Full Year 2018 Net Income of $22.4 Billion; Diluted EPS of

$4.28

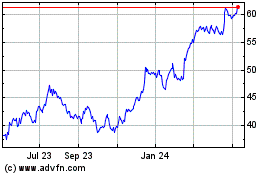

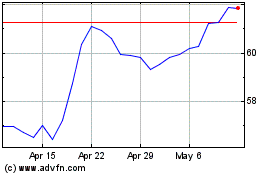

Wells Fargo & Company (NYSE:WFC):

- Full year 2018 financial results:

- Net income of $22.4 billion, compared

with $22.2 billion in 2017

- Diluted earnings per share (EPS) of

$4.28, compared with $4.10

- Return on assets (ROA) of 1.19 percent,

return on equity (ROE) of 11.53 percent, and return on average

tangible common equity (ROTCE) of 13.73 percent1

- Revenue of $86.4 billion, down from

$88.4 billion

- Noninterest expense of

$56.1 billion, down from $58.5 billion

- Returned $25.8 billion to shareholders

through common stock dividends and net share repurchases

- Net share repurchases of $17.9 billion,

which more than doubled from $6.8 billion in 2017

- Common stock dividends of $1.64 per

share, up 6 percent from $1.54 per share

- Period-end common shares outstanding

down 310.3 million shares, or 6 percent

- Fourth quarter 2018 financial results:

- Net income of $6.1 billion, compared

with $6.2 billion in fourth quarter 2017

- Diluted earnings per share (EPS) of

$1.21, compared with $1.16

- ROA of 1.28 percent, ROE of 12.89

percent, and ROTCE of 15.39 percent1

- Revenue of $21.0 billion, down from

$22.1 billion

- Net interest income of $12.6 billion,

up $331 million

- Noninterest income of $8.3 billion,

down $1.4 billion

- Noninterest expense of $13.3 billion,

down $3.5 billion

- Income tax expense of

$966 million, compared with an income tax benefit of

$1.6 billion

- Average deposits of $1.3 trillion, down

$42.6 billion, or 3 percent

- Average loans of $946.3 billion, down

$5.5 billion, or 1 percent

- Provision expense of $521 million, down

$130 million, or 20 percent

- Net charge-offs of 0.30 percent of

average loans (annualized), down from 0.31 percent

- Reserve release2 of $200 million,

compared with $100 million release

- Nonaccrual loans of $6.5 billion, down

$1.2 billion, or 15 percent

Financial results reported in this document are preliminary.

Final financial results and other disclosures will be reported in

our Annual Report on Form 10-K for the year ended December 31,

2018, and may differ materially from the results and disclosures in

this document due to, among other things, the completion of final

review procedures, the occurrence of subsequent events, or the

discovery of additional information.

Selected Financial Information

Quarter ended Year ended Dec. 31,

Dec 31, 2018

Sep 30,2018

Dec 31,2017

2018 2017

Earnings

Diluted earnings per common share

$ 1.21 1.13

1.16

4.28 4.10 Wells Fargo net income (in billions)

6.06 6.01 6.15

22.39 22.18 Return on assets (ROA)

1.28 % 1.27 1.26

1.19 1.15 Return on equity

(ROE)

12.89 12.04 12.47

11.53 11.35 Return on average

tangible common equity (ROTCE) (a)

15.39 14.33 14.85

13.73 13.55

Asset Quality Net charge-offs

(annualized) as a % of average total loans

0.30 %

0.29 0.31

0.29 0.31 Allowance for credit losses as a % of

total loans

1.12 1.16 1.25

1.12 1.25 Allowance for

credit losses as a % of annualized net charge-offs

374 406

401

390 408

Other Revenue (in billions)

$

21.0 21.9 22.1

86.4 88.4 Efficiency ratio (b)

63.6 % 62.7 76.2

65.0 66.2 Average loans (in

billions)

$ 946.3 939.5 951.8

945.2 956.1

Average deposits (in billions)

1,268.9 1,266.4 1,311.6

1,275.9 1,304.6 Net interest margin

2.94

% 2.94 2.84

2.91

2.87

(a) Tangible common equity is a non-GAAP

financial measure and represents total equity less preferred

equity, noncontrolling interests, and goodwill and certain

identifiable intangible assets (including goodwill and intangible

assets associated with certain of our nonmarketable equity

securities but excluding mortgage servicing rights), net of

applicable deferred taxes. The methodology of determining tangible

common equity may differ among companies. Management believes that

return on average tangible common equity, which utilizes tangible

common equity, is a useful financial measure because it enables

investors and others to assess the Company's use of equity. For

additional information, including a corresponding reconciliation to

GAAP financial measures, see the “Tangible Common Equity” tables on

page 36.

(b) The efficiency ratio is noninterest

expense divided by total revenue (net interest income and

noninterest income).

Wells Fargo & Company (NYSE:WFC) reported net income of

$6.1 billion, or $1.21 per diluted common share, for

fourth quarter 2018, compared with $6.2 billion, or $1.16 per

share, for fourth quarter 2017, and $6.0 billion, or

$1.13 per share, for third quarter 2018.

Chief Executive Officer Tim Sloan said, “I’m proud of the

transformational changes we made at Wells Fargo during 2018

including significant progress on our six goals. We have made

meaningful improvements to how we manage risk across the company,

particularly operational and compliance risk. We improved customer

service which resulted in both ‘Customer Loyalty’ and ‘Overall

Satisfaction with Most Recent Visit’ branch survey scores reaching

a 24-month high in December. Our voluntary team member attrition in

2018 improved to its lowest level in six years reflecting our

efforts to make Wells Fargo a better place to work, and we continue

to attract impressive leaders from outside the company. We launched

many customer-focused innovations including our online mortgage

application, Control TowerSM, Pay with Wells Fargo, and our new

Propel® Card. Our commitment to building stronger communities was

demonstrated by exceeding our target of donating $400 million to

communities across the U.S., and a recent example was our Holiday

Food Bank program which provided over 50 million meals during the

holidays. Our focus on delivering long-term shareholder value

included meeting our 2018 expense target and returning a record

$25.8 billion to shareholders in 2018, up 78% from 2017. I

want to thank our team members for their commitment to making Wells

Fargo a better bank in 2018. I’m confident that we’ll continue to

make Wells Fargo even better in 2019.”

Chief Financial Officer John Shrewsberry said, “Wells Fargo

reported $6.1 billion of net income in the fourth quarter. Compared

with the third quarter, we grew both loans and deposits and credit

performance remained strong. In addition, our effective income tax

rate was lower compared with the prior quarter, and we maintained

solid capital levels even as we reduced our common shares

outstanding. We continued to have positive business trends in the

fourth quarter with primary consumer checking customers, consumer

credit card active accounts, debit and credit card usage,

commercial loan balances, and loan originations in auto, small

business, home equity and student lending all growing compared with

a year ago. Our focus on reducing expenses enabled us to meet our

2018 expense target, and we are on track to meet our 2019 expense

target as well.”

Net Interest Income

Net interest income in the fourth quarter was $12.6 billion, up

$72 million from third quarter 2018, driven primarily by the

benefits of higher average interest rates and favorable hedge

ineffectiveness accounting results, partially offset by the impacts

from balance sheet mix and lower variable income. Net interest

margin was 2.94 percent, flat compared with the prior quarter.

Noninterest Income

Noninterest income in the fourth quarter was $8.3 billion, down

$1.0 billion from third quarter 2018. Fourth quarter noninterest

income included lower market sensitive revenue3, mortgage banking

fees and trust and investment fees, partially offset by higher

other income.

- Mortgage banking income was $467

million, down from $846 million in third quarter 2018. Net

mortgage servicing income was $109 million, down from

$390 million in the third quarter predominantly due to updated

mortgage servicing rights valuation assumptions driven by recent

market observations. The production margin on residential

held-for-sale mortgage loan originations4 decreased to

0.89 percent, from 0.97 percent in the third quarter,

primarily due to lower retail margins, partially offset by a lower

percentage of correspondent volume. Residential mortgage loan

originations in the fourth quarter were $38 billion, down from

$46 billion in the third quarter primarily due to

seasonality.

- Market sensitive revenue3 was $40

million, down from $631 million in third quarter 2018, primarily

due to lower net gains from equity securities as lower deferred

compensation plan investment results were partially offset by

higher equity investment gains. The decrease related to the

deferred compensation plan was offset by lower employee benefits

expense. Revenue from trading activities declined compared with the

prior quarter as well, driven by wider spreads in credit and asset

backed products.

- Other income was $595 million, up

from $466 million in the third quarter. The increase in the

fourth quarter included a $117 million gain from the previously

announced sale of 52 branches.

