0000727273

CADIZ INC

false

--12-31

Q3

2023

4,444

2,097

6,541

2

2

6,545

1,265

7,810

0.15

11,620

6,144

17,764

5

171

17,940

3,818

21,758

0.45

0.01

0.01

100,000

100,000

329

329

329

329

8.875

8.875

0.01

0.01

7,500

7,500

2,300

2,300

2,300

2,300

0.01

0.01

85,000,000

70,000,000

66,604,981

66,604,981

55,823,810

55,823,810

8.875

550

8.875

560

8.875

550

8.875

550

8.875

560

8.875

550

2020 2021 2022

2019 2020 2021 2022

3

4

0

66,604,981

2

3

0.001

2,300

750,000

00007272732023-01-012023-09-30

0000727273us-gaap:CommonStockMember2023-01-012023-09-30

0000727273cdzi:DepositorySharesMember2023-01-012023-09-30

xbrli:shares

00007272732023-11-08

thunderdome:item

iso4217:USD

00007272732023-07-012023-09-30

00007272732022-07-012022-09-30

iso4217:USDxbrli:shares

00007272732022-01-012022-09-30

00007272732023-09-30

00007272732022-12-31

xbrli:pure

0000727273us-gaap:SeriesAPreferredStockMember2023-01-012023-09-30

0000727273us-gaap:SeriesAPreferredStockMember2022-01-012022-12-31

0000727273us-gaap:SeriesAPreferredStockMember2023-09-30

0000727273us-gaap:SeriesAPreferredStockMember2022-12-31

00007272732021-12-31

00007272732022-09-30

0000727273us-gaap:CommonStockMember2022-12-31

0000727273us-gaap:PreferredStockMember2022-12-31

0000727273us-gaap:SeriesAPreferredStockMemberus-gaap:PreferredStockMember2022-12-31

0000727273us-gaap:AdditionalPaidInCapitalMember2022-12-31

0000727273us-gaap:RetainedEarningsMember2022-12-31

0000727273us-gaap:CommonStockMember2023-01-012023-03-31

0000727273us-gaap:PreferredStockMember2023-01-012023-03-31

0000727273us-gaap:SeriesAPreferredStockMemberus-gaap:PreferredStockMember2023-01-012023-03-31

0000727273us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-31

0000727273us-gaap:RetainedEarningsMember2023-01-012023-03-31

00007272732023-01-012023-03-31

0000727273us-gaap:CommonStockMember2023-03-31

0000727273us-gaap:PreferredStockMember2023-03-31

0000727273us-gaap:SeriesAPreferredStockMemberus-gaap:PreferredStockMember2023-03-31

0000727273us-gaap:AdditionalPaidInCapitalMember2023-03-31

0000727273us-gaap:RetainedEarningsMember2023-03-31

00007272732023-03-31

0000727273us-gaap:CommonStockMember2023-04-012023-06-30

0000727273us-gaap:PreferredStockMember2023-04-012023-06-30

0000727273us-gaap:SeriesAPreferredStockMemberus-gaap:PreferredStockMember2023-04-012023-06-30

0000727273us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-30

0000727273us-gaap:RetainedEarningsMember2023-04-012023-06-30

00007272732023-04-012023-06-30

0000727273us-gaap:CommonStockMember2023-06-30

0000727273us-gaap:PreferredStockMember2023-06-30

0000727273us-gaap:SeriesAPreferredStockMemberus-gaap:PreferredStockMember2023-06-30

0000727273us-gaap:AdditionalPaidInCapitalMember2023-06-30

0000727273us-gaap:RetainedEarningsMember2023-06-30

00007272732023-06-30

0000727273us-gaap:CommonStockMember2023-07-012023-09-30

0000727273us-gaap:PreferredStockMember2023-07-012023-09-30

0000727273us-gaap:SeriesAPreferredStockMemberus-gaap:PreferredStockMember2023-07-012023-09-30

0000727273us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-30

0000727273us-gaap:RetainedEarningsMember2023-07-012023-09-30

0000727273us-gaap:CommonStockMember2023-09-30

0000727273us-gaap:PreferredStockMember2023-09-30

0000727273us-gaap:SeriesAPreferredStockMemberus-gaap:PreferredStockMember2023-09-30

0000727273us-gaap:AdditionalPaidInCapitalMember2023-09-30

0000727273us-gaap:RetainedEarningsMember2023-09-30

0000727273us-gaap:CommonStockMember2021-12-31

0000727273us-gaap:PreferredStockMember2021-12-31

0000727273us-gaap:SeriesAPreferredStockMemberus-gaap:PreferredStockMember2021-12-31

0000727273us-gaap:AdditionalPaidInCapitalMember2021-12-31

0000727273us-gaap:RetainedEarningsMember2021-12-31

0000727273us-gaap:CommonStockMember2022-01-012022-03-31

0000727273us-gaap:PreferredStockMember2022-01-012022-03-31

0000727273us-gaap:SeriesAPreferredStockMemberus-gaap:PreferredStockMember2022-01-012022-03-31

0000727273us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-31

0000727273us-gaap:RetainedEarningsMember2022-01-012022-03-31

00007272732022-01-012022-03-31

0000727273us-gaap:CommonStockMember2022-03-31

0000727273us-gaap:PreferredStockMember2022-03-31

0000727273us-gaap:SeriesAPreferredStockMemberus-gaap:PreferredStockMember2022-03-31

0000727273us-gaap:AdditionalPaidInCapitalMember2022-03-31

0000727273us-gaap:RetainedEarningsMember2022-03-31

00007272732022-03-31

0000727273us-gaap:CommonStockMember2022-04-012022-06-30

0000727273us-gaap:PreferredStockMember2022-04-012022-06-30

0000727273us-gaap:SeriesAPreferredStockMemberus-gaap:PreferredStockMember2022-04-012022-06-30

0000727273us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-30

0000727273us-gaap:RetainedEarningsMember2022-04-012022-06-30

00007272732022-04-012022-06-30

0000727273us-gaap:CommonStockMember2022-06-30

0000727273us-gaap:PreferredStockMember2022-06-30

0000727273us-gaap:SeriesAPreferredStockMemberus-gaap:PreferredStockMember2022-06-30

0000727273us-gaap:AdditionalPaidInCapitalMember2022-06-30

0000727273us-gaap:RetainedEarningsMember2022-06-30

00007272732022-06-30

0000727273us-gaap:CommonStockMember2022-07-012022-09-30

0000727273us-gaap:PreferredStockMember2022-07-012022-09-30

0000727273us-gaap:SeriesAPreferredStockMemberus-gaap:PreferredStockMember2022-07-012022-09-30

0000727273us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-30

0000727273us-gaap:RetainedEarningsMember2022-07-012022-09-30

0000727273us-gaap:CommonStockMember2022-09-30

0000727273us-gaap:PreferredStockMember2022-09-30

0000727273us-gaap:SeriesAPreferredStockMemberus-gaap:PreferredStockMember2022-09-30

0000727273us-gaap:AdditionalPaidInCapitalMember2022-09-30

0000727273us-gaap:RetainedEarningsMember2022-09-30

0000727273cdzi:DirectOfferingMemberus-gaap:PrivatePlacementMember2023-01-012023-01-31

0000727273cdzi:DirectOfferingMemberus-gaap:PrivatePlacementMember2023-01-31

0000727273cdzi:FirstAmendedCreditAgreement1Member2023-01-012023-01-31

0000727273cdzi:FirstAmendedCreditAgreement1Membersrt:MaximumMember2023-02-022023-02-02

0000727273cdzi:FirstAmendedCreditAgreement1Member2023-02-02

0000727273cdzi:SeniorSecuredDebtMember2023-01-012023-09-30

0000727273cdzi:SeniorSecuredDebtMember2023-09-30

0000727273cdzi:AtecAcquisitionMember2022-11-092022-11-09

0000727273us-gaap:IntersegmentEliminationMember2023-01-012023-09-30

0000727273cdzi:WaterAndLandResourcesMember2023-07-012023-09-30

0000727273cdzi:WaterTreatmentMember2023-07-012023-09-30

0000727273cdzi:WaterAndLandResourcesMember2023-01-012023-09-30

0000727273cdzi:WaterTreatmentMember2023-01-012023-09-30

0000727273cdzi:WaterAndLandResourcesMember2023-09-30

0000727273cdzi:WaterAndLandResourcesMember2022-12-31

0000727273cdzi:WaterTreatmentMember2023-09-30

0000727273cdzi:WaterTreatmentMember2022-12-31

0000727273us-gaap:LandAndLandImprovementsMembercdzi:WaterAndLandResourcesMember2023-09-30

