TIDMVIN

RNS Number : 0232S

Value and Income Trust plc

01 November 2019

VALUE AND INCOME TRUST PLC

Unaudited Half-Yearly Financial Report

For The Six Months Ended 30 September 2019

Summary

30 September 2019 31 March 2019 30 September 2018

Group net asset value

per share

(valuing debt at market) 316.73p 312.16p 330.46p

========================= ================= ===================== =================

Group net asset value

per share

(valuing debt at par) 337.71p 332.45p 349.70p

========================= ================= ===================== =================

Share price (mid) 249.00p 251.00p 265.50p

========================= ================= ===================== =================

Dividend per share 5.8p 11.8p 5.6p

(first and second (total) (first and second

interim) interim)

========================= ================= ===================== =================

Value and Income Trust PLC ('VIT') is a specialist investment

trust whose shares are listed on the London Stock Exchange. VIT

invests in higher yielding, less fashionable areas of the UK

commercial property and equity markets, particularly in medium and

smaller sized companies. VIT aims for long-term real growth in

dividends and capital values without undue risk.

Over the six months ended 30 September 2019, VIT's share price

fell by 0.8% while the net asset value per share, valuing debt at

par, increased by 1.6%. The FTSE All-Share Index rose by 2.1% over

the half year. VIT's property portfolio was revalued independently

at 30 September 2019.

The Company announced on 11 September 2019 the dates of the

quarterly dividends for the year to 31 March 2020. The first

quarterly dividend of 2.9p per share was paid on 25 October 2019 to

all shareholders on the register on 27 September 2019. The second

quarterly dividend of 2.9p per share will be paid on 31 January

2020 to those shareholders on the register on 3 January 2020. The

ex-dividend date will be 2 January 2020.

The third quarterly dividend of 2.9p per share will be paid on

24 April 2020 to those shareholders on the register on 27 March

2020. The ex-dividend date will be 26 March 2020. The Board will

announce in due course the proposed fourth and final payment for

the year which, subject to shareholder approval, will be paid on or

around 31 July 2020.

SUMMARY OF PORTFOLIO

30 September 2019 31 March 2019 30 September 2018

GBPm % GBPm % GBPm %

UK Equities 129.5 64 128.7 64 135.7 65

=================== =========== ====== ========= ==== =========== ======

UK Property 71.3 35 68.8 34 67.9 32

=================== =========== ====== ========= ==== =========== ======

Net current assets 2.9 1 3.8 2 5.6 3

=================== =========== ====== ========= ==== =========== ======

203.7 100 201.3 100 209.2 100

=================== =========== ====== ========= ==== =========== ======

ENQUIRIES: Patrick Harrington

OLIM Limited, Investment Manager, Equities

Tel: 020 7367 5660

Website: www.olim.co.uk

Louise Cleary

OLIM Property Limited, Investment Manager,

Property

Tel: 020 7647 6701

Website: www.olimproperty.co.uk

Investment Managers' Reports

UK Equities

The Market

Over the six month period to the end of September 2019, the UK

stock market, as measured by the FTSE All-Share Index, rose by 2.1%

and, including dividends, the total return was 4.5%. The market has

traded within a well-defined range over the first half of VIT's

year. It rose fairly steadily in the early months before peaking in

late July. Since then the market has fallen back as economic growth

and Brexit concerns have come to the fore, although the share

prices had rebounded somewhat from their August low point by the

end of September.

Within the UK market, large companies, measured by the FTSE 100

Index, rose by 1.8%, whilst the more domestically focussed FTSE 250

Index of mid-sized companies rose by 4.3%, driven in part by a

number of high profile takeover bids from overseas buyers. The FTSE

World Index rose by 3.1%, measured in dollars. Once again, world

markets were led by the US, where the S&P 500 index rose by

5.0%, and by the German market, which rose by 7.8% in local

currency over the six month period. Elsewhere in the world market

performances were more subdued, with a fall of 5.0% recorded on

average in Asian markets, which were unsettled by the unrest in

Hong Kong, and a 4.5% fall in the FTSE All Emerging All-Cap

Index.

The modest rise in share prices in September was triggered by

coincident monetary easing by many of the world's central banks. In

particular, the US Federal Reserve cut interest rates twice over

the course of the summer and the European Central Bank (ECB)

resumed its bond buying programme. Falling interest rates prompted

a strong rally in bonds and the benchmark US ten year bond yield

closed September at just 1.7%, over seventy basis points lower than

at the end of March and in the same period ten year UK gilt yields

fell by fifty basis points to 0.5%, well below the prevailing rate

of UK inflation. In the currency markets the pound weakened against

most currencies as the risk of a "no-deal" Brexit was perceived to

have increased, despite parliamentary efforts to block this

outcome. During the period the pound fell by 5.7% against the

dollar and 3.0% against the Euro to finish the period at GBP1:$1.23

and GBP1:EUR1.13. Commodity prices were generally weak as economic

growth expectations declined; copper and oil both fell by over 10%,

although oil briefly rallied after the attacks on the Saudi Arabian

oil facilities.

Performance

VIT's equity portfolio modestly outperformed over the half year

with a total return of +4.8% compared to the FTSE All Share Index

Return of +4.5%. This was despite a difficult background for

high-yielding shares; the FTSE Higher Yield Index underperformed

the FTSE All Share Index by around 4% in capital terms in the

period. In broad terms, asset allocation between sectors was the

main positive, whilst stock selection was a small negative

influence. The main positive sector influences were the underweight

positions in Tobacco and Oil Producers and the overweight in

Personal Goods, although these were somewhat offset by the

underweight position in Pharmaceuticals. In stock selection terms

mid-caps were generally strong with good performances coming from

Beazley (+21%), Restaurant Group (+21%), Marston's (+20%) and

Babcock International (+13%). Vodafone (+16%) also outperformed

after announcing plans to dispose of its tower assets. These good

performances were partially offset by weakness in some of the

Trust's financial holdings including Lloyds Banking Group (-13%)

and Legal & General (-10%). BT (-20%) and Cineworld (-22%) were

also weak.

VIT's Portfolio

We continued to make a relatively significant level of changes

to the portfolio in the half year with the aim of improving the

overall yield and growth prospects of the investments. For new

investments, particular attention is being paid to the companies'

underlying growth, their balance sheet strength and their level of

cash generation. During the half year we made complete sales of

Johnson Matthey, where we have become concerned about the longer

term outlook for the company's diesel engine related activities,

and Centrica, which has faced increasingly difficult markets with

the result that it cut its dividend (announced well after the

disposal was made). We also took profits in a number of stocks that

are now low yielding after having performed well including Beazley,

Croda International, Spectris and Unilever.

