UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c) of the

Securities Exchange Act of 1934

| | |

| CHECK THE APPROPRIATE BOX: |

☐ Preliminary Information Statement |

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

☒ Definitive Information Statement |

ImmunityBio, Inc.

(Name of Registrant as Specified in its Charter)

| | |

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): |

☒ No fee required. |

☐ Fee paid previously with preliminary materials. |

☐ Fee computed on table in exhibit required by Item 25(b) of Schedule 14A per Item 1 of this Schedule and Exchange Act Rules 14c-5(g) and 0-11. |

NOTICE OF ACTION BY WRITTEN CONSENT OF OUR STOCKHOLDERS AND INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

Date of Mailing: On or about September 28, 2023

To Our Stockholders:

This notice and the accompanying information statement (the “Information Statement”) is furnished by the Board of Directors (the “Board”) of ImmunityBio, Inc. (“ImmunityBio,” the “Company,” “we” or “us”). The Company, a Delaware corporation, is a public company registered with the Securities and Exchange Commission (the “SEC”). The Information Statement has been filed with the SEC and is being furnished, pursuant to Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), to notify the holders of record of our common stock, par value $0.0001 per share (our “Common Stock”), as of the close of business on September 13, 2023 (the “Record Date”) of actions we are taking pursuant to a written consent representing a majority of the voting power of our Common Stock, in lieu of a meeting of stockholders.

The purpose of the Information Statement is to inform the Company’s stockholders of the action taken by our Board on September 8, 2023 and by the holders of a majority of the issued and outstanding shares of our Common Stock by written consent delivered to the Company on September 15, 2023 (the “Stockholder Written Consent”), resolving to amend the Company’s Amended and Restated Certificate of Incorporation (the “Restated Certificate”) in the form attached to the Information Statement (the “Certificate of Amendment”). This consent was sufficient to approve the Certificate of Amendment under Delaware law and the Restated Certificate. The attached Information Statement describes the Certificate of Amendment approved by Stockholder Written Consent, which will increase the Company’s authorized shares of Common Stock to 1,350,000,000 shares from 900,000,000 shares. The change in authorized capital will become effective no earlier than twenty (20) calendar days after the filing and dissemination of the Information Statement.

NO VOTE OR OTHER ACTION OF THE COMPANY’S STOCKHOLDERS IS REQUIRED IN CONNECTION WITH THE INFORMATION STATEMENT. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

There are no stockholder dissenters’ or appraisal rights in connection with any of the matters discussed in the accompanying Information Statement. Please read this Information Statement carefully and entirely. It describes the terms of the actions taken by the stockholders. Although you will not have an opportunity to vote on the approval of the Certificate of Amendment, the Information Statement contains important information about the Certificate of Amendment.

| | |

| By Order of the Board of Directors, |

|

|

|

| Jason Liljestrom |

| Corporate Secretary |

San Diego, California

September 28, 2023

ImmunityBio, Inc.

3530 John Hopkins Court San Diego, CA 92121

Office: +1-844-696-5235 Email: info@ImmunityBio.com

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES REGULATORY AGENCY HAS APPROVED OR DISAPPROVED THE TRANSACTIONS, PASSED UPON THE MERITS OR FAIRNESS OF THE TRANSACTIONS, OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURES IN THE INFORMATION STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Information Statement is dated September 28, 2023 and is first being mailed to our stockholders on or about September 28, 2023. The Information Statement can also be accessed on our proxy hosting website at https://materials.proxyvote.com/45256X.

INFORMATION STATEMENT

REGARDING CORPORATE ACTION TAKEN BY WRITTEN CONSENT IN LIEU OF SPECIAL MEETING.

NO VOTE OR OTHER CONSENT OF OUR STOCKHOLDERS IS SOLICITED IN CONNECTION WITH THIS INFORMATION STATEMENT. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

This information statement (this “Information Statement”) is being furnished by the Board of Directors (the “Board”) of ImmunityBio, Inc., a Delaware corporation (“ImmunityBio,” “we,” “us” or “our”), on or about September 28, 2023, to the holders of record at the close of business on September 13, 2023 (the “Record Date”) of the outstanding shares of the Company’s common stock, par value $0.0001 per share (our “Common Stock”). The purpose of this Information Statement is to inform ImmunityBio’s stockholders of an action by written consent of holders of a majority of the Common Stock (the “Stockholder Written Consent”). This Information Statement can also be accessed on our proxy hosting website at https://materials.proxyvote.com/45256X.

