Circ re propsals to merge the Company's share classes

March 02 2010 - 6:55AM

UK Regulatory

TIDMIGV

THE INCOME & GROWTH VCT PLC

2 MARCH 2010

RECOMMENDED PROPOSALS TO MERGE THE SHARE CLASSES OF THE COMPANY AND MAKE

CONSEQUENTIAL AMENDMENTS TO THE ARTICLES, APPROVE REVISED MANAGEMENT AND

ADMINISTRATION ARRANGEMENTS, AMEND THE INVESTMENT POLICY OF THE COMPANY AND

RENEW AND INCREASE THE AUTHORITY TO ISSUE AND BUY-BACK SHARES.

SUMMARY

The board of directors of the Company ("Board"), which is managed by Matrix

Private Equity Partners LLP ("Matrix Private Equity"), is pleased to advise

that they are today writing to shareholders with proposals to consolidate the

share classes of the Company into one class of share ("Share Merger")

The Share Merger, if approved, is expected to become effective on 29 March

2010. The proposal requires the approval of resolutions to be proposed to

shareholders of the Company at an extraordinary general meeting and separate

class meetings to be held on 26 March 2010 ("the Meetings").

The Board also consider it appropriate, subject to the Share Merger becoming

effective, to approve revised management, administration and performance

incentive arrangements with Matrix Private Equity and amend the existing

articles of association to reflect the Share Merger. In addition, it is also

proposed to amend the investment policy of the Company in relation to its

uninvested cash and renew and increase share issue and share repurchase

authorities. The proposals require the approval of resolutions to be proposed

to shareholders of the Company at the Meetings.

BACKGROUND

The Company was originally launched in 2000 and initially raised funds pursuant

to an issue of ordinary shares of 1p each in the capital of the Company

("Ordinary Shares"). The Company then raised further funds through the issue S

ordinary shares of 1p each in the capital of the Company ("S Shares") in 2008.

It was agreed that the Company should raise this additional capital through a

separate class of shares on the basis that it would be managed solely by Matrix

Private Equity, unlike the then Ordinary Shares which was originally managed by

multiple fund managers, including Matrix Private Equity.

It was envisaged that the Ordinary Shares fund and S Shares fund would continue

to be managed separately due to their then differing investment management

mandates and arrangements. In March 2009, Matrix Private Equity became the sole

investment manager in respect of the Ordinary Shares fund (although it assumed

responsibility for all of the Ordinary Share fund in October 2008). As a result

of Matrix Private Equity now being the sole investment manager of both the

Ordinary Shares fund and S Shares fund, the investment policies of both classes

have become aligned, thus reducing the original rationale to keep the share

classes separate.

The Board therefore propose to merge the share classes which will provide the

Company with cost savings and strategic benefits.

THE SHARE MERGER

The Share Merger will be effected by first merging the Ordinary Shares into the

S Shares and then redesignating the S Shares as Ordinary Shares (this being

referred to herein as "New Ordinary Shares").

The Share Merger will be completed by reference to the relative NAVs of the

Ordinary Shares fund and the S Shares fund (adjusted for dividends to be paid)

as at 31 December 2009.

MATRIX PRIVATE EQUITY AND THE REVISED MANAGEMENT, ADMINISTRATION AND

PERFORMANCE INCENTIVE ARRANGEMENTS

Matrix Private Equity is the Company's investment manager and it has also

assumed the responsibilities of providing administrative services in place of

Matrix-Securities Limited following a reorganisation of the Matrix Group.

Matrix Private Equity will continue to be the investment manager to the Company

following the Share Merger on, in light of the Share Merger, the revised terms

(subject to Shareholder approval) as follows:

* The existing management and administration arrangements between the

Company, Matrix Private Equity and Matrix-Securities Limited (amongst

others) will be replaced with a new investment management agreement with

Matrix Private Equity covering both management and administration services

for an annual fee (inclusive of VAT, if any) of an amount equivalent to 2.4

per cent. of the net assets of the Company (one-sixth of which to be

subject to a minimum of GBP130,000 and a maximum of GBP150,000, the remainder

of such fee not being subject to any cap).

* The new agreement will be on substantially the same terms as the existing S

Share fund management and administration arrangements, subject to being

supplemented by any material arrangements within the Ordinary Share fund

management and administration arrangements and the appointment being on 12

months' notice (albeit there currently being an initial fixed period in

respect of the S Share fund arrangements which has not expired). Matrix

Private Equity has agreed to continue to meet the annual expenses of the

Company in excess of 3.25 per cent. of the NAV of the Company for each

financial period, this being the annual expenses cap as currently provided

under the existing annual expenses deed and which will also be provided for

in the new agreement.

* The existing S Share fund performance incentive arrangement will be

terminated while the performance incentive arrangement of the Ordinary

Share fund shall continue but be amended fin light of the Share Merger to

cover the amalgamated share class. New investments made (i.e. no

performance incentive fees will be payable on the S Share fund investments

made) by the Company following the Share Merger will be added to the

calculation in respect of 70 per cent. only (both in terms of cost and in

assessing gains and losses over (this being the current investment

allocation between the Ordinary Shares fund and the S Shares fund). In

addition, the "High Watermark Test" will be amended to provide that the

losses of the S Shares fund existing investments as at 31 December 2009

will need to be made up before any payment is due to Matrix Private Equity.

