately $10 million for the full year. The Company has now reported six consecutive quarters of cash positive or neutral operations.

Management Commentary

“In 2023, our team focused and delivered on our priorities that advanced our strategy,” said Patrick Holt, President & CEO of Amarin. “We enter 2024 with a number of positives: we have a solid cash position and no debt; our European business is showing early signs of progress following new leadership and a new strategy; our U.S. business continues to retain IPE market leadership and is in a solid position with exclusive contracts to start 2024; and our partners in the Rest of World (ROW) are advancing commercialization and

market access efforts. As we begin this year and in-line with this morning’s announced share repurchase program, we have confidence in the business and we are focused on delivering value for shareholders.”

2023 Key Achievements & 2024 Priorities

Europe

•In 2023, Amarin secured pricing and reimbursement and launched VAZKEPA in 3 additional markets, including Spain and the Netherlands. VAZKEPA is now available in 9 markets across Europe. Amarin delivered approximately 65% growth in the fourth quarter versus the third quarter 2023.

•In 2024, we will focus on opportunities to accelerate revenue in Europe in key launched markets including Spain and the United Kingdom, and advance pricing and reimbursement processes in key markets including Italy, France, and Germany.

United States

•In 2023, the Amarin team continued to retain its IPE market share leadership in the U.S. at 57%, despite additional generic competition.

•In 2024, we will focus on maintaining IPE market share leadership and profitability while continuing to adapt to dynamic market conditions.

Rest of World

•In 2023, the Amarin team secured 5 Rest of World regulatory approvals, including China (VHTG), and entered into marketing and commercialization agreements in key markets and regions, including Australia & New Zealand and ASEAN/South Korea.

•In 2024, we will support pricing and reimbursement and commercialization efforts across key markets, including Australia and China, and continue to progress Rest of World regulatory filings.

Amarin Announces Plan to Initiate Share Repurchase Program of Up to $50 Million

On January 9, 2024, Amarin entered into a conditional share repurchase agreement with Cantor Fitzgerald & Co. (“Cantor”) to purchase up to $50 million of Amarin’s ordinary shares held in the form of American depository shares (ADSs). The implementation of the share repurchase program will require Amarin shareholder approval as well as UK High Court approval, as required under UK company law. The Company intends to call its 2024 annual general meeting of shareholders early in the second quarter of 2024 to seek shareholder approval of the program, which would be followed by the UK High court process. Amarin anticipates that these steps could be completed by the end of the second quarter of 2024, with share repurchases commencing shortly thereafter.

Additional details regarding the share repurchase agreement can be found in the appendix of this press release and corresponding financial filings.

2024 Financial Outlook

Amarin continues to make progress on reducing operating expenses and managing its cash position and is on-track to deliver $40 million of annual savings based on the reduction in force announced in July 2023. With the recent cash preservation initiatives, Amarin reiterates its belief that current cash and investments and other assets are adequate to support continued operations including the share repurchase program. We will continue to focus on cash preservation and prudently invest in the right opportunities which are value additive.

J.P. Morgan Presentation Details

Amarin’s president and chief executive officer Patrick Holt is scheduled to participate at the 42nd Annual J.P. Morgan Healthcare Conference on January 10, 2024.

42nd Annual J.P. Morgan Healthcare Conference (January 8th-11th, 2024; San Francisco, California)

Date/Time: January 10, 2024, 4:30 p.m. ET/ 1:30 p.m. PST

Webcast: https://jpmorgan.metameetings.net/events/healthcare24/sessions/49593-amarin-corporation-plc/webcast?gpu_only=true&kiosk=true

The conference presentation will be webcast live and archived on the Company’s website in the Investor Relations section under Events and Presentations at Events | Amarin Corporation plc.

About Amarin

Amarin is an innovative pharmaceutical company leading a new paradigm in cardiovascular disease management. We are committed to increasing the scientific understanding of the cardiovascular risk that persists beyond traditional therapies and advancing the treatment of that risk for patients worldwide. Amarin has offices in Bridgewater, New Jersey in the United States, Dublin in Ireland, Zug in Switzerland, and other countries in Europe as well as commercial partners and suppliers around the world.

