Bitcoin price maintains stability while investors observe trends

and new records in other markets

The price of Bitcoin (COIN:BTCUSD) fluctuated around $34,000 at

Wall Street’s open on October 27th, while investors watched BTC’s

performance in relation to macroeconomic assets. The market

remained relatively stable, with analysts suggesting a price range

between $33,000 and $35,000, as commented by Fernando Pereira, an

analyst at Bitget: “As buying pressure is still high, I believe

it will still be possible to trade in this region over the weekend,

and next week we may see a retreat towards around $32,000“,

said Pereira. However, the proximity of weekly and monthly closures

is seen as a critical factor in assessing future trends. Analysts

also remain cautious due to the upcoming FOMC meeting of the U.S.

Federal Reserve. Additionally, some have noted that Bitcoin has

outperformed the S&P 500 since September, which could drive the

price above $40,000. Bitcoin, historically correlated with U.S.

stock markets, now appears to be dissociating, recording an annual

gain of over 100%. Elsewhere, Bitcoin reached historic prices in

Turkey and Nigeria, driven by the depreciation of their local

currencies and economic uncertainty. Demand has grown with local

exchanges moving $40 million in Bitcoin in 24 hours.

Ethereum Dencun update promises to reduce transaction costs and

boost scalability

The upcoming Ethereum (COIN:ETHUSD) update, known as Dencon,

with a scheduled launch in the first quarter of 2024, will play a

key role in the blockchain’s journey towards scalability, acting as

a settlement layer. Goldman Sachs (NYSE:GS) recently highlighted

that this update “will increase data availability for layer 2

rollups through proto-danksharding, resulting in reduced

transaction costs for rollups and ultimately benefiting end

users.” Additionally, Dencon will establish important

foundations for future scalability improvements, including

danksharding. Danksharding is an approach that seeks to enhance

Ethereum’s scalability by sharding the network, increasing data

storage capacity, rather than just increasing transaction

speed.

Lido DAO distances itself from LayerZero’s wstETH bridge on

Avalanche and other networks

On October 26th, the staking protocol Lido DAO (COIN:LDOUSD)

announced that it did not endorse the wstETH bridge launched by

LayerZero on Avalanche (COIN:AVAXUSD), BNB (COIN:BNBUSD), and

Scroll (COIN:SCRLUSD). Lido expressed concerns about the lack of

audit and canonicity of the bridge. The action generated

apprehension in the Lido community, with some seeing it as an

attempt to pressure the protocol and others as aggressive marketing

strategy. LayerZero removed Scroll from the networks supporting

wstETH (COIN:WSTETHUSD) in response to community concerns.

FLOKI jumps with TokenFi launch, but risk of correction looms

The price of FLOKI (COIN:FLOKIUSD) has risen nearly 140% in

October, trading at $0.0001848 at the time of writing. The meme

coin, famous for its controversial marketing strategies, saw a

boost after New York-based Grayscale Investments submitted an

application for a new Bitcoin exchange-traded fund (ETF) on the

NYSE Arca. Additionally, the launch of the TokenFi tokenization

platform was announced today, featuring its native token, TOKEN.

The TokenFi platform by Floki was launched on various DeFi

networks, allowing users to create cryptocurrencies without

technical knowledge. The team also announced the distribution of

10% of the initial TOKEN supply to liquidity pools on Uniswap and

Pancakeswap, along with rewards for long-term Floki stakers.

Launch of the dYdX Chain reinforces the role of the DYDX token and

offers new participation opportunities

The dYdX Foundation (COIN:DYDXUSD) has launched dYdX Chain,

promoting DYDX as the primary currency and distributing fees in

USDC (COIN:USDCUSD). DYDX holders can be validators or delegate to

secure the network and receive rewards. Governance will be

accessible, allowing staked DYDX tokens to participate in

decisions. This strengthens the dYdX ecosystem and hints at future

expansion plans.

