RNS No 9603q

UNITED OVERSEAS GROUP PLC

15th September 1998

UNITED OVERSEAS GROUP plc

Interim Results for the 6 months ended 30 June 1998

Record pre-tax profits of #3.1m, up 15%; EPS and dividend up 13%;

non-executive board appointment; and

appointment of a new joint financial adviser and broker

United Overseas Group plc ("UOG"), Europe's largest distributor of excess

inventories of branded consumer products - toiletries, cosmetics, toys,

games, household goods and sporting goods - to retail and wholesale

customers, announces record Interim Results for the six months ended 30 June

1998. These were achieved against a background of extremely challenging

conditions, in both domestic and export markets.

Highlights from the Chairman's Statement and Results are as

follows:

* Turnover up 13% to #47.1m (1997: #41.5m) including 58% increase at UOG

AB.

* Average gross margin maintained at 26%.

* Pre-tax profits up 15% to #3.1m (1997: #2.6m).

* 13% increases in earnings per share - 1.58p (1997:1.39p) - and dividend

per share - 0.43p (1997: 0.38p).

* Acquisition of Intertrading Agencies Boersema Beheer BV successfully

completed on 2 September 1998; Eppe Boersema has been appointed to the

board with responsibility for the Group's business in Northern

Continental Europe.

* Appointment of Alex Watson as a non-executive director of UOG with

immediate effect.

As regards the Group's future outlook, Norman Riddell - Chairman - said:

"The second half of the year has traditionally been the period of strongest

sales and earnings for the Group. Whilst we believe trading conditions will

remain challenging, the continuing quality of our supplier and customer

partnerships enable us to feel confident that the Group's progress should

continue through the remainder of 1998."

UOG also announces the immediate appointment of BT Alex. Brown International,

a division of Bankers Trust International PLC, as joint financial adviser and

broker.

For further information, please contact:

United Overseas Group:

Norman Riddell, Chairman 0171 588 2990

Jeffrey Curtiss, chief executive 0171 786 9600 until noon

thereafter 01733 362300

Terry Balkham, finance director 0171 786 9600 until noon,

thereafter 01733 362300

BT Alex Brown International:

David Wilson 0171 885 2500

Marshall Securities Limited

Stephen Connolly/John McCready 0171 490 3788

Binns & Co. Public Relations Ltd

Peter Binns/Paul Vann 0171 786 9600

Chairman's Statement

It is with pleasure that I am reporting to you on the results of the Group for

the six month period to 30 June 1998. As the Group's Interim Results in 1997

covered only a trading period from 25 March to 30 June, proforma comparisons

for the period from 1 January are provided both for the half year and full

year.

Against a background of extremely challenging conditions, in both the export

market, due to the strength of Sterling and also the domestic market where

consumer sales have been constrained, the profit before tax for the six months

to 30 June 1998 was #3.1 million, an increase of 15% on a proforma basis over

the corresponding period in 1997. Sales in the period were #47.1 million,

which represented an increase of 13% on 1997. These results represent solid

performances from the Group companies where domestic business in the UK

developed encouragingly, although exports declined in the period.

Particularly noteworthy was the growth of our business in Scandinavia with UOG

AB acheiving a turnover increase of 58% over the same period in 1997. Also,

our relatively new business, European Stock Solutions, based in Leeds,

recorded very significant progress in its development.

The Board has declared a dividend of 0.43p per ordinary share for the six

months to 30 June 1998, which is payable on 26 October 1998 to shareholders on

the register on 2 October 1998.

The acquisition of Intertrading Agencies Boersema Beheer BV, which was

approved by the shareholders on 22 May, was successfully completed on 2

September and work on the construction of the first stage of the Group's

European Distribution Centre in Moerdijk, Netherlands is on schedule for

completion in the second quarter of 1999. We believe that these developments

represent a fundamental building block for the Group's future progress on the

European mainland in the years ahead.

I am pleased to announce two further appointments to the Board of your

Company. Mr Eppe Boersema has been appointed Managing Director, Northern

Continental Europe, and Mr Alex Watson as a Non-Executive Director. Both

bring infinite wisdom to United Overseas and I am delighted to welcome them to

the Group.

The second half of the year has traditionally been the period of strongest

sales and earnings for the Group. Whilst we believe trading conditions will

remain challenging, the continuing quality of our supplier and customer

partnerships enable us to feel confident that the Group's progress should

continue through the remainder of 1998.