0000727273cdzi:WaterProgramsMembercdzi:WaterAndLandResourcesMember2023-09-30

0000727273us-gaap:PipelinesMembercdzi:WaterAndLandResourcesMember2023-09-30

0000727273us-gaap:BuildingMembercdzi:WaterAndLandResourcesMember2023-09-30

0000727273cdzi:LeaseholdImprovementsFurnitureFixturesMembercdzi:WaterAndLandResourcesMember2023-09-30

0000727273cdzi:LeaseholdImprovementsFurnitureFixturesMembercdzi:WaterTreatmentMember2023-09-30

0000727273us-gaap:MachineryAndEquipmentMembercdzi:WaterAndLandResourcesMember2023-09-30

0000727273us-gaap:MachineryAndEquipmentMembercdzi:WaterTreatmentMember2023-09-30

0000727273us-gaap:ConstructionInProgressMembercdzi:WaterAndLandResourcesMember2023-09-30

0000727273us-gaap:LandAndLandImprovementsMembercdzi:WaterAndLandResourcesMember2022-12-31

0000727273cdzi:WaterProgramsMembercdzi:WaterAndLandResourcesMember2022-12-31

0000727273us-gaap:PipelinesMembercdzi:WaterAndLandResourcesMember2022-12-31

0000727273us-gaap:BuildingMembercdzi:WaterAndLandResourcesMember2022-12-31

0000727273cdzi:LeaseholdImprovementsFurnitureFixturesMembercdzi:WaterAndLandResourcesMember2022-12-31

0000727273cdzi:LeaseholdImprovementsFurnitureFixturesMembercdzi:WaterTreatmentMember2022-12-31

0000727273us-gaap:MachineryAndEquipmentMembercdzi:WaterAndLandResourcesMember2022-12-31

0000727273us-gaap:MachineryAndEquipmentMembercdzi:WaterTreatmentMember2022-12-31

0000727273us-gaap:ConstructionInProgressMembercdzi:WaterAndLandResourcesMember2022-12-31

0000727273cdzi:NewLoanMember2021-07-02

0000727273cdzi:NewLoanMembercdzi:RepaymentAfterEighteenmonthsOfTheClosingDateMember2021-07-02

0000727273cdzi:NewLoanMembercdzi:RepaymentAfterThirtymonthsOfTheClosingDateMember2021-07-02

0000727273cdzi:NewLoanMember2023-02-022023-02-02

0000727273cdzi:NewLoanMember2023-02-02

0000727273cdzi:ConversionOptionOnDebtMember2023-02-02

0000727273cdzi:ConversionOptionOnDebtMembercdzi:ReclassifiedToAdditionalPaidinCapitalMember2023-09-30

0000727273cdzi:ConversionOptionOnDebtMember2023-07-012023-09-30

0000727273cdzi:ConversionOptionOnDebtMember2023-01-012023-09-30

0000727273us-gaap:SeriesAPreferredStockMember2021-07-022021-07-02

0000727273cdzi:NewLoanMembercdzi:IssuanceAfterOneYearOfTheClosingDateMember2021-07-02

0000727273cdzi:DepositorySharesMember2021-07-02

0000727273cdzi:NewLoanMembercdzi:After24monthsAnniversaryOfTheClosingOfTheDebtMember2021-07-02

0000727273cdzi:WarrantsIssuedToLendersMember2021-07-022021-07-02

0000727273cdzi:AWarrantMember2021-07-02

utr:D

0000727273cdzi:BWarrantMember2021-07-02

0000727273cdzi:TwoThousandNineteenEquityIncentivePlanMember2019-07-10

0000727273cdzi:TwoThousandNineteenEquityIncentivePlanMembercdzi:AccruesYearlyMembercdzi:OutsideDirectorMember2021-07-012021-07-01

0000727273cdzi:TwoThousandNineteenEquityIncentivePlanMembercdzi:AccruesQuarterlyMembercdzi:OutsideDirectorMember2021-07-012021-07-01

0000727273cdzi:TwoThousandNineteenEquityIncentivePlanMembercdzi:DirectorsConsultantsAndEmployeesMember2023-01-012023-09-30

0000727273cdzi:TwoThousandNineteenEquityIncentivePlanMembersrt:DirectorMember2023-01-012023-09-30

0000727273us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedPaymentArrangementEmployeeMember2021-04-012021-04-30

0000727273cdzi:MilestonerRSUSMemberus-gaap:ShareBasedPaymentArrangementEmployeeMember2021-04-012021-04-30

0000727273cdzi:MilestonerRSUSMemberus-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2021-04-012021-04-30

0000727273cdzi:MilestonerRSUSMemberus-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2021-04-012021-04-30

00007272732021-04-30

0000727273cdzi:NonmilestoneRestrictedStockUnitsRsusMemberus-gaap:ShareBasedPaymentArrangementEmployeeMember2021-04-012021-04-30

0000727273cdzi:NonmilestoneRestrictedStockUnitsRsusMemberus-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2023-01-032023-01-03

0000727273cdzi:NonmilestoneRestrictedStockUnitsRsusMemberus-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2023-03-012023-03-01

0000727273cdzi:NonmilestoneRestrictedStockUnitsRsusMemberus-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2022-07-012022-07-31

0000727273cdzi:NonmilestoneRestrictedStockUnitsRsusMemberus-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2021-04-012021-04-30

0000727273cdzi:NonmilestoneRestrictedStockUnitsRsusMemberus-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2022-01-012022-12-31

0000727273us-gaap:RestrictedStockUnitsRSUMember2022-02-042022-02-04

0000727273us-gaap:RestrictedStockUnitsRSUMembercdzi:VestingUponCompletionOfFinalBindingWaterSupplyAgreementMember2022-02-042022-02-04

0000727273us-gaap:RestrictedStockUnitsRSUMembercdzi:VestingOnMarch12023Member2022-02-042022-02-04

0000727273cdzi:PerformanceStockUnitsMember2022-02-042022-02-04

0000727273cdzi:PerformanceStockUnitsMembercdzi:VestingUponPriceHurdleOf7PerShareMember2022-02-042022-02-04

0000727273cdzi:PerformanceStockUnitsMembercdzi:VestingUponPriceHurdleOf7PerShareMember2022-02-04

0000727273cdzi:PerformanceStockUnitsMembercdzi:VestingUponPriceHurdleOf9PerShareMember2022-02-042022-02-04

0000727273cdzi:PerformanceStockUnitsMembercdzi:VestingUponPriceHurdleOf9PerShareMember2022-02-04

0000727273cdzi:PerformanceStockUnitsMembercdzi:VestingUponPriceHurdleOf11PerShareMember2022-02-042022-02-04

0000727273cdzi:PerformanceStockUnitsMembercdzi:VestingUponPriceHurdleOf11PerShareMember2022-02-04

0000727273cdzi:PerformanceStockUnitsMembercdzi:VestingUponPriceHurdleOf13PerShareMember2022-02-042022-02-04

0000727273cdzi:PerformanceStockUnitsMembercdzi:VestingUponPriceHurdleOf13PerShareMember2022-02-04

0000727273us-gaap:RestrictedStockUnitsRSUMembercdzi:AConsultantMember2023-07-012023-07-01

0000727273us-gaap:RestrictedStockUnitsRSUMembercdzi:AConsultantMembercdzi:VestingUponCompletionOfCertainMilestoneMember2023-07-012023-07-01

0000727273us-gaap:RestrictedStockUnitsRSUMembercdzi:AConsultantMember2023-07-01

0000727273us-gaap:RestrictedStockUnitsRSUMembercdzi:AConsultantMembercdzi:VestingOnOctober12023Member2023-07-012023-07-01

0000727273us-gaap:RestrictedStockUnitsRSUMembercdzi:AConsultantMembercdzi:VestingOnFebruary12024Member2023-07-012023-07-01

0000727273us-gaap:DomesticCountryMemberus-gaap:InternalRevenueServiceIRSMember2023-09-30

0000727273us-gaap:StateAndLocalJurisdictionMemberus-gaap:CaliforniaFranchiseTaxBoardMember2023-09-30

0000727273us-gaap:DomesticCountryMemberus-gaap:InternalRevenueServiceIRSMember2023-01-012023-09-30

0000727273us-gaap:StateAndLocalJurisdictionMemberus-gaap:CaliforniaFranchiseTaxBoardMember2023-01-012023-09-30

utr:Y

utr:M

0000727273srt:MinimumMember2023-09-30

0000727273srt:MaximumMember2023-09-30

0000727273cdzi:FennerValleyFarmsLLCLeaseAgreementMember2016-02-29

utr:acre

0000727273cdzi:FennerValleyFarmsLLCLeaseAgreementMember2016-02-292016-02-29

0000727273cdzi:FennerValleyFarmsLLCLeaseAgreementMember2022-03-31

0000727273cdzi:PropertyRelatedToDevelopmentOfAlfalfaMember2023-09-30

0000727273cdzi:LandImprovementsBuildingsLeaseholdImprovementsMachineryAndEquipmentAndFurnitureAndFixturesMember2023-01-012023-09-30

