Current Report Filing (8-k)

September 06 2019 - 4:53PM

Edgar (US Regulatory)

false000166977900016697792019-09-032019-09-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 3, 2019

Camping World Holdings, Inc.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Delaware

|

|

001-37908

|

|

81-1737145

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

250 Parkway Drive, Suite 270

Lincolnshire, IL 60069

|

|

Telephone: (847) 808-3000

|

|

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

|

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425).

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12).

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)).

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Class A Common Stock,

$0.01 par value per share

|

CWH

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.05. Costs Associated with Exit or Disposal Activities.

On September 3, 2019, the Board of Directors (the “Board”) of Camping World Holdings, Inc. (the “Company”) approved a plan to strategically shift its business away from locations where the Company does not have the ability or where it is not feasible to sell and/or service recreational vehicles (“RVs”) (the “Plan”). As of September 3, 2019, the Company operated 169 locations that sell and/or service RVs and 37 locations that do not sell and/or service RVs but sell an assortment of outdoor lifestyle products, excluding seven specialty retail locations operated by TheHouse.com (the “Outdoor Lifestyle Locations”). At certain Outdoor Lifestyle Locations, the Company is in the process of attempting to acquire and/or obtain the developmental consents, approvals and permits necessary for the sale and/or service of RVs.

The Company is in the early stages of evaluating the impact of the Plan and has had preliminary discussions regarding the sale, repurposing, relocation or closing of certain locations, with the current expectation of either selling, repurposing, relocating or closing approximately 27 to 37 Outdoor Lifestyle Locations. The actual number of stores the Company sells, repurposes, relocates, or closes may change. As part of the Plan, the Company is also evaluating the impact on the Company’s supporting infrastructure and operations. For instance, the Company is in the process of rationalizing inventory levels and composition, as well as warehousing and distribution resources. The Company will have a reduction of headcount and labor costs for those locations that are sold or closed and the Company expects to incur material charges associated with the activities contemplated under the Plan, with the majority of those activities currently expected to be completed by December 31, 2019.

The Company is unable in good faith to make a determination of an estimate of the costs associated with the Plan and related store closures at this time, partly due to the uncertainty of the specific stores to be sold or closed and the method of disposition. The Company will amend this Current Report on Form 8-K within four business days of when it is able to estimate these costs.

Item 2.06. Material Impairments.

The text of Item 2.05 of this Current Report on Form 8-K, which describes the Company’s planned strategic shift and related store closures, is hereby incorporated by reference into this Item 2.06. Following the approval of the Plan to sell, repurpose, relocate or close approximately 27 to 37 Outdoor Lifestyle Locations in connection with the Company’s strategic realignment, management and the Board concluded on September 3, 2019 that material impairment charges and/or accelerated depreciation charges are expected to be required against certain of the Company’s property and equipment and operating lease assets. This conclusion was reached based on the expectation that the future undiscounted cash flows for the locations that will be sold, repurposed, relocated, or closed under the Plan would likely not be sufficient to realize the net carrying value of the assets and liabilities of those locations. Additionally, the Company expects that the carrying value of those locations and the included property and equipment would exceed their respective fair values resulting in an impairment loss. Additional analysis will be necessary to determine if the carrying value of the operating lease assets exceeds their fair value.

The Company is unable in good faith to make a determination of an estimate of the impairment charges related to the Plan and related store closures at this time, partly due to the uncertainty of the specific stores to be sold or closed and the method of disposition. The Company will amend this Current Report on Form 8-K within four business days of when it is able to estimate these impairment charges.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this Current Report on Form 8-K that do not relate to matters of historical fact should be considered forward-looking statements, including, without limitation, statements regarding our strategic shift, the financial impact of this change in strategy, included anticipated costs and impairment charges, and the number and timing of expected store closures. These forward-looking statements are based on management’s current expectations.

