0000730263 False 0000730263 2023-12-06 2023-12-06 iso4217:USD xbrli:shares iso4217:USD xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 6, 2023

_______________________________

THOR Industries, Inc.

(Exact name of registrant as specified in its charter)

_______________________________

| Delaware | 1-9235 | 93-0768752 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

601 East Beardsley Avenue

Elkhart, Indiana 46514-3305

(Address of Principal Executive Offices) (Zip Code)

(574) 970-7460

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

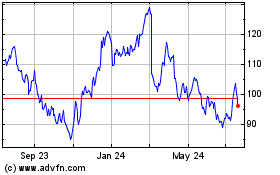

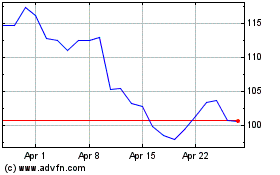

| Common Stock (Par value $.10 Per Share) | THO | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On December 6, 2023, THOR Industries, Inc. (the “Company”) issued a press release announcing certain financial results for the first quarter ended October 31, 2023. A copy of the Company’s press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein. The Company also posted an updated investor slide presentation and a list of investor questions and answers to the “Investors” section of its website. A copy of the Company’s slide presentation and investor questions and answers are attached hereto as Exhibit 99.2 and 99.3, respectively, and are incorporated by reference herein.

Item 7.01. Regulation FD Disclosure.

The press release attached hereto as Exhibit 99.1 provides earnings guidance with updated information on industry and Company projections for the Company’s fiscal year 2024. The slide presentation attached hereto as Exhibit 99.2, and incorporated by reference herein, also provides earnings guidance as well as updated information on industry wholesale shipments and retail market share. The Company also posted an updated list of investor questions and answers to the “Investors” section of its website. A copy of the Company's investor questions and answers is attached hereto as Exhibit 99.3 and is incorporated by reference herein.

In accordance with general instruction B.2 to Form 8-K, the information set forth in Items 2.02 and 7.01 of this Form 8-K (including Exhibits 99.1, 99.2 and 99.3) shall be deemed “furnished” and not “filed” with the Securities and Exchange Commission for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and shall not be incorporated by reference into any filing thereunder or under the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | THOR Industries, Inc. |

| | | |

| | | |

| Date: December 6, 2023 | By: | /s/ Colleen Zuhl |

| | | Colleen Zuhl |

| | | Senior Vice President and Chief Financial Officer |

| | | |

EXHIBIT 99.1

THOR Industries Announces First Quarter Fiscal 2024 Results

Reaffirms Full-Year Fiscal 2024 Outlook & Continues to Navigate Prolonged Challenging Environment With a Prudent Focus on Operational Execution

Fiscal First Quarter 2024 Highlights

- Net sales for the first quarter were $2.50 billion.

- Consolidated gross profit margin for the first quarter was 14.3%.

- Net income attributable to THOR Industries and diluted earnings per share for the first quarter of fiscal 2024 were $53.6 million and $0.99, respectively.

- During the first quarter, the Company continued to return capital to shareholders through its share repurchase program, repurchasing $30.0 million of common stock, bringing the total amount repurchased since the initial authorization in December 2021 to $237.2 million.

- The Company reaffirms its full-year fiscal 2024 consolidated net sales, consolidated gross profit margin and diluted earnings per share guidance.

ELKHART, Ind., Dec. 06, 2023 (GLOBE NEWSWIRE) -- THOR Industries, Inc. (NYSE: THO) today announced financial results for its first fiscal quarter ended October 31, 2023.

“We are pleased with our performance to start fiscal 2024 as the fiscal first quarter played out largely as expected. As anticipated, independent dealer destocking efforts in North America and seasonally lower first quarter production within our European segment impacted our unit shipment volumes during the quarter. Despite this, our fiscal 2024 first quarter financial performance demonstrates the collective efforts of our operating companies to prioritize profitability in a soft demand environment. Against this backdrop, our experienced operating teams remain focused on prudently managing cost structures and enacting commercial strategies to adapt to evolving market conditions. Over our history, the agility and flexibility of our business model has been core to our success and will continue to position THOR and its independent dealers well as we move through fiscal 2024 and beyond,” said Bob Martin, President and CEO of THOR Industries.

First-Quarter Financial Results

Consolidated net sales were $2.50 billion in the first quarter of fiscal 2024, compared to $3.11 billion for the first quarter of fiscal year 2023.

Consolidated gross profit margin for the first quarter was 14.3%, a decrease of 140 basis points when compared to the first quarter of fiscal year 2023.

Net income attributable to THOR Industries, Inc. and diluted earnings per share for the first quarter of fiscal year 2024 were $53.6 million and $0.99, respectively, compared to $136.2 million and $2.53, respectively, for the first quarter of fiscal 2023.

THOR’s consolidated results were driven by the results of its individual segments as noted below.

Segment Results

North American Towable RVs

| ($ in thousands) | Three Months Ended October 31, | | %

Change

|

| | 2023 | | 2022 | |

| Net Sales | $ | 945,454 | | $ | 1,317,806 | | (28.3 | ) |

| Gross Profit | $ | 118,011 | | $ | 195,866 | | (39.7 | ) |

| Gross Profit Margin % | | 12.5 | | | 14.9 | | |

| Income Before Income Taxes | $ | 49,249 | | $ | 111,007 | | (55.6 | ) |

| | As of October 31, | | %

Change

|

| ($ in thousands) | 2023 | | 2022 | |

| Order Backlog | $ | 795,798 | | $ | 1,567,829 | | (49.2 | ) |

| | | | | | | | | |

- North American Towable RV net sales were down 28.3% for the first quarter of fiscal 2024 compared to the prior-year period, driven by a 13.0% decrease in unit shipments and a 15.3% decrease in the overall net price per unit. The decrease in the overall net price per unit was primarily due to a shift in product mix toward travel trailers and more moderately-priced units along with higher sales discounting levels compared to the prior-year quarter.

- North American Towable RV gross profit margin was 12.5% for the first quarter of fiscal 2024, compared to 14.9% in the prior-year period. The decrease in gross profit margin was primarily driven by increased sales discounts and a higher manufacturing overhead percentage due to the reduction in net sales, partially offset by a decrease in the material cost percentage, before the effects of discounting, due to the combined favorable impacts of product mix changes and cost-savings initiatives.

- North American Towable RV income before income taxes for the first quarter of fiscal 2024 was $49.2 million, compared to $111.0 million in the first quarter of fiscal 2023. This decrease was driven by decreased net sales and the corresponding decline in gross margin percentage.

North American Motorized RVs

| ($ in thousands) | Three Months Ended October 31, | | %

Change

|

| | 2023 | | 2022 | |

| Net Sales | $ | 711,159 | | $ | 1,123,519 | | (36.7 | ) |

| Gross Profit | $ | 79,392 | | $ | 185,735 | | (57.3 | ) |

| Gross Profit Margin % | | 11.2 | | | 16.5 | | |

| Income Before Income Taxes | $ | 37,052 | | $ | 124,433 | | (70.2 | ) |

| | As of October 31, | | %

Change

|

| ($ in thousands) | 2023 | | 2022 | |

| Order Backlog | $ | 1,237,547 | | $ | 2,864,309 | | (56.8 | ) |

| | | | | | | | | |

- North American Motorized RV net sales decreased 36.7% for the first quarter of fiscal 2024 compared to the prior-year period. The decrease was primarily due to a 31.5% reduction in unit shipments, partly due to greater independent dealer restocking in the prior-year period, as well as a 5.2% decrease resulting from changes in product mix and net price per unit as current-year shipments trended toward more moderately-priced Class B and Class C units compared to higher-priced Class A units.

- North American Motorized RV gross profit margin was 11.2% for the first quarter of fiscal 2024, compared to 16.5% in the prior-year period. The decrease in the gross profit margin for the first quarter was primarily driven by an increase in sales discounts, higher material costs largely due to increased chassis costs and an increase in manufacturing overhead cost as a percentage of net sales due to the reduction in net sales.

- North American Motorized RV income before income taxes for the first quarter of fiscal 2024 decreased to $37.1 million compared to $124.4 million in the prior-year period, driven by the decrease in net sales and the decline in the gross margin percentage.

