UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE

ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2023

Commission file number: 001-34936

Noah Holdings Limited

1226 South Shenbin Road

Shanghai 201107

People’s Republic of China

+86 (21) 8035-8292

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F

x Form 40-F

¨

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | Noah

Holdings Limited |

| | |

| | By: |

/s/

Qing Pan |

| | |

Name: |

Qing Pan |

| | |

Title: |

Chief Financial Officer |

| | |

| Date: December 29, 2023 | |

Exhibit 99.1

NOAH Announces Change of Chief Executive Officer

Company separates CEO and chairperson roles

to improve corporate governance

Mr. Zhe Yin appointed as CEO; Ms. Jingbo

Wang to remain as Chairwoman

SHANGHAI, Dec. 29,

2023 /PRNewswire/ – Noah Holdings Limited (the “Company” or “Noah”) (NYSE: NOAH and HKEX:

6686), a leading wealth management service provider in China offering comprehensive global investment and asset allocation advisory

services primarily for high-net-worth investors, today announced that its Board of Directors (the “Board”) has approved a

separation of the chief executive officer and chairperson roles. Mr. Zhe Yin, co-founder and director of the Company and chairman

of Gopher Asset Management Co., Ltd., has been appointed as the chief executive officer of the Company, effective December 29,

2023, to succeed Ms. Jingbo Wang, who will remain as the chairwoman of the Board and the chairwoman of the Company’s corporate

governance and nominating committee. The decision to separate the roles of the chief executive officer and chairperson was taken for the

purpose of achieving better corporate governance pursuant to the Corporate Governance Code as set out in Appendix 14 to the Rules Governing

the Listing of Securities on The Stock Exchange of Hong Kong Limited, specifically code provision C.2.1, and reflects the Company's commitment

to adhering to corporate governance best practices.

Mr. Yin

is one of the founders of the Company and has been a director since June 2007. Mr. Yin is a highly accomplished senior executive

in the wealth and asset management industry with over 22 years of professional experience and possesses an in-depth understanding of the

Company’s operations and culture. He has been serving as

the chairman of Gopher Asset Management Co., Ltd. (“Gopher

Asset Management”), one of the Company’s

consolidated affiliated entities, since March 2021, and served as the chief executive officer of Gopher Asset Management from April 2014

to March 2021 and as the chairman of Gopher Asset Management from February 2010 to April 2014.

Prior to co-founding Noah, Mr. Yin worked at Xiangcai Securities

Co., Ltd. from November 2003 to September 2005 as a deputy general manager of the private banking department. From July 1997

to October 2003, Mr. Yin served as various positions at Bank of Communications Co., Ltd. Shanghai Branch, with his last

position as the foreign exchange product manager of private finance division. From August 2021 to September 2022, Mr. Yin

served as a director of Dalian Zeus Entertainment Co., Ltd , the shares of which are listed on the Shenzhen Stock Exchange (stock code:

002354). From November 2017 to June 2021, Mr. Yin served as an independent director of Guizhou Xinbang Pharmaceutical Co.,

Ltd, the shares of which are listed on the Shenzhen Stock Exchange (stock code: 002390).

Mr. Yin

served as a co-chairman of the Fund of Funds Professional Committee of the Asset Management Association of China from 2017 to August 2021.

Mr. Yin has repeatedly been named among the most influential private equity investors in China by respected industry organizations.

For instance, he was named one of the Top 20 China’s Best Private Equity Investors in 2017 and one of the Top 50 China’s Best

Private Equity Investors in 2019, respectively, by ChinaVenture Investment Consulting., Ltd., a leading financial services technology

enterprise in China’s private equity investment industry.

In addition, he was honored as one of the Most Influential Investors in China’s

VC/PE Fund Limited Partner Market 2021 selected by Zero2IPO Group, a leading venture capital and private equity service provider and a

well-known investment firm in China.