Using the monies raised we started new holdings in PayPoint and

FDM Group. PayPoint is a payments and transaction services business

focussed on convenience retailers whilst FDM is an international IT

consultancy business. Both companies have attractive cash

generation characteristics, generate high returns on capital

employed and have strong balance sheets. Whilst FDM has the

stronger dividend and earnings growth record, PayPoint is

supplementing its ordinary dividend with regular special payments.

We also added to existing holdings including Lloyds Banking Group,

ITV, Royal Dutch Shell, DS Smith and Phoenix Group, all on an

attractive yield basis.

In total, GBP10.7m of sales were made against GBP9.4m of

purchases meaning we made net sales of approximately GBP1.3m and we

will be looking to invest this small effective cash balance in due

course.

Outlook

Globally, economic growth is slowing, particularly in Europe.

President Trump's trade policies have raised the risks in the world

economy, with particular anxiety about the impact of his proposed

tariffs on Chinese and European goods, though so far these have not

been too extensive. GDP growth in America has moderated to an

annual rate of 2% as the impact of the 2018 tax cuts has

evaporated, but the Federal Reserve has reacted by cutting interest

rates and signalled that further cuts are likely and that it will

resume Quantitative Easing (QE). The ECB has also restarted its

programme of bond buying in an effort to boost flagging Eurozone

growth. Despite all the uncertainty surrounding Brexit, the UK

economy has continued to grow at a reasonable pace. Whilst the

reported annual growth to the end of June of 1.3% is below the

long-term average it shows the UK economy is some way from a

recession.

The labour markets in both the USA and the UK have continued to

tighten, with unemployment in both areas at the lowest levels for

more than 40 years. This has led to a rebound in the rate of wage

growth in the UK, which has now reached 4%. This is well ahead of

inflation and should provide significant support to consumer

spending. Despite all the difficulties and threats to world

stability, forecasts for global growth in 2019 remain at around 3%

with a slight acceleration expected in 2020. In the UK, economic

growth is slowing but not as fast as many economists have

predicted. The ongoing Brexit saga is clearly affecting confidence

in some areas and current UK growth expectations for 2019 as a

whole remain fairly subdued at 1.3%. The Bank of England has not

changed interest rates for over a year after increasing them once

in 2017 and once in 2018. Given the cuts elsewhere in the world,

pressure is clearly growing on the Bank to reduce rates, especially

given the uncertainty surrounding Brexit. Unfortunately, Brexit

remains the predominant topic of politics and the UK Parliament is

currently paralysed as a result, although the forthcoming General

Election may resolve this. At the time of writing, the Prime

Minister has sought an extension to the Article 50 process which

has been granted and which will delay the country's departure once

more. This may be advantageous from an economic perspective, but

the General Election adds new uncertainties. The likelihood of a

hard-left Labour administration appears to be diminishing, in part

due to the Labour Party's equivocation over Brexit.

The valuation of the UK equity market at the end of VIT's half

year of 12.7x earnings for the current 2019 year, falling to 11.8x

for 2020 (source: Bloomberg) looks attractive and is below the

long-term average. Furthermore, the average yield of 4.2% looks

compelling, especially when compared with gilt yields and cash

returns, which remain well below the current rate of inflation. To

the overseas investor the UK looks good value compared to overseas

markets, with the pound trading at a severely reduced exchange rate

since the EU Referendum in June 2016. As a consequence of this we

have seen a number of bids for UK companies including the recently

announced takeover of Greene King by a well-known Hong Kong based

investor. Until the shape of Brexit is determined, much uncertainly

will overhang our market but we do believe that investors will take

advantage of the low valuation once the future of our relationship

with Europe has been resolved.

Patrick Harrington

OLIM Limited

1 November 2019

Investment Managers' Reports

Property

The Market

UK commercial property capital values turned down a year ago and

are continuing to slip on unprecedently low transaction volumes -

barely two-thirds of their long-term averages. Most UK

institutional property investors have looked like rabbits caught in

the headlights of an oncoming Brexit train. Retail, office and

industrial investment turnover so far in 2019 has been well down,

with only the newer alternatives sector bucking the trend, with

transactions actually ahead of 2018 levels.

Valuers have been surprisingly slow to address weakness in high

street shops, shopping centres and retail warehouses. Retail

capital and rental values started falling two years ago but

valuations are still well behind the curve on rental value falls,

which are now accelerating and dragging capital values down

further.

The MSCI Quarterly Property Index, the most representative

recent measure of the performance of institutional investment

property portfolios, showed a total return of only 0.8% over the

six months to end September and 1.3% for calendar 2019 to date.

UK Commercial Property - Average Annual

% Growth Rates to September 2019

3 Months 6 Months 1 Year 3 Years 5 Years 10 Years

Capital Values -2.8 -3.4 -2.2 +1.7 +2.7 +3.6

============================= ======== ======== ====== ======= ======= ========

Rental Values +0.2 +0.4 +0.1 +1.2 +2.0 +1.0

============================= ======== ======== ====== ======= ======= ========

Total Returns +2.0 +1.6 +3.1 +6.0 +8.4 +10.1

============================= ======== ======== ====== ======= ======= ========

Source: MSCI Quarterly Index

- Annualised

A flight to property safety continues, with a widening gulf

between safe, long-let property and the rest of the market. There

are almost no UK institutional buyers at any price now for retail

warehouses, shopping centres or high street shops unless they

present real redevelopment opportunities for alternative use, and

potential hedge fund or opportunistic buyers are still only window

shopping. Company Voluntary Arrangements (CVAs), even at profitable

retail groups, have hammered values across the board and there will

be many more retail company failures and shops closing over the

next few years. Last year there were net closures of 7,500 retail

units in Great Britain, against net openings of 3,000 five years

before and the stream of CVAs and bankruptcies is turning into a

tsunami. On-line's share of non-food retail spending is forecast to

rise from 19% today to 34% in 5 years' time and over 50% in 8-10

years' time, and retail property investment volumes are down by

two-thirds since 2016. Even the strongest retailers are now

demanding rent reductions on existing leases from landlords who are

conceding deep rent cuts in CVAs to their competitors trading

nearby.

Only one retail sector is bucking the trend - supermarkets -

where the high quality of income from the strong main operators on

long, often index-linked leases, is proving attractive to investors

fleeing the non-food retail storm. Even here however, over-rented

and over-sized supermarkets are falling in value.

