Ralph Lauren Reports Revenue Drop Led by North America -- Earnings Review

May 23 2018 - 9:40AM

Dow Jones News

By Allison Prang

Ralph Lauren Corp. released its fourth-quarter financial results

before the market opened Wednesday. Here's what you need to

know.

PROFIT: Ralph Lauren swung to a profit of $41.3 million, or 50

cents a share, from a loss of $204 million, or $2.48 a share, in

the prior-year quarter. On an adjusted basis, the company made 90

cents a share, up from 89 cents a share. Analysts polled by Thomson

Reuters expected 83 cents a share on an adjusted basis.

REVENUE: The company reported revenue of $1.53 billion, down

2.3%. North America saw the biggest decline, falling 14%, while

revenue in Europe and Asia rose 13% and 17% respectively. Analysts

polled by Thomson Reuters were expecting revenue of $1.48 billion.

On a constant currency basis, Ralph Lauren said revenue fell by

6.7%. For North America, it declined by 14%, for Europe it fell by

1% and for Asia it rose by 11%.

NORTH AMERICA: For North America, which still brings in most of

the company's total revenue out of the three regions, Ralph Lauren

said "the decline was due to lower sales in the wholesale channel,

driven by distribution and brand exits, strategic reductions in

shipments and promotional activity to increase quality of sales, as

well as lower consumer demand."

EUROPE: As for Europe, Ralph Lauren said a decline in comparable

sales was fueled by performance in physical storefronts but was

partly balanced out by performance in digital commerce. "Brick

& mortar comparables were pressured by traffic challenges in

select markets, continued quality of sales initiatives, and planned

inventory reductions," the company said.

ASIA: Ralph Lauren said wholesale and retail performance made

for the increase in revenue and the number of transactions as well

as improved average unit retail helped same-store sales.

COMPARABLE SALES: Ralph Lauren's same-store sales rose 4%. In

North America specifically, they were flat, while comparable sales

rose 7% in Europe and 9% in Asia. Analysts polled by Consensus

Metrix were expecting same-store sales to fall 0.9% overall, and to

decline 5.7% in North America. They were expecting a 4.4% increase

for Europe and a 7.2% increase in Asia.

COSTS: The company's cost of goods sold declined 17% to $620.7

million. Selling, general and administrative costs rose 8.6% to

$828.6 million and restructuring costs and what the company called

other charges dropped substantially to $29.3 million from $124.7

million.

FY 2019 GUIDANCE: Ralph Lauren said on a constant-currency

basis, it expects revenue to fall by the low-single digits. Helped

by gross margin expansion, Ralph Lauren said it expects its

operating margin to increase "slightly" on a constant currency

basis. The company expects capital expenditures to be about $275

million.

1Q GUIDANCE: Ralph Lauren anticipates on a constant currency

basis revenue will be between flat and "down slightly." Also on a

constant currency basis, it expects operating margin will "be up

slightly." It expects revenue growth will be helped by between

about 150 and 200 basis points from foreign currency. The company's

operating margin will also be helped by between 20 and 40 basis

points from foreign currency, Ralph Lauren expects.

Shares rose 3.2% premarket. So far in 2018, they've risen

12%.

Write to Allison Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

May 23, 2018 09:25 ET (13:25 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

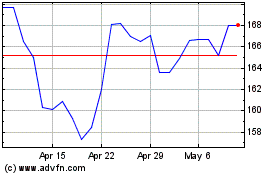

Ralph Lauren (NYSE:RL)

Historical Stock Chart

From Aug 2024 to Sep 2024

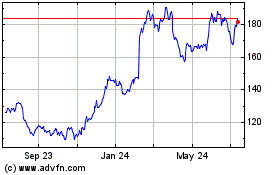

Ralph Lauren (NYSE:RL)

Historical Stock Chart

From Sep 2023 to Sep 2024