0001367644false00013676442024-01-092024-01-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 9, 2024

EMERGENT BIOSOLUTIONS INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-33137 | | 14-1902018 |

| (State or other jurisdiction | | (Commission File Number) | | (IRS Employer |

| of incorporation) | | | | Identification No.) |

400 Professional Drive, Suite 400,

Gaithersburg, Maryland 20879

(Address of principal executive offices, including zip code)

(240) 631-3200

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, Par Value $0.001 per share | EBS | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On January 9, 2024, the Company issued a press release announcing that during the week of January 8, 2024, representatives of the Company will participate in the 42nd Annual J.P. Morgan Healthcare Conference. A copy of the press release is attached as Exhibit 99.1 to this current Report on Form 8-K and is incorporated by reference herein. These Company representatives will present the slides furnished as Exhibit 99.2 to this Current Report on Form 8-K, which are incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| EMERGENT BIOSOLUTIONS INC. |

| | | |

| Dated: January 9, 2024 | By: | /s/ RICHARD S. LINDAHL |

| | Name: Richard S. Lindahl

Title: Executive Vice President, Chief Financial

Officer and Treasurer |

| | |

Emergent BioSolutions to Present at the 42nd Annual J.P. Morgan Healthcare Conference on January 9, 2024

GAITHERSBURG, Md., January 9, 2024 – Emergent BioSolutions (NYSE: EBS), a global company providing solutions that address public health threats and brings lifesaving, life-extending products to market, today announced that Haywood Miller, Interim Chief Executive Officer and Chief Financial Officer, Rich Lindahl, will present at the 42nd Annual J.P. Morgan Healthcare Conference on Thursday, January 11, 2024, at 9:00 a.m. PT.

The audio link for Emergent's session may be accessed here, and will be live for up to 30 days.

The company’s slides will be made available at the time of the presentation on the Investors section of the Emergent website.

About Emergent BioSolutions

At Emergent, our mission is to protect and enhance life. For 25 years, we’ve been at work defending people from things we hope will never happen—so we are prepared just in case they ever do. We provide solutions for complex and urgent public health threats through a portfolio of vaccines and therapeutics that we develop and manufacture for governments and consumers. We also offer a range of integrated contract development and manufacturing services for pharmaceutical and biotechnology customers. To learn more about how we plan to protect or enhance 1 billion lives by 2030, visit our website and follow us on LinkedIn, X (formerly Twitter), and Instagram.

Safe Harbor Statement

This communication, and the presentation to which it relates, include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, are forward-looking statements. We generally identify forward-looking statements by using words like “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “future,” “goal,” “intend,” “may,” “plan,” “position,” “possible,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would,” and similar expressions or variations thereof, or the negative thereof, but these terms are not the exclusive means of identifying such statements. Forward-looking statements are based on our current intentions, beliefs and expectations regarding future events based on information that is currently available. We cannot guarantee that any forward-looking statement will be accurate. Readers should realize that if underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results could differ materially from our expectations. Readers are, therefore, cautioned not to place undue reliance on any forward-looking statements. Any forward-looking statement speaks only as of the date of this communication and, except as required by law, we do not undertake any obligation to update any forward-looking statement to reflect new information, events or circumstances.

There are a number of important factors that could cause our actual results to differ materially from those indicated by any forward-looking statements. Readers should consider this cautionary statement, as well as the risk factors and other disclosures included in our periodic reports filed with the Securities and Exchange Commission, when evaluating our forward-looking statements.

Investor Contact:

Richard S. Lindahl

Executive Vice President, CFO

lindahlr@ebsi.com

Media Contact:

Assal Hellmer

Vice President, Communications

mediarelations@ebsi.com

42nd Annual J.P. Morgan Healthcare Conference January 2024 Haywood Miller Interim CEO Rich Lindahl CFO