Gala Games’ remarkable recovery defies legal challenges

Gala Games (COIN:GALAUSD) saw its price rise nearly 40% in the

week despite facing legal obstacles involving CEO Eric Schiermeyer

and co-founder Wright Thurston. After a 31% drop in September, the

alternative coin market has recovered, with GALA now trading at

$0.018. However, legal developments could affect the future of Gala

Games, with an optimistic price target of $0.02 and a downside risk

to $0.015, resulting in a risk-reward ratio of 0.69.

Sensei Inu: An innovative Meme Coin that rewards cryptographic

knowledge

The Sensei Inu (SINU) pre-sale raised over $300,000, indicating

a successful launch. Differentiating itself from other meme coins,

Sensei Inu rewards users based on their cryptocurrency knowledge

through question and answer games. Its innovative tokenomics model

includes burning, DAO, referrals, and community to balance token

supply. The five-phase roadmap promises long-term growth. With 50%

of tokens available in the pre-sale, Sensei Inu is gaining momentum

rapidly.

Ethereum account abstraction vulnerability patched by Fireblocks in

UniPass

Cryptocurrency infrastructure company Fireblocks identified and

fixed an Ethereum account abstraction vulnerability. The ERC-4337

vulnerability was found in the UniPass smart contract wallet and

could have allowed an attacker to take control of the UniPass

wallet account. Fireblocks worked with UniPass to address the

vulnerability, which affected hundreds of wallets. Account

abstraction is a technology that introduces more generalized and

flexible accounts on Ethereum (COIN:ETHUSD). The vulnerability was

successfully mitigated through a white-hat operation.

High-Level Mastercard users can now spend SAND token in the EU

High-level Mastercard (NYSE:MA) debit card users can now spend

the SAND token from the Metaverse Sandbox platform (COIN:SANDUSD)

in appropriate markets in the European Economic Area. Additionally,

the card already allows spending with Bitcoin (COIN:BTCUSD), Ether

(COIN:ETHUSD), and USDT (COIN:USDTUSD). The card, which also offers

customization with NFTs, was announced in 2022 and recently began

shipping personalized NFT cards.

Kraken appoints new UK managing director, prepares to share data

with IRS

Global cryptocurrency exchange Kraken announced Bivu Das as the

new managing director in the UK, succeeding Blair Halliday. Das, a

former Starling Bank executive and fintech entrepreneur, will lead

Kraken’s efforts to expand its business in the UK. Despite new

regulatory restrictions in the UK cryptocurrency market, Das

expressed confidence that Kraken is well-positioned to navigate the

changes. Additionally, Kraken is preparing to share selected user

information with the IRS in the United States following a court

order received in June. The exchange expects to share this

information in November 2023.

HTX announces profit in Q3 2023 despite operational challenges

Cryptocurrency exchange HTX, formerly known as Huobi Global,

announced a profit of $98 million in the third quarter of 2023,

with revenues of $202 million and expenses of $104 million. Despite

challenging market conditions, HTX maintained its revenue growth.

CEO Justin Sun expressed optimism for the fourth quarter,

anticipating revenues of $190 million and an estimated profit of

$104 million. He believes the cryptocurrency bear market is coming

to an end and expects a recovery. However, HTX has faced recent

operational challenges, including staff reductions and a security

breach.

Binance founder CZ loses $11.9 billion as exchange revenue drops

The fortune of Binance founder Changpeng “CZ” Zhao likely

decreased by $11.9 billion due to a 38% drop in revenue from the

world’s largest cryptocurrency exchange, as calculated by the

Bloomberg Billionaires Index. This would reduce his wealth to

around $17.2 billion, compared to the peak of $96 billion reached

in January 2022. The decline in Binance’s revenue came after a

zero-fee promotion in the first quarter that boosted market share

to 62%, but fell to 51% by the end of the third quarter.

Sam Bankman-Fried denies fraud in FTX case before jury

During the closing arguments of the case, Sam “SBF”

Bankman-Fried, former CEO of FTX, faced questions from his defense

lawyers in New York. He denied allegations of fraud and

misappropriation of funds from FTX customers during his leadership

at the cryptocurrency exchange. Bankman-Fried also highlighted

FTX’s bankruptcy filing and its relationship with Alameda Research.

