TIDMXLM

RNS Number : 4007X

XLMedia PLC

19 December 2019

19 December 2019

XLMedia PLC

("XLMedia" or the "Group" or the "Company")

Business and Trading Update

XLMedia (AIM: XLM), a leading global digital performance

publisher, today outlines a number of strategic initiatives

following an internal review initiated by Stuart Simms, who was

appointed Chief Executive Officer of the Group on 2 October 2019,

and updates on trading for the remainder of 2019 and the full year

to 31 December 2020.

The key elements of this internal review centre on the Group's

operating model, organisational structure and culture.

Over the past two months, this ongoing review has assessed the

core operational base of the business, including both scale and

commercial responsiveness, with the resulting conclusion that the

Group will require increasing expenditure in 2020 in order to

support sustainable growth in the medium term. These new

initiatives are aimed at strengthening the Group's core business,

mitigating ongoing regulatory headwinds and better positioning the

Group for growth.

The following decisions were taken to strengthen the foundations

for the Group's wider growth aspirations:

-- To invest in and expand the Group's global publishing activities

XLMedia has over 13 years' experience as a technology-driven,

online performance publisher and operates over 2,000 content rich

websites across sectors. The Group's core skill is the creation of

consumer engagement. The Group monetises online content by sending

paying users to its partners and gets paid based on the value it

brings to those partners through performance-based models. As a

global business, XLMedia will seek to further deploy its online

real estate and market knowledge to expand its geographical

footprint in areas such as North and Latin America and APAC, and to

broaden its growth potential.

Owning strong publishing assets puts the Group in a position to

create better engagement and results than other traditional

performance marketing, whereby consumers actively choose the

content they want to consume, generating both greater value and

increased levels of engagement.

To facilitate this expansion, management will increase its spend

beyond historical budgets, in both new and existing online

properties, to invest organically in the business alongside

actively seeking acquisitions. This new initiative is designed to

increase exposure and traffic in new territories in addition to

improving engagement in existing territories through improved

functionality, rich content and design. Ultimately, the Group aims

to both extend its geographic reach and expand into new verticals,

which complement the Group's existing focus on gaming, gambling,

personal finance and sports betting.

-- To initiate a detailed review on the Group's technology

platform to leverage data and AI opportunities more effectively

Going forward, the Company will seek to leverage opportunities

that exist around smart data analysis and AI more effectively in

order to deliver appropriate content and offers to consumers which,

in turn, bring value to XLMedia's partners. A thorough review will

be conducted in the next three months and the Company will re-focus

its technology investments based on its findings.

-- To implement a transformation plan aimed to evolve the

Group's operating model and people strategy

The plan is to review and address shortcomings of the current

operating model through a structured program of transformation

which will review, and evolve as necessary, all areas of the

business. There are many talented people in the business and the

review will have a particular focus on our employees and how best

to retain and nurture talent. Management aims to implement a

progressive people strategy, which complements the wider efforts to

leverage both existing data and AI platforms. Immediate changes

have already been made through eliminating executive positions

which were held both at headquarter and at subsidiary levels, now

operating with a unified, aligned executive team. These

transformation costs are estimated to be c.$3 million in aggregate

across 2019 and 2020.

Trading update

Trading for the year ended 31 December 2019 has been broadly

consistent with previous guidance, with management focused on the

planning and execution of the transformation strategy aimed at

evolving the business for sustainable growth. The Board expects the

Group to deliver consolidated revenues of c.$78 million and

adjusted EBITDA(1) to be c.$32 million for the year ending 31

December 2019.

Management remains encouraged by the US sports betting markets

as they continue to regulate. The Group has already built a number

of websites, is engaged with US users across multiple states, and

is in the process of expanding its local presence. In addition, the

Group is actively looking for acquisition opportunities to

accelerate its expansion into this important market.

Regulatory headwinds highlighted earlier in the year are

expected to continue to create trading uncertainty for XLMedia, and

the review has been central in addressing the future

diversification of the Group's revenue base. However, in the longer

term, the board believes that fully regulated markets will provide

better, sustainable conditions in which to operate.

As a result of the implementation of the initiatives outlined

above, the Group will incur a greater level of direct costs

(investment in core capabilities / assets / new markets) than was

budgeted for in 2020 financial year, in addition to one off

transformation costs which are estimated to be c.$3 million in

aggregate across 2019 and 2020.

The combination of increased spend on direct costs to support

growth, further predicted regulatory headwinds and implementation

of a transformation plan which prepares XLMedia for the next phase

of growth means the Board is today also updating market guidance

for the year ending 31 December 2020.

The initiatives outlined above are proactive measures designed

to benefit the business in the longer term. As a result of those

measures, the investment and costs budgeted for 2020 are

significantly higher than previously anticipated and will

consequently impact the overall performance of the Group.

Therefore, despite revenues for the year ending 31 December 2020

expected to remain broadly stable versus 2019, adjusted EBITDA is

anticipated to be materially lower than previous management

expectations.

Stuart Simms, Chief Executive Officer of XLMedia, commented:

"Having now spent a couple of months immersed in the business, I

am excited to be leading it towards the next phase of growth.

Whilst there are some clear near-term headwinds and operating

issues (similar in many other companies of our size and stage of

development), our core expertise, assets and market presence remain

incredibly strong.

"We have already identified and are investing in market

opportunities which will generate sustainable growth in the future.

I look forward to the coming months to continue to evolve our

strategy, progress with the transformation program and execution of

our strategic plan."

The information contained within this announcement (the

"Announcement") is deemed by the Company to constitute inside

information as stipulated under the Market Abuse Regulation (EU)

No. 596/2014. Upon the publication of this Announcement via a

Regulatory Information Service, this inside information is now

considered to be in the public domain.

For further information, please contact:

XLMedia plc Stuart Simms, Group Chief Via Vigo Communications

Executive Officer Liat Hellman, Acting

Group Chief Financial Officer www.xlmedia.com

Vigo Communications Jeremy Garcia / Fiona Tel: 020 7390 0233

Henson / Fiona Norman www.vigocomms.com

Cenkos Securities plc (Nomad and Joint Tel: 020 7397 8900

Broker) Giles Balleny / Max Gould www.cenkos.com

Berenberg (Joint Broker) Chris Bowman Tel: 020 3207 7800

/ Mark Whitmore / Simon Cardron www.berenberg.com

(1) Adjusted EBITDA - Earning before interest, taxes,

depreciation and amortisation and excluding share based

payments

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTGGGPPPUPBGBR

(END) Dow Jones Newswires

December 19, 2019 02:00 ET (07:00 GMT)

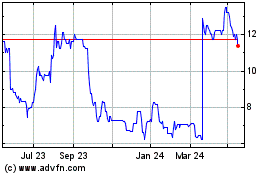

Xlmedia (LSE:XLM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Xlmedia (LSE:XLM)

Historical Stock Chart

From Jul 2023 to Jul 2024