Office values in general edged ahead in 2018, with rental growth

in the big provincial cities and a handful of trophy purchases of

long-let large buildings, mainly by Far Eastern buyers, propping up

the London office market despite downward pressure on rents. But

Brexit uncertainty has now frightened off some overseas buyers and

made many large as well as smaller companies take serviced office

space rather than sign long leases. WeWork (a serviced office

operator where their sub-tenants can leave when they like) have

signed long leases on over 4 million square feet, about a tenth of

all new Central London office lettings, over the past 4 years. Over

GBP300 million a year of WeWork London office rental income is at

risk if WeWork run out of cash following their failed float. London

office capital and rental values will fall over the next year.

Provincial office values should be more resilient, underpinned by

some rental growth.

Warehouse/industrial property has been the star performer over

the past two years. The structural shift from bricks and mortar to

online retailing has driven up rents both for large distribution

depots near motorway junctions and smaller warehouse units for

"last mile" local deliveries. But investor demand has forced

investment valuation yields for industrial/warehouse property down

below retail and office yields for the first time since reliable

yield records began forty years ago - and, more seriously, to a

yield level even lower than at the property market peak in 2007.

Any further growth in industrial/warehouse values in 2019/20 will

therefore only be in those areas where rising rents more than

offset adverse valuation yield movements.

Most other types of investment property now (usually called

"alternatives" in the property market), such as hotels, pubs,

cinemas, bowling, bingo, petrol filling stations/ convenience

stores, healthcare and educational property, should continue to

outperform conventional commercial investment property over the

next few years, as they have in the recent past. In these

alternative sectors, unlike traditional retailing, structural

change can benefit multiple operators. In the pub sector, for

example, the 39,000 pubs still trading in 2018 had revenue 6%

higher in real terms and employed 6% more people than the 50,000

pubs trading in 2008, with the biggest increases in pubs with over

10 employees.

The twin keys to outperformance in most alternative property

types remains generally strong national operators, often building a

dominant position (as Stonegate will have with 5,000 pubs after its

takeover of EI Group, like Cineworld/Odeon/Vue in cinemas and

Hollywood Bowl/Tenpin in bowling) and long, index-linked leases

signed because conventional open market rent reviews have been

impractical. Investments with such leases are increasingly sought

after by many institutional investors who feel underweight in these

alternative sectors.

These contrasting trends in UK commercial property may produce a

fall in average capital values around 4%, (broadly offset by the

income yield), giving a just positive total return for the MSCI

Quarterly and Annual Indices over 2019 as a whole. Within those

averages, capital values of retail property (except supermarkets),

may be down by between 10% and 15%. Many shops and retail warehouse

units are only re-lettable well below current rent levels as

tenants fail and leases expire. Many traditional shopping centres

are obsolete in 21st century Britain and some high streets and

retail warehouse parks are clearly heading the same way. The unfair

business rates burden, with painfully slow phasing of the downward

adjustment after each revaluation of the rates paid, is simply

crippling bricks and mortar retailing against the internet.

Comparative Yields - End December

(Except 2019 End September)

2019 2018 2017 2016 2014 2011 2008 2006

Property (Equivalent Yield) 5.5 5.4 5.5 5.7 5.9 6.8 8.1 5.4

Long Gilts Conventional 0.6 1.5 1.4 1.5 2.0 2.5 3.7 4.6

=========================================================== ===== ===== ===== ===== ===== ===== =====

Index Linked -2.5 -1.8 -1.8 -1.8 -0.8 -0.2 0.8 1.1

=========================================================== ===== ===== ===== ===== ===== ===== =====

UK Equities 4.2 4.5 3.6 3.5 3.4 3.5 4.5 2.9

=========================================================== ===== ===== ===== ===== ===== ===== =====

R.P.I

(Annual Rate) 2.4 3.2 4.1 2.5 2.0 4.8 0.9 4.4

=========================================================== ===== ===== ===== ===== ===== ===== =====

Property less Conventional

Yield Gaps: Gilts 4.9 3.9 4.1 4.2 3.9 4.3 4.4 0.8

============ ===================================== ====== ===== ===== ===== ===== ===== ===== =====

less Index Linked Gilts 8.0 7.2 7.3 7.5 6.7 7.0 7.3 4.4

================================================== ====== ===== ===== ===== ===== ===== ===== =====

less Equities 1.3 0.9 1.9 2.2 2.5 3.3 3.6 2.5

================================================== ====== ===== ===== ===== ===== ===== ===== =====

Source: MSCI and ONS

Any forecast for the UK economy in 2019 and beyond continues to

hang heavily on Brexit, which is by definition uncharted political

and constitutional territory.

Economic growth in 2019 may repeat the disappointment of 2018 at

around 1.3%. Business investment has fallen for eight of the last

nine quarters, with business sentiment indicators ever weaker, and

services, construction and manufacturing flat, after allowing for

precautionary stock-building in March which has since unwound.

Average earnings are now clearly growing faster than prices but

retail spending is still under serious pressure as consumers have

stopped running up debt, especially for big ticket purchases, and

remain generally cautious and price-sensitive. Short-term interest

rates are unlikely to rise further for the foreseeable future, and

long-term rates have fallen further, in line with overseas bond

markets, despite the danger of a high-spending, left-wing Labour

government.

The outlook for growth in most developed economies is

deteriorating, with political turmoil in the United States and

trade wars with China, and trade disputes with Europe. Rising

tension in the Middle East could also affect oil supplies.

Partly because of Brexit uncertainty and most UK institutions'

reluctance to invest, UK commercial property now offers record high

yield margins of 4.9 points over UK conventional gilts and no less

than 8 points over UK index-linked gilts. So long as tenants can

pay their rent, these bargain basement yields offer an

exceptionally attractive hunting ground for investors buying long,

preferably index-linked income secured on strong tenants in

well-specified buildings in prosperous locations. The price premium

institutional investors are prepared to pay for that security

against average or riskier commercial property has been growing

since the Referendum in 2016. Once they regain their nerve and

start buying again after 12 December, safe property will outperform

even more as open market rental growth evaporates. Carefully chosen

low risk indexed property is also overwhelmingly likely to

outperform both conventional and index-linked bonds over the short,

medium and long term from today's yields.

VIT's Portfolio

VIT's property portfolio is independently valued by Savills at

the end of March and September each year. The latest valuation

total was GBP71,350,000 as at 30 September 2019.

