Amended Tender Offer Statement by Issuer (sc To-i/a)

June 13 2022 - 4:50PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

(Amendment No. 1)

(Rule 13e-4)

Tender Offer

Statement Under Section 14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

SOCIETAL CDMO, INC.

(Name of Subject Company (Issuer) and Filing Person (Offeror))

Options to Purchase Common Stock, Par Value $0.01 Per Share

(Title of Class of Securities)

75629F109

(CUSIP Number

of Class of Securities)

J. David Enloe, Jr.

President and Chief Executive Officer

Societal CDMO, Inc.

1 E.

Uwchlan Ave, Suite 112

Exton, Pennsylvania 19341

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Filing Person)

Copies to:

Rachael M. Bushey

Jennifer L. Porter

Troutman Pepper Hamilton Sanders LLP

3000 Two Logan Square

Eighteenth and Arch Streets

Philadelphia, Pennsylvania 19103

(215) 981-4331

| ☐ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a

tender offer. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

| |

☐ |

third party tender offer subject to Rule 14d-1.

|

| |

☒ |

issuer tender offer subject to Rule 13e-4.

|

| |

☐ |

going-private transaction subject to Rule 13e-3.

|

| |

☐ |

amendment to Schedule 13D under Rule 13d-2.

|

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☐

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

| |

☐ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| |

☐ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

|

Explanatory Note

This Amendment No. 1 amends and supplements the Tender Offer Statement on Schedule TO (the “Schedule TO”) originally filed with the Securities

and Exchange Commission on June 1, 2022 by Societal CDMO, Inc. (the “Company”), in connection with its offer to exchange on the terms and subject to the conditions set forth in the Offer to Exchange Eligible Options For

New Restricted Stock Units, dated June 1, 2022 (the “Offer to Exchange”).

This Amendment No. 1 is being filed to provide the

summarized financial information required by Item 1010(c) of Regulation M-A with respect to the Company. Except as specifically provided herein, the information contained in the Offer to Exchange

remains unchanged by this Amendment No. 1. You should read this Amendment No. 1 together with the Offer to Exchange.

Item 10. Financial Statements.

Item 10 of the

Schedule TO is hereby amended and supplemented by adding the following:

(c) Summary Information.

Summary financial information pursuant to Item 1010(c) of Regulation M-A is set forth on Schedule A to the

Amendment to the Offer to Exchange and is incorporated herein by reference.

Item 12. Exhibits.

Item 12 of the Schedule TO is hereby amended and restated as follows:

Item 12. Exhibits.

|

|

|

| Exhibit

Number |

|

Description |

|

|

| (a)(1)(A) |

|

Offer to Exchange Eligible Options for New Restricted Stock Units, dated June 1, 2022 |

|

|

| (a)(1)(B) |

|

Form of Announcement to Eligible Employees |

|

|

| (a)(1)(C) |

|

Election Form |

|

|

| (a)(1)(D) |

|

Notice of Withdrawal of Election Form |

|

|

| (a)(1)(E) |

|

Form of Email Confirming Receipt of Election Form |

|

|

| (a)(1)(F) |

|

Form of Email Confirming Receipt of Notice of Withdrawal of Election Form |

|

|

| (a)(1)(G) |

|

Form of Reminder Email to Eligible Employees Regarding the Expiration of the Exchange Offer |

|

|

| (a)(1)(H) |

|

Form of Email to Eligible Employees Confirming Acceptance of Eligible Options |

|

|

| (a)(1)(I) |

|

Form of Email Notice Regarding Rejection of Options for Exchange |

|

|

| (a)(1)(J) |

|

Form of Expiration Notice Email |

|

|

| (a)(1)(K) |

|

Form of Welcome Email |

|

|

| (a)(1)(L) |

|

Form of Email Notice Regarding Invalid Election Form |

|

|

| (a)(1)(M) |

|

Form of RSU Award Agreement for New RSUs Granted under Offer to Exchange Program (incorporated by reference to Exhibit 10.28 to the Registrant’s Annual Report on

Form 10-K (File No. 001-36329), filed on February 26, 2021) |

|

|

| (a)(1)(N)* |

|

Amendment No. 1 to the Offer to Exchange Eligible Options for New Restricted Stock Units, dated June 13, 2022 |

|

|

|

| (a)(1)(O)* |

|

Cover letter to all Eligible Employees regarding Amendment No. 1 to the Offer to Exchange Eligible Options for New Restricted Stock Units, dated June 13, 2022 |

|

|

| (d)(1) |

|

Societal CDMO, Inc. 2018 Amended and Restated Equity Incentive Plan (incorporated by reference to Exhibit 10.2 to the Registrant’s Quarterly Report on

Form 10-Q (File No. 001-36329), filed on May 9, 2018) |

|

|

| (d)(2) |

|

Form of Non-Qualified Stock Option Award Agreement under the 2018 Amended and Restated Equity Incentive Plan (incorporated by reference to Exhibit 10.26 to the Registrant’s

Annual Report on Form 10-K (File No. 001-36329), filed on February 26, 2021) |

|

|

| (d)(3) |

|

Form of Non-Qualified Stock Option Inducement Award Agreement (incorporated by reference to Exhibit 10.1 to the Registrant’s Quarterly Report on Form

10-Q (File No. 001-36329), filed on August 9, 2021) |

|

|

| 107 |

|

Filing Fee Table |

SIGNATURES

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

|

|

|

SOCIETAL CDMO, INC. |

|

|

| By: |

|

/s/ J. David Enloe, Jr. |

|

|

J. David Enloe, Jr. |

|

|

President and Chief Executive Officer |

Dated: June 13, 2022

Societal CDMO (NASDAQ:SCTL)

Historical Stock Chart

From Aug 2024 to Sep 2024

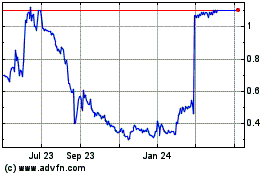

Societal CDMO (NASDAQ:SCTL)

Historical Stock Chart

From Sep 2023 to Sep 2024