TIDMIGV

The Income & Growth VCT plc

Annual Financial Results of the Company for the Year ended 30 September 2009

Investment Objective

The objective of The Income & Growth VCT plc ("I&G VCT" or "the

Company") is to provide investors with an attractive return, by maximising the

stream of dividend distributions from the income and capital gains generated

by a diverse and carefully selected portfolio of investments.

The Company invests in companies at various stages of development.

In some instances this may include investments in new and secondary issues of

companies which may already be quoted on the Alternative Investment Market

("AiM") or PLUS.

Financial Highlights - ordinary shares of 1p each (`O' Shares)

- Increase of 24.3% in year in cumulative dividends paid to

Shareholders

- Annual dividends paid to Shareholders maintained at 2008 level

- Decrease of 21.7% in year in shareholder total return (share

price basis)

- Decrease of 8.1% in year in total shareholder return (net asset

value basis)

Dividends paid

Year ended Dividends paid in Cumulative dividends

each year since launch paid since launch

(p) per share (p) per share

30 September 2009 4.00 20.45

30 September 2008 4.00 16.45

30 September 2007 3.75 12.45

30 September 2006 3.25 8.70

30 September 2005 (restated) 1.25 5.45

Dividends paid include distributions from both income and capital.

Dividends proposed

A final dividend of 2 pence per `O Share, comprising 0.5 pence from

income and 1.5 pence from capital, will be recommended to Shareholders at the

Annual General Meeting of the Company to be held on 3 March 2010 for payment

on 17 March 2010.

Performance Summary

Year ended Share

NAV total price total

Net asset return to return to

Net value per shareholders Share shareholders

assets (GBP `O' Share since launch price since launch

million) (p) per (p) 1 per

`O' Share (p) `O' Share (p)

30 September 2009 24.9 71.5 91.9 54.8 75.2

30 September 2008 29.6 83.6 100.0 79.5 96.0

30 September 2007 36.8 100.5 2 115.0 87.5 100.0

30 September 2006 44.2 112.9 121.6 84.5 93.2

30 September 2005 49.2 122.5 128.0 87.5 93.0

(restated)

1 Source: London Stock Exchange

2 After deducting the dividend of 2p per share paid on 24 October 2007

Financial Highlights - S ordinary shares of 1p each (`S' Shares)

- Initial income dividend of 0.5 pence proposed

- Decrease of 5.5% in year in shareholder total return (share price

basis)

- Decrease of 1.5% in year in total shareholder return (net asset

value basis)

Dividends proposed

A final income dividend of 0.5 pence per `S' Share will be

recommended to Shareholders at the Annual General Meeting of the Company to be

held on 3 March 2010 for payment on 17 March 2010.

Performance Summary

Year ended NAV total Share

Net asset return to price total

value per shareholders Share return to

Net assets `S' Share since launch price shareholders

(p) per since launch

(GBP million) `S' Share (p) (p) 1 per

`S' Share (p)

30 September 2009 11.0 93.2 93.2 94.5 94.5

30 September 2008 11.2 94.6 94.6 100.0 100.0

At close of Offer for 11.2 94.5 94.5 100.0 100.0

subscription

1 Source: London Stock Exchange

The share prices and net asset value (NAV) total returns for both Funds

comprise the share price and NAV respectively per share assuming the dividends

paid were re-invested on the date on which the shares were quoted ex-dividend

in respect of each dividend.

Chairman's Statement

I am pleased to present to Shareholders the annual results of the

Company for the year ended 30 September 2009.

Performance

`O' Shares

At 30 September 2009, the Net Asset Value (NAV) per `O' Share was

71.45 pence (2008: 83.56 pence). Adjusted for the dividends paid to

shareholders during the year, this represents a decrease of 9.7% over the

twelve month period. This compares with an increase of 17.45% in the FTSE

SmallCap CR Index and an increase of 3.96% in the FTSE AIM CR Index during the

same period. The NAV Total Return per `O' Share fell in the year by 8.1% from

100.01 pence at 30 September 2008 to 91.90 pence at 30 September 2009.

The headline performance figures appear somewhat disappointing and

will be discussed later. In general the underlying performance of the

portfolio in the year offers encouragement. The MPEP portfolio achieved

realised gains of GBP597,637 but these were offset by provisions and lower

valuations giving rise to unrealised losses of GBP3.2 million, resulting in net

losses of some GBP2.6 million. The Foresight legacy portfolio suffered a fall in

value with further provisions leading to unrealised net losses of some

GBP311,938.

UK sector price earnings multiples have, in the main, increased

over this twelve month period. These do, of course, impact on our portfolio

valuation in both the quoted and unquoted sectors. Some sectors have shown

increases whilst several have experienced declines. The MPEP portfolio at the

year end represented 78.5% of total venture capital investments, whilst the

Foresight and Nova legacy portfolios represented the balance.

Falls in the share prices of several of our quoted stocks,

particularly Oxonica, have been partially off-set by gains elsewhere in the

portfolio. The total dividends paid in the year under review was 4 pence per

share which is equal to a total of 4 pence per share paid in the financial

year 2008.

Cumulative dividends paid to date have been 20.45 pence per `O'

Share.

`S' Shares

At 30 September 2009, the NAV and NAV Total Return per `S' Share

both fell marginally to 93.18 pence (2008: 94.59 pence) and 93.18 pence (2008:

94.59 pence), both being a decrease of 1.5%.

Economic background

Investors have moved stock markets up a long way but the real

economy is still tough.

After several months of almost consistent gains equity markets

appeared to have consolidated around current levels. Poorer than expected US

jobs figures have been held responsible for these recent market conditions.

The number of workers on US payrolls during September 2009 fell almost 50%

more than was expected and the unemployment rate now stands at a 26 year high.

This data released recently together with the impact of events surrounding

financial problems in Dubai reinforces strongly the argument that the economic

recovery will not be plain sailing.

The portfolio

`O' Shares

Overall, the MPEP portfolio continues to hold-up well given the current

economic climate. Good trading performances have been produced by some of the

investments; notably DiGiCo Europe, which produced an unrealised gain of

GBP511,337 and Amaldis 2008 of GBP337,767 but Blaze Signs Holdings, Youngman Group

and PXP Holdings, all companies in the broader construction sector, provided

unrealised losses of GBP1.26 million, GBP914,937 and GBP454,124 respectively.

Despite the Construction & Materials sector price earnings multiple showing a

strong rise over the year, this has not evidenced itself yet in the trading

performances of these three companies and this has had a material adverse

effect on the valuation of the portfolio over the period. There is an old

adage that stock markets anticipate events while trading results lag the

events!