Since the end of March, the sales of three properties have

completed, a short-let industrial in Luton, a high street

supermarket in Sudbury and a shop in Lymington for GBP6,575,000 at

a yield of 7.2% net of sale costs. This was 3.5% above Savills'

March valuation total with a weighted average unexpired lease term

length of 7 years. There were four purchases over the last six

months for GBP8,800,000 at an initial yield of 6.6% net of

acquisition costs. Three within the industrial sector at Aberdeen,

Thetford and Thirsk and a bowling alley in Doncaster, all having

index-related leases and a long weighted average unexpired lease

length of 21 years (14 years if a break option is exercised). These

four have just been valued at end-September at 5.2% above their

total purchase price excluding costs and in-line including

costs.

Over the six months, the capital value of the existing portfolio

declined by 0.6% and rental income rose by 0.9% (due to 6 rent

reviews). The portfolio gave a total return of 3.0% including the

profitable sales and purchases, against 0.8% on the MSCI (formerly

IPD) Index of commercial property. Four properties rose in value,

four declined and fifteen were unchanged. The best performing

sectors within the portfolio were the Industrials, a petrol filling

station and the caravan park. There is now only one shop remaining

in the portfolio (compared to 23 five years ago). The running yield

on valuation was 6.4% at end September (MSCI: 4.8%) against 6.4% at

the end of March. There are no empty properties, against an MSCI

void rate of 7.5%. All 27 properties and 29 tenancies are let on

full repairing and insuring leases with upward only rent reviews

and a weighted average unexpired lease length of 17 years (15 years

if the tenants' break options are exercised). The rental income now

has 67.8% with R.P.I.-linked increases (32.6% with annual reviews

and 35.2% five yearly) and a further 15.7% has fixed increases

(6.3% with annual reviews and 9.4% five yearly). The 83.5%

index-related share of rental income is up from 79% at end March

and 39% five years ago. Our objective is to have a high exposure to

those sectors of the market that will outperform and to minimise

exposure to those sectors that could underperform due to market

changes throughout the property market cycle. Every property,

tenant and sector is reviewed regularly to provide a long term

growing income stream from strong tenants as well as capital

growth.

VIT's property portfolio is partly funded from three fixed rate

loans - GBP15 million of VIT 11% Debenture Stock repayable in 2021

and GBP35 million repayable in 2026, comprising GBP20m of historic

9 3/8% Debenture Stock and a GBP15 million bank loan drawn down in

mid-2016 at an average fixed rate of 4.4%. Because the Debenture

Stocks were issued at a premium, our effective average annual

interest cost is 7.5% compared to the 13% p.a. long-term total

return on VIT's properties, and 9% on the IPD Index.

Louise Cleary

OLIM Property Limited

1 November 2019

Interim Board Report

Management and Administration of VIT

Value and Income Services Limited (VIS), a wholly owned

subsidiary of the Company, is the Company's Alternative Investment

Fund Manager (AIFM). As AIFM, VIS has responsibility for the

overall portfolio management and risk management of the assets of

the Company. VIS has delegated its portfolio management

responsibilities for the equity portfolio to OLIM Limited (OLIM)

and for the property portfolio to OLIM Property Limited (OLIMP)

(collectively the Investment Managers). The delegation by VIS of

its portfolio management responsibilities is in accordance with the

delegation requirements of the Alternative Investment Fund Managers

Directive (AIFMD). The Investment Managers remain subject to the

supervision and direction of VIS. The Investment Managers are

responsible to VIS and ultimately to the Company in regard to the

management of the investment of the assets of the Company in

accordance with the Company's investment objectives and policies.

VIS has a risk committee which reviews the effectiveness of the

Company's internal controls and risk management systems and

procedures and identifies, measures, manages and monitors the risks

identified as affecting the Company's business.

BNP Paribas Securities Services is the Company's Depositary and

oversees the Company's custody and cash arrangements.

Principal Risks and Uncertainties

The Board carries out a regular review and robust assessment of

the principal risks facing the Group including those that would

threaten its business model, future performance, solvency or

liquidity. These principal risks and uncertainties are summarised

below and are considered equally applicable to the second half of

the financial year as for the period under review.

-- Market risk: The fair value of, or future cash flows from, a

financial instrument held by the Group may fluctuate because of

changes in market prices. This market risk comprises three elements

- price risk, interest rate risk and currency risk.

Price risk: Changes in market prices (other than those arising

from interest rate or currency risk) may affect the value of the

Group's investments. It is the Board's policy to hold an

appropriate spread of investments in the portfolio in order to

reduce the risk arising from factors specific to a particular

sector. For equities, asset allocation and stock selection both act

to reduce market risk. The Investment Managers actively monitor

market prices throughout the year and report to VIS and to the

Board, which meet regularly in order to review investment strategy.

The equity investments held by the Group are listed on the London

Stock Exchange and all investment properties held by the Group are

commercial properties located in the UK with long, strong income

streams.

Interest rate risk: Interest rate movements may affect the fair

value of the investments in property and the level of income

receivable on cash deposits. The possible effects on fair value and

cash flows that could arise as a result of changes in interest

rates are taken into account when making investment and borrowing

decisions. The Board imposes borrowing limits to ensure that

gearing levels are appropriate to market conditions and reviews

these on a regular basis. Current borrowings comprise debenture

stocks and the ten year secured term loan, providing secure

long-term funding. It is the Board's policy to maintain a gearing

level, measured on the most stringent basis of calculation after

netting off cash equivalents, of between 25% and 40%.

Currency risk: A small proportion of the Group's investment

portfolio is invested in securities whose fair value and dividend

stream are affected by movements in foreign exchange rates. It is

not the Board's policy to hedge this risk.

-- Liquidity risk: This is the risk that the Group will

encounter difficulty in meeting obligations associated with

financial liabilities. The Group's assets comprise readily

realisable securities which can be sold to meet commitments, if

required, and investment properties which, by their nature, are

less readily realisable.

-- Credit risk: This is the failure of a counterparty to a

transaction to discharge its obligations under that transaction

that could result in the Group suffering a loss. The risk is not

significant and is managed as follows:

- investment transactions are carried out with a large number of

brokers, whose credit-standing is reviewed periodically by OLIM

(which report to VIS) and limits are set on the amount that may be

due from any one broker.

- the risk of counterparty exposure due to failed trades causing

a loss to the Group is mitigated by the review of failed trade

reports on a daily basis. In addition, a stock reconciliation to

third party administrators' records is performed on a daily basis

to ensure that discrepancies are picked up on a timely basis. VIS

carries out periodic reviews of the Depositary's operations and

reports its findings to the Company. This review also includes

checks on the maintenance and security of investments held.

