false

0001175535

0001175535

2023-12-13

2023-12-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 Or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 13, 2023

Whitestone REIT

(Exact name of registrant as specified in charter)

|

Maryland

|

|

001-34855

|

|

76-0594970

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

| |

|

|

|

|

| |

2600 South Gessner, Suite 500,

|

|

77063

|

|

| |

Houston, Texas

|

|

|

|

| |

(Address of principal executive offices)

|

|

(Zip Code)

|

|

Registrant's telephone number, including area code: (713) 827-9595

Not Applicable

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule #14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Shares of Beneficial Interest, par value $0.001 per share

|

WSR

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

On December 13, 2023, Whitestone REIT (“the Company”) issued a press release, responding to a proposal from Erez Asset Management LLC (“Erez”).

Copies of the Company’s press release dated December 13, 2023, letter from the Company to Erez dated December 13, 2023 and letter from Erez to Whitestone dated November 6, 2023 are attached hereto as Exhibits 99.1, 99.2, and 99.3, respectively, and are incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

Whitestone REIT

|

| |

|

(Registrant)

|

| |

|

|

|

Date:

|

December 13, 2023

|

By: /s/ David K. Holeman

|

| |

|

Name: David K. Holeman

Title: Chief Executive Officer

|

Exhibit 99.1

Whitestone REIT Board of Trustees Responds to Proposal from Bruce Schanzer / Erez Asset Management, LLC (“Erez”)

Houston, Dec. 13, 2023 – Whitestone REIT (NYSE:WSR) (“Whitestone” or the “Company”) announced today that, after careful review and consideration, the Board of Trustees of Whitestone has unanimously rejected a proposal by Bruce Schanzer, Chairman of Erez, demanding a majority change in our Board of Trustees with the sole purpose of embarking on an immediate sale or liquidation of Whitestone, without regard for maximizing long-term value for shareholders.

For the sake of transparency, to maintain open communication with its shareholders, and to minimize misinformation regarding this matter, the Board has decided to release its response publicly.

The full text of the Whitestone Board of Trustees’ response to Bruce Schanzer / Erez, along with the original letter sent to us on November 6, 2023, can be found in this morning’s 8k filing:

Whitestone SEC Filings

About Whitestone REIT

Whitestone REIT (NYSE: WSR) is a community-centered real estate investment trust (REIT) that acquires, owns, operates, and develops open-air, retail centers located in some of the fastest growing markets in the country: Phoenix, Austin, Dallas-Fort Worth, Houston and San Antonio.

Our centers are convenience focused: merchandised with a mix of service-oriented tenants providing food (restaurants and grocers), self-care (health and fitness), services (financial and logistics), education and entertainment to the surrounding communities. The Company believes its strong community connections and deep tenant relationships are key to the success of its current centers and its acquisition strategy. For additional information, please visit the Company's investor relations website.

Forward-Looking Statements

This Report contains forward-looking statements within the meaning of the federal securities laws, including discussion and analysis of our financial condition, pending acquisitions and the impact of such acquisitions on our financial condition and results of operations, anticipated capital expenditures required to complete projects, amounts of anticipated cash distributions to our shareholders in the future and other matters. These forward-looking statements are not historical facts but are the intent, belief or current expectations of our management based on its knowledge and understanding of our business and industry. Forward-looking statements are typically identified by the use of terms such as “may,” “will,” “should,” “potential,” “predicts,” “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates” or the negative of such terms and variations of these words and similar expressions, although not all forward-looking statements include these words. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements.

Factors that could cause actual results to differ materially from any forward-looking statements made in this Report include: the imposition of federal income taxes if we fail to qualify as a real estate investment trust (“REIT”) in any taxable year or forego an opportunity to ensure REIT status; uncertainties related to the national economy, the real estate industry in general and in our specific markets; legislative or regulatory changes, including changes to laws governing REITs; adverse economic or real estate developments or conditions in Texas or Arizona, Houston and Phoenix in particular, including the potential impact of COVID-19 on our tenants’ ability to pay their rent, which could result in bad debt allowances or straight-line rent reserve adjustments; inflation and increases in interest rates, operating costs or general and administrative expenses; availability and terms of capital and financing, both to fund our operations and to refinance our indebtedness as it matures; decreases in rental rates or increases in vacancy rates; litigation risks; lease-up risks, including leasing risks arising from exclusivity and consent provisions in leases with significant tenants; our inability to renew tenant leases or obtain new tenant leases upon the expiration of existing leases; our inability to generate sufficient cash flows due to market conditions, competition, uninsured losses, changes in tax or other applicable laws; geopolitical conflicts, such as the ongoing conflict between Russia and Ukraine; the need to fund tenant improvements or other capital expenditures out of operating cash flow; and the risk that we are unable to raise capital for working capital, acquisitions or other uses on attractive terms or at all and other factors detailed in the Company's most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other documents the Company files with the Securities and Exchange Commission from time to time.