Within the MPEP portfolio, in October 2008 an investment of GBP595,842 was made

into ATG Media Holdings to support the MBO of Metropress, publisher of the

Antiques Trade Gazette and online auction operator. In 2009, a new investment

was made into MC440 to support the management buy-out of Westway Cooling, a

company based in Greenford, Middlesex, specialising in installing, servicing

and maintaining high quality air-conditioning systems and associated building

services plant in the refurbishment and maintenance market. The 'O' Share Fund

invested GBP389,703. Further investments of GBP129,264 and GBP47,158 in November

2008 and January 2009 respectively were made in the loan stocks of PXP

Holdings and Monsal Holdings.

In March 2009 SectorGuard plc acquired Legion Group plc and subsequently

changed its name to Legion Group.

In March 2009 DiGiCo Europe also repaid GBP142,804 of the 'O' Share Fund's loan

stock investment. At the beginning of July 2009, the 'O' Share Fund then sold

its investment in Tottel Publishing to Bloomsbury Group earning a fourfold

gain on its original investment by returning a total of GBP2.05 million in terms

of income and proceeds to the Fund throughout the life of the investment. The

'O' Share Fund's original investment cost of GBP514,800 had been reduced to

GBP325,182 in March of this year when Tottel Publishing repaid 50% of the

Company's loan stock investment.

Following the year-end, in November 2009, the `O' Share Fund

invested a further GBP90,909 into British International Holdings and sold its

investment in PastaKing for initial proceeds of GBP779k. This realisation

contributed to total returns of GBP949k to the Fund throughout the life of the

investment, representing a 3.25 fold return on the Company's original

investment of GBP292,405.

The old Foresight portfolio continues to underperform with Oxonica, mentioned

above, producing an unrealised loss for the year of GBP1.11 million. By

contrast, Camwood provided an unrealised gain of GBP460,789.

`S' Shares

During the year the S Share Fund produced a satisfactory performance given the

economic environment.

In October 2008 the `S' Share Fund invested GBP404,158 into ATG Media Holdings

referred to above. In June 2009, the 'S' Share Fund also invested GBP169,483 in

the management buy-out of Westway Cooling, a company specialising in

installing, servicing and maintaining high quality air-conditioning systems

and associated building services plant in the refurbishment and maintenance

market.

Cash available for investment

During this economic turmoil, both the Board and the Manager have continued to

work to ensure that our cash deposits for both the `O' and `S' Shares remain

as secure as possible. We have for some time been spreading our significant

cash deposits with a number of the leading global cash funds rather than

depositing direct to individual banks, thereby reducing our exposure to any

one particular bank. However, the current low level of interest rates on cash

deposits means it will continue to be difficult for the Company to pay

dividends from income for both the `O' and `S' Shares. The Board and Manager

both strongly believe that at this time the security and protection of capital

is more important than striving for a small increase in deposit rates at the

cost of much higher risk.

Revenue Account

The Revenue return for the Company as a whole has decreased sharply from

GBP717,196 to GBP193,683 over the year.

Management fees and other running costs at the Company level have remained

constant between the years. The principal cause for the decline in revenue is

the fall in the Company's income of GBP523,365. This can be attributed to three

main reasons. First, the significant fall in interest rates has caused income

from the liquidity funds to more than halve by GBP367,447; secondly, dividends

from investee companies fell by GBP106,873 and finally, loan stock interest

received declined by GBP45,659.

In 2008, the `O' Share Fund benefited from a non recurring estimated VAT

recovery on past management fees of GBP83,278.

Dividends

`O' Shares

The Company's revenue return per `O' Share was 0.52 pence per share

(2008: 1.66 pence per share). Your Board will be recommending a final income

dividend of 0.5 pence and a final capital dividend of 1.5 pence payable to `O'

Fund Shareholders in respect of the year ended 30 September 2009 at the Annual

General Meeting to be held on 3 March 2010. Including these dividends,

cumulative dividends paid to date amount to 22.45 pence per `O' Share.

`S' Shares

The Company's revenue return per `S' Share was 0.09 pence per share

(2008: 1.26 pence per share). Your Board will be recommending a final income

dividend of 0.5 pence per `S' Share in respect of the year ended 30 September

2009 at the Annual General Meeting to be held on 3 March 2010.

The dividends will be paid on 17 March 2010 to both `O' and `S'

Shareholders on the Register on 19 February 2010.

Dividend investment scheme

The Company's Dividend Investment Scheme ("The Scheme") provides Shareholders

of both classes with the opportunity to re-invest their dividends into new

shares of the relevant class. It provides a convenient, easy and cost

effective way for Shareholders to build their shareholding in the Company as,

instead of receiving cash dividends, they can elect to receive new shares in

the Company.

Board Members have indicated that they will be participating in the

Scheme to the extent of their full entitlement. I would encourage all

Shareholders to consider participating in the Scheme.

The Scheme currently provides that the issue price of new shares is

at net asset value per share. We are proposing that the Scheme be altered so

as to allow shares to be issued to Shareholders at the share price at the

relevant time. We consider that this proposal provides a more equitable basis

to Shareholders for ascertaining the issue price under the Scheme. A

resolution will, therefore, be proposed at the Annual General Meeting of the

Company to be held on 3 March 2010 to authorise the Directors to allot shares

of both classes at their mid market share price even if this less than the net

asset value per share of that class.

Shareholders are allotted new ordinary shares in the relevant class. These

shares will then, subject to Shareholders' individual circumstances, attract

VCT tax reliefs applicable for the tax year in which the shares are allotted

(currently at 30%).

Copies of the Scheme Rules are available on the Company's website,

www.incomeandgrowthvct.co.uk, and personalised application forms for the

Scheme are enclosed with Shareholders copies of this Report. Further copies of

the forms can be obtained from the Scheme Administrator, Capita Registrars by

telephoning: 0871 664 0300 (Calls cost 10p per minute plus network extras.

Lines are open 8.30 am - 5.30 pm Mon-Fri. If calling from overseas please ring

+44 208 639 2157). Shareholders who hold their shares in uncertificated form

in CREST at the relevant record date must complete a CREST Dividend Election

Input Message in respect of each dividend to elect to receive the dividend in

the form of new shares. Application forms may be submitted at any time and

should be returned to Capita Registrars at the address given on the form and

elections via CREST should be made so as to be received no later than 5.00 pm

on the date that is at fifteen days before the payment date for a particular

dividend to ensure that you qualify to receive the dividend as shares. Please

note that in the case of the proposed final dividends payable on 17 March 2010

this deadline with be 5.00 pm on 2 March 2010.