- cash is held only with reputable banks with high quality

external credit ratings which are monitored on a regular basis.

-- Property risk: The Group's commercial property portfolio is

subject to both market and specific property risk. Since the UK

commercial property market has been markedly cyclical for many

years, it is prudent to expect that to continue. The price and

availability of credit, real economic growth and the constraints on

the development of new property are the main influences on the

property investment market. Against that background, the specific

risks to the income from the portfolio are tenants being unable to

pay their rents and other charges, or leaving their properties at

the end of their leases. All leases are on full repairing and

insuring terms, with upward only rent reviews.

-- Political risk: The full political, economic and legal

consequences of the EU Referendum result to leave the European

Union are not yet known.

Additional risks and uncertainties include:

-- Discount volatility: The Company's shares may trade at a

price which represents a discount to its underlying net asset

value.

-- Regulatory risk: The Group operates in a complex regulatory

environment and therefore faces a number of regulatory risks. A

breach of Section 1158 of the Corporation Tax Act 2010 would result

in the Company being subject to capital gains tax on portfolio

investments. Breaches of other regulations, including but not

limited to, the Companies Act 2006, the FCA Listing Rules or the

FCA Disclosure, Guidance and Transparency Rules, the Market Abuse

Regulation, the Foreign Account Tax Compliance Act, the Common

Reporting Standard, the Packaged Retail and Insurance-based

Investment Products (PRIIPs) Regulation, the Second Markets in

Financial Instruments Directive (MiFID II), and the General Data

Protection Regulation (GDPR), could lead to a number of detrimental

outcomes and reputational damage. Breaches of controls by service

providers to the Company could also lead to reputational damage or

loss. The Audit and Management Engagement Committee monitors

compliance with regulations by reviewing internal control reports

from the Administrator and from the Investment Managers.

Statement of Directors' Responsibilities

The Directors confirm that to the best of their knowledge:

-- the condensed set of Financial Statements within the

Half-Yearly Financial Report has been prepared in accordance with

International Accounting Standard 34 'Interim Financial Reporting';

and

-- the Interim Board Report includes a true and fair review of

the information required by 4.2.7R and 4.2.8R of the FCA's

Disclosure, Guidance and Transparency Rules.

For and on behalf of the Board of Value and Income Trust PLC

James Ferguson

Chairman

1 November 2019

Group Statement of Financial Position

As at 30 September 2019

As at As at As at

30 September 2019 31 March 2019 30 September 2018

Notes (Unaudited) (Audited) (Unaudited)

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

ASSETS

NON CURRENT ASSETS

Investments held at

fair value through profit

or loss 129,484 128,706 135,706

Investment properties 71,350 68,800 67,850

--------------------- ------------------ ------------------

8 200,834 197,506 203,556

Deferred tax asset 345 389 248

--------------------- ------------------ ------------------

201,179 197,895 203,804

CURRENT ASSETS

Cash and cash equivalents 4,584 4,338 6,043

Receivables 492 907 717

--------------------- ------------------ ------------------

5,076 5,245 6,760

--------------------- ------------------ ------------------

TOTAL ASSETS 206,255 203,140 210,564

CURRENT LIABILITIES

Payables (2,510) (1,794) (1,371)

--------------------- ------------------ ------------------

TOTAL ASSETS LESS CURRENT

LIABILITIES 203,745 201,346 209,193

NON-CURRENT LIABILITIES

Borrowings (49,920) (49,913) (49,905)

--------------------- ------------------ ------------------

NET ASSETS 153,825 151,433 159,288

--------------------- ------------------ ------------------

EQUITY ATTRIBUTABLE

TO EQUITY SHAREHOLDERS

Called up share capital 4,555 4,555 4,555

Share premium 18,446 18,446 18,446

Retained earnings 6 130,824 128,432 136,287

--------------------- ------------------ ------------------

TOTAL EQUITY 153,825 151,433 159,288

--------------------- ------------------ ------------------

NET ASSET VALUE PER

ORDINARY SHARE (Pence) 337.71p 332.45p 349.70p

--------------------- ------------------ ------------------

Group Statement of Comprehensive Income

For the 6 months ended 30 September 2019

6 months ended 6 months ended Year ended

30 September 2019 30 September 2018 31 March 2019

(Unaudited) (Unaudited) (Audited)

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Notes

INCOME

Dividend income 3,857 - 3,857 3,626 - 3,626 6,215 - 6,215

Other operating

income 2 2,191 - 2,191 2,143 - 2,143 4,296 - 4,296

6,048 - 6,048 5,769 - 5,769 10,511 - 10,511

GAINS AND LOSSES

ON

INVESTMENTS

Realised gains

on held-at-

fair-value

investments and

investment

properties

Unrealised

(losses)/gains

on

held-at-fair-value

investments and

investment

properties - 3,165 3,165 - 4,178 4,178 - 5,294 5,294

- (908) (908) - 4,649 4,649 - (3,600) (3,600)

TOTAL INCOME 6,048 2,257 8,305 5,769 8,827 14,596 10,511 1,694 12,205

-------------- ---------- ---------- -------------- ----------- ---------- -------------- ---------- ---------

EXPENSES

Investment management

fees (180) (420) (600) (175) (407) (582) (348) (813) (1,161)

Other operating

expenses (357) - (357) (389) - (389) (781) - (781)

FINANCE COSTS (2,088) - (2,088) (2,084) - (2,084) (4,168) - (4,168)

TOTAL EXPENSES (2,625) (420) (3,045) (2,648) (407) (3,055) (5,297) (813) (6,110)

-------------- ---------- ---------- -------------- ----------- ---------- -------------- ---------- ---------

PROFIT BEFORE

TAX 3,423 1,837 5,260 3,121 8,420 11,541 5,214 881 6,095

TAXATION (124) 80 (44) (116) 77 (39) (241) 343 102

-------------- ---------- ---------- -------------- ----------- ---------- -------------- ---------- ---------

TOTAL COMPREHENSIVE

INCOME FOR THE PERIOD 3,299 1,917 5,216 3,005 8,497 11,502 4,973 1,224 6,197

-------------- ---------- ---------- -------------- ----------- ---------- -------------- ---------- ---------

EARNINGS PER

ORDINARY

SHARE (Pence) 3 7.25 4.21 11.46 6.60 18.65 25.25 10.92 2.68 13.60

The total column of this statement represents the Statement of

Comprehensive Income of the Group, prepared in accordance with

IFRS. The revenue return and capital return columns are

supplementary to this and are prepared under guidance issued by the

Association of Investment Companies. All items in the above

statement derive from continuing operations.