The ongoing entitlement of Foresight Group to performance incentive fees in

respect of the portfolio of the Ordinary Shares fund they previously managed

will continue in its current form.

The Board believes that these arrangements are the most appropriate for the

Company at the current time and considers that they best achieve the principle

of Shareholders not being disadvantaged. Shareholders should be aware that any

future incentive payments will only crystallise in the event of a significant

increase in the current value of the investment portfolio.

Matrix Private Equity, created by a merger between GLE Development Capital

Limited and Matrix Private Equity Limited, is the private equity arm of Matrix

Group and manages funds primarily through a range of VCTs raised from private

investors. Total funds under management are circa GBP120 million across six funds

with the portfolio of equity investments in companies currently numbering

forty.

Matrix Private Equity specialises in backing management buy outs and takes a

partnership approach to investing, working alongside ambitious, entrepreneurial

management teams wishing to buy businesses. Equity investments, typically up to

GBP7 million, are made in UK privately owned companies across a broad range of

industries and sectors, helping entrepreneurial management teams to achieve

substantial gains for all shareholders. Matrix Private Equity often works with

a highly experienced operating partner who has direct management experience and

a wide range of contacts. Matrix Private Equity is recognised as one of the

most experienced teams and active investors in this segment of the private

equity market.

Matrix Private Equity (telephone: 0203 206 7000) was incorporated and

registered in England and Wales as a limited liability partnership on 27 June

2006. Matrix Private Equity's registered office and principal place of business

is at One Vine Street, London W1J 0AH. Matrix Private Equity is authorised and

regulated by the FSA to provide investment management services. The principal

legislation under which Matrix Private Equity operates is the provisions of the

Limited Liability Partnership Act 2000 and the relevant provisions of the

Companies Act 2006 (and regulations made thereunder).

AMENDMENT TO THE INVESTMENT POLICY

The Board believes that the current investment policy on the uninvested funds

constrains them from considering a wider range of alternatives to the current

holdings in money-market funds and, accordingly, shareholders are being asked

to approve a change in investment policy relating to the funds awaiting

investment, so that the Company's cash and liquid resources be invested to

maximise income returns in a range of instruments of varying maturities,

subject to the overriding criterion that the risk of loss of capital be

minimised.

The Board will consider whether the Company's cash resources could be invested

in a wider range of opportunities, to aim to achieve a higher rate of income

return, while still aiming to safeguard the Company's capital. The Board wishes

to emphasise strongly that it is not their present intention to increase the

level of risk associated with higher levels of income. However, the Board would

like to be able to consider a wider range of alternatives in the future should

a suitable situation occur, subject to the general aim of safeguarding the

Company's capital being maintained.

EXPECTED TIMETABLE

Share Merger NAV Reference Date 31 December 2009

Extraordinary General Meeting 10.30 am on 26 March 2010

Ordinary Share Class Meeting 10.40 am on 26 March 2010

S Share Class Meeting 10.45 am on 26 March 2010

Record Date for the Share Merger close of business on 26 March

2010

Effective Date for the Share Merger close of business on 29 March

2010

Amendment to the listing of Shares 30 March 2010

CREST accounts re-credited 31 March 2010

Certificates for the New Ordinary Shares 5 April 2010

dispatched

FURTHER INFORMATION

Shareholders will receive a copy of a circular convening the Meetings to be

held on 26 March 2010 at which shareholders will be invited to approve

resolutions in connection with the proposals. A copy of the circular for the

Company has also been submitted to the UK Listing Authority and will be shortly

available for inspection at the UK Listing Authority's Document Viewing

Facility which is situated at:

Financial Services Authority

25 The North Colonnade

Canary Wharf

London E14 5HS

Telephone: 0207 066 1000

For further information, please contact:

Investment Manager to the Company

Matrix Private Equity Partners LLP

Mark Wignall

Telephone: 020 3206 7000

Administrator to the Company

Matrix Private Equity Partners LLP/Matrix-Securities Limited

Robert Brittain/Sarah Penfold

Telephone: 020 3206 7000

Solicitors to the Company

Martineau

Kavita Patel

Telephone: 0870 763 2000

END

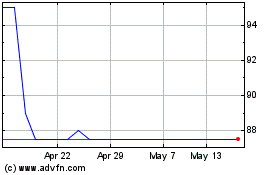

Touchstar (LSE:TST)

Historical Stock Chart

From Jun 2024 to Jul 2024

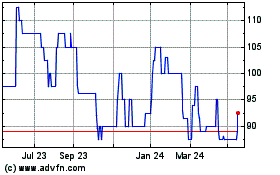

Touchstar (LSE:TST)

Historical Stock Chart

From Jul 2023 to Jul 2024