This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, including statements regarding the future performance of the Company or our business strategy, future operations, future financial position, future revenues and earnings, our ability to achieve the objectives of our restructuring initiatives, including our future results, projected costs, prospects, plans and objectives of management, are forward-looking statements. We generally identify forward-looking statements by using words like “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “future,” “goal,” “intend,” “may,” “plan,” “position,” “possible,” “predict,” “project,” “should,” “target,” “will,” “would,” and similar expressions or variations thereof, or the negative thereof, but these terms are not the exclusive means of identifying such statements. Forward-looking statements are based on our current intentions, beliefs and expectations regarding future events based on information that is currently available. We cannot guarantee that any forward-looking statement will be accurate. Readers should realize that if underlying assumptions prove inaccurate or if known or unknown risks or uncertainties materialize, actual results could differ materially from our expectations. You are, therefore, cautioned not to place undue reliance on any forward-looking statement. Any forward-looking statement speaks only as of the date on which such statement is made, and, except as required by law, we do not undertake any obligation to update any forward-looking statement to reflect new information, events or circumstances. There are a number of important factors that could cause our actual results to differ materially from those indicated by such forward-looking statements, including, among others, the availability of USG funding for contracts related to procurement of our MCM products, including CYFENDUS® (Anthrax Vaccine Adsorbed (AVA), Adjuvanted), BioThrax® (Anthrax Vaccine Adsorbed), ACAM2000®, (Smallpox (Vaccinia) Vaccine, Live), among others, as well as contracts related to development of medical countermeasures; the availability of government funding for our other commercialized products, including EbangaTM (ansuvimab-zykl), BAT® (Botulism Antitoxin Heptavalent) and RSDL® (Reactive Skin Decontamination Lotion Kit); our ability to meet our commitments to quality and compliance in all of our manufacturing operations; our ability to negotiate additional USG procurement or follow-on contracts for our MCM products that have expired or will be expiring; the commercial availability and acceptance of over-the-counter NARCAN® (naloxone HCl) Nasal Spray; the impact of the generic marketplace on NARCAN® (naloxone HCI) Nasal Spray and future NARCAN® sales; our ability to perform under our contracts with the USG, including the timing of and specifications relating to deliveries; our ability to provide CDMO services for the development and/or manufacture of product and/or product candidates of our customers at required levels and on required timelines; the ability of our contractors and suppliers to maintain compliance with current good manufacturing practices and other regulatory obligations; our ability to negotiate further commitments related to the collaboration and deployment of capacity toward future commercial manufacturing under our existing CDMO contracts; our ability to collect reimbursement for raw materials and payment of services fees from our CDMO customers; the results of pending stockholder litigation and government investigations and their potential impact on our business; our ability to comply with the operating and financial covenants required by our senior secured credit facilities and the amended and restated credit agreement relating to such facilities, and our 3.875% Senior Unsecured Notes due 2028; our ability to resolve the going concern qualification in our consolidated financial statements and otherwise successfully manage our liquidity in order to continue as a going concern; the procurement of our product candidates by USG entities under regulatory authorities that permit government procurement of certain medical products prior to FDA marketing authorization, and corresponding procurement by government entities outside of the United States; our ability to realize the expected benefits of the sale of our travel health business to Bavarian Nordic; the impact of the organizational changes we announced in January 2023 and August 2023; our ability to identify and acquire companies, businesses, products or product candidates that satisfy our selection criteria; the impact of cyber security incidents, including the risks from the unauthorized access, interruption, failure or compromise of our information systems or those of our business partners, collaborators or other third parties; the success of our commercialization, marketing and manufacturing capabilities and strategy; and the accuracy of our estimates regarding future revenues, expenses, capital requirements and needs for additional financing. The foregoing sets forth many, but not all, of the factors that could cause actual results to differ from our expectations in any forward-looking statement. You should consider this cautionary statement, as well as the risks identified in our periodic reports filed with the Securities and Exchange Commission, when evaluating our forward-looking statements. Trademarks Emergent®, CYFENDUS® (Anthrax vaccine adsorbed), BioThrax® (Anthrax Vaccine Adsorbed), RSDL® (Reactive Skin Decontamination Lotion Kit), BAT® (Botulism Antitoxin Heptavalent (A,B,C,D,E,F and G)-(Equine)), Anthrasil® (Anthrax Immune Globulin Intravenous (Human)), VIGIV (Vaccinia Immune Globulin Intravenous (Human)), Trobigard® (atropine sulfate, obidoxime chloride), ACAM2000® (Smallpox (Vaccinia) Vaccine, Live), NARCAN® (naloxone HCI) Nasal Spray, TEMBEXA® (brincidofovir) and any and all Emergent BioSolutions Inc. brands, products, services and feature names, logos and slogans are trademarks or registered trademarks of Emergent BioSolutions Inc. or its subsidiaries in the United States or other countries. All other brands, products, services and feature names or trademarks are the property of their respective owners. Safe Harbor Statement/Trademarks 2

