false000073025500007302552024-01-032024-01-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): January 03, 2024 |

CalAmp Corp.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

0-12182 |

95-3647070 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

15635 Alton Parkway Suite 250 |

|

Irvine, California |

|

92618 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (949) 600-5600 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock, $0.01 per share |

|

CAMP |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Effective January 22, 2024, Christopher R. Adams, age 57, will commence employment as President and Chief Executive Officer of CalAmp Corp. (the “Company”) and will be appointed a member of the Company’s Board of Directors. Effective upon the employment of Mr. Adams, Jason Cohenour will cease service as Interim Chief Executive Officer, but will continue to serve as a member of the Company’s Board of Directors.

Mr. Adams currently serves as VP/GM of the Automotive Sensing Division of onsemi, a semiconductor manufacturing company, a position he has held since May 2020. Prior to onsemi, from October 2019 to May 2020, Mr. Adams served as the Chief Operating Officer at SafeAI, an autonomous mining and construction company. From September 2015 to October 2019, Mr. Adams served as a General Manager of BAE Systems, an aerospace company. Mr. Adams received an Bachelor of Science degree from University of British Columbia, and an Masters degree in Electrical Engineering from Stanford University.

Under an offer letter dated December 30, 2023 (the “Offer Letter”), the terms of which were accepted by Mr. Adams on January 3, 2023, Mr. Adams will be paid a salary of $535,600 per year (the “Base Salary”), and will be eligible to receive annual target incentive compensation of 100% of Base Salary, prorated for fiscal year 2024. The Company will also grant 750,000 time-vesting restricted stock units (“RSUs”) to Mr. Adams and 750,000 performance vesting RSUs (“PSUs”) on February 5, 2024. One-third of the time-vesting RSUs will vest on the first anniversary of Mr. Adams’ start date and the remaining two-thirds will vest in substantially equal quarterly installments over the subsequent two year period, in each case subject to Mr. Adams’ continuous service with the Company through each applicable vesting date, and subject to the terms of the Company’s standard RSU award agreement. The PSUs will have a performance period of three years with specific performance criteria to be determined by the Company’s Board of Directors. Mr. Adams is also entitled to reimbursement of up to $5,000 per month for up to twelve months for travel expenses associated with commuting to the Company’s headquarters, and the Company will reimburse Mr. Adams up to $50,000 of relocation expenses before December 31, 2025.

Mr. Adams has also been offered an executive employment agreement in the form of the Company’s standard executive employment agreement, which among other things provides for change in control and salary continuation benefits that are designed to protect against the loss of his position as a result of termination without “cause” or termination for “good reason” both in conjunction and not in conjunction with a “change in control”, each of which terms are defined in the executive employment agreement. Pursuant to the executive employment agreement, if Mr. Adams is terminated without cause or with good reason not in conjunction with a change in control, he is entitled to severance in the form of (i) continuation of payments equal to 12 months of annual base salary, (ii) any earned but unpaid bonus, (iii) a pro-rated portion of his target bonus for the year of termination based on the number of days worked within the applicable performance period, and (iv) continued COBRA coverage for 12 months. Any options that are exercisable will remain exercisable for up to 12 months following termination, and any unvested equity awards will be forfeited and canceled. If Mr. Adams is terminated without cause or he terminates his employment for good reason within the three-month period immediately preceding or the 12-month period immediately following a change in control, then he would be entitled to (1) continuation of payments equal to 24 months of annual base salary, (2) an amount equal to two times his target bonus for the year of termination, (3) continued COBRA coverage for 18 months, (4) 100% of the then unvested equity awards held by Mr. Adams would become immediately vested and (5) any options that are exercisable or become exercisable will remain exercisable for up to 6 months following termination.

There are no family relationships between Mr. Adams and any other director or executive officer of the Company, or with any person selected to become an officer or a director of the Company. There are no related party transactions between the Company and Mr. Adams that would require disclosure under Item 404(a) of Regulation S-K.

|

|

Item 7.01. |

Regulation FD Disclosure. |

The Company issued a press release on January 8, 2024, announcing its hiring of Mr. Adams. A copy of this press release is furnished as Exhibit 99.1 to this report and is incorporated herein by reference.

