RNS Number:9972E

TriVest VCT PLC

12 December 2002

TriVest VCT Plc

Preliminary Results Announcement

Chairman's Statement

I am pleased to present to shareholders the second Annual Report of the Company

for the twelve months ended 30 September, 2002 and my first since becoming

Chairman in February of this year.

In general, the last twelve months have been at least as trying for venture

capital companies as they have been for listed investments reflecting the weaker

conditions in the world economy. In common with the majority of venture capital

funds the failures amongst a fund's investments are usually seen before the

successes come to fruition and it has, therefore, proved both desirable and

necessary that the Board continues to apply its realistic valuation policy. This

is reflected in four holdings which have been re-valued to a zero valuation.

Further details are contained below and in the Managers' Review. However, this

valuation policy should not disguise the fact that the Board and the Managers

firmly believe that there are potential successes within the portfolio. These

are also discussed in the Managers' Review.

At 30 September, 2002, the Company's net asset value per share was 77.05 pence.

The Company will have distributed since its launch accumulated dividends,

including the currently proposed dividend detailed below, of 3.27 pence

(including any associated tax credits). This compares with a subscription price

of 100 pence and an initial net asset value (after expenses of issue) of 94.5

pence per share.

Your Board has maintained a close dialogue throughout the year under review with

each of the three investment managers. In addition, members of the Board took

the opportunity to visit the operations of a number of the Company's more

significant investments in order to monitor progress for themselves. During the

year your Board became increasingly concerned with that part of the portfolio

managed by LICA Development Capital Limited (LICA) where three out of the ten

investments have been written down to a zero valuation. Your Board expressed its

concerns to LICA on a number of occasions and met with LICA specifically to

review its investment processes, investment monitoring and reporting procedures

but your Board's concerns remained. I am now pleased to report that following

our representations to LICA, it was acquired by Nova Capital Management Limited

(Nova). Your Board welcomes this development as this new company, managed by

experienced venture capital managers, should provide greater management skills

and resources, which can be applied towards the remainder of LICA's portfolio.

Nova specialises in targeting under-managed or under-performing portfolios of

private equity and venture capital companies. Their objective is to create

value in portfolios through the application of a hands-on, management based

approach aimed at improving the operational performance of the underlying assets

and thereby optimising exit values.

David Williamson, Michael Kelly and Don Forrest lead Nova's executive team.

David worked for almost 20 years at the specialist private equity and investment

banking firm, Granville plc, latterly as chief executive. Michael Kelly has

spent the last 13 years building the global interim management firm, Executive

Interim Management, where he was senior partner. Don Forrest has over 20 years

experience of senior finance and administration positions with private equity

and venture capital firms.

The LICA component is now almost fully invested having committed just over

#8.2m. During the year under review, three new investments were made; Stortext

Group Limited (#380,435), The Good Book Guide Limited (#800,000 in two tranches)

and DriveTec (UK) Limited (#500,000). Additions were also made to LeSac Limited

(LeSac) and to Zynergy Group Limited (Zynergy). Unfortunately, provision

against deterioration in value has had to be made for five investments. The

Board has felt obliged to revalue LeSac, Machinery & Automated Systems

Technology Limited (MAST) and Zynergy down to zero for the different reasons

given in the Managers' Review. Zynergy, for example, has exciting technology but

is at an early stage in developing its business model and has found raising

additional funding in the present climate extremely difficult. It is currently

undertaking a fund raising exercise but it is still too early to be able to

predict a successful outcome. In addition, neither The Good Book Guide Limited

nor Trident Publishing Limited (Trident) has experienced sufficiently robust

trading conditions to justify retention of their holdings at cost. Following a

detailed review by the incoming management team at LICA, in both instances our

equity holdings have been reduced to a nil valuation and a provision of fifty

per cent has been made against the cost of the loan stock.

GLE continue to invest their allocation of the Company's funds. During the year

under review, a total of #2.35m was invested and three new holdings were added

to the portfolio; Inca Interiors Limited (#350,000), Special Mail Services

Limited (#1,000,000) and BG Consulting Group Limited (#1,000,000).