0000727273cdzi:LandImprovementsBuildingsLeaseholdImprovementsMachineryAndEquipmentAndFurnitureAndFixturesMember2022-01-012022-09-30

0000727273cdzi:AtecAcquisitionMember2022-12-31

0000727273us-gaap:FairValueInputsLevel1Member2022-12-31

0000727273us-gaap:CertificatesOfDepositMemberus-gaap:FairValueInputsLevel1Member2023-01-012023-09-30

0000727273us-gaap:FairValueInputsLevel1Member2023-09-30

0000727273us-gaap:FairValueInputsLevel2Member2023-09-30

0000727273us-gaap:FairValueInputsLevel3Member2023-09-30

00007272732013-01-31

0000727273cdzi:SharesEarnedUponTheSigningOfBindingAgreementsMember2013-01-31

0000727273cdzi:SharesEarnedUponTheCommencementOfConstructionMember2013-01-31

00007272732013-01-312013-01-31

0000727273cdzi:ConversionOfConvertibleSeniorNotes2020IntoPreferredStockMember2020-03-052020-03-05

0000727273us-gaap:PreferredClassAMember2020-03-05

0000727273cdzi:Series1PreferredStockMember2022-01-012022-12-31

0000727273cdzi:Series1PreferredStockMember2022-12-31

0000727273cdzi:DepositorySharesMembercdzi:SaleIncludingOverallotmentOptionMember2021-06-292021-06-29

0000727273srt:MaximumMembercdzi:SaleIncludingOverallotmentOptionMembercdzi:SaleIncludingOverallotmentOptionMember2021-06-292021-06-29

0000727273cdzi:DepositorySharesMember2021-06-29

0000727273us-gaap:SeriesAPreferredStockMember2021-06-292021-06-29

0000727273us-gaap:SeriesAPreferredStockMember2021-07-01

0000727273us-gaap:SeriesAPreferredStockMember2021-07-012021-07-01

0000727273cdzi:DepositorySharesMember2021-07-01

00007272732021-07-022023-09-30

0000727273cdzi:DepositorySharesMember2023-09-30

0000727273us-gaap:SeriesAPreferredStockMembersrt:ScenarioForecastMember2026-07-02

0000727273cdzi:DepositorySharesMembersrt:ScenarioForecastMember2026-07-02

0000727273us-gaap:SeriesAPreferredStockMembercdzi:UponChangeOfControlMember2021-07-01

0000727273cdzi:DepositorySharesMembercdzi:UponChangeOfControlMember2021-07-01

0000727273cdzi:WaterProjectMember2023-09-30

0000727273cdzi:WaterProjectMember2022-09-30

0000727273cdzi:AtecAcquisitionMember2023-09-30

united states

Securities and Exchange Commission

Washington, D. C. 20549

FORM 10-Q

(Mark One)

☑ Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

for the quarterly period ended September 30, 2023

OR

☐ Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

for the transition period from …… to …….

Commission File Number 0-12114

Cadiz Inc.

(Exact name of registrant specified in its charter)

| Delaware | 77-0313235 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

| 550 South Hope Street, Suite 2850 | |

| Los Angeles, California | 90071 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (213) 271-1600

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

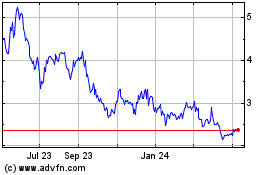

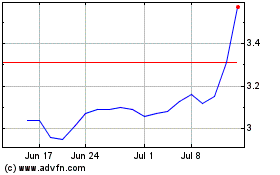

| Common Stock, par value $0.01 per share | CDZI | The NASDAQ Global Market |

| Depositary Shares (each representing a 1/1000th fractional interest in share of 8.875% Series A Cumulative Perpetual Preferred Stock, par value $0.01 per share) | CDZIP | The NASDAQ Global Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer" , "smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

☐ Large accelerated filer ☐ Accelerated filer ☑ Non-accelerated filer

☑ Smaller Reporting Company ☐ Emerging growth company

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes ☐ No ☑

As of November 8, 2023, the Registrant had 66,710,795 shares of common stock, par value $0.01 per share, outstanding.

Cadiz Inc.

Condensed Consolidated Statements of Operations and Comprehensive Loss (Unaudited)

| |

|

For the Three Months |

|

| |

|

Ended September 30, |

|

| ($ in thousands, except per share data) |

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

| Total revenues |

|

$ |

368 |

|

|

$ |

599 |

|

| |

|

|

|

|

|

|

|

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

| Cost of sales |

|

|

692 |

|

|

|

1,163 |

|

| General and administrative |

|

|

5,127 |

|

|

|

3,700 |

|

| Depreciation |

|

|

308 |

|

|

|

180 |

|

| |

|

|

|

|

|

|

|

|

| Total costs and expenses |

|

|

6,127 |

|

|

|

5,043 |

|

| |

|

|

|

|

|

|

|

|

| Operating loss |

|

|

(5,759 |

) |

|

|

(4,444 |

) |

| |

|

|

|

|

|

|

|

|

| Interest expense, net |

|

|

(1,173 |

) |

|

|

(2,097 |

) |

| |

|

|

|

|

|

|

|

|

| Loss before income taxes |

|

|

(6,932 |

) |

|

|

(6,541 |

) |

| Income tax expense |

|

|

(4 |

) |

|

|

(2 |

) |

| Loss from equity-method investments |

|

|

- |

|

|

|

(2 |

) |

| |

|

|

|

|

|

|

|

|

| Net loss and comprehensive loss |

|

$ |

(6,936 |

) |

|

$ |

(6,545 |

) |

| |

|

|

|

|

|

|

|

|

| Less: Preferred stock dividend |

|

|

(1,265 |

) |

|

|

(1,265 |

) |

| |

|

|

|

|

|

|

|

|

| Net loss and comprehensive loss applicable to common stock |

|

$ |

(8,201 |

) |

|

$ |

(7,810 |

) |

| |

|

|

|

|

|

|

|

|

| Basic and diluted net loss per common share |

|

$ |

(0.12 |

) |

|

$ |

(0.15 |

) |

| |

|

|

|

|

|

|

|

|

| Basic and diluted weighted average shares outstanding |

|

|

66,611 |

|

|

|

50,793 |

|

See accompanying notes to the unaudited condensed consolidated financial statements.

| Cadiz Inc. |

| Condensed Consolidated Statements of Operations and Comprehensive Loss (Unaudited) |

| |

|

For the Nine Months |

|

| |

|

Ended September 30, |

|

| ($ in thousands, except per share data) |

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

| Total revenues |

|

$ |

1,307 |

|

|

$ |

927 |

|

| |

|

|

|

|

|

|

|

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

| Cost of sales |

|

|

1,482 |

|

|

|

1,163 |

|

| General and administrative |

|

|

14,378 |

|

|

|

10,911 |

|

| Depreciation |

|

|

942 |

|

|

|

473 |

|

| |

|

|

|

|

|

|

|

|

| Total costs and expenses |

|

|

16,802 |

|

|

|

12,547 |

|

| |

|

|

|

|

|

|

|

|

| Operating loss |

|

|

(15,495 |

) |

|

|

(11,620 |

) |

| |

|

|

|

|

|

|

|

|

| Interest expense, net |

|

|

(3,637 |

) |

|

|

(6,144 |

) |

| Loss on derivative liability |

|

|

(220 |

) |

|

|

- |

|

| Loss on early extinguishment of debt |

|

|

(5,331 |

) |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| Loss before income taxes |

|

|

(24,683 |

) |

|

|

(17,764 |

) |

| Income tax expense |

|

|

(8 |

) |

|

|

(5 |

) |

| Loss from equity-method investments |

|

|

- |

|

|

|

(171 |

) |

| |

|

|

|

|

|

|

|

|

| Net loss and comprehensive loss |

|

$ |

(24,691 |

) |

|

$ |

(17,940 |

) |

| |

|

|

|

|

|

|

|

|

| Less: Preferred stock dividend |

|

|

(3,818 |

) |

|

|

(3,818 |

) |

| |

|

|

|

|

|

|

|

|

| Net loss and comprehensive loss applicable to common stock |

|

$ |

(28,509 |

) |

|

$ |

(21,758 |

) |

| |

|

|

|

|

|

|

|

|

| Basic and diluted net loss per common share |

|

$ |

(0.44 |

) |

|

$ |

(0.45 |

) |

| |

|

|

|

|

|

|

|

|

| Basic and diluted weighted average shares outstanding |

|

|

65,299 |

|

|

|

48,689 |

|

See accompanying notes to the unaudited condensed consolidated financial statements.

