Initial Statement of Beneficial Ownership (3)

December 28 2021 - 4:02PM

Edgar (US Regulatory)

FORM 3

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0104

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Hoefelmann Dirk Ole |

2. Date of Event Requiring Statement (MM/DD/YYYY)

9/22/2021

|

3. Issuer Name and Ticker or Trading Symbol

PLUG POWER INC [PLUG]

|

|

(Last)

(First)

(Middle)

C/O PLUG POWER INC.,, 968 ALBANY-SHAKER ROAD |

4. Relationship of Reporting Person(s) to Issuer (Check all applicable)

_____ Director _____ 10% Owner

___X___ Officer (give title below) _____ Other (specify below)

GM, Electrolyzer Solutions / |

|

(Street)

LATHAM, NY 12110

(City)

(State)

(Zip)

| 5. If Amendment, Date Original Filed(MM/DD/YYYY)

| 6. Individual or Joint/Group Filing(Check Applicable Line)

_X_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Beneficially Owned

|

1.Title of Security

(Instr. 4) | 2. Amount of Securities Beneficially Owned

(Instr. 4) | 3. Ownership Form: Direct (D) or Indirect (I)

(Instr. 5) | 4. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Common Stock | 250000 (1) | D | |

| Common Stock | 269 | I | 401(k) Plan (2) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 4) | 2. Date Exercisable and Expiration Date

(MM/DD/YYYY) | 3. Title and Amount of Securities Underlying Derivative Security

(Instr. 4) | 4. Conversion or Exercise Price of Derivative Security | 5. Ownership Form of Derivative Security: Direct (D) or Indirect (I)

(Instr. 5) | 6. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Stock Option (Right to Buy) | (3) | 3/3/2031 | Common Stock | 250000 | $43.81 | D | |

| Explanation of Responses: |

| (1) | Consists of a restricted stock award made pursuant to Plug Power's 2011 Stock Option and Incentive Plan (the "2011 Plan"). The restricted stock vests in three substantially equal installments, with the first installment vesting on March 3, 2022. |

| (2) | The reporting person holds 269 shares of common stock in Plug Power Inc.'s 401(k) plan. The information in this report is based on a plan statement as of December 6, 2021. |

| (3) | Awarded pursuant to the 2011 Plan. This option shall vest and become exercisable in three substantially equal annual installments, with the first installment vesting on March 3, 2022. |

Remarks:

Exhibit 24 - Power of Attorney |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Hoefelmann Dirk Ole

C/O PLUG POWER INC.,

968 ALBANY-SHAKER ROAD

LATHAM, NY 12110 |

|

| GM, Electrolyzer Solutions |

|

Signatures

|

| /s/ Gerard L. Conway, Jr., Attorney-in-Fact | | 12/28/2021 |

| **Signature of Reporting Person | Date |

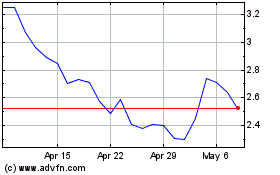

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Aug 2024 to Sep 2024

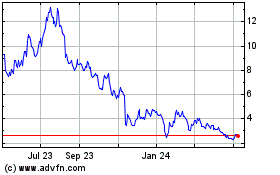

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Sep 2023 to Sep 2024