Mr. Yin

received his MBA degree from China Europe International Business School in Shanghai, China, in September 2010 and his bachelor’s

degree in economics from Shanghai University of Finance and Economics in Shanghai, China, in July 1997.

Ms. Wang commented, “This strategic move underscores our

commitment to enhancing corporate governance, fostering talent development, and facilitating leadership succession planning. Mr. Yin's

alignment with our company values and culture, coupled with his instrumental role in building our Gopher Asset Management franchise, positions

him as the ideal candidate to lead the Company as the CEO. Under Mr. Yin's leadership, I am confident that Noah will continue

to execute our growth initiatives and create substantial value for our clients and shareholders. As the chairwoman of the Board, I

look forward to supporting Mr. Yin in his new role while continuing to oversee the Company’s strategic planning, board activities,

and corporate governance."

ABOUT NOAH HOLDINGS LIMITED

Noah Holdings Limited (NYSE: NOAH and HKEX:6686) is a leading and pioneer

wealth management service provider in China offering comprehensive one-stop advisory services on global investment and asset allocation

primarily for high net worth investors. Noah is a Cayman Islands holding company and carries on business in Hong Kong as Noah Holdings

Private Wealth and Asset Management Limited. In the first nine months of 2023, Noah distributed RMB57.5 billion (US$7.9 billion) of investment

products. Through Gopher Asset Management, Noah had assets under management of RMB154.9 billion (US$21.2 billion) as of September 30,

2023.

Noah's wealth management business primarily distributes private equity,

private secondary, mutual fund and other products denominated in RMB and other currencies. Noah's network covers major cities in mainland

China, as well as offices in Hong Kong (China), Taiwan (China), New York, Silicon Valley and Singapore. A total of 1,408 relationship

managers across 59 cities provide customized financial solutions for clients through this network, and meet their international investment

needs. The Company's wealth management business had 452,222 registered clients as of September 30, 2023. Through Gopher Asset Management,

Noah manages private equity, public securities, real estate, multi-strategy and other investments denominated in RMB and other currencies.

The Company also provides other services.

For more information, please visit Noah at ir.noahgroup.com.

SAFE HARBOR STATEMENT

This announcement contains forward-looking statements. These statements

are made under the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking

statements can be identified by terminology such as "will," "expects," "anticipates," "future,"

"intends," "plans," "believes," "estimates," "confident" and similar statements. Noah

may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission, in its

annual reports to shareholders, in announcements, circulars or other publications made on the website of The Stock Exchange of Hong Kong

Limited (the "Hong Kong Stock Exchange"), in press releases and other written materials and in oral statements made by its officers,

directors or employees to third parties. Statements that are not historical facts, including statements about Noah's beliefs and expectations,

are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. These statements include, but are

not limited to, estimates regarding the sufficiency of Noah's cash and cash equivalents and liquidity risk. A number of factors could

cause Noah's actual results to differ materially from those contained in any forward-looking statement, including but not limited to the

following: its goals and strategies; its future business development, financial condition and results of operations; the expected growth

of the wealth management and asset management market in China and internationally; its expectations regarding demand for and market acceptance

of the products it distributes; investment risks associated with investment products distributed to Noah's investors, including the risk

of default by counterparties or loss of value due to market or business conditions or misconduct by counterparties; its expectations regarding

keeping and strengthening its relationships with key clients; relevant government policies and regulations relating to its industries;

its ability to attract and retain qualified employees; its ability to stay abreast of market trends and technological advances; its plans

to invest in research and development to enhance its product choices and service offerings; competition in its industries in China and

internationally; general economic and business conditions globally and in China; and its ability to effectively protect its intellectual

property rights and not to infringe on the intellectual property rights of others. Further information regarding these and other risks

is included in Noah's filings with the U.S. Securities and Exchange Commission and the Hong Kong Stock Exchange. All information provided

in this press release and in the attachments is as of the date of this press release, and Noah does not undertake any obligation to update

any such information, including forward-looking statements, as a result of new information, future events or otherwise, except as required

under the applicable law.

