false

0000850209

0000850209

2023-11-29

2023-11-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 29, 2023

Foot Locker, Inc.

(Exact name of registrant as specified in charter)

|

New York

|

1-10299

|

13-3513936

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

330 West 34th Street, New York, New York 10001

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (212) 720-3700

|

|

(Former name or former address, if changed since last report.)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on

which registered

|

|

Common Stock, par value $0.01 per share

|

|

FL

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02.

|

Results of Operations and Financial Condition.

|

On November 29, 2023, Foot Locker, Inc. (the “Company”) issued a press release (the “Press Release”) announcing its third quarter 2023 financial and operating results. A copy of the Press Release is furnished as Exhibit 99.1 to this Current Report on Form 8-K, which, in its entirety, is incorporated herein by reference.

The Company is hosting a conference call on November 29, 2023 to discuss its third quarter 2023 financial and operating results, during which the Company will provide an update on the business.

The Company is making reference to financial measures not presented in accordance with U.S. generally accepted accounting principles (“GAAP”) in the Press Release, an investor presentation concerning its third quarter 2023 financial and operating results (the “Investor Presentation”), and a conference call. A reconciliation of these non-GAAP financial measures to the nearest comparable GAAP financial measures is contained in the Press Release. The Company believes these non-GAAP financial measures provide useful information to investors because they allow for a more direct comparison of its third quarter 2023 performance to its performance in the comparable prior-year period. The non-GAAP financial measures are provided in addition to, and not as an alternative to, the Company’s reported results prepared in accordance with GAAP. A reconciliation to GAAP is provided in the Condensed Consolidated Statements of Operations.

The information contained in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such filing.

|

Item 7.01.

|

Regulation FD Disclosure.

|

In conjunction with the Press Release, the Company also made available the Investor Presentation. The Investor Presentation, which is available under the “Investor Relations” section of the Company’s corporate website, located at investors.footlocker-inc.com, is included as Exhibit 99.2 to this Current Report on Form 8-K, which, in its entirety, is incorporated herein by reference. Information on the Company’s corporate website is not, and will not be deemed to be, a part of this Current Report on Form 8-K or incorporated into any other filings the Company may make with the U.S. Securities and Exchange Commission.

The information contained in Item 7.01 of this Current Report on Form 8-K, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, and shall not be deemed incorporated by reference into any filing under the Securities Act, or the Exchange Act, except as expressly set forth by specific reference in such filing.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

| |

|

| (d) |

Exhibits. |

SIGNATURE

Pursuant to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

FOOT LOCKER, INC.

|

| |

|

|

Date: November 29, 2023

|

By:

|

/s/ Michael Baughn

|

| |

|

Name: |

Michael Baughn |

| |

|

Title: |

Executive Vice President and

Chief Financial Officer

|

Exhibit 99.1

N E W S R E L E A S E

| Contacts: |

Kate Fitzsimons

Investor Relations

ir@footlocker.com

(212) 720-4600

Olivia Mata

Corporate Communications

mediarelations@footlocker.com

(815) 763-3159

|

FOOT LOCKER, INC. REPORTS 2023 THIRD QUARTER RESULTS; NARROWS 2023 OUTLOOK

● Total Sales Decreased 8.6%; Comparable-Store Sales Decreased 8.0%

● EPS of $0.30 and Non-GAAP EPS of $0.30

● Narrowing 2023 Sales and Earnings Guidance Range

● Investing in Basketball with NBA Partnership and Home Court Initiative

● Strategically Entering India with License Partners

NEW YORK, NY, November 29, 2023 – Foot Locker, Inc. (NYSE: FL), the New York-based specialty athletic retailer, today reported financial results for its third quarter ended October 28, 2023.

Mary Dillon, President and Chief Executive Officer, said, “We delivered third quarter results that were ahead of our expectations as strong execution and early progress against our Lace Up plan improved conversion trends across channels. Looking forward, we are updating our outlook to reflect the momentum we have in our strategic initiatives into the fourth quarter, which includes strong results over the Thanksgiving week period, against the backdrop of ongoing consumer uncertainty. As such, we are narrowing our 2023 outlook and still expect to end the year with inventory levels flat to down slightly, as compared with the prior year.”

Ms. Dillon continued, “As we move into the fourth quarter, we are thrilled to be partnering with the NBA as an official league marketing partner in the U.S. Combined with the recent rollout of our Home Court experience, we believe this will drive deeper engagement with our customers and cement Foot Locker’s leadership at the center of basketball and sneaker culture. We look forward to rounding out our reset year and building on our progress in 2024 and beyond, and we are confident we are on the right path to delivering longer-term shareholder value.”

