false0001643154NONE00016431542023-08-142023-08-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 14, 2023 |

iAnthus Capital Holdings, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

British Columbia |

000-56228 |

98-1360810 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

214 King Street West Suite 314 |

|

Toronto, Ontario |

|

M5H 3S6 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (646) 518-9418 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

N/A |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 14, 2023, iAnthus Capital Holdings, Inc. issued a press release announcing its financial results for the second quarter ended June 30, 2023. A copy of the press release is attached hereto as Exhibit 99.1, which is incorporated herein by reference.

The information furnished in this section of this Current Report on Form 8-K and Exhibit 99.1 attached hereto shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit

No. Description

99.1 Press release dated August 14, 2023

104 Cover Page Interactive Data File (embedded within the inline XRBL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

IANTHUS CAPITAL HOLDINGS, INC. |

|

|

|

|

Date: |

August 14, 2023 |

By: |

/s/ Richard Proud |

|

|

|

Richard Proud

Chief Executive Officer |

Exhibit 99.1

iAnthus Reports Second Quarter 2023 Financial Results

NEW YORK, NY and TORONTO, ON – August 14, 2023 – iAnthus Capital Holdings, Inc. (“iAnthus” or the “Company”) (CSE: IAN, OTCPK: ITHUF), which owns, operates, and partners with regulated cannabis operations across the United States, today reported its financial results for the second quarter ended June 30, 2023. The Company’s Quarterly Report on Form 10-Q, which includes its unaudited interim condensed consolidated financial statements for the three and six months ended June 30, 2023 and the related management’s discussion and analysis of financial condition and results of operations, can be accessed on the Securities and Exchange Commission’s (“SEC’s”) website at www.sec.gov, the Company’s SEDAR profile at www.sedar.com, and on the Company’s website at www.iAnthus.com. The Company’s financial statements are reported in accordance with U.S. generally accepted accounting principles (“GAAP”). All currency is expressed in U.S. dollars.

Second Quarter 2023 Financial Highlights

•Revenue of $38.7 million, a sequential increase of 5.2% from Q1 2023 and a decrease of 11.0% from the same quarter in the prior year.

•Gross profit of $18.4 million, a sequential increase of 18.7% from Q1 2023 and a decrease of 6.5% from the same quarter in the prior year.

•Gross margin of 47.5%, reflecting a sequential increase of 529bps when compared to Q1 2023 and an increase of 227bps from the same quarter in the prior year.

•Net loss of $20.1 million, or a net loss of $0.00 per share, compared to a net loss of $18.6 million, or a net loss of $0.00 per share in Q1 2023, and compared to a net loss of $373.6 million, or a net loss of $0.65 per share, in the same quarter in the prior year.

•Adjusted EBITDA(6) of ($0.4) million, a sequential decrease from an Adjusted EBITDA of $0.9 million in Q1 2023, and down from $2.3 million from the same quarter in the prior year. EBITDA and Adjusted EBITDA are non-GAAP measures. Reconciliation tables of EBITDA and Adjusted EBITDA as used in this press release to GAAP are included below.