The VCF portfolio saw the largest number of investments during the year with

seven, all technology related, investments having been made. Approximately, a

further #3.42m was invested in Aquasium Technology Limited (#500,000), Blue

Curve Limited (#500,000), SmartFOCUS Holdings Limited (#500,000), Alaric Systems

Limited (#400,000), Sarantel Limited (#590,621 in two tranches), Oxonica Limited

(#428,522) and Wire-e Limited (#500,000). In addition, since the year end a

further #80,490 was added to our holding in Alaric. Regrettably, iDesk plc was

placed in Receivership in April 2002 and has been valued at zero by the Board.

The Company's holdings are discussed in more detail later in this Report in the

Managers' Review.

The Company's revenue earnings were 2.27 pence per share and your Board is

recommending a final dividend per ordinary share in respect of the year under

review of 1.75 pence.

Gordon Howe, one of the Company's Directors at its inception, has passed his

seventieth birthday and has asked to stand down as one of the Directors. He will

do so immediately after the forthcoming AGM. Gordon, who chaired the Audit

Committee, has been an invaluable source of experience, knowledge and wisdom. On

behalf of my fellow Directors and myself, I would like to take this opportunity

to pay tribute to his enormous contribution and, personally, to thank him for

his constant support and advice. The Board will now actively seek a replacement

with suitable skills, knowledge and experience.

Colin Hook,

Chairman.

12 December 2002

STATEMENT OF TOTAL RETURN

(incorporating the Revenue Account of the Company)

for the year ended 30 September 2002

Period from

6th Sept 2000

Year ended 30th September 2002 to 30th Sept 2001

Notes Revenue Capital Total Revenue Capital Total

# # # # # #

Unrealised

gains and

(losses) on

investments - (5,655,183) (5,655,183) - (782,897) (782,897)

Realised

gains and

(losses) on

investments - (393,904) (393,904) - 112,584 112,584

Income 2 2,151,739 - 2,151,739 1,240,092 - 1,240,092

Investment

management

fees 3 (203,825) (611,473) (815,298) (168,395) (505,183) (673,578)

Other

expenses (575,017) - (575,017) (373,105) - (373,105)

-------------- -------------- -------------- -------------- ----------- ------------

Return on

ordinary

activities

before

taxation 1,372,897 (6,660,560) (5,287,663) 698,592 (1,175,496) (476,904)

Tax on

ordinary

activities (424,405) 173,260 (251,145) (157,001) 101,037 (55,964)

-------------- -------------- -------------- -------------- ----------- ------------

Return on

ordinary

activities

after

taxation 948,492 (6,487,300) (5,538,808) 541,591 (1,074,459) (532,868)

Dividend 6 (731,009) - (731,009) (501,618) - (501,618)

------------- ------------- -------------- ------------- -------------- --------------

Transfer

to/(from)

reserves 217,483 (6,487,300) (6,269,817) 39,973 (1,074,459) (1,034,486)

------------- -------------- -------------- ------------- -------------- --------------

Return per

Ordinary Share 4 2.27p (15.52)p (13.25)p 1.67p (3.32)p (1.65)p

All revenue and capital items in the above statement derive from continuing

operations.

No operations were acquired or discontinued in the period.

BALANCE SHEET

AS AT 30 SEPTEMBER 2002

as at 30 September 2002 as at 30 September 2001

# # # # # #

Fixed Assets

Investments 29,986,724 16,034,927

Current Assets

Debtors and prepayments 669,423 515,195

Other assets 2,651,158 1,730,436

Cash at bank 18,025 21,315,917

------------ -------------

3,338,606

23,561,548

Creditors: amounts

falling due

within one year

Corporation tax 269,186 48,266

Other creditors 14,882 378,418

Accruals 853,879 694,688

------------ ------------

(1,137,947) (1,121,372)

------------- -------------

Net current assets 2,200,659 22,440,176

-------------- -------------

Net assets 32,187,383 38,475,103

-------------- -------------

Capital and reserves

Called up share capital 417,720 418,015

Capital redemption reserve 295 -

Share premium account - 39,091,574

Special reserve 39,073,671 -

Capital reserve - realised (1,198,879) (291,562)