Third Quarter Results

| |

●

|

Total sales decreased by 8.6%, to $1,986 million, as compared with sales of $2,173 million in the third quarter of 2022. Excluding the effect of foreign exchange rate fluctuations, total sales for the third quarter decreased by 10.0%.

|

| |

●

|

Comparable-store sales decreased by 8.0%, driven by ongoing consumer softness, changing vendor mix, and a 3% negative impact from the repositioning of Champs Sports.

|

Please refer to the Sales by Banner table below for detailed sales performance by banner and region.

| |

●

|

Gross margin declined by 470 basis points as compared with the prior-year period, driven by higher markdowns as well as occupancy deleverage and higher shrink.

|

-MORE-

| |

●

|

SG&A increased by 100 basis points as a percentage of sales compared with the prior-year period, with savings from the cost optimization program more than offset by underlying deleverage on the sales decline, inflation, and investments in front-line wages and technology. |

| |

●

|

Net income was $28 million in the third quarter, as compared with net income of $96 million in the corresponding prior-year period. On a Non-GAAP basis, net income was $28 million, as compared with $121 million in the corresponding prior-year period.

|

| |

●

|

For the quarter, the Company had earnings of $0.30 per share, as compared with $1.01 per share in the third quarter of 2022. Non-GAAP earnings per share decreased to $0.30 per share, as compared with $1.27 per share in the corresponding prior-year period.

|

See the tables below for the reconciliation of Non-GAAP measures.

Balance Sheet

At quarter-end, the Company’s cash and cash equivalents totaled $187 million, while debt on its balance sheet was $449 million.

As of October 28, 2023, the Company’s merchandise inventories were $1.9 billion, 10.5% higher than at the end of the third quarter last year, including an approximate 6.0% impact from the strategic pull-forward of inventory into the third quarter to best position the Company for the upcoming holiday season. Excluding the effect of foreign currency fluctuations, merchandise inventories increased by 9.9% as compared with the third quarter of last year.

Dividend and Share Repurchases

During the third quarter of 2023, the Company paid a quarterly dividend of $0.40 per share for a total of $38 million.

As previously announced, the Company has paused dividends to increase balance sheet flexibility in support of longer-term strategic initiatives.

The Company did not repurchase any shares during the third quarter.

Investing in Basketball Leadership

On November 16, 2023, Foot Locker and the National Basketball Association (NBA) announced a multi-year partnership under which Foot Locker will serve as an official league marketing partner in the U.S. This collaboration, which builds on a partnership history dating back to 1999, will enable Foot Locker to meaningfully engage with fans throughout the NBA season – including at marquee league events such as NBA All-Star – while celebrating the intersection of basketball and sneaker culture.

Foot Locker also will receive media exposure across league platforms, including on-court virtual signage during national broadcasts and on NBA social media channels. Additionally, the partnership will be extended to Foot Locker's loyalty program, FLX, providing additional connection points for customers throughout the season.

In early November, Foot Locker rolled out its new global platform, The Heart of Sneakers, featuring a star-studded range of NBA talent including Nike’s Kevin Durant, adidas’ Anthony Edwards, Puma’s LaMelo Ball and Under Armour’s Steph Curry, in an engaging holiday campaign. The NBA partnership – supported by authentic brand campaigns – underscores Foot Locker’s rich history and longstanding connection to basketball and sneaker culture.

-MORE-

Foot Locker also recently began rolling out its Home Court experience in select locations in the U.S. Home Court brings the excitement and passion of basketball to customers in a multi-branded concept designed with elevated merchandising and storytelling. By creating distinct, basketball-led experiences for its customers, as well as players, fans, creators and sneakerheads, Foot Locker is investing in its basketball leadership while also supporting category growth across its brand partners.

Announcing Entry into India

As part of its efforts to pursue growth through license partners in newer markets, while still focusing on core banners and regions, Foot Locker also announced today its entry into India in 2024. The Company has entered into long-term licensing agreements with two strong operators in India – Metro Brands Limited (MBL), one of India’s largest footwear and accessories specialty retailers, and Nykaa Fashion, a highly curated fashion and ecommerce destination showcasing #FirstInFashion selections from both domestic and global brands, attracting over 17.6 million monthly visitors. Under the terms of the agreements, MBL is granted exclusive rights to own and operate Foot Locker stores within India and to sell authorized merchandise in Foot Locker stores. Nykaa Fashion will be the exclusive ecommerce partner and will operate the Foot Locker India website as well as retail authorized merchandise on a Foot Locker branded shop on the Nykaa platform.

These agreements will enable Foot Locker to efficiently access the large and growing sneaker market in India, consistent with the Company’s efforts to strategically pursue growth opportunities in new markets, expand sneaker culture globally and bring Foot Locker’s elevated, multi-brand experiences and strong vendor partnerships to even more people around the world.

Store Base Update

During the third quarter, the Company opened 22 new stores, remodeled, or relocated 36 stores, and closed 14 stores.

