Report of Foreign Issuer (6-k)

October 11 2017 - 6:03AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of October, 2017

Commission File Number 1565025

AMBEV S.A.

(Exact name of registrant as specified in its charter)

AMBEV S.A.

(Translation of Registrant's name into English)

Rua Dr. Renato Paes de Barros, 1017 - 3rd Floor

04530-000 São Paulo, SP

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

INDIVIDUAL FORM

Article 11 - CVM Instruction # 358/2002

In September 2017:

( X ) the only transactions with securities and derivatives were those presented below, in compliance with Article 11 - CVM Instruction # 358/2002.

(1)

( ) no securities and derivatives operations took place, in compliance with Article 11 - CVM Instruction # 358/2002, with my securities and derivatives positions as follows.

|

Company Name: Ambev S.A.

|

|

Name: Ambev S.A.

|

CPF/CNPJ: 07.526.557/0001-00

|

|

Qualification: Outstanding Shares in Treasury

|

Initial Balance

|

|

Securities / Derivatives

|

Securities Characteristics

(2)

|

Quantity

|

%

|

|

Same Class and Type

|

Total

|

|

Shares

|

Common

|

10,032,272

|

0.0638

|

0.0638

|

Transac

tions in the month

|

|

Securities / Derivatives

|

Securities Characteristics

(2)

|

Intermediary

|

Operation

|

Day

|

Quantity

|

Price

|

Volume (R$)

(3)

|

|

Shares

|

Common

|

Direct with the Company

|

Conversion in ADRs

|

06

|

4,236

|

0.00

|

0.00

|

|

Shares

|

Common

|

Direct with the Company

|

Conversion in ADRs

|

07

|

5,816

|

0.00

|

0.00

|

|

Shares

|

Common

|

Direct with the Company

|

Conversion in ADRs

|

08

|

8,481

|

0.00

|

0.00

|

|

Shares

|

Common

|

Direct with the Company

|

Conversion in ADRs

|

12

|

17,061

|

0.00

|

0.00

|

|

Shares

|

Common

|

Direct with the Company

|

Conversion in ADRs

|

15

|

5,445

|

0.00

|

0.00

|

|

Shares

|

Common

|

Direct with the Company

|

Conversion in ADRs

|

25

|

20,575

|

0.00

|

0.00

|

|

|

|

|

Total Conversion ADRs (Out)

