U.S. Index Futures Modestly Higher Before Key Economic Data Release; Early Closure for July 4th Holiday

July 03 2024 - 7:01AM

IH Market News

U.S. index futures are modestly higher this Wednesday, with

investors awaiting a series of significant economic data. U.S.

markets will close early today at 1 PM and remain closed on

Thursday due to the July 4th holiday.

At 6:21 AM, Dow Jones futures (DOWI:DJI) were up 47 points, or

0.12%. S&P 500 futures advanced 0.02%, and Nasdaq-100 futures

gained 0.05%. The 10-year Treasury yield stood at 4.429%.

In the commodities market, West Texas Intermediate crude oil for

August fell 0.05% to $82.77 per barrel. Brent crude oil for

September rose 0.01%, close to $86.25 per barrel. The American

Petroleum Institute (API) reported that crude oil inventories fell

by 9.2 million barrels in the previous week.

The most-traded iron ore contract on the Dalian Commodity

Exchange (DCE) rose 2.55% to $118.79 per metric ton. Benchmark iron

ore for August SZZFQ4 on the Singapore Exchange rose 3.1% to

$113.35 per ton.

Wednesday’s U.S. economic indicator schedule begins at 8:15 AM

with the ADP employment report for June. At 8:30 AM, the Commerce

Department will release the May trade balance. At the same time,

8:30 AM, the Labor Department will report weekly jobless claims for

the week ending last Saturday.

At 9:45 AM, S&P Global will present the revised reading of

the June services sector Purchasing Managers’ Index (PMI). Factory

orders for May will be released at 10 AM by the Commerce

Department. Also at 10 AM, the ISM Services Index for June will be

published by the ISM. At 10:30 AM, the Department of Energy (DoE)

will reveal last week’s crude oil inventory status. Finally, at 2

PM, the Federal Reserve will release the minutes of the last

Federal Open Market Committee (FOMC) meeting.

Asia-Pacific markets mostly rose on Wednesday after a series of

regional data releases. Japan’s composite PMI fell to 49.7 in June

from 52.6 in May, indicating the first contraction in Japan’s

private sector in seven months. China’s Caixin services PMI

registered 51.2 in June, slowing from the previous month (54.0).

Additionally, Alibaba (NYSE:BABA) announced plans

to repurchase 613 million of its own shares for a total of $5.8

billion in the quarter ending in June.

Japan’s Nikkei 225 rose 1.26% to 40,580.76 points, while South

Korea’s Kospi advanced 0.47% to 2,794.01 points, and the Kosdaq

rose 0.75% to 836.1 points. Hong Kong’s Hang Seng climbed 1.14%,

driven by real estate stocks, while Australia’s S&P/ASX 200

closed up 0.28%. In India, the BSE Sensex and Nifty 50 reached new

all-time highs. Conversely, China’s Shanghai Composite Index fell

by 0.49%.

European stock markets are operating higher on Wednesday, with

the Stoxx 600 index led by technology stocks. Among individual

stocks, Maersk (TG:DP4B) shares are up 2.7% after withdrawing from

sales negotiations with DB Schenker. Investors are closely watching

the parliamentary elections in the United Kingdom, with

expectations of a victory for the Labour Party.

On Tuesday, U.S. stocks rose after an uncertain start. The Dow

Jones advanced 0.41%, and the Nasdaq gained 0.84%. The S&P 500

rose 0.62% to close above 5,500 points, its 32nd record this year.

Falling bond yields boosted gains despite concerns about interest

rates following Powell’s speech and the JOLTS report.

The Labor Department reported 8.140 million job openings in May,

an increase of 221,000 from the previous month. Redbook Research

showed a 5.8% increase in the Redbook Index for the week ending

June 29 compared to the same period last year. Powell mentioned

progress on inflation but stated the need for more evidence before

considering lowering interest rates. Among individual stocks,

Tesla (NASDAQ:TSLA) shares closed up 10% after

reporting higher-than-expected sales, AMD

(NASDAQ:AMD) rose 4.2%, while Nike (NYSE:NKE) and

Nvidia (NASDAQ:NVDA) ended lower.

On the earnings front, Constellation Brands

(NYSE:STZ) will report before the market opens.

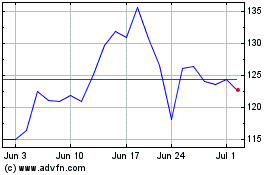

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Jun 2024 to Jul 2024

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Jul 2023 to Jul 2024