The actions contemplated by the Stockholder Written Consent are being taken without notice, meetings or votes in accordance with the Delaware General Corporation Law (“DGCL”), the Company’s Amended and Restated Certificate of Incorporation (the “Restated Certificate”) and its Bylaws. This Information Statement is being mailed to the stockholders of the Company as of the Record Date, September 13, 2023.

On September 8, 2023, the Board approved, and recommended to stockholders for approval, an amendment to the Restated Certificate that will increase the Company’s authorized shares of Common Stock to 1,350,000,000 shares from 900,000,000 shares (the “Certificate of Amendment”). The full text of the Certificate of Amendment is attached to this Information Statement as Appendix A.

On September 15, 2023, holders of 532,536,501 shares of Common Stock, representing approximately 80%, of our Common Stock voting power (and thus a majority of voting power), executed and delivered to the Company the Stockholder Written Consent to approve the Certificate of Amendment. The Stockholder Written Consent was sufficient to approve the Certificate of Amendment under the DGCL and our Restated Certificate.

We are not aware of any substantial interest, direct or indirect, by security holders or otherwise, that is in opposition to matters of action being taken. In addition, pursuant to the DGCL, this action to be taken by majority written consent in lieu of a special stockholder meeting does not create appraisal or dissenters’ rights.

The Board has determined to pursue stockholder action by majority written consent of those shares entitled to vote as of the Record Date, to reduce the costs and management time required to hold a special meeting of stockholders, and to implement the above action in a timely manner.

Under Section 14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), actions taken by written consent without a meeting of stockholders cannot become effective until twenty (20) calendar days after the mailing date of this Information Statement, or as soon thereafter as is practicable. We are not seeking written consent from any stockholders other than as set forth above, and our other stockholders will not be given an opportunity to vote with respect to the actions taken. All necessary corporate approvals have been obtained, and this Information Statement is furnished solely for the purpose of advising stockholders of the actions taken by written consent and giving stockholders advance notice of the actions taken.

ImmunityBio, Inc. | 1 | Information Statement

FORWARD-LOOKING STATEMENTS

This Information Statement and other reports that we file with the SEC may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act, which are based on our management’s beliefs and assumptions and on information currently available to our management. All statements other than statements of historical fact are “forward-looking statements” for purposes of these provisions, including any projections of earnings, revenues or other financial items, any statement of the plans and objectives of management for future operations, the need and ability to obtain additional financing to fund our operations and complete the development and commercialization of our various product candidates and the timing thereof, and any statement of assumptions underlying any of the foregoing. These statements may contain words such as “expects,” “anticipates,” “plans,” “believes,” “projects,” and words of similar meaning. These statements relate to our future business and financial performance.

Actual outcomes may differ materially from these statements. The risks listed in this Information Statement, as well as any cautionary language in this Information Statement, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from any expectations we describe in our forward-looking statements. There may be other risks that we have not described that may adversely affect our business and financial condition. Except as required by law, we disclaim any obligation to update or revise any of the forward-looking statements contained in this Information Statement. We caution you not to rely upon any forward-looking statement as representing our views as of any date after the date of this Information Statement. You should carefully review the information and risk factors set forth in other reports and documents that we file from time to time with the SEC.

OUTSTANDING VOTING SECURITIES AND CONSENTING STOCKHOLDERS

As of the date of the Stockholder Written Consent, ImmunityBio had 667,589,845 issued and outstanding shares of Common Stock (excluding 163,800 shares held by a majority-owned subsidiary of the Company). Each share of Common Stock entitles the holder thereof to one vote on all matters submitted to stockholders.

On September 15, 2023, holders of 532,536,501 shares of Common Stock executed and delivered to the Board the Stockholder Written Consent, representing approximately 80%, of our Common Stock voting power (and thus a majority of voting power), approving the amendment to the Restated Certificate to increase the amount of authorized Common Stock. Because the action was approved by stockholders owning a majority of our outstanding voting power, no proxies are being solicited with this Information Statement. No consideration was paid for the Stockholder Written Consent.