European RVs

| ($ in thousands) | Three Months Ended October 31, | | %

Change

|

| | 2023 | | 2022

| |

| Net Sales | $ | 708,201 | | $ | 504,302 | | | 40.4 |

| Gross Profit | $ | 122,828 | | $ | 68,865 | | | 78.4 |

| Gross Profit Margin % | | 17.3 | | | 13.7 | | | |

| Income (Loss) Before Income Taxes | $ | 28,767 | | $ | (6,468 | ) | | 544.8 |

| | As of October 31, | | %

Change

|

| ($ in thousands) | 2023 | | 2022 | |

| Order Backlog | $ | 3,331,171 | | $ | 2,985,205 | | 11.6 |

| | | | | | | | |

- European RV net sales increased 40.4% for the first quarter of fiscal 2024 compared to the prior-year period, driven by a 19.5% increase in unit shipments and a 20.9% increase in the overall net price per unit due to the total combined impact of changes in foreign currency, product mix and price. This overall net price per unit increase of 20.9% includes a 10.0% increase due to the impact of foreign currency exchange rate changes.

- European RV gross profit margin was 17.3% of net sales for the first quarter compared to 13.7% in the prior-year period. This improvement in the gross profit margin for the quarter was primarily driven by net selling price increases, product mix changes and a reduction in the labor and manufacturing overhead costs as a percentage of net sales.

- European RV income before income taxes for the first quarter of fiscal 2024 was $28.8 million, compared to a loss before income taxes of $6.5 million during the first quarter of fiscal 2023. The improvement was primarily driven by the increase in net sales and the improvement in the gross profit margin percentage.

Management Commentary

“In lockstep with our independent dealer partners, THOR continues to navigate the prolonged challenging RV environment in North America. Prudent focus on operational execution across each of our business segments once again enabled THOR to deliver resilient margin performance even while we successfully worked to drive down prices in North America to reflect current market demand. Our teams’ execution within our long-standing operating model enabled THOR to generate positive net cash from operations despite consolidated net sales decreasing 19.5% compared to the prior-year period. Regardless of the prolonged macro challenges, our dedication to our strategy of prudent partnership with our dealers remains steadfast. We continue to employ our variable cost model to adapt to near-term market conditions as well as advance on our strategic initiatives to enhance future performance. As a consequence of our actions and North American dealer independent inventory destocking, we and our independent dealer partners are much better positioned to outperform as we move ahead,” said Todd Woelfer, Senior Vice President and Chief Operating Officer.

“In North America, we remain committed to our disciplined approach to operations that prioritizes profitability while maintaining market-leading positions across each of THOR’s product categories. During the quarter, we continued to sustain production levels lower than retail demand levels which resulted in the destocking of another 3,700 units of THOR products from channel inventory. At the same time, our teams continued to employ targeted promotional strategies in order to drive retail sales while also introducing our value-enhancing model year 2024 product offerings aimed at meeting consumer demand and addressing affordability challenges caused by current macroeconomic conditions. In Europe, despite the typical seasonal slowdown in production as a result of the summer holidays, we achieved positive fiscal first quarter income before income taxes as net sales increased 40.4% year-over-year and gross profit margin increased 360 bps to 17.3%. While we expect to complete the restocking cycle for European motorized products in the second quarter of fiscal 2024, we are extremely pleased with the continued efforts of our European team to strengthen its operations and profitability profile. Additionally, our global teams continued to collectively make progress on certain automation, innovation and supply chain initiatives, demonstrating our commitment to investing in the long-term growth of our business,” continued Woelfer.

“In the first quarter of fiscal 2024, we generated cash flow from operations of $59.7 million. During the quarter, we continued to reinvest in the business and return capital to shareholders. In October, we announced a 7% increase in our regular quarterly dividend, which marked our 14th consecutive year of increasing our dividend. Also within the quarter, we repurchased $30.0 million of our common stock, representing 327,876 shares at an average repurchase price of $91.61. At the end of the first fiscal quarter, we had liquidity of more than $1.40 billion, including approximately $425.8 million in cash on hand and approximately $998.0 million available under our asset-based revolving credit facility (ABL), providing significant financial flexibility moving forward as we continue to execute against our long-term strategic plan through thoughtful capital deployment,” said Colleen Zuhl, Senior Vice President and Chief Financial Officer.

“Subsequent to quarter-end, the Company entered into an amendment to its term-loan credit facility to extend its maturity from February 2026 to November 2030 and reduce the applicable margin used to determine the interest rate on USD loans by 0.25%. As of the November 15, 2023 amendment date, the principal amounts outstanding under the term-loan agreement were $450.0 million on the USD term loan tranche and €330.0 million ($358.6 million as of November 15, 2023) on the Euro term loan tranche. Covenants and other material provisions of the term-loan agreement remain materially unchanged. Concurrently, the Company also amended its ABL agreement, extending the maturity from September 2026 to November 2028. Maximum availability under the ABL remains at $1.00 billion and there were no borrowings outstanding on the ABL as of the November 15, 2023 amendment date. The applicable margin, covenants, and other material provisions of the ABL remain materially unchanged. These transactions were a leverage-neutral event, and we are committed to our long-term net leverage ratio target of less than 1.0x across the business cycle,” added Zuhl.

Outlook

“Despite continued mixed economic data and uncertainty on the macroeconomic level, our fiscal first quarter results demonstrate the strength of our business model and resilience of our operating companies in navigating the current environment. We continue to work closely with our independent dealer partners to monitor retail trends and adjust production accordingly to ensure channel inventory remains appropriate during the retail offseason months. At the same time, we remain focused on solid operational execution to enhance our gross profit margin performance in fiscal 2024 and generate solid cash flow to drive long-term shareholder value,” concluded Martin.

Fiscal 2024 Guidance

Based on the Company’s fiscal first quarter performance and current expectations for the remainder of the fiscal year, the Company is reaffirming its previously communicated full-year fiscal 2024 guidance. As the Company’s fiscal 2024 guidance assumes a much stronger second half of fiscal 2024, in conjunction with the traditional retail selling season, the Company recognizes opportunity and risk to the forecast dependent upon future macro conditions and their impact on retail consumers.

For fiscal 2024, the Company’s full-year guidance includes:

- Consolidated net sales in the range of $10.5 billion to $11.0 billion

- Consolidated gross profit margin in the range of 14.5% to 15.0%

- Diluted earnings per share in the range of $6.25 to $7.25

Supplemental Earnings Release Materials

THOR Industries has provided a comprehensive question and answer document, as well as a PowerPoint presentation, relating to its quarterly results and other topics.

To view these materials, go to http://ir.thorindustries.com.

About THOR Industries, Inc.

THOR Industries is the sole owner of operating companies which, combined, represent the world’s largest manufacturer of recreational vehicles.

For more information on the Company and its products, please go to www.thorindustries.com.

Forward-Looking Statements

This release includes certain statements that are “forward-looking” statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are made based on management’s current expectations and beliefs regarding future and anticipated developments and their effects upon THOR, and inherently involve uncertainties and risks. These forward-looking statements are not a guarantee of future performance. We cannot assure you that actual results will not differ materially from our expectations. Factors which could cause materially different results include, among others: the impact of inflation on the cost of our products as well as on general consumer demand; the effect of raw material and commodity price fluctuations, and/or raw material, commodity or chassis supply constraints; the impact of war, military conflict, terrorism and/or cyber-attacks, including state-sponsored or ransom attacks; the impact of sudden or significant adverse changes in the cost and/or availability of energy or fuel, including those caused by geopolitical events, on our costs of operation, on raw material prices, on our suppliers, on our independent dealers or on retail customers; the dependence on a small group of suppliers for certain components used in production, including chassis; interest rate fluctuations and their potential impact on the general economy and, specifically, on our profitability and on our independent dealers and consumers; the ability to ramp production up or down quickly in response to rapid changes in demand while also managing costs and market share; the level and magnitude of warranty and recall claims incurred; the ability of our suppliers to financially support any defects in their products; legislative, regulatory and tax law and/or policy developments including their potential impact on our independent dealers, retail customers or on our suppliers; the costs of compliance with governmental regulation; the impact of an adverse outcome or conclusion related to current or future litigation or regulatory investigations; public perception of and the costs related to environmental, social and governance matters; legal and compliance issues including those that may arise in conjunction with recently completed transactions; lower consumer confidence and the level of discretionary consumer spending; the impact of exchange rate fluctuations; restrictive lending practices which could negatively impact our independent dealers and/or retail consumers; management changes; the success of new and existing products and services; the ability to maintain strong brands and develop innovative products that meet consumer demands; the ability to efficiently utilize existing production facilities; changes in consumer preferences; the risks associated with acquisitions, including: the pace and successful closing of an acquisition, the integration and financial impact thereof, the level of achievement of anticipated operating synergies from acquisitions, the potential for unknown or understated liabilities related to acquisitions, the potential loss of existing customers of acquisitions and our ability to retain key management personnel of acquired companies; a shortage of necessary personnel for production and increasing labor costs and related employee benefits to attract and retain production personnel in times of high demand; the loss or reduction of sales to key independent dealers, and stocking level decisions of our independent dealers; disruption of the delivery of units to independent dealers or the disruption of delivery of raw materials, including chassis, to our facilities; increasing costs for freight and transportation; the ability to protect our information technology systems from data breaches, cyber-attacks and/or network disruptions; asset impairment charges; competition; the impact of losses under repurchase agreements; the impact of the strength of the U.S. dollar on international demand for products priced in U.S. dollars; general economic, market, public health and political conditions in the various countries in which our products are produced and/or sold; the impact of changing emissions and other related climate change regulations in the various jurisdictions in which our products are produced, used and/or sold; changes to our investment and capital allocation strategies or other facets of our strategic plan; and changes in market liquidity conditions, credit ratings and other factors that may impact our access to future funding and the cost of debt.

