Elys Game Technology Reports Third Quarter 2023 Business and Financial Results

November 20 2023 - 4:05PM

Elys Game Technology, Corp. (“Elys” or the “Company”)

(OTC:ELYS) (BER:3UW), an interactive gaming and sports

betting technology company, today provided a business update and

reported financial results for the third quarter ended September

30, 2023.

Third Quarter and Recent Operational

Highlights

- Established a multiyear

market access agreement with Caesars Entertainment,

unlocking access to the Colorado sports betting market. The

strategic agreement signals Elys’ first entry into the North

American mobile sports betting landscape. Pending regulatory

approvals, the Company expects to launch its U.S. mobile sportsbook

operations in Colorado in 2024.

- Introduced

www.SportBet.com, the Company’s new online

and mobile sports betting brand for the United States

market. The “5D by Elys” mobile app is included under the

brand, forming a comprehensive sports betting platform with

cross-platform compatibility. This development positions Elys’

online sports betting launch under a highly recognizable,

consumer-friendly brand.

- Completed installation of

its North American hub infrastructure, successfully

establishing a robust technology footprint for the expansion of

Elys’ platform.

- Multigioco, an Elys

subsidiary, unveiled its enhanced offerings in Italy with

a revamped online casino, sports betting site, and mobile app. The

significant relaunch in the Italian market improves player

experience with optimized performance, speed, and a robust security

profile while also setting the stage for meaningful cost savings by

eliminating expenses associated with trading and risk management,

platform development, and iGaming aggregation.

- Secured a third sportsbook

location in Washington, D.C., expanding the Company’s

footprint in the city and building upon the success of its small

business sportsbook business model.

Third Quarter 2023 Financial

ResultsResults compare 2023 fiscal third quarter end

(September 30, 2023) to 2022 fiscal third quarter end (September

30, 2022) unless otherwise indicated.

- Total revenue

decreased 11.8% to $8.5 million from $9.6 million in the prior

year. The change is primarily attributable to higher payouts

benefiting Elys’ sportsbook customers as well as a decrease in

web-based turnover due to a reduction in online casino and poker

offerings during the third quarter, thereby reducing our blended

revenue conversion. At the end of September 2023, a historically

quiet period for sports betting, the Company underwent a platform

switchover that provides significantly enhanced online casino and

poker offerings for our Italian operations. The switchover had an

immaterial impact on online sportsbook revenue that was partially

offset by an increase in land-based sportsbook revenue due to the

activation of new physical locations. For the first nine months of

2023, total revenue increased by approximately $0.06 million.

- Total handle

(turnover) decreased 2.4% to $162.6 million from $166.5

million in the prior year period. The decrease in handle in the

third quarter was due to the reduction in web-based turnover caused

by the aforementioned online casino and poker reduction ahead of

the platform switchover. For the first nine months of 2023, the

total handle increased 2.4% to $585.8 million consistent with the

Company’s growth expectations.

- Operating expenses

decreased 10.2% to $11.4 million from $12.7 million in the prior

year period. The change is primarily attributable to decreases in

general and administrative costs as well as a reduction in

technology development costs. For the first nine months of 2023,

overall operating costs continued to downtrend, with a reduction of

$0.13 million, reflecting management’s commitment to profitability,

despite the additional expenses incurred for U.S. and Canadian

facing investments during the first nine months of 2023.

- Net loss from continuing

operations was $(3.2) million, or $(0.10) per share,

compared to $(3.8) million, or $(0.14) per share, in the prior year

period. The change is primarily attributable to the decrease in

loss from operations, despite lower revenues and a reduction in

other non-operating expenses of $0.3 million compared to the prior

year period. For the first nine months of 2023, net loss was $(9.1)

million, or $(0.27) per share, compared to $(11.1) million, or

$(0.41) per share, in the prior year period.

- Cash and cash

equivalents were $2.6 million at September 30, 2023,

compared to $3.4 million at December 31, 2022.

Management Commentary“In Q3, we

laid critical foundations for a large-scale expansion into the

rapidly growing online sports betting market in the United States

and Canada,” said Mike Ciavarella, Executive Chairman of Elys Game

Technology Corp. “Over the past few years, we have executed our

go-to-market strategy by making significant investments related to

our product platform and infrastructure development for our future

commercial operations in North America. Elys now stands at the

inflection point where these investments begin to convert into

revenues in 2024.