Section 228 of the DGCL provides in substance that unless a company’s certificate of incorporation provides otherwise, stockholders may take any action without a meeting of stockholders, without prior notice and without a vote if a consent or consents in writing, setting forth the action so taken, is signed by stockholders of the outstanding stock having not less than the minimum number of votes that would be necessary to authorize and take such action at a meeting at which all shares entitled to vote thereon were present voted.

NO APPRAISAL RIGHTS

Under Delaware corporate law, stockholders have no appraisal or dissenters’ rights in connection with the Certificate of Amendment.

INTERESTS OF CERTAIN PARTIES IN THE MATTERS TO BE ACTED UPON

None of the directors or executive officers of the Company have any substantial interest resulting from the Certificate of Amendment that is not shared by all other stockholders, pro rata, and in accordance with their respective interests.

COST OF THIS INFORMATION STATEMENT

The entire cost of furnishing this Information Statement will be borne by the Company. We will request brokerage houses, nominees, custodians, fiduciaries and other like parties to forward this Information Statement to the beneficial owners of our Common Stock held of record, as of the Record Date, by them.

ImmunityBio, Inc. | 2 | Information Statement

HOUSEHOLDING OF STOCKHOLDER MATERIALS

Beneficial owners of common stock who share a single address will receive only one copy of this Information Statement. This practice, known as “householding,” is designed to reduce printing and mailing costs. If any beneficial stockholder(s) sharing a single address wish to discontinue householding and receive a separate copy of this Information Statement, we will have a separate copy promptly delivered to them upon their written or oral request. To make the request, they may contact Broadridge Investor Communications (“Broadridge”), either by calling 866-540-7095, or by writing to Broadridge, Householding Department, 51 Mercedes Way, Edgewood, NY 11717, and including their name, the name of their broker, or other nominee, and their account number(s). Beneficial owners may also contact Broadridge if they received multiple copies of the Information Statement and prefer to receive a single copy in the future.

AMENDMENT TO OUR CERTIFICATE OF INCORPORATION TO INCREASE THE AUTHORIZED SHARES OF COMMON STOCK

General

Our Restated Certificate currently authorizes 900,000,000 shares of Common Stock and 20,000,000 shares of preferred stock, par value $0.0001 per share.

On September 15, 2023, the consenting stockholders approved the filing of an amendment to our Restated Certificate to increase the authorized shares of Common Stock to 1,350,000,000 shares from 900,000,000 shares. Such amendment was previously approved by the Board.

Reasons for the Increase in Authorized Shares of Common Stock

As of September 13, 2023, there were 667,589,845 shares of Common Stock issued and outstanding. In order to provide future funding for the Company’s operations, it will be necessary to raise additional capital. One of the most effective ways for us to raise capital is to issue additional shares of Common Stock, or other instruments that are convertible into Common Stock. Most lenders that fund convertible instruments require that the borrower direct its stock transfer agent to establish a reserve of authorized shares to be available for shares that the Company has committed, or may have to, issue, including derivative securities and certain existing contingent obligations requiring the issuance of shares of Common Stock. In the event that there are insufficient authorized shares to honor the issuance of any shares to which the Company has already committed, there may be contractual penalties. The increase in the Company’s authorized shares to 1,350,000,000 shares from 900,000,000 shares is intended to provide adequate authorized shares to cover all of the Company’s current, committed issuances of Common Stock and the Company’s expected funding needs for at least the next 12 months.

Principal Effects of the Increase in Authorized Shares of Common Stock

While the authorization of additional shares of Common Stock is intended to increase our financial flexibility, the sale and issuance of such additional shares will result in the dilution of our existing stockholders. Upon the occurrence of the sale and issuance of all additional 450,000,000 shares authorized by the Certificate of Amendment, our existing stockholders would be diluted substantially. If we choose to raise capital by incurring debt through an instrument convertible into Common Stock, the number of shares of Common Stock issuable upon such conversion would likely be contingent on a number of factors currently unknown to us, such as the market price of our Common Stock and certain interest rates. Any dilution of our Common Stock resulting from this Certificate of Amendment, whether immediate or over time, could cause the price per share of our Common Stock to decline significantly, which could result in financial harm to our existing stockholders.