These and other risks and uncertainties are discussed more fully in our Quarterly Report on Form 10-Q for the quarter ended October 31, 2023 and in Item 1A of our Annual Report on Form 10-K for the year ended July 31, 2023.

We disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained in this release or to reflect any change in our expectations after the date hereof or any change in events, conditions or circumstances on which any statement is based, except as required by law.

| |

| THOR INDUSTRIES, INC. |

| CONDENSED CONSOLIDATED STATEMENTS OF INCOME |

| FOR THE THREE MONTHS ENDED OCTOBER 31, 2023 AND 2022 |

| ($000’s except share and per share data) (Unaudited) |

| | | | | | | |

| | | Three Months Ended October 31, |

| | | | 2023 | | % Net Sales (1) | | | 2022 | | % Net Sales (1) |

| | | | | | | |

| Net sales | | $ | 2,500,759 | | | | $ | 3,108,084 | | |

| | | | | | | |

| Gross profit | | $ | 357,932 | | 14.3 | % | | $ | 486,476 | | 15.7 | % |

| | | | | | | |

| Selling, general and administrative expenses | | | 217,896 | | 8.7 | % | | | 241,624 | | 7.8 | % |

| | | | | | | |

| Amortization of intangible assets | | | 32,344 | | 1.3 | % | | | 35,219 | | 1.1 | % |

| | | | | | | |

| Interest expense, net | | | 20,197 | | 0.8 | % | | | 22,807 | | 0.7 | % |

| | | | | | | |

| Other income (expense), net | | | (14,913 | ) | (0.6 | )% | | | (7,555 | ) | (0.2 | )% |

| | | | | | | |

| Income before income taxes | | | 72,582 | | 2.9 | % | | | 179,271 | | 5.8 | % |

| | | | | | | |

| Income taxes | | | 17,549 | | 0.7 | % | | | 41,848 | | 1.3 | % |

| | | | | | | |

| Net income | | | 55,033 | | 2.2 | % | | | 137,423 | | 4.4 | % |

| | | | | | | |

| Less: Net income attributable to non-controlling interests | | | 1,468 | | 0.1 | % | | | 1,238 | | — | % |

| | | | | | | |

| Net income attributable to THOR Industries, Inc. | | $ | 53,565 | | 2.1 | % | | $ | 136,185 | | 4.4 | % |

| | | | | | | |

| Earnings per common share | | | | | | |

| Basic | | $ | 1.01 | | | | $ | 2.54 | | |

| Diluted | | $ | 0.99 | | | | $ | 2.53 | | |

| | | | | | | |

| Weighted-avg. common shares outstanding – basic | | | 53,295,835 | | | | | 53,656,415 | | |

| Weighted-avg. common shares outstanding – diluted | | | 53,853,719 | | | | | 53,928,751 | | |

| | | | | | | |

| (1) Percentages may not add due to rounding differences |

| |

| SUMMARY CONDENSED CONSOLIDATED BALANCE SHEETS ($000’s) (Unaudited) |

| | | | | | | | | | | |

| | | October 31,

2023 | | July 31,

2023 | | | | October 31,

2023 | | July 31,

2023 |

| Cash and equivalents | | $ | 425,828 | | $ | 441,232 | | Current liabilities | | $ | 1,716,798 | | $ | 1,716,482 |

| Accounts receivable, net | | | 616,619 | | | 643,219 | | Long-term debt | | | 1,271,877 | | | 1,291,311 |

| Inventories, net | | | 1,714,229 | | | 1,653,070 | | Other long-term liabilities | | | 260,208 | | | 269,639 |

| Prepaid income taxes, expenses and other | | | 48,853 | | | 56,059 | | Stockholders’ equity | | | 3,923,590 | | | 3,983,398 |

| Total current assets | | | 2,805,529 | | | 2,793,580 | | | | | | |

| Property, plant & equipment, net | | | 1,377,647 | | | 1,387,808 | | | | | | |

| Goodwill | | | 1,768,777 | | | 1,800,422 | | | | | | |

| Amortizable intangible assets, net | | | 950,495 | | | 996,979 | | | | | | |

| Equity investments and other, net | | | 270,025 | | | 282,041 | | | | | | |

| Total | | $ | 7,172,473 | | $ | 7,260,830 | | | | $ | 7,172,473 | | $ | 7,260,830 |

| | | | | | | | | | | | | | | |

Contact:

Michael Cieslak, CFA

mcieslak@thorindustries.com

(574) 294-7724

EXHIBIT 99.2

www.thorindustries.com FIRST QUARTER OF FISCAL 2024 FINANCIAL RESULTS

FORWARD - LOOKING STATEMENTS This presentation includes certain statements that are “forward - looking” statements within the meaning of the U . S . Private Securities Litigation Reform Act of 1995 , Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . These forward - looking statements are made based on management’s current expectations and beliefs regarding future and anticipated developments and their effects upon THOR, and inherently involve uncertainties and risks . These forward - looking statements are not a guarantee of future performance . We cannot assure you that actual results will not differ materially from our expectations . Factors which could cause materially different results include, among others : the impact of inflation on the cost of our products as well as on general consumer demand ; the effect of raw material and commodity price fluctuations, and/or raw material, commodity or chassis supply constraints ; the impact of war, military conflict, terrorism and/or cyber - attacks, including state - sponsored or ransom attacks ; the impact of sudden or significant adverse changes in the cost and/or availability of energy or fuel, including those caused by geopolitical events, on our costs of operation, on raw material prices, on our suppliers, on our independent dealers or on retail customers ; the dependence on a small group of suppliers for certain components used in production, including chassis ; interest rate fluctuations and their potential impact on the general economy and, specifically, on our profitability and on our independent dealers and consumers ; the ability to ramp production up or down quickly in response to rapid changes in demand while also managing costs and market share ; the level and magnitude of warranty and recall claims incurred ; the ability of our suppliers to financially support any defects in their products ; legislative, regulatory and tax law and/or policy developments including their potential impact on our independent dealers, retail customers or on our suppliers ; the costs of compliance with governmental regulation ; the impact of an adverse outcome or conclusion related to current or future litigation or regulatory investigations ; public perception of and the costs related to environmental, social and governance matters ; legal and compliance issues including those that may arise in conjunction with recently completed transactions ; lower consumer confidence and the level of discretionary consumer spending ; the impact of exchange rate fluctuations ; restrictive lending practices which could negatively impact our independent dealers and/or retail consumers ; management changes ; the success of new and existing products and services ; the ability to maintain strong brands and develop innovative products that meet consumer demands ; the ability to efficiently utilize existing production facilities ; changes in consumer preferences ; the risks associated with acquisitions, including : the pace and successful closing of an acquisition, the integration and financial impact thereof, the level of achievement of anticipated operating synergies from acquisitions, the potential for unknown or understated liabilities related to acquisitions, the potential loss of existing customers of acquisitions and our ability to retain key management personnel of acquired companies ; a shortage of necessary personnel for production and increasing labor costs and related employee benefits to attract and retain production personnel in times of high demand ; the loss or reduction of sales to key independent dealers, and stocking level decisions of our independent dealers ; disruption of the delivery of units to independent dealers or the disruption of delivery of raw materials, including chassis, to our facilities ; increasing costs for freight and transportation ; the ability to protect our information technology systems from data breaches, cyber - attacks and/or network disruptions ; asset impairment charges ; competition ; the impact of losses under repurchase agreements ; the impact of the strength of the U . S . dollar on international demand for products priced in U . S . dollars ; general economic, market, public health and political conditions in the various countries in which our products are produced and/or sold ; the impact of changing emissions and other related climate change regulations in the various jurisdictions in which our products are produced, used and/or sold ; changes to our investment and capital allocation strategies or other facets of our strategic plan ; and changes in market liquidity conditions, credit ratings and other factors that may impact our access to future funding and the cost of debt . These and other risks and uncertainties are discussed more fully in our Quarterly Report on Form 10 - Q for the quarter ended October 31 , 2023 and in Item 1 A of our Annual Report on Form 10 - K for the year ended July 31 , 2023 . We disclaim any obligation or undertaking to disseminate any updates or revisions to any forward - looking statements contained in this presentation or to reflect any change in our expectations after the date hereof or any change in events, conditions or circumstances on which any statement is based, except as required by law . 2