Contacts:

Noah Holdings Limited

Melo Xi

Tel: +86-21-8035-8292

ir@noahgroup.com

Exhibit 99.2

Hong

Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement,

make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising

from or in reliance upon the whole or any part of the contents of this announcement.

Noah

Holdings

Noah

Holdings Private Wealth and Asset Management Limited

諾亞控股私人財富資產管理有限公司

(Incorporated

in the Cayman Islands with limited liability under the name Noah Holdings Limited and carrying on business in Hong Kong as Noah

Holdings Private Wealth and Asset Management Limited)

(Stock

Code: 6686)

CHANGE

OF CHIEF EXECUTIVE OFFICER

The

board (the “Board”) of directors (the “Directors”) of Noah Holdings Private Wealth and Asset Management

Limited (“Noah” or the “Company”, together with its subsidiaries and its consolidated affiliated

entities, the “Group”) hereby announces that, for the purpose of achieving better corporate governance of the Company

pursuant to code provision C.2.1 of the Corporate Governance Code as set out in Appendix 14 to the Rules Governing the Listing of

Securities on The Stock Exchange of Hong Kong Limited (the “Hong Kong Listing Rules”), the Board has approved a separation

of the chief executive officer and chairperson roles, with Mr. Zhe Yin (殷哲) (“Mr. Yin”)

being appointed as the chief executive officer of the Company (the “CEO”) to succeed Ms. Jingbo Wang (汪靜波)

(“Ms. Wang”) with effect from December 29, 2023. Upon such change, Ms. Wang will still remain as the

chairwoman of the Board and the chairwoman of the corporate governance and nominating committee of the Company.

Ms. Wang

confirmed that she has no disagreement with the Board and there is no matter in connection with her stepping down from the position as

the CEO that needs to be brought to the attention of the shareholders of the Company (“Shareholders”).

Upon

such change, the Company has complied with all code provisions as set out in Appendix 14 to the Hong Kong Listing Rules since the

roles of the chairperson and chief executive officer are not performed by the same individual, reflecting the Company’s commitment

to achieving better corporate governance practices.

The

Board would like to express its gratitude and appreciation to Ms. Wang for her contribution during her term of office as the CEO,

while also extending a warm welcome and congratulations to Mr. Yin on his appointment as the new CEO.

The

biographical particulars of Mr. Yin are as follows:

Mr. Yin,

aged 49, is one of the founders of the Company and has been a Director since June 2007. Mr. Yin is a highly accomplished senior

executive in the wealth and asset management industry with over 22 years of professional experience and possesses an in-depth understanding

of the Company’s operations and culture. He has been serving as the chairman of Gopher Asset Management Co., Ltd. (歌斐資產管理有限公司)

(“Gopher Asset Management”), one of the Company’s consolidated affiliated entities, since March 2021, and

served as the chief executive officer of Gopher Asset Management from April 2014 to March 2021 and as the chairman of Gopher

Asset Management from February 2010 to April 2014.

Prior

to co-founding our Company, Mr. Yin worked at Xiangcai Securities Co., Ltd. (湘財證券有限責任公司,

currently known as 湘財證券股份有限公司)

from November 2003 to September 2005 as a deputy general manager of the private banking department. From July 1997 to

October 2003, Mr. Yin served as various positions at Bank of Communications Co., Ltd. Shanghai Branch (交通銀行股份有限公司上海分行),

with his last position as the foreign exchange product manager of private finance division. From August 2021 to September 2022,

Mr. Yin served as a director of Dalian Zeus Entertainment Co., Ltd. (大連天神娛樂股份有限公司),

the shares of which are listed on the Shenzhen Stock Exchange (stock code: 002354). From November 2017 to June 2021, Mr. Yin

served as an independent director of Guizhou Xinbang Pharmaceutical Co., Ltd. (貴州信邦製藥股份有限公司),

the shares of which are listed on the Shenzhen Stock Exchange (stock code: 002390).