“Our www.SportBet.com website, complemented by

our advanced platform and recent market access partnership with

Caesars Entertainment, equips us to attract players nationwide over

the coming quarters. The impending launch in Colorado serves as our

initial online sports betting market entry point, and we regard our

partnership with Caesars as a gateway to future opportunities in

other states. At the same time, we are maintaining our solid and

stable operations in the Italian market, where we recently

introduced a revamped platform and all-new product lineup. This

platform not only enhances the overall player experience but also

incorporates changes that significantly reduce expenses and puts

our Multigioco subsidiary on track to meet the Company’s profit

goals through 2024.

“As we begin our strategic rollout into the vast

addressable online sports betting market in the United States, we

are confident in our ability to replicate our Italian success

story. The U.S. sports betting opportunity contains decades of

pent-up demand, and we expect to carve out significant market share

with our ‘best odds’ approach and user-friendly platform as our

experience in Italy demonstrates. Our measured and strategic

approach to this vast market sets us apart. Through meticulous

study of player behavior and regulatory dynamics, we aim to emerge

as a responsible and formidable operator in the budding U.S.

market, extracting long-term value for Elys shareholders.”

Update on the Listing of Common

SharesOn October 13, 2023, Elys Game Technology received

written notice from the Listing Qualifications Department of The

Nasdaq Stock Market LLC (“Nasdaq”) informing the Company that

trading of its common shares would be suspended as of the opening

of business on October 17, 2023. As a result, Elys’ common shares

began trading on the OTC markets in October, where they continue to

trade today.

To prioritize the value for its shareholders,

the Company will remain listed on the OTC Markets until further

analysis of the exchange listing of our common shares is completed.

Elys’ management team and board of directors are diligently

assessing various major listing venues to determine the most

strategic path forward, one that will ultimately offer the best

opportunity to maximize shareholder value in the long term.

About Elys Game Technology,

Corp.Elys Game Technology, Corp. is a global gaming

technology company operating in multiple countries worldwide. Elys

offers its clients a full suite of omnichannel leisure gaming

products and services, such as online sports betting, e-sports,

virtual sports, online casino, poker, bingo, interactive games, and

online slots on a B2C basis in Italy and has B2B operations in five

states as well as the District of Columbia in the U.S. market. The

Company provides sports betting software, online casino software,

services for commercial and tribal casinos, retail betting

establishments, and franchise distribution networks.

Elys’ vision is to become a global gaming

industry leader by developing pioneering and innovative online

casino software. Additional information is available on our

corporate website at www.elysgame.com.

Investors may also find us on Twitter @ELYS5D;

Instagram @elys5d; LinkedIn Elys America; YouTube @Elys5D; and on

Facebook @Elys5D.

Forward-Looking StatementsThis

press release contains certain forward-looking statements within

the meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. These statements are identified by

the use of the words “could,” “believe,” “anticipate,” “intend,”

“estimate,” “expect,” “may,” “continue,” “predict,” “potential,”

“project,” and similar expressions that are intended to identify

forward-looking statements and include statements regarding Elys.

These forward-looking statements are based on management’s

expectations and assumptions as of the date of this press release

and are subject to a number of risks and uncertainties, many of

which are difficult to predict that could cause actual results to

differ materially from current expectations and assumptions from

those set forth or implied by any forward-looking statements.

Important factors that could cause actual results to differ

materially from current expectations include, among others, the

risk factors described in the Company’s Annual Report on Form 10-K

for the year ended December 31, 2022, and its subsequent filings

with the U.S. Securities and Exchange Commission, including

subsequent periodic reports on Form 10-Q and current reports on

Form 8-K. The information in this release is provided only as of

the date of this release. The Company undertakes no obligation to

update or revise publicly any forward-looking statements, whether

as a result of new information, future events, or otherwise, after

the date on which the statements are made or to reflect the

occurrence of unanticipated events, except as required by law.

