TIDMWTI

RNS Number : 2187W

Weatherly International PLC

31 July 2018

31 July 2018

The information contained within this announcement is deemed by

the Company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No. 596/2014. Upon the publication of

this announcement via the Regulatory Information Service, this

inside information is now considered to be in the public

domain.

Weatherly International plc (AIM:WTI)

("Weatherly" or the "Company")

Publication of Administrators' Statement of Proposals and Change

of Registered Office

Further to the Company's announcement on 1 June 2018 detailing

the appointment of Administrators, Weatherly announces that the

Administrators' Statement of Proposals can be found at the

following website:

https://www.fticonsulting-emea.com/cip/weatherly-international-plc

Pursuant to Paragraph 49(6) of Schedule B1 of the Insolvency Act

1986 (as amended), should you wish to receive a copy of the

Statement of Proposals free of charge, please write to the

Company's registered office at: Weatherly International plc, C/O

FTI Consulting LLP, 200 Aldersgate St, London EC1A 4HD.

The key conclusions of the Administrators' Statement of

Proposals are set out below:

"Secured creditors

At the date of appointment, the Secured Lenders were owed

approximately $126m by the Group. WTI is a guarantor of this debt.

The Secured Lenders hold security dated 7 May 2015 over the Group.

As a result, the Secured Lenders have security over all of the

Groups assets, which includes fixed and floating charges.

The return to the Secured Lenders is currently uncertain.

Preferential creditors

Under the Act the main classes of preferential creditor are

employees in respect of certain claims in relation to arrears of

wages, holiday and pensions contributions.

The Administrators have paid retained staff their wages to the

date of their redundancy. Consequently, there are not anticipated

to be any arrears of wages claims. However, it is anticipated that

there may be claims in respect of accrued but untaken holiday

pay.

We are currently awaiting confirmation from the RPS of the level

of preferential claims against the Company. We currently envisage

that there will be no funds available to make a distribution to

preferential creditors.

Unsecured creditors

Unsecured creditors rank behind both secured and preferential

creditors. Under Section 176A of the Act where after 15 September

2003 the Company has granted a creditor a floating charge, a

proportion of the net property of the company achieved from

floating charge asset realisations must be made available for the

unsecured creditors ("the Prescribed Part").

There are unlikely to be sufficient funds to repay the Secured

Creditors, therefore returns to unsecured creditors would only

potentially come from the Prescribed Part, up to a maximum of

GBP600k.

We currently have insufficient information to estimate the

likely size of the Prescribed Part and the return to unsecured

creditors, given that calculation is subject to the total level of

floating charge realisations, the costs of realisations and the

cost of paying preferential creditors, all of which remain

uncertain.

However, given the information that we have to date it is

unlikely that there will be a dividend to unsecured creditors.

Shareholders

As it is unlikely that there will be sufficient assets to repay

the Company's creditors in full it is highly unlikely that there

will be any return or distribution to shareholders.

Administrators' proposals

The main purpose of the Administration is statutory objective b,

achieving a better outcome for each of the Company's creditors as a

whole than would be possible if the Company were wound up without

first being in Administration.

The Administrators are seeking a decision from the creditors to

approve the proposals using the deemed consent procedure.

If a creditor agrees with the proposed decision to approve the

proposals, then they do not need to do anything. Unless 10% of

creditors, who would be entitled to vote at a qualifying decision

procedure, object to the decision to approve the proposals they

will automatically be approved on 8 August 2018.

If a creditor wishes to object to the decision, send notice of

objection so that it is received by no later than 23.59 hours on 8

August 2018. If a creditor has not already submitted proof of their

debt, they should complete a proof of debt form. Objections by a

creditor will not count unless they have lodged a proof of debt by

no later than 23.59 on 8 August 2018.

It is the Administrators' responsibility to determine whether

any objections received are sufficient for this Deemed Consent

Procedure to end without a decision being made. If sufficient

objections are received, then the administrator will write to

creditors to seek approval for this decision using a qualifying

decision process.

In order to provide clarity to creditors on the further specific

areas for which the Administrators are seeking approval in their

Proposals specific proposals are set out below, which apply to the

Company.

Proposed Strategy, Actions and Activities

The Administrators will continue to manage the affairs of the

Company in order to achieve the purpose of the Administration.

The Administrators will be authorised to:

-- Do all such other things and generally exercise all of their

powers as contained in Schedules B1 and 1 of the Act, as the

Administrators consider desirable or expedient to achieve the

statutory purpose of the Administration.