Mr. Yin

served as a co-chairman of the Fund of Funds Professional Committee of the Asset Management Association of China (中國證券投資基金業協會母基金專業委員會)

from 2017 to August 2021. Mr. Yin has repeatedly been named among the most influential private equity investors in China by

respected industry organizations. For instance, he was named one of the Top 20 China’s Best Private Equity Investors in 2017 and

one of the Top 50 China’s Best Private Equity Investors in 2019, respectively, by ChinaVenture Investment Consulting., Ltd.

(上海投中信息諮詢股份有限公司),

a leading financial services technology enterprise in China’s private equity investment industry. In addition, he was honored as

one of the Most Influential Investors in China’s VC/PE Fund Limited Partner Market 2021 (2021年中國股權投資基金有限合夥人市場最具影響力投資人)

selected by Zero2IPO Group, a leading venture capital and private equity service provider and a well-known investment firm in China.

Mr. Yin

received his MBA degree from China Europe International Business School

(中歐國際工商學院) in Shanghai, China, in September 2010 and his

bachelor’s degree in economics from Shanghai University of Finance and Economics

(上海財經大學) in Shanghai, China, in

July 1997.

Mr. Yin

entered into a director agreement (the “Director Agreement”) with the Company on July 17, 2017 without a

fixed term, while is subject to the requirements in respect of retirement by rotation under the Hong Kong Listing Rules and

re-election at the annual general meeting of the Company under the articles of association of the Company and the Hong Kong Listing

Rules. Either party may terminate the Director Agreement by giving not less than thirty (30) days’ prior written notice to the

other party. No additional service agreement or appointment letter will be entered into between the Company and Mr. Yin with

respect to the appointment of Mr. Yin as the CEO. Mr. Yin is not entitled to receive any director’s fee under the

Director Agreement but is eligible to receive other emoluments (e.g. salaries, allowances, benefits in kind, performance related

bonuses and contributions to retirement benefits scheme) for his role as a Director and the CEO at an amount to be determined by the

Board based on the recommendation of the compensation committee of the Company (the “Compensation Committee”)

with reference to the prevailing market conditions, his performance, his contributions to the Company and the compensation policy of

the Company, and shall be reviewed by the Compensation Committee and the Board annually.

As

of the date of this announcement, Mr. Yin is interested in the 17,118,000 shares of the Company (the “Shares”)

(taking into account the Company’s share subdivision which took effect on October 30, 2023), including 16,461,500 Shares and

656,500 underlying Shares held by Yin Investment Co., Ltd., a company incorporated in British Virgin Islands and wholly owned by

Rhythm Profit Investment Ltd., which in turn is wholly owned by Ark Trust (Hong Kong) Limited as trustee of a trust that was established

by Mr. Yin (as the settlor) for the benefit of Mr. Yin and his family. Save as disclosed above, Mr. Yin does not have

any other interests or is deemed to be interested in any Shares within the meaning of Part XV of the Securities and Futures Ordinance

(Chapter 571 of the Laws of Hong Kong).

Save

as disclosed above, as of the date of this announcement, Mr. Yin confirms that he does not hold any other position with the Company

or any members of the Group, nor does he have any relationship with any Directors, senior management, substantial Shareholders or controlling

Shareholders (as defined in the Hong Kong Listing Rules) of the Company. Save as disclosed above, Mr. Yin confirms that he has not

held any directorship in any public companies the securities of which are listed on any securities market in Hong Kong or overseas in

the past three years.

Save

as disclosed above, there is no other matter that needs to be brought to the attention of the Shareholders in connection with Mr. Yin’s

appointment as the CEO, and the Board is not aware of any other information that needs to be disclosed pursuant to Rule 13.51(2)(h) to

(v) of the Hong Kong Listing Rules.

