RNS Number:5634W

TriVest VCT PLC

29 May 2002

TriVest VCT Plc

Interim Results for the six month period to 31st March 2002

Chairman's Statement

I am pleased to present the Company's Interim Report for the six months to 31

March, 2002. This is also my first Report to you since becoming Chairman in

February of this year.

We already have a diversified portfolio of 22 companies together with several

other interesting investment proposals currently being assessed. The Board is

pleased to announce that TriVest is approximately half way towards its target of

investing between 80 and 90 per cent. of the net funds raised in the October

2000 fundraising in qualifying holdings by September 2003 (the deadline required

by the Inland Revenue).

The underlying climate for venture capital transactions has inevitably been

influenced by the less than ideal conditions for listed securities. Stock

markets have been subject to a number of political and economic uncertainties

which has, in turn, resulted in a reduced 'deal flow' in the venture capital

sector. A rise in business failures both within the United Kingdom and elsewhere

in the world has contributed to a substantially more wary approach by private

equity investors. In response, entrepreneurs have been obliged to moderate their

expectations both in terms of the availability of capital and the valuation

placed on their businesses. This may yet work to the advantage of TriVest VCT

plc, which is not fully invested.

Since the end of the last financial year, our three venture capital managers

have made a number of additional investments to the Company's portfolio. GLE

have added Inca Holdings Limited; LICA have added DriveTec (UK) Limited,

Stortext Group Limited and The Good Book Guide Limited and VCF have added Alaric

Systems Limited, Aquasium Technology Limited, Blue Curve Limited, Sarantel

Limited and SmartFOCUS Holdings Limited. A brief description of each of these

investments is set out below.

Regrettably, this period has also brought its first corporate casualties with

the value of a number of investments being written down to zero. The Board has

deemed it prudent to adopt a conservative valuation policy which has meant that,

in total, £4.7 million has been written off the value of the portfolio since the

year end. LeSac Limited and Machinery and Automated Systems Technology Limited

("MAST") have both found trading conditions extremely difficult and as a result

LeSac is currently in administration and MAST is being liquidated. We remain

hopeful that we may realise some value from these investments, but in the

meantime, we have adopted the most conservative approach of valuing both

holdings at zero. Again over the last year, iDesk experienced a sustained fall

in demand for outsourced call-centre services. Despite a thorough re-appraisal

of its activities and a major cost cutting exercise, trading losses have

exhausted the company's cash reserves and it was placed in administrative

receivership in April 2002. This investment has also been valued down to nil.

At Zynergy, its Rights Issue launched towards the end of last year closed on 21

December 2001, having raised the necessary £1 million minimum subscription

(including an investment by TriVest of £489,530). The Offer continues with KBC

Peel Hunt as Broker with the aim of raising a maximum of £4.5 million. In view

of the difficulties we believe that Zynergy is experiencing raising the

necessary additional capital in this funding climate, the Board has deemed it

prudent to write down TriVest's equity and loan stock investments to nil

although it is hoped that the company will survive and be able to realise value

from a sale of its technology.

Finally, the Board has also felt it prudent to write down its investment in

Heritage Image Partnership Limited in view of this company's plans to achieve a

merger or sale.

Shareholders approved the cancellation of the share premium account of the

Company at the Annual General Meeting held on 13 February 2002. This

cancellation was sanctioned by the court on 1 May 2002 and became effective on 9

May 2002. A special reserve, the cancelled share premium account, has been

created by the cancellation of share premium. The Company may use this reserve

to fund buy-backs of ordinary shares as and when considered by the Board to be

in the best interest of the shareholders.

At 31 March, 2002, revenue reserves available for distribution to shareholders

were £531,998. As previously, the Board does not propose to declare an interim

dividend but expects to be able to propose a final dividend for the year to 30

September 2002. The net asset value was 81.28p (94.8p at 31 March 2001) and the

total return per share was (0.107p) (0.304p at 31 March 2001).