The information presented in Item 7.01 of this Current Report on Form 8-K and Exhibit 99.1 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act’), or otherwise subject to the liabilities of that section, unless the Company specifically states that the information is to be considered “filed” under the Exchange Act or specifically incorporates it by reference into a filing under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

CALAMP CORP. |

|

|

|

|

Date: |

January 8, 2024 |

By: |

/s/ Jikun Kim |

|

|

|

Jikun Kim

Senior Vice President and CFO

(Principal Financial Officer) |

Exhibit 99.1

CalAmp Appoints Chris Adams as President and Chief Executive Officer

Company hires technology veteran to accelerate its transformation and drive profitable growth

IRVINE, CA, January 8, 2024 – CalAmp (Nasdaq: CAMP), a connected intelligence company helping people and organizations improve operational performance with telematics solutions, is pleased to announce that Chris Adams will be joining the company as President and Chief Executive Officer (CEO), effective January 22, 2024.

Adams is an accomplished technology leader who brings a wealth of knowledge and experience to CalAmp. He possesses a unique combination of technical depth, operational skills, and general management experience from a broad range of technology companies – most recently as VP/GM of the Automotive Sensing Division at onsemi.

“After a comprehensive search process, we are pleased to welcome Chris as CalAmp’s new President and CEO. His deep experience in semiconductor, hardware, and software solutions across several market segments – most recently in the automotive segment – makes him an excellent choice to lead CalAmp through the next phase of its transformation. We have great confidence in his ability to drive the company to create greater value for customers and investors,” said Henry Maier, Chairman of the Board at CalAmp.

Adams started his career in engineering and engineering leadership and has served in general management roles for more than 20 years. Prior to his current role at onsemi, Adams held business unit leadership roles with LSI Logic, Sony Electronics, and BAE Systems. Adams also served as President and CEO of Pixim, an imaging semiconductor company that was subsequently acquired by Sony Electronics. Adams holds a Master of Science Degree in Electrical Engineering from Stanford University.

"I'm excited to have the opportunity to lead this exceptional organization, which has such deep expertise in the large and growing telematics industry," said Adams. "CalAmp has long been an innovator and I believe the transformation the organization has been undergoing will provide more value to customers and ultimately lasting value to investors. The organization has all the ingredients necessary to drive profitable growth and to solidify its leadership position in telematics solutions.”

Jason Cohenour, Interim CEO of CalAmp, will be working with Chris and the CalAmp management team to ensure a smooth transition of leadership responsibilities. Following the transition, Cohenour will resume his role as independent director of CalAmp’s board of directors.

About CalAmp

CalAmp (Nasdaq: CAMP) provides flexible solutions to help organizations worldwide monitor, track and protect their vital assets. Our unique device-enabled software and cloud platform enables commercial and government organizations worldwide to improve efficiency, safety, visibility and compliance while accommodating the unique ways they do business. With over 10 million active edge devices and 275+ approved or pending patents, CalAmp is the telematics leader organizations turn to for innovation and dependability. For more information, visit calamp.com, or LinkedIn, Twitter, YouTube or CalAmp Blog.

CalAmp, LoJack, TRACKER, Here Comes The Bus, Bus Guardian, CalAmp Vision, CrashBoxx and associated logos are among the trademarks of CalAmp and/or its affiliates in the United States, certain other countries and/or the EU. Spireon acquired the LoJack® U.S. Stolen Vehicle Recovery (SVR) business from CalAmp and holds an exclusive license to the LoJack mark in the United States and Canada. Any other trademarks or trade names mentioned are the property of their respective owners.

