TIDMVEIL

RNS Number : 8790S

Vietnam Enterprise Investments Ltd

14 March 2023

14 March 2023

Vietnam Enterprise Investments Limited

("VEIL" or "the Company")

Monthly Update

VEIL is a London listed investment company investing primarily

in listed equities in Vietnam and is a FTSE 250 constituent. The

Company's NAV performance for February 2023 is set out in this

notice.

Company Performance

-- As of 28 February, VEIL's NAV decreased 10.8% over the

previous month against a fall of 9.0% for its reference index, the

Vietnam Index ("VNI"), both in US dollar terms.

-- The Company's NAV per share was US$7.76 as of 28 February and its total NAV was US$1.6bn.

-- VEIL's three month's NAV per share performance in US dollar

terms is +1.4%, -37.2% over one year and +22.4% over three years.

Over the same time periods, the performance of the VNI was +1.7%,

-33.0% and +18.8%, respectively.

-- The share price fell 13.4% in February and has declined 4.0%

year-to-date, both in US dollar terms.

-- In GBP terms, the Company's NAV per share was GBP6.41 as of

28 February (-9.3% for the month and -1.8% year-to-date) and its

total NAV was GBP1.3bn. The share price was down 11.9% for the

month and 4.6% year-to-date.

-- The share price discount to NAV as of 28 February was 13.3%,

compared with 10.8% at the end of January 2023.

-- The Company repurchased 170,000 shares in February, to be

held in treasury, these were the first repurchases in 2023.

Dien Vu, VEIL's Portfolio Manager commented:

"Following two months of double-digit returns the Vietnam Index

fell 9.0% in February. This was mainly due to unease over recent

missed payments in the corporate bond market and renewed concerns

of a higher terminal Federal Reserve rate.

"The State Bank of Vietnam has granted the first tranche of

credit quotas to banks for 2023, with an average allocation of

9.0%, down from 11.0% at this stage in 2022. This announcement is

not expected to significantly affect lending activities or the

banking system's liquidity. As a result of improving fungibility

and weaker borrowing demand, the lending rate has dropped a

moderate 0.4% year-to-date, and deposit rates for six months and

longer reduced between 0.5% to 1.5%.

"Interest rates may remain at their current levels over the

coming months due to pressure on the State Bank of Vietnam to

maintain or even raise rates in line with other major central

banks, and the prospect of more persistent inflation. The CPI for

the first two months of the year increased 4.6% year-on-year and we

believe this could be managed on average around 4.2%-5.0% in

2023.

"The service sector is looking resilient as Vietnam welcomed a

total of 1.8 million visitors in January and February, and retail

sales grew 13.0% year-on-year. The 2023 target of ten million

international arrivals looks achievable and bodes well for foreign

receipts and tourism-related businesses. Standalone macroeconomic

numbers for February are impacted by seasonal holiday effects, but

combined with January we can see that year-to-date industrial

production fell by 6.3% against the same stage last year and total

trade decreased by 12.6% to $96.1bn. These may not be stellar

numbers, but on a brighter note the trade balance remained solid

with a surplus of US$2.8bn, and the Purchasing Managers Index rose

to 51.2, its first positive month after three months of contraction

and its highest rate of expansion since August 2022.

"In the portfolio, investor concern over the bond market was

pronounced, having a knock-on effect to two of VEIL's real estate

holdings. Vinhomes ("VHM) and Khang Dien Housing ("KDH") were both

unfortunate bystanders of sector-wide underperformance, losing over

10% in February as foreign investors turned to risk-off mode.

Mobile World Group ("MWG") was also a laggard due to management

giving weak 2023 guidance in its latest call, announcing 2023

revenue expectations of between US$5.7bn to US$6.4bn (an increase

of 1-12% year-on-year) and net profit of US$178m to US$200m (growth

of 2-15% year-on-year), anticipating a slow start to the year and

an improvement over H2 2023."

Economic Overview

-- Exports and imports in the first two months of the year

declined 10.4% and 16.0% year-on-year to US$49.4bn and US$46.6bn,

respectively, leading to a trade surplus of US$2.8bn. Exports to

China grew 4.2% year-on-year whilst other key markets fell,

including the US (-21.0%), EU (-4.2%), and ASEAN (-7.9%).

-- Disbursed FDI fell 4.9% year-on-year to US$2.6bn in the first

two months of 2023, while registrations dropped 38.0% to just

US$3.1bn, mainly due to a lack of large-scale expansions of

existing projects.

-- The Index for Industrial Production fell 6.3% year-on-year

for January and February combined, with manufacturing falling

6.9%.

-- The Purchasing Managers Index rose to 51.2, showing that new

orders increased for the first time in four months and indicating

that production might start to pick up in the coming months.

-- February's CPI rose 0.5% month-on-month and 4.3% year-on-year

and can be attributed to rising petrol and gas cylinder prices

which is in-line with the global trend.

-- The Vietnamese dong ("VND") depreciated 1.2% against the US

dollar in February, and 0.5% year-to-date. The VND appreciated 1.2%

against the pound sterling in January and has depreciated 0.1%

year-to-date.

Top Ten Holdings (66.8% of NAV)

Company Sector VNI % NAV % Monthly Return One-year

% Return %

Asia Commercial

1 Bank Banks 2.0 13.5 -7.7 -13.7

================== =================== ===== ===== ============== =========

Vietnam Prosperity

2 Bank Banks 2.8 12.4 -13.6 -35.4

================== =================== ===== ===== ============== =========

3 Hoa Phat Group Materials/Resources 2.8 7.0 -10.8 -46.3

================== =================== ===== ===== ============== =========

4 Vietcombank Banks 10.8 6.9 0.3 6.1

================== =================== ===== ===== ============== =========

5 Mobile World Group Retail 1.4 6.2 -15.2 -43.2

================== =================== ===== ===== ============== =========

6 FPT Corporation Software/Services 2.2 5.0 -5.0 1.4

================== =================== ===== ===== ============== =========

7 Becamex IDC Property 2.1 4.6 -2.7 2.5

================== =================== ===== ===== ============== =========

8 PetroVietnam Gas Energy 4.8 4.5 -4.0 -13.5

================== =================== ===== ===== ============== =========

9 Vinhomes Property 4.4 3.5 -19.6 -47.2

================== =================== ===== ===== ============== =========

10 Khang Dien Housing Property 0.4 3.1 -10.4 -49.2

================== =================== ===== ===== ============== =========

Vietnam, Index - - - -9.0 -33.0

================== =================== ===== ===== ============== =========

Source: Bloomberg, Dragon Capital

NB: All returns are given in USD terms

For further information, please contact:

Vietnam Enterprise Investments Limited

Rachel Hill

Phone: +44 122 561 8150

Mobile: +44 797 121 4852

rachelhill@dragoncapital.com

Jefferies International Limited

Stuart Klein

Phone: +44 207 029 8703

stuart.klein@jefferies.com

Buchanan

Charles Ryland / Henry Wilson / George Beale

Phone: +44 20 7466 5111

veil@buchanan.uk.com

LEI: 213800SYT3T4AGEVW864

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCNKQBPABKKAND

(END) Dow Jones Newswires

March 14, 2023 03:00 ET (07:00 GMT)

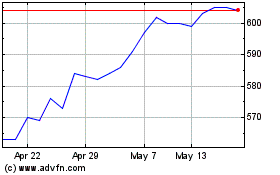

Vietnam Enterprise Inves... (LSE:VEIL)

Historical Stock Chart

From Oct 2024 to Nov 2024

Vietnam Enterprise Inves... (LSE:VEIL)

Historical Stock Chart

From Nov 2023 to Nov 2024