UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

|

|

|

|

|

|

|

|

|

|

|

Filed by the Registrant

|

|

ý

|

|

Filed by a Party other than the Registrant

|

|

¨

|

Check the appropriate box:

|

|

|

|

|

|

|

¨

|

|

Preliminary Proxy Statement

|

|

|

|

|

¨

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

¨

|

|

Definitive Proxy Statement

|

|

|

|

|

ý

|

|

Definitive Additional Materials

|

|

|

|

|

¨

|

|

Soliciting Material under Rule 14a-12

|

Independence Contract Drilling, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

ý

|

|

No fee required.

|

|

¨

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

___________________________________________________________________________

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

___________________________________________________________________________

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

___________________________________________________________________________

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

___________________________________________________________________________

|

|

|

|

(5)

|

|

Total fee paid:

___________________________________________________________________________

|

|

¨

|

|

Fee paid previously with preliminary materials.

|

|

¨

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

(1)

|

|

Amount Previously Paid:

___________________________________________________________________________

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

___________________________________________________________________________

|

|

|

|

(3)

|

|

Filing Party:

___________________________________________________________________________

|

|

|

|

(4)

|

|

Date Filed:

___________________________________________________________________________

|

May 15, 2018

Re:

Independence Contract Drilling, Inc. 2018 Annual Meeting of Stockholders

Election of Directors (Proposal 1)

Dear Independence Contract Drilling Stockholder:

On behalf of the Board of Directors (the “Board”) and the Compensation Committee of the Board (the “Compensation Committee”) of Independence Contract Drilling, Inc. (the “Company”), we are writing to request your support at the 2018 Annual Meeting of Stockholders (the “Annual Meeting”) by voting in accordance with the Board’s recommendations in the election of directors.

We note that Glass Lewis (“GL”) issued a report recommending that the Company’s stockholders vote “FOR” the election of each of the directors. However, Institutional Shareholder Services (“ISS”) in its report (the “ISS Report”) recommended a “WITHHOLD” vote against all three of the nominees for director who are Compensation Committee members.

We strongly disagree with ISS’s recommendation

.

In making its negative recommendation, ISS focused on our CEO’s 2017 compensation and the related absence of certain compensation-related disclosures that are not required to be included in the 2018 Proxy Statement. As discussed below, we believe that the 2017 CEO compensation is both reasonable and in line with our peer group and shareholder return, and that compensation decisions with respect to 2018 compensation further align the interests of CEO pay with Company performance.

Some of the key points that we address in further detail below include:

|

|

|

|

•

|

Pay for Performance

. The Compensation Committee is focused on aligning CEO pay utilizing an increasing percentage of performance-based pay. For 2017, the value of equity-based compensation (based on grant date values) increased both in amount and as a percentage of total pay. In addition, for compensation decisions made in 2018, the Company increased the percentage of performance-based equity awards to 50% of the total value of equity award grants. The Compensation Committee intends to utilize this increased level of performance-based equity compensation on a go-forward basis.

|

|

|

|

|

•

|

Shareholder Return

. During the three-year performance period ended December 31, 2017, the oil and gas industry experienced a significant decline in demand for its products and services, with oil prices falling to as low as $26 per barrel during this period. As a result, absolute shareholder return for the entire oilfield services industry during this period as negative. Given the unique nature and extreme cyclicality of the U.S. land contract drilling industry, we believe total shareholder return ("TSR") measurement across our industry peers is a much more accurate assessment of performance compared to measurement against broad indices such as the Russell 3000 or MSCI ACWI: Energy Equipment & Services index. Among the Company’s land drilling peers and similarly situated oilfield service companies, the Company is above the median or approaching the top quartile for 2017 TSR and for three-year TSR ending December 31, 2017.

|

|

|

|

|

•

|

Peer Group

. The Company’s disclosed peer group of companies includes several peers that are much larger in size than the Company. To mitigate this factor in making compensation decisions, the Compensation Committee placed CEO pay within the bottom quartile of this peer group. In addition, the Committee evaluated CEO pay against a subset of smaller public companies noting that CEO pay fell within the midpoint of this peer group. Further, in making 2018 compensation decisions in February of this year, the Compensation Committee changed the peer group of companies it utilized. This change eliminated many companies with substantially greater size than the Company.