Capital reserve - unrealised (6,362,880) (782,897)

Revenue reserves 257,456 39,973

-------------- -------------

32,187,383 38,475,103

-------------- -------------

NAV per share 77.05p 92.04p

CASH FLOW STATEMENT

for the year ended 30 September 2002

Period from

Year 6th September

ended 2002 to 30

30 September September

2002 2001

# # # #

Operating activities

Investment income received 1,983,788 725,400

Dividend income 3,261 -

Investment management fees paid (1,164,109) (411,302)

Other cash payments (659,754) (72,094)

------------- -----------

Net cash inflow from operating

activities 163,186 242,004

Taxation

UK Corporation tax paid (19,951)

Investing activities

Acquisition of investments (42,092,881) (25,448,624)

Disposal of investments 22,091,997 8,743,384

--------------- ---------------

(20,000,884) (16,705,240)

Dividends

Payment of dividend (501,618) -

--------------- ---------------

Cash outflow before financing and

liquid resource management (20,359,267) (16,463,236)

Financing

Issue of ordinary shares - 39,509,589

Purchase of own shares (17,903) -

------------- -------------

(17,903) 39,509,589

----------- --------------

Management of liquid resources

Increase in monies held pending

investment (920,722) (1,730,436)

(Decrease)/Increase in cash for the --------------- --------------

year (21,297,892) 21,315,917

=============== ==============

Notes

1. The revenue column of the statement of total return is the profit and loss

account of the Company.

2. In accordance with the policy statement published under "Management and

Administration" in the Company's prospectus dated 13 October 2000, the

Directors have charged 75% of the investment management expenses to

capital reserve.

3. The revenue return per Ordinary Share is based on the net revenue from

ordinary activities after tax of #948,492 and is based on 41,794,736 Ordinary

Shares, being the weighted average number of Ordinary Shares in issue during

the period.

4. The financial information set out in these statements does not constitute the

Company's statutory accounts for the year ended 30 September 2002 but is

derived from those accounts. Statutory accounts will be delivered to the

Registrar of Companies after the Annual General Meeting.

5. The Company proposes to pay a final dividend of 1.75p per share on 12

February 2003 to all shareholders on the register on 17 January 2003.

6. The Annual General Meeting will be held at 11.00am on 29 January 2003 at

Gossard House, 7-8 Savile Row, London W1S 3PE.

