Current Report Filing (8-k)

March 31 2023 - 8:16AM

Edgar (US Regulatory)

0001437925false00014379252023-03-292023-03-29iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): March 29, 2023

GOLDEN MATRIX GROUP, INC. |

(Exact name of registrant as specified in its charter) |

Nevada | | 001-41326 | | 46-1814729 |

(State or other jurisdiction of incorporation or organization) | | (Commission file number) | | (IRS Employer Identification No.) |

3651 Lindell Road, Suite D131

Las Vegas, NV 89103

(Address of principal executive offices)(zip code)

Registrant’s telephone number, including area code: (702) 318-7548

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, $0.00001 Par Value Per Share | | GMGI | | The NASDAQ Stock Market LLC (The NASDAQ Capital Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

On March 29, 2023, the Board of Directors of Golden Matrix Group, Inc. (the “Company”) authorized and approved a share repurchase program for up to $2 million of the currently outstanding shares of the Company’s common stock. Subject to any future extension in the discretion of the Board of Directors of the Company, the repurchase program is scheduled to expire on September 29, 2023, when a maximum of $2.0 million of the Company’s common stock has been repurchased, or when such program is discontinued by the Board of Directors.

Under the stock repurchase program, shares may be repurchased from time to time in the open market or through negotiated transactions at prevailing market rates, or by other means in accordance with federal securities laws. Repurchases will be made at management’s discretion at prices management considers to be attractive and in the best interests of both the Company and its stockholders, subject to the availability of stock, general market conditions, the trading price of the stock, alternative uses for capital, and the Company’s financial performance. Open market purchases are expected to be conducted in accordance with the limitations set forth in Rule 10b-18 of the Securities Exchange Act of 1934 (the “Exchange Act”) and other applicable laws and regulations. Repurchases may also be made under a Rule 10b5-1 plan, which would permit shares to be repurchased when the Company might otherwise be precluded from doing so under insider trading laws.

The repurchase program may be suspended, terminated or modified at any time for any reason, including market conditions, the cost of repurchasing shares, the availability of alternative investment opportunities, liquidity, and other factors deemed appropriate. These factors may also affect the timing and amount of share repurchases. The repurchase program does not obligate the Company to purchase any particular number of shares. There is no guarantee as to the exact number or value of shares that will be repurchased by the Company, if any.

The repurchase program will be funded using the company’s working capital.

Information regarding share repurchases will be available in the Company’s periodic reports on Form 10-Q and 10-K filed with the Securities and Exchange Commission as required by the applicable rules of the Exchange Act.

On March 31, 2023, the Company filed a press release disclosing the adoption of the repurchase program, a copy of which is attached hereto as Exhibit 99.1, which is incorporated by reference into this Item 8.01 in its entirety.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, hereunto duly authorized.

| GOLDEN MATRIX GROUP, INC. | |

| | |

Date: March 31, 2023 | By: | /s/ Anthony Brian Goodman | |

| | Anthony Brian Goodman | |

| | Chief Executive Officer | |

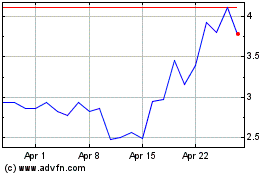

Golden Matrix (NASDAQ:GMGI)

Historical Stock Chart

From Aug 2024 to Sep 2024

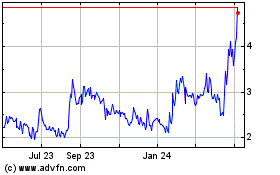

Golden Matrix (NASDAQ:GMGI)

Historical Stock Chart

From Sep 2023 to Sep 2024