|

|

|

|

|

|

|

Table 1: Financial Results |

in thousands of US$, except share and per share amounts (unaudited) |

|

Q2 2023 |

|

Q1 2023 |

|

Q2 2022 |

Revenue |

$ |

38,715 |

$ |

36,753 |

$ |

43,481 |

Gross profit |

|

18,390 |

|

15,512 |

|

19,668 |

Gross margin |

|

47.5% |

|

42.2% |

|

45.2% |

Net loss |

|

(20,149) |

|

(18,595) |

|

(373,562) |

Net loss per share |

|

(0.00) |

|

(0.00) |

|

(0.65) |

|

|

|

|

|

|

|

Table 2: Reconciliation of Net Loss to EBITDA and Adjusted EBITDA |

in thousands of US$ |

|

Q2 2023 |

|

Q1 2023 |

|

Q2 2022 |

Net loss |

$ |

(20,149) |

$ |

(18,595) |

$ |

(373,562) |

Depreciation and amortization |

|

6,809 |

|

6,991 |

|

7,394 |

Interest expense, net |

|

3,895 |

|

3,731 |

|

5,777 |

Income tax expense |

|

5,442 |

|

3,799 |

|

5,391 |

EBITDA (Non-GAAP) (6) |

$ |

(4,003) |

$ |

(4,074) |

$ |

(355,000) |

Adjustments |

|

|

|

|

|

|

Write-downs and other charges, net |

|

20 |

|

516 |

|

154 |

Inventory reserves and write-downs |

|

- |

|

356 |

|

177 |

Accretion expense |

|

974 |

|

978 |

|

775 |

Share-based compensation (1) |

|

1,593 |

|

1,489 |

|

21,372 |

Losses from change in fair value of financial instruments |

|

11 |

|

33 |

|

138 |

Debt obligation fees (2) |

|

- |

|

- |

|

390 |

Non-recurring charges (3) |

|

1,092 |

|

529 |

|

18,218 |

Loss on debt extinguishment (4) |

|

- |

|

1,288 |

|

316,577 |

Other income (5) |

|

(117) |

|

(220) |

|

(527) |

Total Adjustments |

$ |

3,573 |

$ |

4,969 |

$ |

357,274 |

Adjusted EBITDA (Non-GAAP) (6) |

$ |

(430) |

$ |

895 |

$ |

2,274 |

(1)Represents ordinary share-based compensation expense for Q2 2023 and Q1 2023. Q2 2022 reflects a $21.0 million share-based compensation expense related to the graded vesting from the restricted stock units granted as a result of closing the Company's Recapitalization Transaction on June 24, 2022.

(2)Reflects accrued interest on the exit fee owed to the holders of the Company’s 13.0% senior secured convertible debentures. As the Company's Recapitalization Transaction closed on June 24, 2022, the Company will no longer incur debt obligation fees relating to such debentures.

(3)Includes one-time, non-recurring costs related to the Company’s Recapitalization Transaction, its strategic review process, ongoing legal disputes, and severance and other non-recurring costs associated with having become a U.S. reporting company. These non-recurring costs are offset by insurance proceeds received as reimbursement for certain legal costs incurred.

(4)Q1 2023 reflects a one-time loss of $1.3 million on debt extinguishment related to the amendment of the $11.0 million senior secured bridge notes issued by iAnthus New Jersey, LLC. Q2 2022 reflects one-time loss of $316.6 million on debt extinguishment related to closing of the Company's Recapitalization Transaction.

(5)Q2 2023 and Q1 2023 reflect approximately $0.1 million related to payroll tax refunds, and accounts payable write-offs of approximately $0.1 million. Q2 2022 reflects accounts payable write-offs of $0.3 million and payroll tax refunds of $0.2 million.

(6)See “Non-GAAP Financial Information” below for more information regarding the Company’s use of non-GAAP financial measures.

Non-GAAP Financial Information

This press release includes certain non-GAAP financial measures as defined by the SEC and the Canadian Securities Administrators. Reconciliations of these non-GAAP financial measures to the most directly comparable financial measures calculated and presented in accordance with GAAP are included in the tables above. This information should be considered as supplemental in nature and not as a substitute for, or superior to, any measure of performance prepared in accordance with GAAP.

In evaluating our business, we consider and use EBITDA as a supplemental measure of operating performance. We define EBITDA as earnings before interest, taxes, depreciation and amortization. We present EBITDA because we believe it is frequently used by securities analysts, investors and other interested parties as a measure of financial performance. We define Adjusted EBITDA as EBITDA before stock-based compensation, accretion expense, write-downs and impairments, gains and losses from changes in fair values of financial instruments, income or losses from equity-accounted investments, changes in accounting policy, non-recurring costs related to the Company’s Recapitalization Transaction, and litigation costs related to ongoing legal proceedings.