Separate application forms do need to be completed in respect of

each class of share but you do not need to resubmit an `O' Share application

form if you have already joined the Scheme in respect of the `O' Shares.

Merger of `O' and `S' Share Classes

The Board are currently considering proposals which may result in

resolutions being put forward to Shareholders in the near future regarding a

merger of the `O' and `S' Share Funds.

Valuation policy

For several years now, quoted stocks have been valued at bid prices, rather

than mid-market prices. It is worth commenting that the Fund does hold a

number of relatively early stage AIM-quoted stocks with limited marketability.

In such cases, the price at which a sizeable block of shares could be traded,

if at all, may vary significantly from the market price used.

Share buy-backs

During the year ended 30 September 2009, the Company bought back

754,444 Ordinary Fund Shares (representing 2.13% of the Ordinary Fund Shares

in issue at the beginning of the period) at a total cost of GBP350,963 (net of

expenses).

Outlook

In a recent special report on the world economy entitled `The long

climb', The Economist highlighted various views and projections for the global

economy. A variety of economic indicators have been contributing to renewed

confidence but the latest US jobs data was perceived as a `reality check' for

economists worldwide. The report indicated that certain parts of the global

economy have a long road ahead of them and governments around the globe will

play a crucial role in securing recovery and, more importantly, maintaining it

once recovery is assured by playing a greater role, particularly in the

financial sector, through increased regulation to protect balance sheets and

the tax-payer from further liability.

On a positive note, Olivier Blanchard, chief economist at the

International Monetary Fund, was quoted two months ago in The Sunday Times

saying "The recovery has started. In most countries growth will be positive

for the rest of the year, as well as in 2010". However, the view remains among

many observers that the strength of stock markets over the last few months may

be highlighting a `false dawn'. Commentators are discussing the possibility of

the market being `W' shaped or experiencing a `double-bottom'. If such an

event occurs, small, early stage growth businesses will be tested further. The

recent news from Dubai may well be the catalyst for this eventuality.

The Company overall retains its significant cash position. This

continues to place the Company in an excellent position to take advantage of

what are expected to be increasingly attractive purchase opportunities which

should become available as this recession continues or as the economy climbs

out of recession. Therefore, while short term valuations may be subject to

continuing pressures, your Board still expects to see attractive investment

opportunities and a recovery in performance and portfolio values over the

longer term.

The current level of interest rates in the United Kingdom mean that

it will be difficult for the Company to pay a dividend from revenue in the

forthcoming year. Moreover, it is too early to say whether it will be possible

for the Company to pay a dividend from capital reserves.

I&G website

May I remind you that the Company has its own website which is

available at www.incomeandgrowthvct.co.uk.

Colin Hook

Chairman

Investment Policy

The Company's policy is to invest primarily in a diverse portfolio

of UK unquoted companies. Investments are structured as part loan and part

equity in order to receive regular income and to generate capital gains from

trade sales and flotations of investee companies.

Investments are made selectively across a number of sectors,

primarily in management buyout transactions (MBOs) i.e. to support incumbent

management teams in acquiring the business they manage but do not yet own.

Investments are primarily made in companies that are established and

profitable.

The Company has a small legacy portfolio of investments in

companies from its period prior to 30 September 2008, when it was a

multi-manager VCT. This includes investments in early stage and technology

companies and in companies quoted on the AiM or PLUS.

Uninvested funds are held in cash and lower risk money market

funds.

UK companies

The companies in which investments are made must have no more than

GBP15 million in the case of the `O' Share Fund and GBP7 million in the case of

the `S' Share Fund of gross assets at the time of investment to be classed as

a VCT qualifying holding. (This figure varies between the two Funds because of

a change in tax legislation which applies to Funds, including the `S' Share

Fund, raised after 6 April 2006).

VCT regulation

The investment policy is designed to ensure that the Company

continues to qualify and is approved as a VCT by HM Revenue & Customs

("HMRC"). Amongst other conditions, the Company may not invest more than 15%

of its investments in a single company and must have at least 70% by value of

its investments throughout the period in shares or securities comprised in VCT

qualifying holdings, of which a minimum overall of 30% by value must be

ordinary shares which carry no preferential rights. In addition, although the

Company can invest less than 30% of an investment in a specific company in

ordinary shares it must have at least 10% by value of its total investments in

each VCT qualifying company in ordinary shares which carry no preferential

rights.

Asset mix

The Company initially holds its funds in a portfolio of readily

realisable interest-bearing investments and deposits. The investment portfolio

of qualifying investments is built up over a three year period with the aim of

investing and maintaining at least 70% of net funds raised in qualifying

investments.

Risk diversification and maximum exposures

Risk is spread by investing in a number of different businesses

across different industry sectors. To reduce the risk of high exposure to

equities, each qualifying investment is structured using a significant

proportion of loan stock (up to 70% of the total investment in each VCT

qualifying company). Initial investments in VCT qualifying companies are

generally made in amounts ranging from GBP200,000 to GBP1 million at cost. No

holding in any one company will represent more than 10% of the value of the

Company's investments at the time of investment. Ongoing monitoring of each

investment is carried out by the Investment Manager, generally through taking

a seat on the board of each VCT qualifying company.

Co-investment

The Company aims to invest in larger, more mature unquoted

companies through investing alongside the four other VCTs advised by the

Investment Manager with a similar investment policy. This enables the Company

to participate in combined investments advised on by the Investment Manager of

up to GBP5 million.

Investment Manager's Review

Summary

In the face of continued economic deterioration in the UK and

worldwide this has been a challenging year for new investment. New deals

coming to the market have been generally unattractive and we have taken the

view that vendors' price expectations would prove unsustainable over the

medium term. We have therefore been cautious and selective in our

consideration of potential deals. We have in particular continued to avoid

transactions requiring high levels of bank borrowing, believing that economic

conditions were still deteriorating and that this would make over-leveraged

companies much too vulnerable in a tougher environment. We remain of the view

that the market has not yet re-established the equilibrium necessary for high

quality businesses to be sold at prices acceptable to private equity managers.

The MPEP portfolio at 30 September 2009 comprised 29 investments

with a cost of GBP15.7 million and valued at GBP16.5 million representing an

uplift of 5.1% on cost. Realisations during the year generated cash proceeds

of GBP2 million.