Colin Hook, Chairman

28 May 2002

Investments made in the six month period ended 31 March 2002

GLE Development Capital

Inca Holdings Limited

Based in Ashford, Inca Holdings is the holding company for a group which

specialises in the design, supply and installation of contract kitchens to house

developers. Trading since investment, whilst marginally behind the original

business plan, shows a strong profit performance. The company's order book is

at record levels with over 50 per cent. of next year's budget promised or

contracted.

LICA Development Capital Limited

The Good Book Guide Ltd

The Good Book Guide is a well-respected brand offering, mainly English readers,

regular editorial reviews and the opportunity to purchase books by mail order

and over the internet, often at discounted pricing. Since acquisition from the

Administrators the company has undergone a restructuring to reduce costs,

improve distribution, leverage off its editorial content and seek new

distribution channels. A new and experienced management team has been recruited

and the company is broadly trading in line with its original business plan at

the time of acquisition.

DriveTec (UK) Limited

DriveTec was established to exploit a portfolio of innovative technologies in

the transmissions sector for applications in the automotive, construction and

industrial sectors. The company now has a complete and experienced management

team in place. One of the technologies that the company is developing is the

Electro-mechanical Power Split (EPS) gearbox which has the potential to reduce

fuel consumption and carbon emissions by between 20 and 40 per cent. of a

standard stepped-gearbox. DriveTec is planning to launch a pre-production

prototype in a Ford Mondeo Estate as soon as Autumn 2002.

Stortext Group Limited

Based in Edinburgh, Stortext specialises in digital scanning and document

storage. It is a service business, deploying and customising software products

to client-specific service requirements. The technology exploits two major

developments in business automation: the growth in digital storage due to

proliferation of electronic documents; and the increasing outsourcing of related

software applications.

VCF Partners

Aquasium Technology Limited

Aquasium is engaged in the design, manufacture and marketing of bespoke electron

beam welding and vacuum furnace equipment. The company was formed by a

Management Buy-In team who acquired two businesses from Smiths Group plc.

Electron beam welding is a reliable and efficient method of joining together a

wide range of metals, producing clean, high integrity joints. Vacuum furnaces

are used in hardening, tempering and brazing applications. The company,

together with its predecessors, has over forty years experience in both of these

areas. Its products are used in the processes of a wide range of manufacturing

industries including automotive, electronics, medical, power generation and

aerospace.

Blue Curve Limited

Blue Curve sells software to investment banks and fund managers to automate the

production and distribution of research information. Analysis is a key to

customer retention for investment banks but it is also a major cost. The

company's software cuts costs and is therefore in demand, particularly when

investment banks spending is under pressure. The company had sold 10 licences

to blue chip companies at the time of TriVest's investment in October 2001.

SmartFOCUS Holdings Limited

SmartFOCUS provides analytic software to enable accurate targeting and execution

of marketing campaigns. The company which was formed in 1988 is an established

solution provider in this area with 300 customers forming a wide customer base

spread across financial services, retail, marketing services and other

consumer-driven sectors. SmartFOCUS adds value to its customers' marketing

campaigns by linking with multiple databases, returning query results in seconds

and presenting the results in an easily understandable graphic way.

Alaric Systems Limited

Alaric specialises in the development, sale, distribution and support of

payments systems software including systems for electronic payments

authorisation and e-commerce integration. The company is also involved in the

use of mathematical modelling techniques for payments and other fraud detection.

Sarantel Limited

Sarantel owns proprietary antenna technology with applications in mobile phone

and other wireless devices. The company's technology delivers major performance

benefits over traditional antennae.