This presentation contains financial measures (Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization), Adjusted Gross Margin, Adjusted Gross Margin %, Adjusted Revenues, and Adjusted Cost of Sales) that are considered “non-GAAP” financial measures under applicable Securities and Exchange Commission rules and regulations. These non-GAAP financial measures should be considered supplemental to and not a substitute for financial information prepared in accordance with generally accepted accounting principles. The Company’s definition of these non-GAAP measures may differ from similarly titled measures used by others. For its non-GAAP measures, the Company adjusts for specified items that can be highly variable or difficult to predict, or reflect the noncash impact of charges or accounting changes. As needed, such adjustments are tax effected utilizing the federal statutory tax rate for the U.S., except for changes in the fair value of contingent consideration as the vast majority is non-deductible for tax purposes. The Company views these non-GAAP financial measures as a means to facilitate management’s financial and operational decision-making, including evaluation of the Company’s historical operating results and comparison to competitors’ operating results. These non-GAAP financial measures reflect an additional way of viewing aspects of the Company’s operations that, when viewed with GAAP results and the reconciliations to the corresponding GAAP financial measure, may provide a more complete understanding of factors and trends affecting the Company’s business. For more information on these non-GAAP financial measures, please see the tables captioned "Reconciliation of Loss before Income Taxes to Adjusted EBITDA," and "Reconciliation of Total Revenues to Adjusted Revenues, Cost of Sales to Adjusted Cost of Sales, and Gross Margin and Gross Margin % to Adjusted Gross Margin and Adjusted Gross Margin %" and "Reconciliation of Segment Level (Products and Service) Revenues, Cost of Sales to Adjusted Cost of Sales, and Gross Margin and Gross Margin % to Adjusted Gross Margin and Adjusted Gross Margin %" included at the end of this presentation. The determination of the amounts that are excluded from these non-GAAP financial measures are a matter of management judgment and depend upon, among other factors, the nature of the underlying expense or income amounts. Because non-GAAP financial measures exclude the effect of items that will increase or decrease the Company’s reported results of operations, management strongly encourages investors to review the Company’s consolidated financial statements and publicly filed reports in their entirety. For additional information on the non-GAAP financial measures noted here, please refer to the reconciliation tables provide in the Appendix to this presentation. Non-GAAP Financial Measures 3

About Emergent 4

• At Emergent, our mission is simple – to protect and enhance life • For 25 years, we’ve been at work helping protect people from things we hope will never happen—so we are prepared, just in case they ever do • We provide solutions for complex and urgent public health threats through a portfolio of vaccines, therapeutics and treatments that we develop, manufacture and distribute to governments and consumers worldwide • We also offer targeted contract development and manufacturing services for pharmaceutical and biotechnology customers Our Leadership in Public Health 5

Emergent At-a-Glance 6 PUBLIC HEALTH THREAT PREPAREDNESS AND RESPONSE SOLUTIONS PRODUCTS BUSINESS G O V E R N M E N T / M C M C O M M E R C I A L C O N T R A C T D E V E L O P M E N T & M A N U F A C T U R I N G ( C D M O ) BIOSERVICES BUSINESS A N T H R A X (VACCINES AND THERAPEUTICS) S M A L L P O X (VACCINES AND THERAPEUTICS) B O T U L I S M (THERAPEUTIC) C H E M I C A L T H R E A T S (DRUG/DEVICE) N E R V E A G E N T A N T I D O T E S (AUTO-INJECTOR TECHNOLOGY) O P I O I D O V E R D O S E E M E R G E N C Y (THERAPEUTICS) D E V E L O P M E N T S E R V I C E S ( D V S ) D R U G S U B S T A N C E ( D S ) D R U G P R O D U C T ( D P )