The predominance in the investment portfolio of management buy-out

investments reflects our strategy of seeking to capitalise companies properly

at the time of investment so that they are well positioned to contend with

difficult times. Only two investments have received very modest additional

funding during the year and a third since the year-end totalling GBP267,351

across the portfolio. We continue to believe that the portfolio, taken as a

whole, is resilient and of high quality and given recent general comment on

the tightening of bank lending, do not consider that the portfolio is exposed

to unsustainable levels of third party debt.

The legacy Foresight portfolio which comprises largely technology

and early-stage companies shows a rather worse position. This portfolio

comprises 11 investments with a cost of GBP9.3 million and valued at GBP2.8

million representing 29.6% of cost. There have been no realisations during the

year from this portfolio.

MPEP `O' Share Fund investments

A total of GBP1.2 million was deployed into investments by the `O'

Share Fund during the year and since the year-end, two new investments of

GBP787,820 were completed. As reported previously in the Half-Yearly Report,

these included a new investment of GBP595,842 to support the management buy-out

of ATG Media Holdings, the London-based publisher of the Antique Trade Gazette

and provider of an online auction platform and two small follow-on loan stock

investments into PXP of GBP129,264 and Monsal of GBP47,158.

A new investment GBP389,703 was also made in June into MC440 Limited

to support the management buy-out of Westway Cooling, a company based in

Greenford, Middlesex, which specialises in installing, servicing and

maintaining high quality air-conditioning systems and associated building

services plant in the refurbishment and maintenance market. The investment

comprised loan stock and an equity stake of 3.3%. With a turnover of GBP9.6

million and a record order book we believe that this company is well placed to

grow even in the present challenging market conditions. It has made a good

start, in line with our expectations, following the MBO.

After the year-end, a further investment of GBP90,909 was completed

in November 2009 into British International Holdings, while in December, one

of the VCT's acquisition vehicles, Calisamo Management Limited changed its

name to CB Imports Group Limited and invested GBP696,911 to acquire Country

Baskets, a distributor of floral sundries.

The `O' Share Fund successfully realised its investment in Tottel

Publishing. The company was sold to Bloomsbury Publishing Group for GBP10

million at the beginning of July earning a fourfold gain on the original

investment cost and returning total proceeds to the Fund of GBP2.05 million. The

investment was exited earlier than envisaged at the time of the investment and

the original investment cost of GBP514,800 had already been reduced to GBP325,182

in March of this year when Tottel repaid 50% of the Fund's loan stock

investment.

Following the year-end, in November 2009, the `O' Share Fund

successfully sold its investment in PastaKing, the Newton Abbott based

foodservice company to NBGI for initial proceeds of GBP779k. This realisation

contributed to total returns of GBP949k to the Fund throughout the life of the

investment, representing a 3.25 fold return on the Company's original

investment of GBP292,405. A number of companies in the portfolio are trading

strongly and expanding their businesses. DiGiCo Europe has continued to roll

out new products and this has led to rising profit growth this year. The

company repaid GBP142,804 of loan stock in May 2009 plus the premium due.

Amaldis (2008) too has had a very good year and has successfully completed

launches of a number of new product lines.

The performance of Monsal during the year has also improved

significantly and the outlook is further enhanced by the prospect of new

capital contracts as water companies commit to new waste management projects

and the company exploits its expertise in anaerobic digestion.

Inevitably, in the current environment, a number of our companies

are re-assessing their market position and streamlining their businesses to

adapt to less certain conditions. BG Consulting Consulting Group/Duncary 4 is

in the process of reconstructing its business which should strengthen the

company's position in the marketplace and enhance the value of the VCT's

investment. Earlier this year, Letraset underwent a capital reorganisation to

address its recent decline in revenue and re-align itself for the future.

The `O' Share Fund has received further consideration from Special

Mail Services based on performance totalling GBP19,808 during the year.

As part of a new initiative to generate additional high-quality MBO

investments, the Fund holds investments of GBP1 million each alongside other

MPEP advised funds in three acquisition vehicles, Apricot Trading, Aust

Construction Investors and Calisamo Management, headed by experienced Chairmen

well known to MPEP. These individuals are working closely with us in seeking

to identify and complete investments in specific sectors relevant to their

industry knowledge and experience. We have established these companies to

provide time for us to identify and invest in suitable target companies at

sufficiently attractive prices. Since the year-end, Calisamo has completed an

investment into Country Baskets and changed its name to CB Imports Group

Limited, while the other two companies have commenced trading, providing

management consultancy services in their chosen sector.

Unfortunately there are a few companies in the portfolio,

particularly those which are more directly exposed to the construction and

retail sectors that are suffering from the negative effects of the recession.

Youngman, PXP and Plastic Surgeon have all suffered from the significant

downturn in the construction industry as business volumes have shrunk and

reduced demand from major customers has impacted on revenue. Youngman in

particular was well-placed to withstand these pressures and remains

profitable. It is still too early to assess when we are likely to see signs of

recovery in these areas. Blaze Signs has also continued to experience a fall

in activity arising from much reduced levels of new signage rollouts from its

major customers.

Foresight and Nova `O' Share Fund investments

With effect from 1 October 2008, MPEP assumed responsibility from

Foresight for the eleven investments it managed on behalf of the `O' Share

Fund.

Some of these businesses, for example Biomer and NexxtDrive, remain

at an early stage in terms of revenue generation and have not yet achieved

break-even levels and remain cash negative.

Camwood is the strongest performer in the portfolio and is making

good progress. The development of its AppDNA application for Microsoft Windows

is now doing well and appears to be gaining traction in its market. DCG Group

remains profitable and is doing particularly well in the US. The performance

of Aquasium has also shown improvement over the last year. Oxonica lost a

major litigation case at the Court of Appeal. The majority of the executive

team have since left the company which has delisted itself from AiM. The

company's future remains uncertain.

`S' Share Fund

The Fund completed investments in ATG Media Holdings (GBP404,158 for

a 3.6% equity stake) and MC440 (Westway) (GBP169,483 representing a 1.4% equity

stake) alongside the `O' Share Fund as described above.

Since the year-end, a new investment of GBP303,089 was made into CB

Imports Group Limited, a distributor of floral sundries.

The Fund has retained in cash a high percentage of the funds raised

in 2008 and we will apply this to new investments when the market recovers and

the right opportunities begin to emerge.

Investment outlook

It is difficult to predict where the economy will go over the

coming year. It shows little sign of improvement and remains fragile. We have

however worked very hard with investee companies to make sure that they are

taking all the measures they can to cut costs. We expect that follow-on

finance to support portfolio companies may become a focus over the coming

months. We also anticipate much more attractive buying conditions emerging as

the year progresses. Having retained significant uninvested cash, we believe

the Company is well placed to cover both the portfolio needs that may arise

and the new investment opportunities presented.

