0001014052

false

0001014052

2023-08-16

2023-08-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 16, 2023

Digerati Technologies, Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-15687 |

|

74-2849995 |

(State or other jurisdiction

of incorporation) |

|

Commission File Number |

|

(IRS Employer

Identification No.) |

| 8023 Vantage Dr., Suite 660, San Antonio, TX |

|

78230 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code (210) 614-7240

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| None |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Letter

Amendment to Credit Agreement with Post Road

As previously disclosed,

in November 2020, Digerati Technologies, Inc. (the “Company”) and Verve Cloud, Inc., a Nevada corporation formerly known

as T3 Communications, Inc., a Nevada corporation that is a controlled subsidiary of the Company (“Verve Cloud”), and Verve

Cloud’s subsidiaries (Verve Cloud and its subsidiaries, collectively, the “Verve Cloud Nevada Parties”) entered into

a credit agreement (the “Credit Agreement”) with Post Road Administrative LLC and its affiliate Post Road Special

Opportunity Fund II LP (collectively, “Post Road”). The Company is a party to certain sections of the Credit Agreement.

Next Level Internet, Inc. became a Verve Cloud Nevada Party in February 2022. As previously disclosed, through May 8, 2023, the Credit

Agreement had been amended seven times.

Pursuant

to the Credit Agreement, as amended, the principal balance owed by the Verve Cloud Nevada Parties to Post Road and

its affiliates, as of August 4, 2023, was approximately $35,020,452.20.

On

August 16, 2023, the Company, the Verve Cloud Nevada Parties, and Post Road entered into the Letter Agreement to the Credit Agreement

(the “Letter Agreement”), with an effective date of August 4, 2023 (the “Effective Date”).

Pursuant

to the Letter Agreement, the Company, the Verve Cloud Nevada Parties, and Post Road have agreed to the capitalization of all accrued

and unpaid cash interest due and payable by Verve Cloud as of the Effective Date. As a result of the capitalization of all accrued and

unpaid cash interest and the amendment fee in consideration of Post Road’s agreement to enter into the Letter Agreement, the outstanding

principal balance owed by the Verve Cloud Nevada Parties to Post Road and its affiliates, as of August 4, 2023, was approximately

$36,937,372.42.

Pursuant

to the Letter Agreement, Post Road has agreed to Verve Cloud’s payment in kind of all interest accruing, and otherwise due and payable

after the Effective Date until the Maturity Date.

Pursuant

to the Letter Agreement, the Company, the Verve Cloud Nevada Parties, and Post Road have agreed to amend the Credit Agreement and the

Term Loan C Note to replace the “August 4, 2023” date therein with “November 2, 2023,” in order to extend the

outside Maturity Date of the Term Loan C ninety (90) days from the Effective Date.

The

foregoing summary of the Letter Agreement contains only a brief description of the material terms of the Letter Agreement and such description

is qualified in its entirety by reference to the full text of the Letter Agreement, filed herewith as Exhibit 10.1, and incorporated by

reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Dated: August 21, 2023 |

Digerati Technologies, Inc. |

| |

|

| |

By: |

/s/ Antonio Estrada Jr. |

| |

|

Antonio Estrada Jr., |

| |

|

Chief Financial Officer |

2

Exhibit 10.1

Letter Agreement

August 16, 2023

Verve Cloud, Inc.

825 W. Bitters St., Suite 104

San Antonio, TX 78216

Attn: Antonio Estrada

Mr. Estrada:

Reference

is hereby made to that certain Credit Agreement dated as of November 17, 2020 (as amended by that certain First Amendment to Credit Agreement

dated as of December 20, 2021, that certain Joinder and Second Amendment to Credit Agreement dated as of February 4, 2022, that certain

Forbearance Agreement and Third Amendment to Credit Agreement dated as of June 13, 2022 (as amended by that certain Amendment to Forbearance

Agreement dated as of October 17, 2022, with an effective date as of August 8, 2022, by that certain Second Amendment to Forbearance Agreement

dated as of December 15, 2022, with an effective date of November 15, 2022, and as may otherwise be amended, restated, supplemented or

otherwise modified from time to time), that certain Consent, Limited Waiver and Fourth Amendment to Credit Agreement and Amendment to

Notes dated as of February 3, 2023, with an effective date of December 23, 2022 (the “Fourth Amendment”), that certain

Fifth Amendment to Credit Agreement dated as of March 13, 2023, with an effective date of February 28, 2023, that certain Sixth Amendment

to Credit Agreement dated as of April 3, 2023, that certain Seventh Amendment to Credit Agreement dated as of May 1, 2023, with an effective

date of April 28, 2023 (the “Seventh Amendment”), and as may otherwise be amended, restated, supplemented or otherwise

modified from time to time, the “Credit Agreement”; capitalized terms used but not otherwise defined herein shall have

the meanings given to such terms in the Credit Agreement), by and among Verve Cloud, Inc., a Nevada corporation formerly known as T3 Communications,