Investment Portfolio Summary

Date of initial Total cost Valuation at % of

investment of investment 31-Mar-02 portfolio

Unaudited by value

GLE Development Capital Limited

T J Brent Limited December 2000 £900,000 £900,000 2.68%

Specialist contractor to the water utility sector

Letraset Limited June 2001 £500,000 £500,000 1.49%

(Formerly Creative Opportunities Ltd)

Manufacturer and distributor of graphic art

products

Inca Holdings Ltd * October 2001 £350,000 £350,000 1.04%

Supplier of quality kitchens

£1,750,000 £1,750,000

--------------- ---------------

LICA Development Capital Limited

Trident Publishing Limited (formerly Picalee May 2001 £705,000 £705,000 2.10%

Limited)

Publisher - Maritime sector

i-documentsystems group plc December 2000 £517,625 £687,505 2.05%

Electronic Document Management

The Good Book Guide Ltd * November 2001 £680,000 £680,000 2.03%

Multi-channel book retailer

DriveTec(UK) Limited * November 2001 £500,000 £500,000 1.49%

Innovative technology in the transmissions sector

Watkins Books Limited March 2001 £500,000 £500,000 1.49%

Supplier of books in Alternative Sciences, Health,

Philosophy and related sectors

Tikit Group plc June 2001 £517,624 £497,826 1.48%

Provider of consultancy, services and software

solutions for law firms

Stortext Group Limited September 2001 £380,435 £154,170 0.46%

Integrated outsourced document storage business

LeSac Limited (1) February 2001 £1,500,000 £0 0.00%

Manufacturer of plastic packaging for

powder/granular products and liquids

Machinery & Automated Systems Technology February 2001 £1,000,000 £0 0.00%

Limited (MAST)

Development of LeSac's third generation packaging

machinery

Zynergy Group Limited (2) February 2001 £1,789,530 £0 0.00%

Commercialises new materials for medical devices

--------------- ---------------

£8,090,214 £3,724,501

VCF Partners

ANT Limited July 2001 £1,000,000 £900,000 2.68%

Provider of embedded browser/email software for

consumer electronics and Internet appliances

Aquasium Technology Limited * October 2001 £500,000 £500,000 1.49%

Design, manufacture and marketing of bespoke

electron beam welding and vacuum furnace

equipment

Blue Curve Limited * October 2001 £500,000 £500,000 1.49%

Software for automating the production and

distribution of research information by banks and

fund managers

SmartFOCUS Holdings Limited * December 2001 £500,000 £500,000 1.49%

Provider of analytic software to support targeting

and execution of marketing campaigns

Alaric Systems Ltd * February 2002 £400,000 £400,000 1.19%

Software development, implementation and support

in the credit/debit card authorisation and

payments

market

Heritage Image Partnership Limited March 2001 £300,000 £100,000 0.30%

Internet Image Library

Monactive Limited (formerly Xpert Client March 2001 £250,000 £250,000 0.75%

Systems Limited)

Software Asset Management

Sarantel Limited * March 2002 £172,840 £172,840 0.52%

Antennae for mobile phones and other wireless

devices

iDesk plc November 2000 £250,000 £0 0.00%

Technical Help Desks

--------------- ---------------

£3,872,840 £3,322,840

--------------- ---------------

Investment Managers' Totals £13,713,054 £8,797,341

--------------- ---------------

Fixed Interest Securities 25,229,440 24,744,772 73.77%

--------------- ---------------

TOTAL £38,942,494 £33,542,113 100.00%

--------------- ---------------

* New investment made in the six month period ended 31 March 2002.

1 An additional investment of £500,000 was made in LeSac Limited during the

period.

2 Additional investments totaling £489,530 were made in Zynergy Group Limited

during the period.