Investment Portfolio Summary - 'O' Share Fund

as at 30 September 2009

% of % of

Cost at Valuation Additional Valuation Equity Portfolio

at investments at held 2 by value

30-Sep-09 30-Sep-08 30-Sep-09

GBP GBP GBP GBP

Image Source Group Limited 305,000 2,241,678 - 2,259,232 39.6% 11.72%

Royalty free photography

creator

Amaldis (2008) Limited 80,313 1,248,967 - 1,586,734 9.2% 8.22%

(Original Additions)

Manufacturer and distributor

of beauty products

HWA Limited (Holloway White 34,553 2,359,597 - 1,457,407 21.1% 7.55%

Allom)

High value property

restoration

and refurbishment

DiGiCo Europe Limited 514,096 763,337 - 1,131,870 4.3% 5.87%

Designer and manufacturer of

audio mixing desks

Camwood Limited 3 1,028,181 552,444 - 1,013,233 34.7% 5.25%

Provider of software

repackaging

services

Apricot Trading Limited 1,000,000 1,000,000 - 1,000,000 24.5% 5.18%

Company seeking to acquire

businesses in the marketing

services and media sector

Aust Construction Investors 1,000,000 1,000,000 - 1,000,000 16.3% 5.18%

Company seeking to acquire

businesses in the

construction

sector

Calisamo Management Limited 1,000,000 1,000,000 - 1,000,000 16.3% 5.18%

Company seeking to acquire

businesses in the healthcare

sector

I-Dox plc 5 872,625 816,667 - 796,250 2.4% 4.13%

Provider of document storage

systems

VSI Limited 245,595 675,439 - 794,146 9.2% 4.12%

Provider of software for CAD

and CAM vendors

PastaKing Holdings Limited 292,405 856,250 - 778,913 4.5% 4.04%

Manufacturer and supplier of

fresh pasta meals

Youngman Group Limited 1,000,052 1,615,929 - 700,992 8.5% 3.63%

Manufacturer of ladders and

access towers

ATG Media Holdings Limited 595,842 - 595,842 595,842 5.3% 3.09%

Publisher and online auction

platform operator

Tikit Group plc 4 500,000 899,999 - 595,651 3.0% 3.09%

Provider of consultancy,

services

and software solutions for

law firms

Aquasium Technology Limited 3 700,000 311,306 - 564,739 16.7% 2.93%

Manufacturing and marketing

of

bespoke electron beam welding

and vacuum furnace equipment

Focus Pharma Holdings Limited 516,900 516,900 - 525,858 2.1% 2.73%

Licensor and distributor of

generic pharmaceuticals

MC 440 Limited (Westway 389,703 - 389,703 389,703 3.3% 2.03%

Cooling)

Installation, service and

maintenance

of air conditioning systems

Vectair Holdings Limited 215,914 341,830 - 375,136 4.6% 1.94%

Designer and distributor of

washroom products

British International 500,000 375,112 - 359,765 5.0% 1.86%

Holdings

Limited

Helicopter service operator

Monsal Holdings Limited 471,605 318,335 47,158 353,704 5.7% 1.83%

Supplier of engineering

services

to water and waste sectors

Brookerpaks Limited 55,000 417,540 - 324,447 17.1% 1.68%

Importer and distributor of

garlic

and vacuum-packed vegetables

to

supermarkets and the

wholesale

trade

ANT plc3 462,816 196,979 - 275,770 2.7% 1.43%

Provider of embedded browser/

email software for consumer

electronics and Internet

appliances

DCG Group Limited 3 312,074 321,013 - 262,861 6.3% 1.36%

Design, supply and

integration

of data storage solutions

Biomer Technology Limited 4 137,170 137,170 - 226,585 4.4% 1.17%

Developer of biomaterials for

medical devices

NexxtDrive Limited 4 812,014 203,004 - 203,004 8.4% 1.05%

Developer and exploiter of

mechanical transmission

technologies

Sarantel plc 3 1,881,251 68,078 - 153,175 3.6% 0.79%

Developer and manufacturer

of antennae for mobile phones

and other wireless devices

Blaze Signs Holdings Limited 1,338,500 1,392,644 - 132,589 12.5% 0.69%

Manufacturer and installer of

signs

B G Consulting Group Limited/ 1,153,976 256,530 - 115,027 33.2% 0.60%

Duncary 4 Limited

Technical training business

Racoon International Holdings 550,852 13,692 - 79,496 7.7% 0.41%

Limited

Supplier of hair extensions,

hair care products and

training

The Plastic Surgeon Holdings 307,071 153,536 - 76,768 4.6% 0.40%

Limited

Supplier of snagging and

finishing services to

property

sector

Legion Group plc (formerly 150,000 64,286 - 53,571 0.7% 0.28%

SectorGuard plc)

Provider of manned guarding,

mobile patrols and alarm

response

services

Campden Media Limited 334,880 65,842 - 44,438 3.6% 0.23%

Magazine publisher and

conference organiser

Corero plc (formerly Mondas 600,000 73,672 - 34,381 6.5% 0.18%

plc) 3

Provider of e-business

technologies

Alaric Systems Limited 3 595,803 30,647 - 30,647 8.1% 0.16%

Software developer and

provider

of support services in the

credit/

debit card authorisation and

payments market

Aigis Blast Protection 272,120 68,030 - 0 0.00%

Limited 3 3.7%

Specialist blast containment

materials company

Inca Interiors Limited 350,000 0 - 0 0.0% 0.00%

Design, supply and

installation

of quality kitchens to house

developers

Letraset Limited 650,000 0 - 0 5.0% 0.00%

Manufacturer and worldwide

distributor of graphic art

products

Oxonica plc 3 2,524,527 1,113,991 - 0 10.6% 0.00%

Leading international

nanomaterials group

PXP Holdings Limited 920,176 324,860 129,264 0 6.8% 0.00%

(Pinewood

Structures)

Designer, manufacturer and

supplier of timber frames for

buildings

Bloomsbury Professional - - - 1,294,585 0.0% 0.00%

Limited

(formerly Tottel Publishing

Limited) - company sold in

July 2009

Publisher of specialist legal

and

taxation titles

Other investments in the 380,436 0 0 0 - 0.00%

portfolio 1

==== ==== ==== ==== ====

'O' Share Fund Total 25,051,450 23,089,889 1,161,967 19,291,934 100.00%

==== ==== ==== ==== ====

1 'Other investments in the portfolio' comprises Stortext-FM Limited/Stortext

(DO) Limited.