| Cadiz Inc. |

| Condensed Consolidated Balance Sheets (Unaudited) |

| | | September 30, | | | December 31, | |

| ($ in thousands, except per share data) | | 2023 | | | 2022 | |

| | | | | | | | | |

| ASSETS | | | | | | | | |

| Current assets: | | | | | | | | |

| Cash and cash equivalents | | $ | 13,306 | | | $ | 9,997 | |

| Restricted cash | | | - | | | | 1,288 | |

| Accounts receivable | | | 410 | | | | 454 | |

| Inventories | | | 2,128 | | | | 316 | |

| Prepaid expenses and other current assets | | | 782 | | | | 380 | |

| Total current assets | | | 16,626 | | | | 12,435 | |

| | | | | | | | | |

| Property, plant, equipment and water programs, net | | | 85,536 | | | | 84,138 | |

| Long-term deposit/prepaid expenses | | | 420 | | | | 420 | |

| Goodwill | | | 5,714 | | | | 5,714 | |

| Right-of-use asset | | | 463 | | | | 553 | |

| Long-term restricted cash | | | 134 | | | | 2,497 | |

| Other assets | | | 5,562 | | | | 5,030 | |

| Total assets | | $ | 114,455 | | | $ | 110,787 | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Accounts payable | | $ | 1,626 | | | $ | 1,107 | |

| Accrued liabilities | | | 1,184 | | | | 1,545 | |

| Current portion of long-term debt | | | 193 | | | | 140 | |

| Dividend payable | | | 1,265 | | | | 1,288 | |

| Contingent consideration liabilities | | | 1,450 | | | | 1,450 | |

| Short-term deferred revenue | | | 93 | | | | - | |

| Operating lease liabilities | | | 119 | | | | 109 | |

| Total current liabilities | | | 5,930 | | | | 5,639 | |

| | | | | | | | | |

| Long-term debt, net | | | 37,394 | | | | 48,950 | |

| Long-term lease obligations with related party, net | | | 22,333 | | | | 20,745 | |

| Long-term operating lease liabilities | | | 354 | | | | 444 | |

| Deferred revenue | | | 750 | | | | 750 | |

| Other long-term liabilities | | | 39 | | | | 36 | |

| Total liabilities | | | 66,800 | | | | 76,564 | |

| | | | | | | | | |

| Commitments and contingencies (Note 10) | | | | | | | | |

| | | | | | | | | |

| Stockholders’ equity: | | | | | | | | |

| | | | | | | | | |

| Preferred stock - $.01 par value; 100,000 shares authorized at September 30, 2023 and December 31, 2022; shares issued and outstanding – 329 at September 30, 2023 and December 31, 2022 | | | 1 | | | | 1 | |

| 8.875% Series A cumulative, perpetual preferred stock - $.01 par value; 7,500 shares authorized at September 30, 2023 and December 31, 2022; shares issued and outstanding – 2,300 at September 30, 2023 and December 31, 2022 | | | 1 | | | | 1 | |

| Common stock - $.01 par value; shares authorized – 85,000,000 at September 30, 2023 and 70,000,000 at December 31, 2022; shares issued and outstanding – 66,604,981 at September 30, 2023 and 55,823,810 at December 31, 2022 | | | 664 | | | | 556 | |

| Additional paid-in capital | | | 678,796 | | | | 636,963 | |

| Accumulated deficit | | | (631,807 | ) | | | (603,298 | ) |

| Total stockholders’ equity | | | 47,655 | | | | 34,223 | |

| Total liabilities and stockholders’ deficit | | $ | 114,455 | | | $ | 110,787 | |

See accompanying notes to the unaudited condensed consolidated financial statements.

| Cadiz Inc. |

| Condensed Consolidated Statements of Cash Flows (Unaudited) |

| |

|

For the Nine Months |

|

| |

|

Ended September 30, |

|

| ($ in thousands) |

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

| Cash flows from operating activities: |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(24,691 |

) |

|

|

(17,940 |

) |

| Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

| Depreciation |

|

|

942 |

|

|

|

473 |

|

| Amortization of debt discount and issuance costs |

|

|

337 |

|

|

|

1,777 |

|

| Amortization of right-of-use asset |

|

|

90 |

|

|

|

18 |

|

| Interest expense added to loan principal |

|

|

711 |

|

|

|

- |

|

| Interest expense added to lease liability |

|

|

1,570 |

|

|

|

1,390 |

|

| Unrealized loss on derivative liability |

|

|

220 |

|

|

|

- |

|

| Loss on early extinguishment of debt |

|

|

5,331 |

|

|

|

- |

|

| Loss on equity method investments |

|

|

- |

|

|

|

171 |

|

| Compensation charge for stock and share option awards |

|

|

1,142 |

|

|

|

1,348 |

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

| Accounts receivable |

|

|

44 |

|

|

|

(276 |

) |

| Inventories |

|

|

(1,812 |

) |

|

|

(335 |

) |

| Prepaid expenses and other current assets |

|

|

(402 |

) |

|

|

(43 |

) |

| Other assets |

|

|

(532 |

) |

|

|

(214 |

) |

| Accounts payable |

|

|

1,312 |

|

|

|

253 |

|

| Lease liabilities |

|

|

(80 |

) |

|

|

(98 |

) |

| Deferred revenue |

|

|

93 |

|

|

|

|

|

| Other accrued liabilities |

|

|

323 |

|

|

|

102 |

|

| |

|

|

|

|

|

|

|

|

| Net cash used in operating activities |

|

|

(15,402 |

) |

|

|

(13,374 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from investing activities: |

|

|

|

|

|

|

|

|

| Additions to property, plant and equipment and water programs |

|

|

(3,815 |

) |

|

|

(2,432 |

) |

| Contributions to equity-method investments |

|

|

- |

|

|

|

(101 |

) |

| |

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

|

|

(3,815 |

) |

|

|

(2,533 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from financing activities: |

|

|

|

|

|

|

|

|

| Net proceeds from issuance of stock |

|

|

38,490 |

|

|

|

11,741 |

|

| Proceeds from the issuance of long-term debt |

|

|

233 |

|

|

|

275 |

|

| Dividend payments |

|

|

(3,841 |

) |

|

|

(3,841 |

) |

| Principal payments on long-term debt |

|

|

(15,119 |

) |

|

|

(117 |

) |

| Issuance costs of long-term debt |

|

|

(27 |

) |

|

|

- |

|

| Costs for early extinguishment of debt |

|

|

(600 |

) |

|

|

- |

|

| Taxes paid related to net share settlement of equity awards |

|

|

(261 |

) |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| Net cash provided by financing activities |

|

|

18,875 |

|

|

|

8,058 |

|

| |

|

|

|

|

|

|

|

|

| Net decrease in cash, cash equivalents and restricted cash |

|

|

(342 |

) |

|

|

(7,849 |

) |

| |

|

|

|

|

|

|

|

|

| Cash, cash equivalents and restricted cash, beginning of period |

|

|

13,782 |

|

|

|

19,856 |

|

| |

|

|

|

|

|

|

|

|

| Cash, cash equivalents and restricted cash, end of period |

|

$ |

13,440 |

|

|

$ |

12,007 |

|

See accompanying notes to the unaudited condensed consolidated financial statements.