Norman M M Riddell

Chairman

14 September 1998

Consolidated Profit and Loss Account

Actual Proforma Proforma Actual Actual

6 months 6 months 12 months 03/03/97 03/03/97

ended ended ended to to

30/06/98 30/06/97 31/12/97 30/06/97 31/12/97

(unaudited) (unaudited) (unaudited) (unaudited) (audited)

Notes #000 #000 #000 #000 #000

Turnover 47,058 41,512 90,978 20,905 70,371

Cost of

sales (34,802) (30,760) (66,403) (15,487) (51,132)

------ ------ ------ ------ ------

Gross

profit 12,256 10,752 24,575 5,418 19,239

Distribution

costs (2,080) (1,798) (4,005) (974) (3,182)

Administrative

costs (6,187) (5,715) (10,688) (2,823) (7,796)

Other

operating

income 4 5 4 5 4

------ ------ ------ ------ ------

Operating

profit 3,993 3,244 9,886 1,626 8,265

Net

interest

payable (942) (595) (1,450) (282) (1,137)

------ ------ ------ ------ ------

Profit on

ordinary

activities

before

taxation 3,051 2,649 8,436 1,344 7,128

Taxation 2 (1,005) (943) (2,902) (478) (2,437)

------ ------ ------ ------ ------

Profit on

ordinary

activities

after

taxation 2,046 1,706 5,534 866 4,691

Minority

interests (84) (328) (569) (156) (389)

------ ------ ------ ------ ------

Profit

attributable

to

shareholders 1,962 1,378 4,965 710 4,302

Dividends (533) (453) (1,396) (453) (1,396)

------ ------ ------ ------ ------

Retained

profit for

the period 1,429 925 3,569 257 2,906

------ ------ ------ ------ ------

Earnings 3

per share 1.58p 1.39p 4.51p 0.76p 3.91p

------ ------ ------ ------ ------

Dividends 5

per share 0.43p 0.38p 1.14p 0.38p 1.14p

------ ------ ------ ------ ------

Consolidated Balance Sheet

At 30/06/98 At 30/06/97 At 31/12/97

(unaudited) (unaudited) (audited)

Notes #000 #000 #000

Fixed assets

Intangible assets 90 81 75

Tangible assets 2,167 1,315 1,675

Investments - 10 -

------ ------ ------

2,257 1,406 1,750

------ ------ ------

Current assets

Stocks 40,301 30,589 36,989

Debtors 25,317 17,063 20,787

Cash at bank and in hand 978 2,044 3,040

------ ------ ------

66,596 49,696 60,816

Creditors: amounts falling

due within one year (41,418) (27,997) (36,703)

------ ------ ------

Net current assets 25,178 21,699 24,113

------ ------ ------

Total assets less current 27,435 23,105 25,863

liabilities

Creditors: amounts falling due

after more than one year (357) (194) (226)

------ ------ ------

Net assets 27,078 22,911 25,637

------ ------ ------

Capital and reserves

Called up share capital 12,403 11,931 12,403

Share premium account 45,763 45,898 45,763

Goodwill write off reserve - (36,170) (36,477)

Share capital to be issued 1,000 - 1,000

Profit and loss account 4 (32,257) 238 2,863

------ ------ ------

Equity shareholders' funds 26,909 21,897 25,552

Equity minority interests 169 1,014 85

------ ------ ------

27,078 22,911 25,637

------ ------ ------

Consolidated Cash Flow Statement

Actual Proforma Proforma Actual Actual

6 months 6 months 12 months 03/03/97 03/03/97

ended ended ended to to

30/06/98 30/06/97 31/12/97 30/06/97 31/12/97

(unaudited) (unaudited) (unaudited) (unaudited) (audited)

#000 #000 #000 #000 #000

Net cash

outflow

from operating

activities (8,634) (12,725) (5,683) (8,686) (1,898)

------ ------ ------ ------ ------

Returns on

investments and

servicing of

finance

Interest

received 18 25 46 16 37

Interest paid

and similar

charges (936) (608) (1,468) (546) (1,152)

Interest

element

of hire

purchase and

finance leases (22) (12) (27) (6) (21)

------ ------ ------ ------ ------

Net cash

outflow from

returns on

investments and

servicing of

finance (940) (595) (1,449) (536) (1,136)

------ ------ ------ ------ ------

Taxation

UK corporation

tax paid (1,080) (785) (3,004) (493) (2,712)

Overseas

taxation paid (445) (225) (355) (139) (269)

------ ------ ------ ------ ------

Net cash

outflow from

taxation (1,525) (1,010) (3,359) (632) (2,981)

------ ------ ------ ------ ------

Capital

expenditure

and financial

investment

Purchase of

intangible

fixed assets (23) - - - -

Purchase of

tangible

fixed assets (176) (366) (727) (341) (702)

Sale of

tangible

fixed assets 8 18 100 14 96

------ ------ ------ ------ ------

Net cash

outflow

from capital

expenditure and

financial

investment (191) (348) (627) (327) (606)

------ ------ ------ ------ ------

Acquisitions

and disposals

Purchase of

subsidiary

undertakings - (100) (100) (100) (100)

Net cash

acquired with

subsidiary

undertakings - - - (12,718) (12,718)

------ ------ ------ ------ ------

Net cash

outflow

from acquisitions

and disposals - (100) (100) (12,818) (12,818)

------ ------ ------ ------ ------

Equity

dividends paid (943) (6,000) (6,453) - (453)

------ ------ ------ ------ ------

Cash outflow

before use of

liquid

resources

and financing (12,233) (20,778) (17,671) (22,999) (19,892)

------ ------ ------ ------ ------

Financing

Issue of

share capital - 18,000 18,000 18,000 18,000

Expenses paid

in connection

with share

issues - (822) (957) (822) (957)

Capital element

of finance

lease rentals (264) - (284) - -

New short

term finance - 6,000 6,000 - -

Loans repaid

- (10,095) (10,000) (10,048) (10,237)

------ ------ ------ ------ ------

Net cash

(outflow)/inflow

from financing (264) 13,083 12,759 7,130 6,806

------ ------ ------ ------ ------

Decrease in

cash in

the period (12,497) (7,695) (4,912) (15,869) (13,086)

------ ------ ------ ------ ------

Notes:

1. Nature of financial information

The company prepares statutory accounts annually to 31 December. These are

the interim accounts covering the six months ended 30 June 1998.