2 The percentage of equity held for these companies may be subject to further

dilution of an additional 1% or more if, for example, management of the

investee company exercises share options.

3 Investment formerly managed by Foresight Group up to 10 March 2009.

4 Investment formerly managed by Nova Capital Management Limited until 31

August 2007 and by Foresight Group until 10 March 2009

5 Investment formerly managed by Nova Capital Management Limited until 31

August 2007.

Investment Portfolio Summary - 'S' Share Fund

as at 30 September 2009

% of % of

Cost at Valuation Additional Valuation Equity Portfolio

at investments at held 1 by value

30-Sep-09 30-Sep-08 30-Sep-09

GBP GBP GBP GBP

ATG Media Holdings Limited 404,158 - 404,158 404,158 3.6% 67.54%

Publisher and online auction

platform operator

MC 440 Limited (Westway 169,483 - 169,483 169,483 1.4% 28.32%

Cooling)

Installation, service and

maintenance of air

conditioning

systems

The Plastic Surgeon Holdings 99,011 49,506 - 24,753 1.5% 4.14%

Limited

Supplier of snagging and

finishing services to

property

sector.

==== ==== ==== ==== ====

'S' Share Fund Total 672,652 49,506 573,641 598,394 100.00%

==== ==== ==== ==== ====

==== ==== ==== ==== ====

Company total 25,724,102 23,139,395 1,735,608 19,890,328 100.00%

==== ==== ==== ==== ====

1 The percentage of equity held for these companies may be subject to further

dilution of an additional 1% or more if, for example, management of the

investee company exercises share options.

Statement of Directors' Responsibilities

The Directors are responsible for preparing the Directors' Report,

the Directors' Remuneration Report and the financial statements in accordance

with applicable law and regulations. They are also responsible for ensuring

that the Annual Report includes information required by the Listing Rules of

the Financial Services Authority.

Company law requires the Directors to prepare financial statements

for each financial year. Under that law the Directors have elected to prepare

the financial statements in accordance with United Kingdom Generally Accepted

Accounting Practice (United Kingdom Accounting Standards and applicable law).

Under company law the Directors must not approve the financial statements

unless they are satisfied that they give a true and fair view of the state of

affairs of the Company and of the profit or loss of the Company for that

period. In preparing these financial statements the directors are required to:

- select suitable accounting policies and then apply them

consistently;

- make judgments and estimates that are reasonable and prudent;

- state whether applicable accounting standards have been followed,

subject to any material departures disclosed and explained in the

financial statements;

- prepare the financial statements on the going concern basis unless

it is inappropriate to presume that the company will continue in business.

The Directors are responsible for keeping proper accounting records

that are sufficient to show and explain the company's transactions and

disclose with reasonable accuracy at any time the financial position of the

Company and enable them to ensure that the financial statements comply with

the Companies Act 2006. They are also responsible for safeguarding the assets

of the Company and hence for taking reasonable steps for the prevention and

detection of fraud and other irregularities.

The Directors are responsible for the maintenance and integrity of the

corporate and financial information included on the company's website.

Legislation in the United Kingdom governing the preparation and dissemination

of the financial statements and other information included in annual reports

may differ from legislation in other jurisdictions.

The Directors confirm that to the best of their knowledge that:

(a) the financial statements, prepared in accordance with UK Generally

Accepted Accounting Practice (UK GAAP) and the 2003 Statement of Recommended

Practice, `Financial Statements of Investment Trust Companies and Venture

Capital Trusts' (SORP), revised in 2005 and 2009, give a true and fair view of

the assets, liabilities, financial position and the loss of the Company.

(b) the management report, comprising the Chairman's Statement, Investment

Portfolio Summary, Investment Manager's Review and Directors' Report includes

a fair review of the development and performance of the business and the

position of the Company, together with a description of the principal risks

and uncertainties that it faces.

For and on behalf of the Board:

Colin Hook

Chairman

Unaudited Non-Statutory Analysis between the 'O' Share and 'S' Share Funds

for the year ended 30 September 2009

1. Income statements for the year ended 30 September 2009

'O' Share 'S' Share

Fund Fund

Revenue Capital Total Revenue Capital Total

GBP GBP GBP GBP GBP GBP

Unrealised losses on - (3,522,533) (3,522,533) - (24,753) (24,753)

investments held at

fair

value

Realised gains on

investments held at

fair value - 597,637 597,637 - - -

Income 713,044 67,950 780,994 218,315 - 218,315

Investment (138,772) (416,316) (555,088) (54,110) (162,329) (216,439)

management

fees

Other expenses (368,365) - (368,365) (143,399) - (143,399)

==== ==== ==== ==== ==== ====

Profit/(loss) on 205,907 (3,273,262) (3,067,355) 20,806 (187,082) (166,276)

ordinary

activities before

taxation

Tax on profit/(loss)

on

ordinary activities (23,356) 23,356 - (9,674) 9,674 -

==== ==== ====

Profit/(loss) on

ordinary

activities after

taxation

for the financial 182,551 (3,249,906) (3,067,355) 11,132 (177,408) (166,276)

year

==== ==== ==== ==== ==== ====

Basic and diluted

earnings per share

0.52 p (9.25)p (8.73)p 0.09 p (1.50)p (1.41)p

Average number of 11,806,467

shares in issue

35,148,192

Total

Revenue Capital Total

GBP GBP GBP

Unrealised losses on

investments held at

fair

value - (3,547,286) (3,547,286)

Realised gains on

investments held at

fair value - 597,637 597,637

Income 931,359 67,950 999,309

Investment

management

fees (192,882) (578,645) (771,527)

Other expenses (511,764) - (511,764)

==== ==== ====

Profit/(loss) on

ordinary

activities before

taxation 226,713 (3,460,344) (3,233,631)

Tax on profit/(loss)

on

ordinary activities (33,030) 33,030 -

==== ==== ====

Profit/(loss) on

ordinary

activities after

taxation

for the financial

year 193,683 (3,427,314) (3,233,631)

==== ==== ====

2. Balance sheets as at 30 September 2009

'O' Share 'S' Share Adjustments Total

Fund Fund (see note

below)