Forward-Looking Statements

This announcement contains forward-looking statements (including within the meaning of Section 21E of the U.S. Securities Exchange Act of 1934, as amended, and Section 27A of the U.S. Securities Act of 1933, as amended) concerning CalAmp. These statements include, but are not limited to, statements that address our expected future business and financial performance and statements about (i) our plans, objectives and intentions with respect to future operations, services and products, (ii) our competitive position and opportunities, (iii) our comprehensive review of strategic alternatives focused on enhancing shareholder value, and (iv) other statements identified by words such as such as “may”, “will”, “expect”, “intend”, “plan”, “potential”, “believe”, “seek”, “could”, “estimate”, “judgment”, “targeting”, “should”, “anticipate”, “predict”, “project”, “aim”, “goal”, and similar words, phrases or expressions. These forward-looking statements are based on management’s current expectations and beliefs, as well as assumptions made by, and information currently available to, management, current market trends and market conditions, and involve risks and uncertainties, many of which are outside of our control, and which may cause actual results to differ materially from those contained in forward-looking statements. Accordingly, you should not place undue reliance on such statements. Particular uncertainties that could materially affect future results include any risks associated with global economic conditions and concerns; the outcome of our comprehensive review of strategic alternatives, including the availability of any strategic alternatives that are worthwhile to pursue; the effects of global outbreaks of pandemics or contagious diseases or fear of such outbreaks, such as the recent coronavirus (COVID-19) pandemic; global component shortages due to supply chain constraints, such as those caused by the COVID-19 pandemic; disruptions in sales, operations, relationships with customers, suppliers, employees; our ability to successfully and timely accomplish our transformation to a SaaS solutions provider; our transition out of the automotive vehicle financing business; competitive pressures; pricing declines; demand for our telematics products; rates of growth in our target markets; prolonged disruptions of our contract manufacturers’ facilities or other significant operations; force majeure or force-majeure-like events at our contract manufacturers’ facilities including component shortages; the ongoing diversification of our global supply chain; our dependence on outsourced service providers for certain key business services and their ability to execute to our requirements; our ability to improve gross margin; cost-containment measures; legislative, trade, tariff, and regulatory actions; integration, unexpected charges or expenses in connection with acquisitions; the impact of legal proceedings and compliance risks; the impact on our business and reputation from information technology system failures, network disruptions, cyber-attacks, or losses or unauthorized access to, or release of, confidential information; the ability of the Company to comply with laws and regulations regarding data protection; our ability to protect our intellectual property and the unpredictability of any associated litigation expenses; any expenses or reputational damage associated with resolving customer product and warranty and indemnification claims; our ability to sell to new types of customers and to keep pace with technological advances; market acceptance of the end products into which our products are designed; and other events and trends on a national, regional and global scale, including those of a political, economic, business, competitive, and regulatory nature. More information on these risks and other potential factors that could affect our financial results is included in our filings with the U.S. Securities and Exchange Commission (“SEC”), including in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of our most recently filed periodic reports on Form 10-K and Form 10-Q and subsequent filings, which you may obtain for free at the SEC’s website at http://www.sec.gov. We undertake no intent or obligation to publicly update or revise any of these forward-looking statements, whether as a result of new information, future events or otherwise, which speak as of their respective dates except as required by law.

|

|

CalAmp Investor Contact: |

CalAmp Media Contact: |

Jikun Kim |

Mark Gaydos |

SVP & CFO |

Chief Marketing & Product Officer |

ir@calamp.com |

Mgaydos@calamp.com |

v3.23.4

Document And Entity Information

|

Jan. 03, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 03, 2024

|

| Entity Registrant Name |

CalAmp Corp.

|

| Entity Central Index Key |

0000730255

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

0-12182

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

95-3647070

|

| Entity Address, Address Line One |

15635 Alton Parkway

|

| Entity Address, Address Line Two |

Suite 250

|

| Entity Address, City or Town |

Irvine

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92618

|

| City Area Code |

(949)

|

| Local Phone Number |

600-5600

|

| Entity Information, Former Legal or Registered Name |

Not applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.01 per share

|

| Trading Symbol |

CAMP

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

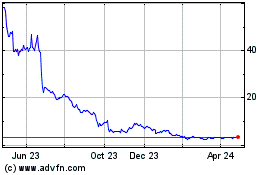

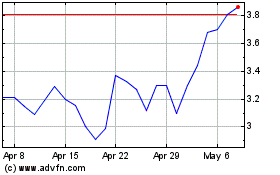

CalAmp (NASDAQ:CAMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

CalAmp (NASDAQ:CAMP)

Historical Stock Chart

From Apr 2023 to Apr 2024