Coporacion America Airports S.A. Announces Pricing of Initial Public Offering

February 01 2018 - 12:08PM

Business Wire

Corporación América Airports S.A. (NYSE: CAAP) (“Corporación

América Airports” or the “Company”), a global airport operator,

announced today the pricing of its initial public offering of

28,571,429 common shares of the Company at $17.00 per common share.

The Company is selling 11,904,762 shares and the selling

shareholder is selling 16,666,667 shares. In addition, the

underwriters have been granted a 30-day option to purchase up to an

additional 4,285,714 shares to cover over-allotments.

The shares are expected to begin trading on the New York Stock

Exchange on February 1, 2018 under the symbol “CAAP.”

Oppenheimer, BofA Merrill Lynch, Citigroup and Goldman Sachs are

acting as joint book-runners and Santander is acting as co-manager

in the offering.

The offering will be made only by means of a prospectus filed as

part of an effective registration statement filed with the

Securities and Exchange Commission on Form F-1. A final prospectus

for the offering, when available, may be obtained from the

underwriters.

The Prospectus can be obtained from Oppenheimer &

Co. Inc., 85 Broad Street, New York, New York 10004, Attn:

Syndicate Prospectus Department, telephone: +1 (212) 667-8563, or

via e-mail: EquityProspectus@opco.com; BofA Merrill

Lynch, NC1-004-03-43, 200 North College Street, 3rd floor,

Charlotte NC 28255-0001, Attn: Prospectus Department,

e-mail: dg.prospectus_requests@baml.com;

Citigroup Global Markets Inc., c/o Broadridge Financial

Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, telephone:

+1 (800) 831-9146; Goldman Sachs & Co. LLC, 200 West

Street, New York, New York 10282, Attn: Prospectus Department,

telephone: +1 (866) 471-2526, or via e-mail:

prospectus-ny@ny.email.gs.com.

A registration statement on Form F-1 relating to these

securities was filed with, and declared effective by, the

Securities and Exchange Commission (the “SEC”). The registration

statement can be accessed through the SEC’s website at

www.sec.gov.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy nor may there be any sale of these

securities in any state or jurisdiction in which such an offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About Corporación América Airports S.A.

Corporación América Airports acquires, develops and operates

airport concessions. The Company is the largest private sector

airport operator in the world based on the number of airports under

management and the tenth largest based on passenger traffic.

Currently, the Company operates 52 airports in 7 countries across

Latin America and Europe (Argentina, Brazil, Uruguay, Peru,

Ecuador, Armenia and Italy). In 2016, it served 71.8 million

passengers.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180201006104/en/

Corporación América Airports S.A.Gimena Albanesi,

+54911-4565-9227Investor

RelationsGimena.Albanesi@caairports.com

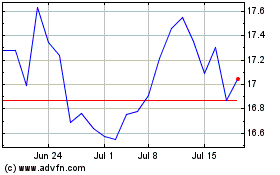

Corporacion America Airp... (NYSE:CAAP)

Historical Stock Chart

From Apr 2024 to May 2024

Corporacion America Airp... (NYSE:CAAP)

Historical Stock Chart

From May 2023 to May 2024