Investor Contact:Tom Colton and Alec

WilsonGateway Group, Inc.949-574-3860ELYS@gateway-grp.com

-Financial Tables to Follow-

|

ELYS GAME TECHNOLOGY, CORP.Consolidated Balance

Sheets(Unaudited) |

| |

| |

|

September 30,2023 |

|

December 31,2022 |

|

Current Assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

2,551,000 |

|

|

$ |

3,400,166 |

|

|

Accounts receivable |

|

|

735,725 |

|

|

|

731,962 |

|

|

Gaming accounts receivable |

|

|

1,841,921 |

|

|

|

1,431,497 |

|

|

Prepaid expenses |

|

|

2,637,882 |

|

|

|

900,205 |

|

|

Related party receivable |

|

|

22,511 |

|

|

|

22,511 |

|

|

Other current assets |

|

|

379,781 |

|

|

|

338,871 |

|

|

Total Current Assets |

|

|

8,168,820 |

|

|

|

6,825,212 |

|

| |

|

|

|

|

|

|

|

|

| Non - Current

Assets |

|

|

|

|

|

|

|

|

|

Restricted cash |

|

|

— |

|

|

|

364,701 |

|

|

Property and equipment |

|

|

975,211 |

|

|

|

610,852 |

|

|

Right of use assets |

|

|

1,471,190 |

|

|

|

1,498,703 |

|

|

Intangible assets |

|

|

10,069,843 |

|

|

|

10,375,524 |

|

|

Goodwill |

|

|

1,662,016 |

|

|

|

1,662,278 |

|

|

Marketable securities |

|

|

— |

|

|

|

19,999 |

|

|

Total Non - Current Assets |

|

|

14,178,260 |

|

|

|

14,532,057 |

|

|

Total Assets |

|

$ |

22,347,080 |

|

|

$ |

21,357,269 |

|

| |

|

|

|

|

|

|

|

|

| Current

Liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

$ |

8,917,952 |

|

|

|

6,790,523 |

|

|

Gaming accounts payable |

|

|

3,492,128 |

|

|

|

2,213,532 |

|

|

Taxes payable |

|

|

61,187 |

|

|

|

179,720 |

|

|

Related party payable |

|

|

46,916 |

|

|

|

422,129 |

|

|

Promissory notes payable - related parties |

|

|

411,939 |

|

|

|

752,000 |

|

|

Operating lease liability |

|

|

381,439 |

|

|

|

369,043 |

|

|

Financial lease liability |

|

|

1,895 |

|

|

|

6,831 |

|

|

Bank loan payable - current portion |

|

|

2,987 |

|

|

|

3,151 |

|

|

Total Current Liabilities |

|

|

13,316,443 |

|

|

|

10,736,929 |

|

| |

|

|

|

|

|

|

|

|

| Non-Current

Liabilities |

|

|

|

|

|

|

|

|

|

Deferred tax liability |

|

|

1,391,102 |

|

|

|

1,696,638 |

|

|

Operating lease liability |

|

|

1,059,970 |

|

|

|

1,157,979 |

|

|

Financial lease liability |

|

|

1,244 |

|

|

|

2,288 |

|

|

Bank loan payable |

|

|

152,643 |

|

|

|

148,169 |

|

|

Convertible notes payable, net of discount of $169,003 |

|

|

209,347 |

|

|

|

— |

|

|

Convertible notes payable – related parties, net of discount of

$2,039,673 |

|

|

2,936,049 |

|

|

|

— |

|

|

Other long-term liabilities |

|

|

577,725 |

|

|

|

464,851 |

|

|

Total Non – Current Liabilities |

|

|

6,328,080 |

|

|

|

3,469,925 |

|

|

Total Liabilities |

|

|

19,644,523 |

|

|

|

14,206,854 |

|

| |

|

|

|

|

|

|

|

|

| Stockholders'

Equity |

|

|

|

|

|

|

|

|

|

Common stock, $0.0001 par

value, 80,000,000 shares

authorized; 35,794,381 and 30,360,810 shares

issued and outstanding as of September 30, 2023 and December 31,

2022 |

|

|

3,579 |

|

|

|

3,036 |

|

| Additional paid-in

capital |

|

|

78,952,510 |

|

|

|

74,249,244 |

|

| Accumulated other

comprehensive loss |

|

|

(609,554 |

) |

|

|

(600,619 |

) |

| Accumulated deficit |

|

|

(75,643,978 |

) |

|

|

(66,501,246 |

) |

| Total Stockholders'