Ms. Wang,

the chairwoman of the Board, commented, “This strategic move underscores our commitment to enhancing corporate governance, fostering

talent development, and facilitating leadership succession planning. Mr. Yin’s alignment with our company values and culture,

coupled with his instrumental role in building our Gopher Asset Management franchise, positions him as the ideal candidate to lead the

Group as the CEO. Under Mr. Yin’s leadership, I am confident that Noah will continue to execute our growth initiatives

and create substantial value for our clients and Shareholders. As the chairwoman of the Board, I look forward to supporting Mr. Yin

in his new role while continuing to oversee the Company’s strategic planning, board activities, and corporate governance.”

Safe

Harbor Statement

This

announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the

U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as

“will,” “expects,” “anticipates,” “future,” “intends,”

“plans,” “believes,” “estimates,” “confident” and similar statements. Noah may also

make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission, in its

annual reports to shareholders, in announcements, circulars or other publications made on the website of The Stock Exchange of Hong

Kong Limited (the “Hong Kong Stock Exchange”), in press releases and other written materials and in oral

statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including

statements about Noah’s beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent

risks and uncertainties. These statements include, but are not limited to, estimates regarding the sufficiency of Noah’s cash

and cash equivalents and liquidity risk. A number of factors could cause Noah’s actual results to differ materially from those

contained in any forward-looking statement, including but not limited to the following: its goals and strategies; its future

business development, financial condition and results of operations; the expected growth of the wealth management and asset

management market in China and internationally; its expectations regarding demand for and market acceptance of the products it

distributes; investment risks associated with investment products distributed to Noah’s investors, including the risk of

default by counterparties or loss of value due to market or business conditions or misconduct by counterparties; its expectations

regarding keeping and strengthening its relationships with key clients; relevant government policies and regulations relating to its

industries; its ability to attract and retain qualified employees; its ability to stay abreast of market trends and technological

advances; its plans to invest in research and development to enhance its product choices and service offerings; competition in its

industries in China and internationally; general economic and business conditions globally and in China; and its ability to

effectively protect its intellectual property rights and not to infringe on the intellectual property rights of others. Further

information regarding these and other risks is included in Noah’s filings with the U.S. Securities and Exchange Commission and

the Hong Kong Stock Exchange. All information provided in this press release and in the attachments is as of the date of this press

release, and Noah does not undertake any obligation to update any such information, including forward-looking statements, as a

result of new information, future events or otherwise, except as required under the applicable law.

The

full version of the press release issued by the Company on December 29, 2023 announcing the aforementioned information is available

at the Company’s Investor Relations website at https://ir.noahgroup.com/.

| |

By order of the Board |

| |

Noah Holdings Private Wealth

and Asset Management Limited

Jingbo Wang |

| |

Chairwoman of the Board |

Hong

Kong, December 29, 2023

As

of the date of this announcement, the Board comprises Ms. Wang, the chairwoman and Mr. Yin as Directors; Ms. Chia-Yue

Chang, Mr. Kai Wang and Mr. Boquan He as non-executive Directors; and Dr. Zhiwu Chen, Ms. Cynthia Jinhong Meng, Ms. May Yihong

Wu and Mr. Jinbo Yao as independent Directors.

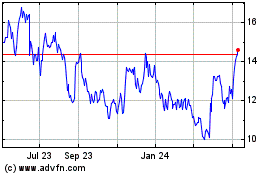

Noah (NYSE:NOAH)

Historical Stock Chart

From Mar 2024 to Apr 2024

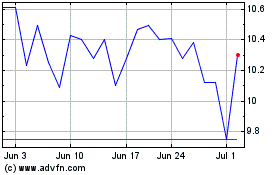

Noah (NYSE:NOAH)

Historical Stock Chart

From Apr 2023 to Apr 2024