Investment Portfolio Summary

Cost at Valuation at Valuation at % of

30-Sep-02 30-Sep-01 30-Sep-02 portfolio

by value

GLE Development Capital Limited

T J Brent Limited 900,000 900,000 1,030,111 3.44%

Specialist contractor to the water utility sector

BG Consulting Group Limited 1,000,000 N/A 1,000,000 3.33%

Technical training business and outplacement careers

consultancy

Special Mail Services Limited 1,000,000 N/A 1,000,000 3.33%

Specialist, secure credit card delivery business

Letraset Limited 500,000 500,000 500,000 1.67%

Manufacturer and worldwide distributor of graphic arts

products

Inca Interiors Limited (fomerly Inca Holdings Limited) 350,000 N/A 350,000 1.17%

Supplier of quality kitchens

Total 3,750,000 1,400,000 3,880,111 12.94%

LICA Development Capital Limited

The Good Book Guide Limited 800,000 N/A 310,000 1.03%

Multi-channel book retailer

Trident Publishing Limited 698,999 705,000 314,500 1.05%

Book publisher in the maritime sector

i-documentsystems Group plc 517,625 666,667 510,417 1.70%

Provider of document storage systems

DriveTec (UK) Limited 500,000 N/A 500,000 1.67%

Developer of transmissions technologies for applications

in the automative, construction and industrial sectors

Watkins Books Limited 500,000 500,000 500,000 1.67%

Supplier of books in alternative sciences, health, philosophy

and related sectors

Tikit Group plc 517,624 478,260 417,391 1.39%

Provider of consultancy services and software solutions

for law firms

Stortext Group Limited 380,435 N/A 18,089 0.06%

Integrated outsourced document storage business

Le Sac Limited 1,500,000 1,000,000 0 0.00%

Manufacturer of plastic packaging for powder/granular

products and liquids

Machinery and Automated Systems Technology Limited 1,000,000 950,000 0 0.00%

Developer of Vertical Turning and Machining Centres

Zynergy Group Limited 1,789,530 640,000 0 0.00%

Commercialiser of new materials for medical devices

TOTAL 8,204,213 4,939,927 2,570,397 8.57%

VCF LLP

ANT Limited 1,000,000 1,000,000 950,000 3.17%

Provider of embedded browser/email software for consumer

electronics and Internet appliances

Sarantel Limited 590,621 N/A 590,621 1.97%

Developer and manufacturer of antennae for mobile phones

and other wireless devices

Aquasium Technology Limited 500,000 N/A 500,000 1.67%

Business engaged in the design, manufacturing and

marketing of bespoke electron beam welding and vacuum

furnace equipment

Blue Curve Limited 500,000 N/A 500,000 1.67%

Provider of software for automating the production and

distribution of research information by banks and fund

managers

SmartFOCUS Holdings Limited 500,000 N/A 500,000 1.67%

Provider of analytic software to support targeting and

execution of marketing campaigns

Wire-e Limited 500,000 N/A 500,000 1.67%

Provider of mobile data communication services

Oxonica Limited 428,522 N/A 428,522 1.43%

Specialist in the design, manipulation and engineering of

properties of materials at the nano-scale

Alaric Systems Limited 400,000 N/A 400,000 1.33%

Software developer and provider of support services in the

credit/debit card authorisation and payments market

Monactive Limited 250,000 250,000 250,000 0.83%

Provider of software management tools that monitor usage

of software versus licences held

Heritage Image Partnerships Limited 300,000 300,000 150,000 0.50%

On-line image library

iDesk plc 250,000 125,000 0 0.00%

Provider of outsourced technical helpdesk services

TOTAL 5,219,143 1,675,000 4,769,143 15.91%

Managers' Totals 17,173,356 8,014,927 11,219,651 37.42%

Fixed interest portfolio 19,176,248 8,020,000 18,767,073 62.58%

TOTAL 36,349,604 16,034,927 29,986,724 100.00%

Managers' Review

GLE Development Capital

T J Brent Limited

T J Brent is a specialist utility contractor. Its principal activity involves

the laying and refurbishment of pipes, connection of houses to the mains and the

installation and replacement of water meters. Trading is in line with budget.

The company is actively pursuing several new material long-term contracts.

TriVest invested #900,000 in T J Brent in December 2000. The valuation of the

ordinary shares is made on the earnings multiple basis, ie at a discount to the

price/earnings multiple of the construction and building materials sector of the

FTSE Actuaries Share Indices. The loan stock is valued at cost.

Accounts for the year ended 31 March 2002

Turnover Profit before tax Net assets

#63,783,000 #753,000 # 1,052,000

B G Consulting Group Limited

Based in London, BG Consulting is a City outplacement consultancy and provider

of specialist technical training. TriVest invested #1 million in the company in

September 2002 as part of a management buy-out of the former training and

careers divisions of the Baines Gwinner Group from Whitehead Mann plc. The

training business was founded in 1995 and primarily services the global

investment and corporate banking markets, providing training in a range of

financial skills. The careers business provides a one-to-one outplacement

consultancy to middle and senior level executives working in banks, fund

management firms and City law firms. Services provided include personal

development, networking and self-marketing and psychometric assessment. The

directors of the company believe that it is on track to meet its budget. No

audited accounts have been produced since the company was incorporated in May

2002. The investment is valued at cost.

Special Mail Services Limited

Special Mail Services is a provider of secure delivery and disguised mail

services specialising in the credit and bank card market. TriVest invested #1

million in the company in September 2002 as part of a management buy-out of

Special Delivery Services Limited (SDS). SDS was established in 1992 and has 12

depots nationwide with its head office in Northampton. The investment is

valued at cost.