Unaudited Statement of Total Return

(incorporating the Revenue Account of the Company for the six months ended 31st

March 2002)

Six months to 31st March 2002

(unaudited)

Notes Revenue Capital Total

£ £ £

Realised gains and losses on investments - (118,664) (118,664)

Unrealised gains and losses on investments - (4,617,484) (4,617,484)

Income 1,083,884 - 1,083.884

Investment management fees 3 (117,476) (352,427) (469,903)

Other expenses (252,427) - (252,427)

------------- ------------- -------------

Return on ordinary activities before 713,981 (5,088,575) (4,374,594)

taxation

Tax on ordinary activities (221,956) 99,397 (122,559)

------------- ------------- -------------

Return attributable to equity shareholders 492,025 (4,989,178) (4,497,153)

Dividends in respect of equity shares - - -

------------- ------------- -------------

Transfer to reserves 492,025 (4,989,178) (4,497,153)

------------- ------------- -------------

Return per share 5 0.012p (0.119)p (0.107)p

------------- ------------- -------------

Period to 31st March 2001

(unaudited)

Notes Revenue Capital Total

£ £ £

Realised gains and losses on investments - - -

Unrealised gains and losses on investments - 63,709 63,709

Income 374,689 - 374,689

Investment management fees 3 (56,396) (169,187) (225,583)

Other expenses (134,303) - (134,303)

------------- ------------- -------------

Return on ordinary activities before 183,990 (105,478) 78,512

taxation

Tax on ordinary activities (48,480) (33,837) (14,643)

------------- ------------- -------------

Return attributable to equity shareholders 135,510 (71,641) 63,869

Dividends in respect of equity shares - - -

------------- ------------- -------------

Transfer to reserves 135,510 (71,641) 63,869

------------- ------------- -------------

Return per share 5 0.645p (0.341)p 0.304p

------------- ------------- -------------

Period to 30th September 2001

(audited)

Notes Revenue Capital Total

£ £ £

Realised gains and losses on investments - 112,584 112,584

Unrealised gains and losses on investments - (782,897) (782,897)

Income 1,240,092 - 1,240,092

Investment management fees 3 (168,395) (505,183) (673,578)

Other expenses (373,105) - (373,105)

------------- ------------- -------------

Return on ordinary activities before 698,592 (1,175,496) (476,904)

taxation

Tax on ordinary activities (157,001) 101,037 (55,964)

------------- ------------- -------------

Return attributable to equity shareholders 541,591 (1,074,459) (532,868)

Dividends in respect of equity shares (501,618) - (501,618)

------------- ------------- -------------

Transfer to reserves 39,973 (1,074,459) (1,034,486)

------------- ------------- -------------

Return per share 5 1.670p (3.320)p (1.650)p

------------- ------------- -------------

Unaudited Balance Sheet

As at 31st March 2002

Notes 31st March 2002

(unaudited)

£ £

Fixed Assets

Investments 7 33,542,113

--------------

33,542,113

Current Assets

Debtors and prepayments 695,170

Other assets -

Cash at Bank 134,129

-----------

829,299

Creditors: amounts falling due within one year (393.462)

------------

Net current assets 435,837

--------------

Net assets 33,977,950

--------------

Capital and reserves 8

Called up share capital 418,015

Share premium account 39,091,574

Capital reserve - realised (663,256)

Capital reserve - unrealised (5,400,381)

Revenue reserves 531,998

--------------

Equity shareholders' funds 33,977,950

--------------

Net asset value per share 81.28p

Notes 31st March 2001

(unaudited)

£ £

Fixed Assets

Investments 7 22,507,333

--------------

22,507,333

Current Assets

Debtors and prepayments 442,813

Other assets -

Cash at Bank 12,962,032

--------------

13,404,845

Creditors: amounts falling due within one year (4,697,503)

--------------

Net current assets 8.707,342

--------------

Net assets 31,214,675

--------------

Capital and reserves 8

Called up share capital 329,058

Share premium account 30,821,748

Capital reserve - realised (135,350)

Capital reserve - unrealised 63,709

Revenue reserves 135,510

--------------

Equity shareholders' funds 31,214,675

--------------

Net asset value per share 94.80p

Notes 30th September 2001

(audited)