As of October 28, 2023, the Company operated 2,607 stores in 26 countries in North America, Europe, Asia, Australia, and New Zealand. In addition, 190 franchised stores were operating in the Middle East and Asia.

-MORE-

2023 Financial Outlook

Fiscal year 2023 represents the 53 weeks ending February 3, 2024. The Company’s full year 2023 outlook, which includes the 53rd week, is summarized in the table below.

Note the Company still intends to update the market on its longer-term financial targets and updated capital allocation plans when it reports fourth quarter results.

|

Metric

|

Prior Full Year Guidance

|

Updated Full Year Guidance

|

Fourth Quarter Guidance |

Commentary

|

| Sales Change |

Down 8.0% to 9.0% |

Down 8.0% to 8.5% |

Down 2.0% to 4.0% |

Includes 1% annual lift from the 53rd week |

|

Comparable Sales Change

|

Down 9.0% to 10.0%

|

Down 8.5% to 9.0%

|

Down 7.0% to 9.0% |

|

| Store Count Change |

Down ~9% |

Down ~7% |

|

Delayed timing of store closures |

|

Square Footage Change

|

Down ~4%

|

Down ~2% |

|

|

|

Licensing Revenue

|

~$17 million

|

~$15 million

|

~$5 million |

|

|

Gross Margin

|

27.8% to 28.0%

|

27.8%-27.9%

|

27.0% to 27.2% |

|

|

SG&A Rate

|

22.7% to 22.9%

|

22.8%-22.9%

|

22.7% to 23.0% |

|

|

D&A

|

~$203 million

|

~$200 million

|

~$50 million |

|

|

Interest

|

~$12 million

|

~$11 million

|

~$4 million |

|

|

Non-GAAP Tax Rate

|

~33.0%

|

~36.0%

|

~33.0%-34.0% |

|

|

Non-GAAP EPS

|

$1.30-$1.50

|

$1.30-$1.40

|

$0.26-$0.36 |

Includes $0.11 from the 53rd week

|

|

Adj. Capital Expenditures*

|

~$290 million

|

~$275 million

|

|

Project timing

|

* Adjusted Capex includes capitalized Technology expense

The Company provides earnings guidance only on a non-GAAP basis and does not provide a reconciliation of the Company’s forward-looking capital expenditures and diluted earnings per share guidance to the most directly comparable GAAP financial measures because of the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations.

Conference Call and Webcast

The Company is hosting a live conference call at 9:00 a.m. ET today, November 29, 2023, to review these results and provide an update on the business. An investor presentation will be available under the Investor Relations section of the Company’s corporate website before the start of the conference call. This conference call may be accessed live by calling toll-free 1-844-701-1163 or international toll 1-412-317-5490, or via the Investor Relations section of footlocker-inc.com. Please log on to the website 15 minutes prior to the call to register. An archived replay of the conference call can be accessed approximately one hour following the end of the call at 1-877-344-7529 in the U.S., 1-855-669-9658 in Canada, and 1-412-317-0088 internationally with passcode 5718718 through December 13, 2023. A replay of the call will also be available via webcast from footlocker-inc.com.

-MORE-

Disclosure Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the federal securities laws. Other than statements of historical facts, all statements which address activities, events, or developments that the Company anticipates will or may occur in the future, including, but not limited to, such things as future capital expenditures, expansion, strategic plans, financial objectives, dividend payments, stock repurchases, financial outlook, and other such matters, are forward-looking statements. These forward-looking statements are based on many assumptions and factors, which are detailed in the Company’s filings with the U.S. Securities and Exchange Commission.

These forward-looking statements are based largely on our expectations and judgments and are subject to a number of risks and uncertainties, many of which are unforeseeable and beyond our control. For additional discussion regarding risks and uncertainties that may affect forward-looking statements, see “Risk Factors” disclosed in the Company’s Annual Report on Form 10-K for the year ended January 28, 2023, filed on March 27, 2023. Any changes in such assumptions or factors could produce significantly different results. The Company undertakes no obligation to update the forward-looking statements, whether as a result of new information, future events, or otherwise.