About VASCEPA®/VAZKEPA® (icosapent ethyl) Capsules

VASCEPA (icosapent ethyl) capsules are the first prescription treatment approved by the U.S. Food and Drug Administration (FDA) comprised solely of the active ingredient, icosapent ethyl (IPE), a unique form of eicosapentaenoic acid. VASCEPA was launched in the United States in January 2020 as the first drug approved by the U.S. FDA for treatment of the studied high-risk patients with persistent cardiovascular risk despite being on statin therapy. VASCEPA was initially launched in the United States in 2013 based on the drug’s initial FDA approved indication for use as an adjunct therapy to diet to reduce triglyceride levels in adult patients with severe (≥500 mg/dL) hypertriglyceridemia. Since launch, VASCEPA has been prescribed more than twenty million times. VASCEPA is covered by most major medical insurance plans. In addition to the United States, VASCEPA is approved and sold in Canada, China, Lebanon and the United Arab Emirates. In Europe, in March 2021 marketing authorization was granted to icosapent ethyl in the European Union for the reduction of risk of cardiovascular events in patients at high cardiovascular risk, under the brand name VAZKEPA. In April 2021 marketing authorization for VAZKEPA (icosapent ethyl) was granted in Great Britain (applying to England, Scotland and Wales). VAZKEPA (icosapent ethyl) is currently approved and sold in Europe in Sweden, Denmark, Finland, Austria, the UK, Spain and the Netherlands.

United States

Indications and Limitation of Use

VASCEPA is indicated:

•As an adjunct to maximally tolerated statin therapy to reduce the risk of myocardial infarction, stroke, coronary revascularization and unstable angina requiring hospitalization in adult patients with elevated triglyceride (TG) levels (≥ 150 mg/dL) and

•established cardiovascular disease or

•diabetes mellitus and two or more additional risk factors for cardiovascular disease.

•As an adjunct to diet to reduce TG levels in adult patients with severe (≥ 500 mg/dL) hypertriglyceridemia.

The effect of VASCEPA on the risk for pancreatitis in patients with severe hypertriglyceridemia has not been determined.

Important Safety Information

•VASCEPA is contraindicated in patients with known hypersensitivity (e.g., anaphylactic reaction) to VASCEPA or any of its components.

•VASCEPA was associated with an increased risk (3% vs 2%) of atrial fibrillation or atrial flutter requiring hospitalization in a double-blind, placebo-controlled trial. The incidence of atrial fibrillation was greater in patients with a previous history of atrial fibrillation or atrial flutter.

•It is not known whether patients with allergies to fish and/or shellfish are at an increased risk of an allergic reaction to VASCEPA. Patients with such allergies should discontinue VASCEPA if any reactions occur.

•VASCEPA was associated with an increased risk (12% vs 10%) of bleeding in a double-blind, placebo-controlled trial. The incidence of bleeding was greater in patients receiving concomitant antithrombotic medications, such as aspirin, clopidogrel or warfarin.

•Common adverse reactions in the cardiovascular outcomes trial (incidence ≥3% and ≥1% more frequent than placebo): musculoskeletal pain (4% vs 3%), peripheral edema (7% vs 5%), constipation (5% vs 4%), gout (4% vs 3%), and atrial fibrillation (5% vs 4%).

•Common adverse reactions in the hypertriglyceridemia trials (incidence >1% more frequent than placebo): arthralgia (2% vs 1%) and oropharyngeal pain (1% vs 0.3%).

•Adverse events may be reported by calling 1-855-VASCEPA or the FDA at 1-800-FDA-1088.

•Patients receiving VASCEPA and concomitant anticoagulants and/or anti-platelet agents should be monitored for bleeding.

FULL U.S. FDA-APPROVED VASCEPA PRESCRIBING INFORMATION CAN BE FOUND AT WWW.VASCEPA.COM.