FIRST QUARTER FISCAL 2024 SUMMARY FIRST QUARTER FISCAL 2024 HIGHLIGHTS ŀ Financial performance demonstrates the collective efforts of our operatin g companies to prioritize profitability in a soft demand environment in North America ▪ European segment continues to deliver year - over - year top and bottom line growth driven by strong operating performance ▪ Prudent focus on operational and commercial initiatives to better position THOR and its North American dealers ahead of the calendar 2024 selling season ▪ Channel inventory appropriately positioned ▪ Introduction of model year 2024 lineup aimed at meeting current demand ŀ Company announced a 7% increase in its regular quarterly dividend, which marked the 14th consecutive year of increasing its dividend, and of common stock $30.0 million repurchased NET SALES BY SEGMENT NET SALES $2.50B (19.5)% (1) GROSS MARGIN 14.3% (140) bps (1) DILUTED EPS (2) $0.99 (60.9)% (1) NET CASH FROM OPERATIONS $59.7M Segment Net Sales Net Sales Growth (1) North American Towable $945.5M (28.3)% North American Motorized $711.2M (36.7)% European $708.2M +40.4% (1) As compared to the first quarter of fiscal year 2023 (2) Attributable to THOR Industries 3

$3,029.1 $8,921.3 $18,070.4 $7,417.3 $5,364.5 $4,397.7 $10,444.7 $1,567.8 $670.0 $1,067.0 $2,215.1 $4,277.4 $2,864.3 $1,237.5 $1,292.1 $2,308.5 $3,348.4 $2,985.2 $3,331.2 10/31/19 10/31/20 10/31/21 10/31/22 10/31/23 European $708.2 28.3% NA Motorized $711.2 28.4% NA Towable $945.5 37.8% Other $135.9 5.5% 101,500 60,200 82,400 83,800 10/31/19 10/31/20 NORTH AMERICAN INDEPENDENT DEALER INVENTORY OF THOR PRODUCTS 122,300 RV BACKLOG OF $5.36 BILLION (27.7)% (1) Inventory Units (3) Includes units of Tiffin products subsequent to the December 2020 acquisition of the Tiffin Group NA Towables NA Motorized European (4) Includes Tiffin backlog subsequent to the December 2020 acquisition of the Tiffin Group (3) 10/31/23 (3) 10/31/22 $795.8 (4) FIRST QUARTER OF FISCAL YEAR 2024 RECAP GROSS MARGIN 14.3% (140) bps (1) DILUTED EPS (2) $0.99 (60.9)% (1) NET SALES $2.50 BILLION (19.5)% (1) (4) (3) 10/31/21 UNIT SHIPMENTS 45,581 (9.5)% (1) (1) As compared to the first quarter of fiscal year 2023 (2) Attributable to THOR Industries 4 (4) NET SALES ($ millions)

($ in Millions) First Quarter Fiscal 2024 Net Sales YOY Change Gross Profit YOY Change Gross Profit Margin YOY Change $945.5 million (28.3)% $118.0 million (39.7)% 12.5% (240) bps NORTH AMERICAN TOWABLE SEGMENT 5 Key Drivers ▪ Unit shipments decreased 13 . 0 % primarily due to a softening in current consumer and dealer demand ▪ Disciplined wholesale production assisted independent dealers in maintaining appropriate channel inventory levels ahead of calendar 2024 selling season ▪ Overall net price per unit decreased 15 . 3 % primarily due to a shift in product mix towards travel trailers and more moderately - priced units along with higher sales discounting levels compared to the prior - year quarter ▪ Calendar year 2023 travel trailer and fifth wheel market share of 42 . 2 % (+ 10 bps y/y) ▪ Gross profit margin decrease d riven by increased sales discounts and a higher manufacturing overhead percentage due to the reduction in net sales, partially offset by a decrease in the material cost percentage, before the effects of discounting, due to the combined favorable impacts of product mix changes and cost - savings initiatives ▪ Order backlog of $ 795 . 8 million

($ in Millions) First Quarter Fiscal 2024 Net Sales YOY Change Gross Profit YOY Change Gross Profit Margin YOY Change $711.2 million (36.7)% $79.4 million (57.3)% 11.2% (530) bps NORTH AMERICAN MOTORIZED SEGMENT 6 Key Drivers ▪ Unit shipments decreased 31 . 5 % due to a softening in current consumer and dealer demand as well as greater independent dealer restocking in the prior - year period ▪ Disciplined wholesale production assisted independent dealers in maintaining appropriate channel inventory levels ahead of calendar 2024 selling season ▪ Calendar year 2023 market share of 49 . 0 % (+ 30 bps y/y) ▪ Gross profit margin decrease d riven by an increase in sales discounts, higher material costs largely due to increased chassis costs and an increase in manufacturing overhead cost as a percentage of net sales due to the reduction in net sales ▪ Order backlog of $ 1 . 24 billion

EUROPEAN SEGMENT Key Drivers ▪ Net sales increase driven by a 19 . 5 % increase in unit shipments and a 20 . 9 % increase in the overall net price per unit due to the total combined impact of changes in foreign currency, product mix and price ▪ Favorable foreign currency exchange impact of 10 . 0 % on net sales compared to prior - year period ▪ Higher concentration of sales of motorcaravans and campervans in the current fiscal quarter on improved chassis supply ▪ Gross profit margin improvement primarily driven by net selling price increases, product mix changes and a reduction in the labor and manufacturing overhead costs as a percentage of net sales ▪ Independent dealer inventory levels of motorized products generally remain below historical levels ▪ Strong order backlog of $ 3 . 33 billion ($ in Millions) First Quarter Fiscal 2024 Net Sales YOY Change Gross Profit YOY Change Gross Profit Margin YOY Change $708.2 million 40.4% $122.8 million 78.4% 17.3% 360 bps 7

8 NET DEBT / TTM EBITDA (2)(3) 1.2x NET DEBT / TTM ADJUSTED EBITDA (2)(3) 1.1x STRONG FINANCIAL POSITION ($ millions) $94.0 $59.7 1QFY23 1QFY24 OPERATING CASH FLOW TOTAL LONG - TERM DEBT AS OF OCTOBER 31, 2023 (1)(3) ($ millions) LIQUIDITY AS OF OCTOBER 31, 2023 ($ millions) SELECTED FINANCIAL RATIOS AS OF OCTOBER 31, 2023 TLB $740.3 Senior Unsecured Notes $500.0 ABL Other $0.0 $65.0 Total Long - Term Debt $1,305.3 Cash equivalents $425.8 Available credit under ABL $998.0 Total Liquidity $1,423.8 Capital Expenditures ($ millions) 1QFY23: $55.9 1QFY24: $38.2 (1) Total gross debt obligations as of October 31, 2023 inclusive of the current portion of long - term debt (2) See the Appendix to this presentation for reconciliation of non - GAAP measures to most directly comparable GAAP financial measures (3) Long - term debt figures and financial ratios shown are as of October 31, 2023 prior to our November 15, 2023 amendments to the term - loan credit facility and ABL

CAPITAL MANAGEMENT PRIORITIES AND FISCAL YEAR 2024 ACTIONS Invest in THOR’s business ▪ Capex spending of $38.2 million Pay THOR's dividend ▪ Increased regular quarterly dividend to $0.48 in October 2023 ▪ Represents 14 th consecutive year of dividend increases Reduce the Company's debt obligations ▪ Subsequent to Q 1 , entered into amendments to our term - loan credit facility to extend maturity from Feb . 2026 to Nov . 2030 and reduce the applicable margin used to determine the interest rate on the USD portion of the Term Loan B by 0 . 25 % ▪ Committed to long - term net debt leverage ratio target of less than 1.0x; currently at 1.1x Repurchase shares on a strategic and opportunistic basis ▪ Repurchased $30.0 million ▪ $461.2 million available to be repurchased as of October 31, 2023 under current authorizations Support opportunistic strategic investments 9