-MORE-

Condensed Consolidated Statements of Operations

(unaudited)

Periods ended October 28, 2023 and October 29, 2022

(In millions, except per share amounts)

| |

|

Third Quarter

|

|

|

Year-to-Date

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Sales

|

|

$ |

1,986 |

|

|

$ |

2,173 |

|

|

$ |

5,774 |

|

|

$ |

6,413 |

|

|

Licensing revenue

|

|

|

3 |

|

|

|

3 |

|

|

|

10 |

|

|

|

9 |

|

|

Total revenue

|

|

|

1,989 |

|

|

|

2,176 |

|

|

|

5,784 |

|

|

|

6,422 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales

|

|

|

1,443 |

|

|

|

1,477 |

|

|

|

4,149 |

|

|

|

4,323 |

|

|

Selling, general and administrative expenses

|

|

|

446 |

|

|

|

467 |

|

|

|

1,319 |

|

|

|

1,382 |

|

|

Depreciation and amortization

|

|

|

47 |

|

|

|

52 |

|

|

|

148 |

|

|

|

157 |

|

|

Impairment and other

|

|

|

6 |

|

|

|

20 |

|

|

|

59 |

|

|

|

38 |

|

|

Income from operations

|

|

|

47 |

|

|

|

160 |

|

|

|

109 |

|

|

|

522 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net

|

|

|

(2 |

) |

|

|

(3 |

) |

|

|

(7 |

) |

|

|

(13 |

) |

|

Other income / (expense), net

|

|

|

2 |

|

|

|

(14 |

) |

|

|

(1 |

) |

|

|

(33 |

) |

|

Income before income taxes

|

|

|

47 |

|

|

|

143 |

|

|

|

101 |

|

|

|

476 |

|

|

Income tax expense

|

|

|

19 |

|

|

|

47 |

|

|

|

42 |

|

|

|

154 |

|

|

Net income

|

|

|

28 |

|

|

|

96 |

|

|

|

59 |

|

|

|

322 |

|

|

Net loss attributable to noncontrolling interests

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1 |

|

|

Net income attributable to Foot Locker, Inc.

|

|

$ |

28 |

|

|

$ |

96 |

|

|

$ |

59 |

|

|

$ |

323 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share

|

|

$ |

0.30 |

|

|

$ |

1.01 |

|

|

$ |

0.63 |

|

|

$ |

3.38 |

|

|

Weighted-average diluted shares outstanding

|

|

|

94.7 |

|

|

|

94.7 |

|

|

|

94.9 |

|

|

|

95.7 |

|

Non-GAAP Financial Measures

In addition to reporting the Company’s financial results in accordance with generally accepted accounting principles (“GAAP”), the Company reports certain financial results that differ from what is reported under GAAP. Non-GAAP financial measures that will be presented will exclude (i) gains or losses related to our minority investments, (ii) impairments and other, and (iii) certain tax matters that we believe are nonrecurring or unusual in nature.

Certain financial measures are identified as non-GAAP, such as sales changes excluding foreign currency fluctuations, adjusted income before income taxes, adjusted net income, and adjusted diluted earnings per share. We present certain amounts as excluding the effects of foreign currency fluctuations, which are also considered non-GAAP measures. Where amounts are expressed as excluding the effects of foreign currency fluctuations, such changes are determined by translating all amounts in both years using the prior-year average foreign exchange rates. Presenting amounts on a constant currency basis is useful to investors because it enables them to better understand the changes in our business that are not related to currency movements.

These non-GAAP measures are presented because we believe they assist investors in comparing our performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core business or affect comparability. In addition, these non-GAAP measures are useful in assessing our progress in achieving our long-term financial objectives and are consistent with how executive compensation is determined.

We estimate the tax effect of all non-GAAP adjustments by applying a marginal tax rate to each item. The income tax items represent the discrete amount that affected the period. The non-GAAP financial information is provided in addition, and not as an alternative, to our reported results prepared in accordance with GAAP. The various non-GAAP adjustments are summarized in the tables below.

-MORE-

Non-GAAP Reconciliation

(unaudited)

Periods ended October 28, 2023 and October 29, 2022

(In millions, except per share amounts)

Reconciliation of GAAP to non-GAAP results:

| |

|

Third Quarter

|

|

|

Year-to-Date

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

|

2022 |

|

|

Pre-tax income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes

|

|

$ |

47 |

|

|

$ |

143 |

|

|

$ |

101 |

|

|

$ |

476 |

|

|

Pre-tax adjustments excluded from GAAP:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Impairment and other (1)

|

|

|

6 |

|

|

|

20 |

|

|

|

59 |

|

|

|

38 |

|

|

Other income / expense (2)

|

|

|

(5 |

) |

|

|

14 |

|

|

|

(6 |

) |

|

|

32 |

|

|

Adjusted income before income taxes (non-GAAP)

|

|

$ |

48 |

|

|

$ |

177 |

|

|

$ |

154 |

|

|

$ |

546 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

After-tax income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Foot Locker, Inc.