£ £

Fixed Assets

Investments 7 16,034,927

--------------

16,034,927

Current Assets

Debtors and prepayments 515,195

Other assets 1,730,436

Cash at Bank 21,315,917

--------------

23,561,548

Creditors: amounts falling due within one year (1,121,372)

--------------

Net current assets 22,440,176

--------------

Net assets 38,475,103

--------------

Capital and reserves 8

Called up share capital 418,015

Share premium account 39,091,574

Capital reserve - realised (291,562)

Capital reserve - unrealised (782,897)

Revenue reserves 39,973

--------------

Equity shareholders' funds 38,475,103

--------------

Net asset value per share 92.04p

Summarised Cash Flow Statement

Six months Period Period

31st March 31st March 30th September

2002 2001 2001

(unaudited) (unaudited) (audited)

£ £ £

Operating activities

Net revenue on activities before taxation 713,981 183,990 698,592

Taxation deducted at source on investment income (102,274) - (7,698)

Capitalised management fees (352,427) (169,187) (505,183)

Decrease/(Increase) in debtors (179,975) (442,813) (515,195)

Increase/(Decrease) in creditors (338,577) 4,682,860 571,488

------------- ------------- -------------

Net cash inflow/(outflow) from operating activities (167,272) 4,254,850 242,004

Equity dividends paid (501,618) - -

Acquisitions and disposal of investments (22,243,334) (22,443,624) (16,705,240)

Management of liquid resources 1,730,436 - (1,730,436)

Financing - 31,150,806 39,509,589

------------- ------------- -------------

(Decease)/Increase in cash for the period (21,181,788) 12,962,032 21,315,917

Reconciliation of net cash flow to movement in net debt

(Decrease)/Increase in cash for the period (21,181,788) 12,962,032 21,315,917

Net funds at the start of the period 21,315,917 - -

------------- ------------- -------------

Net funds at the end of the period 134,129 12,962,032 21,315,917

------------- ------------- -------------

Unaudited Notes to the Financial Statements

1. The revenue column of the statement of total return is the profit and loss

account of the Company.

2. All revenue and capital items in the above statement of total return derive

from continuing operations.

3. In accordance with the policy statement published under "Management and

Administration" in the Company's prospectus dated 13th October 2000, the

Directors have charged 75 per cent. of the investment management expenses

to the capital reserve. This is in line with the Board's long-term split of

returns from the investment portfolio of the company.

4. Earnings for the six months to 31st March 2002 should not be taken as a

guide to the results for the full year.

5. Basic return per Ordinary Share is based on the net revenue on ordinary

activities after taxation and is based on a weighted average of 41,801,516

Ordinary Shares (31st March 2001: 21,000,380).

6. The financial information for the six months ended 31st March 2002 and the

period ended 31st March 2001 has not been audited. The accounting policies

used by Trivest VCT plc in preparing this interim report are consistent

with those used in preparing the statutory accounts for the period ended 30

September 2001.

The information for the period ended 30th September 2001 does not comprise

full financial statements within the meaning of Section 240 of the

Companies Act 1985. The financial statements for the period ended 30th

September 2001 have been filed with the registrar of Companies. The

auditors have reported on these financial statements and that report was

unqualified and did not contain a statement under Section 237(2) of the

Companies Act 1985.

7. Summary of investments during the period

Fixed Traded Unlisted

interest on AIM or traded

securities on OFEX

£ £ £

Cost/Valuation at 30th September 2001 8,020,000 1,144,927 1,533,992

Purchases at cost 28,111,900 17,625 2,398,287

Sales - proceeds (10,858,896) - -

- realised gains/(losses) (43,464) - -

Increase/(decrease) in unrealised gains/(losses) (484,668) 22,778 (1,830,794)

--------------- --------------- ---------------

Cost/Valuation at 31st March 2002 24,744,872 1,185,330 2,101,485

--------------- --------------- ---------------

Book cost at 31st March 2002 25,229,440 1,035,249 4,767,279

Unrealised gains/(losses) at 31st March 2002 (484,668) 150,081 (2,665,794)