|

|

|

|

|

•

|

Emerging Growth Status

. The Company is an “emerging growth company” ("EGC") under applicable Securities and Exchange Commission rules and regulations. As an EGC, the Company is not required to include in its filings expansive compensation disclosure and analysis ("CD&A") required by more-seasoned public companies. Beginning in 2019, the Company will no longer be classified as an EGC and will include expanded CD&A disclosures.

|

PAY FOR PERFORMANCE

The Compensation Committee is focused on aligning CEO pay utilizing an increasing percentage of performance-based pay. For 2017, the value of equity-based compensation (based on grant date values) increased both in amount and as a percentage of total pay. In addition, for compensation decisions made in 2018, the Company increased the percentage of performance-based equity awards to 50% of the total value of equity award grants. The Compensation Committee intends to utilize this increased level of performance-based equity compensation on a go-forward basis.

With respect to the GL and ISS reports, we consider the following informative regarding pay for performance:

|

|

|

|

•

|

GL’s 2017 Pay for Performance chart gave ICD an “A” rating and showed higher than median performance combined with CEO compensation at lower levels than the associated median of peer CEO compensation.

|

|

|

|

|

•

|

ISS’ Relative Degree of Alignment placed the Company slightly above the median on CEO pay and TSR performance approaching the top quartile - clearly showing relative performance exceeding the positioning of the CEO’s compensation compared to the ISS peer group. However, while the GL report acknowledged this pay for performance alignment, ISS on the other hand, gave it a “High Concern”.

|

In addition to efforts to further increase the mix of performance-based pay compared to fixed pay, we feel that the performance goals utilized are properly aligned with our longer-term strategic objectives. The Company’s annual incentive plan is tied 100% to corporate-level performance measures and achievement of established performance goals. As described in the 2018 Proxy Statement (p. 23), corporate-level performance measures were weighted 1/3 to each of TRIR, Adjusted EBITDA, and Cost per Day objectives, as further described in the 2018 Proxy Statement, our CEO’s established performance goals for 2017 related to (i) development of internal and external training initiatives, (ii) development of organizational and strategic initiatives and (iii) business development, including the addition of new key customers. For 2018, 50% of the annual incentive for our CEO is tied directly to Adjusted EBITDA performance metrics, 15% is tied to safety-related metrics, 15% is tied to cost per day metrics and 20% is tied to achievement of personal performance goals.

SHAREHOLDER RETURN

During the three-year performance period ended December 31, 2017, the oil and gas industry experienced a significant decline in demand for its products and services, with oil prices falling to as low as $26 per barrel during this period. As a result, absolute shareholder return for the entire oilfield services industry during this period was negative. Given the unique nature and extreme cyclicality of the U.S. land contract drilling industry, we believe TSR measurement across our industry peers is a much more accurate assessment of performance compared to measurement against broad indices such as the Russell 3000 or MSCI ACWI: Energy Equipment & Services index. Among the Company’s land drilling peers and similarly situated oilfield service companies, the Company is above the median or approaching the top quartile for 2017 TSR and for three-year TSR ending December 31, 2017. For the period January 1, 2018 through May 14, 2018, the Company’s share price has increased approximately 22%.

The following chart shows the Company’s TSR versus the peer group of companies utilized by the Compensation Committee in analyzing relative TSR:

PEER GROUP

The Company’s disclosed peer group of companies includes several peers that are much larger in size than the Company. In order to mitigate this factor in making compensation decisions, the Compensation Committee placed CEO pay within the bottom quartile of this peer group.

In addition, the Compensation Committee also evaluated CEO pay against a subset of smaller public companies with revenues between $50 million and $200 million, noting that CEO pay fell within the midpoint of this peer group. The group of smaller companies utilized by the Company to further evaluate its 2017 compensation decisions included the following companies:

Comstock Resources, Inc.