Noninterest Expense

Noninterest expense in the fourth quarter declined $424 million

from the prior quarter to $13.3 billion, predominantly due to

a $671 million decline in employee benefits driven by lower

deferred compensation expense (largely offset in market sensitive

revenue), lower FDIC expense due to the completion of their special

assessment, and lower operating losses. These decreases were

partially offset by higher other expense, operating lease expense

on lease asset impairment, outside professional services and salary

expense. The efficiency ratio was 63.6 percent in fourth

quarter 2018, compared with 62.7 percent in the third

quarter.

Fourth quarter 2018 operating losses were $432 million and

included a $175 million accrual for an agreement reached in

December 2018 with all 50 state Attorneys General and the District

of Columbia regarding previously disclosed matters.

Income Taxes

The Company’s effective income tax rate was 13.7 percent for

fourth quarter 2018, compared with 20.1 percent for third quarter

2018, which included net discrete income tax expense in the third

quarter related to re-measurement of our initial estimates for the

impacts of the Tax Cuts & Jobs Act (Tax Act) recognized in

fourth quarter 2017. The fourth quarter 2018 income tax rate

included $158 million of net discrete income tax benefits

primarily related to the results of state income tax audits and

incremental state tax credits. In addition, the fourth quarter

income tax rate benefited from $137 million related to

revisions to our full year 2018 effective income tax rate made

during the quarter. The Company's full year 2018 effective income

tax rate was 20.2 percent (18 percent before discrete items). We

currently expect the effective income tax rate for full year 2019

to be approximately 18 percent, excluding the impact of any

unanticipated discrete items.

Loans

Total average loans were $946.3 billion in the fourth

quarter, up $6.9 billion from the third quarter. Period-end

loan balances were $953.1 billion at December 31, 2018, up

$10.8 billion from September 30, 2018. Commercial loans

were up $11.5 billion compared with September 30, 2018, due to

$12.2 billion of growth in commercial and industrial loans,

partially offset by a $583 million decline in commercial real

estate loans. Consumer loans decreased $709 million from the prior

quarter, reflecting the following:

- Real estate 1-4 family first mortgage

loans increased $792 million, as $9.8 billion of

held-for-investment nonconforming mortgage loan originations were

predominantly offset by payoffs and $1.6 billion of sales of

purchased credit-impaired (PCI) Pick-a-Pay mortgage loans.

Additionally, $562 million of nonconforming mortgage loan

originations that would have otherwise been included in 1-4 family

first mortgage loan outstandings were designated as held-for-sale

in fourth quarter 2018 in anticipation of the future issuance of

residential mortgage-backed securities (RMBS).

- Real estate 1-4 family junior lien

mortgage loans decreased $932 million, as payoffs continued to

exceed originations

- Credit card loans increased $1.2

billion primarily due to seasonality

- Automobile loans declined

$1.0 billion due to expected continued runoff

Period-End Loan Balances

(in millions)

Dec 31, 2018 Sep 30,2018

Jun 30,2018 Mar 31,2018 Dec 31,2017 Commercial

$ 513,405 501,886 503,105

503,396 503,388 Consumer

439,705

440,414 441,160 443,912

453,382 Total loans

$ 953,110

942,300 944,265 947,308

956,770 Change from prior quarter

$ 10,810

(1,965 ) (3,043 ) (9,462 ) 4,897

Debt and Equity Securities

Debt securities include available-for-sale and held-to-maturity

debt securities, as well as debt securities held for trading. Debt

securities were $484.7 billion at December 31, 2018, up

$12.4 billion from the third quarter, predominantly due to a

net increase in available-for-sale and held for trading debt

securities. Debt securities purchases of approximately

$16.9 billion, primarily U.S. Treasury and federal agency

mortgage-backed securities (MBS) in the available-for-sale

portfolio, more than offset runoff and sales.

Net unrealized losses on available-for-sale debt securities were

$2.6 billion at December 31, 2018, compared with net

unrealized losses of $3.8 billion at September 30, 2018,

predominantly due to lower interest rates, partially offset by

higher credit spreads.

Equity securities include marketable and non-marketable equity

securities, as well as equity securities held for trading. Equity

securities were $55.1 billion at December 31, 2018, down

$6.6 billion from the third quarter, predominantly due to a

decrease in equity securities held for trading.

Deposits

Total average deposits for fourth quarter 2018 were $1.3

trillion, up $2.6 billion from the prior quarter as growth in

commercial deposits was partially offset by lower consumer and

small business banking deposits, which included $1.8 billion of

deposits associated with the previously announced sale of 52

branches that closed on November 30. The average deposit cost for

fourth quarter 2018 was 55 basis points, up 8 basis points from the

prior quarter and 27 basis points from a year ago.

Capital

Capital in the fourth quarter continued to exceed our internal

target, with a Common Equity Tier 1 ratio (fully phased-in) of

11.7 percent5, down from 11.9 percent in the prior quarter. In

fourth quarter 2018, the Company repurchased 142.7 million

shares of its common stock, which net of issuances, reduced

period-end common shares outstanding by 130.3 million. The

Company paid a quarterly common stock dividend of $0.43 per

share.

Credit Quality

Net Loan Charge-offs

The quarterly loss rate in the fourth quarter was 0.30 percent

(annualized), compared with 0.29 percent in the prior quarter

and 0.31 percent a year ago. Commercial and consumer losses were

0.10 percent and 0.53 percent, respectively. Total credit losses

were $721 million in fourth quarter 2018, up $41 million from

third quarter 2018. Commercial losses decreased $20 million

driven by lower commercial and industrial loan net charge-offs and

higher recoveries in commercial real estate, while consumer losses

increased $61 million predominantly driven by seasonal

increases in credit card and other revolving credit and installment

loan charge-offs.

Net Loan Charge-Offs

Quarter ended December 31, 2018

September 30, 2018 December 31, 2017

($ in millions)

Net

loancharge-offs

As a % ofaverageloans

(a)

Net

loancharge-offs

As a % ofaverageloans

(a)

Net

loancharge-offs

As a % ofaverageloans

(a)

Commercial: Commercial and industrial $

132 0.15 % $ 148 0.18 % $ 118 0.14 % Real estate mortgage (12 )

(0.04 ) (1 ) — (10 ) (0.03 ) Real estate construction (1 ) (0.01 )

(2 ) (0.04 ) (3 ) (0.05 ) Lease financing 13 0.26 7

0.14 10 0.20

Total commercial

132 0.10 152 0.12

115 0.09 Consumer: Real estate 1-4

family first mortgage (22 ) (0.03 ) (25 ) (0.04 ) (23 ) (0.03 )

Real estate 1-4 family junior lien mortgage (10 ) (0.11 ) (9 )

(0.10 ) (7 ) (0.06 ) Credit card 338 3.54 299 3.22 336 3.66

Automobile 133 1.16 130 1.10 188 1.38 Other revolving credit and

installment 150 1.64 133 1.44 142 1.46

Total consumer 589 0.53

528 0.47 636 0.56

Total $ 721 0.30 %

$ 680 0.29 % $ 751

0.31 %

(a) Quarterly net charge-offs (recoveries)

as a percentage of average loans are annualized. See explanation on

page 33 of the accounting for purchased credit-impaired (PCI) loans

and the impact on selected financial ratios.

Nonperforming Assets

Nonperforming assets decreased $289 million, or 4 percent, from

third quarter 2018 to $6.9 billion. Nonaccrual loans decreased

$218 million from third quarter 2018 to $6.5 billion reflecting

both lower consumer and commercial nonaccruals.

Nonperforming Assets (Nonaccrual Loans

and Foreclosed Assets)

December 31, 2018 September 30,

2018 December 31, 2017 ($ in millions)

Totalbalances

As a%

oftotalloans

Totalbalances

As a%

oftotalloans

Totalbalances

As a%

oftotalloans

Commercial:

Commercial and industrial $ 1,486 0.42 % $ 1,555 0.46 % $ 1,899

0.57 % Real estate mortgage 580 0.48 603 0.50 628 0.50 Real estate

construction 32 0.14 44 0.19 37 0.15 Lease financing 90

0.46 96 0.49 76 0.39

Total commercial

2,188 0.43 2,298

0.46 2,640 0.52 Consumer: Real

estate 1-4 family first mortgage 3,183 1.12 3,267 1.15 3,732 1.31

Real estate 1-4 family junior lien mortgage 945 2.75 983 2.78 1,086

2.73 Automobile 130 0.29 118 0.26 130 0.24 Other revolving credit

and installment 50 0.14 48 0.13 58 0.15

Total consumer 4,308 0.98

4,416 1.00 5,006 1.10

Total nonaccrual loans (a) 6,496

0.68 6,714 0.71 7,646

0.80 Foreclosed assets: Government insured/guaranteed

88 87 120 Non-government insured/guaranteed 363 435

522

Total foreclosed assets 451

522 642 Total nonperforming

assets $ 6,947 0.73 %

$ 7,236 0.77 % $

8,288 0.87 % Change from prior quarter:

Total nonaccrual loans (a) $ (218 ) $ (412 ) $ (572 ) Total

nonperforming assets (289 ) (389 )

(636 )

(a) Financial information for periods

prior to December 31, 2018, has been revised to exclude mortgage

loans held for sale (MLHFS), loans held for sale (LHFS) and loans

held at fair value. For additional information, see the "Five

Quarter Nonperforming Assets" table on page 32.