2023 Key Milestones 7 Strengthened Portfolio • Launched NARCAN® Nasal Spray over-the-counter opioid reversal treatment • New $379.6 million U.S. Dept. of Defense contract for RSDL® • Received U.S. FDA approval of CYFENDUS® (formerly AV7909), a two-dose anthrax vaccine for post-exposure prophylaxis use • Awarded $75 million option to Emergent’s existing contract for the acquisition of newly licensed anthrax vaccine CYFENDUS® • Awarded a 10-year contract by the BARDA for advanced development, manufacturing scale-up, and procurement of Ebanga™, a treatment for Ebola • Submitted supplemental Biologics License Application to FDA for ACAM2000® vaccine to include immunization against Mpox virus Improved Financial Position • Implemented organizational changes resulting in $60 million in annual savings • Shift in resource deployment resulting in $100 million in annual savings • Amended and extended maturity of our secured credit facility to May 2025 • Travel Health business divestiture – valued at up to $380 million

PROPRIETARY AND CONFIDENTIAL 8 Our Products Business

Our Products 9 *EbangaTM is a trademark of RIDGEBACK BIOTHERAPEUTICS L.P. **The Trobigard Auto-injector is approved by the Federal Agency for Medicines and Health Products of Belgium. It is not approved by the U.S. Food and Drug Administration or the health regulatory authority of any other jurisdiction. A N T H R A X Anthrasil® [Anthrax Immune Globulin Intravenous (human)] CYFENDUS® (Anthrax Vaccine Adsorbed, Adjuvanted] BioThrax® (Anthrax Vaccine Adsorbed) raxibacumab injection A fully human monoclonal antibody S M A L L P O X ACAM2000® (Smallpox (Vaccinia) Vaccine, Live) VIGIV CNJ-016® [Vaccinia Immune Globulin Intravenous (Human)] TEMBEXA® (brincidofovir) B O T U L I S M BAT® [Botulism Antitoxin Heptavalent (A, B, C, D, E, F, G) - (Equine)] E B O L A EbangaTM* (ansuvimab-zykl) C H E M I C A L T H R E A T S RSDL® (Reactive Skin Decontamination Lotion Kit) N E R V E A G E N T A N T I D O T E S Trobigard® Auto-injector** (atropine sulfate, obidoxime chloride auto-injector) O P I O I D O V E R D O S E E M E R G E N C Y NARCAN® Nasal Spray (naloxone HCl) Nasal Spray T H R E A T F O C U S P R O D U C T S

State of the Opioid Crisis & Our Response 10 • Drug overdose deaths have reach record levels – more than 109,000 deaths in 2022.¹ • In 2022, approximately one life was lost every seven minutes due to opioid overdose. Today it is the leading cause of accidental death in the U.S.¹ • More than 64 million doses of NARCAN® Nasal Spray have been distributed in the U.S. and Canada since FDA approval in 2016. • Demand for naloxone is expected to increase as the epidemic continues and federal/state programs continue to combat the crisis. How Emergent has responded: • Added NARCAN® Nasal Spray to its portfolio in 2018. • Built nationwide logistics network, NARCAN Direct™, to service public interest partners and the prescription market. • Launched over-the-counter NARCAN® Nasal Spray in August 2023. • Distributed over 10 million two-dose boxes in 2023 in U.S. and Canada ¹Centers for Disease Control and Prevention. Provisional Drug Overdose Death Counts. Available at: https://www.cdc.gov/nchs/nvss/vsrr/drug-overdose-data.htm. Updated February 15, 2023. Accessed August 25, 2023.

OTC Designation for NARCAN® Nasal Spray 11 • Began shipping hundreds of thousands of two-dose cartons of NARCAN® Nasal Spray to retailers nationwide in August • Announced suggested MSRP of $44.99 and lowered public interest price to $41 per two-dose carton • Widespread availability across 32,000 locations, including major retailers and e-commerce sites in September • Pursuing additional channels to expand access, e.g. businesses, workplaces

PROPRIETARY AND CONFIDENTIAL 12 Bioservices Business

13 Contract Development & Manufacturing (CDMO) offerings: Development services Drug substance Drug product & packaging Mammalian Plasma Protein Viral Technology Platforms: Bioservices Overview Molecule-to-market drug substance and drug product development and manufacturing services to biopharma innovators, government, and non-government organizations.

