Definitive Materials Filed by Investment Companies. (497)

February 22 2021 - 4:46PM

Edgar (US Regulatory)

4979/30/2020ETF Managers Trust0001467831FALSEN-1A0001467831ck0001467831:S000058619Member2021-02-222021-02-2200014678312021-02-222021-02-220001467831ck0001467831:S000058619Memberck0001467831:C000192552Member2021-02-222021-02-22

Filed pursuant to Rule 497(e)

File Nos. 811-22310; 333-182274

Supplement to the

Prospectus and Statement of Additional Information (“SAI”)

dated January 29, 2021, of the

ETFMG AI Powered Equity ETF (AIEQ)

February 22, 2021

The entire section of the Prospectus titled “SUMMARY – Principal Investment Strategies” is replaced with the following:

The Fund is actively managed and invests primarily in equity securities listed on a U.S. exchange based on the results of a proprietary, quantitative model (the “EquBot Model”) developed by EquBot Inc. (“EquBot”) that runs on the IBM Watson™ platform. EquBot, the Fund’s sub-adviser, is a technology based company focused on applying artificial intelligence (“AI”) based solutions to investment analyses. As an IBM Global Entrepreneur company, EquBot leverages IBM’s Watson AI to conduct an objective, fundamental analysis of U.S. domiciled common stocks, including Special Purpose Acquisitions Corporations (“SPAC”), and real estate investment trusts (“REITs”) based on up to ten years of historical data and apply that analysis to recent economic and news data. A SPAC is a “blank check” company with no commercial operations that is designed to raise capital via an initial public offering for the purpose of engaging in a merger, acquisition, reorganization, or similar business combination (a “Combination”) with one or more operating companies (each a SPAC-derived company).

Each day, the EquBot Model ranks each company based on the probability of the company benefiting from current economic conditions, trends, and world events and identifies approximately 30 to 200 companies with the greatest potential over the next twelve months for appreciation and their corresponding weights, targeting a maximum risk adjusted return versus the broader U.S. equity market. The Fund may invest in the securities of companies of any market capitalization. The EquBot model recommends a weight for each company based on its potential for appreciation and correlation to the other companies in the Fund’s portfolio. If a SPAC that is selected for investment by the Fund announces a Combination with an operating company, the pre-Combination SPAC and, subsequently, the SPAC-derived company will be screened for investment and may continue to be held by the Fund so long as it continues to meet the requirements of the EquBot Model. If the SPAC announces a Combination with a business which does not meet the criteria of the EquBot Model, the SPAC will be removed from the Fund as promptly as practicable following the determination being made. The EquBot model limits the weight of any individual company to 10%. At times, a significant portion of the Fund’s assets may consist of cash and cash equivalents.

IBM’s Watson AI is a computing platform capable of answering natural language questions by connecting large amounts of data, both structured (e.g., spreadsheets) and unstructured (e.g., news articles), and learning from each analysis it conducts (e.g., by recognizing patterns) to produce a more accurate answer with each subsequent question.

The Fund’s investment adviser utilizes the recommendations of the EquBot Model to decide which securities to purchase and sell, while complying with the Investment Company Act of 1940 (the “1940 Act”) and its rules and regulations. The Fund’s sub-adviser anticipates primarily making purchase and sale decisions based on information from the EquBot Model. Additionally, the model will systematically take into consideration the tax treatment of a particular transaction or series of transactions and liquidity or other constraints relating to trading a security selected pursuant to the EquBot Model. The Fund may frequently and actively purchase and sell securities.

The Fund may lend its portfolio securities to brokers, dealers, and other financial organizations. These loans, if and when made, may not exceed 33 1/3% of the total asset value of the Fund (including the loan collateral). By lending its securities, the Fund may increase its income by receiving payments from the borrower.

Please retain this Supplement with your Prospectus and SAI for future reference.

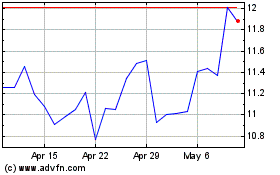

Amplify Junior Silver Mi... (AMEX:SILJ)

Historical Stock Chart

From Apr 2024 to May 2024

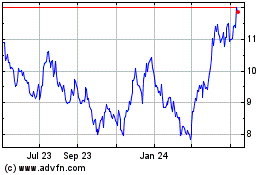

Amplify Junior Silver Mi... (AMEX:SILJ)

Historical Stock Chart

From May 2023 to May 2024