| Cadiz Inc. |

| Condensed Consolidated Statements of Stockholders’ Equity (Unaudited) |

For the three and nine months ended September 30, 2023 ($ in thousands, except share data)

| | | | | | | | | | | | | | | | | | | 8.875% Series A Cumulative | | | Additional | | | | | | | Total | |

| | | Common Stock | | | Preferred Stock | | | Perpetual Preferred Stock | | | Paid-in | | | Accumulated | | | Stockholders’ | |

| | | Shares | | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Deficit | | | Equity | |

| Balance as of December 31, 2022 | | | 55,823,810 | | | $ | 556 | | | | 329 | | | $ | 1 | | | | 2,300 | | | $ | 1 | | | $ | 636,963 | | | $ | (603,298 | ) | | $ | 34,223 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock-based compensation expense | | | 217,452 | | | | 2 | | | | - | | | | - | | | | - | | | | - | | | | 63 | | | | - | | | | 65 | |

| Issuance of shares pursuant to direct offerings | | | 10,500,000 | | | | 105 | | | | - | | | | - | | | | - | | | | - | | | | 38,385 | | | | - | | | | 38,490 | |

| Dividends declared on 8.875% series A cumulative perpetual preferred shares ($550 per share) | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (1,265 | ) | | | (1,265 | ) |

| Net loss and comprehensive loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (10,691 | ) | | | (10,691 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of March 31, 2023 | | | 66,541,262 | | | | 663 | | | | 329 | | | $ | 1 | | | | 2,300 | | | $ | 1 | | | | 675,411 | | | | (615,254 | ) | | | 60,822 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock-based compensation expense | | | 54,344 | | | | 1 | | | | - | | | | - | | | | - | | | | - | | | | 163 | | | | - | | | | 164 | |

| Dividends declared on 8.875% series A cumulative perpetual preferred shares ($560 per share) | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (1,288 | ) | | | (1,288 | ) |

| Net loss and comprehensive loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (7,064 | ) | | | (7,064 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of June 30, 2023 | | | 66,595,606 | | | | 664 | | | | 329 | | | $ | 1 | | | | 2,300 | | | $ | 1 | | | | 675,574 | | | | (623,606 | ) | | | 52,634 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock-based compensation expense | | | 9,375 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 652 | | | | - | | | | 652 | |

| Reclassification of derivative liability | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 2,570 | | | | - | | | | 2,570 | |

| Dividends declared on 8.875% series A cumulative perpetual preferred shares ($550 per share) | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (1,265 | ) | | | (1,265 | ) |

| Net loss and comprehensive loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (6,936 | ) | | | (6,936 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of September 30, 2023 | | | 66,604,981 | | | $ | 644 | | | | 329 | | | $ | 1 | | | | 2,300 | | | $ | 1 | | | | 678,796 | | | | (631,807 | ) | | | 47,655 | |

See accompanying notes to the unaudited condensed consolidated financial statements.

| Cadiz Inc. |

| Condensed Consolidated Statements of Stockholders’ Equity (Unaudited) |

For the three and nine months ended September 30, 2022 ($ in thousands, except share data)

| | | | | | | | | | | | | | | | | | | 8.875% Series A Cumulative | | | Additional | | | | | | | Total | |

| | | Common Stock | | | Preferred Stock | | | Perpetual Preferred Stock | | | Paid-in | | | Accumulated | | | Stockholders’ | |

| | | Shares | | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Deficit | | | Equity | |

| Balance as of December 31, 2021 | | | 43,656,169 | | | $ | 435 | | | | 329 | | | $ | 1 | | | | 2,300 | | | $ | 1 | | | $ | 613,572 | | | $ | (573,400 | ) | | $ | 40,609 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock-based compensation expense | | | 236,995 | | | | 2 | | | | - | | | | - | | | | - | | | | - | | | | 431 | | | | - | | | | 433 | |

| Issuance of shares pursuant to direct offerings | | | 6,857,140 | | | | 69 | | | | - | | | | - | | | | - | | | | - | | | | 11,672 | | | | - | | | | 11,741 | |

| Dividends declared on 8.875% series A cumulative perpetual preferred shares ($550 per share) | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (1,265 | ) | | | (1,265 | ) |

| Net loss and comprehensive loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (5,912 | ) | | | (5,912 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of March 31, 2022 | | | 50,750,304 | | | | 506 | | | | 329 | | | $ | 1 | | | | 2,300 | | | $ | 1 | | | | 625,675 | | | | (580,577 | ) | | | 45,606 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock-based compensation expense | | | 19,971 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 423 | | | | - | | | | 423 | |

| Dividends declared on 8.875% series A cumulative perpetual preferred shares ($560 per share) | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (1,288 | ) | | | (1,288 | ) |

| Net loss and comprehensive loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (5,483 | ) | | | (5,483 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of June 30, 2022 | | | 50,770,275 | | | | 506 | | | | 329 | | | $ | 1 | | | | 2,300 | | | $ | 1 | | | $ | 626,098 | | | $ | (587,348 | ) | | $ | 39,258 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock-based compensation Expense | | | 23,292 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 491 | | | | - | | | | 491 | |

| Dividends declared on 8.875% series A cumulative perpetual preferred shares ($550 per share) | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (1,265 | ) | | | (1,265 | ) |

| Net loss and comprehensive loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (6,545 | ) | | | (6,545 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of September 30, 2022 | | | 50,793,567 | | | | 506 | | | | 329 | | | $ | 1 | | | | 2,300 | | | $ | 1 | | | $ | 626,589 | | | $ | (595,158 | ) | | $ | 31,939 | |

See accompanying notes to the unaudited condensed consolidated financial statements.

| Cadiz Inc. |

| Notes to the Consolidated Financial Statements |

NOTE 1 – BASIS OF PRESENTATION

The Condensed Consolidated Financial Statements and notes have been prepared by Cadiz Inc., also referred to as “Cadiz” or “the Company”, without audit and should be read in conjunction with the Consolidated Financial Statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022.

The foregoing Condensed Consolidated Financial Statements include the accounts of the Company and contain all adjustments, consisting only of normal recurring adjustments, which management considers necessary for a fair statement of the Company’s financial position, the results of its operations and its cash flows for the periods presented and have been prepared in accordance with generally accepted accounting principles.

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in the financial statements and the accompanying notes. Actual results could differ from those estimates and such differences may be material to the financial statements. The results of operations for the nine months ended September 30, 2023, are not necessarily indicative of results for the entire fiscal year ending December 31, 2023.

Liquidity

The Condensed Consolidated Financial Statements of the Company have been prepared using accounting principles applicable to a going concern, which assumes realization of assets and settlement of liabilities in the normal course of business.

The Company incurred losses of $24.7 million for the nine months ended September 30, 2023, compared to $17.9 million for the nine months ended September 30, 2022. The Company had working capital of $10.7 million at September 30, 2023 and used cash in its operations of $15.4 million for the nine months ended September 30, 2023. The higher loss in 2023 was primarily due to a loss on early extinguishment of debt in the amount of $5.3 million and increased general and administrative expense related to community partnership and communications investments and corporate communications modernization expenses, offset by higher interest expense in 2022.

Cash requirements during the nine months ended September 30, 2023, primarily reflect certain operating and administrative costs related to development of the Company’s land, water, infrastructure and technology assets for water solutions including the Cadiz Water Conservation & Storage Project (“Water Project”), agricultural operations and water treatment business. The Company’s present activities are focused on the development of its assets in ways that meet an urgent need for groundwater storage capacity in Southern California and growing demand for affordable, reliable, long-term water supplies before the next drought strikes the Southwestern United States.

| Cadiz Inc. |

| Notes to the Consolidated Financial Statements |

On January 30, 2023, the Company completed the sale and issuance of 10,500,000 shares of the Company’s common stock to certain institutional investors in a registered direct offering ( “January 2023 Direct Offering”). The shares of common stock were sold at a purchase price of $3.84 per share, for aggregate gross proceeds of $40.32 million and aggregate net proceeds of approximately $38.5 million. A portion of the proceeds were used to repay the Company’s debt in the principal amount of $15 million, together with fees and interest required to be paid in connection with such repayment under the Credit Agreement. The remaining proceeds are being used for capital expenditures to accelerate development of the Company’s water supply project, working capital and development of additional water resources to meet increased demand on an accelerated timetable.

On February 2, 2023, the Company and its wholly-owned subsidiary, Cadiz Real Estate LLC, as borrowers (collectively, the “Borrowers”) entered into a First Amendment to Credit Agreement with BRF Finance Co., LLC (“Lenders”) and B. Riley Securities, Inc., (“BRS”) as administrative agent, to amend certain provisions of the Credit Agreement dated as of July 2, 2021 (“First Amended Credit Agreement”). Under the First Amended Credit Agreement, the lenders will have a right to convert up to $15 million of outstanding principal, plus any PIK interest and any accrued and unpaid interest (the “Convertible Loan”) into shares of the Company’s common stock at a conversion price of $4.80 per share (the “Conversion Price”)(see “Note 3 – Long-Term Debt”, below).

The Company may meet its debt and working capital requirements through a variety of means, including extension, refinancing, equity placements, the sale or other disposition of assets, or reductions in operating costs. The covenants in the senior secured debt do not prohibit the Company’s use of additional equity financing and allow the Company to retain 100% of the proceeds of any common equity financing. The Company does not expect the loan covenants to materially limit its ability to finance its asset development activities.

Management assesses whether the Company has sufficient liquidity to fund its costs for the next twelve months from each financial statement issuance date. Management evaluates the Company’s liquidity to determine if there is a substantial doubt about the Company’s ability to continue as a going concern. In the preparation of this liquidity assessment, management applies judgement to estimate the projected cash flows of the Company including the following: (i) projected cash outflows (ii) projected cash inflows, (iii) categorization of expenditures as discretionary versus non-discretionary and (iv) the ability to raise capital. The cash flow projections are based on known or planned cash requirements for operating costs as well as planned costs for project development.