GBP GBP GBP GBP GBP

Fixed assets

Assets held at fair

value

through profit and

loss -

investments 19,291,934 598,394 19,890,328

Current assets

Debtors and 285,807 15,937 (115,868) 185,876

prepayments

Other assets 5,440,722 10,521,348 15,962,070

Cash at bank 37,925 17,713 55,638

==== ==== ==== ==== ====

5,764,454 10,554,998 (115,868) 16,203,584

Creditors: amounts

falling due within

one (174,507) (152,176) 115,868 (210,815)

year

==== ==== ==== ==== ====

Net current

assets/(liabilities)

5,589,947 10,402,822 15,992,769

==== ==== ==== ==== ====

Net assets 24,881,881 11,001,216 35,883,097

==== ==== ==== ==== ====

Capital and reserves

Called up share 466,309

capital 348,244 118,065

Share premium 308,614

reserve 308,614 -

Capital redemption 73,017

reserve 73,017 -

Capital reserve - (5,279,832)

unrealised (5,205,574) (74,258)

Special reserve 17,123,088 10,828,918 27,952,006

Profit and loss 12,362,983

account 12,234,492 128,491

==== ==== ==== ==== ====

Equity shareholders'

funds

24,881,881 11,001,216 35,883,097

==== ==== ==== ==== ====

Number of shares in

issue: 34,824,397 11,806,467

Basic net asset

value per

1p share: 71.45p 93.18p

Diluted net asset

value

per 1p share: 71.45p 93.18p

Note: The adjustment above nets off the inter-fund debtor and creditor

balances, so that the "Total of both Funds" balance sheet agrees to the

Statutory Balance Sheet below.

3. Reconciliation of movements in Shareholders' Funds for the year ended 30

September 2009

'O' Share 'S' Share

Fund Fund Total

GBP GBP GBP

Opening shareholders' funds 29,624,220 11,167,492 40,791,712

Net share capital bought back

in the year (353,751) - (353,751)

Net share capital subscribed for

in the year 96,826 - 96,826

Loss for the year (3,067,355) (166,276) (3,233,631)

Dividends paid / payable in year (1,418,059) - (1,418,059)

==== ==== ====

Closing shareholders' funds 24,881,881 11,001,216 35,883,097

==== ==== ====

Income Statement

for the year ended 30 September 2009

30 September 30 September

2009 2008

Revenue Capital Total Revenue Capital Total

GBP GBP GBP GBP GBP GBP

Net unrealised

losses on

investments - (3,547,286) (3,547,286) - (7,553,875) (7,553,875)

Net gains on

realisation of

investments - 597,637 597,637 - 2,053,510 2,053,510

Income 931,359 67,950 999,309 1,454,724 - 1,454,724

Recoverable VAT - - - 83,278 249,833 333,111

Investment

management fees (192,882) (578,645) (771,527) (197,028) (1,013,810) (1,210,838)

Other expenses (511,764) - (511,764) (517,005) - (517,005)

==== ==== ==== ==== ==== ====

Profit/(loss) on

ordinary activities

before taxation 226,713 (3,460,344) (3,233,631) 823,969 (6,264,342) (5,440,373)

Tax on profit/(loss)

on ordinary

activities (33,030) 33,030 - (106,773) 106,773 -

==== ==== ==== ==== ==== ====

Profit/(loss) on

ordinary activities

after taxation for

the financial year 193,683 (3,427,314) (3,233,631) 717,196 (6,157,569) (5,440,373)

==== ==== ==== ==== ==== ====

Basic and diluted

earnings per share -

'O' Share Fund 0.52p (9.25)p (8.73)p 1.66p (16.72)p (15.06)p

Basic and diluted

earnings per share -

'S' Share Fund 0.09p (1.50)p (1.41)p 1.26p (1.30)p (0.04)p

All the items in the above statement derive from continuing operations. No

operations were acquired or discontinued in the period. The total column is

the Profit and Loss Account of the Company. There were no other recognised

gains and losses in the year.

Other than the revaluation movements arising in investments held at fair value

through Profit and Loss Account, there were no differences between the

profit/(loss) as stated above and at historical cost.

Balance Sheet

as at 30 September 2009

as at 30 as at 30

September 2009 September 2008

GBP GBP GBP GBP GBP GBP

Fixed assets

Investments at fair value 19,890,328 23,139,395

Current assets

Debtors and prepayments 185,876 1,843,777

Current investments 15,962,070 16,336,014

Cash at bank 55,638 65,690

==== ====

16,203,584 18,245,481

Creditors: amounts falling

due within one year (210,815) (593,164)

==== ==== ====

Net current assets 15,992,769 17,652,317

==== ==== ==== ==== ==== ====

Net assets 35,883,097 40,791,712

==== ==== ==== ==== ==== ====

Capital and reserves

Called up share capital 466,309 472,580

Share premium account 308,614 11,266,282

Capital redemption reserve 73,017 65,472

Capital reserve - unrealised (5,279,832) (1,252,761)

Special reserve 27,952,006 18,169,799

Profit and loss account 12,362,983 12,070,340

==== ==== ==== ==== ==== ====

35,883,097 40,791,712

==== ==== ==== ==== ==== ====

Net asset value per share

'O' Shares - basic 71.45p 83.56p

'O' Shares - diluted 71.45p 82.39p

'S' Shares - basic and diluted 93.18p 94.59p

Reconciliation of Movements in Shareholders' Funds

for the year ended 30 September 2009

2009 2008

GBP GBP

Opening shareholders' funds 40,791,712 36,778,493

Net share capital bought back in the year (353,751) (1,063,732)

Net share capital subscribed for in the year 96,826 11,248,511

Loss for the year (3,233,631) (5,440,373)

Dividends paid/payable in the year (1,418,059) (731,187)

==== ====

Closing shareholders' funds 35,883,097 40,791,712

==== ====

Cash Flow Statement

for the year ended 30 September 2009

Year ended Year ended

30 September 2009 30 September 2008

Operating activities GBP GBP

Investment income received 1,081,127 1,435,092

VAT received and interest thereon 408,305 -

Investment management fees paid (1,200,016) (782,286)

Other cash payments (477,847) (564,901)

==== ====

Net cash (outflow)/inflow from

operating activities (188,431) 87,905

Investing activities

Acquisition of investments (735,608) (5,735,193)

Disposal of investments 2,215,027 7,247,239

==== ====

Net cash inflow from investing

activities 1,479,419 1,512,046

Equity Dividends

Payment of equity dividends (1,418,059) (1,385,722)

==== ====

Net cash (outflow)/inflow before

financing and liquid resource management (127,071) 214,229

Management of liquid resources

Decrease/(increase) in monies held

pending investment 373,944 (9,754,517)

Financing

Issue of Ordinary shares 96,826 11,171,285

Purchase of own shares (353,751) (1,612,169)

==== ====

Net cash (outflow)/inflow from financing (256,925) 9,559,116

==== ====

(Decrease)/increase in cash for the year (10,052) 18,828

==== ====

Notes

1. Basis of accounting

The accounts have been prepared under UK Generally Accepted Accounting

Practice (UK GAAP) and, the Statement of Recommended Practice, `Financial

Statements of Investment Trust Companies and Venture Capital Trusts' ("the

SORP") issued by the Association of Investment Trust Companies in January 2003

and revised in 2005 and in 2009.