These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to, the following: our ability to implement our strategic shift; any remediation of the material weaknesses in

our internal control over financial reporting; the availability of financing to us and our customers; fuel shortages, or high prices for fuel; the well-being, as well as the continued popularity and reputation for quality, of our manufacturers; current softness in the RV industry, which has increased our costs and reduced our margins, uncertainty regarding how long the ongoing softness in the RV industry will last; general economic conditions in our markets and ongoing economic and financial uncertainties; our ability to attract and retain customers; competition in the market for services, protection plans, products and resources targeting the RV lifestyle or RV enthusiast; our expansion into new, unfamiliar markets, businesses, or product lines or categories, as well as delays in opening or acquiring new retail locations; unforeseen expenses, difficulties, and delays frequently encountered in connection with expansion through acquisitions; our failure to maintain the strength and value of our brands; our ability to successfully order and manage our inventory to reflect consumer demand in a volatile market and anticipate changing consumer preferences and buying trends; fluctuations in our same store sales and whether they will be a meaningful indicator of future performance; the cyclical and seasonal nature of our business; our ability to operate and expand our business and to respond to changing business and economic conditions, which depends on the availability of adequate capital; changes in consumer preferences; our reliance on eight fulfillment and distribution centers for our retail, e-commerce and catalog businesses; risks associated with selling goods manufactured abroad; our dependence on our relationships with third party providers of services, protection plans, products and resources and a disruption of these relationships or of these providers’ operations; whether third party lending institutions and insurance companies will continue to provide financing for RV purchases; our ability to retain senior executives and attract and retain other qualified employees; our ability to meet our labor needs; risks associated with leasing substantial amounts of space, including our inability to maintain the leases for our retail locations or locate alternative sites for our stores in our target markets and on terms that are acceptable to us; our dealerships’ susceptibility to termination, non-renewal or renegotiation of dealer agreements if state dealer laws are repealed or weakened; our failure to comply with certain environmental regulations; a failure in our e-commerce operations, security breaches and cybersecurity risks; our inability to enforce our intellectual property rights and accusations of our infringement on the intellectual property rights of third parties; disruptions to our information technology systems or breaches of our network security; realization of anticipated benefits and cost savings related to recent acquisitions; the impact of ongoing lawsuits against us and certain of our officers and directors, as well as any potential future class action litigation; potential litigation relating to products we sell as a result of recent acquisitions, including firearms and ammunition; and whether we are able to realize any tax benefits that may arise from our organizational structure and any redemptions or exchanges of CWGS, LLC common units for cash or stock.

These and other important factors discussed under the caption “Risk Factors” in our Annual Report on Form 10-K filed for the year ended December 31, 2018, as updated by our Quarterly Report on Form 10-Q for the period ended June 30, 2019, and our other reports filed with the SEC could cause actual results to differ materially from those indicated by the forward-looking statements made in this Current Report on Form 8-K. Any such forward-looking statements represent management’s estimates as of the date of this Current Report on Form 8-K. While we may elect to update such forward-looking statements at some point in the future, we disclaim any obligation to do so, even if subsequent events cause our views to change, except as required under applicable law. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this Current Report on Form 8-K.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

CAMPING WORLD HOLDINGS, INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Melvin L. Flanigan

|

|

|

Name:

|

Melvin L. Flanigan

|

|

|

Title:

|

Chief Financial Officer and Secretary

|

Date: September 6, 2019

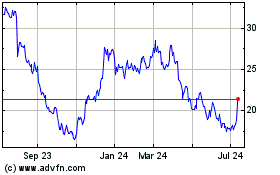

Camping World (NYSE:CWH)

Historical Stock Chart

From Aug 2024 to Sep 2024

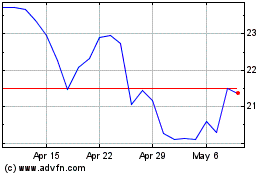

Camping World (NYSE:CWH)

Historical Stock Chart

From Sep 2023 to Sep 2024