Inc. (the “Company”), T3 Communications, Inc., a Florida corporation (“T3FL”), Verve Cloud, Inc.,

a Texas corporation formerly known as Shift8 Networks, Inc. (“VerveTX”), Nexogy, Inc., a Florida corporation (“Nexogy”),

Next Level Internet, Inc., a California corporation (“Next Level; and together with T3FL, VerveTX and Nexogy, being referred

to herein individually as a “Guarantor” and collectively as the “Guarantors”; the Company and the

Guarantors being hereinafter referred to herein individually as a “Loan Party” and collectively as the “Loan

Parties”), the Lenders party thereto, and Post Road Administrative LLC, a Delaware limited liability company, as administrative

agent for the Lenders (together with its successors and assigns in such capacity, the “Administrative Agent”).

The Company has

promised to pay accrued interest on the Loans in arrears on the first Business Day of each calendar month (each such Business Day, an

“Interest Payment Date”). Any failure by the Company to make a monthly interest payment within five (5) calendar days

of the respective Interest Payment Date shall constitute an Event of Default under Section 13.1.1 (Non-Payment of Loans) of the Credit

Agreement.

Pursuant to

Section 3.3 (Interest Payments; PIK) of the Credit Agreement, the Company may elect to defer until the Maturity Date payment of accrued

and unpaid interest otherwise due and payable with respect to the Loans on the Interest Payment Date in accordance with the Original PIK

Option and the Fourth Amendment PIK Option. All accrued and unpaid interest, the payment of which is so deferred, shall be compounded

and added to the unpaid principal balance of the applicable Loan.

Pursuant to

the Seventh Amendment, the Administrative Agent and the Lenders agreed to, among other things, defer the cash interest otherwise due and

payable under the Term Loan A and the Term Loan C by the Company on the April 3, 2023 and the May 1, 2023 Interest Payment Dates to the

June 1, 2023 Interest Payment Date.

Subject to the

terms and conditions contained herein, the Company, the Administrative Agent and the Lenders have agreed to (i) the capitalization of

all accrued and unpaid cash interest due and payable by the Company under the Term Loan A and the Term Loan C as of August 4, 2023 (the

“Effective Date”) (such capitalized interest to be added to the unpaid principal balance of the applicable Loan on

the Effective Date), (ii) the Company’s payment in kind of all interest accruing, and otherwise due and payable, under the Loans

after the Effective Date until the Maturity Date, and (iii) amend the Credit Agreement and the Term Loan C Note to replace the “August

4, 2023” date therein with “November 2, 2023,” in order to extend the outside Maturity Date of the Term Loan C ninety

(90) days from the Effective Date.

In consideration

of the foregoing, the parties hereto are entering into this Letter Agreement (this “Letter Agreement”) in order to

evidence their understandings with respect thereto. Accordingly, for good and valuable consideration, the receipt and sufficiency of which

are hereby acknowledged, the parties hereto, for themselves, and their respective successors and assigns, do hereby mutually covenant

and agree as follows:

1.

The parties acknowledge and agree that as of the Effective Date, and prior to giving effect to the capitalization of the Unpaid Interest

pursuant to Paragraph 2 below, or the capitalization of the Amendment Fee pursuant to Paragraph 6 below, the outstanding principal balance

of the Term Loan A is $23,888,015.07 and the outstanding principal balance of the Term Loan C is $11,132,437.13.

2.

Notwithstanding anything contained in the Credit Agreement or the other Loan Documents to the contrary, the Company, the

Administrative Agent and the Lenders agree to capitalize all accrued and unpaid cash interest otherwise due and payable by the

Company under the Loans as of the Effective Date (including, without limitation, all accrued and unpaid cash interest that was

otherwise due and payable by the Company on the April 3, 2023, May 1, 2023, June 1, 2023, July 3, 2023 and August 1, 2023 Interest

Payment Dates) (all such accrued and unpaid cash interest, the “Unpaid Interest”). The Unpaid Interest shall be

capitalized and added to the outstanding principal balance of the Term Loan A or the Term Loan C, as applicable, on the Effective

Date, and shall be due and payable by the Company in cash on the Maturity Date in accordance with the Credit Agreement and the other

Loan Documents. The Administrative Agent and the Lenders hereby waive the Events of Default existing under Section 13.1.1(b)

(Non-Payment of the Loans) of the Credit Agreement as a result of the Company’s failure to pay the Unpaid Interest within five

(5) days after the date when due. This waiver is being given for, and is applicable to, only the Unpaid Interest, and shall not be

deemed to be a waiver of, or a consent to, any other failure to comply with any other provision of the Credit Agreement, to any

presently existing or future Unmatured Event of Default, or to any other presently existing or future Event of Default (including,

without limitation, the Specified Defaults (as defined in the Fourth Amendment)). Such waiver shall not prejudice or constitute a

waiver of any right or remedies that the Administrative Agent and the Lenders may have or be entitled to with respect to any other

breach of any other provision of the Credit Agreement.