FULL - YEAR FISCAL 2024 GUIDANCE OUTLOOK ASSUMPTIONS ▪ Modest year - over - year consolidated net sales decline driven by anticipated reductions in overall average selling prices and lower unit shipments of motorized products, partially offset by higher anticipated wholesale shipment volumes within the North American Towable segment ▪ North American industry wholesale shipment range between 350 , 000 and 365 , 000 units for fiscal 2024 anticipated and matched 1 : 1 with retail demand ▪ Expected gross profit margin improvement largely driven by a return to more historical levels within the North American Towable segment ▪ Improved supply - demand dynamics with recalibrated dealer lot inventory ▪ Realization of sourcing strategies and value - enhancing model year 2024 product offering ▪ Investments in automation and innovation strategies expected to increase capex investments and SG&A expense as a % of sales OTHER MODELING ASSUMPTIONS $ 10.5 – $ 11.0 B NET SALES GROSS PROFIT MARGIN DILUTED EARNINGS PER SHARE 14.5 % – 15.0 % $ 6.25 – $ 7.25 ▪ Amortization of intangibles expense: $128.7 million ▪ Tax rate: between 24% and 26% (1) ▪ Full - year fiscal 2024 capital expenditures: $260 million ▪ Non - cash charge of approximately $ 20 . 0 million to be recognized in interest expense in 2 Q 24 , related to Nov . 2023 amendments to term - loan credit facility and ABL 10 (1) Before consideration of any discrete tax items

KEY TAKEAWAYS Prudent focus on operational and commercial initiatives to better position THOR and its North American dealers ahead of the calendar 2024 selling season Continued strong financial performance in our European segment driven by continued efforts of our management team, favorable price - cost realization, operational efficiencies and further improvements in chassis supply Announced a 7% increase in our regular quarterly of common $30.0 million dividend and repurchased stock, highlighting the Company’s focus to return capital to shareholders Full - year fiscal 2024 outlook reaffirmed, reflecting the strength of THOR’s flexible business model and resilience of our operating companies in navigating the current environment 11

APPENDIX 12

The Global RV Industry Leader THOR SNAPSHOT (1) (1) As of July 31, 2023 Founded 1980 Headquarters Elkhart, Indiana Countries with Distribution 25+ Team Members 24,900 Countries with Manufacturing 6 Facilities Worldwide >400 Independent Dealership Locations 3,500 NET SALES BY SEGMENT (1) NET SALES BY COUNTRY (1) United States, 66.9% Germany, 16.3% Other Europe, 11.0% Canada, 5.3% Other, 0.5% North American Towable 37.8% North American Motorized 29.8% European 27.3% Other, 5.1% EUROPEAN OTHER NORTH AMERICAN MOTORIZED NORTH AMERICAN TOWABLE 13

THOR’S PRODUCT LEADERSHIP ( 1 ) As of calendar YTD September 30 , 2023 . Data reported by Statistical Surveys, Inc is based on official state and provincial records . This information is subject to adjustment, is continuously updated and is often impacted by delays in reporting by various states or provinces . European data is sourced from industry retail registrations statistics that have been compiled from individual countries’ reporting of retail sales . E U R O P E A N All RV Segments N O R T H A M E R I C A N CATEGORY Class B Class C Class A Fifth Wheels Travel Trailers 20.4% 38.3% 54.5% 51.0% 44.3% 41.6% MARKET SHARE (1) #2 #1 #1 #1 #1 #1 MARKET POSITION (1) 14

120.8 121.1 156.5 176.5 201.3 194.3 192.2 199.5 229.1 249.7 239.1 207.6 250.6 258.9 298.3 323.0 334.5 298.1 208.6 152.4 217.1 227.6 257.6 282.8 312.8 326.9 442.0 426.1 376.0 359.4 389.6 544.0 434.9 316.8 249.3 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 (e) (e) 173.1 163.1 203.4 227.8 259.5 247.2 247.5 254.6 292.7 321.2 300.1 256.8 311.0 320.9 370.0 384.5 390.4 353.5 237.0 165.6 242.3 252.4 285.7 321.1 430.7 356.7 374.2 504.6 483.7 406.1 430.4 600.2 493.3 297.1 369.7 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 (e) (e) TOWABLE RV WHOLESALE MARKET TRENDS (UNITS 000's) YTD Shipments (Units) Sept. 2023 238,121 Sept. 2022 415,594 Unit Change (177,473) % Change (42.7)% YTD Shipments (Units) Sept. 2023 202,361 Sept. 2022 369,772 Unit Change (167,411) % Change (45.3)% 52.3 41.9 46.9 51.3 58.2 52.8 55.3 55.1 63.5 71.5 61.0 49.2 60.4 62.0 71.7 61.4 55.8 55.4 28.4 13.2 25.2 24.8 28.2 38.3 44.0 47.3 54.7 62.6 57.6 46.6 40.8 56.2 58.4 47.8 52.9 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 (e) (e) YTD Shipments (Units) % Change Unit Change Sept. 2022 Sept. 2023 (22.0)% (10,062) 45,822 35,760 Historical Data: Recreation Vehicle Industry Association (RVIA) RV INDUSTRY OVERVIEW North America RV WHOLESALE MARKET TRENDS (UNITS 000's) MOTORIZED RV WHOLESALE MARKET TRENDS (UNITS 000's) (e) Calendar year 2023 and 2024 represent the most recent RVIA "most likely" estimate from their August 2023 issue of Roadsigns 15

Europe (1) Source : European Caravan Federation; CYTD through September 30, 2023 and 2022; European retail registration data available at www.CIVD.de % Change Total CYTD September 30, 2023 2022 % Change Motorcaravans CYTD September 30, 2023 2022 % Change Caravans CYTD September 30, 2023 2022 Country (2.4)% 78,011 76,128 0.8 % 56,901 57,376 (11.2)% 21,110 18,752 Germany (4.3)% 25,875 24,758 (4.6)% 20,031 19,102 (3.2)% 5,844 5,656 France 0.7 % 20,012 20,148 5.5 % 9,469 9,990 (3.7)% 10,543 10,158 U.K. (16.0)% 9,112 7,655 (3.1)% 2,011 1,949 (19.6)% 7,101 5,706 Netherlands (13.8)% 7,631 6,581 (11.4)% 6,044 5,353 (22.6)% 1,587 1,228 Switzerland (32.6)% 5,966 4,024 (26.2)% 3,069 2,266 (39.3)% 2,897 1,758 Sweden (5.6)% 5,461 5,155 (5.8)% 4,919 4,634 (3.9)% 542 521 Italy (8.8)% 6,395 5,833 (5.3)% 5,218 4,943 (24.4)% 1,177 890 Belgium (12.8)% 5,831 5,082 (8.5)% 4,482 4,099 (27.1)% 1,349 983 Spain (17.2)% 20,036 16,581 (16.7)% 12,325 10,272 (18.2)% 7,711 6,309 All Others (6.7)% 184,330 171,945 (3.6)% 124,469 119,984 (13.2)% 59,861 51,961 Total The Company monitors retail trends in the European RV market as reported by the European Caravan Federation, whose industry data is reported to the public quarterly Industry wholesale shipment data for the European RV market is not available 201 192 146 138 135 140 143 152 162 166 174 182 198 203 210 208 189 154 150 156 147 137 140 152 168 190 202 211 236 261 218 144 141 170 162 151 182 217 222 219 220 253 272 274 251 274 292 324 320 310 366 289 206 228 247 264 304 333 376 416 471 493 465 522 570 449 North America 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 FULL - YEAR COMPARISON OF NEW VEHICLE REGISTRATIONS BY CONTINENT (UNITS 000's) (1) (2) RV INDUSTRY OVERVIEW Europe EUROPEAN INDUSTRY UNIT REGISTRATIONS BY COUNTRY (1) (2) Source : Statistical Surveys; North American retail registration data available at www.statisticalsurveys.com 16