Europe

For further information about the Summary of Product Characteristics (SmPC) for VAZKEPA® in Europe, please click here.

Globally, prescribing information varies; refer to the individual country product label for complete information.

Additional Information Regarding Amarin Share Repurchase Agreement

The implementation of the repurchase agreement is conditional upon shareholder and UK court approval, as required under UK company law. The Company intends to accelerate its annual general meeting of shareholders early in the second quarter of 2024 in order to seek such shareholder approval, following which it will proceed with the requisite court process to undertake a reduction of capital in order to create the necessary distributable profits for the funding of the repurchases. Amarin anticipates that these steps could be completed by the end of the second quarter of 2024, with share repurchases commencing shortly thereafter. Following receipt of the requisite approvals, Cantor will purchase such ADSs in compliance with the safe harbor provisions of Rule 10b-18 of the U.S. securities laws and the terms of the approved repurchase contract. The repurchase program will conclude at such time as Cantor has purchased $50 million of ADSs, unless terminated earlier by either Amarin or Cantor, as provided for in the repurchase agreement. Subject to the necessary shareholder and court approvals being obtained, the repurchases will be funded out of distributable profits utilizing the Company’s existing cash resources. The repurchase program was approved by the Amarin board in compliance with UK company law regarding distributions and the maintenance of capital. A copy of the repurchase agreement will be available for inspection by

Amarin’s shareholders at the registered office address of Amarin in the run up to the 2024 annual general meeting and, once entered into, will be available for inspection for at least 10 years from the date of such agreement.

Forward-Looking Statements

This press release contains forward-looking statements which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including beliefs about Amarin’s key achievements in 2023 and the potential impact and outlook for achievements in 2024 and beyond; Amarin’s 2024 financial outlook and cash position; Amarin’s overall efforts to expand access and reimbursement to VAZKEPA across global markets; and the overall potential and future success of VASCEPA/VAZKEPA and Amarin generally. These forward-looking statements are not promises or guarantees and involve substantial risks and uncertainties. A further list and description of these risks, uncertainties and other risks associated with an investment in Amarin can be found in Amarin's filings with the U.S. Securities and Exchange Commission, including Amarin’s annual report on Form 10-K for the full year ended 2022. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. Amarin undertakes no obligation to update or revise the information contained in its forward-looking statements, whether as a result of new information, future events or circumstances or otherwise. Amarin’s forward-looking statements do not reflect the potential impact of significant transactions the company may enter into, such as mergers, acquisitions, dispositions, joint ventures or any material agreements that Amarin may enter into, amend or terminate.

Implementation of the share repurchase program is subject to shareholder and UK court approval, which may not be obtained in a timely manner or at all; Cantor may be unable to repurchase some or all of the ADSs within the parameters provided for in the share repurchase agreement; and the share repurchase may not have the expected results.

Availability of Other Information About Amarin

Amarin communicates with its investors and the public using the company website () and the investor relations website (investor.amarincorp.com), including but not limited to investor presentations and FAQs, Securities and Exchange Commission filings, press releases, public conference calls and webcasts. The information that Amarin posts on these channels and websites could be deemed to be material information. As a result, Amarin encourages investors, the media and others interested in Amarin to review the information that is posted on these channels, including the investor relations website, on a regular basis. This list of channels may be updated from time to time on Amarin’s investor relations website and may include social media channels. The contents of Amarin’s website or these channels, or any other website that may be accessed from its website or these channels, shall not be deemed incorporated by reference in any filing under the Securities Act of 1933.