Limitations on the Company’s liquidity and ability to raise capital may adversely affect it. Sufficient liquidity is critical to meet the Company’s resource development activities. Although the Company currently expects its sources of capital to be sufficient to meet its near-term liquidity needs, there can be no assurance that its liquidity requirements will continue to be satisfied. If the Company cannot raise needed funds, it might be forced to make substantial reductions in its operating expenses, which could adversely affect its ability to implement its current business plan and ultimately its viability as a company.

Supplemental Cash Flow Information

During the nine months ended September 30, 2023, approximately $1,248,000 in interest payments on the Company’s senior secured debt was paid in cash and approximately $711,000 was recorded as interest payable in kind. There are no scheduled principal payments due on the senior secured debt prior to its maturity.

| Cadiz Inc. |

| Notes to the Consolidated Financial Statements |

At September 30, 2023, accruals for cash dividends payable on the Series A Preferred Stock was $1.27 million (see Note 9 – “Common and Preferred Stock”). The cash dividends were paid on October 14, 2023.

The balance of cash, cash equivalents, and restricted cash as shown in the condensed consolidated statements of cash flows is comprised of the following:

| Cash, Cash Equivalents and Restricted Cash | | September 30, 2023 | | | December 31, 2022 | | | September 30, 2022 | |

| (in thousands) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Cash and Cash Equivalents | | $ | 13,306 | | | $ | 9,997 | | | $ | 6,957 | |

| Restricted Cash | | | - | | | | 1,288 | | | | 1,265 | |

| Long Term Restricted Cash | | | 134 | | | | 2,497 | | | | 3,785 | |

| Cash, Cash Equivalents and Restricted Cash in the Consolidated Statement of Cash Flows | | $ | 13,440 | | | $ | 13,782 | | | $ | 12,007 | |

The restricted cash amounts primarily represented funds deposited into a segregated account, representing an amount sufficient to pre-fund quarterly dividend payments on Series A Preferred Stock underlying the Depositary Shares issued in the Depositary Share Offering through July 2023.

ATEC Water Systems, LLC

On November 9, 2022, the Company completed the acquisition of the assets of ATEC Systems, Inc. into ATEC Water Systems, LLC (“ATEC”), a water filtration technology company, at a purchase price of up to $2.2 million (“ATEC Acquisition”). The final allocation of purchase consideration to assets and liabilities is ongoing as the Company continues to evaluate certain balances, estimates and assumptions during the measurement period. Consistent with the allowable time to complete the Company’s assessment, the valuation of certain acquired assets and liabilities, including environmental liabilities and income taxes, is currently pending finalization.

Revenue Recognition

The Company’s revenue is currently derived from rental revenue from its agricultural lease, sales of farm crops, and sales of water filtration systems by ATEC. The Company recognizes revenue by following the five-step model under ASC 606 to achieve the core principle that an entity recognizes revenue to depict the transfer of goods or services to customers at an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. The five-step model requires that the Company (i) identifies the contract with the customer, (ii) identifies the performance obligations in the contract, (iii) determines the transaction price, including variable consideration to the extent that it is probable that a significant future reversal will not occur, (iv) allocates the transaction price to the respective performance obligations in the contract, and (v) recognizes revenue when (or as) the Company satisfies the performance obligation.

| Cadiz Inc. |

| Notes to the Consolidated Financial Statements |

|

Recent Accounting Pronouncements

Accounting Guidance Adopted

In June 2016, Financial Accounting Standards Board (“FASB”) issued an accounting standards update which introduces new guidance for the accounting for credit losses on certain financial instruments. This update is effective for fiscal years beginning after December 15, 2022, and for interim periods within those fiscal years, with early adoption permitted. The adoption of this new standard on January 1, 2023, had no impact on the Company’s consolidated financial statements.

NOTE 2 – REPORTABLE SEGMENTS

The Company currently operates in two segments based upon its organizational structure and the way in which its operations are managed and evaluated. The Company’s largest segment is Land and Water Resources, which comprises all activities regarding its properties in the eastern Mojave Desert including development of the Water Project, and agricultural operations. The Company’s second operating segment is its water treatment business, ATEC Water Systems LLC (“ATEC”) which provides innovative water filtration solutions for impaired or contaminated groundwater sources. The Company acquired the assets of ATEC Systems, Inc. in November 2022 into its new subsidiary ATEC. There were intersegment sales of $311 thousand during the nine months ended September 30, 2023, which resulted in an intercompany elimination of profits in the amount of $102 thousand.

We evaluate our performance based on segment operating (loss). Interest expense, income tax expense and losses related to equity method investments are excluded from the computation of operating (loss) for the segments. Segment net revenue, segment operating expenses and segment operating (loss) information consisted of the following for the three and nine months ended September 30, 2023:

| | | Three Months Ended September 30, 2023 | |

| | | | | | | | | | |

| (in thousands) | | Land and Water Resources | | | Water Treatment | | | Total | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total revenues | | | 199 | | | | 169 | | | | 368 | |

| | | | | | | | | | | | | |

| Costs and expenses: | | | | | | | | | | | | |

| Cost of sales | | | 513 | | | | 179 | | | | 692 | |

| General and administrative | | | 4,927 | | | | 200 | | | | 5,127 | |

| Depreciation | | | 277 | | | | 31 | | | | 308 | |

| | | | | | | | | | | | | |

| Total costs and expenses | | | 5,717 | | | | 410 | | | | 6,127 | |

| | | | | | | | | | | | | |

| Operating loss | | $ | (5,518 | ) | | $ | (241 | ) | | $ | (5,759 | ) |

| Cadiz Inc. |

| Notes to the Consolidated Financial Statements |

| | | Nine Months Ended September 30, 2023 | |

| | | | | | | | | | | | | |

| (in thousands) | | Land and Water Resources | | | Water Treatment | | | Total | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total revenues | | | 708 | | | | 599 | | | | 1,307 | |

| | | | | | | | | | | | | |

| Costs and expenses: | | | | | | | | | | | | |

| Cost of sales | | | 967 | | | | 515 | | | | 1,482 | |

| General and administrative | | | 13,926 | | | | 452 | | | | 14,378 | |

| Depreciation | | | 826 | | | | 116 | | | | 942 | |

| | | | | | | | | | | | | |

| Total costs and expenses | | | 15,719 | | | | 1,083 | | | | 16,802 | |

| | | | | | | | | | | | | |

| Operating loss | | $ | (15,011 | ) | | $ | (484 | ) | | $ | (15,495 | ) |

The Company only operated in one segment during the nine months ended September 30, 2022, as the water treatment segment did not exist prior to the ATEC Acquisition in November 2022.

Assets by operating segment are as follows (dollars in thousands):

| | | September 30, | | | December 31, | |

| | | 2023 | | | 2022 | |

| Operating Segment: | | | | | | | | |

| Water and Land Resources | | $ | 109,561 | | | $ | 107,439 | |

| Water Treatment | | | 4,894 | | | | 3,348 | |

| | | $ | 114,455 | | | $ | 110,787 | |

Goodwill by operating segment is as follows (dollars in thousands):

| | | September 30, | | | December 31, | |

| | | 2023 | | | 2022 | |

| Operating Segment: | | | | | | | | |

| Water and Land Resources | | $ | 3,813 | | | $ | 3,813 | |

| Water Treatment | | | 1,901 | | | | 1,901 | |

| | | $ | 5,714 | | | $ | 5,714 | |

Property, plant, equipment and water programs consist of the following (dollars in thousands):

| | | September 30, 2023 | |

| | | Water and Land Resources | | | Water Treatment | |

| | | | | | | | | |

| Land and land improvements | | $ | 32,357 | | | $ | - | |

| Water programs | | | 29,563 | | | | - | |

| Pipeline | | | 22,094 | | | | - | |

| Buildings | | | 1,715 | | | | - | |

| Leasehold improvements, furniture and fixtures | | | 1,606 | | | | 4 | |

| Machinery and equipment | | | 3,719 | | | | 176 | |

| Construction in progress | | | 3,378 | | | | - | |

| | | | 94,432 | | | | 180 | |

| Less accumulated depreciation | | | (8,967 | ) | | | (109 | ) |

| | | $ | 85,465 | | | $ | 71 | |

| Cadiz Inc. |

| Notes to the Consolidated Financial Statements |

| | | December 31, 2022 | |

| | | Water and Land Resources | | | Water Treatment | |

| | | | | | | | | |

| Land and land improvements | | $ | 30,579 | | | $ | - | |

| Water programs | | | 29,210 | | | | - | |

| Pipeline | | | 22,091 | | | | - | |

| Buildings | | | 1,715 | | | | - | |

| Leasehold improvements, furniture and fixtures | | | 1,606 | | | | 3 | |

| Machinery and equipment | | | 3,229 | | | | 166 | |

| Construction in progress | | | 3,680 | | | | - | |

| | | | 92,110 | | | | 169 | |

| Less accumulated depreciation | | | (8,141 | ) | | | - | |

| | | $ | 83,969 | | | $ | 169 | |

NOTE 3 – LONG-TERM DEBT

The carrying value of the Company’s senior secured debt approximates fair value. The fair value of the Company’s senior secured debt (Level 2) is determined based on an estimation of discounted future cash flows of the debt at rates currently quoted or offered to the Company by its lenders for similar debt instruments of comparable maturities by its lenders.