Allowance for Credit Losses

The allowance for credit losses, including the allowance for

unfunded commitments, totaled $10.7 billion at

December 31, 2018, down $249 million from September 30,

2018. Fourth quarter 2018 included a $200 million reserve release2,

which reflected continued improvement in the credit quality of the

loan portfolio. The allowance coverage for total loans was

1.12 percent, compared with 1.16 percent in third quarter

2018. The allowance covered 3.7 times annualized fourth quarter net

charge-offs, compared with 4.1 times in the prior quarter. The

allowance coverage for nonaccrual loans was 165 percent at

December 31, 2018, compared with 163 percent at

September 30, 2018.

Business Segment Performance

Wells Fargo defines its operating segments by product type and

customer segment. Segment net income for each of the three business

segments was:

Quarter ended (in millions)

Dec 31,

2018 Sep 30,2018 Dec 31,2017 Community Banking

$ 3,169 2,816 3,472 Wholesale Banking

2,671 2,851 2,373 Wealth and Investment Management

689 732 675

Community Banking offers a

complete line of diversified financial products and services for

consumers and small businesses including checking and savings

accounts, credit and debit cards, and automobile, student,

mortgage, home equity and small business lending, as well as

referrals to Wholesale Banking and Wealth and Investment Management

business partners. The Community Banking segment also includes the

results of our Corporate Treasury activities net of allocations in

support of the other operating segments and results of investments

in our affiliated venture capital and private equity

partnerships.

Selected Financial Information

Quarter ended (in millions)

Dec 31,

2018 Sep 30,2018

Dec 31,2017

Total revenue

$ 11,461 11,816 11,720

Provision for credit losses

534 547 636 Noninterest expense

7,032 7,467 10,216 Segment net income

3,169 2,816

3,472 (in billions) Average loans

459.7 460.9 473.2 Average

assets

1,015.9 1,024.9 1,073.2 Average deposits

759.4 760.9 738.3

Fourth Quarter 2018 vs. Third Quarter 2018

- Net income of $3.2 billion, up

$353 million, or 13 percent, primarily due to lower

noninterest expense and income tax expense, partially offset by

lower revenue

- Revenue was $11.5 billion, down

$355 million, or 3 percent, driven predominantly by lower

mortgage banking income and lower market sensitive revenue

reflecting lower deferred compensation plan investment results

(offset in employee benefits expense), partially offset by a

$117 million gain on the previously announced sale of 52

branches

- Noninterest expense of $7.0 billion was

down $435 million, or 6 percent, driven mainly by lower deferred

compensation expense (offset in market sensitive revenue),

operating losses, and FDIC expense, partially offset by higher

other expense

Fourth Quarter 2018 vs. Fourth Quarter 2017

- Net income was down $303 million, or 9

percent, predominantly due to higher income tax expense, as fourth

quarter 2017 included an income tax benefit from the Tax Act, and

lower revenue, partially offset by lower noninterest expense

- Revenue declined $259 million, or

2 percent, predominantly due to lower market sensitive revenue

and mortgage banking income, partially offset by gains from the

sales of PCI Pick-a-Pay loans and the previously announced sale of

52 branches

- Noninterest expense decreased $3.2

billion, or 31 percent, driven by lower operating losses

- Provision for credit losses decreased

$102 million, largely due to continued credit improvement in

the automobile and consumer real estate portfolios

Business Metrics and Highlights

- Primary consumer checking customers6,7

of 23.9 million, up 1.2 percent from a year ago. The previously

announced sale of 52 branches and $1.8 billion of deposits which

closed in fourth quarter 2018 reduced the growth rate by 0.5

percent

- More than 318,000 branch customer

experience surveys completed during fourth quarter 2018 (over 1.4

million in 2018), with both ‘Customer Loyalty’ and ‘Overall

Satisfaction with Most Recent Visit’ scores up from the prior

quarter and reaching a 24-month high in December

- Debit card point-of-sale purchase

volume8 of $89.8 billion in the fourth quarter, up 8 percent

year-over-year

- General purpose credit card

point-of-sale purchase volume of $20.2 billion in the fourth

quarter, up 5 percent year-over-year

- 29.2 million digital (online and

mobile) active customers, including 22.8 million mobile active

users7,9

- 5,518 retail bank branches as of the

end of fourth quarter 2018, reflecting 93 branch consolidations in

the quarter and 300 in 2018; in addition, completed the previously

announced sale of 52 branches in Indiana, Ohio, Michigan and part

of Wisconsin in fourth quarter 2018

- Home Lending

- Originations of $38 billion, down

from $46 billion in the prior quarter, primarily due to

seasonality; included home equity originations of $673 million,

down 6 percent from the prior quarter and up 14 percent from the

prior year

- Applications of $48 billion, down

from $57 billion in the prior quarter

- Application pipeline of

$18 billion at quarter end, down from $22 billion at September

30, 2018

- Production margin on residential

held-for-sale mortgage loan originations4 of 0.89 percent,

down from 0.97 percent in the prior quarter, primarily due to lower

retail margins

- Automobile originations of $4.7 billion

in the fourth quarter, up 9 percent from the prior year

- Student loan originations of $258

million in fourth quarter 2018, up 16 percent from the prior

year

- Small Business Lending10 originations

of $595 million, up 19 percent from the prior year

Wholesale Banking provides

financial solutions to businesses across the United States and

globally with annual sales generally in excess of $5 million.

Products and businesses include Commercial Banking, Commercial Real

Estate, Corporate and Investment Banking, Principal Investments,

Treasury Management, and Commercial Capital.

Selected Financial Information

Quarter ended (in millions)

Dec 31,

2018 Sep 30,2018 Dec 31,2017 Total revenue

$ 6,926 7,304 7,440 Provision (reversal

of provision) for credit losses

(28 ) 26 20

Noninterest expense

4,025 3,935 4,187 Segment net income

2,671 2,851 2,373 (in billions) Average loans

470.2

462.8 463.5 Average assets

839.1 827.2 837.2 Average

deposits

421.6 413.6

465.7

Fourth Quarter 2018 vs. Third Quarter 2018

- Net income of $2.7 billion, down

$180 million, or 6 percent

- Revenue of $6.9 billion decreased

$378 million, or 5 percent, as higher net interest income,

commercial real estate brokerage and other fees were more than

offset by lower market sensitive revenue, investment banking fees

and other income

- Noninterest expense of $4.0 billion

increased $90 million, or 2 percent, reflecting higher

operating lease expense, partially offset by lower FDIC

expense

- Provision for credit losses decreased

$54 million, driven primarily by higher recoveries

Fourth Quarter 2018 vs. Fourth Quarter 2017

- Net income increased $298 million, or

13 percent, as fourth quarter 2018 results benefited from a lower

effective income tax rate

- Revenue decreased $514 million, or

7 percent, largely due to the impact of the sales of Wells

Fargo Insurance Services USA (WFIS) in fourth quarter 2017 and

Wells Fargo Shareowner Services in first quarter 2018, as well as

lower market sensitive revenue, operating lease income and treasury

management fees, partially offset by increases related to losses

taken in fourth quarter 2017 from adjustments to leveraged leases

and other tax advantaged businesses due to the Tax Act

- Noninterest expense decreased

$162 million, or 4 percent, on lower expense related to

the sales of WFIS and Wells Fargo Shareowner Services, as well as

lower project-related expense and FDIC expense, partially offset by

higher regulatory, risk and technology expense

Business Metrics and Highlights

- Commercial card spend volume11 of $8.6

billion, up 11 percent from the prior year on increased transaction

volumes primarily reflecting customer growth, and up 5 percent

compared with third quarter 2018

- U.S. investment banking market share of

3.2 percent in 201812, compared with 3.6 percent in

201712

Wealth and Investment

Management (WIM) provides a full range of personalized

wealth management, investment and retirement products and services

to clients across U.S. based businesses including Wells Fargo

Advisors, The Private Bank, Abbot Downing, Wells Fargo

Institutional Retirement and Trust, and Wells Fargo Asset

Management. We deliver financial planning, private banking, credit,

investment management and fiduciary services to high-net worth and

ultra-high-net worth individuals and families. We also serve

clients’ brokerage needs, supply retirement and trust services to

institutional clients and provide investment management

capabilities delivered to global institutional clients through

separate accounts and the Wells Fargo Funds.