17 Intention to RV is high Consumer satisfaction among RV owners is very strong RV Owner future purchase intent is high Interest in the RV lifestyle continues to exceed pre - pandemic levels 38 % CONSUMER TRENDS SUPPORT LONG - TERM RV INDUSTRY GROWTH Supported by Real Data from RVers 99 % 20 Million (1) SimilarWeb; U.S. data, only; (2) 2022 THOR North American Travel Trailer Study; (3) 2022 THOR North American Fifth Wheel Study; (4) 2023 THOR North American Class A RV Study; (5) 2022 THOR North American Class C RV Study; (6) RVIA 2023 RV Holiday Travel survey 92 % of Travel Trailer Owners plan to purchase an RV in the future; intention is also high across RV types: Class A RV (93%), Camper Van (57%), Class C RV (96%), Fifth Wheel (95%) (2) (3) (4) (5) increase in RV OEM website traffic when comparing 4QFY23 to 4QFY19 RV Dealership (up 67%), Campground Booking (up 53%), and RV Rental (up 70%) websites also experienced increases (1) of Class C Owners report satisfaction with their units, while Class A RV (96%), Camper Van (97%), Travel Trailer (94%) and Fifth Wheel (96%) Owners also report strong satisfaction (2) (3) (4) (5) Americans are estimated to be planning to take an RV trip between Thanksgiving and New Year’s Day (6)

18 QUARTERLY EBITDA RECONCILIATION ($ in thousands) TTM Fiscal Quarters TTM $ 291,850 1QFY24 $ 55,033 4QFY23 $ 91,282 3QFY23 $ 119,729 2QFY23 $ 25,806 1QFY23 $ 137,423 Net Income Add Back: 94,837 20,197 22,645 26,362 25,633 22,807 Interest Expense, Net 100,814 17,549 40,631 35,722 6,912 41,848 Income Taxes 277,213 67,278 74,102 68,151 67,682 66,993 Depreciation and Amortization $ 764,714 $ 160,057 $ 228,660 $ 249,964 $ 126,033 $ 269,071 EBITDA Add Back: 41,572 10,452 12,905 9,672 8,543 8,392 Stock - Based Compensation Expense 19,652 — 5,352 6,500 7,800 5,500 Change in LIFO Reserve Net (Income) Expense Related to Certain (13,939) (10,000) (1,733) (1,006) (1,200) (1,900) Contingent Liabilities (6,320) (979) 714 (295) (5,760) (202) Non - Cash Foreign Currency Loss (Gain) Market Value Loss (Gain) on Equity 10,722 2,871 3,476 2,682 1,693 3,044 Investments 16,371 5,935 5,748 4,688 — — Equity Method Investment Loss (Gain) (11,457) (1,418) (5,042) — (4,997) — Other Loss (Gain), Including Sales of Property, Plant and Equipment $ 821,315 $ 166,918 $ 250,080 $ 272,205 $ 132,112 $ 283,905 Adjusted EBITDA $ 10,514,280 $ 2,500,759 $ 2,738,066 $ 2,928,820 $ 2,346,635 $ 3,108,084 Net Sales 7.8 % 6.7 % 9.1 % 9.3 % 5.6 % 9.1 % Adjusted EBITDA Margin (%) Total Long - Term Debt as of October 31, 2023 (1) Less Cash and Cash Equivalents Net Debt Net Debt / TTM EBITDA Net Debt / TTM Adjusted EBITDA (1) Total debt obligations as of October 31, 2023 inclusive of the current portion of long - term debt Adjusted EBITDA is a non - GAAP performance measure included to illustrate and improve comparability of the Company's results from period to period . Adjusted EBITDA is defined as net income before net interest expense, income tax expense and depreciation and amortization adjusted for certain items and other one - time items . The Company considers this non - GAAP measure in evaluating and managing the Company's operations and believes that discussion of results adjusted for these items is meaningful to investors because it provides a useful analysis of ongoing underlying operating trends . The adjusted measures are not in accordance with, nor are they a substitute for, GAAP measures, and they may not be comparable to similarly titled measures used by other companies . $ 1,305,297 425,828 $ 879,469 1.2 x 1.1 x

www.thorindustries.com INVESTOR RELATIONS CONTACT Michael Cieslak, CFA mcieslak@thorindustries.com (574) 294 - 7724

Exhibit 99.3

FIRST QUARTER FISCAL 2024

INVESTOR QUESTIONS & ANSWERS

December 6, 2023

Forward-Looking Statements

Reference is made to the forward-looking statements

disclosure provided at the end of this document.

Executive Overview

Fiscal First Quarter 2024 Highlights

| • | Net sales for the first quarter were $2.50 billion. |

| • | Consolidated gross profit margin for the first quarter was 14.3%. |

| • | Net income attributable to THOR Industries and diluted earnings per share for the first quarter of fiscal

2024 were $53.6 million and $0.99, respectively. |

| • | During the first quarter, the Company continued to return capital to shareholders through its share repurchase

program, repurchasing $30.0 million of common stock, bringing the total amount repurchased since the initial authorization in December

2021 to $237.2 million. |

| • | The Company reaffirms its full-year fiscal 2024 consolidated net sales, consolidated gross profit margin

and diluted earnings per share guidance. |

Quick Reference to Contents

| Current Market Conditions and Outlook Assumptions |

2 |

| Q&A |

|

| |

|

Market Update |

3 |

| |

|

Operations Update |

4 |

| |

|

Financial Update |

6 |

| Segment Data |

|

| |

|

Summary of Key Quarterly Segment Data – North American Towable RVs |

8 |

| |

|

Summary of Key Quarterly Segment Data – North American Motorized RVs |

9 |

| |

|

Summary of Key Quarterly Segment Data – European RVs |

10 |

| Forward-Looking Statements |

11 |

Current Market Conditions and Outlook Assumptions

| • | Market demand conditions in North America. |

The RV industry’s calendar 2023

retail sales have been impacted by the current macroeconomic conditions faced by consumers and dealers, including higher inflation and

interest rates. While near-term North American industry retail demand has significantly softened from the record calendar 2021 level and

strong 2022 levels, we anticipate the recent softened demand to be temporary as interest in the RV lifestyle continues to grow. To be

clear, we acknowledge that the temporary nature of the soft demand is directly tied to strong headwinds faced by consumers from the current

macroeconomic environment and expect that the softness will persist until those forces begin to ease up on the consumer. The Recreational

Vehicle Industry Association’s (“RVIA”) August 2023 forecast estimates total North American wholesale shipments in calendar

year 2023 to be between 287,200 and 307,000 units, down from the record wholesale unit shipments in calendar year 2021 of 600,240 and

wholesale unit shipments in calendar 2022 of 493,268. For calendar year 2024, the RVIA projects that the industry will return to growth

with a forecasted wholesale unit shipment range between 363,700 and 375,700 units.

| • | Market demand conditions in Europe. |

Similar to North America, European retail

sales have been impacted by current macroeconomic conditions. However, as a result of persistent chassis supply constraints that have

limited the level of motorized product output, we have seen relative strength in retail registrations in Europe when compared to North

America. According to the European Caravan Foundation (“ECF”), total retail registrations in Europe for the first nine months

of calendar year 2023 decreased 6.7% compared to the same period of calendar 2022. Due to chassis constraints, independent RV dealer inventory

levels of our motorized European RV products are generally below pre-pandemic levels in certain of the various countries we serve, including

within Germany, which accounts for approximately 60% of our European product sales.

Consolidated RV backlog was $5.4 billion

as of October 31, 2023. North American RV backlog was $2.0 billion as of October 31, 2023, a decrease of 54.1% compared to $4.4 billion

as of October 31, 2022. European RV backlog was $3.3 billion as of October 31, 2023, an increase of 11.6% compared to $3.0 billion as

of October 31, 2022.

| • | Near-term and long-term RV industry outlook in both North America and Europe. |

The RV industry has experienced a slowdown

in retail activity as consumers have been adversely impacted by elevated unit prices, higher interest rates, and overall inflation impacting

many facets of their budget. However, high RV utilization, strong show attendance and high repeat buyer intentions in the face of this

decreasing appetite to purchase in the short-term exhibits the resilience of consumer interest in the RV lifestyle. While we remain cautious

and continue to expect near-term demand to be materially impacted by the current macroeconomic conditions, particularly in North America,

our long-term optimism remains undeterred. Our positive long-term outlook is supported by favorable demographics, strong interest in the

RV lifestyle and a favorable perception of RVing as promoting a safe and healthy lifestyle. Numerous studies conducted by THOR, RVIA and

others show that people of all generations love the freedom of the outdoors and that RVers are extremely satisfied with their RV experience.

The growth in industry-wide RV sales in recent years has also resulted in exposing a much broader range of consumers to the lifestyle.

