TIDMVEIL

RNS Number : 9546M

Vietnam Enterprise Investments Ltd

17 January 2023

17 January 2023

Vietnam Enterprise Investments Limited

("VEIL" or "the Company")

Monthly Update

2.6% NAV Return in December 2022

VEIL is a closed-end fund investing primarily in listed equity

in Vietnam, and a FTSE 250 constituent. The Company's NAV

performance for December 2022 is set out in this notice.

Fund Performance

-- As of 31 December, VEIL's NAV increased 2.6% over the

previous month against a rise of 0.4% for its reference index, the

Vietnam Index ("VNI"), both in US dollar terms.

-- The Company's NAV per share was US$7.85 as of 31 December

(-35.7% YTD) and its total NAV was US$1.6bn.

-- VEIL's NAV per share performance in US dollar terms is -10.7%

over three months, -35.7% over one year and +16.1% over three

years. Over the same time periods, the performance of the Vietnam

Index was -9.7%,

-34.1% and +7.6%, respectively.

-- The share price rose 2.9% in December and has declined 32.3% YTD, both in US dollar terms

-- In GBP terms, the Company's NAV per share was GBP6.53 as of

31 December (1.7% for the month and -27.5% YTD) and its total NAV

was GBP1.3bn. The share price was up 1.9% for the month and down

23.8% YTD.

-- The share price discount to NAV as of 31 December was 10.7%,

compared with 10.9% at the end of November.

-- The Company repurchased 50,000 shares in December, compared

with no shares repurchased in November. In 2022, 3.2% of issued

shares as of 1 January 2022 were repurchased.

Dien Vu, the Portfolio Manager of VEIL commented:

"A solid December closed out a tumultuous year for the Vietnam

equity market, with VEIL outperforming its reference benchmark for

the month but trailing it for the year. This is just the second

time in the last ten years that the fund has underperformed the VNI

on an annual basis. On a three-year rolling basis, the time-period

in which the Company aims to outperform its reference benchmark,

the Company is ahead by 8.5%.

Foreign investors continued to be attracted by Vietnam's

decade-year low valuations, a second consecutive month of strong

inflows amounting to US$566m meant the final two months of the year

totalled US$1.2bn of the US$1.3bn that Vietnam attracted through

the whole of 2022. For contrast, 2021 saw net outflows of US$2.6bn

despite the market rising 39.0% for the year against a drop of

34.1% in 2022.

Eight out of the fund's top ten constituents outperformed the

market in December. Most notably among these were Vietnam

Prosperity Bank ("VPB") and Phu Nhuan Jewelry ("PNJ"), both

managing to deliver double-digit returns. FPT Corporation ("FPT")

also stood out with a solid return. On the downside, PetroVietnam

Gas ("GAS") and Vinhomes ("VHM") were the main laggards.

GAS fell out of favour with investors as global oil prices fell

in December, triggering concerns that 2023 earnings for the company

may decelerate as a result. Attitudes towards VHM soured as

investors were concerned about the risk of delays in property

handovers, which are forecast to have a significant impact on 4Q

2022 and full-year 2022 earnings. A clear slowdown in the property

sector due to a tighter liquidity environment has evidently had a

short-term impact on the stock.

VPB rose 11.2% in December due to investor expectations that the

hurdles needing to be cleared for a strategic investor to take a

position in the bank will be completed soon. If such a transaction

happens, it has the potential to turn VPB into one of the biggest

banks in Vietnam by charter capital.

Vietnam's economy registered a resounding 8.0% growth in 2022 -

the fastest in a decade - to reach US$409bn. With a population of

nearly 100mn this puts GDP per capita at US$4,110, officially

entering the upper middle-income group (above US$4,045).

Vietnam's macro environment was steady in 2022, with inflation

under control averaging 3.2% for the year (below the Government's

4.0% target) and the Vietnamese dong depreciating by just 3.2%

against the US dollar. Further bright spots included a record

US$22.4bn of disbursed FDI (+13.5% year-on-year), US$19bn of inward

remittances (+5.6% year-on-year) and a trade surplus of US$11.2bn,

compared to US$4.0bn in 2021.