All income is attributable to the equity holders of Value and

Income Trust PLC, the parent company. There are no minority

interests.

The Board has declared a first quarterly dividend of 2.90p per

share (2019 - 2.80p) which was paid on 25 October 2019 to those

shareholders on the register on 27 September 2019 with an

ex-dividend date of 26 September 2019 and a second quarterly

dividend of 2.90p per share (2019 - 2.80p) which will be paid on 31

January 2020 to those shareholders on the register on 3 January

2020 with an ex-dividend date of 2 January 2020. The third

quarterly dividend of 2.90p (2019 - 2.80p) will be paid on 24 April

2020 to those shareholders on the register on 27 March 2020. The

ex-dividend date will be 26 March 2020.

Group Statement of Changes in Equity

For the 6 months ended 30 September 2019

6 months ended 30 September 2019

(Unaudited)

Share Share Retained

capital premium earnings Total

GBP'000 GBP'000 GBP'000 GBP'000

Net assets at 31 March 2019 Notes 4,555 18,446 128,432 151,433

Net profit for the period - - 5,216 5,216

Dividends paid 4 - - (2,824) (2,824)

======== ======== ========= ========

NET ASSETS AT 30 SEPTEMBER

2019 4,555 18,446 130,824 153,825

-------- -------- --------- --------

Year ended 31 March 2019

(Audited)

Share Share Retained

capital premium earnings Total

GBP'000 GBP'000 GBP'000 GBP'000

Net assets at 31 March 2018 4,555 18,446 127,518 150,519

Net profit for the period - - 6,197 6,197

Dividends paid 4 - - (5,283) (5,283)

======== -------- --------- --------

NET ASSETS AT 31 MARCH 2019 4,555 18,446 128,432 151,433

-------- -------- --------- --------

6 months ended 30 September 2018

(Unaudited)

Share Share Retained

capital premium earnings Total

GBP'000 GBP'000 GBP'000 GBP'000

Net assets at 31 March 2018 4,555 18,446 127,518 150,519

Net profit for the period - - 11,502 11,502

Dividends paid 4 - - (2,733) (2,733)

------------ ------------- ----------- -------

NET ASSETS AT 30 SEPTEMBER

2018 4,555 18,446 136,287 159,288

------------ ------------- ----------- -------

Group Statement of Cash Flows

For the 6 months ended 30 September 2019

6 months ended 6 months ended Year ended

30 September 30 September

2019 2018 31 March 2019

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

CASH FLOWS FROM OPERATING ACTIVITIES

Dividend income received 4,383 3,811 5,994

Rental income received 1,800 1,582 4,295

Interest received 6 1 8

Operating expenses paid (1,045) (1,079) (1,975)

========= --------- ---------

NET CASH INFLOW FROM OPERATING

ACTIVITIES 5,144 4,315 8,322

CASH FLOWS FROM INVESTING ACTIVITIES

Purchase of investments (17,613) (10,713) (30,634)

Sale of investments 17,616 13,609 32,447

======== -------- --------

NET CASH INFLOW FROM INVESTING

ACTIVITIES 3 2,896 1,813

CASH FLOW FROM FINANCING ACTIVITIES

Interest paid (2,077) (2,074) (4,153)

Dividends paid (2,824) (2,733) (5,283)

======== -------- --------

NET CASH OUTFLOW FROM FINANCING

ACTIVITIES (4,901) (4,807) (9,436)

========= --------- ---------

NET INCREASE IN CASH AND CASH

EQUIVALENTS 246 2,404 699

Cash and cash equivalents at

the start of the period 4,338 3,639 3,639

CASH AND CASH EQUIVALENTS AT

THE OF THE PERIOD 4,584 6,043 4,338

--------- --------- ---------

Notes to the Financial Statements

1 Accounting policies

The Financial Statements have been prepared in accordance with

International Financial Reporting Standards (IFRSs) which comprise

standards and interpretations approved by the International

Accounting Standards Board (IASB) together with interpretations of

the International Accounting Standards and Standing Interpretations

Committee approved by the International Accounting Standards

Committee (IASC) that remain in effect, and to the extent that they

have been adopted by the European Union.

The functional and presentational currency of the Group is

pounds sterling because that is the currency of the primary

economic environment in which the Group operates. The Financial

Statements and the accompanying notes are presented in pounds

sterling and rounded to the nearest thousand pounds except where

otherwise indicated.

(a) Basis of preparation

The Financial Statements have been prepared on a going concern

basis and on the historical cost basis, except for the revaluation

of certain financial assets. Where presentational guidance set out

in the Statement of Recommended Practice 'Financial Statements of

Investment Trust Companies and Venture Capital Trusts' (the SORP)

issued by the Association of Investment Companies (AIC) in October

2019 is consistent with the requirements of IFRSs, the Directors

have sought to prepare the Financial Statements on a basis

compliant with the recommendations of the SORP, except for the

allocation of finance costs to revenue as explained below.

The Board has considered the requirements of IFRS 8, 'Operating

Segments'. The Board is charged with setting the Group's investment

strategy. The Board has delegated the day to day implementation of

this strategy to the Investment Managers but the Board retains

responsibility to ensure that adequate resources of the Group are

directed in accordance with its decisions. The Board is of the view

that the Group is engaged in a single segment of business, being

investments in quoted UK equities and UK commercial properties. The

view that the Group is engaged in a single segment of business is

based on the fact that one of the key financial indicators received

and reviewed by the Board is the total return from the investment

portfolio taken as a whole. A review of the investment portfolio is

included in the Investment Managers' Reports.

All expenses and finance costs are accounted for on an accruals

basis. Expenses are presented as capital where a connection with

the maintenance or enhancement of the value of investments can be

demonstrated. In this respect, and in accordance with the SORP, the

investment management fees are allocated 30% to revenue and 70% to

capital to reflect the Board's expectations of long-term investment

returns.

It is normal practice and in accordance with the SORP for

investment trust companies to allocate finance costs to capital on

the same basis as the investment management fee allocation.

However, as the Group has a significant exposure to property, and

property companies allocate finance costs to revenue to match

rental income, the Directors consider that, contrary to the SORP,

it is inappropriate to allocate finance costs to capital.

The Group's Financial Statements have been prepared using the

same accounting policies as those applied for the Financial

Statements for the year ended 31 March 2019, which received an

unqualified audit report.