Amarin Contact Information

Investor & Media Inquiries:

Mark Marmur

Amarin Corporation plc

PR@amarincorp.com

# # #

JANUARY 2024 42nd Annual J.P. Morgan Healthcare Conference Patrick Holt President & CEO

This presentation contains forward-looking statements, such as those relating to the commercial potential of VASCEPA® (VAZKEPA® in Europe), clinical and regulatory efforts and timelines, potential regulatory and pricing approvals, generic product launches, research and development, intellectual property and litigation matters, and other statements and beliefs that are forward-looking in nature and depend upon or refer to future events or conditions, including certain financial initiatives, metrics, and guidance. These statements involve known and unknown risks, uncertainties and other factors that can cause actual results to differ materially. Investors should not place undue reliance on forward-looking statements, which speak only as of the presentation date of this presentation. Please refer to the “Risk Factors” section in Amarin’s most recent Forms 10-K and 10-Q filed with the SEC and cautionary statements outlined in recent press releases for more complete descriptions of risks in an investment in Amarin. THIS PRESENTATION IS INTENDED FOR COMMUNICATION �WITH INVESTORS AND NOT FOR DRUG PROMOTION. FORWARD LOOKING �STATEMENTS & DISCLAIMER AMARIN, VASCEPA, VAZKEPA and REDUCE-IT are trademarks of Amarin Pharmaceuticals Ireland Limited. VAZKEPA is a registered trademark in Europe and other countries and regions and is pending registration in the United States. 2

Q&A AGENDA AMARIN: �Reasons to Believe & Our Strategy 2023: �Delivering On Strategic Priorities 2024: �Accelerate Operational Momentum 01 02 03 04 AMARIN, VASCEPA, VAZKEPA and REDUCE-IT are trademarks of Amarin Pharmaceuticals Ireland Limited. VAZKEPA is a registered trademark in Europe and other countries and regions and is pending registration in the United States. 3

01 Amarin: reasons to believe & our STRATEGY 4

AMARIN: REASONS TO BELIEVE Compelling Science Built on REDUCE-IT Study 25% RRR on top of statins; Global opportunity and impact for cardiovascular patients Solid Cash Position & No Debt $321M cash position; +$10M for FY 2023; 6 Quarters of Cash Flow Positive or Neutral Operations1 New EU Leadership, Teams Driving Encouraging Initial European Results; Substantial EU Runway Europe: ~65% Revenue Growth in Q4'23 vs. Q3 '23 Spain: Early launch progress building momentum; UK: Signals of advancing uptake IP Strength: Potential for patent protection in Europe up to 2039 U.S. Business: Focused on Branded Market Leadership & Extending Life Cycle VASCEPA continues to maintain market leadership more than three years post-generic entry with 57% market share; plans in place to maintain IPE market leadership Continued Progress with Partners in RoW China: VHTG Launched; CVRR indication filing accepted by health authorities with a clinical trial waiver OUR PEOPLE & OUR CULTURE 1 Excludes one-time supply restructuring payments.

OUR STRATEGY: FOCUS ON OPERATIONAL MOMENTUM TO MAXIMIZE PATIENT UPTAKE ON VASCEPA/VAZKEPA EUROPE Accelerate European Revenue and P&R Outcomes RoW �Maximize Patient Uptake via Partnerships U.S. Extend Product Lifecycle and �Drive Profit

02 2023: delivering on strategic priorities 7

COMMERCIAL Europe: Launched in 3 Key European Markets; P&R Progress Ongoing U.S.: Maintained 57% IPE Market Share More Than 3 Years Post-Generic Entry RoW: VHTG Launch, CVRR Submission/Acceptance in China; Entered 3 New Partnerships R&D/MEDICAL ~50 Additional Publications Supporting VASCEPA/VAZKEPA 140 Educational Initiatives Executed Across Europe Strong, Coordinated Presence at 5 Major Congresses 5 RoW Regulatory Approvals Supporting Partnership Strategy FINANCIAL Delivered Over $300 Million in Revenues for 2023 Reduced OpEx by $100M vs 2022 Continued Progress on Supply Negotiations $321 Million Total Cash; No Debt PEOPLE & CULTURE: Recent Employee Engagement Survey Showed Highly Engaged Team, Strongly Committed to Helping Amarin Achieve Its Priorities 2023 PROGRESS AT-A-GLANCE

