Two Suitors Compete to Scoop Brooks Brothers Out of Bankruptcy

July 09 2020 - 7:36PM

Dow Jones News

By Soma Biswas

A battle is brewing for control of Brooks Brothers Group Inc.,

with at least two apparel ventures looking to take over the

bankrupt clothing retailer, according to people familiar with the

matter.

Sparc Group LLC, an apparel company backed by Authentic Brands

Group LLC and mall owner Simon Property Group Inc., is considering

bidding to buy Brooks Brothers out of bankruptcy, these people

said.

WHP Global Inc., which has agreed to finance Brooks Brothers

during its bankruptcy, is also crafting a buyout offer, according

to people familiar with the matter.

Brooks Brothers filed for bankruptcy on Wednesday after two

centuries in business, unable to withstand the coronavirus pandemic

and the forced shutdown of retail shopping. The company, which

struggled in recent years with a shift toward more casual dress

styles at work, will soon start a formal process to field

offers.

Both potential bidders are planning to keep most Brooks Brothers

stores intact, betting that the retailer's survival is tied to a

strong brick-and-mortar presence, according to people familiar with

the matter.

WHP, founded in 2018 with backing from Oaktree Capital

Management LP, is looking to add Brooks Brothers to its portfolio

after buying the Joseph Abboud and Anne Klein brands from

struggling parent companies.

Authentic Brands Group has been buying up brands for a decade.

The firm teamed up with Saks Fifth Avenue parent Hudson's Bay Co.

to buy the Barney's brand out of bankruptcy last year. Sparc, the

venture Authentic formed with Simon Property, last week proposed a

deal to buy clothing retailer Lucky Brand Dungarees LLC out of

bankruptcy. Sparc also owns hundreds of Aéropostale, Forever 21 and

Nautica stores.

The possible bidders are also competing behind the scenes to

supply the financing needed to carry Brooks Brothers through

bankruptcy, the people also said. The company has signed on to a

$75 million loan from WHP, but Sparc is in talks with Brooks

Brothers to offer a bigger loan, they said.

A Brooks Brothers spokeswoman declined to comment.

Neither loan can be finalized until it is approved in the U.S.

Bankruptcy Court in Wilmington, Del., where Brooks Brothers is

scheduled to make its debut appearance Friday.

WHP's proposed loan to Brooks Brothers would give it collateral

rights over the company's brand name and trademarks, ensuring that

even if Brooks Brothers ends up liquidating, WHP would gain control

over the intellectual property.

Under the conditions offered by WHP, Brooks Brothers would need

to sell itself by Sept. 14.

Write to Soma Biswas at soma.biswas@wsj.com

(END) Dow Jones Newswires

July 09, 2020 19:21 ET (23:21 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

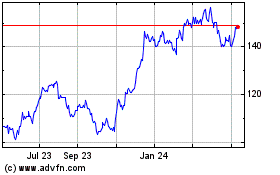

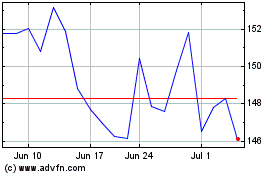

Simon Property (NYSE:SPG)

Historical Stock Chart

From Aug 2024 to Sep 2024

Simon Property (NYSE:SPG)

Historical Stock Chart

From Sep 2023 to Sep 2024