Tourism and public investment have the potential to be among

Vietnam's strongest growth drivers in 2023. Chinese arrivals

accounted for 32% of the 18.5mn overseas tourists in 2019, and so

the country's reopening is expected to provide a welcome boost for

the sector, which saw just 3.7mn visitors in 2022. Furthermore, the

Government's budget for public investment is nearly US$30bn and

will go towards key infrastructure projects including airports and

motorways. These drivers, combined with increased manufacturing

from newly relocated FDI companies, should help contribute to

Vietnam achieving its 2023 GDP growth target of 6.0-6.5%.

Economic Overview

-- GDP growth in 2022 reached 8.0%, its highest level in over a

decade. Q4 2022 GDP growth was 5.9%, reflecting the global economic

slowdown.

-- The services sector was the main driver of GDP growth, with

year-on-year increases of 8.12% in Q4 and 10.0% for 2022. The

sector contributed 56.7% to overall GDP growth in 2022 with

accommodation & catering services leading the way, up 37.6% in

Q4 and +40.6% for 2022.

-- December's CPI rose 0.4% month-on-month and 4.4% year-on-year for 2022.

-- The Vietnamese dong appreciated 4.5% against the USD in

December, putting the total depreciation at 3.2% YTD as of 31

December. The Vietnamese dong appreciated 3.7% against the pound

sterling in December and its total appreciation was 7.8% YTD as of

31 December.

-- 2022 exports reached US$371.9bn and imports US$360.2bn,

making a trade surplus of US$11.2bn for the year, compared to a

surplus of U$4.0bn in 2021.

-- Trade did, however, slow down in December, with declines of

14.0% and 8.1% for exports and imports, respectively.

-- The Vietnam Purchasing Manager's Index was reported at 46.4,

a fifteen year low, and a second consecutive month below 50

following thirteen monthly expansions previously.

-- Disbursed FDI was US$2.7bn in December, with the total

year-to-date figure reaching US$22.4bn (+13.5% year-on-year).

Top Ten Holdings (66.3% of NAV)

Company Sector VNI % NAV % Monthly Return One-year

% Return %

Vietnam Prosperity

1 Bank Banks 3.0 12.9 11.2 -27.6

================== =================== ===== ===== ============== =========

Asia Commercial

2 Bank Banks 1.8 12.1 3.4 -23.4

================== =================== ===== ===== ============== =========

3 Mobile World Group Retail 1.6 8.0 1.5 -38.6

================== =================== ===== ===== ============== =========

4 Hoa Phat Group Materials/Resources 2.6 6.3 2.1 -50.5

================== =================== ===== ===== ============== =========

5 Vietcombank Banks 9.5 5.8 3.0 -1.9

================== =================== ===== ===== ============== =========

6 FPT Corporation Software/Services 2.1 4.7 7.5 -2.1

================== =================== ===== ===== ============== =========

7 PetroVietnam Gas Energy 4.9 4.4 -3.9 4.7

================== =================== ===== ===== ============== =========

8 Becamex IDC Real Estate 2.1 4.3 4.1 22.6

================== =================== ===== ===== ============== =========

9 Vinhomes Real Estate 5.2 4.3 -8.1 -41.8

================== =================== ===== ===== ============== =========

10 Phu Nhuan Jewelry Retail 0.6 3.5 10.2 22.6

================== =================== ===== ===== ============== =========

Vietnam, Index - - - 0.4 -34.1

================== =================== ===== ===== ============== =========

Source: Bloomberg, Dragon Capital

NB: All returns are given in USD terms

For further information, please contact:

Vietnam Enterprise Investments Limited

Rachel Hill

Phone: +44 122 561 8150

Mobile: +44 797 121 4852

rachelhill@dragoncapital.com

Jefferies International Limited

Stuart Klein

Phone: +44 207 029 8703

stuart.klein@jefferies.com

Buchanan

Charles Ryland / Henry Wilson / George Beale

Phone: +44 20 7466 5111

veil@buchanan.uk.com

LEI: 213800SYT3T4AGEVW864

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVNKOBNQBKKPDD

(END) Dow Jones Newswires

January 17, 2023 02:00 ET (07:00 GMT)

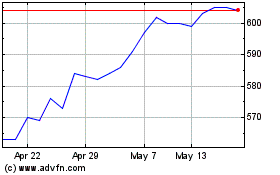

Vietnam Enterprise Inves... (LSE:VEIL)

Historical Stock Chart

From Feb 2025 to Mar 2025

Vietnam Enterprise Inves... (LSE:VEIL)

Historical Stock Chart

From Mar 2024 to Mar 2025