Hartford CEO Surprised by Chubb Proposal; Board Has Now Rejected Three

April 22 2021 - 2:31PM

Dow Jones News

By Leslie Scism

Chubb Ltd.'s March proposal to acquire rival Hartford Financial

Services Group Inc. arrived with little warning, surprising

Hartford's chief executive.

On March 11, insurance company Chubb offered to buy Hartford in

a roughly $23 billion transaction. After its board discussed the

proposal, Hartford rejected the offer before the end of the

month.

In an interview Thursday, Hartford Chief Executive Christopher

Swift said he received a quick head's up from Chubb that an offer

was coming. But there were no dinner meetings or other advance

conversations about the potential pairing of two of the nation's

best-known property-casualty insurers.

He said the March offer was an impersonal start to what are now

three proposals from Chubb to acquire Hartford. Each one has been

evaluated and unanimously rejected by the insurer's board.

"He wrote us three letters," Mr. Swift said of Chubb's chief

executive, Evan Greenberg. "He didn't ask to sit down with me ahead

of time. He didn't ask to meet. He gave me a head's up one

afternoon he was sending a letter."

As for the proposals: "They just showed up in my email," and the

two companies "corresponded from there," Mr. Swift said.

Early Thursday, Hartford Financial filed with the Securities and

Exchange Commission copies of Chubb's second and third proposals,

along with its first-quarter earnings report. Chubb's third

proposal took the deal price up to $70 a share in a cash-and-stock

deal, from $65 a share in cash as initially proposed. The proposal

letter, dated April 14, said the $70 share price was "the top end

of our range."

The disclosures came as Hartford also said it would boost its

share-buyback program. Mr. Swift said the buybacks reflect

increased confidence that the worst of the coronavirus pandemic is

behind the U.S. economy thanks to vaccines, improved medical

treatments and other developments.

Chubb said in a statement Thursday that Hartford "has chosen not

to engage in response to any of our proposals. The path to a

transaction would have been engagement coming from The Hartford on

the terms of our last proposal."

Chubb didn't have immediate comment on Mr. Swift's description

of the deal process.

A transaction would have been one of the biggest-ever deals in

the U.S. property-casualty insurance industry. In 2016, Mr.

Greenberg merged a business insurer, ACE Ltd., with the

personal-property and business insurer Chubb, and kept the

better-known name, in an approximately $30 billion transaction.

Hartford's shares were down nearly 1% to $66.82 in

early-afternoon trading Thursday. The shares had traded below $60

when the first Chubb approach was made.

Mr. Swift said in the interview that the Hartford directors'

rejection of Chubb's proposals was "a rejection of even

contemplating sitting down because of the strength and the

conviction they have in our strategic plan. We are moving

forward."

He added: "The board knows its fiduciary duty. It had its

advisers and lawyers look at everything with a clear eye."

In its first-quarter results, Hartford profit fell 9% to $244

million and "core earnings," which are adjusted to strip out items

considered nonrecurring, dropped 58% to $203 million.

Results included the impact of a $650 million settlement with

the Boy Scouts of America, $214 million in pretax net catastrophe

losses, and $185 million in Covid-19-related excess mortality

losses in Hartford's business of selling life insurance and other

products for employers' benefits packages.

Hartford is a leading seller of insurance to small businesses in

the U.S., which is a franchise Chubb was eager to acquire. Chubb is

best known for selling coverage to protect rich people's personal

property, as well as complex insurance packages for some of the

world's biggest companies.

"We have a strong capital base; we'll buy shares back. We've

been undervalued for a while, but I think clearly better days are

ahead of us, " Mr. Swift said.

Write to Leslie Scism at leslie.scism@wsj.com

(END) Dow Jones Newswires

April 22, 2021 14:16 ET (18:16 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

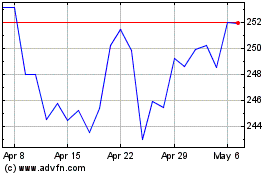

DBA Chubb (NYSE:CB)

Historical Stock Chart

From Aug 2024 to Sep 2024

DBA Chubb (NYSE:CB)

Historical Stock Chart

From Sep 2023 to Sep 2024