Effective Date

Under Rule 14c-2 of the Exchange Act, the Certificate of Amendment shall be effective no earlier than twenty (20) calendar days after this Information Statement is first mailed to stockholders of the Company. We anticipate the effective date to be on or about October 18, 2023.

ImmunityBio, Inc. | 3 | Information Statement

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table sets forth certain information, as of September 13, 2023, with respect to the holdings of (i) each person who is the beneficial owner of more than 5% of our Common Stock, (ii) each of our directors, (iii) each executive officer, and (iv) all of our current directors and executive officers as a group. Beneficial ownership representing less than 1% is denoted with an asterisk (*) in the table below.

Beneficial ownership of our Common Stock is determined in accordance with the rules of the SEC and includes any shares of Common Stock over which a person exercises sole or shared voting or investment power, or of which a person has a right to acquire ownership at any time within 60 days of September 13, 2023.

Except as otherwise indicated, we believe that the persons named in this table have sole voting and investment power with respect to all shares of Common Stock held by them. Applicable percentage ownership in the following table is based on 667,589,845 shares of Common Stock outstanding as of September 13, 2023 plus, for each individual, any securities that individual has the right to acquire within 60 days of that date.

| | | | | | | | | | | | | | |

| Name and Address of Beneficial Owner (1) | | Number of

Shares of

Common

Stock

Beneficially

Owned | | Percentage

of

Common

Stock

Beneficially

Owned |

| | | | |

| 5% Stockholders: | | | | |

Patrick Soon-Shiong, M.D., FRCS (C), FACS (2) | | 650,212,966 | | 82.8 | % |

Cambridge Equities, LP (3) | | 261,705,814 | | 39.2 | % |

MP 13 Ventures, LLC (3) | | 261,705,814 | | 39.2 | % |

Nant Capital, LLC (4) | | 245,744,084 | | 31.3 | % |

California Capital Equity, LLC (5) | | 106,511,412 | | 16.0 | % |

NantWorks, LLC (6) | | 98,535,253 | | 14.8 | % |

NantMobile, LLC (7) | | 47,557,934 | | 7.1 | % |

| Other Directors and Named Executive Officers: | | | | |

Richard Adcock (8) | | 918,916 | | * |

David Sachs (9) | | 205,376 | | * |

Michael D. Blaszyk (10) | | 559,583 | | * |

John Owen Brennan (11) | | 233,583 | | * |

Wesley Clark (12) | | 216,583 | | * |

Cheryl L. Cohen (13) | | 494,618 | | * |

Linda Maxwell, M.D., M.B.A., FRCSC (14) | | 208,583 | | * |

Christobel Selecky (14) | | 208,583 | | * |

Barry J. Simon, M.D. (15) | | 3,957,696 | | * |

All directors and executive officers as a group (11 persons) (16) | | 657,275,151 | | 83.4 | % |

________________

(1)The address of each of the individuals named in the table above is c/o ImmunityBio, Inc., 3530 John Hopkins Court, San Diego, California 92121. The address of each of California Capital Equity, LLC (California Capital), Cambridge Equities, LP (Cambridge), and MP 13 Ventures, LLC (MP 13 Ventures) is 9922 Jefferson Boulevard, Culver City, California 90232. The address of each of Nant Capital, LLC (Nant Capital), NantWorks, LLC (NantWorks), and NantMobile, LLC (NantMobile) is 9920 Jefferson Boulevard, Culver City, California 90232.

ImmunityBio, Inc. | 4 | Information Statement

(2)Consists of (i) 261,705,814 shares held by Cambridge; (ii) 129,227,017 shares held by Nant Capital; (iii) 47,557,934 shares held by NantMobile; (iv) 32,606,985 shares held by NantCancerStemCell, LLC (NantCancerStemCell); (v) 29,473,932 shares directly held by Dr. Soon-Shiong; (vi) 9,986,920 shares held by NantWorks; (vii) 8,383,414 shares held by NantBio, Inc. (NantBio); (viii) 7,976,159 shares held by California Capital; (ix) 5,618,326 shares held by the Chan Soon-Shiong Family Foundation; (x) 116,517,067 shares that Nant Capital has the right to acquire within 60 days of September 13, 2023 pursuant to the conversion of certain promissory notes; and (xi) 1,159,398 shares that Dr. Soon-Shiong has the right to acquire within 60 days of September 13, 2023 pursuant to the exercise of vested stock options. Dr. Soon-Shiong has the sole power to vote or direct the vote, and the sole power to dispose or direct the disposition, of all shares he directly holds and shares issuable upon the exercise of stock options that were exercisable as of September 13, 2023. In addition, Dr. Soon-Shiong may be deemed to beneficially own, and share voting power and investment power over, all shares described as being beneficially owned by Cambridge, Nant Capital, NantMobile, NantCancerStemCell, NantWorks, NantBio and California Capital, as well as the Chan Soon-Shiong Foundation, of which Dr. Soon-Shiong is the Chairman.