14 Financial Results

Notable Revenue Elements Q3 2023 vs. Q3 20221 15 ($ in millions) 1. All financial information incorporated within this presentation is unaudited. 2. Product sales, net are reported net of variable consideration including returns, rebates, wholesaler fees and prompt pay discounts in accordance with U.S. generally accepted accounting principles (GAAP). Q3 2023 Q3 2022 % Change Product sales, net (2): Anthrax MCM $ 32.9 $ 28.4 16 % NARCAN® 142.1 87.9 62 % Smallpox MCM 24.7 50.4 (51) % Other Products 50.1 19.5 157 % Total product sales, net $ 249.8 $ 186.2 34 % CDMO Revenues: Services $ 13.2 $ 36.1 (63) % Leases 1.0 0.2 NM Total CDMO Revenues $ 14.2 $ 36.3 (61) % Contracts and grants $ 6.5 $ 17.4 (63) % Total revenues $ 270.5 $ 239.9 13 % NM - Not Meaningful

Key Financial Performance Metrics Q3 2023 vs. Q3 2022 16 R&D $ --- R&D Margin %1 SG&A $ --- SG&A Margin %2 Adjusted Corporate Gross Margin3 Corporate Gross Margin ($ in millions) 21% 8% 33% 1. R&D Margin is calculated as Gross R&D Expense divided by Total Revenues. 2. SG&A Margin is calculated as Gross SG&A Expense divided by Total Revenues. 3. See the Appendix for a definition of non-GAAP terms and reconciliation tables. Q3 2022 Q3 2022 Q3 2022 Q3 2022 Q3 2022 Q3 2023 Q3 2023 Q3 2023 Q3 2023 Q3 2023 18% 6% 34% 32% 34% 33% 38% 34%

Segment Reporting Q3 2023 vs. Q3 20221 17 Revenue Adjusted Gross Margin2 --- Adjusted Gross Margin2 % Adjusted Gross Margin2 --- Adjusted Gross Margin2 % Revenue ($ in millions) PRODUCTS SEGMENT SERVICES SEGMENT 62% 56% 1. For additional detail related to the method and specific inputs by which both revenue and adjusted gross margin are calculated, please refer to the table in the section entitled “Additional Financial Information” found in the press release issued by the Company on November 8, 2023. 2. See the Appendix for a definition of non-GAAP terms and reconciliation tables. Q3 2022 Q3 2023 Q3 2022 Q3 2022 Q3 2022 Q3 2022 Q3 2023 Q3 2023 Q3 2023 Q3 2023 55% 49% (71)% (155)% $(25.7) $(22.0)

Balance Sheet & Cash Flow Metrics 18 As of September 30, 2023 For the Nine Months Ended September 30, 2023 CASH $87.8 ACCOUNTS RECEIVABLE, NET $216.5 INVENTORIES, NET $354.1 TOTAL DEBT1 $866.3 NET DEBT2 $778.5 CASH USED IN OPERATING ACTIVITIES $(238.4) CASH PROVIDED BY INVESTING ACTIVITIES $223.7 CAPITAL EXPENDITURES $40.2 CASH USED IN FINANCING ACTIVITIES $(540.4) ($ in millions) 1. Debt amount indicated on the Company’s balance sheet is net of unamortized debt issuance costs of $4.5M. 2. Net Debt is calculated as Total Debt minus Cash ($866.3M - $87.8M = $778.5M).