Accounts for Special Delivery Services Limited for the year ended 31 March 2002

Turnover Profit before tax Net assets

#14,006,000 #1,402,000 #766,000

Letraset Limited

The principal activity of Letraset is the production and worldwide distribution

of graphic art products. The products are sold to end users via a network of

specialist distributors in each of the major developed markets. TriVest invested

#500,000 in Letraset in June 2001. Based in Ashford in Kent, the company has

been profitable and cash generative since investment. Letraset continues to

launch new products on the back of its strong brand. TriVest's investment

continues to be valued at cost.

Accounts for the year ended 31 May 2002

Turnover Profit before tax Net assets

#5,222,000 #172,000 #577,000

Inca Interiors Limited (formerly Inca Holdings Limited)

Based in Ashford in Kent, Inca Interiors specialises in the design, supply and

installation of contract kitchens to house developers. The company is trading

well and is ahead of budget. It continues to attract new customers and to

maintain a strong schedule of work and order book. TriVest invested #350,000 in

the company in October 2001 as part of a management buy-out. The valuation is

at cost.

Accounts for the period from 24 August 2001 to 31 May 2002

Turnover Profit before tax Net assets

#2,308,000 #85,000 # 860,000

* The company commenced trading on 1 February 2002 having acquired the existing

business and trade of Inca Interiors (South East) Limited following an MBO in

October 2001.

LICA Development Capital Limited

The Good Book Guide Limited

Founded in 1977, The Good Book Guide is an international multi-channel book

retailer with sales derived from its monthly magazine, occasional specialist

catalogues and its website. In its early years the company pioneered the

international direct marketing of books through its distinctive

magazine-cum-catalogue.

TriVest made an investment of #500,000 in November 2001 when the business was

acquired from the administrators and rebranded within a new company. TriVest

invested a further #300,000 in May 2002. Since acquisition the company has been

undergoing a fundamental restructuring and effectively a relaunch of the

business. The benefits of this will take a considerable time to bear fruit and

a review is currently being conducted of how best to maximise shareholder value.

The company has not yet published its first set of audited accounts.

Reflecting the uncertainties of the business despite the value of the name, the

valuation has been amended to take full provision on the equity and a 50%

provision on the loan stock.

Trident Publishing Limited

Trident Publishing is a Newco which was formed specifically for the MBO

acquisition of Chatham Publishing, the leading, independent, maritime publisher.

TriVest made an investment of #705,000 in Trident in May 2001. The Company

redeemed #6,001 of loan stock during the year. Sales have not yet developed

sufficiently to produce profitability on the present cost base and a review is

currently being conducted of the best way forward to maximise the value of the

titles owned. The Company has not yet published its first set of audited

accounts. Pending the results of the review the valuation has been reduced by

taking full provision on the equity and a 50% provision on the loan stock.

i-documentsystems Group plc

i-documentsystems is an established and fast growing software company which

specialises in the development of products for document, content and information

management. The group's principal product is Image-Gen, a sophisticated

web-based software package which allows a complex paper-based process, such as

the local authority planning application process, to be converted into a

straightforward and robust electronic process leading to significant savings in

cost and time. Image-Gen is a proven product which has been "live" as a

web-based system since 1995.

TriVest made an investment of #517,624 in the company in December 2000. In a

recent trading statement a target of 50 local authority clients and #3 million

of revenue was reported as having been achieved in the year to 31 October 2002.

The company is listed on the Alternative Investments Market and the valuation is

based on market price as at 30 September 2002.

Accounts for the year ended 31 October 2001

Turnover Loss before tax Net assets

#1,201,000 #1,181,000 #2,667,000

DriveTec (UK) Limited

DriveTec specialises in the development of transmissions technologies for

applications in the automotive, construction and industrial sectors. One of

the technologies that the company is developing is the Electro-mechanical Power

Split (EPS) torque-managing system that has the potential to reduce fuel

consumption, and therefore carbon emissions, by up to 50%.

TriVest made an investment of #500,000 in November 2001 as part of a financing

which has enabled the company to develop the EPS project to "proof of design"

stage. The company has recently embarked on a new funding round which will

focus on advancing the EPS project to the next stage - a feasibility model

demonstrator - after which the project will be marketed for exit. The valuation

is at cost. The new funding round is at a small premium to this cost.