--------------- --------------- ---------------

24,744,772 1,185,330 2,101,485

--------------- --------------- ---------------

Gains on investments

Realised gains/(losses) based on historical cost (118,664) - -

Less amounts recognised as unrealised loss in previous (75,200) - -

years

------------ ------------ ------------

Realised gains/(losses) based on carrying value at 30th (43,464) - -

September 2001

Net movement in unrealised appreciation/(depreciation) (484,668) 22,778 (1,830,794)

in the period

--------------- ------------ ---------------

Gains/(Losses) on investments for the period ended 31st (528,132) 22,778 (1,830,794)

March 2002

------------ ------------ ---------------

7. Summary of investments during the period

(continued)

Preference Qualifying Total

Shares Loans

£ £ £

Cost/Valuation at 30th September 2001 - 5,336,008 16,034,927

Purchases at cost 100,000 2,474,518 33,012,230

Sales - proceeds - - (10,858,896)

- realised gains/(losses) - - (43,464)

Increase/(decrease) in unrealised gains/(losses) - (2,400,000) (4,692,684)

--------------- --------------- ---------------

Cost/Valuation at 31st March 2002 100,000 5,410,526 33,542,113

--------------- --------------- ---------------

Book cost at 31st March 2002 100,000 7,810,526 38,942,494

Unrealised gains/(losses) at 31st March 2002 - (2,400,000) (5,400,381)

--------------- --------------- ---------------

100,000 5,410,526 33,542,113

--------------- --------------- ---------------

Gains on investments

Realised gains/(losses) based on historical cost - - (118,664)

Less amounts recognised as unrealised loss in previous - - (75,200)

years

------------ ------------ ------------

Realised gains/(losses) based on carrying value at 30th - - (43,464)

September 2001

Net movement in unrealised appreciation/(depreciation) - (2,400,000) (4,692,684)

in the period

--------------- ------------ ---------------

Gains/(Losses) on investments for the period ended 31st - (2,400,000) (4,736,148)

March 2002

------------ ------------ ---------------

8. Capital & reserves

Called up Share Realised Unrealised

share premium capital capital Revenue

capital account reserve reserve reserve Total

£ £ £ £ £ £

At 1st October 418,015 39,091,574 (291,562) (782,897) 39,973 38,475,103

2001

Profit/(loss) on - - (43,464) - - (43,464)

disposal of

investments

Change in - - - (4,692,684) - (4,692,684)

unrealised

investment

valuation

Realisation of - - (75,200) 75,200 - -

previously

unrealised

depreciation

Capitalised - - (253,030) - - (253,030)

management fees

less tax charge

Retained net - - - - 492,025 492,025

revenue reserve

for the period

---------- -------------- ------------- -------------- ----------- -------------

At 31st March 2002 418,015 39,091,574 (663,256) (5,400,381) 531,998 33,977,950

---------- -------------- ------------- -------------- ---------- -------------

9. A copy of these interim results will be posted to shareholders shortly.

Further copies can be obtained, free of charge, from the Company's

registered office: Gossard House, 7-8 Savile Row, London, W1S 3PE.

This information is provided by RNS

The company news service from the London Stock Exchange

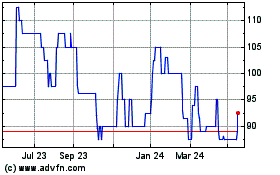

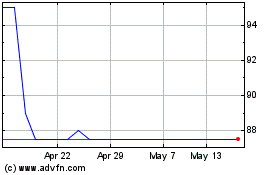

Touchstar (LSE:TST)

Historical Stock Chart

From Jun 2024 to Jul 2024

Touchstar (LSE:TST)

Historical Stock Chart

From Jul 2023 to Jul 2024