On July 2, 2021, the Company entered into a new $50 million senior secured credit agreement (“Credit Agreement”) with Lenders and BRS, as administrative agent for the Lenders (“Senior Secured Debt”). The obligations under the Senior Secured Debt are secured by substantially all the Company’s assets on a first-priority basis (except as otherwise provided in the Credit Agreement). In connection with any repayment or prepayment of the debt, the Company is required to pay a repayment fee equal to the principal amount being repaid or prepaid, multiplied by (i) 4.0%, if such repayment or prepayment is made on or after the eighteen-month anniversary of the closing of the debt and prior to the thirty-month anniversary of the closing of the debt, and (ii) 6.0%, if such repayment or prepayment is made at any time after the thirty-month anniversary of the closing of the debt. At any time, the Company will be permitted to prepay the principal of the debt, in whole or in part, provided that such prepayment is accompanied by any accrued interest on such principal amount being prepaid plus the applicable repayment fee described above.

On February 2, 2023, the Company entered into a First Amendment to Credit Agreement to amend certain provisions of the Credit Agreement (“First Amended Credit Agreement”). In connection with the First Amended Credit Agreement, the Company repaid $15 million of the Senior Secured Debt together with fees and interest required to be paid in connection with such repayment under the Credit Agreement. Under the First Amended Credit Agreement, the lenders have a right to convert up to $15 million of outstanding principal, plus any PIK interest and any accrued and unpaid interest (the “Convertible Loan”) into shares of the Company’s common stock at a conversion price of $4.80 per share (the “Conversion Price”). Additionally, the maturity date of the Credit Agreement was extended from July 2, 2024, to June 30, 2026. The annual interest rate remains unchanged at 7.00%. Interest on $20 million of the principal amount will be paid in cash. Interest on the $15 million principal amount of the Convertible Loan will be paid in kind on a quarterly basis by addition such amount to the outstanding principal amount of the outstanding Convertible Loan. The amendment was recorded as a debt extinguishment.

| Cadiz Inc. |

| Notes to the Consolidated Financial Statements |

As a result of the First Amended Credit Agreement, the Company bifurcated the new conversion option from the debt and recorded a derivative liability. As of the effective date of the First Amended Credit Agreement, the derivative liability had a fair value of approximately $2.4 million which was recorded as loss on early extinguishment of debt. In addition, the loss on early extinguishment of debt included $2.0 million of repayment fees for both repaid and amended principal and $980 thousand of unamortized debt issuance costs.

The fair value of the derivative liability was remeasured each reporting period using an option pricing model, and the change in fair value was recorded as an adjustment to the derivative liability with the change in fair value recorded as income or expense. On August 14, 2023, the Credit Agreement was further amended to remove a conversion exchange cap provision (“Conversion Option Modification”). As a result of the Conversion Option Modification, the Company reclassified the carrying value of the bifurcated conversion option at the time of the modification from a derivative liability in the amount of $2.57 million to additional paid-in capital. Total unrealized losses of derivative liabilities accounted for as derivatives prior to the Conversion Option Modification were $0 and $220 thousand for the three and nine months ended September 30, 2023, respectively.

In the event of certain asset sales, the incurrence of indebtedness or a casualty or condemnation event, in each case, under certain circumstances as described in the Credit Agreement, the Company will be required to use a portion of the proceeds to prepay amounts under the debt. In the event of any additional issuance of depositary receipts (“Depositary Receipts”) representing interests in shares of 8.875% Series A Cumulative Perpetual Preferred Stock (“Series A Preferred Stock”) by the Company, the Company will be required to, within five business days after the receipt of the net cash proceeds, apply 75% of the net cash proceeds to prepay amounts due under the debt (including the applicable repayment fee described above).

The Credit Agreement includes customary affirmative and negative covenants, including delivery of financial statements and other reports. The negative covenants limit the ability of the Company to, among other things, incur debt, incur liens, make investments, sell assets, pay dividends and enter into transactions with affiliates. In addition, the Credit Agreement includes customary events of default and remedies.

While any amount remains outstanding under the debt, the Lenders will have the right to convert the outstanding principal, plus unpaid interest, on the debt into Depositary Receipts at the per share exchange price of $25.00 at any time up to 100% of the principal and unpaid interest on the debt may be exchanged for Depositary Receipts.

In connection with the issuance of the Senior Secured Debt, on July 2, 2021 (the “Original Issue Date”) the Company issued to the Lenders two warrants (“A Warrants” and “B Warrants”), each granting an option to purchase 500,000 shares of our common stock (collectively, the “Warrants”). The A Warrants may be exercised any time prior to July 2, 2024 (the “Expiration Date”) and have an exercise price of $17.38 equal to 120% of the closing price per share of our common stock on the Original Issue Date. The B Warrants may be exercised in the period from 180 days after the Original Issue Date to the Expiration Date and have an exercise price of $21.72 equal to 150% of the closing price of our common stock on the Original Issue Date.

| Cadiz Inc. |

| Notes to the Consolidated Financial Statements |

NOTE 4 – STOCK-BASED COMPENSATION PLANS

The Company has issued options and has granted stock awards pursuant to its 2019 Equity Incentive Plan, as described below.

2019 Equity Incentive Plan

The 2019 Equity Incentive Plan (“2019 EIP”) was originally approved by stockholders at the July 10, 2019, Annual Meeting, with an amendment to the plan approved by stockholders at the July 12, 2022, Annual Meeting. The plan, as amended, provides for the grant and issuance of up to 2,700,000 shares and options to the Company’s employees, directors and consultants.

Effective July 1, 2021, under the 2019 EIP, each outside director receives $75,000 of cash compensation and receives a deferred stock award consisting of shares of the Company’s common stock with a value equal to $25,000 on June 30 of each year. The award accrues on a quarterly basis, with $18,750 of cash compensation and $6,250 of stock earned for each fiscal quarter in which a director serves. The deferred stock award vests automatically on the January 31st that first follows the award date.

Stock Awards to Directors, Officers, and Consultants

The Company has granted stock awards pursuant to its 2019 EIP.

Of the total 2,700,000 shares reserved under the 2019 Equity Incentive Plan, as amended, 2,312,925 shares and restricted stock units (“RSUs”) have been awarded to the Company directors, employees and consultants as of September 30, 2023. Of the 2,312,925 shares and RSUs awarded, 46,744 shares were awarded to the Company’s directors for services performed during the plan year ended June 30, 2023. These shares will vest and be issued on January 31, 2024.

825,000 RSUs were granted to employees in April 2021 as long-term equity incentive awards ( “April 2021 RSU Grant”). Of the 825,000 RSUs granted under the April 2021 RSU Grant, 510,000 RSUs were scheduled to vest upon completion of certain milestones, including (a) 255,000 RSUs which vested in July 2021 upon completion of refinancing of the Company’s then existing senior secured debt and funding to complete the purchase of the Northern Pipeline (“ Northern Pipeline Vesting Event”), and (b) 255,000 RSUs scheduled to vest upon completion of final binding water supply agreement(s) for the delivery of at least 9,500 acre-feet of water per annum to customers. Of the remaining 315,000 RSUs granted under the April 2021 RSU Grant, 60,000 RSUs vested and were issued on January 3, 2023, and 255,000 RSUs vested and were issued on March 1, 2023. Additionally, in July 2022, 60,000 RSUs were granted to employees as long-term equity incentive awards ( “July 2022 RSU Grant”). The RSUs granted under the July 2022 RSU Grant are scheduled to vest on January 2, 2024. The RSU incentive awards are subject in each case to continued employment with the Company through the vesting date.

| Cadiz Inc. |

| Notes to the Consolidated Financial Statements |

Of the 255,000 RSUs earned upon the Northern Pipeline Vesting Event, the Company issued 158,673 shares net of taxes withheld and paid in cash by the Company. Of the 255,000 RSUs issued on March 1, 2023, the Company issued 158,673 shares net of taxes withheld and paid in cash by the Company.