Equity |

|

|

2,702,557 |

|

|

|

7,150,415 |

|

| Total Liabilities and

Stockholders’ Equity |

|

$ |

22,347,080 |

|

|

$ |

21,357,269 |

|

|

ELYS GAME TECHNOLOGY, CORP.Consolidated Statements

of Changes in Stockholders' EquityNine months ended

September 30, 2023 and September 30,

2022(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months EndedSeptember

30, |

|

For the Nine Months EndedSeptember

30, |

| |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Revenue |

|

$ |

8,464,591 |

|

|

$ |

9,591,294 |

|

|

$ |

32,233,378 |

|

|

$ |

32,175,015 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs and

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling expenses |

|

|

6,724,275 |

|

|

|

6,874,581 |

|

|

|

26,158,349 |

|

|

|

24,029,532 |

|

|

General and administrative expenses |

|

|

4,318,720 |

|

|

|

5,385,407 |

|

|

|

13,498,145 |

|

|

|

14,273,817 |

|

|

Depreciation and amortization |

|

|

354,334 |

|

|

|

423,361 |

|

|

|

1,043,432 |

|

|

|

1,315,593 |

|

|

Restructuring and severance expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,205,689 |

|

| Total Costs and

Expenses |

|

|

11,397,329 |

|

|

|

12,683,349 |

|

|

|

40,699,926 |

|

|

|

40,824,631 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from

Operations |

|

|

(2,932,738 |

) |

|

|

(3,092,055 |

) |

|

|

(8,466,548 |

) |

|

|

(8,649,616 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other (Expenses)

Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net of interest income |

|

|

(162,474 |

) |

|

|

(9,104 |

) |

|

|

(273,701 |

) |

|

|

(22,641 |

) |

|

Amortization of debt discount |

|

|

(142,381 |

) |

|

|

— |

|

|

|

(215,651 |

) |

|

|

— |

|

|

Other income |

|

|

9,994 |

|

|

|

21,931 |

|

|

|

13,521 |

|

|

|

90,783 |

|

|

Changes in fair value of contingent purchase consideration |

|

|

— |

|

|

|

(482,059 |

) |

|

|

— |

|

|

|

(1,397,833 |

) |

|

Other expense |

|

|

— |

|

|

|

(45,528 |

) |

|

|

(7,017 |

) |

|

|

(56,539 |

) |

|

Gain (loss) on marketable securities |

|

|

— |

|

|

|

(49,250 |

) |

|

|

(19,999 |

) |

|

|

43,250 |

|

| Total Other (Expenses)

Income |

|

|

(294,861 |

) |

|

|

(564,010 |

) |

|

|

(502,847 |

) |

|

|

(1,342,980 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss Before Income

Taxes |

|

|

(3,227,599 |

) |

|

|

(3,656,065 |

) |

|

|

(8,969,395 |

) |

|

|

(9,992,596 |

) |

|

Income tax provision |

|

|

4,240 |

|

|

|

(167,574 |

) |

|

|

67,199 |

|

|

|

(200,518 |

) |

| Net Loss from

continuing operations |

|

|

(3,223,359 |

) |

|

|

(3,823,639 |

) |

|

|

(8,902,196 |

) |

|

|

(10,193,114 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Discontinued

operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating loss |

|

|

(34,690 |

) |

|

|

— |

|

|

|

(198,335 |

) |

|

|

— |

|

| Loss on recission |

|

|

(42,201 |

) |

|

|

— |

|

|

|

(42,201 |

) |

|

|

— |

|

| Net loss from

discontinued operations |

|

|

(76,891 |

) |

|

|

— |

|

|

|

(240,536 |

) |

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(3,300,250 |

) |

|

$ |

(3,823,639 |

) |

|

$ |

(9,142,732 |

) |

|

$ |

(10,193,114 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Comprehensive

(Loss) Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

|

(102,111 |

) |

|

|

(367,765 |

) |

|

|

(8,935 |

) |

|

|

(877,996 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive

Loss |

|

$ |

(3,402,361 |

) |

|

$ |

(4,191,404 |

) |

|

$ |

(9,151,667 |

) |

|

$ |

(11,071,110 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss per common share