(b) Going concern

The Group's business activities, together with the factors

likely to affect its future development and performance, are set

out in the Interim Board Report. The financial position of the

Group as at 30 September 2019 is shown in the Statement of

Financial Position. The cash flows of the Group for the half year

to 30 September 2019, which are not untypical, are set out in the

Group Statement of Cash Flows. The Group had fixed debt totalling

GBP49,920,000 as at 30 September 2019; none of the borrowings is

repayable before 2021. The Group had no short term borrowings. As

at 30 September 2019, the Group's total assets less current

liabilities exceeded its total non current liabilities by a factor

of over four.

The assets of the Group consist mainly of securities and

investment properties that are held in accordance with the Group's

investment policy, as set out on page 1. Most of these securities

are readily realisable, even in volatile markets. The Directors,

who have reviewed carefully the Group's forecasts for the coming

year, consider that the Group has adequate financial resources to

enable it to continue in operational existence for the foreseeable

future. Accordingly, the Directors believe that it is appropriate

to continue to adopt the going concern basis in preparing the

Group's Financial Statements.

(c) Basis of consolidation

The consolidated Financial Statements incorporate the Financial

Statements of the Company and the entity controlled by the Company

(its subsidiary). An investor controls an investee when it is

exposed, or has rights, to variable returns from its involvement

with the investee and has ability to affect those returns through

its power over the investee. The Company consolidates the investee

that it controls. All intra-group transactions, balances, income

and expenses are eliminated on consolidation.

Value and Income Services Limited is a private limited company

incorporated in Scotland under company number SC467598. It is a

wholly owned subsidiary of the Company and has been appointed to

act as the Alternative Investment Fund Manager of the Company.

(d) Presentation of Statement of Comprehensive Income

In order to reflect better the activities of an investment trust

company and in accordance with guidance issued by the AIC,

supplementary information which analyses the Statement of

Comprehensive Income between items of a revenue and capital nature

has been presented alongside the Statement of Comprehensive Income.

In accordance with the Company's Articles, net capital returns may

be distributed by way of dividend.

(e) Dividends payable

Interim dividends are recognised as a liability in the period in

which they are paid as no further approval is required in respect

of such dividends. Final dividends are recognised as a liability

only after they have been approved by Shareholders in general

meeting.

(f) Investments

Equity investments

All equity investments are classified on the basis of their

contractual cashflow characteristics and the Group's business model

for managing its assets. The business model, which is the

determining feature, is such that the portfolio of equity

investments is managed, and performance is evaluated, on the basis

of fair value. Consequently, all equity investments are measured at

fair value through profit or loss.

For listed investments, fair value through profit or loss is

deemed to be bid market prices or closing prices for SETS stocks

sourced from the London Stock Exchange. SETS is the London Stock

Exchange electronic trading service covering most of the market

including all FTSE 100 constituents and most liquid FTSE 250

constituents along with some other securities. Gains and losses

arising from changes in fair value are included in net profit or

loss for the period as a capital item in the Statement of

Comprehensive Income and are ultimately recognised in the retained

earnings.

Investment properties

Investment properties are initially recognised at cost, being

the fair value of consideration given, including transaction costs

associated with the investment property. Any subsequent capital

expenditure incurred in improving investment properties is

capitalised in the period incurred and included within the book

cost of the property.

After initial recognition, investment properties are measured at

fair value, with gains and losses recognised in the Statement of

Comprehensive Income.

The Group leases out all of its properties on operating leases.

A property held under an operating lease is classified and

accounted for as an investment property where the Group holds it to

earn rental, capital appreciation or both. Any such property leased

under an operating lease is carried at fair value. Fair value is

established by half-yearly professional valuation on an open market

basis by Savills (UK) Limited, Chartered Surveyors and Valuers, and

in accordance with the RICS Valuation - Professional Standards

issued in July 2017 (the 'RICS Red Book'). The determination of

fair value by Savills is supported by market evidence.

2 Other operating income

6 months ended 6 months ended Year ended

September 2019 September 2018 March 2019

GBP'000 GBP'000 GBP'000

Rental income 2,186 2,142 4,287

Interest receivable

on short term deposits 5 1 9

================ ---------------- ------------

2,191 2,143 4,296

---------------- ---------------- ------------

3 Return per ordinary share

The return per ordinary share is based on the following

figures:

6 months ended 6 months ended Year ended

September 2019 September 2018 March 2019

GBP'000 GBP'000 GBP'000

Revenue return 3,299 3,005 4,973

Capital return 1,917 8,497 1,224

Weighted average ordinary

shares in issue 45,549,975 45,549,975 45,549,975

Return per share - revenue 7.25p 6.60p 10.92p

Return per share - capital 4.21p 18.65p 2.68p

============== -------------- ------------

Total return per share 11.46p 25.25p 13.60p

-------------- -------------- ------------

4 Dividends paid

6 months ended 6 months ended Year ended

30 September 30 September

2019 2018 31 March 2019

GBP'000 GBP'000 GBP'000

Dividends on ordinary

shares:

Third quarterly dividend

of 2.80p per share (2018

- 2.70p) paid

26 April 2019 1,275 1,230 1,230

Final dividend of 3.40p

per share (2018 - 3.30p)

paid 26 July 2019 1,549 1,503 1,503

First quarterly dividend

of 2.80p per share (2018

- 2.70p) paid

26 October 2018 * - - 1,275

Second quarterly dividend

of 2.80p per share (2018

- 2.70p) paid 25 January

2019 * - - 1,275

============== -------------- -------------

Dividends paid in the

period 2,824 2,733 5,283

-------------- -------------- -------------

* First and second quarterly dividends for the year to 31 March

2020 have been declared with pay dates falling after 30 September

2019. These have not been included as liabilities in these

Financial Statements.

5 Interim dividend

The Directors have declared a first quarterly dividend of 2.90p

per ordinary share, paid on 25 October 2019 to shareholders

registered on 27 September 2019, with an ex dividend date of 26

September 2019 (2019 - 2.80p) and a second interim dividend of

2.90p per share, payable on 31 January 2020 to shareholders

registered on 3 January 2020, with an ex dividend date of 2 January

2020 (2019 - 2.80p). The third quarterly dividend of 2.90p (2019 -

2.80p) will be paid on 24 April 2020 to those shareholders on the

register on 27 March 2020. The ex-dividend date will be 26 March

2020.

6 Retained earnings

The table below shows the movement in retained earnings analysed

between revenue and capital items.