Accounts for the period 1 November 2000 to 31 December 2001

Turnover Loss before tax Net liabilities*

# - #387,000 #183,000

* The net liabilities figure shown above includes a liability in respect of

convertible loan stock of #8,081,000.

Watkins Books Limited

Watkins is the pre-eminent UK supplier of books and information in the

alternative sciences, health, philosophy and related sectors. As part of its

plans to develop its unique brand Watkins has expanded its retail operations,

revamped its mail order business and further developed its website. It

re-launched itself as a publishing imprint in Spring 2002. The retail operations

are growing at 20% per annum and are now into profit. Watkins expects to move

into overall profit in 2003, and it believes it has global brand potential in a

strongly growing media niche sector.

TriVest invested #500,000 in the company in March 2001. The investment is held

at cost.

Accounts for the year ended 31 March 2001

Turnover Loss before tax Net assets

#1,059,000 #95,000 #82,000*

* The net asset figure shown above includes a liability in respect of

convertible loan stock of #1,301,000.

Tikit Group plc

Tikit provides consultancy services and software solutions primarily to IT

departments of the top 200 law firms. Tikit also resells third party software

applications where it considers these to be 'best of breed'. Tikit has

developed a proficient technical skillbase focussed on the requirements of major

legal practices and has established a strong brand reputation in its market

sector.

In November 2001 the company acquired Aurra Consulting Limited. This

acquisition complemented and developed Tikit's consultancy and services

capacity. In August 2002 the company acquired the entire share capital of

Granite & Comfrey Limited, a leading supplier of systems and services for

managing the internal know-how of law firms and legal organisations.

TriVest invested #517,625 in the company in June 2001. The company reported

sales in the first 6 months of 2002, 20% below the comparable period of 2001 at

#3.73 million with profit before tax down from #450,000 to #268,000. Weakening

demand from legal practices has been the main factor. Tikit has been listed on

the Alternative Investments Market since June 2001 and the valuation is based on

current market price.

Accounts for the year ended 31 December 2001

Turnover Profit before tax Net assets

#9,123,000 #1,006,000 #3,510,000

Stortext Group Limited

Based in Edinburgh, Stortext specialises in digital scanning and document

storage. It is a service business, deploying and customising software products

to client-specific service requirements. The technology exploits two major

developments in business automation: the growth in digital storage due to

proliferation of electronic documents; and the increasing outsourcing of related

software applications.

TriVest invested #380,435 in the company in September 2001. The valuation is

based on the price of the recent share issue in March 2002 at which time TriVest

declined to invest reflecting disappointment with the progress made by the

company.

Accounts for the year ended 31 March 2001

Turnover Loss before tax Net assets

#1,791,000 #2,202,000 #2,374,000

LeSac Limited

The principal activity of LeSac was to commercialise a unique and patented

packaging system that offered significant advantages over existing solutions

through a combination of lower material content, increased space utilisation and

lower environmental tax levies. It became clear to LeSac's Board in early 2002

that development costs to meet specific customer requirements were much higher

than anticipated and also that developing new and faster packaging machines to

remain competitive required significant further funding. The amount required to

keep the company alive while new investors were found could not be justified in

relation to the risk involved.

TriVest made its initial investment in the company of #1,000,000 in February

2001 (a further investment of #500,000 was made in November 2001). The company

was put into administrative receivership on 10 April 2002 and the Administrator

has not yet published any financial information. The Board has revalued the

equity and loan stock to nil.

Machinery & Automated Systems Technology Limited ('MAST')

MAST was engaged in developing and bringing to market LeSac's (also a TriVest

investee company) third generation packaging machinery having decided to reduce

other activities in order to focus on the LeSac work. TriVest invested

#1,000,000 in the company in February 2001. With LeSac having revised its

business philosophy, the commercial rationale for MAST came under review. In

consequence, the company was placed into liquidation on 31 January, 2002. The

Liquidator has not yet published any financial information and the Board does

not at this point in time have a clear indication of the likely level of

realisation of assets. It has therefore felt it prudent to revalue the equity

and loan stock to nil.