(3)Consists of 261,705,814 shares held by Cambridge. MP 13 Ventures is the general partner of Cambridge and thus may be deemed to beneficially own, and share voting power and investment power with Cambridge over, all shares beneficially owned by Cambridge. Dr. Soon-Shiong is the sole member of MP 13 Ventures and may be deemed to control MP 13 Ventures and each entity directly or indirectly controlled by MP 13 Ventures (including Cambridge).

(4)Consists of (i) 129,227,017 shares held by Nant Capital and (ii) 116,517,067 shares that Nant Capital has the right to acquire within 60 days of September 13, 2023 pursuant to the conversion of certain promissory notes. Dr. Soon Shiong is the sole shareholder of Nant Capital and may be deemed to control Nant Capital.

(5)Consists of (i) 7,976,159 shares held by California Capital; (ii) 9,986,920 shares held by NantWorks; (iii) 8,383,414 shares held by NantBio; (iv) 47,557,934 shares held by NantMobile; and (v) 32,606,985 shares held by NantCancerStemCell. California Capital is the sole shareholder of NantWorks and may be deemed to beneficially own, and share voting power and investment power over, all shares beneficially owned by NantWorks, NantBio, NantMobile and NantCancerStemCell. Dr. Soon-Shiong is the sole member of California Capital and thus may be deemed to control California Capital.

(6)Consists of (i) 9,986,920 shares held by NantWorks; (ii) 8,383,414 shares held by NantBio; (iii) 47,557,934 shares held by NantMobile; and (iv) 32,606,985 shares held by NantCancerStemCell. NantWorks is the majority shareholder of NantBio, NantMobile and NantCancerStemCell and thus may be deemed to beneficially own, and share voting power and investment power over, all shares beneficially owned by NantBio, NantMobile and NantCancerStemCell. California Capital is the sole shareholder of NantWorks.

(7)Consists of 47,557,934 shares held by NantMobile. NantMobile is a majority-owned subsidiary of NantWorks.

(8)Consists of (i) 185,582 shares directly held by Mr. Adcock and (ii) 733,334 shares that Mr. Adcock has the right to acquire within 60 days of September 13, 2023 pursuant to the exercise of vested stock options.

(9)Consists of (i) 122,042 shares directly held by Mr. Sachs and (ii) 83,334 shares that Mr. Sachs has the right to acquire within 60 days of September 13, 2023 pursuant to the exercise of vested stock options.

(10)Consists of (i) 193,667 shares directly held by Mr. Blaszyk, (ii) 71,915 shares indirectly held, and (iii) 294,001 shares that Mr. Blaszyk has the right to acquire within 60 days of September 13, 2023 pursuant to the exercise of vested stock options.

(11)Consists of (i) 25,000 shares directly held by Mr. Brennan and (ii) 208,583 shares that Mr. Brennan has the right to acquire within 60 days of September 13, 2023 pursuant to the exercise of vested stock options.

(12)Consists of (i) 8,000 shares directly held by Gen. Clark and (ii) 208,583 shares that Gen. Clark has the right to acquire within 60 days of September 13, 2023 pursuant to the exercise of vested stock options.

(13)Consists of (i) 200,617 shares directly held by Ms. Cohen and (ii) 294,001 shares that Ms. Cohen has the right to acquire within 60 days of September 13, 2023 pursuant to the exercise of vested stock options.

(14)Consists of (i) 208,583 shares that each of Ms. Maxwell and Ms. Selecky has the right to acquire within 60 days of September 13, 2023 pursuant to the exercise of vested stock options.