|

|

61,614

|

|

0.00

|

|

Shares

|

Common

|

Direct with the Company

|

Exerc Options

|

01

|

16,877

|

5.138373

|

86,720.32

|

|

Shares

|

Common

|

Direct with the Company

|

Exerc Options

|

01

|

52,575

|

1.092840

|

57,456.06

|

|

Shares

|

Common

|

Direct with the Company

|

Exerc Options

|

01

|

107,925

|

1.296480

|

139,922.60

|

|

Shares

|

Common

|

Direct with the Company

|

Exerc Options

|

01

|

71,150

|

3.120960

|

222,056.30

|

|

Shares

|

Common

|

Direct with the Company

|

Exerc Options

|

01

|

34,950

|

17.198000

|

601,070.10

|

|

Shares

|

Common

|

Direct with the Company

|

Exerc Options

|

01

|

79,590

|

17.840000

|

1,419,885.60

|

|

Shares

|

Common

|

Direct with the Company

|

Exerc Options

|

04

|

95,210

|

11.972000

|

1,139,854.12

|

|

Shares

|

Common

|

Direct with the Company

|

Exerc Options

|

06

|

30,125

|

9.359600

|

281,957.95

|

|

Shares

|

Common

|

Direct with the Company

|

Exerc Options

|

13

|

51,502

|

9.359600

|

482,038.12

|

|

Shares

|

Common

|

Direct with the Company

|

Exerc Options

|

13

|

33,764

|

11.972000

|

404,222.61

|

|

Shares

|

Common

|

Direct with the Company

|

Exerc Options

|

14

|

19,415

|

17.198000

|

333,899.17

|

|

Shares

|

Common

|

Direct with the Company

|

Exerc Options

|

21

|

46,000

|

3.120960

|

143,564.16

|

|

Shares

|

Common

|

Direct with the Company

|

Exerc Options

|

21

|

30,125

|

9.359600

|

281,957.95

|

|

Shares

|

Common

|

Direct with the Company

|

Exerc Options

|

21

|

45,700

|

11.972000

|

547,120.40

|

|

|

|

|

Total Sell

|

|

714,908

|

|

6,141,725.46

|

|

|

|

|

|

|

|

|

|

|

Shares

|

Common

|

Direct with the Company

|

Plan of Shares Acquisition

|

01

|

231,650

|

18.31

|

4,241,511.50

|

|

Shares

|

Common

|

Direct with the Company

|

Plan of Shares Acquisition

|

01

|

102,276

|

19.76

|

2,020,973.76

|

|

Shares

|

Common

|

Direct with the Company

|

Plan of Shares Acquisition

|

04

|

5,100

|

19.73

|

100,623.00

|

|

Shares

|

Common

|

Direct with the Company

|

Plan of Shares Acquisition

|

06

|

14,007

|

20.13

|

281,960.91

|

|

Shares

|

Common

|

Direct with the Company

|

Plan of Shares Acquisition

|

13

|

41,845

|

21.18

|

886,277.10

|

|

Shares

|

Common

|

Direct with the Company

|

Plan of Shares Acquisition

|

14

|

15,758

|

21.19

|

333,912.02

|

|

Shares

|

Common

|

Direct with the Company

|

Plan of Shares Acquisition

|

21

|

121,825

|

21.36

|

2,602,182.00

|

|

Shares

|

Common

|

Direct with the Company

|

Plan of Shares Acquisition

|

28

|

10,043

|

21.06

|

211,505.58

|

|

|

|

|

Total Buy

|

|

542,504

|

|

10,678,945.87

|

Final Balance

|

|

Securities / Derivatives

|

Securities Characteristics

(2)

|

Quantity

|

%

|

|

Same Class and Type

|

Total

|

|

Shares

|

Common

|

9,798,254

|

0.0623

|

0.0623

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

When filling in the form, delete the lines that do not have any information. If there is no acquisition/change in the position of any person in relation to Article 11 - CVM Instruction # 358/2002, send a statement with that information.

(2)

Issue/Series, convertibility, simple, term, guaranties, type/class, among others.

(3)

Quantity multiplied by price

.

INDIVIDUAL FORM

Article 11 - CVM Instruction # 358/2002

In September 2017:

( X ) the only transactions with securities and derivatives were those presented below, in compliance with Article 11 - CVM Instruction # 358/2002.

(1)

( ) no securities and derivatives operations took place, in compliance with Article 11 - CVM Instruction # 358/2002, with my securities and derivatives positions as follows.

|

Company Name: Ambev S.A.

|

|

Name: Ambev S.A.

|

CPF/CNPJ: 07.526.557/0001-00

|

|

Qualification: Outstanding Shares in Treasury

|

Initial Balance

|

|

Securities / Derivatives

|

Securities Characteristics

(2)

|

Quantity

|

%

|

|

Same Class and Type

|

Total

|

|

ADR

(*)

|

Common

|

0

|

0.0000

|

0.0000

|

Transac

tions in the month

|

|

Securities / Derivatives

|

Securities Characteristics

(2)

|

Intermediary

|

Operation

|

Day

|

Quantity

|

Price USD

|

Volume (USD)

(3)

|

|

|

|

|

|

|

|

|

|

|

ADR

(*)

|

Common

|

Direct with the Company

|

Conversion in ADRs

|

06

|

4,236

|

0.00

|

0.00

|

|

ADR

(*)

|

Common

|

Direct with the Company

|

Conversion in ADRs

|

07

|

5,816

|

0.00

|

0.00

|

|

ADR

(*)

|

Common

|

Direct with the Company

|

Conversion in ADRs

|

08

|

8,481

|

0.00

|

0.00

|

|

ADR

(*)

|

Common

|

Direct with the Company

|

Conversion in ADRs

|

12

|

17,061

|

0.00

|

0.00

|

|

ADR

(*)

|

Common

|

Direct with the Company

|

Conversion in ADRs

|

15

|

5,445

|

0.00

|

0.00

|

|

ADR

(*)

|

Common

|

Direct with the Company

|

Conversion in ADRs

|

25

|

20,575

|

0.00

|

0.00

|

|

|

|

|

Total Conversion ADRs (In)

|

|

61,614

|

|

0.00

|

|

|

|

|

|

|

|

|

|

|

ADR (*)

|

Common

|

Direct with the Company

|

Plan of Shares Acquisition

|

06

|

6,239

|

6.45

|

40,240.76

|

|

ADR (*)

|

Common

|

Direct with the Company

|

Plan of Shares Acquisition

|

07

|

34,634

|

6.46

|

223,737.04

|

|

ADR (*)

|

Common

|

Direct with the Company

|

Plan of Shares Acquisition

|

08

|

52,194

|

6.43

|

335,605.56

|

|

ADR (*)

|

Common

|

Direct with the Company

|

Plan of Shares Acquisition

|

12

|

5,714

|

6.68

|

38,170.90

|

|

ADR (*)