We believe many of those who have been recently exposed to the industry for the first time will become future owners, and that those who

became first-time owners during the pandemic will become long-term RVers - resulting in future trade-in sales opportunities. In addition,

we view the significant investments by independent dealers, campground owners and various governmental agencies into camping and RV facilities

to be positive long-term factors, which should only further enhance the experience of current RVers and encourage new buyers to enter

the lifestyle.

Q&A

MARKET UPDATE

| 1. | Can you comment on the North American market demand environment? What is your current forward-looking

outlook? |

| a. | North American retail activity continues to be challenged in calendar 2023 as a result of near-term macroeconomic

pressures adversely impacting consumer sentiment and demand. Given these pressures, the RV industry has seen a calendar year-over-year

decline in North American retail registrations of approximately 17% through September 30, 2023. As we approach calendar year-end, we project

calendar 2023 North American retail registrations to exceed 370,000 units. Looking ahead, we remain cautiously optimistic that retail

demand begins to stabilize as we move through calendar 2024 as consumers adjust to the macro environment and our industry recalibrates

its pricing and product offerings to address affordability challenges. For fiscal 2024 planning purposes, we continue to forecast an industry

retail demand range of between 350,000 and 365,000 units, which assumes some modest softening in year-over-year retail registration trends

to begin calendar 2024. Furthermore, while we anticipate a mix shift towards more affordable RV products, the breadth of our product offering

across product categories and price points allows us to quickly pivot to evolving market demands. |

While we acknowledge there is still

a range of potential retail sales scenarios, we remain fully confident that we will see a positive inflection in future retail demand

once near-term macroeconomic pressures subside. Based upon recent THOR and industry studies, we remain strongly optimistic about both

the industry’s and THOR’s future growth. This longer-term optimism is supported by data that indicates interest in the RV

lifestyle continues to exceed pre-pandemic levels, RV utilization remains high, consumer satisfaction among RV owners is very strong,

and repeat buyer intentions reaffirm the “stickiness” of the RV lifestyle. Of recent note, according to the RVIA 2023 RV holiday

travel survey, 20 million Americans are planning to take an RV trip between Thanksgiving and New Year’s Day.

| 2. | What is the near-term outlook of your North American independent dealers? What are the expected ordering

patterns in this macro environment? |

| a. | The current North American dealer outlook continues to be cautious. Given a slower retail environment

in calendar 2023 and rising floorplan costs associated with higher interest rates, our independent dealers are taking a more conservative

approach to inventory management entering the winter months. While we currently believe North American dealer inventory positions are,

on balance, relatively healthy and fresh, dealers are still expected to remain hesitant to hold excess inventory ahead of the calendar

2024 retail show and selling season with a continued focus on rightsizing prior model year inventory levels during the seasonally slower

months. Looking to calendar 2024, we anticipate dealers will closely monitor consumer traffic and sales conversions, but we do

expect to see the continuation of cautious ordering patterns in the wholesale channel consisting of smaller, more frequent orders as dealers

operate in a higher interest rate environment. We view this as a positive development as we believe the proactive planning discussions

taking place between our operating companies and independent dealer partners will result in improved inventory sell-through trends and

higher margins earned across our brands relative to previous years. |

OPERATIONS UPDATE

| 1. | Can you comment on production and the cadence of North American wholesale shipments for the balance

of fiscal 2024? |

| a. | Consistent with our disciplined production approach in fiscal 2023, during the first quarter, our North

American operating teams continued to sustain production levels lower than demand levels heading into the off-season months. In the fiscal

first quarter, we were able to assist independent dealers in successfully destocking approximately 3,700 units from channel inventory.

As a result, North American dealer inventory levels of THOR products approximated 83,800 units at October 31, 2023, down significantly

from the 122,300 units at October 31, 2022 and the 113,000 units six months ago at April 30, 2023. Our operating plan for fiscal 2024

continues to be focused on matching wholesale production to our forecasted industry retail demand range of between 350,000 to 365,000

units. |

Our focus for the second fiscal quarter

of 2024 is to slow our production output through reduced production rates and extended holiday shutdowns to closely align wholesale shipments

to match current levels of retail in an effort to assist our independent dealers in mitigating the impact of higher interest rates and

other carrying costs while rebalancing the mix of channel inventory. For this reason, we expect a rather modest restocking of dealer inventory

in the second quarter of our fiscal 2024 compared to most previous years. As we enter the second half of fiscal 2024, we expect a pronounced

ramp up of wholesale shipments that aligns closely with the pace of retail sales entering the prime selling season.

Given the anticipated ramp up of orders

in the third fiscal quarter, during the second quarter our teams will be selectively building “open” units for core brands.

Consistent with normal course of business, this approach allows us to maximize labor efficiencies while also being sensitive to dealer

inventory levels in this higher interest rate environment. Compared to last year, channel inventory levels are healthier and THOR companies

will continue to manage production in a disciplined manner.

| 2. | Can you comment on North American average wholesale selling prices? Where do you see average wholesale

selling prices trending in fiscal 2024? |

| a. | As we indicated last quarter, we expect to reduce the average wholesale prices of our North American towable

and motorized products in fiscal 2024 as a result of our enacted strategies focused on creating buying propositions for retail customers

and mix shifts towards more moderately-priced units. In the first quarter of fiscal 2024, we did see a low-double-digit decline in the

average wholesale selling price for towable products when compared to the average wholesale selling prices in the fourth quarter of fiscal

2023. While we continued to realize relief on certain input costs and further introduced our model year 2024 product offering at value

price points, the sequential decline in the North America Towable average selling price was also impacted more-than-previously-anticipated

by product mix shifts towards entry-level and travel trailer units. On a year-over-year basis, the average wholesale selling price for

towable products decreased by a high-teens percentage, reflective of product mix changes, realized cost relief and unit recontenting as

well as increased sales discounts. |

The shift in mix toward lower-priced

towable units also aligns with the strategic priorities of our independent dealers to focus on increasing inventory turnover and effectively

managing floorplan financing. With elevated interest rates and the potential for lender curtailments adversely affecting dealer cash flow,

dealers have focused on reducing borrowings on floorplan lines and focusing on more rapidly turning units to enhance cash conversion.

Dealers and manufacturers focusing on products that most resonate with consumers creates a more healthy supply and demand dynamic as the

broader economy begins to strengthen.

Looking ahead, we will continue to work

closely with our independent dealer partners in monitoring retail sales trends. The breadth of our product offering across product categories

and price points and continuous focus on product repositioning allows us to quickly pivot to evolving market demands, which will impact

average selling prices.

With respect to average wholesale selling

prices for motorized products, we have seen more modest decreases on both a sequential and year-over-year basis as a result of continued

inflationary pressures on chassis partially offsetting other factors. Looking ahead, subject to any pronounced mix shift changes, we do

not expect any material deviation in average selling prices for motorized products from fiscal first quarter levels.

| 3. | Can you comment on the strong first quarter of fiscal 2024 performance and the outlook of THOR Industries’

European segment? |

| a. | Our European segment reported positive income before income taxes in the fiscal first quarter for the

first time since acquiring EHG in fiscal 2019. The strong fiscal first quarter performance built off the robust European performance in

fiscal 2023 and once again demonstrated the efforts of our European management team, favorable price-cost realization, operational efficiencies

and improvements in chassis supply necessary to further restock dealer inventory levels of motorized product. Despite macroeconomic softness

and uncertainty in Europe, overall European RV retail registrations decreased only 6.7% in the first nine months of calendar 2023 compared

to the same period in calendar 2022. In Germany and France, our largest European markets, RV retail registrations decreased just 2.4%

and 4.3%, respectively, in the first nine months of calendar 2023. |

Looking ahead, our fiscal 2024 operating

plan continues to be based on a low-double-digit decrease in retail registrations compared to fiscal 2023. While we continue to expect

dealer inventory levels in our primary markets to reach normalized levels for the majority of our brands by the end of our fiscal second

quarter, we are extremely pleased with the continued efforts of our European team to strengthen its operations and profitability. Our

European team continues to be focused on diversifying our supply chain and driving efficiencies across our manufacturing footprint in

an effort to sustain the long-term profitability profile of the European business.

| 4. | Airxcel has recently received additional attention coming out its OEM Product Showcase and Dealer Open

House. What were the takeaways? |

| a. | A central purpose for the Airxcel acquisition in calendar 2021 was to ensure a robust and competitive

supply chain marketplace. Over the past year, Airxcel has invested heavily in its business to expand its product lineup. Through product

line extensions and the introduction of new products and brands, Airxcel has positioned itself to support and gain market share with THOR,

and non-THOR, OEMs looking to differentiate their products within product categories historically dominated by one or two suppliers. Airxcel’s

Product Showcase in October served as a forum to display the breadth of Airxcel’s product lineup. The feedback was very positive

with daily OEM prototyping discussions taking place since the showcase. As a result, we are encouraged by Airxcel’s growth prospects

moving forward. |

At the same time, we will maintain strong

relationships with each of our existing key suppliers as we continue to collaborate on the development of new products, dual source components

and build a resilient industry supply chain in an effort to drive positive outcomes for our core OEM businesses.