3.

As a result of the capitalization of the Unpaid Interest pursuant to Paragraph 2 above, and prior to giving effect to the capitalization

of the Amendment Fee pursuant to Paragraph 6 below, the parties acknowledge and agree that as of the Effective Date the outstanding principal

balance of the Term Loan A is $25,155,276.15 and the outstanding principal balance of the Term Loan C is $11,723,013.80.

4.

Notwithstanding anything contained in the Credit Agreement or the other Loan Documents to the contrary, and unless otherwise agreed

to in writing by the Administrative Agent and the Lenders, all interest accruing under the Loans after the Effective Date shall be

paid by the Company in kind by increasing on a ratable basis the outstanding principal amount of each Loan on the applicable

Interest Payment Date by the amount of interest so paid in kind (the “PIK Interest”). Following an increase in

the outstanding principal amount of each of the Term Loan A and the Term Loan C as a result of the occurrence of PIK Interest,

interest shall accrue be payable on such increased amount of the Loans from and after the date of the occurrence of PIK Interest in

accordance with the Credit Agreement. Unless prepaid, all PIK Interest shall be due and payable by the Company in cash on the

Maturity Date in accordance with the Credit Agreement and the other Loan Documents.

5.

Subject to the terms contained herein, the Loan Parties, the Administrative Agent and the Lenders hereby agree to amend the Credit

Agreement by replacing the “August 4, 2023” date within the definition of “Maturity Date” in Section 1.1 (Definitions)

with “November 2, 2023,” and agree to amend the Term Loan C Note by replacing the “August 4, 2023” date in the

fourth paragraph thereto with “November 2, 2023.” Additionally, each of the Parent and each Loan Party agrees to use its commercially

reasonable efforts to take, or cause to be taken, all commercially reasonable actions to enter into amendments to the Credit Agreement

and certain of the other Loan Documents with the Administrative Agent and the Lenders, and to execute and deliver such other agreements,

certificates and documents related thereto as reasonably requested by the Administrative Agent, all within forty-five (45) days of the

Effective Date and in form and substance acceptable to the Administrative Agent and the Lenders.

6.

In consideration of the Administrative Agent’s agreement to enter into this Letter Agreement, and in addition to the payments

of principal and interest required under the Credit Agreement and the other Loan Documents, the Loan Parties covenant and agree to pay

to Administrative Agent a one- time non-refundable fee on each Loan equal to (a) what the outstanding principal balance of each Loan would

have been on the Effective Date had all accrued and unpaid cash interest that was otherwise due and payable by the Company on the April

3, 2023, May 1, 2023, June 1, 2023, July 3, 2023 and August 1, 2023 Interest Payment Dates been capitalized and added to the outstanding

principal balance of such Loan (those outstanding principal balances being $25,195,577.26 with respect to the Term Loan A and $11,741,795.16

with respect to the Term Loan C), less (b) the current outstanding principal balance of the respective Loan referenced in Paragraph 3

above (collectively, the “Amendment Fee”), which Amendment Fee shall be deemed fully earned on the date of this Letter

Agreement. The Amendment Fee applicable to the Term Loan A is $40,301.11 and the Amendment Fee applicable to the Term Loan C is $18,781.36.

The Amendment Fee shall be additional interest that has accrued on, and shall be capitalized and added to the outstanding principal amount

of the Term Loan A or the Term Loan C, as applicable, as of the Effective Date.

7.

As a result of the capitalization of both the Unpaid Interest and the Amendment Fee, the parties acknowledge and agree that as

of the Effective Date the outstanding principal balance of the Term Loan A is $25,195,577.26 and the outstanding principal balance of

the Term Loan C is $11,741,795.16.

8.

The parties acknowledge and agree that neither this Letter Agreement, nor any act or omission on the part of the Administrative

Agent or any other Lender, shall constitute a waiver of any Unmatured Event of Default or Event of Default, except as expressly set forth

in Paragraph 2 above, or of any rights and remedies available to the Administrative Agent or any other Lender under the Loan Documents,

this Letter Agreement, any other agreement or otherwise, all of which are hereby reserved.

9.