|

|

$ |

28 |

|

|

$ |

96 |

|

|

$ |

59 |

|

|

$ |

323 |

|

|

After-tax adjustments excluded from GAAP:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Impairment and other, net of income tax benefit of $2, $5, $11, and $10 million, respectively (1)

|

|

|

4 |

|

|

|

15 |

|

|

|

48 |

|

|

|

28 |

|

|

Other income / expense, net of income tax (expense)/benefit of $(1), $4, $(1), and $7 million, respectively (2)

|

|

|

(4 |

) |

|

|

10 |

|

|

|

(5 |

) |

|

|

25 |

|

|

Tax reserves benefit / charge (3)

|

|

|

— |

|

|

|

— |

|

|

|

(4 |

) |

|

|

5 |

|

|

Adjusted net income (non-GAAP)

|

|

$ |

28 |

|

|

$ |

121 |

|

|

$ |

98 |

|

|

$ |

381 |

|

| |

|

Third Quarter

|

|

|

Year-to-Date

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Earnings per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share

|

|

$ |

0.30 |

|

|

$ |

1.01 |

|

|

$ |

0.63 |

|

|

$ |

3.38 |

|

|

Diluted EPS amounts excluded from GAAP:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Impairment and other (1)

|

|

|

0.04 |

|

|

|

0.16 |

|

|

|

0.51 |

|

|

|

0.29 |

|

|

Other income / expense (2)

|

|

|

(0.04 |

) |

|

|

0.10 |

|

|

|

(0.06 |

) |

|

|

0.26 |

|

|

Tax reserves benefit / charge (3)

|

|

|

— |

|

|

|

— |

|

|

|

(0.04 |

) |

|

|

0.05 |

|

|

Adjusted diluted earnings per share (non-GAAP)

|

|

$ |

0.30 |

|

|

$ |

1.27 |

|

|

$ |

1.04 |

|

|

$ |

3.98 |

|

Notes on Non-GAAP Adjustments:

|

(1)

|

For the third quarter of 2023, impairment and other included $7 million of reorganization costs, primarily related to severance and transformation consulting expense of $1 million. Additionally in the quarter, we recorded a $3 million net benefit from the settlement of lease obligations associated with Sidestep stores, partially offset by impairment on atmos U.S. assets of $1 million. For year-to-date 2023, impairment and other included transformation consulting expense of $27 million, impairment charges of $19 million, primarily accelerated tenancy charges on right-of-use assets for the closures of the Sidestep banner and certain Foot Locker Asia stores, and $12 million of reorganization costs, related to severance and the closure of the Sidestep banner, certain Foot Locker Asia stores, and a North American distribution center.

For the third quarter of 2022, impairment and other charges included $17 million of transformation consulting, $2 million of severance costs for the closure of a North American distribution center, and $1 million of acquisition integration costs. For year-to-date 2022, impairment and other charges included $27 million of transformation consulting, $5 million of impairment of long-lived assets and right-of-use assets and accelerated tenancy charges, $4 million of acquisition integration costs, and $2 million of severance costs related to the distribution center closure.

|

|

(2)

|

For the third quarter of 2023, other income / expense consisted of a $3 million gain from the sale of a North American corporate office property and an additional $2 million gain from the second quarter sale of our Singapore and Malaysian Foot Locker businesses to our license partner. The 2023 year-to-date period also included $1 million of our share of losses related to equity method investments.

Other income / expense for the third quarter of 2022 primarily consisted of a $15 million loss on minority investments, primarily due to a change in fair value of the investment in Retailors, Ltd., a publicly-listed entity, partially offset by an additional $1 million gain on the divestiture of the Team Sales business that occurred in the second quarter. The year-to-date 2022 amount includes $52 million of losses on minority investments, primarily from Retailors, Ltd., a $19 million gain on the Team Sales business divestiture, and $1 million of dividend income.

|

|

(3)

|

In the first quarter of 2023, the Company recorded a $4 million benefit related to income tax reserves due to a statute of limitations release. In the second quarter of 2022, the Company recorded a $5 million charge related to income tax reserves due to the resolution of a foreign tax settlement.

|

-MORE-

Sales by Banner

(unaudited)

Periods ended October 28, 2023 and October 29, 2022

(In millions)