-- Investigate and as appropriate pursue any claims the Company may have.

-- Agree the claims of the secured, preferential and unsecured

creditors against the Company unless they conclude, in our

reasonable opinion, that the Company will have no assets available

for distribution.

-- Distribute funds to the secured, preferential creditors and

unsecured creditors as and when claims are agreed and funds and

circumstances permit.

Creditors Committee

Creditors have been invited to determine whether to form a

Creditors' Committee. To enable the creditors to make an informed

decision as to whether they wish to either seek to form a

Committee, or to nominate themselves to serve on a Committee,

further information about of the role of the Committee and what

might be expected from its members has been prepared by R3 has been

made available to creditors.

In the event the creditors of the Company so determine, a

creditors committee be appointed comprising of not more than five

and not less than three creditors.

Proposed Exit Routes

The most likely exit route for the Company is moving to

dissolution after the completion of its Administration.

Once all assets have been realised, and if there are no funds

available to enable a distribution to the unsecured creditors

(other than the Prescribed Part) and a liquidation process is not

required, the Administrators shall file a notice pursuant to

Paragraph 84 of Schedule B1 to the Act together with their final

progress report at Court and with the Registrar of Companies for

the dissolution of that company.

In the event that the Administrators believe liquidation to be

the most appropriate route for a company, for example if there are

onerous assets that need to be disclaimed, or there are matters

that require further investigation, we will exit the Administration

of that company by a compulsory liquidation. The Administrators

give notice that on such a petition the Joint Administrators will

seek their appointment as liquidators pursuant to Section 140 of

the Act, with any liquidator being able to undertake acts required

or authorised under any enactment individually. The creditors are

entitled to nominate a different person as the proposed liquidator,

provided that the nomination is made after the receipt of these

proposals and before the proposals are approved.

Discharge of Administrators

The Administrators will be discharged from liability in

accordance with Paragraph 98(1) of Schedule B1 of the Act

immediately upon our appointment as Administrators ceasing to have

effect.

Administrators' Remuneration

The creditors committee, if one is appointed, will be asked to

agree that the basis of the Administrators' remuneration be fixed

by reference to the time properly given by the Administrators' and

their staff in attending to matters arising in the Administration,

calculated at the prevailing standard hourly charge out rates used

by FTI at the time when the work is performed, plus VAT, and be

asked to agree any category 2 expenses.

If a creditors' committee is not appointed, the Secured Lender

(and preferential creditors if applicable) of the relevant company

shall be asked to fix the basis of the Administrators' remuneration

in accordance with Rule 18.18 of the Rules, to be fixed by

reference to the time properly given by the Administrators' and

their staff in attending to matters arising in the Administration,

calculated at the prevailing standard hourly charge out rates used

by FTI at the time when the work is performed, plus VAT."

Any other enquiries regarding the Company or its administration

should be directed to WTIshareholders@fticonsulting.com.

In addition, the Company confirms that it has changed its

registered office to C/O FTI Consulting LLP, 200 Aldersgate St,

London, EC1A 4HD.

Additional Statutory Information Pursuant to Rule 3.37 of the

Insolvency (England and Wales) Rules 2016

Registered Office: C/O FTI Consulting LLP, 200 Aldersgate St,

London, EC1A 4HD

Court Reference: CR-2018-4537

Court High Court of Justice, Business and Property Courts of

England and Wales Insolvency and Companies List (ChD)

Further announcements will be made as required.

For further information please contact:

FTI Consulting LLP +44 (0) 20 3727 1418

(Administrators)

Simon Kirkhope / Andrew Johnson

Strand Hanson Limited +44 (0) 20 7409 3494

(Nominated Adviser & Broker)

Rory Murphy / James Dance / Jack Botros

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCFKKDDABKDBON

(END) Dow Jones Newswires

July 31, 2018 02:00 ET (06:00 GMT)

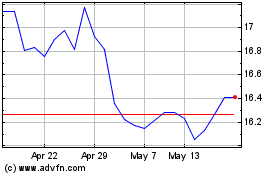

Wti Oil Etc (LSE:WTI)

Historical Stock Chart

From Nov 2024 to Dec 2024

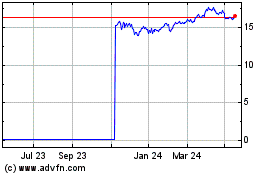

Wti Oil Etc (LSE:WTI)

Historical Stock Chart

From Dec 2023 to Dec 2024