Impactful launch with strong initial uptake (>1,700 patients to date) Continued acceleration with >30% increase in pharmacy sales Q-to-Q Re-entry plan developed and in place Targeted Patient & Customer Base at Launch�Address urgency to treat. Focus on high-risk patients backed up by data and treated by specialists. 1 2 3 Focused efforts on strengthening scientific assessment Capitalize on existing positive scientific assessment Accelerating Revenue Evolving Pricing & Reimbursement Approach Supporting commercialization in other important markets; 7 additional pricing & reimbursement submissions ongoing Resource Optimisation/Prioritisation�Resource allocation on prioritised geographies and implementation of new, efficient operational model. Enhanced VAZKEPA Value Proposition�Country-centric value offering reflecting different payer’s needs. NEW LEADERSHIP DRIVES FOCUSED EUROPEAN STRATEGY INCREASING IMPACT IN EU5 A Spain United Kingdom Italy France Germany CONTINUED COMMERCIALIZATION AND ADVANCEMENT OF P&R PROCESSES IN REST OF EUROPE B EUROPE: NEW STRATEGY IS DELIVERING ~65% GROWTH Q4 VS. Q3 ’23

Total IPE Norm TRx Trend Norm TRx DECEMBER 2023 Strides/Amneal announce agreement to commercialize icosapent ethyl capsules U.S.: MORE THAN 3 YEARS POST-GENERIC ENTRY, BRANDED VASCEPA REMAINS IPE MARKET LEADER WITH 57% MARKET SHARE Over The Last 12 Months, �U.S. Business �has remained relatively flat. NOVEMBER 2020 Hikma launches icosapent ethyl capsules; first generic Vascepa® launch JUNE 2021 DRL launches icosapent�ethyl capsules JANUARY 2022 Apotex launches icosapent ethyl capsules DECEMBER 2022 Teva launches icosapent ethyl capsules

Note: The company is pursuing expansion into these various additional markets and the status of regulatory and/or patent approval will vary market to market. South Korea and ASEAN (Lotus) Approval Processes Ongoing China Launched in October 2023 (VHTG) Australia / New Zealand Australia Approved �November 2022,�New Zealand Approved January 2023 REST-OF-WORLD (ROW): EXPANDED TO NEW REGIONS AND INITIATED COMMERCIAL EFFORTS IN CHINA CHINA: Edding launched VASCEPA with VHTG indication Submitted CVRR indication accepted by NMPA (accepted by health authorities) AUSTRALIA/NEW ZEALAND: Amarin & CSL Seqirus entered into an exclusive license and distribution agreement CSL Seqirus focused on advancing pricing and reimbursement and commercialize VAZKEPA® across Australia and New Zealand SOUTH KOREA & ASEAN: Amarin & Lotus entered into a long-term exclusive partnership to distribute and commercialize VAZKEPA® (icosapent ethyl) across 10 countries (ASEAN and South Korea). Regulatory Approval Achieved; P&R Efforts in Process Regulatory Preparations Underway Launched

+$8M +$5M2 +$5M +$10M Q4 ’23 Total Revenue of $72-$74M USA Revenue: ~$64-$65M European Revenue: ~$1.5 million; ~65% increase versus Q3 2023 ROW Revenue: ~$7-8M (includes Edding Supply Shipments & Milestone Achievement) Full Year 2023 Cash Position Cash Balance of $321M as of 12/31/23; Cash Flow Positive $10M for Full Year 2023 6 quarters of cash flow positive or neutral ops1 Total Revenue Q4/FY 2023 PRELIMINARY FINANCIAL RESULTS 1 Excludes one-time supply restructuring payments.