The proforma comparative results for the six months ended 30 June 1997 and for

the twelve months ended 31 December 1997 have been prepared using the

unaudited management accounts of the company's subsidiaries excluding the

demerged activities of the former group and after making such adjustments as

considered necessary. The company was incorporated on 3 March 1997. The

actual results for the period 3 March 1997 to 30 June 1997 and 3 March 1997 to

31 December 1997 are extracted from the previous year's interim and final

accounts respectively.

The proforma comparative results for the six months ended 30 June 1997 and the

twelve months ended 31 December 1997, and the actual results for the period 3

March 1997 to 30 June 1997 and the six months ended 30 June 1998, are

unaudited. The interim accounts have been prepared in accordance with the

accounting policies set out in the company's annual report for the period

ended 31 December 1997.

The financial information set out above does not constitute statutory accounts

within the meaning of Section 240 of the Companies Act 1985. The results for

the period 3 March 1997 to 31 December 1997 are an abridged version of the

full statutory accounts which carry an unqualified audit report and have been

delivered to the Registrar of Companies.

2. Taxation

The taxation charge on the profit on ordinary activities for the six months

ended 30 June 1998, 30 June 1997 and the period 3 March 1997 to 30 June 1997,

is based on the anticipated tax position for the full year.

3. Earnings per share

Earnings per share for the six months ended 30 June 1998 are calculated on the

basis of the profit on ordinary activities after taxation and minority

interests of #1,962,000 divided by 124,032,000, being the weighted average

number of ordinary shares of 10 pence each in issue during the period.

Proforma earnings per share for the six months ended 30 June 1997 and the

twelve months ended 31 December 1997 are based on a weighted average number of

ordinary shares of 10 pence each in issue of 98,867,260 and 110,027,131

respectively. These weighted average number of ordinary shares are calculated

on the assumption that the 80,799,980 ordinary shares issued in connection

with the admission of the shares to the Official List of the London Stock

Exchange Limited had been in issue throughout the periods, adjusted to reflect

issues made by the company during those periods.

Earnings per share for the period 3 March 1997 to 30 June 1997 and the period

3 March 1997 to 31 December 1997 are based on the weighted average number of

ordinary shares of 10 pence each in issue during the period of 93,238,137 and

110,044,423 respectively.

4. Profit and loss account

In accordance with Financial Reporting Standard 10 Goodwill and Intangible

Assets, goodwill which has arisen from previous acquisitions (separately shown

as a Goodwill Write Off Reserve in the annual report) has been transferred to

the profit and loss account. Goodwill arising on any acquisition after 1

January 1998 will be capitalised and amortised through the profit and loss

account over the Directors' estimate of its useful economic life.

Profit Goodwill

retained on

on ordinary consolidation Total

activities

#000 #000 #000

Balance at 1 January 1998 2,863 - 2,863

Profit on ordinary activities

retained for six months

ended 30 June 1998 1,429 - 1,429

Foreign exchange loss (72) - (72)

Goodwill transferred to profit and

loss account, as prescribed by FRS 10 - (36,477) (36,477)

------ ------ ------

Balance at 30 June 1998 4,220 (36,477) (32,257)

------ ------ ------

5. Dividends

An interim dividend of 0.43 pence per ordinary share (1997 interim dividend of

0.38 pence per ordinary share), based on the results for the six months to 30

June 1998, is payable on 26 October 1998 to shareholders on the register on 2

October 1998.

6. Year 2000

The Group is in the final assessment and operational planning stage of the

review of its systems compliance with year 2000 issues. All costs incurred

where systems are enhanced will be capitalised, whereas all other costs will

be charged through the profit and loss account in accordance with generally

accepted accounting practice.

7. Interim report

Copies of the interim report are being dispatched to shareholders today.

Copies are also available from the Company's registered office, United House,

Shrewsbury Avenue, Woodston, Peterborough, Cambridgeshire, PE2 7BZ.

END

IR NFFNLFFPPEAN

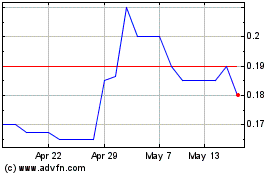

United Oil & Gas (LSE:UOG)

Historical Stock Chart

From Nov 2024 to Dec 2024

United Oil & Gas (LSE:UOG)

Historical Stock Chart

From Dec 2023 to Dec 2024