FINANCIAL UPDATE

| 1. | The Company reaffirmed its financial guidance for full-year fiscal 2024 in its press release today.

What are the key assumptions included in your outlook? |

| a. | The Company reaffirmed its full-year fiscal 2024 guidance, which includes: |

| • | Consolidated fiscal 2024 net sales in the range of $10.5 billion to $11.0 billion |

| • | Consolidated gross profit margin for fiscal 2024 in the range of 14.5% to 15.0% |

| • | Diluted earnings per share for fiscal 2024 in the range of $6.25 to $7.25 |

Net Sales. The forecasted

year-over-year decrease in consolidated net sales is driven by anticipated reductions in average selling prices and lower unit shipments

of motorized products, partially offset by higher anticipated wholesale shipment volumes within the North American Towable segment. In

North America, the Company’s operating plan for fiscal 2024 continues to reflect an industry wholesale shipment range of between

350,000 and 365,000 units with wholesale shipments approximating retail demand. Given the magnitude of destocking for North American towable

products in fiscal 2023, we anticipate fiscal 2024 shipments with our North American Towable segment to increase and align more closely

with retail demand. Conversely, we anticipate lower fiscal 2024 wholesale shipments within our North American Motorized segment relative

to fiscal 2023 as we also return to a 1:1 wholesale-retail relationship. As a reminder, for the Motorized segment, we faced a challenging

fiscal 2024 first quarter comparison to the prior-year quarter as a result of significant independent dealer restocking of North American

motorized product in the first quarter of fiscal 2023. In our European segment, we also expect to return to a 1:1 wholesale-retail relationship

as we expect dealer inventory levels in our primary markets to reach normalized levels for the majority of our brands by the end of our

fiscal second quarter. As a result, we anticipate tougher year-over-year net sales comparisons in the second half of fiscal 2024.

Gross Profit Margin. Despite

lower forecasted year-over-year consolidated net sales, we still expect to realize improved consolidated gross profit margin performance

in fiscal 2024 as our North American Towable segment gross profit margin returns to more historical levels. Our efforts in fiscal 2023

and the first quarter of fiscal 2024 to assist North American independent dealers in significantly reducing lot inventory of towable products,

as well as rebalancing the mix of product, better positions THOR and its independent dealers entering the prime retail selling season

of calendar 2024. In addition to benefiting from recalibrated dealer lot inventory, a return to a more normalized production planning

environment that aligns to stabilizing market demand trends should enable our operating teams to optimize their respective labor and overhead

cost structures. Additionally, we expect to benefit from our sourcing strategies and value-enhancing product offerings, which in turn

assists our independent dealers’ response to consumer demands in this current environment.

Also, while we are mindful that a level

of incentives and promotional activity is necessary to assist our independent dealers in moving product through the channel, our efforts

to assist with product flow are governed by a balanced philosophy of margin protection, which may at times result in temporary market

share losses. Given this philosophy, along with our prudent focus on operational execution in the current down cycle, we do not anticipate

the level of towable incentives in fiscal 2024 to be of the same magnitude when compared to fiscal 2023.

Capital Expenditures and Innovation.

Despite the challenging macro backdrop, we remain committed to driving gross profit margin improvement and long-term growth. As such,

in fiscal 2024, we plan to make incremental investments in automation and innovation strategies which are expected to increase both capital

expenditures with construction projects and the purchase of capital equipment (capital expenditures approximated to be $260 million for

fiscal 2024), as well as SG&A as a percent of sales as a result of additional research and development expenses (SG&A expected

to approximate 8.0% of net sales). As referenced above, our investment in innovation is viewed by management as essential to our long-term

growth strategy, and the investments slated for fiscal 2024 are focused on further execution of these strategies.

Tax Rate. For fiscal 2024,

we plan for our annual effective income tax rate to remain essentially flat to fiscal 2023 with an estimated range between 24.0% and 26.0%

before consideration of any discrete tax items.

Other Modeling Assumptions.

On November 15, 2023, the Company entered into amendments to both its term loan and ABL agreements. As a result of amendments and associated

maturity date extensions, the Company expects to recognize total expense of approximately $20.0 million in the second quarter of

fiscal 2024, which will primarily be a non-cash extinguishment charge included in interest expense. In addition, in the second quarter

of fiscal 2024 the Company will capitalize applicable financing costs related to these amendments which will be amortized over the remaining

term of the amended term loan and ABL agreements.

Additionally, for the full-year fiscal

2024, we expect amortization expense related to intangible assets to be $128.7 million.

| 2. | Can you comment on expected cash flow generation and capital allocation priorities for fiscal 2024? |

| a. | We expect to generate solid net cash flow from operations for fiscal 2024, driven primarily by operating

results as we do not expect changes in net working capital to provide a similar level of operating cash for the Company compared to fiscal

2023. Consistent with historical seasonality, we expect the majority of our cash flow generation to be realized in the second half of

the fiscal year. |

Our anticipated cash flow generation

will allow us to maintain our balanced capital allocation strategy. We will continue to focus on reinvesting in our businesses, paying

our dividend - which we have increased annually for 14 consecutive years (including the increase announced in October 2023), reducing

our debt obligations and repurchasing THOR stock on an opportunistic basis while making selective tuck-in acquisitions or strategic investments

in long-term growth initiatives that we expect to enhance long-term shareholder value. Consistent with our historical approach, we expect

to be disciplined, flexible and balanced in how we deploy capital to generate the greatest return for our shareholders.

Summary of Key Quarterly Segment Data – North American

Towable RVs

Dollars are in thousands

| NET SALES: | |

Three Months Ended October 31, 2023 | | |

Three Months Ended October 31, 2022 | | |

% Change |

| North American Towable | |

| | | |

| | | |

|

| Travel Trailers | |

$ | 619,538 | | |

$ | 822,869 | | |

(24.7) |

| Fifth Wheels | |

| 325,916 | | |

| 494,937 | | |

(34.2) |

| Total North American Towable | |

$ | 945,454 | | |

$ | 1,317,806 | | |

(28.3) |

| # OF UNITS: | |

Three Months Ended October 31, 2023 | | |

Three Months Ended October 31, 2022 | | |

% Change |

| North American Towable | |

| | | |

| | | |

|

| Travel Trailers | |

| 22,630 | | |

| 25,355 | | |

(10.7) |

| Fifth Wheels | |

| 5,477 | | |

| 6,936 | | |

(21.0) |

| Total North American Towable | |

| 28,107 | | |

| 32,291 | | |

(13.0) |

| ORDER BACKLOG | |

As of October 31, 2023 | | |

As of October 31, 2022 | | |

% Change |

| North American Towable | |

$ | 795,798 | | |

$ | 1,567,829 | | |

(49.2) |

| | |

| | | |

| | | |

|

| | |

| | | |

| | | |

|

| TOWABLE RV MARKET SHARE SUMMARY (1) | |

| Calendar Year to Date

September 30, | | |

|

| | |

| 2023 | |

| 2022 | |

|

| U.S. Market | |

| 40.8 | % | |

| 41.0 | % | |

|

| Canadian Market | |

| 42.0 | % | |

| 41.4 | % | |

|

| Combined North American Market | |

| 41.0 | % | |

| 41.0 | % | |

|

(1) Source: Statistical Surveys, Inc. CYTD September

30, 2023 and 2022.

Note: Data reported by Stat Surveys is based on

official state and provincial records. This information is subject to adjustment, is continuously updated, and is often impacted by delays

in reporting by various states or provinces.

Summary of Key Quarterly Segment Data –

North American Motorized RVs

Dollars are in thousands

| NET SALES: | |

Three Months Ended October 31, 2023 | | |

Three Months Ended October 31, 2022 | | |

% Change |

| North American Motorized | |

| | | |

| | | |

|

| Class A | |

$ | 207,911 | | |

$ | 404,578 | | |

(48.6) |

| Class C | |

| 333,776 | | |

| 490,787 | | |

(32.0) |