Zynergy Group Limited

Zynergy Group is an innovative medi-tech organisation seeking to exploit through

a licensing strategy its range of materials, coatings and other similar

technologies. These revolutionary technologies have applications in high-value

sectors, namely minimally-invasive cardiology, balloons, stents and orthopaedics

as well as other critical areas. During the current year, Zynergy's businesses

have been substantially restructured and refocused and as part of this process

Zynergy Orthopaedics and Zynergy Manufacturing Europe have been disposed of and

negotiations for the sale of Zynergy Cardiovascular Inc. are in hand.

TriVest made its initial investment in the company of #1,000,000 in February

2001. Since then it has invested #300,000 in September 2001 and #150,000 in

December 2001 and #340,000 in January 2002 as part of a Rights Issue. On 20

September 2002 the company launched a heavily discounted Rights Offer at 11p per

share to raise not less than #500,000. It is anticipated that the Rights Offer

will close during December 2002.

Zynergy has not produced audited accounts since 31 December 2000 and since this

date the group has been restructured as referred to above. Zynergy has extended

its accounting reference date to 30 June 2002. In view of the difficulties

Zynergy is experiencing in this funding climate the Board has now felt it

prudent to revalue both the equity and loan stock to nil.

Accounts for the year ended 31 December 2000

Turnover Loss before tax Net assets

#2,179,000 #4,066,000 #5,710,000

VCF LLP

ANT Limited

ANT is a software company that develops embedded browsers to improve users'

interactive communication with digital television sets and other consumer

electronic devices.

TriVest made an investment of #1,000,000 in ANT in July 2001. The loan stock

has been valued at cost and a 50% provision has been made against cost on the

equity.

Accounts for the year ended 31 December 2000

Turnover Loss before tax Net assets

#1,866,000 #848,000 #956,000*

* The net asset figure shown above includes a liability in respect of a

convertible loan of #3,057,000.

Sarantel Limited

Sarantel owns proprietary antenna technology with applications in mobile phone

and other wireless devices. The company's technology delivers major performance

benefits over traditional antennae. Market interest in Sarantel's first

product, the GPS antenna, has increased and the company now has a healthy

pipeline of sales prospects.

TriVest invested #172,840 in the company in March 2002 and made a further

investment of #417,780 in August and September 2002. The investment is valued

at cost.

Accounts for the period ended 30 September 2001

Turnover Loss before tax Net liabilities*

# - #1,751,000 #678,000

* The net liabilities figure shown above includes a liability in respect of a

convertible loan of #5,628,000 treated as unconverted.

Aquasium Technology Limited

Aquasium is engaged in the design, manufacture and marketing of bespoke electron

beam welding and vacuum furnace equipment. The company was formed by a

management buy-in team who acquired two businesses from Smiths Group plc.

Electron beam welding is a reliable and efficient method of joining together a

wide range of metals, producing clean, high integrity joints. Vacuum furnaces

are used in hardening, tempering and brazing applications. The company,

together with its predecessors, has over forty years experience in both of these

areas. Its products are used in the processes of a wide range of manufacturing

industries including automotive, electronics, medical, power generation and

aerospace.

TriVest invested #500,000 in October 2001. No audited accounts have been

produced since the company was incorporated in June 2001. The investment is

valued at cost.

Blue Curve Limited

Blue Curve sells software to investment banks and fund managers to automate the

production and distribution of research information. Analysis is key to

customer retention for investment banks but it is also a major cost. The

company's software cuts costs and is therefore in demand, particularly when the

spending levels of investment banks are under pressure.

TriVest invested #500,000 in the company in October 2001. The investment is

valued at cost.

Accounts for Blue Curve Research.net Limited for the year ended 31 December

2001*

Turnover Profit before tax Net assets

#1,607,000 #77,000 #108,000

* Blue Curve Research.net Limited is a wholly owned subsidiary of Blue Curve

Limited and is its only trading subsidiary. Blue Curve Limited is not currently

required to produce consolidated accounts.

SmartFOCUS Holdings Limited

SmartFOCUS provides analytic software to enable accurate targeting and execution

of marketing campaigns. The company is an established solution provider in this

area with 300 customers forming a wide customer base spread across financial

services, retail, marketing services and other consumer-driven sectors.