Upon the change of the Company’s Executive Chair on February 4, 2022, a total of 170,000 unvested RSUs were accelerated and became fully vested as a result of an amended employee agreement, which included 85,000 RSUs scheduled to vest upon completion of final binding water supply agreement(s) and 85,000 RSUs scheduled to vest on March 1, 2023.

The Company issued 450,000 of performance stock units (“PSUs”) upon achievement of certain performance events. The PSUs vest upon the Company’s common stock achieving price hurdles (“Price Hurdles”) but not sooner than three years from date of grant, including (a) 200,000 PSUs to vest upon a Price Hurdle of $7 per share, (b) 150,000 PSUs to vest upon a Price Hurdle of $9 per share, (c) 50,000 PSUs to vest upon a Price Hurdle of $11 per share, and (d) 50,000 PSUs to vest upon a Price Hurdle of $13 per share and are payable, at the option of the Compensation Committee, in either common stock or cash. The PSU incentive award is subject to continue employment with the Company through the vesting date.

Additionally, 400,000 RSUs were granted to a consultant on July 1, 2023 ( “July 2023 RSU Grant). Of the 400,000 RSUs granted under the July 2023 RSU Grant, 200,000 RSUs are scheduled to vest upon completion of certain milestone events. Of the remaining 200,000 RSUs granted, 100,000 RSUs vested and were issued on October 1, 2023, and 100,000 are scheduled to vest on February 1, 2024.

The accompanying consolidated statements of operations and comprehensive loss include stock-based compensation expense of approximately $652,000 and $492,000 in the three months ended September 30, 2023 and 2022, respectively; and, $1,142,000 and $1,348,000 in the nine months ended September 30, 2023 and 2022, respectively.

NOTE 5 – INCOME TAXES

As of September 30, 2023, the Company had net operating loss (“NOL”) carryforwards of approximately $350 million for federal income tax purposes and $300 million for California state income tax purposes. Such carryforwards expire in varying amounts through the year 2037 and 2042 for federal and California purposes, respectively. For federal losses arising in tax years ending after December 31, 2017, the NOL carryforwards are allowed indefinitely. Use of the carryforward amounts is subject to an annual limitation as a result of a previous ownership change and an ownership change that occurred in June of 2021.

As of September 30, 2023, the Company’s unrecognized tax benefits were immaterial.

The Company's tax years 2020 through 2022 remain subject to examination by the Internal Revenue Service, and tax years 2019 through 2022 remain subject to examination by California tax jurisdictions. In addition, the Company's loss carryforward amounts are generally subject to examination and adjustment for a period of three years for federal tax purposes and four years for California purposes, beginning when such carryovers are utilized to reduce taxes in a future tax year.

| Cadiz Inc. |

| Notes to the Consolidated Financial Statements |

|

Because it is more likely than not that the Company will not realize its net deferred tax assets, it has recorded a full valuation allowance against all deferred assets. Accordingly, no deferred tax asset has been reflected in the accompanying condensed consolidated balance sheet.

NOTE 6 – NET LOSS PER COMMON SHARE

Basic net loss per common share is computed by dividing the net loss by the weighted-average common shares outstanding. Options, deferred stock units, convertible debt, convertible preferred shares and warrants were not considered in the computation of net loss per share because their inclusion would have been antidilutive. Had these instruments been included, the fully diluted weighted average shares outstanding would have increased by approximately 5,534,000 and 2,033,000 for the three months ended September 30, 2023 and 2022, respectively; and 5,237,000 and 1,702,000 for the nine months ended September 30, 2023 and 2022, respectively.

NOTE 7 – LEASES & PROPERTY, PLANT, EQUIPMENT AND WATER PROGRAMS

The Company has operating leases for right-of-way agreements, corporate offices, vehicles and office equipment. The Company’s leases have remaining lease terms of 1 month to 37 months as of September 30, 2023, some of which include options to extend or terminate the lease. However, the Company is not reasonably certain to exercise options to renew or terminate, and therefore renewal and termination options are not included in the lease term. The Company does not have any finance leases.

As a lessor, in February 2016, the Company entered into a lease agreement with Fenner Valley Farms LLC (“FVF”) (the “lessee”), pursuant to which FVF is leasing, for a 99-year term, 2,100 acres owned by Cadiz in San Bernardino County, California, to be used to plant, grow and harvest agricultural crops (“FVF Lease Agreement”). As consideration for the lease, FVF paid the Company a one-time payment of $12.0 million upon closing. The Company expects to record rental income of $420,000 annually over the next five years related to the FVF Lease Agreement.

During the nine months ended September 30, 2023, $1,751,000 on construction in progress was placed into service, which included land development, irrigation systems and stand establishment related to the planting of 150 acres of alfalfa.

Depreciation expense on land improvements, buildings, leasehold improvements, machinery and equipment and furniture and fixtures was $942,000 and $473,000 for the nine months ended September 30, 2023 and 2022, respectively.

| Cadiz Inc. |

| Notes to the Consolidated Financial Statements |

|

NOTE 8 – FAIR VALUE MEASUREMENTS

Fair values determined by Level 1 inputs utilize quoted prices (unadjusted) in active markets for identical assets or liabilities. The Company considers a security that trades at least weekly to have an active market. Fair values determined by Level 2 inputs utilize data points that are observable, such as quoted prices, interest rates and yield curves. Fair values determined by Level 3 inputs are unobservable data points for the asset or liability, and include situations where there is little, if any, market activity for the asset or liability.

In 2022, the Company recorded a contingent consideration liability in the amount of $1.45 million related to the purchase price of the ATEC Acquisition for amounts payable upon the sale of a requisite number of water filtration units under an asset purchase agreement.

| (in thousands) | | Level 1 Assets | |

| | | | | |

| Balance at December 31, 2022 | | $ | - | |

| | | | | |

| Investments in Certificates of Deposit | | | 11,500 | |

| | | | | |

| Balance at September 30, 2023 | | | 11,500 | |

| (in thousands) | | Level 3 Liabilities | |

| | | | | |

| Balance at December 31, 2022 | | $ | (1,450 | ) |

| | | | | |

| Derivative liabilities | | | (2,350 | ) |

| Unrealized gains on derivative liabilities, net | | | 130 | |

| | | | | |

| Balance at March 31, 2023 | | | (3,670 | ) |

| | | | | |

| Unrealized losses on derivative liabilities, net | | | (350 | ) |

| | | | | |

| Balance at June 30, 2023 | | | (4,020 | ) |

| | | | | |

| Reclassification of derivative liabilities to additional paid-in capital | | | 2,570 | |

| | | | | |

| Balance at September 30, 2023 | | $ | (1,450 | ) |

| | | Investments at Fair Value as of September 30, 2023 | |

| (in thousands) | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | | | | | | | | | | | | | | | | |

| Assets | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Certificates of Deposit | | $ | 11,500 | | | $ | - | | | $ | - | | | $ | 11,500 | |

| | | | | | | | | | | | | | | | | |

| Total Assets | | $ | 11,500 | | | $ | - | | | $ | - | | | $ | 11,500 | |

| | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Contingent consideration liabilities | | $ | - | | | $ | - | | | $ | 1,450 | | | $ | 1,450 | |

| | | | | | | | | | | | | | | | | |

| Total Liabilities | | $ | - | | | $ | - | | | $ | 1,450 | | | $ | 1,450 | |

| Cadiz Inc. |

| Notes to the Consolidated Financial Statements |

NOTE 9 – COMMON AND PREFERRED STOCK

Common Stock

The Company is authorized to issue 85 million shares of Common Stock at a $0.01 par value. As of September 30, 2023, the Company had 66,604,981 shares issued and outstanding.

In January 2013, the Company revised its then existing agreement with the law firm of Brownstein Hyatt Farber Schreck LLP (“Brownstein”), a related party. Under this agreement, the Company is to issue up to a total of 400,000 shares of the Company’s common stock, with 200,000 shares earned to date and 100,000 shares to be earned upon the achievement of each of two remaining milestones as follows:

| | ■ | 100,000 shares earned upon the signing of binding agreements for more than 51% of the Water Project’s annual capacity, which is not yet earned; and |

| | ■ | 100,000 shares earned upon the commencement of construction of all of the major facilities contemplated in the Final Environmental Impact Report necessary for the completion and delivery of the Water Project, which is not yet earned. |

All shares earned upon achievement of any of the remaining two milestones will be payable three years from the date earned.

Series 1 Preferred Stock