EBITDA and Adjusted EBITDA are not standardized financial measures defined under GAAP, and are not a measure of operating income, operating performance or liquidity presented in accordance with GAAP. EBITDA and Adjusted EBITDA have limitations as an analytical tool, and when assessing the Company’s operating performance, investors should not consider EBITDA or Adjusted EBITDA in isolation, or as a substitute for net income (loss) or other consolidated income statement data prepared in accordance with GAAP. Among other things, EBITDA and Adjusted EBITDA do not reflect the Company’s actual cash expenditures. Other companies may calculate similar measures differently than us, limiting their usefulness as comparative tools. We compensate for these limitations by relying on GAAP results and using EBITDA and Adjusted EBITDA only as supplemental information.

About iAnthus

iAnthus owns and operates licensed cannabis cultivation, processing and dispensary facilities throughout the United States. For more information, visit www.iAnthus.com.

Forward Looking Statements

Statements in this press release contain forward-looking statements. These forward-looking statements are made on the basis of the current beliefs, expectations and assumptions of management, are not guarantees of performance and are subject to significant risks and uncertainty. These forward-looking statements should, therefore, be considered in light of various important factors, including those set forth in the Company’s reports that it files from time to time with the SEC and the Canadian securities regulators, which you should review including, but not limited to, the Annual Report filed with the SEC. When used in this press release, words such as “will,” “could,” “plan,” “estimate”, “expect”, “intend”, “may”, “potential”, “believe”, “should” and similar expressions, identify forward-looking statements.

Forward-looking statements may include, without limitation, statements relating to the Company’s financial performance, business development and results of operations.

These forward-looking statements should not be relied upon as predictions of future events, and the Company cannot assure you that the events or circumstances discussed or reflected in these statements will be achieved or will occur. If such forward-looking statements prove to be inaccurate, the inaccuracy may be material. You should not regard these statements as a representation or warranty by the Company or any other person that the Company will achieve its objectives and plans in any specified time frame, or at all. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company disclaims any obligation to publicly update or release any revisions to these forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this press release or to reflect the occurrence of unanticipated events, except as required by law.

Neither the Canadian Securities Exchange nor the U.S. Securities and Exchange Commission has reviewed, approved or disapproved the content of this press release.

Contact Information

Corporate/Media/Investors:

Philippe Faraut, Chief Financial Officer

iAnthus Capital Holdings, Inc.

1-646-518-9418

investors@ianthuscapital.com

v3.23.2

Document And Entity Information

|

Aug. 14, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 14, 2023

|

| Entity Registrant Name |

iAnthus Capital Holdings, Inc.

|

| Entity Central Index Key |

0001643154

|

| Entity Emerging Growth Company |

true

|

| Securities Act File Number |

000-56228

|

| Entity Incorporation, State or Country Code |

A1

|

| Entity Tax Identification Number |

98-1360810

|

| Entity Address, Address Line One |

214 King Street West

|

| Entity Address, Address Line Two |

Suite 314

|

| Entity Address, City or Town |

Toronto

|

| Entity Address, State or Province |

ON

|

| Entity Address, Postal Zip Code |

M5H 3S6

|

| City Area Code |

(646)

|

| Local Phone Number |

518-9418

|

| Entity Information, Former Legal or Registered Name |

Not applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

N/A

|

| No Trading Symbol Flag |

true

|

| Security Exchange Name |

NONE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

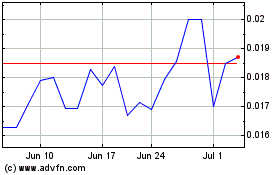

Ianthus Capital (QB) (USOTC:ITHUF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ianthus Capital (QB) (USOTC:ITHUF)

Historical Stock Chart

From Apr 2023 to Apr 2024