The allegations center on the use of FTX customer funds by Alameda

without their knowledge. The trial is expected to conclude soon,

with prosecutors and defense attorneys presenting final arguments

to the jury.

Zodia Markets receives registration in Ireland and expands its

presence in the EU

Zodia Markets, backed by Standard Chartered (LSE:STAN), has

obtained registration as a Virtual Asset Service Provider (VASP) in

the Republic of Ireland by the local central bank. This

registration will allow Zodia Markets to offer trading and

over-the-counter (OTC) exchange services to institutional clients.

With similar permissions obtained in the UK and Abu Dhabi, the

company now has a licensed entity in the European Union (EU),

facilitating its expansion within the bloc. Ireland has become a

popular destination for cryptocurrency companies, possibly due to

its favorable tax regime.

Taiwan presents Bill to regulate virtual assets and impose fines

for unlicensed operation

On October 25th, lawmakers in Taiwan introduced a Virtual Asset

Management Bill to the unicameral parliament. The bill aims to

protect consumers and properly oversee the virtual asset sector. It

establishes sensible requirements for Virtual Asset Service

Providers (VASPs), such as separating customer funds from company

funds, internal controls, audits, and adherence to local trade

associations. The bill also provides for fines for VASPs operating

without a license. Guidelines were issued by Taiwan’s Financial

Supervisory Commission (FSC) in September 2023, prohibiting foreign

VASPs from operating without regulatory approval.

Bitcoin mining in the US defends positive impact in Congress

Executives from over 40 cryptocurrency mining operations and

lobbyists sought support in the U.S. Congress, highlighting how

mining can stabilize the power grid, embrace renewable energies,

and boost national technology. They emphasized their contribution

to energy and national security, countering environmental

criticisms and addressing China-related issues. They also expressed

support for a pro-mining bill.

Bank of England receives more than 50,000 responses to Digital

Libra consultation

The Bank of England (BOE) received over 50,000 responses in its

consultation on the digital pound. Most responses expressed

concerns about privacy, programmability, and the decline of

physical cash. Deputy Governor Jon Cunliffe clarified that users of

the digital pound would have the same level of privacy as when

making electronic payments using traditional currency. He also

emphasized that the BOE would not see people’s data. Cunliffe

promised a discussion paper on stablecoin regulations soon.

Animoca Brands invests in market creation for Web3 startups

Web3 investment company Animoca Brands has expanded its efforts

to offer in-house marketplace creation services for the over 400

startups in its portfolio. The Hong Kong-based company recently

made these capabilities available, aiming to attract more projects.

This puts it in competition with specialized market makers like

GSR, Wintermute, and Keyrock. Animoca employs an in-house Digital

Assets team to optimize the use of its balance sheet, provide

liquidity, and support startups, ensuring efficiency and

scalability. The company emphasizes that these services are not for

profit and follow strict selection criteria.

Yuga Labs receives $1.5 million compensation in Bored Ape NFT copy

case

On October 26th, a federal judge in California ruled that Yuga

Labs, the creator of Bored Ape Yacht Club non-fungible tokens

(NFTs), has the right to receive over $1.5 million in damages from

Ryder Ripps and Jeremy Cahen, who copied Bored Ape Yacht Club NFT

art. The judge rejected the defense that the copies were satirical

and concluded that Ripps and Cahen used them to profit from Yuga’s

success. The decision also included attorney’s fees and the

transfer of digital assets and related social media accounts to

Yuga Labs.

Moonveil raises $5.4M in funding to focus on player freedom

Web3 game studio Moonveil Entertainment, based in the Cayman

Islands, raised $5.4 million in a funding round led by Gumi Cryptos

Capital and Arcane Group, with participation from investors like

Longhash, IOSG, and Infinity Ventures Crypto. The company is

developing games such as Astrark and Project B, focusing on player

freedom and rewarding contributions using tokenomics and NFTs.

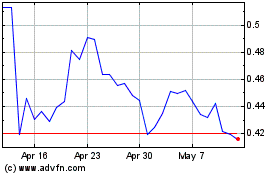

Sandbox (COIN:SANDUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sandbox (COIN:SANDUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024