| |

|

Third Quarter

|

|

|

Year-to-Date

|

|

| |

|

2023

|

|

|

2022

|

|

|

Constant Currencies

|

|

|

Comparable Sales

|

|

|

2023

|

|

|

2022

|

|

|

Constant Currencies

|

|

|

Comparable Sales

|

|

|

Foot Locker

|

|

$ |

796 |

|

|

$ |

852 |

|

|

|

(6.5 |

)% |

|

|

(4.9 |

)% |

|

$ |

2,244 |

|

|

$ |

2,411 |

|

|

|

(6.5 |

)% |

|

|

(5.0 |

)% |

|

Champs Sports

|

|

|

311 |

|

|

|

406 |

|

|

|

(23.4 |

) |

|

|

(20.9 |

) |

|

|

932 |

|

|

|

1,266 |

|

|

|

(26.1 |

) |

|

|

(23.6 |

) |

|

Kids Foot Locker

|

|

|

189 |

|

|

|

181 |

|

|

|

4.4 |

|

|

|

5.0 |

|

|

|

502 |

|

|

|

516 |

|

|

|

(2.7 |

) |

|

|

(2.4 |

) |

|

WSS

|

|

|

163 |

|

|

|

162 |

|

|

|

0.6 |

|

|

|

(9.4 |

) |

|

|

458 |

|

|

|

438 |

|

|

|

4.6 |

|

|

|

(7.0 |

) |

|

Other

|

|

|

1 |

|

|

|

21 |

|

|

|

n.m. |

|

|

|

n.m. |

|

|

|

1 |

|

|

|

111 |

|

|

|

n.m. |

|

|

|

n.m. |

|

|

North America

|

|

|

1,460 |

|

|

|

1,622 |

|

|

|

(10.0 |

) |

|

|

(9.5 |

) |

|

|

4,137 |

|

|

|

4,742 |

|

|

|

(12.5 |

) |

|

|

(11.5 |

) |

|

Foot Locker

|

|

|

407 |

|

|

|

392 |

|

|

|

(5.6 |

) |

|

|

(3.9 |

) |

|

|

1,202 |

|

|

|

1,173 |

|

|

|

(0.6 |

) |

|

|

(1.3 |

) |

|

Sidestep

|

|

|

— |

|

|

|

20 |

|

|

|

n.m. |

|

|

|

n.m. |

|

|

|

26 |

|

|

|

69 |

|

|

|

(63.8 |

) |

|

|

(38.3 |

) |

|

EMEA

|

|

|

407 |

|

|

|

412 |

|

|

|

(10.2 |

) |

|

|

(4.2 |

) |

|

|

1,228 |

|

|

|

1,242 |

|

|

|

(4.1 |

) |

|

|

(2.5 |

) |

|

Foot Locker

|

|

|

81 |

|

|

|

99 |

|

|

|

(16.2 |

) |

|

|

(1.2 |

) |

|

|

281 |

|

|

|

292 |

|

|

|

- |

|

|

|

6.3 |

|

|

atmos

|

|

|

38 |

|

|

|

40 |

|

|

|

5.0 |

|

|

|

0.8 |

|

|

|

128 |

|

|

|

137 |

|

|

|

(0.7 |

) |

|

|

(2.8 |

) |

|

Asia Pacific

|

|

|

119 |

|

|

|

139 |

|

|

|

(10.1 |

) |

|

|

(0.5 |

) |

|

|

409 |

|

|

|

429 |

|

|

|

(0.2 |

) |

|

|

3.4 |

|

|

Total

|

|

$ |

1,986 |

|

|

$ |

2,173 |

|

|

|

(10.0 |

)%

|

|

|

(8.0 |

)%

|

|

$ |

5,774 |

|

|

$ |

6,413 |

|

|

|

(10.0 |

)%

|

|

|

(8.9 |

)%

|

-MORE-

Condensed Consolidated Balance Sheets

(unaudited)

(In millions)

| |

|

October 28,

|

|

|

October 29,

|

|

| |

|

2023

|

|

|

2022

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

187 |

|

|

$ |

351 |

|

|

Merchandise inventories

|

|

|

1,862 |

|

|

|

1,685 |

|

|

Other current assets

|

|

|

325 |

|

|

|

302 |

|

| |

|

|

2,374 |

|

|

|

2,338 |

|

|

Property and equipment, net

|

|

|

884 |

|

|

|

897 |

|

|

Operating lease right-of-use assets

|

|

|

2,182 |

|

|

|

2,449 |

|

|

Deferred taxes

|

|

|

91 |

|

|

|

65 |

|

|

Goodwill

|

|

|

763 |

|

|

|

764 |

|

|

Other intangible assets, net

|

|

|

407 |

|

|

|

424 |

|

|

Minority investments

|

|

|

630 |

|

|

|

722 |

|

|

Other assets

|

|

|

89 |

|

|

|

103 |

|

| |

|

$ |

7,420 |

|

|

$ |

7,762 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

593 |

|

|

$ |

522 |

|

|

Accrued and other liabilities

|

|

|

369 |

|

|

|

455 |

|

|

Current portion of long-term debt and obligations under finance leases

|

|

|

6 |

|

|

|

6 |

|

|

Current portion of lease obligations

|

|

|

491 |

|

|

|

539 |

|

| |

|

|

1,459 |

|

|

|

1,522 |

|

|

Long-term debt and obligations under finance leases

|

|

|

443 |

|

|

|

448 |

|

|

Long-term lease obligations

|

|

|

1,994 |

|

|

|

2,212 |

|

|

Other liabilities

|

|

|

319 |

|

|

|

321 |

|

|

Total liabilities

|

|

|

4,215 |

|

|

|

4,503 |

|

|

Total shareholders' equity

|

|

|

3,205 |

|

|

|

3,259 |

|

| |

|

$ |

7,420 |

|

|

$ |

7,762 |

|

-MORE-

Condensed Consolidated Statement of Cash Flows

(unaudited)