Dawson Geophysical Company

PHX Energy Services Corp.

Callon Petroleum Company

Tesco Corporation

Rex Energy Corporation

Gulfmark Offshore, Inc.

Extreme Drilling Corp.

CARBO Ceramics Inc.

Resolute Energy Corporation

Forbes Energy Services Ltd.

Approach Resources, Inc.

Natural Gas Services Group, Inc.

PetroQuest Energy, Inc.

Silverbow Resources (formerly Swift Energy Company)

Further, the Committee changed the peer group of companies it utilized in making compensation decisions in February 2018, which eliminated many companies with substantially greater size than the Company. The peer group utilized by the Company for analyzing 2018 CEO compensation included the following companies:

Trinidad Drilling Ltd

Parker Drilling Company Inc.

Pioneer Energy Services Corp

Flotek Industries, Inc.

EXCO Resources, Inc.

PHX Energy Servides Corp.

Gulf Island Fabrication, Inc.

ION Geophysical Corporation

Geospace Technologies Corporation

National Gas Services Group, Inc.

AKITA Drilling LTd.

Xtreme Drilling Corp. (TO: XDC)

Panhandle Oil and Gas Inc.

Enservco Corporation

EMERGING GROWTH STATUS

The Company is an EGC under applicable SEC rules and regulations. As an EGC, the Company is not required to include in its filings expansive CD&A required by more-seasoned public companies. Beginning in 2019, the Company will no longer be classified as an EGC and will include expanded CD&A disclosures.

WE RECOMMEND YOU VOTE “FOR” EACH OF OUR DIRECTOR NOMINEES (in Proposal 1)

As outlined above and in our 2018 Proxy Statement, the Board and Compensation Committee remain committed to aligning our executives’ compensation with the interests of our stockholders and the performance of the Company. We believe that our 2017 named executive compensation was consistent with those objectives and our 2018 practices continue that intent. We also believe the absence of certain compensation-related disclosures not required to be included under SEC rules in the 2018 Proxy Statement is not a reasonable basis for a “WITHHOLD” vote against our Compensation Committee members as directors.

We note that the Compensation Committee has established a CEO compensation program that emphasizes pay-for-performance, and incorporates many practices that protect the interests of our stockholders and are consistent with high standards for risk management, including:

|

|

|

|

•

|

A substantial portion of executive pay based on performance against goals set by the Compensation Committee;

|

|

|

|

|

•

|

No tax gross-ups for executive officers; and

|

|

|

|

|

•

|

Compensation subject to clawback in the event of misconduct, consistent with Section 304 of the Sarbanes-Oxley Act.

|

Accordingly, we ask that our stockholders consider the information above and in our 2018 Proxy Statement, and vote “FOR” each of our directors in “Proposal 1”, including each of our Compensation Committee members. Even if instructions for your proxy have already been given, you may change your vote at any time before the Annual Meeting by providing revised voting instructions to your proxy or by voting at the meeting.

Sincerely,

|

|

|

|

|

|

|

Date: May 15, 2018

|

|

/s/ Thomas R. Bates, Jr.

|

|

|

|

Name: Thomas R. Bates, Jr.

|

|

|

|

Title: Chairman of the Board

|

|

|

|

|

|

Date: May 15, 2018

|

|

/s/ Daniel F. McNease

|

|

|

|

Name: Daniel F. McNease

|

|

|

|

Title: Chairman of the Compensation Committee

|

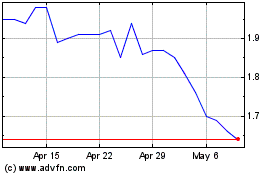

Independence Contract Dr... (NYSE:ICD)

Historical Stock Chart

From Aug 2024 to Sep 2024

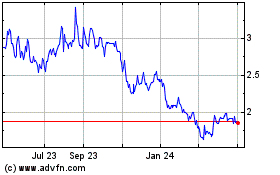

Independence Contract Dr... (NYSE:ICD)

Historical Stock Chart

From Sep 2023 to Sep 2024