Report of Foreign Issuer (6-k)

September 13 2017 - 3:30PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13A-16 OR 15D-16 UNDER THE SECURITIES

EXCHANGE ACT OF 1934

For the month of

September, 2017

Commission File Number: 001-32199

Ship Finance International Limited

--------------------------------------------------------------------------------

(Translation of registrant's name into English)

Par-la-Ville Place

14 Par-la-Ville Road

Hamilton, HM 08, Bermuda

--------------------------------------------------------------------------------

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ X ] Form 40-F [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ________.

Note

: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ________.

Note

: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant's "home country"), or under the rules of the home country exchange on which the registrant's securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

Attached hereto as Exhibit 1 is a copy of the press release of Ship Finance International Limited (the "Company"), dated

September 13, 2017

, announcing the signing of a restructuring agreement with Seadrill Limited.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

SHIP FINANCE INTERNATIONAL LIMITED

|

|

|

|

|

|

|

|

|

Date:

|

September 13, 2017

|

By:

|

/s/ Ole B. Hjertaker

|

|

|

|

|

Name:

|

Ole B. Hjertaker

|

|

|

|

|

Title:

|

Ship Finance Management AS

|

|

|

|

|

|

(Principal Executive Officer)

|

|

EXHIBIT 1

SFL - Signing of Restructuring Agreement with Seadrill Limited

Press release from Ship Finance International Limited -

September 13, 2017

.

Ship Finance International Limited (NYSE: SFL) ("Ship Finance" or the "Company") announces that the Company and certain of its subsidiaries have entered into a restructuring agreement in connection with a comprehensive restructuring of Seadrill Limited and certain of its subsidiaries ("Seadrill").

Seadrill has filed prearranged chapter 11 cases in the Southern District of Texas together with the agreed restructuring plan. This is supported by secured lenders representing more than two-thirds of each of its secured credit facilities, approximately 40 percent of its bondholders and a consortium of investors. The Company and three of the Company's subsidiaries, who own and lease the drilling rigs West Linus, West Hercules and West Taurus to Seadrill, have also entered into the restructuring agreement.

In addition to raising $1.06 billion of new capital, Seadrill will extend and re-profile the secured bank debt and reduce leverage. The agreement should provide Seadrill with a five-year runway and a bridge to an industry recovery.

As part of the restructuring plan, Ship Finance and its relevant subsidiaries have agreed to reduce the contractual charter hire by approximately 30% for a 5-year period starting in 2018, with the reduced amounts added back in the period thereafter. The leases for West Hercules and West Taurus will also be extended for a period of 13 months until December 2024.

Concurrently, the banks who finance the three rigs have agreed to extend the loan period by approximately four years, with reduced amortization in the extension period compared to today's level. The net cash flow from the three rigs in the extension period is estimated to approximately $29 million per year, or approximately $0.08 per share per quarter, net of loan interest and amortization.

Ole B. Hjertaker, CEO of Ship Finance Management AS, said in a comment: "Seadrill has for a long period communicated the need for a restructuring of its balance sheet in order to meet its operational and financial commitments. We are very happy to see that there is strong support for the restructuring from existing stakeholders and also new money investors.

The uncertainty on timing of the restructuring and impact on our leases has been negative for us and our investors. We are happy to announce a comprehensive solution where we are an integral part and with revised terms that will facilitate continued cash flow from the three rigs. The Board adjusted the dividend in connection with the latest quarterly report in August, and we can now focus on new asset acquisitions, with the aim to build our distribution capacity going forward."

Link to information and documents relating to the Seadrill chapter 11 filing:

http://www.seadrill.com/restructuring

September 13, 2017

The Board of Directors

Ship Finance International Limited

Hamilton, Bermuda

Questions can be directed to Ship Finance Management AS:

Investor and Analyst Contacts:

Harald Gurvin, Chief Financial Officer, Ship Finance Management AS

+47 23 11 40 09

André Reppen, Senior Vice President, Ship Finance Management AS

+47 23 11 40 55

Media Contact:

Ole B. Hjertaker, Chief Executive Officer, Ship Finance Management AS

+47 23 11 40 11

About Ship Finance

Ship Finance International Limited has a unique track record in the maritime industry, being consistently profitable and paying dividends every quarter since 2004. The Company's fleet of around 70 vessels is split between tankers, bulkers, container vessels and offshore assets, and Ship Finance's long term distribution capacity is supported by a portfolio of long term charters and significant growth in the asset base over time.

More information can be found on the Company's website: www.shipfinance.bm

Cautionary Statement Regarding Forward Looking Statements

This press release may contain forward looking statements. These statements are based upon various assumptions, many of which are based, in turn, upon further assumptions, including Ship Finance management's examination of historical operating trends. Although Ship Finance believes that these assumptions were reasonable when made, because assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond its control, Ship Finance cannot give assurance that it will achieve or accomplish these expectations, beliefs or intentions.

Important factors that, in the Company's view, could cause actual results to differ materially from those discussed in this presentation include the strength of world economies and currencies, general market conditions including fluctuations in charter hire rates and vessel values, changes in demand in the tanker market as a result of changes in OPEC's petroleum production levels and worldwide oil consumption and storage, changes in the Company's operating expenses including bunker prices, dry-docking and insurance costs, changes in governmental rules and regulations or actions taken by regulatory authorities, potential liability from pending or future litigation, general domestic and international political conditions, potential disruption of shipping routes due to accidents or political events, and other important factors described from time to time in the reports filed by the Company with the United States Securities and Exchange Commission.

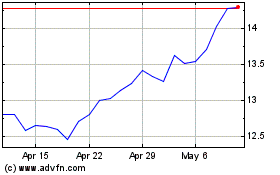

SFL (NYSE:SFL)

Historical Stock Chart

From Aug 2024 to Sep 2024

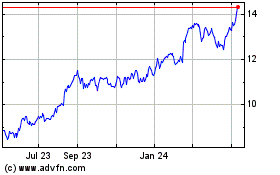

SFL (NYSE:SFL)

Historical Stock Chart

From Sep 2023 to Sep 2024