(In millions)

|

|

|

Thirty-nine weeks ended

|

|

|

|

|

October 28,

|

|

|

October 29,

|

|

|

($ in millions)

|

|

2023

|

|

|

2022

|

|

|

From operating activities:

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$ |

59 |

|

|

$ |

322 |

|

|

Adjustments to reconcile net income to net cash from operating activities:

|

|

|

|

|

|

|

|

|

|

Non-cash impairment and other

|

|

|

20 |

|

|

|

5 |

|

|

Fair value adjustments to minority investments

|

|

|

— |

|

|

|

52 |

|

|

Depreciation and amortization

|

|

|

148 |

|

|

|

157 |

|

|

Deferred income taxes

|

|

|

(5 |

) |

|

|

14 |

|

|

Share-based compensation expense

|

|

|

9 |

|

|

|

25 |

|

|

Gain on sales of businesses

|

|

|

(4 |

) |

|

|

(19 |

) |

|

Gain on sale of property

|

|

|

(3 |

) |

|

|

— |

|

|

Change in assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Merchandise inventories

|

|

|

(249 |

) |

|

|

(466 |

) |

|

Accounts payable

|

|

|

110 |

|

|

|

(58 |

) |

|

Accrued and other liabilities

|

|

|

(131 |

) |

|

|

(46 |

) |

|

Other, net

|

|

|

(52 |

) |

|

|

(18 |

) |

|

Net cash used in operating activities

|

|

|

(98 |

) |

|

|

(32 |

) |

|

From investing activities:

|

|

|

|

|

|

|

|

|

|

Capital expenditures

|

|

|

(165 |

) |

|

|

(218 |

) |

|

Purchase of business, net of cash acquired

|

|

|

— |

|

|

|

(18 |

) |

|

Minority investments

|

|

|

(2 |

) |

|

|

(5 |

) |

|

Proceeds from sales of businesses

|

|

|

16 |

|

|

|

47 |

|

|

Proceeds from minority investments

|

|

|

— |

|

|

|

12 |

|

|

Proceeds from sale of property

|

|

|

6 |

|

|

|

— |

|

|

Net cash used in investing activities

|

|

|

(145 |

) |

|

|

(182 |

) |

|

From financing activities:

|

|

|

|

|

|

|

|

|

|

Dividends paid on common stock

|

|

|

(113 |

) |

|

|

(113 |

) |

|

Purchase of treasury shares

|

|

|

— |

|

|

|

(129 |

) |

|

Payment of obligations under finance leases

|

|

|

(5 |

) |

|

|

(5 |

) |

|

Shares of common stock repurchased to satisfy tax withholding obligations

|

|

|

(10 |

) |

|

|

(1 |

) |

|

Treasury stock reissued under employee stock plan

|

|

|

3 |

|

|

|

3 |

|

|

Proceeds from exercise of stock options

|

|

|

5 |

|

|

|

4 |

|

|

Contribution from non-controlling interest

|

|

|

— |

|

|

|

4 |

|

|

Net cash used in financing activities

|

|

|

(120 |

) |

|

|

(237 |

) |

|

Effect of exchange rate fluctuations on cash, cash equivalents, and restricted cash

|

|

|

4 |

|

|

|

(6 |

) |

|

Net change in cash, cash equivalents, and restricted cash

|

|

|

(359 |

) |

|

|

(457 |

) |

|

Cash, cash equivalents, and restricted cash at beginning of year

|

|

|

582 |

|

|

|

850 |

|

|

Cash, cash equivalents, and restricted cash at end of period

|

|

$ |

223 |

|

|

$ |

393 |

|

-MORE-

Store Count and Square Footage

(unaudited)

Store activity is as follows:

| |

|

January 28,

|

|

|

|

|

|

|

|

|

|

|

October 28,

|

|

|

Relocations/

|

|

| |

|

2023

|

|

|

Opened

|

|

|

Closed

|

|

|

2023

|

|

|

Remodels

|

|

|

Foot Locker U.S.