03 2024: ACCELERATE OPERATIONAL MOMENTUM 13

Accelerate uptake; Focus on advocacy/adoption in 2024. Build on launch uptake; Key account focus in 2024. United Kingdom Plan to resubmit in 2024. INCREASE IMPACT ON EU5 Plan to submit w/strengthened clinical assess. in 2024. Plan to resubmit in Q1 2024. Accelerating Revenue Evolving Pricing & Reimbursement Approach A SUPPORT EFFORTS IN REST OF EUROPE Out of 7 pricing and reimbursement submissions, we aim to conclude successfully on at least 5 in 2024. Continue to Advance P&R Submissions Support Commercialization in Key Launched Markets Belgium Austria Switzerland Portugal Sweden Netherlands Spain Italy France Germany Greece Norway B EUROPE: CORE FOCUS ON ENHANCING REVENUES IN LAUNCH MARKETS, ADVANCING P&R SUBMISSIONS ACROSS EU5 IN 2024 Republic �of Ireland Finland

15 U.S.: EXTENDING MOMENTUM ON BRANDED EXCLUSIVE CONTRACTS TO MAINTAIN IPE MARKET LEADERSHIP IN 2024 Exclusive Accounts Represented 50% Of Total IPE Market Volume beginning of 2024: Exclusive Accounts Represented 50%+ Of Total IPE Market Volume End of 2023: With a Highly Dynamic Market, Amarin is Ready to Execute Plans to Retain IPE Market Leadership & Profitability

REST OF World: MOVE from entering partnerships to advancing access & uptake in key markets Note: The company is pursuing expansion into these various additional markets and the status of regulatory and/or patent approval will vary market to market. Regulatory Approval Achieved; P&R Efforts in Process Regulatory Preparations In Process China Launched in October 2023 (VHTG) Australia / New Zealand Australia Approved �November 2022,�New Zealand Approved January 2023 MENA Launched in Lebanon (2018), UAE (2019), Qatar (2022), Kuwait (2023), KSA (2023) Canada Launched in�February 2020 20+ Regulatory Processes Underway Launched South Korea and ASEAN (Lotus) Approval Processes Ongoing

AMARIN ANNOUNCES PLAN TO INITIATE SHARE REPURCHASE PROGRAM OF UP TO $50 MILLION Company has entered into a conditional share repurchase agreement with Cantor Fitzgerald to purchase up to $50 million of Amarin’s ordinary shares. Program is conditional upon Amarin shareholder and UK court approval, as required under UK company law. Amarin intends to promptly call its 2024 Annual General Meeting of Shareholders to seek shareholder approval. Amarin anticipates that these steps could be completed by the end of the second quarter of 2024 with repurchases commencing shortly thereafter. “...in-line with this morning’s announced share repurchase program, we have confidence in the business and we are focused on delivering value for shareholders.” - Patrick Holt, President & CEO, Amarin

04 Q&A 18

v3.23.4

Document and Entity Information

|

Jan. 10, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 10, 2024

|

| Entity Registrant Name |

AMARIN CORP PLCUK

|

| Entity Incorporation State Country Code |

X0

|

| Entity File Number |

0-21392

|

| Entity Tax Identification Number |

00-0000000

|

| Entity Address, Address Line One |

Iconic Offices, The Greenway

|

| Entity Address, Address Line Two |

Block C Ardilaun Court

|

| Entity Address, Address Line Three |

112 – 114 St Stephens Green

|

| Entity Address, City or Town |

Dublin

|

| Entity Address, Postal Zip Code |

2

|

| Entity Address, Country |

IE

|

| Country Region |

353

|

| City Area Code |

1

|

| Local Phone Number |

6699 020

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Security 12b Title |

American Depositary Shares (ADS(s)), each ADS representing the right to receive one (1) Ordinary Share of Amarin Corporation plc

|

| Trading Symbol |

AMRN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000897448

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

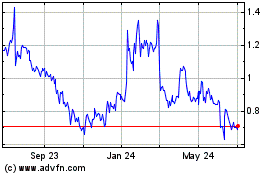

Amarin (NASDAQ:AMRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

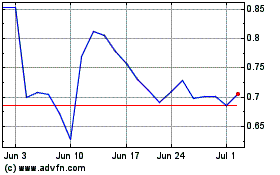

Amarin (NASDAQ:AMRN)

Historical Stock Chart

From Apr 2023 to Apr 2024