(15)Consists of (i) 3,088,655 shares directly held by Dr. Simon and (ii) 869,041 shares that Dr. Simon has the right to acquire within 60 days of September 13, 2023 pursuant to the exercise of vested stock options.

(16)Consists of (i) 33,351,397 shares directly held; (ii) 503,134,484 shares indirectly held; (iii) 116,517,067 shares that Nant Capital has the right to acquire within 60 days of September 13, 2023 pursuant to the conversion of certain promissory notes; and (iv) 4,272,203 shares that the directors and executive officers as a group have the right to acquire within 60 days of September 13, 2023 pursuant to the exercise of vested stock options.

ImmunityBio, Inc. | 5 | Information Statement

ADDITIONAL INFORMATION

This Information Statement should be read in conjunction with certain reports that we previously filed with the SEC, including:

•Our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and

•Our Quarterly Reports on Form 10-Q for the three-month periods ended March 31, 2023 and June 30, 2023.

Financial and other information about our Company is available on our website at ir.immunitybio.com. We make available on our website, free of charge, copies of our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it, to the SEC. All reports we file with the SEC are available free of charge via EDGAR through the SEC website at www.sec.gov. We have included the web addresses of ImmunityBio and the SEC as inactive textual references only. Except as specifically incorporated by reference into this Information Statement, information on these websites is not part of this filing.

As a matter of regulatory compliance, we are sending you this Information Statement that describes the purpose and effect of the above action. Your consent to the above action is not required and is not being solicited in connection with this action. This Information Statement is intended to provide our stockholders with information required by the rules and regulations of the Exchange Act.

ImmunityBio, Inc. | 6 | Information Statement

APPENDIX A

CERTIFICATE OF AMENDMENT

OF AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

IMMUNITYBIO, INC.

(Pursuant to Section 242 of the

General Corporation Law of the State of Delaware)

ImmunityBio, Inc., a corporation organized and existing under the laws of the State of Delaware (the “Corporation”), hereby certifies as follows:

1.The name of this corporation is ImmunityBio, Inc. The Corporation’s original Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on March 12, 2014 under the name Conkwest, Inc., and the Corporation’s Amended and Restated Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on July 31, 2015, as amended on March 9, 2021 and February 1, 2022 (as amended, the “Amended and Restated Certificate of Incorporation”).

2.The Board of Directors of the Corporation duly adopted resolutions proposing to amend the Amended and Restated Certificate of Incorporation, declaring such amendment to be advisable and in the best interests of the Corporation and its stockholders, and authorizing the appropriate officers of the Corporation to solicit the consent of the stockholders therefor.

3.The amendment to the Amended and Restated Certificate of Incorporation set forth in paragraph 5 of this Certificate of Amendment was duly adopted by the Board of Directors of the Corporation in accordance with the provisions of Section 242 of the General Corporation Law of the State of Delaware.

4.The amendment to the Amended and Restated Certificate of Incorporation set forth in paragraph 5 of this Certificate of Amendment was duly approved by the stockholders of the Corporation in accordance with the provisions of Sections 228 and 242 of the General Corporation Law of the State of Delaware.

5.Article IV, Section 1 of the Amended and Restated Certificate of Incorporation is hereby amended and restated in its entirety as follows:

“This Corporation is authorized to issue two classes of stock, to be designated, respectively, as Common Stock and Preferred Stock. The total number of shares of stock that the Corporation shall have authority to issue is 1,370,000,000 shares, of which 1,350,000,000 shares are Common Stock, $0.0001 par value per share, and 20,000,000 shares are Preferred Stock, $0.0001 par value per share.”

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be signed by a duly authorized officer of the Corporation on this [ ] day of October 2023.

| | |

| IMMUNITYBIO, INC. |

|

|

|

| Richard Adcock |

| Chief Executive Officer and President |

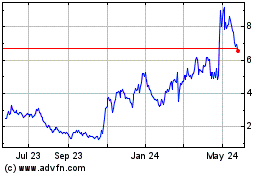

ImmunityBio (NASDAQ:IBRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

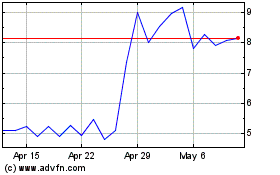

ImmunityBio (NASDAQ:IBRX)

Historical Stock Chart

From Apr 2023 to Apr 2024