Selected Financial Information

Quarter ended (in millions)

Dec 31,

2018 Sep 30,2018 Dec 31,2017 Total revenue

$ 3,957 4,226 4,333 Provision (reversal

of provision) for credit losses

(3 ) 6 (7 )

Noninterest expense

3,044 3,243 3,246 Segment net income

689 732 675 (in billions) Average loans

75.2 74.6

72.9 Average assets

83.6 83.8 83.7 Average deposits

155.5 159.8 184.1

Fourth Quarter 2018 vs. Third Quarter 2018

- Net income of $689 million, down

$43 million, or 6 percent

- Revenue of $4.0 billion decreased

$269 million, or 6 percent, mostly due to net losses from

equity securities on lower deferred compensation plan investment

results of $218 million (offset in employee benefits expense) and

lower asset-based fees

- Noninterest expense of $3.0 billion

decreased $199 million, or 6 percent, primarily driven by

lower employee benefits from deferred compensation plan expense of

$216 million (offset in deferred compensation plan

investments)

Fourth Quarter 2018 vs. Fourth Quarter 2017

- Net income up $14 million, or 2

percent, as fourth quarter 2018 results benefited from a lower

effective income tax rate

- Revenue decreased $376 million, or

9 percent, primarily driven by lower deferred compensation plan

investment results of $235 million (offset in employee benefits

expense), asset-based fees, brokerage transaction revenue, and net

interest income

- Noninterest expense decreased

$202 million, or 6 percent, primarily due to lower employee

benefits from deferred compensation plan expense of $234 million

(offset in deferred compensation plan investments) and lower FDIC

expense, partially offset by higher regulatory, risk and technology

expense

Business Metrics and Highlights

Total WIM Segment

- WIM total client assets of $1.7

trillion, down 10 percent from a year ago, driven primarily by

lower market valuations, as well as net outflows

- Average loan balances up 3 percent from

a year ago largely due to growth in nonconforming mortgage

loans

- Full year 2018 closed referred

investment assets (referrals resulting from the WIM/Community

Banking partnership) of $10.1 billion, down 2 percent compared with

2017

Retail Brokerage

- Client assets of $1.5 trillion, down 10

percent from prior year, driven primarily by lower market

valuations, as well as net outflows

- Advisory assets of $501 billion, down 8

percent from prior year, driven primarily by lower market

valuations, as well as net outflows

Wealth Management

- Client assets of $224 billion, down 10

percent from prior year, driven primarily by lower market

valuations, as well as lower deposit balances

Asset Management

- Total assets under management (AUM) of

$466 billion, down 8 percent from prior year, primarily due to

equity and fixed income net outflows, the sale of Wells Fargo Asset

Management's ownership stake in The Rock Creek Group, LP and

removal of the associated AUM, and lower market valuations,

partially offset by higher money market fund net inflows

Retirement

- IRA assets of $373 billion, down 9

percent from prior year

- Institutional Retirement plan assets of

$364 billion, down 8 percent from prior year

Conference Call

The Company will host a live conference call on Tuesday, January

15, at 7:00 a.m. PT (10:00 a.m. ET). You may participate by dialing

866-872-5161 (U.S. and Canada) or 440-424-4922 (International). The

call will also be available online at

https://www.wellsfargo.com/about/investor-relations/quarterly-earnings/

and https://engage.vevent.com/rt/wells_fargo_ao~7179357.

A replay of the conference call will be available beginning at

11:00 a.m. PT (2:00 p.m. ET) on Tuesday, January 15 through

Tuesday, January 29. Please dial 855-859-2056 (U.S. and Canada) or

404-537-3406 (International) and enter Conference ID #7179357. The

replay will also be available online at

https://www.wellsfargo.com/about/investor-relations/quarterly-earnings/

and https://engage.vevent.com/rt/wells_fargo_ao~7179357.

End Notes

1 Tangible common equity is a non-GAAP financial measure and

represents total equity less preferred equity, noncontrolling

interests, and goodwill and certain identifiable intangible assets

(including goodwill and intangible assets associated with certain

of our nonmarketable equity securities but excluding mortgage

servicing rights), net of applicable deferred taxes. The

methodology of determining tangible common equity may differ among

companies. Management believes that return on average tangible

common equity, which utilizes tangible common equity, is a useful

financial measure because it enables investors and others to assess

the Company's use of equity. For additional information, including

a corresponding reconciliation to GAAP financial measures, see the

“Tangible Common Equity” tables on page 36.

2 Reserve build represents the amount by which the provision for

credit losses exceeds net charge-offs, while reserve release

represents the amount by which net charge-offs exceed the provision

for credit losses.

3 Market sensitive revenue represents net gains from trading

activities, debt securities, and equity securities.

4 Production margin represents net gains on residential mortgage

loan origination/sales activities divided by total residential

held-for-sale mortgage originations. See the "Selected Five Quarter

Residential Mortgage Production Data" table on page 42 for more

information.

5 See table on page 37 for more information on Common Equity

Tier 1. Common Equity Tier 1 (fully phased-in) is a preliminary

estimate and is calculated assuming the full phase-in of the Basel

III capital rules.

6 Customers who actively use their checking account with

transactions such as debit card purchases, online bill payments,

and direct deposit.

7 Data as of November 2018, comparisons with November 2017.

8 Combined consumer and business debit card purchase volume

dollars.

9 Primarily includes retail banking, consumer lending, small

business and business banking customers.

10 Small Business Lending includes credit card, lines of credit

and loan products (primarily under $100,000 sold through our retail

banking branches).

11 Includes commercial card volume for the entire company.

12 Source: Dealogic U.S. investment banking fee market

share.

Forward-Looking Statements

This document contains “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995. In

addition, we may make forward-looking statements in our other

documents filed or furnished with the SEC, and our management may

make forward-looking statements orally to analysts, investors,

representatives of the media and others. Forward-looking statements

can be identified by words such as “anticipates,” “intends,”

“plans,” “seeks,” “believes,” “estimates,” “expects,” “target,”

“projects,” “outlook,” “forecast,” “will,” “may,” “could,”

“should,” “can” and similar references to future periods. In

particular, forward-looking statements include, but are not limited

to, statements we make about: (i) the future operating or

financial performance of the Company, including our outlook for

future growth; (ii) our noninterest expense and efficiency

ratio; (iii) future credit quality and performance, including

our expectations regarding future loan losses and allowance levels;

(iv) the appropriateness of the allowance for credit losses;

(v) our expectations regarding net interest income and net

interest margin; (vi) loan growth or the reduction or

mitigation of risk in our loan portfolios; (vii) future

capital or liquidity levels or targets and our estimated Common

Equity Tier 1 ratio under Basel III capital standards;

(viii) the performance of our mortgage business and any

related exposures; (ix) the expected outcome and impact of

legal, regulatory and legislative developments, as well as our

expectations regarding compliance therewith; (x) future common

stock dividends, common share repurchases and other uses of

capital; (xi) our targeted range for return on assets, return

on equity, and return on tangible common equity; (xii) the

outcome of contingencies, such as legal proceedings; and

(xiii) the Company’s plans, objectives and strategies.

Forward-looking statements are not based on historical facts but

instead represent our current expectations and assumptions

regarding our business, the economy and other future conditions.

Because forward-looking statements relate to the future, they are

subject to inherent uncertainties, risks and changes in

circumstances that are difficult to predict. Our actual results may

differ materially from those contemplated by the forward-looking

statements. We caution you, therefore, against relying on any of

these forward-looking statements. They are neither statements of

historical fact nor guarantees or assurances of future performance.