– basic and diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Continuing operations |

|

$ |

(0.10 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.27 |

) |

|

$ |

(0.41 |

) |

| Discontinued operations |

|

|

(0.00 |

) |

|

|

0.00 |

|

|

|

(0.00 |

) |

|

|

0.00 |

|

| |

|

|

(0.10 |

) |

|

|

(0.14 |

) |

|

|

(0.27 |

) |

|

|

(0.41 |

) |

| Weighted average number of

common shares outstanding – basic and diluted |

|

|

31,886,832 |

|

|

|

26,942,389 |

|

|

|

32,758,530 |

|

|

|

24,871,319 |

|

|

ELYS GAME TECHNOLOGY, CORP.Consolidated

Statements of Cash Flows(Unaudited) |

| |

|

|

|

|

| |

|

For the nine monthsended September

30, |

| |

|

2023 |

|

2022 |

| |

|

|

|

|

|

Net Loss |

|

$ |

(9,142,732 |

) |

|

$ |

(10,193,114 |

) |

| Net loss from discontinued

operations |

|

|

240,536 |

|

|

|

— |

|

| Net loss from continuing

operations |

|

|

(8,902,196 |

) |

|

|

(10,193,114 |

) |

| Adjustments to

reconcile net loss to net cash used in operating

activities |

|

|

|

|

|

|

|

|

| Depreciation and

amortization |

|

|

1,043,431 |

|

|

|

1,315,593 |

|

| Gain on disposal of property

and equipment |

|

|

(5,136 |

) |

|

|

— |

|

| Amortization of debt

discount |

|

|

215,651 |

|

|

|

— |

|

| Restricted stock awards |

|

|

685,688 |

|

|

|

2,012,600 |

|

| Stock-based compensation

expense |

|

|

1,611,635 |

|

|

|

2,381,974 |

|

| Non-cash interest |

|

|

268,320 |

|

|

|

17,637 |

|

| Loss on dissolution of

subsidiary |

|

|

325 |

|

|

|

— |

|

| Change in fair value of

contingent purchase consideration |

|

|

— |

|

|

|

1,397,833 |

|

| Unrealized loss (gain) on

marketable securities |

|

|

19,999 |

|

|

|

(43,250 |

) |

| Movement in deferred

taxation |

|

|

(124,437 |

) |

|

|

(238,616 |

) |

| Changes in Operating

Assets and Liabilities, net of assets acquired and liabilities

assumed |

|

|

|

|

|

|

|

|

| Prepaid expenses |

|

|

(1,757,254 |

) |

|

|

(2,043,015 |

) |

| Accounts payable and accrued

liabilities |

|

|

1,307,024 |

|

|

|

(1,013,194 |

) |

| Accounts receivable |

|

|

1,957 |

|

|

|

(282,002 |

) |

| Gaming accounts

receivable |

|

|

(440,090 |

) |

|

|

981,478 |

|

| Gaming accounts

liabilities |

|

|

1,339,804 |

|

|

|

693,455 |

|

| Taxes payable |

|

|

(122,333 |

) |

|

|

391,339 |

|

| Due from related parties |

|

|

31,279 |

|

|

|

(8,026 |

) |

| Other current assets |

|

|

(39,764 |

) |

|

|

(19,838 |

) |

| Long term liability |

|

|

122,022 |

|

|

|

76,916 |

|

| Net Cash Used in

Operating Activities – continuing operations |

|

|

(4,744,075 |

) |

|

|

(4,572,230 |

) |

| Net Cash Used in

Operating Activities – discontinued operations |

|

|

(76,697 |

) |

|

|

— |

|

| NET CASH USED IN

OPERATING ACTIVITIES |

|

|

(4,820,772 |

) |

|

|

(4,572,230 |

) |

| |

|

|

|

|

|

|

|

|

| Cash Flows from

Investing Activities |

|

|

|

|

|

|

|

|

| Acquisition of property and

equipment and intangible assets |

|

|

(1,112,830 |

) |

|

|

(355,939 |

) |