2. Income

2009 2008

GBP GBP

Income from investments

- from equities 199,022 305,895

- from OEIC funds 291,911 659,358

- from loan stock 399,866 445,525

- from bank deposits 21,480 43,946

- from VAT recoverable 36,050 -

==== ====

948,329 1,454,724

Other income 50,980 -

==== ====

Total income 999,309 1,454,724

Total income comprises

Revenue dividends received 422,983 965,253

Capital dividends received 67,950 -

Interest 457,396 489,471

Other income 50,980 -

==== ====

999,309 1,454,724

Income from investments comprises

Listed overseas securities 291,911 659,358

Unlisted UK securities 598,888 751,420

==== ====

890,799 1,410,778

Income from VAT recoverable relates to interest received on

VAT recoverable recognised in the year ended 30 September 2008.

Loan stock interest above is stated after deducting an amount of GBPnil (2008:

GBP27,067), being a provision made against loan stock interest regarded as

collectable in previous years.

Total loan stock interest due but not recognised in the year was GBP512,386

(2008: GBP568,758).

3. Recoverable VAT

Revenue Capital Total Revenue Capital Total

2009 2009 2009 2008 2008 2008

GBP GBP GBP GBP GBP GBP

Recoverable VAT - - - 83,278 249,833 333,111

As at 30 September 2008, the Directors considered

it reasonable certain that the Company would obtain a repayment of VAT of not

less than GBP462,702. This was based upon information supplied by the Company's

current and former Investment Managers, and discussions with the Company's

professional advisors as a result of the European Court of Justice ruling and

subsequent HMRC briefing that management fees be exempt for VAT purposes.

During the year, a total of GBP408,305 of VAT recoverable and related interest

has been actually received with the amounts disclosed in note 11 still yet to

be received.

4. Net asset value per share

2009 2009 2008 2008

'O' Share 'S' Share 'O' Share 'S' Share

Fund Fund Fund Fund

GBP GBP GBP GBP

Net assets 24,881,881 11,001,216 29,624,220 11,167,492

Number of shares in

issue 34,824,397 11,806,467 35,451,438 11,806,467

Basic net asset value

per

share 71.45p 93.18p 83.56p 94.59p

Diluted net asset

value per

share 71.45p 93.18p 82.39p -

4. Return per `O' Share

The basic revenue return per `O' Share is based on the net revenue

from ordinary activities after taxation of GBP182,551 (2008: GBP599,837) and on

35,148,192 (2008: 36,109,718) `O' Shares, being the weighted average number of

`O' Shares in issue during the year.

The basic capital return per `O' Share is based on net realised

capital loss of GBP3,249,906 (2008: GBP6,036,417) and on 35,148,192 (2008:

36,109,718) `O' Shares, being the weighted average number of `O' Shares in

issue during the year.

5. Return per `S' Share

The basic revenue return per `S' Share is based on the net revenue

from ordinary activities after taxation of GBP11,132 (2008: GBP117,359) and on

11,806,467 (2008: 9,341,544) `S' Shares, being the weighted average number of

`S' Shares in issue during the year.

The basic capital return per `S' Share is based on net realised

capital losses of GBP177,408 (2008: GBP121,152) and on 11,806,467 (2008:

9,341,544) `S' Shares, being the weighted average number of `S' Shares in

issue during the year.

6. Investment Manager's fees

In accordance with the policy statement published under "Management

and Administration" in the Company's Prospectus dated 13 October 2000, the

Directors have charged 75% of the investment management expenses to capital

reserve except for the incentive fee payable, which is charged 100% to

capital.

7. Dividends

The Company proposes to pay a final dividend of 2 pence per share,

comprising 0.5 pence per share from income and 1.5 pence per share from

capital, to `O' Fund Shareholders.

The Company proposes to pay a final dividend of 0.5 pence per

share, comprising 0.5 of a penny per share from income to `S' Fund

Shareholders.

The dividends will be recommended to members at the Annual General

Meeting and, if approved, will be paid on 17 March 2010 to shareholders on the

Register on 19 February 2010.

.

8. Post balance sheet events

On 14 November 2009, the `O' Share Fund's entire holding in

PastaKing Holdings Limited was sold realising net proceeds of GBP779k.

On 30 November 2009, the `O' Share Fund invested GBP91k as a follow

on Loan stock investment in British International Holdings Limited.

On 10 December 2009, the `O' Share Fund's acquisition vehicle

Calisamo Management Limited changed its name to CB Imports Group Limited and

invested GBP697k to acquire Country Baskets, in which the `S' Share Fund also

invested GBP303k.

9. Financial information

The financial information set out in these statements does not

constitute the Company's statutory accounts for the year ended 30 September

2009 but is derived from those accounts. Statutory accounts will be delivered

to the Registrar of Companies after the Annual General Meeting.

10. Annual Report

A Summary Annual Report will be circulated by post to all

Shareholders shortly and copies will be available thereafter to members of the

public from the Company's registered office. Shareholders who wish to receive

a copy of the full Annual Report may request a copy by writing to the Company

Secretary, Matrix-Securities Limited, One Vine Street, London W1J 0AH.

Alternatively copies may be downloaded via the Company's website at

www.incomeandgrowthvct.co.uk

11. The Annual General Meeting of the Company will be held at 11.00

am on Wednesday, 3 March 2010 at One Vine Street, London W1J 0AH.

END

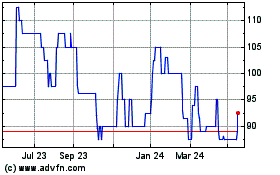

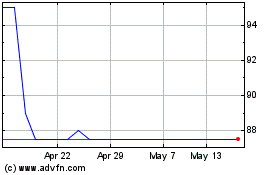

Touchstar (LSE:TST)

Historical Stock Chart

From Jun 2024 to Jul 2024

Touchstar (LSE:TST)

Historical Stock Chart

From Jul 2023 to Jul 2024