Historical Revenues — 2017-2023 ($ IN MIL L IONS) $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 $2,000 2017 2018 2019 2020 2021 2022 2023F PRODUCTS CDMO C&G $561 $782 $1,106 $1,555 $1,793 $1,050 1 $1,121 • Continued focus on Core Products (MCM & NARCAN® Nasal Spray) • De-emphasis on CDMO/Bioservices growth opportunities while sustaining relationships with existing customers • Structuring the business to accelerate return to profitability and stabilize the balance sheet 191. 2023 Full Year Forecast based represents the mid-point of Full Year Guidance range

2023 Guidance – Consistent with Q3 Earnings on 11/8/23 1. See the Appendix for the "Reconciliation of Loss before income taxes to Adjusted EBITDA" and "Reconciliation of Total Revenues to Adjusted Revenues, Cost of Sales to Adjusted Cost of Sales, and Gross Margin and Gross Margin % to Adjusted Gross Margin and Adjusted Gross Margin %" tables for the definitions and reconciliations of these non-GAAP financial measures to the most closely related GAAP financial measures. METRIC ($ in millions) Full Year Forecast Range (as of 11/08/23) Action Previous Range (as of 8/08/23) Total Revenues $1,000 - $1,100 UNCHANGED $1,000 - $1,100 Loss before income taxes $(726)-$(626) NEW Adjusted EBITDA (1) $(25) - $75 REVISED $50 - $100 Adjusted Gross Margin % (1) 32% - 38% REVISED 36% - 39% Product/Service Level Revenue Anthrax MCM $145 - $215 REVISED $200 - $220 NARCAN® $480 - $490 REVISED $425 - $445 Smallpox MCM $180 - $185 REVISED $180 - $200 Other Products $100 - $110 REVISED $100 - $120 CDMO $70 - $75 REVISED $60 - $80 20

Continued to achieve important milestones across our Products business • Significant opportunities to expand access and increase awareness of NARCAN® Nasal Spray • Increased demand – seeking preparedness for threat of opioid overdoses • Expanded addressable market through OTC availability • Continued public interest support from Federal/State programs to address the opioid crisis • Launched national campaign to increase public awareness and education • Key contract awards reinforce the value of our MCM products as an essential part of U.S. and international gov’t preparedness planning Strengthened financial position and [de-risked / reduced volatility] of business • Strategic shift to de-emphasize CDMO business as a source of growth • Amended and extended maturity of secured credit facility • Implemented actions to save over $160 million of annualized operating expense Key Takeaways 21

22 Appendix

Reconciliation of Loss before Income Taxes to Adjusted EBITDA – Q3 2023 vs. Q3 2022 23 APPENDIX ($ in millions) Three Months Ended September 30, 2023 2022 Loss before income taxes $ (265.9) $ (67.2) Adjustments: Depreciation & amortization $ 27.9 $ 32.2 Total interest expense, net 19.4 7.9 Impairments 218.2 — Changes in fair value of contingent consideration (1.1) 0.6 Severance and restructuring costs 20.6 — Acquisition and divestiture costs — (0.1) Gain on sale of business 0.7 — Total adjustments $ 285.7 $ 40.6 Adjusted EBITDA $ 19.8 $ (26.6)

Reconciliation of Loss before Income Taxes to Adjusted EBITDA – FY 2023 Forecast 24 APPENDIX ($ in millions) 2023 Full Year Forecast Loss before income taxes $(726) - $(626) Adjustments: Depreciation & amortization $122 Total interest expense, net 81 Impairments 525 Inventory step-up provision 2 Severance and restructuring costs 34 All other (63) Total adjustments $701 Adjusted EBITDA $(25) - $75

Reconciliation of Total Revenues to Adjusted Revenues, Cost of Sales to Adjusted Cost of Sales, and Gross Margin and Gross Margin % to Adjusted Gross Margin and Adjusted Gross Margin % – Q3 2023 vs. Q3 2022 25 APPENDIX ($ in millions) Three Months Ended September 30, 2023 2022 Total revenues $ 270.5 $ 239.9 Contract and grants revenues (6.5) (17.4) Adjusted Revenues $ 264.0 $ 222.5 Cost of product sales $ 132.5 $ 85.2 Cost of contract development and manufacturing 44.3 62.0 Total cost of sales $ 176.8 $ 147.2 Less: Changes in fair value of contingent consideration (1.1) 0.6 Less: Restructuring costs 13.1 — Adjusted Cost of Sales $ 164.8 $ 146.6 Gross margin (adjusted revenues minus total cost of sales) $ 87.2 $ 75.3 Gross margin % (gross margin divided by Adjusted Revenues) 33 % 34 % Adjusted Gross Margin (Adjusted Revenues minus Adjusted Cost of Sales) $ 99.2 $ 75.9 Adjusted Gross Margin % (Adjusted Gross Margin divided by Adjusted Revenues) 38 % 34 %