While there is no assurance that any list of risks and

uncertainties or risk factors is complete, important factors that

could cause actual results to differ materially from those in the

forward-looking statements include the following, without

limitation:

- current and future economic and market

conditions, including the effects of declines in housing prices,

high unemployment rates, U.S. fiscal debt, budget and tax matters,

geopolitical matters, and any slowdown in global economic

growth;

- our capital and liquidity requirements

(including under regulatory capital standards, such as the Basel

III capital standards) and our ability to generate capital

internally or raise capital on favorable terms;

- financial services reform and other

current, pending or future legislation or regulation that could

have a negative effect on our revenue and businesses, including the

Dodd-Frank Act and other legislation and regulation relating to

bank products and services;

- the extent of our success in our loan

modification efforts, as well as the effects of regulatory

requirements or guidance regarding loan modifications;

- the amount of mortgage loan repurchase

demands that we receive and our ability to satisfy any such demands

without having to repurchase loans related thereto or otherwise

indemnify or reimburse third parties, and the credit quality of or

losses on such repurchased mortgage loans;

- negative effects relating to our

mortgage servicing and foreclosure practices, as well as changes in

industry standards or practices, regulatory or judicial

requirements, penalties or fines, increased servicing and other

costs or obligations, including loan modification requirements, or

delays or moratoriums on foreclosures;

- our ability to realize any efficiency

ratio or expense target as part of our expense management

initiatives, including as a result of business and economic

cyclicality, seasonality, changes in our business composition and

operating environment, growth in our businesses and/or

acquisitions, and unexpected expenses relating to, among other

things, litigation and regulatory matters;

- the effect of the current interest rate

environment or changes in interest rates on our net interest

income, net interest margin and our mortgage originations, mortgage

servicing rights and mortgage loans held for sale;

- significant turbulence or a disruption

in the capital or financial markets, which could result in, among

other things, reduced investor demand for mortgage loans, a

reduction in the availability of funding or increased funding

costs, and declines in asset values and/or recognition of

other-than-temporary impairment on securities held in our debt

securities and equity securities portfolios;

- the effect of a fall in stock market

prices on our investment banking business and our fee income from

our brokerage, asset and wealth management businesses;

- negative effects from the retail

banking sales practices matter and from other instances where

customers may have experienced financial harm, including on our

legal, operational and compliance costs, our ability to engage in

certain business activities or offer certain products or services,

our ability to keep and attract customers, our ability to attract

and retain qualified team members, and our reputation;

- resolution of regulatory matters,

litigation, or other legal actions, which may result in, among

other things, additional costs, fines, penalties, restrictions on

our business activities, reputational harm, or other adverse

consequences;

- a failure in or breach of our

operational or security systems or infrastructure, or those of our

third party vendors or other service providers, including as a

result of cyber attacks;

- the effect of changes in the level of

checking or savings account deposits on our funding costs and net

interest margin;

- fiscal and monetary policies of the

Federal Reserve Board; and

- the other risk factors and

uncertainties described under “Risk Factors” in our Annual Report

on Form 10-K for the year ended December 31, 2017.

In addition to the above factors, we also caution that the

amount and timing of any future common stock dividends or

repurchases will depend on the earnings, cash requirements and

financial condition of the Company, market conditions, capital

requirements (including under Basel capital standards), common

stock issuance requirements, applicable law and regulations

(including federal securities laws and federal banking

regulations), and other factors deemed relevant by the Company’s

Board of Directors, and may be subject to regulatory approval or

conditions.

For more information about factors that could cause actual

results to differ materially from our expectations, refer to our

reports filed with the Securities and Exchange Commission,

including the discussion under “Risk Factors” in our Annual Report

on Form 10-K for the year ended December 31, 2017, as

filed with the Securities and Exchange Commission and available on

its website at www.sec.gov.

Any forward-looking statement made by us speaks only as of the

date on which it is made. Factors or events that could cause our

actual results to differ may emerge from time to time, and it is

not possible for us to predict all of them. We undertake no

obligation to publicly update any forward-looking statement,

whether as a result of new information, future developments or

otherwise, except as may be required by law.

Forward-looking Non-GAAP Financial

Measures. From time to time management may discuss

forward-looking non-GAAP financial measures, such as

forward-looking estimates or targets for return on average tangible

common equity. We are unable to provide a reconciliation of

forward-looking non-GAAP financial measures to their most directly

comparable GAAP financial measures because we are unable to

provide, without unreasonable effort, a meaningful or accurate

calculation or estimation of amounts that would be necessary for

the reconciliation due to the complexity and inherent difficulty in

forecasting and quantifying future amounts or when they may occur.

Such unavailable information could be significant to future

results.

About Wells Fargo

Wells Fargo & Company (NYSE: WFC) is a diversified,

community-based financial services company with $1.9 trillion

in assets. Wells Fargo’s vision is to satisfy our customers’

financial needs and help them succeed financially. Founded in 1852

and headquartered in San Francisco, Wells Fargo provides banking,

investment and mortgage products and services, as well as consumer

and commercial finance, through 7,800 locations, more than 13,000

ATMs, the internet (wellsfargo.com) and mobile banking, and has

offices in 37 countries and territories to support customers who

conduct business in the global economy. With approximately 259,000

team members, Wells Fargo serves one in three households in the

United States. Wells Fargo & Company was ranked No. 26 on

Fortune’s 2018 rankings of America’s largest corporations.

Wells Fargo & Company and

Subsidiaries

QUARTERLY FINANCIAL DATA

TABLE OF CONTENTS

Pages

Summary

Information

Summary Financial Data

17

Income

Consolidated Statement of Income 19 Consolidated Statement of

Comprehensive Income 21 Condensed Consolidated Statement of Changes

in Total Equity 21 Average Balances, Yields and Rates Paid

(Taxable-Equivalent Basis) 22 Five Quarter Average Balances, Yields

and Rates Paid (Taxable-Equivalent Basis) 24 Noninterest Income and

Noninterest Expense 25

Balance

Sheet

Consolidated Balance Sheet 27 Trading Activities 29 Debt Securities

29 Equity Securities 30

Loans

Loans 31 Nonperforming Assets 32 Loans 90 Days or More Past Due and

Still Accruing 32 Purchased Credit-Impaired Loans 33 Changes in

Allowance for Credit Losses 35

Equity

Tangible Common Equity 36 Common Equity Tier 1 Under Basel III 37

Operating

Segments

Operating Segment Results 38

Other

Mortgage Servicing and other related data 40

Wells Fargo & Company and

Subsidiaries

SUMMARY FINANCIAL DATA

Quarter ended % ChangeDec 31, 2018 from Year

ended ($ in millions, except per share amounts)

Dec 31, 2018 Sep 30,2018 Dec 31,2017

Sep 30,2018 Dec 31,2017

Dec 31,

2018 Dec 31,2017 %Change

For the Period

Wells Fargo net income

$

6,064 6,007 6,151 1 % (1 )

$ 22,393 22,183 1 %

Wells Fargo net income applicable to common stock

5,711

5,453 5,740 5 (1 )

20,689 20,554 1 Diluted earnings per

common share

1.21 1.13 1.16 7 4

4.28 4.10 4

Profitability ratios (annualized): Wells Fargo net income to

average assets (ROA)

1.28 % 1.27 1.26 1 2

1.19

% 1.15 3 Wells Fargo net income applicable to common stock

to average Wells Fargo common stockholders’ equity (ROE)

12.89 12.04 12.47 7 3

11.53 11.35 2 Return on average

tangible common equity (ROTCE)(1)

15.39 14.33 14.85 7 4

13.73 13.55 1 Efficiency ratio (2)

63.6 62.7 76.2 1

(17 )

65.0 66.2 (2 ) Total revenue

$ 20,980

21,941 22,050 (4 ) (5 )

$ 86,408 88,389 (2 ) Pre-tax

pre-provision profit (PTPP) (3)

7,641 8,178 5,250 (7 ) 46

30,282 29,905 1 Dividends declared per common share

0.43 0.43 0.39 — 10

1.64 1.54 6 Average common shares

outstanding

4,665.8 4,784.0 4,912.5 (2 ) (5 )

4,799.7

4,964.6 (3 ) Diluted average common shares outstanding

4,700.8 4,823.2 4,963.1 (3 ) (5 )

4,838.4 5,017.3 (4

) Average loans

$ 946,336 939,462 951,822 1 (1 )

$ 945,197 956,129 (1 ) Average assets

1,879,047 1,876,283 1,935,318 — (3 )

1,888,892

1,933,005 (2 ) Average total deposits

1,268,948 1,266,378

1,311,592 — (3 )

1,275,857 1,304,622 (2 ) Average consumer

and small business banking deposits (4)

736,295 743,503

757,541 (1 ) (3 )

747,183 758,271 (1 ) Net interest margin

2.94 % 2.94 2.84 — 4

2.91

%

2.87 1

At Period End Debt securities (5)

$

484,689 472,283 473,366 3 2

$ 484,689 473,366

2 Loans

953,110 942,300 956,770 1 —

953,110 956,770 —

Allowance for loan losses

9,775 10,021 11,004 (2 ) (11 )

9,775 11,004 (11 ) Goodwill

26,418 26,425 26,587 — (1

)

26,418 26,587 (1 ) Equity securities (5)

55,148

61,755 62,497 (11 ) (12 )