|

Common

|

Direct with the Company

|

Plan of Shares Acquisition

|

15

|

200,565

|

6.81

|

1,365,846.30

|

|

|

|

|

Total Buy

|

|

299,346

|

|

2,003,600.56

|

|

|

|

|

|

|

|

|

|

|

ADR

(*)

|

Common

|

Direct with the Company

|

Exerc Options

|

06

|

10,475

|

3.841600

|

40,240.76

|

|

ADR

(*)

|

Common

|

Direct with the Company

|

Exerc Options

|

07

|

40,450

|

5.531200

|

223,737.04

|

|

ADR

(*)

|

Common

|

Direct with the Company

|

Exerc Options

|

08

|

60,675

|

5.531200

|

335,605.56

|

|

ADR

(*)

|

Common

|

Direct with the Company

|

Exerc Options

|

12

|

22,775

|

1.676000

|

38,170.90

|

|

ADR

(*)

|

Common

|

Direct with the Company

|

Exerc Options

|

15

|

206,010

|

6.630000

|

1,365,846.30

|

|

ADR

(*)

|

Common

|

Direct with the Company

|

Exerc Options

|

25

|

20,575

|

1.248396

|

25,685.75

|

|

|

|

|

Total Sell

|

|

360,960

|

|

2,029,286.31

|

|

|

|

|

|

|

|

|

|

Final Balance

|

|

Securities / Derivatives

|

Securities Characteristics

(2)

|

Quantity

|

%

|

|

Same Class and Type

|

Total

|

|

ADR

(*)

|

Common

|

0

|

0.0000

|

0.0000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

When filling in the form, delete the lines that do not have any information. If there is no acquisition/change in the position of any person in relation to Article 11 - CVM Instruction # 358/2002, send a statement with that information.

(2)

Issue/Series, convertibility, simple, term, guaranties, type/class, among others.

(3)

Quantity multiplied by price

.

(*) Each ADR is equivalent to 1 (one) share.

INDIVIDUAL FORM

Article 11 - CVM Instruction # 358/2002

In September 2017:

( X ) the only transactions with securities and derivatives were those presented below, in compliance with Article 11 - CVM Instruction # 358/2002.

(1)

( ) no securities and derivatives operations took place, in compliance with Article 11 - CVM Instruction # 358/2002, with my securities and derivatives positions as follows.

|

Subsidiary Name: Ambev Luxembourg S.À.R.L.

|

|

Qualification: Position – Total Return Swap

|

Transac

tions in the month

|

|

Securities / Derivatives

|

Securities Characteristics

(1)

|

Intermediary

|

Operation

|

Day

(*)

|

Quantity

(**)

|

Price USD

|

Volume (USD)

(2)

|

|

Swap

|

Swap referenced in Shares

|

N/A

|

Total Return Swap Conclusion

|

04 (*)

|

2,363,200

|

19.7085

|

46,575,127.20

|

|

Swap

|

Swap referenced in Shares

|

N/A

|

Total Return Swap Conclusion

|

05 (*)

|

1,098,300

|

19.7490

|

21,690,326.70

|

|

Swap

|

Swap referenced in Shares

|

N/A

|

Total Return Swap Conclusion

|

27 (*)

|

1,411,700

|

20.9785

|

29,615,348.45

|

|

|

|

|

Total operation

|

|

4,873,200

|

|

97,880,802.35

|

(1)

Issue/Series, convertibility, simple, term, guaranties, type/class, among others.

(2)

Quantity multiplied by price

.

(*) In accordance with the Circular Letter/CVM/SEP/Nº07/2017, date information of the total return swap conclusion and not the date of the financial settlement of the transaction.

(**) The reported quantity is not actually related to a purchase or sale, but an economic exposure arising from the conclusion of a swap agreement on a consolidated basis, in accordance with the Circular Letter/CVM/SEP/Nº07/2017.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: October 10, 2017

|

|

|

|

|

|

AMBEV S.A.

|

|

|

|

|

|

|

By:

|

/s/

Ricardo Rittes de Oliveira Silva

|

|

|

Ricardo Rittes de Oliveira Silva

Chief Financial and Investor Relations Officer

|

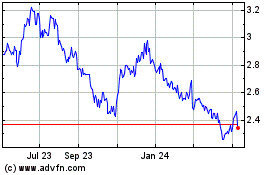

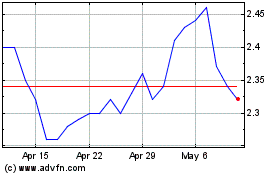

Ambev (NYSE:ABEV)

Historical Stock Chart

From Aug 2024 to Sep 2024

Ambev (NYSE:ABEV)

Historical Stock Chart

From Sep 2023 to Sep 2024