Revenue Capital Total

GBP'000 GBP'000 GBP'000

At 31 March 2019 3,995 124,437 128,432

Movement during the period:-

Profit for the period 3,299 1,917 5,216

Dividends paid on ordinary shares (2,824) - (2,824)

======= ======= =======

At 30 September 2019 4,470 126,354 130,824

------- ------- -------

7 Transaction costs

During the period, expenses were incurred in acquiring and

disposing of investments classified as fair value through profit or

loss. These have been expensed through capital and are included

within gains and losses on investments in the Statement of

Comprehensive Income.

The total costs are as follows:-

6 months ended 6 months ended Year ended

30 September

2019 30 September 2018 31 March 2019

GBP'000 GBP'000 GBP'000

Purchases 56 61 116

Sales 11 11 22

============== ----------------- -------------

67 72 138

-------------- ----------------- -------------

8 Fair value hierarchy disclosures

The table below sets out fair value measurements using the IFRS

13 Fair Value hierarchy:-

Level

Level 1 Level 2 3 Total

At 30 September 2019

(unaudited) GBP'000 GBP'000 GBP'000 GBP'000

Equity investments 129,484 - - 129,484

Investment properties - - 71,350 71,350

------------ ------------ -------- ---------

129,484 - 71,350 200,834

Borrowings - (59,557) - (59,557)

============ ============ ======== =========

129,484 (59,557) 71,350 141,277

------------ ------------ -------- ---------

At 31 March 2019 (audited)

Equity investments 128,706 - - 128,706

Investment properties - - 68,800 68,800

------------ ------------ -------- ---------

128,706 - 68,800 197,506

Borrowings - (59,244) - (59,244)

------------ ------------ -------- ---------

128,706 (59,244) 68,800 138,262

------------ ------------ -------- ---------

At 30 September 2018

(unaudited)

Equity investments 135,706 - - 135,706

Investment properties - - 67,850 67,850

------------ ------------ -------- ---------

135,706 - 67,850 203,556

Borrowings - (58,764) - (58,764)

------------ ------------ -------- ---------

135,706 (58,764) 67,850 144,792

------------ ------------ -------- ---------

Fair value categorisation within the hierarchy has been

determined on the basis of the degree to which the inputs to the

fair value measurements are observable and the significance of the

inputs to the fair value measurement in its entirety as

follows:-

Level 1 - inputs are unadjusted quoted prices in an active

market for identical assets

Level 2 - inputs, not being quoted prices, are observable,

either directly (i.e. as prices) or indirectly (i.e. derived from

prices)

Level 3 - inputs are not observable

The fair values of the debentures are determined by comparison

with the fair values of equivalent gilt edged securities,

discounted to reflect the differing levels of credit worthiness of

the borrowers. The fair values of the loans are determined by a

discounted cash flow calculation based on the appropriate

inter-bank rate plus the margin per the loan agreement. These

instruments are therefore considered to be Level 2 as defined

above. There were no transfers between Levels during the period.

All other assets and liabilities of the Group are included in the

balance sheet at fair value.

9 Relationship with the Investment Managers and other Related Parties

OLIM and OLIM Property each receives an investment management

fee of 0.60% of the capital assets that they manage.

OLIM Limited received an investment management fee of GBP393,000

(half year to 30 September 2018: GBP388,000 and year to 31 March

2019: GBP757,000). At the period end, the balance owed by the Group

to OLIM Limited was GBP65,000 (31 March 2019: GBP74,000) comprising

management fees for the month of September 2019, subsequently paid

in October 2019.

OLIM Property Limited received an investment management fee of

GBP207,000 (half year to 30 September 2018: GBP194,000 and year to

31 March 2019: GBP404,000). At the period end, the balance owed by

the Group to OLIM Property Limited was GBP34,000 (31 March 2019:

GBP34,000) comprising management fees for the month of September

2019, subsequently paid in October 2019.

Value and Income Services Limited is a wholly owned subsidiary

of Value and Income Trust PLC and all costs and expenses are borne

by Value and Income Trust PLC. Value and Income Services Limited

has not traded during the period.

10 Half Yearly Report

The financial information contained in this Half Yearly

Financial Report does not constitute statutory accounts as defined

in sections 434 - 436 of the Companies Act 2006. The financial

information for the six months ended 30 September 2019 and 30

September 2018 has not been audited.

The figures and financial information for the year ended 31

March 2019 has been extracted and abridged from the latest

published audited Financial Statements and do not constitute the

statutory accounts for that year. Those Financial Statements have

been filed with the Registrar of Companies and included the Report

of the Independent Auditor, which contained no qualification or

statement under section 498 of the Companies Act 2006.

This Half Yearly Report was approved by the Board on 1 November

2019.

Other information

Unsolicited Offers for shares in Value and Income Trust PLC

(Boiler room scams)

The Directors have recently become aware that some shareholders

have been targeted by organisations offering to buy their shares in

Value and Income Trust PLC at prices much higher than current

market values. These calls are unsolicited and are usually made by

overseas organisations or organisations using false UK addresses or

phone lines routed abroad who may indicate that the Company is the

subject of a hostile takeover.

Please be aware that the Company is not the subject of a

takeover and that these calls are being made by fraudsters.

Whilst the callers may sound credible and professional,

shareholders should be aware that their intentions are often

fraudulent and high pressure sales techniques may be applied, often

involving a request for an indemnity or a payment to be provided in

advance.

If you receive such a call, you should exercise caution and,

based on advice from the FCA, the following precautions are

suggested:

-- obtain the name of the individual or organisation calling;

-- check the FCA register to confirm if the caller is authorised;

-- call back using the details on the FCA register to verify the caller's identity;

-- discontinue the call if you are in any doubt about the

intentions of the caller, or if calls persist; and

-- report any individual or organisation that makes unsolicited

calls with an offer to buy or sell shares to the FCA and the City

of London Police.

Useful Contact Details:

ACTION FRAUD

Telephone: 0300 123 2040

Website: www.actionfraud.police.uk

FCA

Telephone: 0800 111 6768 (freephone)

E-mail: consumer.queries@fca.org.uk

Website: www.fca.org.uk

Maven Capital Partners UK LLP

Company Secretary

0141 306 7400

1 November 2019

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR XFLFBKFFBFBL

(END) Dow Jones Newswires

November 01, 2019 09:13 ET (13:13 GMT)

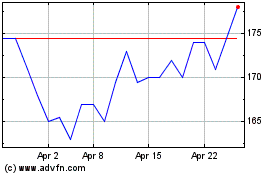

Value And Indexed Proper... (LSE:VIP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Value And Indexed Proper... (LSE:VIP)

Historical Stock Chart

From Jul 2023 to Jul 2024