Nothing in this Letter Agreement shall amend, supplement or otherwise modify, or shall be construed to amend, supplement or

otherwise modify, the terms and conditions set forth in the Credit Agreement or any of the other Loan Documents, including, without

limitation, the Fourth Amendment, except as expressly set forth in Paragraphs 2, 4 and 5 above. Administrative Agent and the Lenders

specifically reserve all of their rights, powers and remedies available under and pursuant to the Credit Agreement and each of the

other Loan Documents, at law and in equity. Additional events may have occurred that would constitute further Unmatured Events of

Default or Events of Default. Administrative Agent and the Lenders hereby reserve the right to declare any such events as Unmatured

Events of Default or Events of Default, as applicable, at any time in the future. Any failure to specify such events in this Letter

Agreement shall in no way constitute a waiver of any Unmatured Event of Default or Event of Default resulting from such events.

10.

This Letter Agreement shall be deemed effective and in full force and effect as of the Effective Date upon Administrative Agent’s

receipt of a duly executed counterpart of this Letter Agreement signed by each of the parties hereto.

11.

Except as expressly modified hereby, the parties hereto ratify and confirm each and every provision of the Credit Agreement, including,

without limitation, each of the Specified Defaults set forth in the Fourth Amendment, as if the same were set forth herein. In the event

that any of the terms and conditions in the Credit Agreement conflict in any way with the terms and provisions hereof, the terms and provisions

hereof shall prevail.

12.

This Letter Agreement is one of the Loan Documents, and shall be governed by, and construed in accordance with, the laws of the

State of New York.

13.

This Letter Agreement may be executed simultaneously in any number of counterparts. Each counterpart shall be deemed to be an original,

and all such counterparts shall constitute one and the same instrument. The parties hereto agree that this Letter Agreement may be executed

via electronic digital signature (i.e., DocuSign), and signature pages may be transmitted between them by facsimile or by electronic mail

and that faxed, .pdf and electronic digital signatures may constitute original signatures and that a faxed or .pdf signature page containing

the signature (faxed, .pdf, electronic digital or original) is binding upon the parties hereto.

[Signatures appear on the following

pages]

| |

Sincerely, |

| |

|

|

| |

POST ROAD ADMINISTRATIVE LLC,

a Delaware limited liability company |

| |

|

|

| |

By: |

/s/ Michael Bogdan |

| |

Name: |

Michael Bogdan |

| |

Title: |

Authorized Signatory |

[Acknowledgements appear on following

pages]

| |

LENDERS: |

| |

|

|

| |

POST ROAD SPECIAL OPPORTUNITY FUND II LP, |

| |

a Delaware limited partnership |

| |

|

|

| |

By: |

/s/ Michael Bogdan |

| |

Name: |

Michael Bogdan |

| |

Title: |

Authorized Signatory |

[Acknowledgements continue on

following pages]

| |

LOAN PARTIES: |

| |

|

|

| |

VERVE CLOUD, INC.,

a Nevada corporation, as the Company, |

| |

formerly known as T3 Communications, Inc. |

| |

|

|

| |

By: |

/s/ Arthur L. Smith |

| |

Name: |

Arthur L. Smith |

| |

Title: |

President and Chief Executive Officer |

| |

|

|

| |

T3 COMMUNICATIONS, INC.,

a Florida corporation |

| |

|

|

| |

By: |

/s/ Arthur L. Smith |

| |

Name: |

Arthur L. Smith |

| |

Title: |

President and Chief Executive Officer |

| |

|

|

| |

VERVE CLOUD, INC.,

a Texas Corporation formerly known as Shift8 Networks, Inc. |

| |

|

|

| |

By: |

/s/ Arthur L. Smith |

| |

Name: |

Arthur L. Smith |

| |

Title: |

President and Chief Executive Officer |

| |

|

|

| |

NEXOGY,

INC.,

a Florida corporation |

| |

|

|

| |

By: |

/s/ Arthur L. Smith |

| |

Name: |

Arthur L. Smith |

| |

Title: |

President and Chief Executive Officer |

| |

|

|

| |

NEXT LEVEL INTERNET, INC.,

a California corporation |

| |

|

|

| |

By: |

/s/ Arthur L. Smith |

| |

Name: |

Arthur L. Smith |

| |

Title: |

Chief Executive Officer |

[Acknowledgements continue on following page]

| |

PARENT: |

| |

|

|

| |

DIGERATI TECHNOLOGIES, INC.,

a Nevada

corporation |

| |

|

|

| |

By: |

/s/ Arthur L. Smith |

| |

Name: |

Arthur L. Smith |

| |

Title: |

President and Chief Executive Officer |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

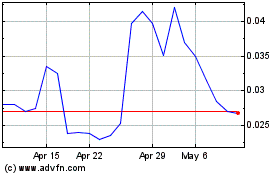

Digerati Technologies (QB) (USOTC:DTGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Digerati Technologies (QB) (USOTC:DTGI)

Historical Stock Chart

From Apr 2023 to Apr 2024