55,148 62,497 (12 ) Assets

1,895,883 1,872,981 1,951,757 1 (3 )

1,895,883

1,951,757 (3 ) Deposits

1,286,170 1,266,594 1,335,991 2 (4 )

1,286,170 1,335,991 (4 ) Common stockholders' equity

174,359 176,934 183,134 (1 ) (5 )

174,359 183,134 (5

) Wells Fargo stockholders’ equity

196,166 198,741 206,936

(1 ) (5 )

196,166 206,936 (5 ) Total equity

197,066

199,679 208,079 (1 ) (5 )

197,066 208,079 (5 ) Tangible

common equity (1)

145,980 148,391 153,730 (2 ) (5 )

145,980 153,730 (5 ) Common shares outstanding

4,581.3 4,711.6 4,891.6 (3 ) (6 )

4,581.3 4,891.6 (6

) Book value per common share (6)

$ 38.06 37.55 37.44

1 2

$ 38.06 37.44 2 Tangible book value per common

share (1)(6)

31.86 31.49 31.43 1 1

31.86 31.43 1 Team

members (active, full-time equivalent)

258,700

261,700 262,700 (1 ) (2 )

258,700 262,700 (2 )

(1) Tangible common equity is a non-GAAP

financial measure and represents total equity less preferred

equity, noncontrolling interests, and goodwill and certain

identifiable intangible assets (including goodwill and intangible

assets associated with certain of our nonmarketable equity

securities but excluding mortgage servicing rights), net of

applicable deferred taxes. The methodology of determining tangible

common equity may differ among companies. Management believes that

return on average tangible common equity and tangible book value

per common share, which utilize tangible common equity, are useful

financial measures because they enable investors and others to

assess the Company's use of equity. For additional information,

including a corresponding reconciliation to GAAP financial

measures, see the "Tangible Common Equity" tables on page 36.

(2) The efficiency ratio is noninterest

expense divided by total revenue (net interest income and

noninterest income).

(3) Pre-tax pre-provision profit (PTPP) is

total revenue less noninterest expense. Management believes that

PTPP is a useful financial measure because it enables investors and

others to assess the Company’s ability to generate capital to cover

credit losses through a credit cycle.

(4) Consumer and small business banking

deposits are total deposits excluding mortgage escrow and wholesale

deposits.

(5) Financial information for the prior

periods of 2017 has been revised to reflect the impact of the

adoption in first quarter 2018 of Accounting Standards Update (ASU)

2016-01 – Financial Instruments – Overall (Subtopic 825-10):

Recognition and Measurement of Financial Assets and Financial

Liabilities.

(6) Book value per common share is common

stockholders' equity divided by common shares outstanding. Tangible

book value per common share is tangible common equity divided by

common shares outstanding.

Wells Fargo & Company and

Subsidiaries

FIVE QUARTER SUMMARY FINANCIAL

DATA

Quarter ended ($ in millions, except per share amounts)

Dec 31, 2018 Sep 30,2018 Jun

30,2018 Mar 31,2018 Dec 31,2017

For the

Quarter Wells Fargo net income

$ 6,064 6,007 5,186 5,136 6,151 Wells Fargo net

income applicable to common stock

5,711 5,453 4,792 4,733

5,740 Diluted earnings per common share

1.21 1.13 0.98 0.96

1.16 Profitability ratios (annualized): Wells Fargo net income to

average assets (ROA)

1.28 % 1.27 1.10 1.09 1.26 Wells

Fargo net income applicable to common stock to average Wells Fargo

common stockholders’ equity (ROE)

12.89 12.04 10.60 10.58

12.47 Return on average tangible common equity (ROTCE)(1)

15.39 14.33 12.62 12.62 14.85 Efficiency ratio (2)

63.6 62.7 64.9 68.6 76.2 Total revenue

$

20,980 21,941 21,553 21,934 22,050 Pre-tax pre-provision

profit (PTPP) (3)

7,641 8,178 7,571 6,892 5,250 Dividends

declared per common share

0.43 0.43 0.39 0.39 0.39 Average

common shares outstanding

4,665.8 4,784.0 4,865.8 4,885.7

4,912.5 Diluted average common shares outstanding

4,700.8

4,823.2 4,899.8 4,930.7 4,963.1 Average loans

$

946,336 939,462 944,079 951,024 951,822 Average assets

1,879,047 1,876,283 1,884,884 1,915,896 1,935,318 Average

total deposits

1,268,948 1,266,378 1,271,339 1,297,178

1,311,592 Average consumer and small business banking deposits (4)

736,295 743,503 754,047 755,483 757,541 Net interest margin

2.94 % 2.94 2.93 2.84 2.84

At Quarter End Debt

securities (5)

$ 484,689 472,283 475,495 472,968

473,366 Loans

953,110 942,300 944,265 947,308 956,770

Allowance for loan losses

9,775 10,021 10,193 10,373 11,004

Goodwill

26,418 26,425 26,429 26,445 26,587 Equity

securities (5)

55,148 61,755 57,505 58,935 62,497 Assets

1,895,883 1,872,981 1,879,700 1,915,388 1,951,757 Deposits

1,286,170 1,266,594 1,268,864 1,303,689 1,335,991 Common

stockholders' equity

174,359 176,934 181,386 181,150 183,134

Wells Fargo stockholders’ equity

196,166 198,741 205,188

204,952 206,936 Total equity

197,066 199,679 206,069 205,910

208,079 Tangible common equity (1)

145,980 148,391 152,580

151,878 153,730 Common shares outstanding

4,581.3 4,711.6

4,849.1 4,873.9 4,891.6 Book value per common share (6)

$

38.06 37.55 37.41 37.17 37.44 Tangible book value per common

share (1)(6)

31.86 31.49 31.47 31.16 31.43 Team members

(active, full-time equivalent)

258,700

261,700 264,500 265,700

262,700

(1) Tangible common equity is a non-GAAP

financial measure and represents total equity less preferred

equity, noncontrolling interests, and goodwill and certain

identifiable intangible assets (including goodwill and intangible

assets associated with certain of our nonmarketable equity

securities but excluding mortgage servicing rights), net of

applicable deferred taxes. The methodology of determining tangible

common equity may differ among companies. Management believes that

return on average tangible common equity and tangible book value

per common share, which utilize tangible common equity, are useful

financial measures because they enable investors and others to

assess the Company's use of equity. For additional information,

including a corresponding reconciliation to GAAP financial

measures, see the "Tangible Common Equity" tables on page 36.

(2) The efficiency ratio is noninterest

expense divided by total revenue (net interest income and

noninterest income).

(3) Pre-tax pre-provision profit (PTPP) is

total revenue less noninterest expense. Management believes that

PTPP is a useful financial measure because it enables investors and

others to assess the Company’s ability to generate capital to cover

credit losses through a credit cycle.

(4) Consumer and small business banking

deposits are total deposits excluding mortgage escrow and wholesale

deposits.

(5) Financial information for the quarter

ended December 31, 2017, has been revised to reflect the impact of

the adoption in first quarter 2018 of ASU 2016-01 – Financial

Instruments – Overall (Subtopic 825-10): Recognition and

Measurement of Financial Assets and Financial Liabilities.

(6) Book value per common share is common

stockholders' equity divided by common shares outstanding. Tangible

book value per common share is tangible common equity divided by

common shares outstanding.

Wells Fargo & Company and

Subsidiaries

CONSOLIDATED STATEMENT OF

INCOME

Quarter ended December 31, % Year ended

December 31, % (in millions, except per share amounts)

2018 2017 Change

2018

2017 Change

Interest income Debt

securities (1)

$ 3,803 3,294 15 %

$

14,406 12,946 11 % Mortgage loans held for sale

190

196 (3 )

777 786 (1 ) Loans held for sale (1)

33 12

175

140 50 180 Loans

11,367 10,367 10

43,974

41,388 6 Equity securities (1)

260 239 9

992 799 24

Other interest income (1)

1,268 850

49

4,358 2,940 48 Total

interest income

16,921 14,958 13

64,647 58,909 10

Interest

expense Deposits

1,765 931 90

5,622 3,013 87

Short-term borrowings

546 255 114

1,717 758 127

Long-term debt

1,802 1,344 34

6,703 5,157 30 Other

interest expense

164 115 43

610 424 44 Total interest

expense

4,277 2,645 62

14,652 9,352 57

Net interest

income 12,644 12,313 3

49,995 49,557 1 Provision

for credit losses

521 651 (20 )

1,744 2,528 (31 ) Net interest

income after provision for credit losses

12,123

11,662 4

48,251

47,029 3

Noninterest income Service charges on

deposit accounts

1,176 1,246 (6 )

