Will Polkadot Accept This Major Request From A RWA Platform? DOT Down 65%

September 10 2024 - 3:30PM

NEWSBTC

Centrifuge, a real-world asset (RWA) solution and a Parachain, has

a plan for Polkadot, a smart contracts platform. In a proposal, the

RWA platform suggests that the newly created Polkadot Community

Foundation allocates $3 million USDC to their T-Bill pool. This

pool is held within the Anemoy Liquid Treasury Fund and aims to

serve multiple objectives. Centrifuge Wants Polkadot To Invest $3

Million In T-Bills In their proposal, allocating the $3 million to

T-Bill as an investment will benefit the broader ecosystem. Of

note, it will help boost the long-term sustainability of the

Polkadot Treasury. This is because the T-Bill pool will generate

stable yields from real-world assets, thereby further increasing

the financial health of the Treasury. Related Reading: Cardano

Foundation Reports Massive Growth In These Key Metrics – ADA Price

Soars 3% Though the funds will be from the foundation, Centrifuge

argues that injecting the $3 million USDC into the T-Bill pool will

help increase the network’s total value locked (TVL). Subsequently,

this will also expand the Treasury’s assets. The foundation might

consider investing in RWAs, as proposed by Centrifuge, as it could

foster the growth of this technology within Polkadot, pushing

adoption and growth as a result. Laying out their proposal,

Centrifuge said if the foundation decides to invest, it would align

with their previous investment in the Anemoy Liquid Treasury Fund.

In turn, this may offer a unique opportunity for Polkadot to

diversify and expand its investment basket. It is especially now

that tokenization and RWA is picking up momentum. RWA Picking Up

Steam, Will DOT Reverse Losses? BlackRock, one of the top asset

managers in the world, is one of the leaders in tokenizing treasury

bills. On Ethereum, the manager has launched BUIDL, a platform

where institutions can invest in tokenized Treasury bills. As of

September 10, BUIDL is the largest tokenized Treasuries provider,

managing over $514 million, according to RWA.xyz. The

proposal is so far garnering community support. Roughly a week

before the decision, over 53% agreed with this proposal. However,

some community members are expressing concerns. Related Reading:

Ethereum Sees Massive Outflows from Derivatives: What Does This

Mean For ETH? Most of them point to the potential risks and the

negative implications of this on the network’s Treasury. One

concern is that if this is approved, it could increase DOT spending

requests, eventually depleting its reserves. While the prospect of

RWA taking off in Polkadot is bullish, DOT is still under pressure.

From the daily chart, DOT is down roughly 65% from March highs. It

is also in a descending channel and retesting multi-month

support. The primary support lies at around

$3.5. On the upper end, resistance is at $5. A break above this

line will lift sentiment, propelling the coin towards $6.5 in a buy

trend continuation formation. Feature image from Unsplash, chart

from TradingView

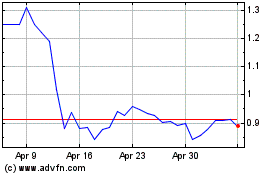

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Aug 2024 to Sep 2024

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Sep 2023 to Sep 2024