Trending: AB InBev Backs Guidance Despite Further Bud Light Woes in US

October 31 2023 - 6:50AM

Dow Jones News

1020 GMT - Anheuser-Busch InBev is among the most mentioned

companies across news items over the past three hours, according to

Factiva data. The world's largest brewer--which houses Stella

Artois and Budweiser among its portfolio--backed guidance Tuesday,

though third-quarter earnings missed market forecasts as volumes

fell, with falls in North America offsetting rises in other areas.

The company's overall volumes fell 3.4% on an organic basis,

missing expectations of a 2.7% fall, with those in North America

volumes falling 17.1%. This continues a trend of falling sales in

the region since April, when Dylan Mulvaney--a transgender

social-media star--made an Instagram post about a personalized can

of Bud Light the brewer sent her as a gift, sparking a boycott. Net

profit rose to $1.47 billion from $1.43 billion a year earlier but

missed a FactSet consensus of $1.85 billion. Revenue rose to $15.57

billion. "The absence of incremental bad news and some buyback

support is reassuring but the increased reliance on Argentina to

drive top-line [organic sales growth] and on-going FX headwinds may

temper the share price reaction today," Citi analysts say in a

research note. Shares rise 3.6% at EUR52.68. Dow Jones & Co.

owns Factiva. (joseph.hoppe@wsj.com)

(END) Dow Jones Newswires

October 31, 2023 06:35 ET (10:35 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

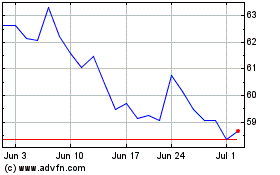

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Mar 2024 to Apr 2024

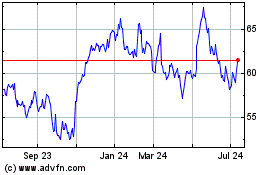

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Apr 2023 to Apr 2024