Investor and Media Contact:

David Mordy

Director of Investor Relations

Whitestone REIT

(713) 435-2219

ir@whitestonereit.com

Exhibit 99.2

December 13, 2023

Bruce Schanzer

Chairman, Erez Asset Management, LLC

Dear Mr. Schanzer,

This letter is written in response to your proposal dated November 6, 2023, and the follow-up virtual meeting you had with Whitestone management on December 6, 2023. Our management team has shared the proposal with us and fully briefed us on the details of your discussion with them. We understand Erez owns shares of Whitestone and that you intend to nominate four Board members (two of which you have identified: yourself and a former employee of Cedar Realty Trust, “Cedar”). The Board of Trustees continuously evaluates all avenues to maximize value for our shareholders and is always committed to advance their best interests.

After carefully reading your letter dated November 6, 2023, and reviewing the discussion with management on December 6, 2023, we understand that you view “a sale of assets or of the company outright” as the only way to drive value at the Company. However, the proposal consists of replicating the strategy employed at Cedar, without giving much consideration to how our portfolio, capital structure and business strategy might differ from that of Cedar. Furthermore, you do not seem to account for how current market conditions (including interest rates, valuation levels, transaction activity and debt financing) stand in contrast to those under which the Cedar transaction occurred. Finally, you ignore the strong total shareholder returns we have generated recently. Since the beginning of 2022, Whitestone has delivered +26% total shareholder return, far outpacing the average total shareholder return of negative (7%) for other shopping center REITs (1). This underscores the progress the Company has made since early 2022 under its new management team by staying focused on executing its business strategy.

Your primary argument to justify your demand for four Board seats and the immediate actions outlined in your letter is that small cap REITs, such as Whitestone and Cedar, are forever precluded from achieving attractive results, driving shareholder value or bridging the gap to NAV. We strongly disagree as our business strategy has already achieved significant value creation for our shareholders and represents a clearer route to successfully maximize shareholder value. Once again, we think that our shareholder returns under our new CEO and executive team since early 2022 speak for themselves.

With respect to your threat to nominate four Board members for election at our 2024 annual meeting: given the size of our current Board (six Trustees), your proposed four candidates would constitute a change in the majority of the Board. This is particularly concerning since your only stated objective is to embark on an immediate sale or liquidation of the Company, and you seem otherwise unable to articulate other means to drive shareholder value and unable to explain how any of your proposed Board nominees would add value to our Board and our shareholders.

As a Board focused on the best interests of its shareholders, we take our fiduciary duties seriously and we have been proactive in both Board refreshment and in expanding the diversity and skillset of our Board. We have established procedures to consider any Board nominations, but we obviously cannot do so for unidentified nominees. While decisions on Board composition ultimately rest with our shareholders, we reject a proposal for majority Board change with the sole purpose of immediately effecting a sale or liquidation of Whitestone without regard for maximizing long-term value for shareholders.

(1) Includes simple average of the total returns from January 1, 2022 to December 11, 2023 for the following shopping center REITs: AKR, BRX, FRT, IVT, KIM, KRG, PECO, REG, ROIC, SITC and UE.

Sincerely,

Whitestone Board of Trustees:

David T. Taylor

Nandita V. Berry

Julia B. Buthman

Amy S. Feng

David K. Holeman

Jeffrey A. Jones

Exhibit 99.3

v3.23.3

Document And Entity Information

|

Dec. 13, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Whitestone REIT

|

| Document, Type |

8-K

|

| Document, Period End Date |

Dec. 13, 2023

|

| Entity, Incorporation, State or Country Code |

MD

|

| Entity, File Number |

001-34855

|

| Entity, Tax Identification Number |

76-0594970

|

| Entity, Address, Address Line One |

2600 South Gessner, Suite 500

|

| Entity, Address, Postal Zip Code |

77063

|

| Entity, Address, City or Town |

Houston

|

| Entity, Address, State or Province |

TX

|

| City Area Code |

713

|

| Local Phone Number |

827-9595

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Shares of Beneficial Interest

|

| Trading Symbol |

WSR

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001175535

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

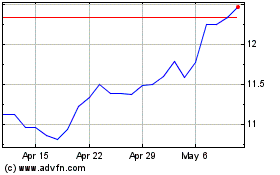

Whitestone REIT (NYSE:WSR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Whitestone REIT (NYSE:WSR)

Historical Stock Chart

From Apr 2023 to Apr 2024