Reconciliation of Total Revenues to Adjusted Revenues, Cost of Sales to Adjusted Cost of Sales, and Gross Margin and Gross Margin % to Adjusted Gross Margin and Adjusted Gross Margin % – FY 2023 Forecast 26 APPENDIX ($ in millions) 2023 Full Year Forecast Total Revenues $1,000 - $1,100 Contracts and Grants Revenues ($25) Adjusted Revenues $975 - $1,075 Total cost of sales $680 - $685 Changes in fair value of contingent consideration and restructuring ($20) Adjusted cost of sales $660 - $665 Gross margin (Adjusted Revenues minus total cost of sales) $295 - $390 Gross margin % (gross margin divided by Adjusted Revenues) 30% - 36% Adjusted Gross Margin (Adjusted Revenues minus Adjusted Cost of Sales) $315 - $410 Adjusted Gross Margin % (Adjusted Gross Margin divided by Adjusted Revenues) 32% - 38%

Reconciliation of Segment Level (Products and Services) Revenues, Cost of Sales to Adjusted Cost of Sales, and Gross Margin and Gross Margin % to Adjusted Gross Margin and Adjusted Gross Margin % – Q3 2023 vs. Q3 2022 27 APPENDIX ($ in millions) Products Services Quarter Ended September 30, Quarter Ended September 30, 2023 2022 % Change 2023 2022 % Change Revenues $ 249.8 $ 186.2 34 % $ 14.2 $ 36.3 (61) % Cost of sales $ 132.5 $ 85.2 56 % $ 44.3 $ 62.0 (29) % Less: Changes in fair value of contingent consideration (1.1) 0.6 * — — NM Less: Restructuring costs 5.0 — NM 8.1 — NM Adjusted cost of sales ** $ 128.6 $ 84.6 52 % $ 36.2 $ 62.0 (42) % Gross margin *** $ 117.3 $ 101.0 16 % $ (30.1) $ (25.7) (17) % Gross margin % *** 47 % 54 % (212) % (71) % Adjusted gross margin **** $ 121.2 $ 101.6 19 % $ (22.0) $ (25.7) 14 % Adjusted gross margin % **** 49 % 55 % (155) % (71) % * % change is greater than +/- 100% ** Adjusted cost of sales, which is a non-GAAP financial measure, is calculated as cost of sales less restructuring costs, and other special items and non-cash items related to changes in fair value of contingent consideration and inventory step-up provision. Refer to the “Reconciliation of Non-GAAP Measures” section of the press release issued by the Company on November 8, 2023 for the reconciliation of this non-GAAP measure to the most closely related GAAP financial measure. *** Gross margin is calculated as revenues less cost of sales. Gross margin % is calculated as gross margin divided by revenues. **** Adjusted gross margin, which is a non-GAAP financial measure, is calculated as revenues less Adjusted cost of sales. Adjusted gross margin %, which is a non- GAAP financial measure, is calculated as Adjusted gross margin divided by revenues. Refer to the “Reconciliation of Non-GAAP Measures” section of the press release issued by the Company on November 8, 2023 for the reconciliation of these non-GAAP measures to the most closely related GAAP financial measures. NM - Not Meaningful

www.emergentbiosolutions.com 28

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

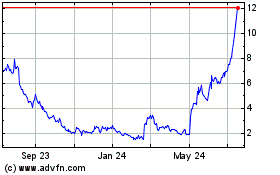

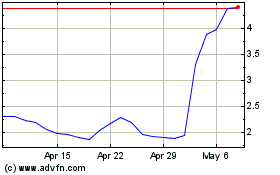

Emergent Biosolutions (NYSE:EBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Emergent Biosolutions (NYSE:EBS)

Historical Stock Chart

From Apr 2023 to Apr 2024