|

|

|

747 |

|

|

|

2 |

|

|

|

9 |

|

|

|

740 |

|

|

|

24 |

|

|

Foot Locker Canada

|

|

|

86 |

|

|

|

— |

|

|

|

2 |

|

|

|

84 |

|

|

|

4 |

|

|

Champs Sports

|

|

|

486 |

|

|

|

1 |

|

|

|

12 |

|

|

|

475 |

|

|

|

6 |

|

|

Kids Foot Locker

|

|

|

394 |

|

|

|

2 |

|

|

|

4 |

|

|

|

392 |

|

|

|

9 |

|

|

WSS

|

|

|

115 |

|

|

|

16 |

|

|

|

2 |

|

|

|

129 |

|

|

|

— |

|

|

Footaction

|

|

|

2 |

|

|

|

— |

|

|

|

1 |

|

|

|

1 |

|

|

|

— |

|

|

North America

|

|

|

1,830 |

|

|

|

21 |

|

|

|

30 |

|

|

|

1,821 |

|

|

|

43 |

|

|

Foot Locker Europe (1)

|

|

|

644 |

|

|

|

24 |

|

|

|

26 |

|

|

|

642 |

|

|

|

17 |

|

|

Sidestep

|

|

|

78 |

|

|

|

— |

|

|

|

78 |

|

|

|

— |

|

|

|

— |

|

|

EMEA

|

|

|

722 |

|

|

|

24 |

|

|

|

104 |

|

|

|

642 |

|

|

|

17 |

|

|

Foot Locker Pacific

|

|

|

94 |

|

|

|

4 |

|

|

|

1 |

|

|

|

97 |

|

|

|

10 |

|

|

Foot Locker Asia

|

|

|

33 |

|

|

|

— |

|

|

|

20 |

|

|

|

13 |

|

|

|

— |

|

|

atmos

|

|

|

35 |

|

|

|

1 |

|

|

|

2 |

|

|

|

34 |

|

|

|

— |

|

|

Asia Pacific

|

|

|

162 |

|

|

|

5 |

|

|

|

23 |

|

|

|

144 |

|

|

|

10 |

|

|

Total

|

|

|

2,714 |

|

|

|

50 |

|

|

|

157 |

|

|

|

2,607 |

|

|

|

70 |

|

Selling and gross square footage are as follows:

| |

October 29, 2022

|

October 28, 2023

|

|

(in thousands)

|

Selling

|

Gross

|

Selling

|

Gross

|

|

Foot Locker U.S.

|

|

2,382 |

|

4,105 |

|

2,383 |

|

4,063 |

|

Foot Locker Canada

|

|

248 |

|

408 |

|

250 |

|

412 |

|

Champs Sports

|

|

1,879 |

|

2,940 |

|

1,778 |

|

2,792 |

|

Kids Foot Locker

|

|

751 |

|

1,267 |

|

760 |

|

1,271 |

|

WSS

|

|

1,067 |

|

1,341 |

|

1,332 |

|

1,600 |

|

Footaction

|

|

29 |

|

51 |

|

3 |

|

6 |

|

North America

|

|

6,356 |

|

10,112 |

|

6,506 |

|

10,144 |

|

Foot Locker Europe (1)

|

|

1,148 |

|

2,371 |

|

1,190 |

|

2,433 |

|

Sidestep

|

|

100 |

|

189 |

|

- |

|

- |

|

EMEA

|

|

1,248 |

|

2,560 |

|

1,190 |

|

2,433 |

|

Foot Locker Pacific

|

|

204 |

|

315 |

|

235 |

|

356 |

|

Foot Locker Asia

|

|

126 |

|

233 |

|

52 |

|

98 |

|

atmos

|

|

37 |

|

66 |

|

35 |

|

61 |

|

Asia Pacific

|

|

367 |

|

614 |

|

322 |

|

515 |

|

Total

|

|

7,971 |

|

13,286 |

|

8,018 |

|

13,092 |

(1) Includes 16 and 14 Kids Foot Locker stores, and the related square footage, operating in Europe for January 28, 2023 and October 28, 2023, respectively.

- END -

Exhibit 99.2

v3.23.3

Document And Entity Information

|

Nov. 29, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Foot Locker, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 29, 2023

|

| Entity, Incorporation, State or Country Code |

NY

|

| Entity, File Number |

1-10299

|

| Entity, Tax Identification Number |

13-3513936

|

| Entity, Address, Address Line One |

330 West 34th Street

|

| Entity, Address, City or Town |

New York

|

| Entity, Address, State or Province |

NY

|

| Entity, Address, Postal Zip Code |

10001

|

| City Area Code |

212

|

| Local Phone Number |

720-3700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

FL

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000850209

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

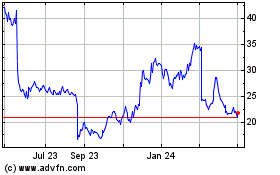

Foot Locker (NYSE:FL)

Historical Stock Chart

From Mar 2024 to Apr 2024

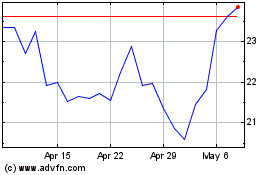

Foot Locker (NYSE:FL)

Historical Stock Chart

From Apr 2023 to Apr 2024