UBS to Launch New Buyback of Up to $4.5 Billion

January 26 2021 - 1:50AM

Dow Jones News

By Pietro Lombardi

UBS Group AG will restart buying back its shares and announced a

new buyback program of up to $4.5 billion, after the bank closed

2020 with a consensus-beating quarterly performance.

The world's largest wealth manager by assets has weathered the

coronavirus pandemic storm better than many of its peers, helped by

strong customer activity in its investment bank and its vast

wealth-management operations. It has already set aside $2 billion

for buybacks.

UBS said Tuesday that it will launch a new three-year buyback

program in the first quarter of up 4 billion Swiss francs ($4.5

billion). Including the conclusion of the existing program, the

bank plans to repurchase up to $1.1 billion of shares in the first

three months of the year.

The bank also said it would propose a dividend of $0.37 a share

for last year.

Swiss bank UBS has met or beat all its financial targets for

last year. Its quarterly profit more than doubled in the last three

months of the year to $1.71 billion from $722 million a year

earlier. Analysts had forecast profit of $966 million.

Operating income rose 15% to $8.12 billion.

"Our strong 2020 results clearly demonstrate the true strength

of our franchise," Chief Executive Ralph Hamers said.

The buyback was a key focus going into the results, the first

under Mr. Hamers, who became CEO in November.

Write to Pietro Lombardi at pietro.lombardi@wsj.com;

@pietrolombard10

(END) Dow Jones Newswires

January 26, 2021 01:35 ET (06:35 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

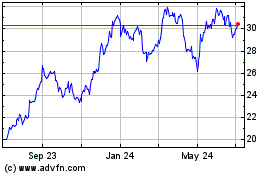

UBS (NYSE:UBS)

Historical Stock Chart

From Aug 2024 to Sep 2024

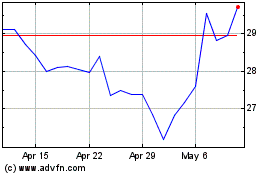

UBS (NYSE:UBS)

Historical Stock Chart

From Sep 2023 to Sep 2024