4,716 5,111 (8 )

Trust and investment fees

3,520 3,687 (5 )

14,509

14,495 — Card fees

981 996 (2 )

3,907 3,960 (1 )

Other fees

888 913 (3 )

3,384 3,557 (5 ) Mortgage

banking

467 928 (50 )

3,017 4,350 (31 ) Insurance

109 223 (51 )

429 1,049 (59 ) Net gains (losses) from

trading activities (1)

10 (1 ) NM

602 542 11 Net

gains on debt securities

9 157 (94 )

108 479 (77 )

Net gains from equity securities (1)

21 572 (96 )

1,515 1,779 (15 ) Lease income

402 458 (12 )

1,753 1,907 (8 ) Other

753 558

35

2,473 1,603 54 Total

noninterest income

8,336 9,737

(14 )

36,413 38,832 (6 )

Noninterest expense Salaries

4,545 4,403 3

17,834 17,363 3 Commission and incentive compensation

2,427 2,665 (9 )

10,264 10,442 (2 ) Employee benefits

706 1,293 (45 )

4,926 5,566 (11 ) Equipment

643 608 6

2,444 2,237 9 Net occupancy

735 715

3

2,888 2,849 1 Core deposit and other intangibles

264 288 (8 )

1,058 1,152 (8 ) FDIC and other deposit

assessments

153 312 (51 )

1,110 1,287 (14 ) Other

3,866 6,516 (41 )

15,602 17,588 (11 ) Total noninterest

expense

13,339 16,800 (21 )

56,126 58,484 (4 )

Income

before income tax expense 7,120 4,599 55

28,538

27,377 4 Income tax expense (benefit)

966

(1,642 ) NM

5,662 4,917

15

Net income before noncontrolling interests 6,154

6,241 (1 )

22,876 22,460 2 Less: Net income from

noncontrolling interests

90 90 —

483 277 74

Wells Fargo net

income $ 6,064 6,151

(1 )

$ 22,393 22,183 1

Less: Preferred stock dividends and other

353

411 (14 )

1,704 1,629

5

Wells Fargo net income applicable to common stock

$ 5,711 5,740 (1 )

$ 20,689 20,554 1

Per share

information Earnings per common share

$ 1.22 1.17

4

$ 4.31 4.14 4 Diluted earnings per common share

1.21 1.16 4

4.28 4.10 4

Average common shares

outstanding 4,665.8 4,912.5 (5 )

4,799.7 4,964.6

(3 )

Diluted average common shares outstanding

4,700.8 4,963.1 (5 )

4,838.4 5,017.3 (4 )

NM - Not meaningful

(1) Financial information for the prior

periods of 2017 has been revised to reflect the impact of the

adoption in first quarter 2018 of ASU 2016-01 – Financial

Instruments – Overall (Subtopic 825-10): Recognition and

Measurement of Financial Assets and Financial Liabilities.

Wells Fargo & Company and

Subsidiaries

FIVE QUARTER CONSOLIDATED STATEMENT OF

INCOME

Quarter ended (in millions, except per share amounts)

Dec 31, 2018 Sep 30,2018 Jun 30,2018

Mar 31,2018 Dec 31,2017

Interest income

Debt securities (1)

$ 3,803

3,595 3,594 3,414 3,294 Mortgage loans held for sale

190 210

198 179 196 Loans held for sale (1)

33 35 48 24 12 Loans

11,367 11,116 10,912 10,579 10,367 Equity securities (1)

260 280 221 231 239 Other interest income (1)

1,268 1,128 1,042

920 850 Total interest income

16,921 16,364 16,015

15,347 14,958

Interest expense

Deposits

1,765 1,499 1,268 1,090 931 Short-term borrowings

546 462 398 311 255 Long-term debt

1,802 1,667 1,658

1,576 1,344 Other interest expense

164

164 150 132 115

Total interest expense

4,277 3,792

3,474 3,109 2,645

Net interest income 12,644 12,572 12,541 12,238

12,313 Provision for credit losses

521

580 452 191 651

Net interest income after provision for credit losses

12,123 11,992 12,089

12,047 11,662

Noninterest income

Service charges on deposit accounts

1,176 1,204 1,163 1,173

1,246 Trust and investment fees

3,520 3,631 3,675 3,683

3,687 Card fees

981 1,017 1,001 908 996 Other fees

888 850 846 800 913 Mortgage banking

467 846 770 934

928 Insurance

109 104 102 114 223 Net gains (losses) from

trading activities (1)

10 158 191 243 (1 ) Net gains on debt

securities

9 57 41 1 157 Net gains from equity securities

(1)

21 416 295 783 572 Lease income

402 453 443 455

458 Other

753 633 485

602 558 Total noninterest income

8,336 9,369 9,012

9,696 9,737

Noninterest expense

Salaries

4,545 4,461 4,465 4,363 4,403 Commission and

incentive compensation

2,427 2,427 2,642 2,768 2,665

Employee benefits

706 1,377 1,245 1,598 1,293 Equipment

643 634 550 617 608 Net occupancy

735 718 722 713 715

Core deposit and other intangibles

264 264 265 265 288 FDIC

and other deposit assessments

153 336 297 324 312 Other

3,866 3,546 3,796

4,394 6,516 Total noninterest expense

13,339 13,763 13,982

15,042 16,800

Income before

income tax expense 7,120 7,598 7,119 6,701 4,599 Income

tax expense (benefit)

966 1,512

1,810 1,374 (1,642 )

Net

income before noncontrolling interests 6,154 6,086 5,309

5,327 6,241 Less: Net income from noncontrolling interests

90 79 123 191

90

Wells Fargo net income

$ 6,064 6,007 5,186

5,136 6,151 Less: Preferred

stock dividends and other

353 554

394 403 411

Wells Fargo net income applicable to common stock

$ 5,711 5,453 4,792

4,733 5,740

Per share

information Earnings per common share

$ 1.22 1.14

0.98 0.97 1.17 Diluted earnings per common share

1.21 1.13

0.98 0.96 1.16

Average common shares outstanding

4,665.8 4,784.0 4,865.8 4,885.7 4,912.5

Diluted average

common shares outstanding 4,700.8

4,823.2 4,899.8 4,930.7

4,963.1

(1) Financial information for the quarter

ended December 31, 2017, has been revised to reflect the impact of

the adoption in first quarter 2018 of ASU 2016-01 – Financial

Instruments – Overall (Subtopic 825-10): Recognition and

Measurement of Financial Assets and Financial Liabilities.

Wells Fargo & Company and

Subsidiaries

CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME

Quarter ended December 31, % Year ended

December 31, % (in millions)

2018 2017

Change

2018 2017 Change Wells

Fargo net income

$ 6,064 6,151

(1)%

$ 22,393 22,183 1%

Other comprehensive income (loss), before tax: Debt

securities (1): Net unrealized gains (losses) arising during the

period

1,035 (106 ) NM

(4,493 ) 2,719 NM

Reclassification of net (gains) losses to net income

80 (215

) NM

248 (737 ) NM Derivatives and hedging activities: Net

unrealized losses arising during the period

(116 )

(558 ) (79)

(532 ) (540 ) (1) Reclassification of net

(gains) losses to net income

78 (83 ) NM

294 (543 )

NM Defined benefit plans adjustments: Net actuarial and prior

service gains (losses) arising during the period

(440

) 45 NM

(434 ) 49 NM Amortization of net

actuarial loss, settlements and other to net income

163 33

394

253 153 65 Foreign currency translation adjustments: Net

unrealized gains (losses) arising during the period

(62 ) 10 NM

(156 )

96 NM

Other comprehensive income (loss), before tax

738 (874 ) NM

(4,820 ) 1,197 NM Income tax

benefit (expense) related to other comprehensive income

(202 ) 319 NM

1,144

(434 ) NM

Other comprehensive income (loss), net of

tax 536 (555 ) NM

(3,676 ) 763 NM Less:

Other comprehensive loss from noncontrolling interests

(1 ) (33 ) (97)

(2 ) (62

) (97)

Wells Fargo other comprehensive income (loss), net of

tax 537 (522 ) NM

(3,674

) 825 NM

Wells Fargo comprehensive

income 6,601 5,629 17

18,719 23,008 (19)

Comprehensive income from noncontrolling interests

89

57 56

481 215 124

Total comprehensive income $ 6,690

5,686 18

$ 19,200

23,223 (17)

NM – Not meaningful

(1) The quarter and year ended December

31, 2017, includes net unrealized gains (losses) arising during the

period from equity securities of ($31) million and $81 million and

reclassification of net (gains) losses to net income related to

equity securities of ($133) million and ($456) million,

respectively. With the adoption in first quarter 2018 of ASU

2016-01, the quarter and year ended December 31, 2018, reflects net

unrealized gains (losses) arising during the period and

reclassification of net (gains) losses to net income from only debt

securities.