| Net Cash Used in

Investing Activities – continuing operations |

|

|

(1,112,830 |

) |

|

|

(355,939 |

) |

| Net Cash Provided by

Investing Activities – discontinued operations |

|

|

76,459 |

|

|

|

— |

|

| NET CASH USED IN

INVESTING ACTIVITIES |

|

|

(1,036,371 |

) |

|

|

(355,939 |

) |

| |

|

|

|

|

|

|

|

|

| Cash Flows from

Financing Activities |

|

|

|

|

|

|

|

|

| Proceeds from convertible

notes |

|

|

350,000 |

|

|

|

— |

|

| Proceeds from convertible

notes, related parties |

|

|

4,400,000 |

|

|

|

— |

|

| Proceeds from Subscriptions –

Net of Fees |

|

|

— |

|

|

|

2,616,679 |

|

| Proceeds from pre-funded

warrants |

|

|

— |

|

|

|

512,813 |

|

| Proceeds from related party

promissory notes |

|

|

— |

|

|

|

665,000 |

|

| Repayment of bank

overdraft |

|

|

— |

|

|

|

(7,043 |

) |

| Repayment of bank loan |

|

|

— |

|

|

|

(33,041 |

) |

| Repayment of financial

leases |

|

|

(5,996 |

) |

|

|

(5,926 |

) |

| NET CASH PROVIDED BY

FINANCING ACTIVITIES |

|

|

4,744,004 |

|

|

|

3,748,482 |

|

| |

|

|

|

|

|

|

|

|

| Effect of change in exchange

rate |

|

|

(100,728 |

) |

|

|

(1,504,030 |

) |

| |

|

|

|

|

|

|

|

|

| Net decrease in cash |

|

|

(1,213,867 |

) |

|

|

(2,683,717 |

) |

| Cash, cash equivalents and

restricted cash – beginning of the period |

|

|

3,764,867 |

|

|

|

7,706,357 |

|

| CASH, CASH EQUIVALENTS

AND RESTRICTED CASH – END OF THE PERIOD |

|

$ |

2,551,000 |

|

|

$ |

5,022,640 |

|

| |

|

|

|

|

|

|

|

|

|

ELYS GAME TECHNOLOGY, CORP.Consolidated

Statements of Cash Flows(Unaudited) |

|

|

|

|

|

|

|

|

|

|

| Reconciliation of

cash, cash equivalents and restricted cash within the Balance

Sheets to the Statement of Cash Flows |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

2,551,000 |

|

|

$ |

4,690,034 |

|

| Restricted cash included in

non-current assets |

|

|

— |

|

|

|

332,606 |

|

| |

|

$ |

2,551,000 |

|

|

$ |

5,022,640 |

|

| Supplemental

disclosure of cash flow information |

|

|

|

|

| Cash paid during the period

for: |

|

|

|

|

|

Interest |

|

$ |

5,735 |

|

|

$ |

5,855 |

|

| Income tax |

|

$ |

199,745 |

|

|

$ |

84,988 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental cash flow

disclosure for non-cash activities |

|

|

|

|

|

|

|

|

| Fair value of common stock

issued on acquisition of Engage IT Services Srl |

|

$ |

1,735,615 |

|

|

$ |

— |

|

| Fair value of common stock

returned on recission of acquisition of Engage IT Services Srl |

|

$ |

(1,938,456 |

) |

|

|

|

|

| Fair value of warrant issued

with convertible debt |

|

$ |

2,424,327 |

|

|

$ |

— |

|

| Fair value of restricted stock

issued to settle liabilities |

|

$ |

60,000 |

|

|

$ |

— |

|

| Fair value of options issued

to settle liabilities |

|

$ |

125,000 |

|

|

$ |

— |

|

Elys Game Technology (NASDAQ:ELYS)

Historical Stock Chart

From Mar 2024 to Apr 2024

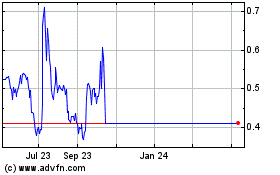

Elys Game Technology (NASDAQ:ELYS)

Historical Stock Chart

From Apr 2023 to Apr 2024