SmartFOCUS adds value to its customers' marketing campaigns by linking with

multiple databases, returning query results in seconds and presenting the

results in an easily understandable graphic way.

TriVest invested #500,000 in the company in December 2001. The investment is

valued at cost.

Accounts for SmartFOCUS Limited for the year ended 31 December 2001*

Turnover Profit before tax Net assets

#2,061,000 #74,000 #127,000

* SmartFOCUS Limited is a wholly owned subsidiary of SmartFOCUS Holdings Limited

and is its only trading subsidiary. SmartFOCUS Holdings Limited is not

currently required to produce consolidated audited accounts.

Wire-e Limited

Wire-e provides mobile communication services to corporates and SMEs. The

service, branded 'Rapide', enables users to access phone numbers and send

e-mails on the move. Founded in 2000, and having launched the Rapide service in

February 2002, Wire-e now has over 170 customers. Customers provide their own

contacts data (e.g. from Outlook, customer/staff directories) to Wire-e and

their employees can access these by voice by mobile phone browser, text message

and desktop browser. Users can also send e-mails, text messages and voice

broadcasts to multiple contacts.

TriVest invested #500,000 in the company in September 2002. The valuation is at

cost.

Accounts for the period 13 April 2000 to 30 June 2001

Turnover Loss before tax Net assets

#- #833,000 #317,000

Oxonica Limited

Oxonica is engaged in the design, manipulation and engineering of properties of

materials at the nano-scale for application in fuel additives, sunscreen,

biotagging and other products. The company has made good progress since the

investment both in terms of product development and investor interest.

TriVest invested #429,000 in the company in June 2002. The investment is valued

at cost.

Accounts for the year ended 31 December 2001

Turnover Loss before tax Net assets

#34,000 #944,000 #18,000

Alaric Systems Limited

Alaric specialises in the development, sale, distribution and support of payment

systems software including systems for electronic payments authorisation and

e-commerce integration. The company is also involved in the use of mathematical

modelling techniques for payments and other fraud detection.

TriVest invested #400,000 in the company in February 2002. The investment is

valued at cost.

Accounts for the year ended 31 March 2002

Turnover Loss before tax Net assets

#1,888,000 #2,121,000 #1,627,000

Monactive Limited

Monactive is a leading provider of Software Asset Management (SAM) tools with

over 100 customers. The Company's software monitors software usage on PC

networks providing corporates with data for cost reduction and compliance. Its

customers are able to reduce their software licensing costs whilst demonstrating

legal compliance.

TriVest invested #250,000 in Monactive in March 2001. The investment is valued

at cost.

Accounts for the year ended 31 July 2002

Turnover Loss before tax Net liabilities

#1,549,000 #982,000 #893,000

Heritage Image Partnership Limited (HIP)

HIP is building an online library of high-resolution images from exclusive

access to the content of heritage institutions, principally museums and

libraries, and sells directly to business customers.

TriVest invested #300,000 in HIP in March 2001. The investment is valued at a

50% provision against cost.

Accounts for the year ended 31 December 2001

Turnover Loss before tax Net assets

#31,000 #1,698,000 #1,257,000

iDesk Plc

iDesk provided telcos, ISPs and other blue chip customers with outsourced

technical help desks, operated from a call centre in London. iDesk also sold

its proprietary and licensed CRM software and provided electronic billing

services.

TriVest made an investment in iDesk Plc of #250,000 in November 2000. No

audited accounts have been produced for the year ended 31 December 2001. The

company was put into administrative receivership on 10 April 2002 and in view of

this, the Board has now revalued the investment to nil.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR GUGGAPUPPGMG

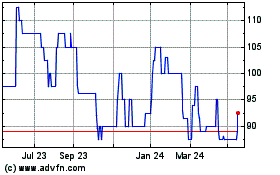

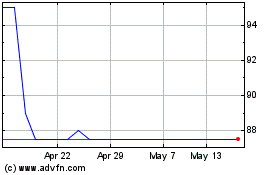

Touchstar (LSE:TST)

Historical Stock Chart

From Jun 2024 to Jul 2024

Touchstar (LSE:TST)

Historical Stock Chart

From Jul 2023 to Jul 2024