FIVE QUARTER CONDENSED CONSOLIDATED

STATEMENT OF CHANGES IN TOTAL EQUITY

Quarter ended (in millions)

Dec 31,

2018 Sep 30,2018 Jun 30,2018 Mar

31,2018 Dec 31,2017

Balance, beginning of period

$ 199,679 206,069 205,910

208,079 206,617 Cumulative effect from change in accounting

policies (1)

— — — (24 ) — Wells Fargo net income

6,064 6,007 5,186 5,136 6,151 Wells Fargo other

comprehensive income (loss), net of tax

537 (1,012 ) (540 )

(2,659 ) (522 ) Noncontrolling interests

(38 ) 57 (77

) (178 ) 247 Common stock issued

239 156 73 1,208 436 Common

stock repurchased (2)

(7,299 ) (7,382 ) (2,923 )

(3,029 ) (2,845 ) Preferred stock redeemed (3)

— (2,150 ) —

— — Preferred stock released by ESOP

268 260 490 231 218

Common stock warrants repurchased/exercised

(131 )

(36 ) (1 ) (157 ) (46 ) Common stock dividends

(2,016

) (2,062 ) (1,900 ) (1,911 ) (1,920 ) Preferred stock

dividends

(353 ) (399 ) (394 ) (410 ) (411 ) Stock

incentive compensation expense

144 202 258 437 206 Net

change in deferred compensation and related plans

(28

) (31 ) (13 ) (813 ) (52 )

Balance, end of period $ 197,066

199,679 206,069 205,910

208,079

(1) The cumulative effect for the quarter

ended March 31, 2018, reflects the impact of the adoption in first

quarter 2018 of ASU 2016-04, ASU 2016-01 and ASU 2014-09.

(2) For the quarter ended June 30, 2018,

includes $1.0 billion related to a private forward repurchase

transaction that settled in third quarter 2018 for 18.8 million

shares of common stock.

(3) Represents the impact of the

redemption of preferred stock, Series J, in third quarter 2018.

Wells Fargo & Company and

Subsidiaries

AVERAGE BALANCES, YIELDS AND RATES PAID

(TAXABLE-EQUIVALENT BASIS) (1)(2)

Quarter ended December 31,

2018 2017 (in millions)

Averagebalance

Yields/rates

Interestincome/expense

Averagebalance

Yields/rates

Interestincome/expense

Earning assets Interest-earning

deposits with banks (3)

$ 150,091 2.18

% $ 825 189,114 1.27 % $ 605 Federal funds

sold and securities purchased under resale agreements (3)

76,108 2.22 426 75,826 1.20 230 Debt

securities (4): Trading debt securities (5)

90,110

3.52 794 81,580 3.17 647 Available-for-sale debt

securities: Securities of U.S. Treasury and federal agencies

7,195 1.80 32 6,423 1.66 27 Securities of U.S.

states and political subdivisions

47,618 4.05

483 52,390 3.91 513 Mortgage-backed securities: Federal

agencies

155,322 2.91 1,128 152,910 2.62 1,000

Residential and commercial

6,666 4.87

81 9,371 4.85 114 Total mortgage-backed

securities

161,988 2.99 1,209 162,281 2.75

1,114 Other debt securities (5)

46,072

4.46 518 48,679 3.62 443 Total

available-for-sale debt securities (5)

262,873

3.41 2,242 269,773 3.10 2,097

Held-to-maturity debt securities:

Securities of U.S. Treasury and federal agencies

44,747

2.19 247 44,716 2.19 246 Securities of U.S. states

and political subdivisions

6,247 4.34 67 6,263

5.26 83 Federal agency and other mortgage-backed securities

95,748 2.46 589 89,622 2.25 503 Other debt

securities

68 3.65 1

1,194 2.64 8 Total held-to-maturity debt securities

146,810 2.46 904 141,795

2.36 840 Total debt securities (5)

499,793 3.15

3,940 493,148 2.90 3,584 Mortgage loans held for sale (6)

17,044 4.46 190 20,517 3.82 196 Loans held for

sale (5)(6)

1,992 6.69 33 1,490 3.19 12

Commercial loans: Commercial and industrial - U.S.

281,431

4.40 3,115 270,294 3.89 2,649 Commercial and

industrial - Non U.S.

62,035 3.73 584 59,233

2.96 442 Real estate mortgage

120,404 4.51

1,369 127,199 3.88 1,244 Real estate construction

23,090 5.32 310 24,408 4.38 270 Lease

financing

19,519 4.48 219

19,226 0.62 31 Total commercial loans

506,479

4.39 5,597 500,360 3.68 4,636

Consumer loans: Real estate 1-4 family first mortgage

285,260 4.02 2,868 281,966 4.01 2,826 Real

estate 1-4 family junior lien mortgage

34,844 5.60

491 40,379 4.96 505 Credit card

37,858 12.69

1,211 36,428 12.37 1,136 Automobile

45,536

5.16 592 54,323 5.13 702 Other revolving credit and

installment

36,359 6.95 637

38,366 6.28 607 Total consumer loans

439,857 5.25 5,799 451,462

5.10 5,776 Total loans (6)

946,336 4.79

11,396 951,822 4.35 10,412 Equity securities (5)

37,412 2.79 261 38,001 2.60 246 Other (5)

4,074 1.78 18 7,103

0.88 16 Total earning assets (5)

$

1,732,850 3.93 % $ 17,089

1,777,021 3.43 % $ 15,301

Funding sources

Deposits: Interest-bearing checking

$ 53,983

1.21 % $ 165 50,483 0.68 % $ 86 Market

rate and other savings

689,639 0.43 741

679,893 0.19 319 Savings certificates

21,955 0.87

48 20,920 0.31 17 Other time deposits

92,676

2.46 575 68,187 1.49 255 Deposits in foreign offices

56,098 1.66 236 124,597

0.81 254 Total interest-bearing deposits

914,351

0.77 1,765 944,080 0.39 931 Short-term borrowings

105,962 2.04 546 102,142 0.99 256 Long-term

debt

226,591 3.17 1,802 231,598 2.32 1,344

Other liabilities

27,365 2.41

164 24,728 1.86 115 Total interest-bearing

liabilities

1,274,269 1.34 4,277 1,302,548

0.81 2,646 Portion of noninterest-bearing funding sources (5)

458,581 — — 474,473

— — Total funding sources (5)

$

1,732,850 0.99 4,277

1,777,021 0.59 2,646

Net interest margin and net

interest income on a taxable-equivalent basis (7) 2.94

% $ 12,812 2.84 % $

12,655

Noninterest-earning assets Cash and due from banks

$ 19,288 19,152 Goodwill

26,423 26,579 Other

(5)

100,486 112,566 Total

noninterest-earning assets (5)

$ 146,197

158,297

Noninterest-bearing funding sources

Deposits

$ 354,597 367,512 Other liabilities

51,739 57,845 Total equity

198,442 207,413

Noninterest-bearing funding sources used to fund earning assets (5)

(458,581 ) (474,473 ) Net noninterest-bearing

funding sources (5)

$ 146,197 158,297

Total assets $ 1,879,047

1,935,318

(1) Our average prime rate was 5.28% and

4.30% for the quarters ended December 31, 2018 and 2017,

respectively. The average three-month London Interbank Offered Rate

(LIBOR) was 2.62% and 1.46% for the same quarters,

respectively.

(2) Yields/rates and amounts include the

effects of hedge and risk management activities associated with the

respective asset and liability categories.

(3) Financial information for the prior

period has been revised to reflect the impact of the adoption in

first quarter 2018 of ASU 2016-18 – Statement of Cash Flows (Topic

230): Restricted Cash in which we changed the presentation of our

cash and cash equivalents to include both cash and due from banks

as well as interest-earning deposits with banks, which are

inclusive of any restricted cash.

(4) Yields and rates are based on interest

income/expense amounts for the period, annualized based on the

accrual basis for the respective accounts. The average balance

amounts represent amortized cost for the periods presented.

(5) Financial information for the prior

period has been revised to reflect the impact of the adoption in

first quarter 2018 of ASU 2016-01 – Financial Instruments – Overall

(Subtopic 825-10): Recognition and Measurement of Financial Assets

and Financial Liabilities.

(6) Nonaccrual loans and related income

are included in their respective loan categories.

(7) Includes taxable-equivalent

adjustments of $168 million and $342 million for the quarters ended

December 31, 2018 and 2017, respectively, predominantly related to

tax-exempt income on certain loans and securities. The federal